We contribute property to the authorized capital

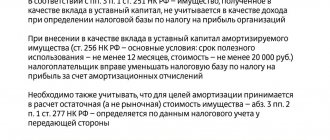

You can contribute not only money to the authorized capital of a company, but also any other property. The reflection of this operation in the accounting and tax accounting of the transferring and receiving parties has a number of features.

Lyubov DEMIDENKO Auditor

The legislation of the Russian Federation provides for the possibility of making a contribution to the authorized capital of a business company (joint stock company or limited liability company) in the form of property that has a monetary value (Article 66 of the Civil Code of the Russian Federation, Article 9, 34 of the Federal Law of December 26, 1995 No. 208-FZ “ On Joint-Stock Companies", Article 15 of the Federal Law of 02/08/98 No. 14-FZ "On Limited Liability Companies").

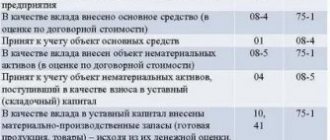

When making a contribution to the authorized capital of property and non-property (non-monetary) contributions, the following is required:

• determination of the right to use property, securities, capital investments transferred as a contribution to the authorized capital of the company;