Tutorial 1C: Accounting 8

In the last lesson, you and I learned how to arrive at inventory items, extras. expenses and services. In this lesson we will continue the topic of acquiring material assets and look at how fixed assets are received by the company. Let's learn how to put them into operation.

We will begin our study of the fixed asset accounting block in the 1C Accounting 8 program with the main reference books related to fixed assets. This is the directory “Fixed Assets” - which contains a list of fixed assets and the directory “Methods of reflecting expenses”, which contains the rules for calculating depreciation on enterprise expenses. Let's get acquainted with other directories in the section related to fixed assets. We will perform the basic operations of purchasing fixed assets that do not require installation. Let's put them into operation. Let's get acquainted with the calculation of depreciation in the 1C Accounting 8 program. At the end, we will complete a practical task.

OS in accounting

In the accounting of an organization, in order to recognize an asset as an item of fixed assets, it is necessary that the following conditions be met in relation to such an item:

- the object is intended to be used for any of the following purposes (clause 4 of PBU 6/01):

- production of products;

- execution of work;

- provision of services;

- management needs of the organization;

- provision for a fee for temporary possession or use.

- the object is intended for use for a period of time exceeding 12 months;

- the organization does not intend to subsequently resell the asset;

- the object is capable of bringing future economic benefits to the organization.

The above means that they are not fixed assets, in particular (clause 3 of PBU 6/01):

- machines, equipment, and other similar objects that are listed as finished products in the manufacturer’s warehouse or as goods in the warehouse of a trading organization;

- objects that have been commissioned for installation or are to be installed, and are also in transit;

- capital and financial investments.

Let us explain what has been said with examples.

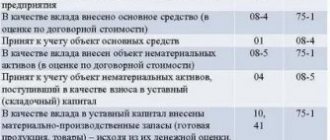

Objects of fixed assets are accounted for by the organization on active account 01 “Fixed assets” (Order of the Ministry of Finance dated October 31, 2000 No. 94n). If we are talking about finished products, then they are accounted for in account 43 “Finished Products”, and goods must be accounted for in account 41 “Goods”. If the organization decides to use the finished products produced by the organization or purchased goods as an object of fixed assets, it is necessary to first reflect the formation of its initial value in the usual manner on account 08 “Investments in non-current assets” (Order of the Ministry of Finance dated October 31, 2000 No. 94n) :

Debit of account 08 – Credit of accounts 43, 41, 10 “Materials”, 60 “Settlements with suppliers and contractors”, 70 “Settlements with personnel for wages”, 69 “Settlements for social insurance and security”, etc.

And then the already formed initial cost of the fixed assets object is included in the debit of account 01:

Directory "Fixed assets".

Let's start studying fixed asset accounting in the 1C Accounting 8 program with reference books. Let's go to the "Reference books" section, "OS and intangible assets" group. Let’s select the directory “Fixed Assets”.

The directory is intended to store a list of fixed assets and information about them.

Information about the fixed asset is filled in upon acceptance for accounting and may change during operation.

The directory has a multi-level, hierarchical structure. To classify fixed assets, you can create groups and subgroups.

When you enter a fixed asset, an inventory number is automatically assigned.

On the Basic Information , you can manually fill in the data:

- Full name - the name of the main tool for filling out printed forms.

- Manufacturer, serial number, passport number, date of manufacture (construction).

- Fixed asset accounting group - category of fixed asset, for example, Buildings, Structures, Transfer devices, etc.

- Type of fixed asset - type of fixed asset: direct fixed asset or capital investment in leased property.

- Depreciation group - depreciation group of a fixed asset.

- OKOF , Code according to ENAOF .

- The Motor transport checkbox is set for motor vehicles.

- Location address and region code.

The Accounting and Tax Accounting tabs contain information on accounting and tax accounting of fixed assets. This information is filled in automatically after the fixed asset is accepted for accounting and put into operation.

You can register the acceptance of a fixed asset for accounting on the Accounting using the hyperlink Enter a document of acceptance for accounting .

An inventory card of a fixed asset (form OS-6) can be generated by clicking the Form OS-6 .

You can add a group of fixed asset objects of the same type, differing only in inventory numbers, to the directory by clicking the Group addition .

In the form that opens, you must indicate:

- The code from which numbering will begin is

- Number of elements created,

- Name of fixed assets.

You can also fill in other information that is common to the objects you are adding.

