Extracting transactions for settlements with budgets - what is it?

A statement of transactions for settlements with the tax office is a formalized document provided by the tax office. It contains information on all accrued and paid taxes, penalties and fines. If there are discrepancies between the data of the taxpayer and the Federal Tax Service, this document will help to verify.

To control the payment of taxes, it is recommended to order a Certificate of Payment Status and such a statement regularly after each payment. This will ensure that the payment has actually been accepted by the tax office. The certificate shows whether the individual entrepreneur has a debt or overpayment of taxes in one line for each tax. The statement contains detailed information and will help you understand the reason for the debt or overpayment.

Accounting balance

The account balance will be the indicator under consideration. The difference between debit and credit will be the balance of the following types:

- Debit balance. Formed in a situation where the debit is greater than the credit. Displayed in the balance sheet asset.

- Credit balance. Formed in a situation where credit exceeds debit. Records the status of the sources through which funds are received. Displayed on the passive.

The difference between debit and credit (that is, between income and expense) can be zero. In this case, the account will be closed. In some cases, accounting has accounts that have both debit and credit balances.

When considering accounting for the reporting period, the following can be noted:

- Opening balance. Another name for it is incoming. This is the account balance. Calculated at the beginning of the reporting time. The calculation is made based on those transactions that were performed by the enterprise before the time in question.

- Debit and credit turnover. For calculations, only those operations that were performed at the time in question are taken.

- Balance for the period. It represents the total result of the enterprise’s actions during the reporting period.

- Closing balance. The second name is outgoing. Represents the balance available in accounts at the end of the month or other reporting time.

We invite you to read: How to make payments to buyers and customers in 2021. Cash and non-cash forms

The reflection of the balance depends on its type. Calculations must be made regularly. This is important for tracking dynamics.

How to order a Budget Statement

You can receive a tax statement electronically or personally contact the inspectorate with an application. The application indicates the details of the taxpayer, the name of the tax for which information is needed and the period of time. A sample application is in this document at the link https://iphelper.ru/wp-content/uploads/2018/02/Zayavlenie_na_vypisku_po_raschetam_s_budjetom.docx.

How to order a budget statement through your personal account

There is an option to order the document through the taxpayer’s personal account on the tax website. To connect to your personal account, you need to contact any tax office with your passport. You will be given a username and password to log into the system.

You can also log in to your personal account using an electronic signature. You can issue a signature at the certification center using the link.

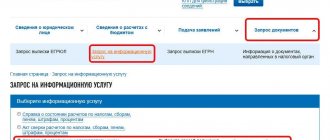

After logging into the personal account of an individual, it is necessary to activate the entrepreneur’s personal account. Through the individual entrepreneur’s account you can order a Statement of settlements with the budget.

The statement is generated in the section My taxes, insurance premiums -> All obligations -> Statement of transactions for settlements with the budget.

Click image for a larger view

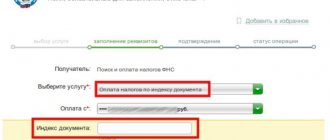

Select the item “Statement of transactions for settlements with the budget” at the bottom of the page

Next, select the reporting year. The statement includes information for only one year. If you want to check the last three years, you need to order an extract for each year separately.

Specify the grouping of payments, your tax number and the format of the statement.

Next, click the double arrow to select all taxes.

We sign and send.

The answer will arrive in a few days in the section on the main page “Notifications...”

Next, select “Information about documents...”

And there will be an answer

After receiving the extract, we proceed to deciphering and analyzing the information.

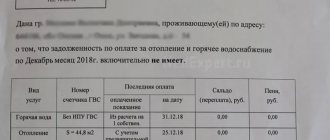

Certificate on the status of settlements for taxes, fees, penalties and fines (sample)

Until the tax office receives the declaration and assesses the tax, any payment is considered an overpayment. If you have a simplified taxation system and make advance payments every quarter, these payments are counted as an overpayment when filing your return.

Column 3 “Taxpayer Data” is formed according to the taxpayer’s data in accordance with the documents he has.

The new forms of certificates indicate data on the amounts of insurance premiums (penalties, fines) paid by an organization (individual entrepreneur, individual who is not an individual entrepreneur).

For 2014, the simplified tax system of 6% would have been paid twice by mistake. The reconciliation received from the Federal Tax Service does not indicate the amount of the overpayment.

How to read a budget statement

The extract contains the date and period that covers the information provided. Below it contains information about taxpayers and inspections: TIN, full name, address and Federal Tax Service number.

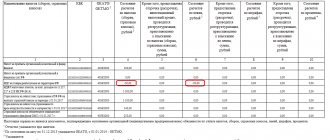

The table shows the basic calculation information.

