How the 4-FSS form has changed

The current 4-FSS calculation form was approved by Order No. 381 of the FSS of the Russian Federation dated September 26, 2016; it must be applied starting with reporting for the 1st quarter of 2021. The main difference from the previously valid form is the absence of sections on contributions for disability and maternity, which is why the new form 4-FSS 2017 has significantly decreased in volume.

Otherwise, today’s 4-FSS calculation looks almost the same as Section II of the old form, dedicated to “traumatic” contributions, and does not contain any special innovations.

The new form of Form 4-FSS for the 1st quarter of 2021 consists of a title page and five tables, of which only tables 1, 2 and 5 are required to be submitted. The title and these sections must be submitted even if the policyholder had no accruals at all during the reporting period on "injury". The remaining tables are filled in when appropriate indicators are available.

Form 4-FSS in 2021

If previously the 4-FSS report was intended for all insurance premiums paid to the Social Insurance Fund, then from the beginning of 2021 it reflects exclusively contributions for “injuries”. For the first quarter and half of 2021 Insurers reported using a modified Form 4-FSS, from which sections relating to insurance premiums in case of temporary disability and maternity were excluded.

Form 4-FSS 2021, the new form of which was approved by Order of the FSS of the Russian Federation dated September 26, 2016 No. 381, was used for reporting for the first quarter and half of the year. For a report for 9 months, it is filled out on a form with amendments made by order of the FSS of the Russian Federation dated 06/07/2017 No. 275.

Deadlines for submitting the new form 4-FSS from 2021

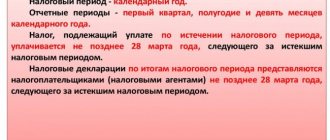

The deadlines for submitting a new calculation for “injuries” remained the same, and depend on the number of employees of the insured (clause 1, article 24 of the law dated July 24, 1998 No. 125-FZ):

- if there are more than 25 employees, then the calculation is submitted electronically, and the deadline for submitting form 4-FSS 2021 is no later than the 25th day of the month, after the reporting quarter;

- if there are fewer employees, then the calculation can be submitted on paper, but in a shorter period of time - on the 20th of the month following the reporting period.

The calculation must be submitted quarterly on an accrual basis. For the 1st quarter of 2021, the electronic form is due on 04/25/2017, and the paper form is due on 04/20/2017.

If the electronic form is not followed when it is necessary, the policyholder faces a fine of 200 rubles. For late submission of Form 4-FSS from 01/01/17, a fine is imposed on only one basis - contributions for “injuries”. For each overdue month, the FSS will collect from 5% to 30% of the amount of contributions excluding benefits paid, but not less than 1000 rubles.

Let us remind you that by April 15, policyholders must confirm their main type of activity by submitting to the Social Insurance Fund a certificate indicating those types of businesses for which income was received in 2021. If this is not done, the Fund will assign the highest class of pro-insurance from all types of activities of the policyholder, which will increase the rate of contributions for “injuries” (Resolution of the Government of the Russian Federation dated June 17, 2016 No. 551).

Filling out form 4-FSS for 9 months of 2021

Changes and adjustments

The Social Insurance Fund made changes to the 4-FSS report form by order No. 275 dated 06/07/2017, and the document must be submitted in the new form, starting with reporting for 9 months.

As a result, the report for the third quarter of the FSS will only be accepted in a new form. The deadline for submitting the report remains the same, without changes. The calculation must be submitted quarterly no later than the 20th day if it is provided on paper, and on the 25th day - in electronic form, in the month following the reporting month.

Let's look at the main changes that need to be taken into account when generating a report:

1) in table 2, rows have been added to reflect the successor organization’s data on the transformed organization or separate division;

2) only budget-funded enterprises make the corresponding entry on the title page;

3) in accordance with the new requirements, the 4-FSS report is required to be submitted electronically by accountants of organizations in which the average number of employees for the previous year is more than 25 people;

4) other organizations choose the form of reporting at their own discretion - in paper or electronic form;

5) by order of the Social Insurance Fund dated March 9, 2017 No. 83, an electronic form was approved for calculating contributions for occupational injuries;

6) enterprises that make payments to employed disabled people, as a result of which they use a reduced rate when calculating insurance payments, or companies that pay additional days off to care for disabled children, are required to present supporting documentation (an extract from a medical and social examination institution, a certificate from parents disabled child, VTEK);

7) in addition, the provision of documents confirming the correctness of the calculation for disabled people and disabled children is mandatory, regardless of whether the reporting is provided in paper or electronic form.