The number of added objects is limited by the bit depth of the code. For example, specifying the start code 01 means that no more than 99 directory entries can be added automatically. If you want to add more elements in batches, you must add enough bits to the initial code.

Group addition of directory elements is done by clicking the Add . All elements will have the same names and contain the information specified in the fields of the group addition form.

To quickly fill out documents with similar fixed asset objects that have the same names, you need to enter at least one such object into the tabular section. The list of fixed assets will be filled with objects that have the same name as the one originally entered, by clicking the Fill - By name command panel of the tabular section.

Results

Capital investment in accounting is a concept that is inextricably linked with long-term investments and the fixed capital of a company.

Accounting for capital investments is carried out according to the rules prescribed by PBU 6/01, Order of the Ministry of Finance dated October 13, 2003 No. 91n and the chart of accounts (Order of the Ministry of Finance dated October 31, 2000 No. 94n). You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Directory "Methods of reflecting expenses."

The directory is located in the “Directories” section, the “Income and Expenses” group.

The directory is intended to store a list of possible ways to reflect depreciation expenses (repayment of cost) in the costs of the enterprise.

The method of reflecting depreciation expenses is indicated when accepting a fixed asset for accounting, when accepting an intangible asset for accounting, when indicating the purpose of use of work clothes and special equipment.

When entering a method for reflecting depreciation expenses, you must specify the accounting and tax account and the corresponding analytics according to which the depreciation amount should be distributed.

Depreciation costs can be distributed in a certain proportion across several cost items and analytical objects, for example, across several divisions of the organization. To do this, you need to set the values of the distribution coefficients in the K . When calculating the amount of depreciation, the values of the specified coefficients are summed up, and then the amount of depreciation is distributed proportionally to the value of each coefficient.

By default, several elements have already been created in it and note that they are called Depreciation (account 20.01), Depreciation (account 26), Depreciation (account 44).

Capital investments

The result of capital investments, or investments, is the formation of an OS object. Before FAS 26/2020 comes into force in accounting, capital investments are taken into account according to the rules of PBU 6/01. But these assets are quite worthy of being subject to a separate standard.

Capital investments, according to FAS 26/2020, are understood as the costs of an organization for the acquisition, creation, improvement and/or restoration of fixed assets, as defined by the new FAS 6/2020. These are the costs for:

The innovation is that expenses for replacing parts, repair costs, technical inspections, and operating system maintenance will also be considered as capital investments.

Other reference books and documents from the section “Fixed Assets”

They may be hidden by default. If the directory is not displayed in the navigation panel, use the “Navigation settings” command in the right corner. In the left window we present available reference books. On the right are directories that are displayed in the navigation panel. Let's find the "OS and Intangible Materials" group and move all the directories to the right window. Now in the navigation panel in the “OS and intangible assets” group I have significantly more reference books presented. Let's get to know them.

Construction objects - the directory is intended to store a list of fixed assets under construction (modernized, reconstructed, installed).

Information register “OKOF depreciation groups” - the register sets the applied depreciation groups for the OKOF classifier element.

The directory “Annual fixed asset depreciation schedules” is intended for storing depreciation schedules for fixed assets in organizations with a seasonal nature of production.

The use of a depreciation schedule is indicated when accounting for a fixed asset.

The use of a depreciation schedule after accepting a fixed asset for accounting or a change in the depreciation schedule is registered in the document Change of fixed asset depreciation schedules.

When entering a schedule, you need to specify the distribution coefficients of the annual depreciation amount by month. The distribution coefficient will be taken into account when performing a routine depreciation operation.

The ENAOF directory contains a classifier of fixed assets for which standard codes and annual depreciation rates are established.

This directory classifies fixed assets for which depreciation is calculated according to ENAOF.

For motor vehicles, depreciation rates are used as a percentage of the cost of the car per 1000 km.

Code for ENAOF is indicated for fixed assets in the Code for ENAOF .

The OKOF directory contains an all-Russian classifier of fixed assets.

The directory is used to classify fixed assets when accepted for accounting to determine the depreciation group.

The OKOF code is indicated for the fixed asset in the OKOF .

The directory “Parameters for the production of fixed assets” is intended for storing a list of natural indicators, in proportion to the volume of which depreciation of fixed assets can be calculated.

The directory “Reasons for writing off fixed assets” is intended to store a list of reasons for writing off fixed assets.

Directory “Events with fixed assets” - is intended for storing a list of events with fixed assets of the organization, for example, acceptance for accounting, relocation, modernization, etc.

