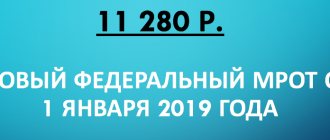

Federal Law No. 41-FZ dated 03/07/2018 on increasing the minimum wage from May 1, 2021 establishes that the minimum wage from May 1, 2021 should be 11,163 rubles per month.

Thus, from 01.05. 2021, an increase in the minimum wage will be introduced based on the subsistence level of the working-age population for the second quarter of the previous year. Previously, it was assumed that this rule would be introduced only from January 1, 2021.

What will the new minimum wage affect?

The federal minimum wage conditionally affects the minimum wage in each region. The latter is established by the constituent entities of the Russian Federation. However, the minimum level of earnings in the region should not be less than the federal indicator (Article 133.1 of the Labor Code). In some cases, on the contrary, it is much greater than the federal value - for example, in the far north.

The regional minimum is increased depending on the economic situation of the subject and territorial conditions. To do this, the federal minimum wage is multiplied by the coefficients established in the constituent entities. Such decisions are recorded in the regulatory acts of the subjects.

The federal law on increasing the minimum wage from May 1, 2021 in Russia will affect many payments:

- temporary unemployment benefits;

- for pregnancy and childbirth - for the period when the woman is unable to work;

- for child care.

Increase in the minimum wage from May 1, 2021

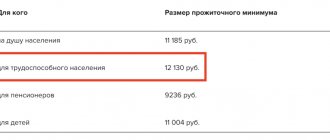

The purpose of increasing the minimum wage was to equate it to the subsistence level - the amount of money required by a person to pay for basic needs. The monetary expression of the latter was taken based on the results of the 2nd quarter of 2021, when per capita of the working-age population per month there were 11,163 rubles. (the amount is established by the norms of government Decree No. 1119 dated September 19, 2017).

The document that fixed the minimum wage from May 1, 2021 is Law No. 82-FZ dated June 19, 2000 (last updated by Federal Law No. 41-FZ dated March 7, 2018). In Art. 1 of the law indicates a new minimum wage level of 11,163 rubles, equal to the subsistence level.

The increase in the minimum wage from May 1 is significant in comparison with previous changes in the indicator:

- in 2014, the minimum value was equal to 5,554 rubles;

- in 2015 the figure was updated - 5,965 rubles;

- in 2021 it increased to RUB 6,204. since the beginning of the year, and since July the value has increased to 7,500 rubles;

- from July 2021, a minimum of 7,800 rubles was in effect;

- from the beginning of 2021, the growth was recorded at RUB 9,489;

- The minimum wage has been increased to 11,163 rubles from May 1, 2021.

Those. in 4 years the minimum wage has more than doubled. The specified limit on the income of able-bodied persons is federal; it applies to business entities throughout the country. Regions have the right to change this value, but only upward. A decrease in the value recorded by federal authorities is not permitted.

Minimum wage and benefits

The regional minimum wage does not affect all benefits or for every employee. For example, to calculate sick pay and allowance for caring for a child up to 1.5 years old, the average daily earnings are taken into account. However, in some cases, the calculation is carried out taking into account the minimum wage:

- the employee does not have a salary in the billing period, or his earnings are below the minimum wage;

- less than six months of experience;

- the employee did not follow the prescribed treatment regimen, and the doctor made a corresponding note on the sick leave;

- The cause of illness or injury is alcohol intoxication.

It is worth taking a closer look at the calculation of hospital compensation and child care payments in accordance with the minimum wage level.

What is the minimum wage

This indicator is regulated by the Federal Law of the Russian Federation. The document states that the minimum wage can be revised several times a year, which may be caused by the difficult economic situation in the country. In fact, the minimum wage is a basic monetary value fixed at the federal level.

The employer does not have the right to pay a monthly salary below the current minimum wage. There are 2 types of minimum wages - regional and federal, the calculation of which differs slightly from each other.

It is worth noting that not only the subject’s salary, but also the payment of social benefits, sick leave and child care benefits, as well as other material subsidies depend on the size of the minimum wage. From November 27, 2021, insurance premiums paid by individual entrepreneurs no longer depend on the current minimum wage rate.