OKVED code on the title page

The changes also affected OKVED codes - in the new version, one code is prescribed in the 4-FSS form if there are two. It is necessary to indicate the code of the main direction of business activity, which is confirmed by the policyholder annually. According to the new filling rules, the accountant indicates the code from the OKVED-2017 classifier on the title page.

Required tables

The updated Form 4-FSS includes a title page and 5 sections, however, not all organizations need to complete all sections of the report.

Let's look at the filling rules:

- all enterprises fill out the title page, tables 1, 2 and 5;

- Table 1.1 is filled out by employers who transfer their employees to other companies or private entrepreneurs;

- table 3 is filled out by policyholders who incurred costs for work-related injuries at the expense of the Social Insurance Fund;

- Table 4 is filled out by employers who have had accidents at work.

Fill out the lines of form 4-FSS for the third quarter of 2017

Please note that the changes affected not only the form, but also the rules and procedures for filling it out. Let's look at the rules that apply to filling out:

1) fill out the form on a computer or on paper with a pen with black or blue ink and in block letters only;

2) only one value is entered in one column; if there is no data, a dash is entered;

3) when filling out a report by a budgetary institution, in the “Budgetary organization” field, the attribute of the organization is entered according to the source of funding;

4) if there is no data to indicate in tables 1.1, 3 and 4, the table data does not need to be provided to the relevant authority;

5) incorrect data can be crossed out by replacing them with correct ones, and it is necessary to leave the signature of the policyholder or his representative with the current date under them. Corrections must be certified with the seal of the organization or the signature of an individual entrepreneur. Correctors and similar products are prohibited from being used;

6) in the form we use continuous numbering of sheets;

7) at the top of each page on which data is entered, we indicate the registration number of the enterprise and the code of subordination based on the notification issued upon registration at the fund institution;

At the bottom of each sheet we put the signature of the manager and the date of signing the calculation;

At the bottom of each sheet we put the signature of the manager and the date of signing the calculation;

9) when submitting reports for 9 months of 2021, we fill in only the first two cells of the reporting period column (that is, you must indicate the code “09” - 9 months);

10) in the OGRN column we write down the main registration code from the state registration certificate of the legal entity; private entrepreneurs indicate the code from the state registration certificate of an individual;

11) in the process of filling out the enterprise’s OGRN of 13 digits in a line of 15 cells, enter 00 in the first two cells;

12) if the company has several OKVED codes, then indicate the code of the company’s key area of activity.

Filling in "1C"

In 1C programs, data for the title page is filled in from the Organizations directory automatically when creating a report. In the cells highlighted in yellow, indicators are entered manually or can be changed if necessary. If the cell is left blank and it is not possible to make changes manually, this indicates that the information base has not included the data that must be specified in the Organizations directory. After filling out the directory, you need to return to the report and update it using the “Update” button of the same name (Fig. 1).

(Fig. 1)

The sent file is subject to verification for compliance with the requirements for calculation in electronic form. If the answer is positive, the calculation is considered provided. If the answer is negative, the policyholder must repeat the calculation procedure. It is advisable to send the report two or three days before the final submission date in order to correct errors if they occur.

In 1C programs, the implementation of this form is planned for the end of August (Fig. 1).

Have questions?

Contact us and we will answer them, 8(804) 333-16-02

Best regards, e-office24 team!

Share with your friends!

Fill out form 4-FSS for the 1st quarter of 2021

When filling out the new Form 4-FSS, you must follow the instructions that are approved by Order No. 381 of the FSS of the Russian Federation (Appendix No. 2). The paper version of the calculation can be filled out using a black or blue pen in block letters, or you can fill it out on a computer, for which you first need to download the new form 4-FSS 2021.

At the top of each page, the policyholder must put down his registration number and subordination code, which are indicated in the notice issued upon registration with the Social Insurance Fund. At the bottom of the page is the signature of the policyholder and the date of signing.