For each event, you must select Event Type .

When registering fixed asset accounting documents, a value from the reference book is selected in the Event .

The document “Receipt (act, invoice)” is intended to reflect various operations for the receipt of goods and services.

Document “Receipt of additional expenses" - is intended to reflect the services of third-party organizations, the costs of which are included in the cost of goods.

The document “Transfer of equipment for installation” is intended to include the cost of equipment and components requiring installation in the costs that form the initial cost of fixed assets.

The document “Receipt (act, invoice)” is intended to reflect various operations for the receipt of goods and services.

The document “Acceptance for accounting of fixed assets” is intended to reflect the acceptance for accounting of fixed assets.

The document “Movement of fixed assets” is intended to reflect the movement of fixed assets to another division and (or) to another financially responsible person.

The document “OS Modernization” is intended to reflect the modernization (reconstruction) of fixed assets.

The document “Inventory of fixed assets” is intended to reflect the results of the inventory of fixed assets.

The document “Write-off of fixed assets” is intended to reflect the write-off of fixed assets.

The document “Preparation for the transfer of fixed assets” is intended to reflect preparation for the transfer of ownership of fixed assets if the sale transaction is subject to state registration.

The document “Transfer of fixed assets” is intended to reflect the sale of fixed assets.

The document “Production of fixed assets” is intended to register the volume of produced products (work performed) for calculating depreciation of fixed assets.

The document “Changing depreciation schedules of fixed assets” is intended for changing depreciation schedules of fixed assets in organizations with a seasonal nature of production.

The document “Changing the special coefficient for calculating depreciation of fixed assets (tax accounting)” is intended for changing the special coefficient for calculating depreciation of fixed assets in tax accounting.

The document “Changing the methods of reflecting expenses for depreciation of fixed assets” is intended to change the method of reflecting expenses for depreciation of fixed assets - cost accounts and analytics, which include expenses for depreciation of fixed assets.

The document “Changing the parameters for calculating depreciation of fixed assets” is intended for changing the parameters for depreciation of fixed assets.

The document “Change in the state of fixed assets” is intended to suspend or resume the calculation of depreciation on fixed assets.

The document “Registration of payment for fixed assets and intangible assets for the simplified tax system” is intended for registration in the tax accounting of the simplified tax system of information on payment to the supplier of fixed assets, intangible assets and modernization costs.

The document “Registration of payment for fixed assets and intangible assets (IP)” is intended for registration in the accounting of individual entrepreneurs of information on payment to the supplier of fixed assets and intangible assets.

The report “Fixed assets depreciation sheet” is intended for analyzing data on fixed assets. In the report, you can analyze accounting and tax accounting data, set a selection by materially responsible person, display the date of acceptance for accounting, etc.

The report “Inventory book of fixed assets” - an inventory book of accounting for fixed assets in the OS-6b form (approved by Decree of the State Statistics Committee of Russia dated January 21, 2003 No. 7) is used by small enterprises to record the availability of fixed assets, as well as their movement within the organization. The inventory book is kept in the accounting department of the organization in one copy.

By use, fixed assets are divided into operating, spare and inactive (mothballed), and by ownership - into owned and leased.

[p.91] Fixed assets of enterprises or individual workshops, the temporary cessation of operation of which is documented in the prescribed manner, are considered inactive (mothballed). [p.91] Physical wear and tear occurs both due to prolonged operation and due to the inactivity of fixed assets. The degree of wear (30%, 25% or any other relative number) indicates not so much the loss of usability, but rather the period remaining before loss of usability. Fixed assets (funds, capital) are characterized by the fact that they, as a general rule, retain their suitability for functioning until the end of their service life. [p.341]

Physical wear and tear is the gradual loss of fixed assets of their original consumer value, both during their operation and inactivity. In turn, physical wear and tear is divided into complete and partial. Complete wear and tear occurs when existing assets are eliminated and replaced with new ones. Partial wear and tear is compensated by repairs. [p.199]

Subsection II Fixed Assets reflects the cost of all fixed assets of the organization listed on its balance sheet, including those leased, provided free of charge, for gratuitous use, or inactive (mothballed, in reserve, etc.). [p.84]

According to clause 118 of Order No. 60n of the Ministry of Finance of the Russian Federation, the Certificate must show the cost of fixed assets provided free of charge, for gratuitous use, inactive (those under conservation, in reserve, under restoration, the period of which exceeds 12 months, etc.). [p.158]