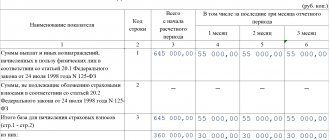

Calculation of sick leave according to the minimum wage

In the cases mentioned above, sick leave payments are determined by the level of the minimum wage. To calculate sickness compensation in 2021, you can take the following example:

- A new employee got a job at the company. There was a difficult economic situation in his region, so from 2016 to 2021 he did not work. After a month of staying in the organization, he went on sick leave, and a week later he presented sick leave to the HR department for 5 days.

- Since the employee did not receive a salary during the estimated time, accounting relies on minimum wage indicators. First, the average salary is determined as 11,163*24 months/730 days. = 367 rubles.

- If the employee’s work experience is 4 years 2 months, the benefit will be equal to 60% (less than 5 years). Payments are calculated in this way - 367 * 5 * 60% = 1101 rubles.

Similar situations arise for employees who have returned from maternity leave.

The percentages used for calculation depend on the length of service of the employee:

- less than 8 years - daily earnings are multiplied by 100%;

- 5-8 years – guarantee of payment of 80% of daily earnings;

- For working experience of no more than 5 years, the bonus is 60%;

- If you have less than six months of experience, the amount is calculated from the minimum wage.

To apply for sick leave benefits, the employee must submit an application for compensation within a month. Otherwise, the funds due to him will not be paid.

For what settlements with employees is the minimum wage still applied?

The minimum wage is taken into account when calculating sick leave for illness, as well as for pregnancy and childbirth. If at the time of issuing the certificate of incapacity for work, the employee’s work experience is less than six months, the salary is below the established minimum wage, or there was a violation of the hospital regime, then the benefit is calculated from the amount of the minimum wage.

From January to April, the average daily earnings for calculating benefits will be 311.97 rubles (9,489.00 rubles x 24 months / 730 days), and from May - 367.00 rubles (11,163.00 rubles x 24 months / 730 days).

Child care allowance

In 2021, payments to employees on maternity leave are made both when raising a child under 1.5 years old, and when caring for a child under 3 years old. The employee receives the following guarantees:

- Benefit from the Social Insurance Fund budget until the child reaches 1.5 years of age (Law No. 81-FZ).

- Compensation payments from the company until the child is 3 years old.

If a baby is born in 2021, a new payment will be provided for the birth of the first child in the family.

In 2021, the employee receives 40% of the month's salary as payment for maternity leave. It can be calculated using the following formula:

Benefit = average monthly earnings * 40%.

When an employee’s average earnings are less than the minimum wage, the benefit is calculated based on the minimum wage:

Monthly care allowance = minimum wage (at the start of leave) * 40%.

In this case, the amount of payment must be no less than the minimum established indicator (Law No. 255-FZ).

Regional minimum wage

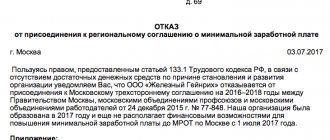

The federal law establishes the size of the minimum wage - the same for all of Russia. But we know that the economic conditions and production base in the regions are very different. In order to comply with the principles of social justice, a regional minimum wage is established at the level of constituent entities of the Russian Federation. This is permitted by Article 133.1 of the Labor Code of the Russian Federation. It also states that the size of the regional minimum wage cannot be lower than the federal one.

To introduce a regional minimum wage, a tripartite agreement is drawn up between the Government of a constituent entity of the Russian Federation, an association of trade unions and an association of employers or a union of industrialists and entrepreneurs. After its signing and publication, the regional government invites other employers who are not included in the association to join the agreement. This proposal is published in the media.

If within 30 days after publication the employer does not provide a reasoned refusal, he automatically participates in the program to increase employee wages to the level of the regional minimum wage. When submitting a reasoned refusal, the employer is obliged to pay a salary not lower than the federal value.

Forecasts

According to the latest news, the Ministry of Labor plans to increase the minimum wage by more than 50% by 2021. At the same time, consumer price growth is projected for the specified period by 12.5%. This forecast for 2019-2020 is based on a new policy of economic strengthening of the state.

From 2021, the minimum level of earnings will be revised annually so that it is equal to the cost of living for the previous year (2nd quarter). According to officials, increasing the minimum wage will have a positive impact on the solvency of the population.

