The legal nature of arrears—the position of the Russian Ministry of Finance

Continuation of the topic started in the article “Overpayment - a fundamental misconception of tax authorities, or a cunning trick?!”

Before diving into the “topic,” I invite readers, each for themselves, to record their position on this issue.

The taxpayer erroneously overstated the amount of tax on his tax return. However, they were paid in a smaller amount in accordance with the actual tax liability. The tax authority, on the basis of the declaration received from the taxpayer, issued a demand to the taxpayer to pay tax in part of the “underpaid” amount.

Question : Does the taxpayer have an obligation to pay the demand?

First, let's evaluate the situation based on the “spirit of the Law.” In other words: “based on the basic provisions and meaning of the legislation on taxes and fees.”

According to paragraph 2 of Art. 11 of the Tax Code of the Russian Federation “arrears - the amount of tax, the amount of collection or the amount of insurance premiums not paid within the period on taxes and fees .”

In accordance with paragraph 1 of Art. 3 of the Tax Code of the Russian Federation “every person must pay LEGALLY ESTABLISHED taxes and fees.” Accordingly, the parameters of a “legally established tax” - first of all, its size and payment deadline - are the most objective factor. And the subjective error of the taxpayer cannot in any way be considered a legal basis for the emergence of a tax liability.

The fact is that the state is not a “white-collar” swindler, profiting from the mistakes of careless and illiterate citizens (and not even “Robin Hood”, lawlessly punishing obvious dodgers and thieves). Tax officials as civil servants in accordance with Art. 15 of the Federal Law of July 27, 2004 No. 79-FZ “On the State Civil Service of the Russian Federation” are obliged to “observe the rights and legitimate interests of citizens and organizations when performing official duties.” According to Art. 32 of the Tax Code of the Russian Federation instructs tax authorities to “comply with the legislation on taxes and fees,” and Art. 33 of the Tax Code of the Russian Federation obliges tax officials to “act in strict accordance with this Code and other federal laws.”

The economic essence of arrears (and let us add, penalties accrued on it) is a quantitative indicator of the material damage caused to the state by the taxpayer as a result of delay in fulfilling tax obligations. The public law method of regulating tax legal relations, enshrined in the Tax Code of the Russian Federation, places on the state the burden of proving the fact of causing material damage, subject to mandatory compliance with the procedures established by the legislation on taxes and fees. Therefore, the situation described in the question is impossible in principle. Let's make a reservation: subject to proper compliance by the tax authorities with the provisions of the legislation on taxes and fees. This is exactly the doctrine that the legislator enshrined in the Tax Code of Russia. Let us confirm this with specific legal norms, based on the authoritative opinion of the authorized government body.

In response to the question about the legal nature of the arrears, the Russian Ministry of Finance in letter dated November 28, 2018 No. 03-02-08/86043 (the letter file is attached to the article) set out absolutely correct conclusions. But, unfortunately, without accompanying them with legal justification. We will try to mitigate this shortcoming without distorting the position of the financial authority.

The whole point is contained in 3 paragraphs. I will quote them verbatim (author's emphasis):

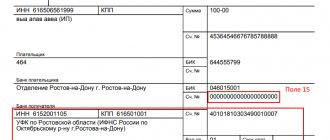

According to paragraph 2 of Art. 11 of the Tax Code of the Russian Federation (Code), an arrear is recognized as an amount of tax not paid within the period by the legislation on taxes and fees . Failure to pay taxes on time is a violation of tax laws. If the arrears are identified outside of a tax audit , the demand for tax payment is sent by the tax authority in accordance with clause 1 of Art. 70 Code. The fact of the existence of arrears is reflected in the document, the form of which was approved by order of the Federal Tax Service of Russia dated February 13, 2017 No. ММВ-7-8/ [email protected]

Please note: the position of the Russian Ministry of Finance is “tied” to a very important provision of clause 2 of Art. 69 of the Tax Code of the Russian Federation: “The requirement to pay tax is sent to the taxpayer if he has

Applying the rules of logic to the quoted fragment of the letter in question from the Russian Ministry of Finance, we will inevitably come to the following two conclusions.

- Firstly, from the first two paragraphs (premises), the conclusion follows “reinforced concrete”: arrears are a violation of the legislation on taxes and fees .

- Secondly, according to the third paragraph, documentation of the “fact of arrears” (formation of an evidence base by the tax authority) is carried out in one of two alternative ways:

Method 1 – identifying arrears “outside of a tax audit.” To confirm this, a document is drawn up in the form approved. by order of the Federal Tax Service of Russia dated February 13, 2021 No. ММВ-7-8/ [email protected]

Method 2 – identifying arrears during a tax audit.

Let's start with a method that is relevant for entrepreneurs to establish the fact of “the presence of arrears” during tax audits. Taking into account the fact that the desk tax audit procedure, as well as how modern information technologies introduced by the Federal Tax Service of Russia into tax control ensure the protection of the rights and legitimate interests of taxpayers, will be discussed in one of the following articles. Here we will focus only on the key points related to the topic of the article. So, the most important thing.

1. In accordance with paragraph 2 of Art. 88 of the Tax Code of the Russian Federation, for each tax declaration (tax report) received by the tax authority, a desk tax audit is mandatory.

And only if the declaration is not received within the required time frame, the tax authority has the right to begin a desk tax audit (in the absence of a declaration) based on the information available to the tax authority about the taxpayer and his taxable income. However, after the receipt (late) of a tax return, a desk tax audit must begin (paragraph 3, paragraph 2, article 88 of the Tax Code of the Russian Federation).