Not all fixed assets owned by an organization are used at the same time. A significant part of them is in operation. But in order for the production process to proceed without interruption, each organization must have a known stock of fixed assets in stock, so that in the event of an object being taken out of service (due to an accident, repair), it can be replaced. The management of the organization is not indifferent to what share of the total cost these groups of fixed assets occupy. Therefore, in accounting they are divided into active (in operation), spare (in reserve) and inactive (in conservation). This classification (grouping) ensures the calculation of depreciation (for example, accelerated depreciation on the active part of fixed assets). In addition, organizations have fixed assets that, for one reason or another, turned out to be redundant; they are subject to sale or transfer to other parts of the organization or legal entities on a lease basis. [p.37]

Based on the invoice data and the notice of stopping or starting up, a mark is made in the depreciation and temporary inactivity column of the inventory card (date, document number), and the card is transferred to the section of inactive fixed assets when the object is stopped, and when starting up, it is returned to its place in the main file cabinet. [p.45]

From the data on the cost of production fixed assets separately (see references to section 3 of the sample form of the Appendix to the balance sheet), data at the beginning and end of the reporting period on the cost of fixed assets leased (by type of fixed assets), provided free of charge, gratuitous use, inactive (those under conservation, in reserve, under restoration, the period of which exceeds 12 months, etc.). [p.375]

In addition, the cost of production is highlighted, i.e. used in generating income from ordinary activities, and non-productive (not used in ordinary activities) fixed assets. From the data on the cost of production fixed assets, fixed assets leased out and inactive are identified separately (in the reference to section 3), i.e. under conservation, property that is pledged. The information in this subsection details the relevant data in the balance sheet item Fixed Assets. [p.78]

The subsection reflects the cost of all fixed assets of the organization listed on its balance sheet, including certain types of fixed assets leased, provided free of charge or inactive (on conservation, in reserve, etc.). Data are given at replacement or original cost. [p.181]

Equipment purchased but not installed, mothballed fixed assets are not depreciated at all according to the accepted procedure. The exception is the means of labor that are repaired and temporarily inactive due to production conditions; their cost continues to be transferred to the extracted and produced products. Thus, the depreciation fund of an enterprise represents the accumulated cost of existing production fixed assets in the part transferred to the cost of manufactured products in proportion to their wear and tear in socially necessary amounts. The purpose of this fund is to provide compensation for the wear and tear of consumed means of labor through renovation, i.e. restoration of their value. [p.119]

Based on their use, fixed assets are divided into active ones, which include means of labor that function during the construction process both in the main and in auxiliary production, and inactive ones, which are considered to be assets at the stage of disposal due to their wear and tear, conservation or in stock [p.69]

Based on their participation in the production process, a distinction is made between operating and inactive fixed assets. Operating assets include all fixed assets that actually perform their functions, i.e., are in operation. The presence of fixed assets under repair does not exclude them from the number of operating ones, which should stimulate a reduction in the time required to repair objects. Fixed assets in stock (reserve) and conservation are considered inactive. The transfer of fixed assets for conservation is carried out with the permission of the relevant organizations and is formalized by a special act. Classification of fixed assets based on their participation in the production process is important for the correct calculation of depreciation and control over the use of fixed assets. [p.38]

INVENTORY OF PRODUCTION FIXED ASSETS is a method of accurately establishing the actual presence, composition and condition of fixed assets at a certain moment. During the inventory, each enterprise compares the physical presence of machines, mechanisms, engines, vehicles and other production fixed assets with those listed on the balance sheet. When discrepancies are identified, the causes are identified and measures to eliminate them are outlined. Based on the results of the inventory, measures are developed and implemented to bring the availability and composition of fixed assets in accordance with the real conditions and objectives of production development. Inventory allows you to identify uninstalled equipment, as well as installed but inactive equipment, and determine the reasons for inaction. During the inventory, equipment that is unnecessary for the enterprise is identified and must be sold externally with the proceeds credited to the fund for the development of production, science and technology. At the same time, the state of accounting for fixed assets is assessed, its cor- [p.88]

Depending on the degree of use, fixed assets are divided in accounting into active, inactive and in reserve. As part of inactive fixed assets, machine tools, machines, vehicles and inventory that are redundant and unused at a given enterprise are especially distinguished. [p.81]

