Amount of authorized capital

The minimum amount of capital is established by the Civil Code and laws on business companies:

- for LLC - 10,000 rubles (Clause 1, Article 14 of Federal Law No. 14-FZ);

- for organizers of gambling through bookmakers or sweepstakes - 600 million rubles (Clause 9, Article 6 of Federal Law No. 244-FZ);

- for banks and credit organizations - from 90 million to 1 billion rubles (Article 11 of Federal Law No. 395-1).

The LLC must maintain the minimum amount of authorized capital throughout its activities. If the amount of net assets turns out to be less than the authorized capital for more than 2 tax periods, the company must either reduce the authorized capital, and if this is not possible, then make a decision on liquidation.

Depositing funds to LLC occurs in compliance with the following rules:

- 10,000 rubles are deposited in cash;

- anything over the minimum size can be entered as property;

- property must have an assessment if the nominal share of the property contribution exceeds 20,000 rubles;

- The deadline for making contributions by the founders is no later than 4 months from the date of state registration.

Types of authorized capital

Let's present the classification as a table:

| Types of management companies | Characteristic |

| Folding | Formed in those organizations that have other constituent documents instead of the Charter (various partnerships) |

| Authorized fund | CC contributed by property |

| Unit trust | Usually takes place in production cooperatives, is the totality of contributions of all members of the cooperative |

Having considered all the theoretical aspects of the formation of authorized capital, the types, methods of its contribution, we will also dwell on what innovations have been introduced and are in effect in 2021.

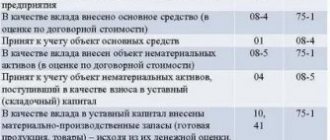

Formation of authorized capital: postings

Each founder contributes his share within the period established in the decision upon establishment, but no later than 4 months from the date of registration of the LLC. If there is more than one founder, the accounting records reflect the debt of each of them in the amount of his share.

Example

The co-founders of the LLC with a declared capital of 60,000 rubles are three individuals. The shares of participants are distributed as follows: 50% of the capital belongs to individual 1, 20% to individual No. 2 and 30% to individual No. 3.

In accounting, the entries for the formation of the management company are as follows:

- Dt 75.01 “Individual No. 1” Kt 80 in the amount of 30,000 rubles;

- Dt 75.01 “Individual No. 2” Kt 80 in the amount of 12,000 rubles;

- Dt 75.01 “Individual No. 2” Kt 80 in the amount of 18,000 rubles.

Thus, on the credit of account 80 the full value of the share capital will be formed in the amount of 60,000 rubles, and on the debit of account 75.01 the debt of each of the founders will be reflected.

The date of the postings must be the next day after the date of registration of the LLC, the content of the postings is as follows: “The debt of the founder has been accrued in the amount of his share.”

Authorized capital of the organization

According to the legislation of the Russian Federation, the minimum authorized capital can be equal to 10 thousand rubles. Initially, it can be formed from contributions of the founders in the form of funds in any currency, securities, rights of use or ownership, various types of property, etc. In the future, the risks that investors may suffer, associated, for example, with bankruptcy or closure of an enterprise, can be calculated based on the organization’s charter and the chosen organizational and legal form of doing business. The fact is that the charter may contain additional obligations.

1. Business partnerships are an association of participants in entrepreneurial activities to conduct joint business. In accordance with the legislation of the Russian Federation, the minimum share capital must be at least 100 times the minimum wage (minimum wage). (1 minimum wage = 100 rubles)

2. Business partnerships (LLC, OJSC, JSC-ZAO AND ALC):

LLC is a limited liability company. A commercial organization that is founded by one or more individuals. The authorized capital of the LLC is in turn divided into shares, respectively, each investor has his own share. And he only risks the loss of property that was transferred as a contribution to the authorized capital. According to the legislation of the Russian Federation, the minimum established amount of authorized capital must be at least 100 times the minimum wage. In turn, the income of the company's participants is also distributed in direct proportion to the size of the shares invested in the authorized capital. A participant in an LLC can leave it at any time and take back his share.