From May 1, 2021, the minimum wage has increased, reaching the subsistence level. It differs for different regions, but cannot be lower than the figure at the federal level.

Based on materials from investpad.ru

Minimum wage in Moscow: how it was affected by the increase in the federal minimum

One of the regions of Russia that determines its minimum wage using its own algorithm is Moscow. Has the increase in the federal minimum since May 1, 2021 affected the minimum wage in Moscow? No, since this region has long adhered to the linking of the minimum wage introduced in it to the level of the subsistence minimum. In 2021, this link is determined by a tripartite agreement concluded for the region on December 15, 2015 for the period 2016-2018.

The minimum wage amount for Moscow is revised quarterly after summing up the latest results on the cost of living. Moreover, here the rule also applies that a decrease in the cost of living should not lead to a decrease in the minimum wage. It is for this reason that the minimum wage in Moscow remains in the amount of 18,742 rubles. from 10/01/2017 after approval of the living wage for the second quarter of 2021 (Moscow government decree of 09/12/2017 No. 663-PP).

Read about the parameters that determine the level of the subsistence minimum in the material “The size of the subsistence minimum in 2021 in Russia.”

Since the current value of the regional minimum wage in Moscow significantly exceeds the federal minimum, there is no need to change it. This amount is valid for employers who have joined the tripartite agreement concluded in the region. But employers who refused such accession are obliged to focus on the federal minimum wage, and for them the changes in its value that occurred both from 01/01/2018 and from 05/01/2018 turned out to be relevant.

Minimum wages in the regions

In accordance with Article 133 of the Labor Code of the Russian Federation, any region of Russia has the right to establish its own minimum wage. The only condition is that it should not be lower than the federal one. In the northern regions, in addition to the national minimum wage level, bonuses and coefficients are awarded. In Moscow and St. Petersburg, the minimum wage has historically been higher than the national average. The minimum level of wages varied significantly in cities with special working conditions (Norilsk and other industrial areas). Before May 1, 2018, almost three dozen regions of the country had a minimum wage that differed from the national minimum wage. After raising the minimum level to 11,163 rubles, the number of such federal subjects decreased.

Regions in which the minimum wage differs from the national average

| Region | Regional minimum wage (rub.) |

| Moscow | 18742 |

| Saint Petersburg | 17,000 (11,163 for public sector employees) |

| Magadan Region | 19500 – 21060 (depending on territory) |

| Kamchatka Krai | 18360 – 21180 (depending on territory) |

| Irkutsk region | 11163 – 27908 (depending on territory) |

| Krasnoyarsk region | 11163 – 26376 (depending on territory) |

| The Republic of Sakha (Yakutia) | 17388 (11163 – for public sector employees) |

| Yamalo-Nenets Autonomous Okrug | 16299 (including allowances and bonuses) |

| Murmansk region | 15185 (11163 – for public sector employees) |

| Moscow region | 13750 (11163 – for public sector employees) |

| Tula region | 13,000 (11,163 for public sector employees) |

| Nenets Autonomous Okrug | 18567 (11163 – for public sector employees) |

| Tomsk region | 11163 – 16500 (depending on territory) |

| Khabarovsk region | 11163 – 15510 (depending on territory) |

| Republic of Karelia | 11163 – 12100 (depending on territory) |

| Kemerovo region | Cost of living in the region for the previous quarter * 1.5 |

| Volgograd region | Cost of living in the region for the previous quarter * 1.2 |

| Bashkortostan | Federal minimum wage + bonuses, allowances and coefficients (the minimum wage includes only salary) |

| KHMAO-Yugra | Federal minimum wage + regional coefficient |

As mentioned above, the regional minimum wage is irrelevant for employees of budgetary institutions receiving salaries from the federal budget. In addition, in order to avoid a sharp increase in regional budget expenditures, many federal subjects establish an all-Russian minimum wage for all budgetary organizations - both federal, regional and local.

Minimum wage as of January 1, 2021

As of January 1, 2021, the amount of contributions individual entrepreneurs make to social insurance “for themselves” directly depends on this value. In other words, the established payments, which were paid once as an advance for the year in advance, amount to 31.1% of the minimum wage:

- 26% – for compulsory pension insurance.

- 5.1% – for compulsory health insurance.