In subsection I “Intangible assets”, in particular, under the article “Business reputation of the organization”, the excess of the purchase price of privatized property over its estimated (initial) value is shown, reflected in the debit of account 04, subaccount “The difference between the purchase price and the estimated value”. Subsection II “Fixed Assets” reflects the cost of all fixed assets of the organization listed on its balance sheet, including those leased, provided free of charge for use or inactive (being mothballed, in reserve, etc.). [p.85]

Subsection I of Form No. 5 reflects the cost of all fixed assets listed on the balance sheet of the enterprise, including fixed assets leased, provided free of charge or inactive (being mothballed, in reserve, etc.). [p.73]

Based on the nature of their use, fixed assets are divided into active and inactive (mothballed) and in reserve. [p.85]

The group of inactive fixed assets consists of fixed assets in stock (inactive equipment, tools, rolling stock, wheelsets), fixed assets in transit (equipment, mechanisms and tools dismantled and transported to other enterprises), materials of the upper structure removed from the road , but not written off from the balance sheet due to unsuitability of fixed assets that are under conservation. [p.310]

In addition, on railways, inactive fixed assets include [p.604]

When it is discovered that this or another object is not recorded in the same group of fixed assets to which it belongs according to its technical and economic characteristics, as well as when. transferring objects from operating to inactive or vice versa, transfer from group to group is made on the basis of invoices with correspondence on the debit and credit of the fixed assets account. [p.605]

Depreciation deductions are not made from the cost of inactive and leased assets; deductions from the cost of leased fixed assets are reflected by the lessor in its balance sheet. [p.606]

Based on their use, fixed assets are divided into operating, in reserve and inactive. From among the existing fixed assets, equipment, vehicles, tools, inventory, etc. that are surplus and not used at the enterprise are separated into a special group. This division of fixed assets is associated mainly with monitoring their condition and calculating depreciation. [p.77]

In the groups listed above, operating fixed assets are taken into account, i.e. those in operation, and inactive fixed assets, i.e. not in operation, are allocated to a special group called Spare equipment. [p.305]

For equipment and vehicles that are inactive and in reserve (in reserve in a warehouse) and listed on the balance sheet of an operating enterprise (organization), depreciation and amortization are accrued, but only for complete restoration. The accrual of depreciation and depreciation continues for those fixed assets that are fully (100%) depreciated, but are still in operation, since depreciation and depreciation are accrued not for individual objects, but for the enterprise or organization as a whole. The accrued amount of depreciation is indicated at least once a year in the inventory cards for object-by-object accounting of fixed assets. [p.168]

Depending on how objects of production and economic activity are used, operating, in reserve and inactive fixed assets are distinguished. This division is necessary to obtain information about the load and efficiency of use of fixed assets, the possibility of replacing worn-out assets, taking measures to transfer or sell unnecessary assets to other enterprises, as well as the correct calculation of depreciation for inclusion in production costs. Operating fixed assets include fixed assets used in production and economic activities. Those in reserve are intended to replace existing ones during repairs, modernization or complete retirement. Dormant ones are those that are not used for various reasons. [p.40]

During operation, fixed assets gradually lose their consumer and physical qualities and become unsuitable for use. The same thing happens when the means of labor are inactive due to the influence of storage conditions and other factors. Material wear and tear of fixed assets is called physical wear and tear. Along with it there is obsolescence. It is expressed in a reduction in the cost of basic [p.48]

According to the degree of use, fixed assets are divided into active ones, those in operation, and inactive ones, those that are in storage or in reserve. [p.130]

Physical wear and tear of fixed assets is the loss of consumer value of fixed assets due to their intensive use, as well as inaction and the impact of natural forces on them, due to which fixed assets are destroyed and become unsuitable for further use. [p.241]

This subsection provides a breakdown of fixed assets by their types according to the All-Russian Classifier of Fixed Assets. The subsection shows the cost of all fixed assets listed on the organization’s balance sheet, including certain types of fixed assets, leased, provided free of charge or inactive (on conservation, in reserve, etc.). The data is given at replacement or initial cost. The item total shows the movement of production and non-production fixed assets on separate lines. Information source accounting data for account 01 Fixed assets. [p.794]

The difference between the proceeds from the sale of products at the wholesale price of the enterprise and its cost constitutes profit, which is the net income of the state enterprise. Part of the profit remains at the disposal of the enterprise, and the other part is sent to the state budget in the form of payments for the use of production assets. Payment for funds provides for their better use, since it is charged regardless of the intensity of their work, and, therefore, with the intensification of the functioning of production assets, the payment per unit of output or work performed is reduced. If an enterprise does not use any equipment in the production process, then in this case it also pays for idle funds. As a result, the profit of the enterprise (association) decreases and its profitability decreases. On average, in the gas industry, payments for production assets are taken equal to 6% of their value, including fixed production assets and working capital. [p.59]