ODO is a company with additional liability. The activities of ODOs are regulated by the LLC rules set out above. The peculiarity of ALC is a unique increase in the risk of the investor. The risk is that the participant's liability is not limited to the amount of his initial contribution to the authorized capital. According to the legislation of the Russian Federation, participants in an ALC bear subsidiary liability. This means that if a company is declared bankrupt and the investor with a larger share cannot pay the debt to the state, then this amount is recovered from another obligatory investor. In addition, in the event of bankruptcy of one of the participants in an ALC, its liability for obligations is distributed among the remaining participants in direct proportion to their contributions to the authorized capital. Thus, it turns out that the greater the contribution the founder makes to the authorized capital of the ALC, the more he is exposed to risks.

JSC is a joint stock company. A commercial organization whose authorized capital is distributed among a certain number of investors (shareholders). The deposit amount is equal to the value of the security (share) that satisfies the rights of a community member. All joint stock companies, in turn, can be divided into open (OJSC) and closed (CJSC). OJSC is characterized by publicity; shareholders can transfer their shares to other persons without the consent of other shareholders. The number of shareholders in the JSC is from 50 people. The minimum authorized capital is at least 1000 times the minimum wage (100 thousand rubles). Each investor risks only the invested capital. If we are talking about a closed joint stock company, then this type of enterprise, unlike an open joint stock company, does not conduct an open subscription for shares; they are distributed among a predetermined circle of people. The number of participants does not exceed 50 people. The minimum authorized capital is at least 100 times the minimum wage (10 thousand rubles).

3. Production cooperatives are a voluntary association of citizens for joint production or other economic activities. This type of enterprise is based on personal and property contributions. The number of members of a production cooperative must be at least five people. In turn, the profit of the artel is distributed among its members in accordance with their labor participation. The risks borne by cooperative members are also directly proportional to contributions to the authorized capital.

In order to decide which form of authorized capital is closest to your organization, you need to answer a number of questions for yourself.

- How many investors plan to contribute their share to the authorized capital of the company?

If the number of investors does not exceed 50 people, then the enterprise can choose any organizational and legal forms other than an open joint-stock company (number of participants - from 50 people).

- What is more important to you: the stability of the enterprise or the maximum protection of investors’ property investments?

To protect the property interests of business participants to the detriment of its stability, it is necessary to form the authorized capital provided for by an LLC, and, conversely, if you want to preserve the business, thereby placing its owners in a less advantageous position, it is necessary to use the type of authorized capital provided for by a closed joint stock company.

- What is the minimum authorized capital you can form based on the shares of all investors?

If this amount is no more than 100 thousand rubles. and not less than 10 thousand rubles, in this case it is possible to form an authorized capital on the basis of ALC, CJSC, economic partnerships and artels. If this amount starts from 100 thousand rubles, then this creates the possibility of forming an authorized capital on the basis of an LLC.

- Do you want joining the ranks of investors to be as simple as possible in the future, or do you want the number of investors to be limited to a narrow circle of people?

The procedure for joining the ranks of investors (shareholders) in organizations such as an open joint-stock company (OJSC) is as simple as possible; The procedure for joining the ranks of a company with additional responsibility (ARS) is a little more complicated; the easiest way to join and leave organizations such as business partnerships and production cooperatives, since these organizations are created on a voluntary basis. The most complex process of increasing or decreasing the number of shareholders is provided for by the charter of organizations of closed joint-stock companies (CJSC).

The choice of the organizational and legal type of the company has a direct impact on the writing of the charter and the formation of the authorized capital, which is intended to become the foundation of the business in the future. We should not forget that over time, the authorized capital can either increase or decrease, depending on the stages of development at which the enterprise is located. But the amount of the authorized capital cannot be unstable, so each change must be reflected in the company’s charter and receive permission from the tax office.

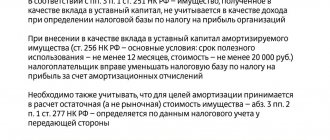

Contribution to the authorized capital: postings

Within 4 months from the date of registration of the Company, the founders must contribute their shares. 10,000 can be deposited only in money, and amounts exceeding the minimum amount of the authorized capital can be deposited with property. Funds are deposited into the cash desk or into the organization's current account, if it is already open.

Contribution of authorized capital to the cash desk, postings: Dt 50 Kt 75.01.