Indicate the adjustment number on the title page: when submitting form 4-FSS for 1 sq. 2021 for the first time, enter “000”, if an updated calculation is submitted - “001”, the next time the same report is updated - “002”, etc. The updated report is submitted in accordance with the form in force in the corrected period. The reporting period code for the 1st quarter is “03”, year “2017”.

All completed pages of the new Form 4-FSS 2017 are numbered, and their number and the number of application pages (if any) are indicated on the title page.

Monetary indicators are indicated in calculations without rounding - in rubles and kopecks. If any indicator is zero, the corresponding column is crossed out.

Table 1 reflects the calculation of the base for calculating contributions for “injuries”. Indicators are entered incrementally from the beginning of the year, and broken down by month of the last quarter of the reporting period.

Table 1.1 is filled out only by those who, under a contract, sent their employees to temporary work with other employers (clause 2.1 of Article 22 of Law No. 125-FZ of July 24, 1998).

Table 2 of the Form 4-FSS report in 2021 is filled out based on the policyholder’s accounting data on the status of settlements for contributions and expenses.

Table 3 is filled in if there are expenses for “injuries”: sick leave payments for accidents and injuries, payment for leave for treatment in a sanatorium, financing of preventive measures.

Table 4 is located on the same page of Form 4-FSS for 2017 as Table 3. Based on the relevant acts on occupational diseases and accidents at work, it indicates the number of people injured.

Table 5 is intended for information on the results of a special assessment of working conditions and medical examinations of workers. This reflects the number of jobs subject to assessment, the number of workers in hazardous industries and, accordingly, the number of jobs assessed and the number of workers who underwent medical examinations at the beginning of the year.

Form 4-FSS 2021: available here.

What changes to consider when filling out the new form 4-FSS

Not many changes have been made. The “Budget Organization” field appeared on the title page . From its name it is clear that it will be filled out by budgetary organizations, indicating in it the attribute of the policyholder depending on the source of funding:

On the title page of Form 4-FSS, data on the average number of employees will now be entered not as of the reporting date, but for the period from the beginning of the year.

In Table 2 , lines have been added that are filled in by the legal successor organization for the converted policyholder or the organization for a closed separate division:

- if there is still a debt to the Social Insurance Fund, then line 1.1 is filled in;

- if there is still a debt for the Social Insurance Fund, then line 14.1 is filled in.

The values of these lines, of course, affect the debt totals.

Form 4-FSS: due date

The Social Insurance Fund sets an individual tariff for insurance premiums for “injuries” for each organization, depending on the main type of economic activity. The more dangerous the production is for workers, the higher the rate for insurance premiums.

Until social insurance makes a decision on assigning a tariff for contributions in favor of “injury”, the enterprise is obliged to use the tariff at which 4-FSS reports were provided for the year.

The deadline for submitting documents to confirm the OVED in 2021 is April 14. Despite the fact that April 15 is a day off, not all FSS employees agree to postpone the deadline for submitting documents to April 17 (there is no specific legislative act for this case).

Below is a diagram that deciphers the procedure and timing for setting the insurance rate.

Form 4-FSS for the 3rd quarter of 2021 - composition

Standard form 4-FSS for the 3rd quarter of 2021 includes mandatory sheets with tables that the policyholder must submit in any case, and additional ones. The first are printed even in the absence of indicators, the second - only if the relevant information is available. The list of data is summarized in a convenient table.

| Required pages f. 4-FSS | Additional pages f. 4-FSS |

| No. 1 – title page | No. 3 – table. 1.1, which provides the data necessary for calculating contributions by categories of policyholders under clause 2.1 of the stat. 22 of Law No. 125-FZ. These are employers who temporarily send their own employees to work in other companies under a contract |

| No. 2 – table. 1, where the calculation of the base for the subsequent accrual of “injuries” is performed | No. 5 – table. 3, 4, which indicate cost items (if insurance coverage is available) and the number of injured employees due to industrial accidents |

| No. 4 – table. 2, where the calculation of contributions for the reporting period is carried out, including an indication of the balances at the beginning and end of the period | |

| No. 6 – table. 5, which provides information about the results of special assessment tests and mandatory medical examinations |