As production and consumption occur, physical wear and tear of the means of labor occurs and, accordingly, a decrease in the cost of the means of labor occurs. The quantitative decrease in use value that occurs during physical wear and tear is accompanied by a decrease in value. Physical wear and tear of labor tools can also occur when they are inactive. In this case, it is not compensated. A decrease in value can also occur as a result of obsolescence. To compensate for the advanced cost of the means of labor, the transferred value is accumulated in cash until a certain period, in order to then turn into the physical form of the means of labor. Consequently, wear and replacement of means of labor constitute different stages of a single process - AA can be straightforward and uniform. It is calculated in proportion to the cost of fixed assets and is distributed evenly over the entire expected life of their operation. It is also possible to calculate depreciation based on the amount of the expected beneficial effect (for example, mileage of a car). In this case, depreciation is calculated per unit of useful effect and is accrued depending on actual use. In addition to uniform depreciation can be accelerated, [p.15]

The rationalization of work practices and methods cannot be approached with pre-made decisions. Each operation or work has its own characteristics, requiring in each specific case the search for original solutions. However, all work methods have similar features that are common to all types of work. This circumstance made it possible to develop the following basic principles of economy of movements and naturalness of movements. Natural movements are easy and best suit the characteristics of the human body. Any work should be performed with the smallest possible number of simple and short movements, which should be smooth, rounded, with rational use of active and passive forces. This remark is easy to understand by considering the structure of the human body. So, the hand moves in an arc with the center at the elbow or shoulder. The leg rotates from the knee or hip. When turning the body, the shoulders describe an arc. Taking into account these features is ensured by the rational arrangement of equipment controls, objects and means of labor in the workplace, the use of reverse movements after moving objects, and maintaining a constant location of objects of labor and tools. Objects of constant use should be located within the optimal working area, if possible at the level of the worker’s hands. Objects that the worker takes with his right hand should be placed on the right, and with his left - on the left, accordingly, the simultaneous movement of various organs of the body. It lies in the need to ensure the simultaneous participation of both hands of the worker in the labor process, the parallel action of various organs, for example, arms and legs. If one hand is working, the other should not be idle. It is necessary that both hands not only perform useful work, but also combine their work in time. This is easily achieved if both hands do the same work. In cases where it is impossible to perform homogeneous work with one object with both hands, it is necessary to load both hands with different work. This approach will not only lead to a reduction in time, [p.95]

INVENTORY OF PRODUCTION FIXED ASSETS is a method of accurately establishing the actual availability, composition and condition of fixed assets at a certain moment. During the inventory, each enterprise compares the actual availability of machines, mechanisms, engines, vehicles and other production fixed assets with those listed on the balance sheet. When discrepancies are identified, the causes are identified and measures to eliminate them are outlined. Based on the results of the inventory, measures are developed and implemented to bring the availability and composition of fixed assets in accordance with the real conditions and objectives of production development. Inventory allows you to identify uninstalled equipment, as well as installed but inactive equipment, and determine the reasons for inaction. During the inventory, equipment that is unnecessary for the enterprise is identified and must be sold externally with the proceeds credited to the fund for the development of production, science and technology. At the same time, the state of accounting of fixed assets is assessed, its compliance with the requirements for ensuring their safety, correct reflection in the accounting of the processes of receipt, disposal, wear and overhaul of fixed assets. During an inventory, all fixed assets available at the enterprise are entered into the inventory [p.89]

Conservation (from Latin onserva-tio - preservation) is a technical measure of protection against corrosion of fixed assets (machines, machine tools, equipment, etc.) during a period of long-term inactivity (storage) Objects located on K- do not participate in the process production. They are not subject to depreciation. At socialist enterprises, cash can only be used in certain exceptional cases. [p.65]

Conservation (from Latin onservatio - preservation) - technical measures to protect against corrosion of fixed assets (machines, machines, equipment, etc.) during a period of long-term inactivity (storage). Objects located on K. do not participate in the production process. They are not subject to depreciation. [p.91]