Contribution to the current account: Dt 51 Kt 75.01 - when transferred from an individual’s current account or when deposited through a bank branch.

Property contribution: Dt 01 (04, 10, 41, 58, 66, 76, 97) Kt 75.01 for the amount of property valuation.

When creating the entry “contribution to the authorized capital through the cash register,” you should take into account the cash limit and funds exceeding the limit that can be deposited into the LLC’s current account.

In the process of economic activity, the amount of the capital may change up or down by the decision of the founders.

How to contribute the authorized capital of an LLC

The introduction of the Criminal Code must be carried out in strict accordance with the law. The material presented below can be presented as step-by-step instructions.

You can make a contribution to the authorized capital in different ways:

- In cash;

- By transfer of funds;

- Shares or other securities;

- With the help of property, etc.

It is worth considering that if the management company is formed, say, by property, then an independent appraiser must participate in this procedure.

Most choose simple deposit methods so as not to complicate anything (cash and non-cash). If the share is paid in cash, a cash order is simply issued, as mentioned above. If the contribution is made with property , then it can immediately be used in the activities of the company.

The worst option is to contribute a share with rights to some property (right of use, etc.). The disadvantage of this method is that any rights can be challenged and called into question. Which will entail many legal problems.

Experts recommend stipulating in the contract everything, even the most insignificant points regarding the shares of the founders.

Increase in capital

An increase in the amount of share capital can be made both by the decision of the founders and by legal requirements.

The company considers the issue and makes a decision to increase capital in the following cases:

- lack of working capital;

- accepting new participants;

- additional issue of shares (for joint-stock companies, joint-stock companies);

- acquisition of licenses for activities that require a larger capital amount.

The source of increase in share capital will be either the LLC’s own property, or contributions from new founders, or additional contributions from existing members of the company.

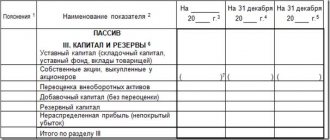

Increase in authorized capital, posting:

| Due to net profit | Dt 84 Kt 80 |

| Due to the contributions of new LLC participants | Dt 75.01 Kt 80 |

| By increasing the contributions of existing participants of the Company | Dt 75.01 Kt 80 |

Decrease in capital

A change in the size of the capital company downward is made either by decision of the owners or as required by law. In both cases, this operation is formalized by a decision of the general meeting of founders with the subsequent submission of documents to the registration authority.

The law requires a reduction in the size of the capital in the event of:

- late payment by the founders;

- if the value of net assets is lower than the authorized capital, that is, in case of unprofitable activities.

If part of the capital is not paid on time, accounting entry Dt 80 Kt 81 “Own shares (shares)” arises for part of the unpaid contribution of the founders. The posting date is the next day after the expiration of the 4-month period from the date of registration of the LLC.

In case of unprofitable activities, part of the capital is directed to repay the loss: Dt 80 Kt 84 “Retained earnings”. The posting date corresponds to the date of the decision to reduce capital to the amount of net assets.

The owners decide to reduce the size of the management company:

- upon withdrawal of a participant from the LLC and payment of his share of participation - Dt 80 Kt 75 “Calculations for contributions to the authorized capital”;

- when the Company redeems part of the capital shares into ownership - Dt 81 “Own shares (shares)” Kt 75.01 “Settlements on contributions to the authorized capital” - with subsequent cancellation of the purchased shares - Dt 80 Kt 81 “Own shares (shares)”;

- with a proportional decrease in the share of participants or the par value of shares. The resulting difference may become the Company’s income - Dt 80 Kt 91.01 “Other income” or paid to participants - Dt 80 Kt 75.01 “Settlements on contributions to the authorized capital”.

The posting dates for capital reductions correspond to the date the registration changes are recorded.

Where is the Criminal Code stored?

Entrepreneurs often ask: where and how is the Criminal Code stored? The fact is that this amount of funds used directly in the process of entrepreneurial activity exists only in documentation.

Funds contributed to the authorized capital are placed in the company's current account. From there they can be distributed for other needs of the organization.

Property (for example, real estate) contributed to the authorized capital must have documents confirming its real value (that’s what appraisers are for).