Columns 1 and 2 indicate the dates the transaction was entered into the card and the payment deadlines. In this example, the first date, January 10, 2021, is the date when the individual entrepreneur submitted the declaration for 2021. The dates in column 2 correspond to the accrual of advance tax payments from the submitted declaration: April 25, July 25 and October 25.

Column 3 indicates the name of the operation. We see two transactions: “paid” and “accrued by calculation”. There are other operations, for example, “additional penalty for recalculation was accrued programmatically”

“Paid” – individual entrepreneur’s payments to the tax office.

“Accrued by calculation” is the tax that must be paid. The tax office makes accrued payments according to the declaration, from which it finds out when and how much the individual entrepreneur must pay.

Columns 4-8 indicate information about the document on which the entry was made. So, for a declaration, the date of submission to the tax office is indicated, and for a payment order, the date of debiting from the current account. The “Type” column contains encrypted documents:

RNAlP - accrued by calculation (information from the declaration or tax calculation).

PlPor - payment order.

PrRas - software calculation of penalties.

PS - collection

Column 9 “Type of payment” can include tax, penalties and fines.

Columns 10-12 indicate the amounts. The entrepreneur’s payments go into the “Credit” column, and the accrued tax goes into the “Debit” column.

Columns 13 and 14 “Balance of settlements” summarize the debt or overpayment on an accrual basis. The “+” sign indicates the taxpayer’s overpayment, and the “–” sign indicates the taxpayer’s overpayment. The settlement balance is divided into two columns: “By type of payment” and “By card payments to the budget.” The first contains information on a specific payment - only for tax, penalty or fine. In the second, the total for the card, taking into account tax and penalties.

A detailed transcript of the extract from the above example looks like this:

The simplified tax system tax extract with the object “income” contains information for the period from January 1, 2021 to October 13, 2021. 1. The balance of settlements as of January 1 in favor of the taxpayer (overpayment) is 82,126 rubles. 2. Based on the results of the submitted declaration under the simplified tax system for 2021, on January 10, 2021, the following liabilities were accrued: - for the 1st quarter of 2021, 1,920 rubles. by April 25, 2021 - for the first half of 2021 RUB 10,295. for the period July 25, 2021 - for 9 months of 2021 RUB 69,911. due October 25, 2021 Total RUB 82,162. The obligations were repaid by the overpayment recorded as of January 1, 2021 and the balance of settlements with the Federal Tax Service is 0. 3. According to payment order No. 47 dated January 10, 2021, the amount of 114,760 rubles was received. in payment of tax. Balance RUB 114,760 in favor of the taxpayer (overpayment). 4. According to payment order No. 11 dated April 7, 2021, the amount of 1,720 rubles was received. in payment of tax. Balance RUB 116,480 in favor of the taxpayer (overpayment). 5. The tax liability for the year according to the declaration for 2021 is reflected in the amount of RUB 114,760. due for payment on May 2, 2021. The obligation was repaid by overpayment. The settlement balance is RUB 1,720. in favor of the taxpayer (overpayment). 6. According to payment order No. 55 dated July 6, 2021, the amount of 7,950 rubles was received. in payment of tax. Balance 9,670 rub. in favor of the taxpayer (overpayment). 7. According to payment order No. 66 dated October 5, 2021, the amount of 81,580 rubles was received. in payment of tax. Balance 91,250 rub. in favor of the taxpayer (overpayment). As of October 13, the tax balance is 91,250 rubles. in favor of the taxpayer (overpayment).

This overpayment does not mean that you can ask the tax office for a refund to your current account. If you look carefully, we see that the balance is 91,250 rubles. consists of three payments: – 1,720 from 04/07/2017 – 7,950 rubles. from 07/06/2017 – 81,580 rubles. dated 10/05/2017. These amounts are nothing more than advance tax payments, which are paid every quarter throughout the year. Before submitting the declaration, these payments are listed on the card as an overpayment, but after tax obligations are completed, they will be offset against the tax payment. The deadline for submitting a declaration under the simplified tax system for individual entrepreneurs is April 30 following the reporting year, so in this example, the overpayment will “go away” after submitting the declaration already in 2021.

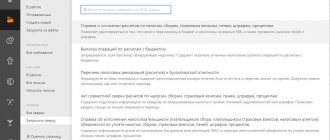

Request for tax reconciliation

You can receive an extract electronically through a reporting system, for example, Elba (section Reporting -{amp}gt; Reconciliation with tax authorities -{amp}gt; Create a request -{amp}gt; Statement for settlements with the budget {amp}lt; indicate the year {amp}gt;). Here and below, click on the image to enlarge.