Increasing the time of use of fixed assets in the calendar period by eliminating the inactivity of drilling rigs (not related to the non-working period), preventing accidents and downtime - rhythmic work, extending the overhaul period of fixed assets based on improving their repair and operation, accelerating repair work, improving equipment designs and tools, improving quality auxiliary materials, etc. [p.296]

Financial intermediation is beneficial in many circumstances. First, not all savers are financial specialists who understand the intricacies of lending and borrowing operations. Secondly, even having certain knowledge in such operations, the saver, by resorting to the services of professionals, is freed from the need to search for a specific investment option, i.e., he saves his own time and resources for pursuing his main business. Third, the saver's money gets to work when it might otherwise have been idle. Fourth, the saver receives income by essentially forcing the financial intermediary to effectively use the funds he receives. Fifth, with the help of intermediaries, risk can be diversified, reduced, or transferred to another party. Sixth, financial intermediaries can accumulate large amounts of funds and, once concentrated, invest them in projects potentially beyond the reach of small investors or savers. [p.61]

Receipt of fixed assets

Let's move directly to accounting for fixed assets and create the first document related to the receipt of fixed assets in our company.

Go to the “OS and Intangible Materials” section of the “Equipment Receipts” magazine. Let's create our first document:

We receive equipment from the supplier:

- Invoice 1501 dated 01/15/2015, invoice 1501 dated 01/15/2015

- Supplier LLC "KVADROKOM" INN/KPP: 5027147377/ 770301001

- OGRN: 1095027003367

- Address 123242, Moscow, Sadovaya-Kudrinskaya street, building No. 11, building 1, apartment Room 2P-14

- Automatic striping machine. EXS 108 1 pc. RUB 1,180,000.00 each

Total: RUB 1,180,000.00 incl. VAT 180,000.00

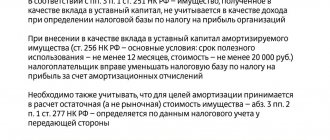

Discrepancies between accounting and tax accounting

In Russian practice, contradictions often arise between accounting standards and the Tax Code (TC), and one of them is associated with the minimum threshold of value, starting from which an object can be classified as a fixed asset.

In particular, according to accounting rules, all assets are more expensive than 40 thousand rubles. are fixed assets, and the Tax Code of the Russian Federation states that only those objects whose cost exceeds 100 thousand rubles can be classified as them. That is, everything that is cheaper is immediately transferred to current expenses and is not further depreciated (Table 4). Table 4. Discrepancies between BU and NU, example

| Price | NU Rules | Accounting rules |

| up to 40 thousand rubles. | transfer to current costs | Options are possible: we classify them as materials and immediately transfer them to costs. — we recognize it as a depreciable fixed asset. |

| from 40 to 100 thousand rubles. | transfer to current costs | recognize as depreciable fixed assets |

| more than 100 thousand rubles. | recognize as depreciable fixed assets | recognize as depreciable fixed assets |

This reporting difference results in deferred tax assets and deferred tax liabilities, which are scheduled to be settled when the differences arise. Fixed assets are one of the key areas of accounting. Correct reflection of their value not only leads to a natural increase in property taxes, but also gives the entrepreneur an important advantage - by calculating depreciation on fixed assets, he fully returns the initial investment. We recommend watching a video on the topic “Fixed assets of an enterprise”

Acceptance for accounting of fixed assets that do not require installation

Now we need to put the acquired fixed asset into operation. To do this, a document “Acceptance for accounting of fixed assets” is created in the 1C Accounting 8 program. You can create it in the journal of documents of the same name.

We will formalize the acceptance for accounting of the OS:

- Date: 01/31/2015

- MOL: director

- Location: Production workshop

- Equipment: Automatic striping machine. EXS 108

- Main tool: Automatic striping machine. EXS 108 OS accounting group: Machinery and equipment (except office)

- Depreciation group: Fourth group (over 5 years up to 7 years inclusive)

- Manufacturer: Factory

- Serial number: 1111

- Passport number (registration): 222

- Release (construction) date: 01/01/2015

- Method of receipt: Purchase for a fee

- The procedure for including cost in expenses: Calculation of depreciation

What objects are considered fixed assets

Russian Accounting Regulations 6/01 (hereinafter PBU) provides clear criteria that an object must satisfy in order to be included in the OS. There are four of them in total. Firstly, the asset must be used to manufacture products, solve management problems, provide (sell) services to consumers, or be provided to the organization’s clients for a fee:

- In the case of production, we are talking about machines, machines, wells, infrastructure facilities, structures, buildings, etc.