Starting from 2021, reconciliation with the Federal Tax Service is possible not only for taxes and fees, but also for insurance premiums for periods starting from 01/01/2017. To reconcile insurance premiums from earlier periods, you should contact the Pension Fund and Social Insurance Fund.

Mandatory quarterly reconciliation with the tax office is carried out if the organization is the largest taxpayer. In addition, it is imperative to check with the tax authorities in the following cases:

- liquidation of a company or individual entrepreneur,

- company reorganization,

- transfer of an individual entrepreneur or organization to another inspection.

Reconciliation can be carried out at the initiative of the Federal Tax Service when an overpayment is detected (clause 3 of Article 78 of the Tax Code of the Russian Federation), as well as at the initiative of the individual entrepreneur or organization itself.

In order for the reconciliation to take place at the request of the taxpayer, he should send a request to his inspectorate. An application for reconciliation of taxes with the tax office is drawn up in any form and sent to the Federal Tax Service by a certified letter by mail, electronically on the Federal Tax Service website or via TKS, or submitted by the taxpayer to the inspectorate during a personal visit.

Having received the taxpayer’s application, within 5 working days the inspectors document the results of the reconciliation in a special act and deliver it to the taxpayer in person or by mail. For an application for reconciliation submitted electronically, a report from the tax office will be received only in electronic form.

The current form of the tax reconciliation act, a sample of which is attached below, was approved by order of the Federal Tax Service of the Russian Federation dated December 16, 2016 No. ММВ-7-17/685 and has been applied since January 27, 2017. The act consists of a title page and sections 1 and 2 containing the results of the reconciliation . Sections are formed for each tax, insurance premium and fee separately, according to the BCC assigned to them.

If the indicators reflected in the act do not raise any objections from the taxpayer, in section 1 you must indicate “Agreed without disagreement.” If there are discrepancies with your data, in column 4 of section 1, next to the amounts that cause objections, you need to put down your numbers, and at the end of section 1 write “Agreed with disagreements.” If an act with discrepancies is signed without indicating their existence, this means that this debt has been recognized by the taxpayer.

In section 2 of the reconciliation report, the Federal Tax Service Inspectorate (column 2) and the taxpayer (column 3) reflect information about arrears and overpayments according to their data. Thus, a positive balance in the reconciliation report with the tax office means that the taxpayer has overpaid taxes, insurance contributions, etc. An overpayment may occur, for example, when making advance payments before submitting a tax return, or if the payment slip erroneously indicated a larger amount of tax than accrued, etc.

We invite you to familiarize yourself with: Rights of workers who are not members of a trade union || How a union member is made redundant

The presence of a negative balance in the reconciliation report with the tax office indicates arrears that arose, for example, due to non-payment of tax, or incorrect filling in of the payment order details, as a result of which tax payments were not received by the Federal Tax Service.

Drawing up disagreements is impossible upon receipt of an electronic reconciliation report, since it is intended only to familiarize the taxpayer with the state of his tax calculations, and is not subject to return to the Federal Tax Service (clause 2.22 of the Federal Tax Service order No. ММВ-7-6/196 dated June 13, 2013).

If there are no discrepancies, the reconciliation of settlements with the tax office is considered completed, the taxpayer and the Federal Tax Service official sign the report, keeping one copy each.

If there are disagreements, you should find out their reasons, which may be:

- taxpayer errors when preparing payment documents for the transfer of tax payments, or when reflecting taxes in accounting,

- mistakes made by tax officials when entering data on settlements with the budget into the taxpayer’s card.

To eliminate discrepancies, the taxpayer must provide supporting documents to the Federal Tax Service (bank statements, copies of payment slips, receipts, etc.). If an error is caused by the tax office, a memo is sent to the appropriate department, and no more than 5 working days are given for correction. Based on the updated data, a new reconciliation report is generated and signed within 3 days.

Thus, the period for reconciliation and execution of the act in the absence of disagreements is no more than 10 working days, and if there are discrepancies, no more than 15 working days.

Answers to popular questions

What to do if the tax was paid by payment order with the correct details, but was never received by the tax office?

It happens. You must write an application to the tax office to search for payment. If the payment is not in the card for transactions with the budget, and you have a payment slip in your hands with a bank mark with the correct details, then we write the application in any form. For example, like this:

If errors are made in the payment slip, you can provide the correct details through your personal account in the My Mail section -> Contact the tax authority -> Budget payments -> Application for clarification of payments -> Other payments. In the form that opens, indicate the details of the payment order: number, date and amount.

In the found payment order, you can enter new correct details and immediately generate and send an application for payment clarification.

Still have questions? Need help deciphering your statement? Write to WhatsApp or Telegram and get a consultation.