- Management tasks are most often solved with the help of computers, other office equipment and cars.

- An example where fixed assets are used to provide services is a restaurant premises with counters, refrigerators, tables, chairs, etc.

- Well, in the case of the transfer of fixed assets for a fee, the rental and leasing business is usually understood.

Secondly, the asset must participate in the organization's activities for at least one year.

Thirdly, an object can be reflected as fixed assets only if the company does not plan to sell it soon. For example, if a company purchases a machine for the production of metal molds, it will definitely fall into the OS category. But if the same equipment is purchased by a dealership, it will be reflected in the reporting as a current asset, since it is used as a regular product. And the last criterion is that the specificity of the object is such that it is truly capable of bringing tangible benefits.

Depreciation calculation

Depreciation is calculated using the document “Regular operation” with the type of operation “Depreciation and depreciation of fixed assets”. It is intended to reflect period-closing transactions. Period closing operations are carried out once a month. It is important to follow the sequence of performing routine operations. The Month End Assistant will perform all the necessary month end operations in the correct sequence. As a rule, it is not necessary to create documents manually.

At this point, the consideration of fixed assets can be considered complete. Proceed to the practical task.

What costs are not included in capital investments?

FSBU 26/2020 “Capital investments” do not apply when an organization performs work, provides services for the creation/improvement/restoration of means of production for other persons and the acquisition/creation of assets intended for sale.

As a result of such costs, assets do not arise that meet the OS criteria under FAS 6/2020. In particular, the criterion of the asset being used by the entity itself for a period of more than 12 months or a normal operating cycle of more than 12 months is not met.

The same applies to long-term assets for sale. In addition, their accounting is regulated by PBU 16/02 “Information on discontinued activities.”

Read in the berator “Practical Encyclopedia of an Accountant”

Transfer of fixed assets to long-term assets for sale

Practical task

Register the receipt of equipment:

- Supplier: KVADROKOM LLC

- Agreement: 1601 dated 01/16/2015

- Invoice 1601 dated 01/16/2015, Invoice: 1601 dated 01/16/2015

- Equipment: Automatic striping machine. Ergonomic pallet strapping system ErgoPack 725E – 1 piece for 720,000 rubles.

TOTAL: 720,000.00 incl. VAT 109,830.51

Register the OS for registration:

- Date: 01/31/2015

- MOL: director

- Location: Production workshop

- Equipment: Automatic striping machine. Ergonomic pallet strapping system ErgoPack 725E

- Main equipment: Automatic striping machine. Ergonomic pallet strapping system ErgoPack 725E OS accounting group: Machinery and equipment (except office)

- Depreciation group: Fourth group (over 5 years up to 7 years inclusive)

- Method of receipt: Purchase for a fee

- The procedure for including cost in expenses: Calculation of depreciation

Register the receipt of equipment:

- Supplier: LLC "COMMERCIAL VEHICLES - GAZ GROUP" INN/KPP: 5256051148/ 525601001

- OGRN: 1045207058687

- Address: 603004, Nizhny Novgorod region, Nizhny Novgorod, Ilyich Ave., building No. 5

TOTAL: 680,000.00 incl. VAT 103,728.81

Register the OS for registration:

- Date: 01/31/2015

- MOL: director

- Location: Administration

- Equipment: GAZelle NEXT

- Fixed asset: GAZelle NEXT Fixed asset accounting group: Vehicles

- Depreciation group: Third group (over 3 years up to 5 years inclusive)

- Motor transport: Yes

- Vehicle registration: Vehicle type code: 51004

- Identification number (VIN): 4564134

- Make: GAZelle NEXT

- Registration plate: а777кв77

- Engine power: 120.00 hp

- Tax rate: 45.00

- Method of receipt: Purchase for a fee

- The procedure for including cost in expenses: Calculation of depreciation

Calculate depreciation for the month of January.

Next Previous

These features are available to both users of local versions and cloud solutions, for example 1C:Fresh, 1C:Ready Workplace (WWW) . To purchase boxed versions or rent the 1C:Accounting 8 program in the cloud, please call +7(499)390-31-58, or e-mail: [email protected]

We recommend that you read the sections

Directories. Documentation. Operations.

| Setting up functionality in the 1C Accounting 8.3 program |

| Purchase of goods and materials and settlements with suppliers |

| Closing a period in 1C Accounting |

| Preparation of regulated reporting |