2. According to paragraph 5 of Art. 88 of the Tax Code of the Russian Federation “if, after considering the submitted explanations and documents, or in the absence of explanations from the taxpayer, the tax authority establishes the fact of committing a tax offense or other violation of the legislation on taxes and fees , officials of the tax authority are obliged to draw up an inspection report in the manner prescribed by Article 100 of this Code.”

Thus, failure to draw up an act upon completion of a desk tax audit means the absence of violations of the legislation on taxes and fees (and not just tax offenses). Let us remind you that arrears, according to the official explanation of the financial authority, are precisely a violation of the legislation on taxes and fees.

3. Tax audit materials (the main one of which is the Audit Report) in the manner established by Art. 101 of the Tax Code of the Russian Federation are considered by the head (his deputy) of the territorial tax authority, who can make two types of Decisions:

- when establishing the fact of a tax offense - on bringing to tax liability;

- in the absence of a fact or corpus delicti of a tax offense - a refusal to bring to tax liability.

And then a very important detail: in any outcome of the case, if the fact of arrears is established (including those already paid by the taxpayer), the Decision must indicate the specific amount of this arrears and (or) accrued penalties (paragraphs 1 and 2 of clause 8 of Art. 101 of the Tax Code of the Russian Federation).

The decision in accordance with paragraph 9 of Art. 101 of the Tax Code of the Russian Federation comes into force one month after delivery to the taxpayer (and in the case of an appeal, immediately after consideration of the appeal by a higher tax authority).

Thus, only after the Decision has entered into force based on the results of consideration of the tax audit materials, the fact of the existence of arrears is considered established. And accordingly, the tax authority receives the right to begin the procedure for claiming it.

4. According to paragraph 2 of Art. 70 of the Tax Code of the Russian Federation “the requirement to pay tax based on the results of a tax audit must be sent to the taxpayer (...) within 20 days from the date of entry into force of the relevant decision, unless otherwise provided by this Code.” “ Other ” is not provided for by the Tax Code of the Russian Federation. Moreover, this rule is duplicated (and without any “ifs”) in paragraph 3 of Art. 101.3 of the Tax Code of the Russian Federation: “ On the basis of a decision that has entered into force, the person in respect of whom the decision was made <...> is sent , in accordance with the procedure established by Article 69 of this Code, a requirement to pay a tax (fee, insurance contributions) and the corresponding penalties.”

The point of view presented here is confirmed by the position of the Ministry of Finance, set out in letter dated 06/11/2019 No. 03-15-05/42607 (the letter is attached to the article). Although the main topic of the letter is individual issues of regulatory regulation of control over the payment of insurance premiums (including transitional provisions in connection with the transfer of administration from the Pension Fund of the Russian Federation to the Federal Tax Service of Russia from 01.01.2017), the penultimate three paragraphs of the letter are devoted to the procedure for sending a request for payment of tax based on tax results checks. I will quote them in full (author's emphasis):

The subject of tax control is the correctness of calculation and timely payment of taxes, fees, and insurance premiums specified in Article 8 of the Code.

The procedure for conducting tax audits, consideration of materials based on the results of their conduct, and decisions by tax authorities based on the results of consideration of materials of tax audits are regulated by Articles 88, 89, 100, 101 of the Code.

The requirement to pay taxes , fees, insurance premiums, penalties, fines based on the results of a tax audit is sent in accordance with Articles 69, 70 and paragraph 3 of Article 101.3 of the Code.

The attentive reader, I hope, noticed that the legislator operates with similar (close in meaning) categories “tax offense” and “violation of legislation on taxes and fees.” Their relationship is revealed in this example.

In accordance with paragraph 1 of Art. 122 of the Tax Code of the Russian Federation, failure to pay taxes within the due period is a tax offense (Article 106 of the Tax Code of the Russian Federation), for which a financial sanction is imposed. Arrears in this case is one of the elements of a tax offense. If the full composition of the tax offense is not confirmed, then the arrears discovered during the tax audit are qualified as a violation of the legislation on taxes and fees. In both cases, the procedure for claiming arrears is initiated in the manner established by clause 3 of Art. 101.3 of the Tax Code of the Russian Federation (in the first case, together with the imposed financial sanction - a fine). Thus, a tax offense is a special case of a broader concept - violation of legislation on taxes and fees.

It is impossible not to mention that the fact of arrears can also be confirmed by the Act of Mutual Reconciliation of Settlements. In this case, the taxpayer voluntarily acknowledges the existence of arrears, relieving the tax authority from the need to carry out the procedures established by the legislation on taxes and fees.

Let's return to the case of establishing the existence of arrears outside of a tax audit.

Based on the fact that every declaration received by the tax authority is subject to a desk tax audit, the scope of application of such a “one-sided” (and therefore obviously subjective) method is limited to cases of tax control of undeclared taxable items. And this is overwhelmingly the sphere of relations with citizens who are not entrepreneurs. For example, property taxes on individuals. And there is a logical explanation for this. In such cases, the tax authority independently keeps records of both tax accruals (notifying taxpayers about them) and payments received to repay them. This allows tax authorities to single-handedly establish the existence of arrears by issuing the appropriate document.

The legality of using such a “unilateral” (without the participation of the taxpayer) method of establishing the fact of “arrears” in the course of other tax control activities is very doubtful. If only because the Law does not directly stipulate such cases. And taxpayers, guided by Art. 21 of the Tax Code of the Russian Federation, “have the right <...> to demand that officials of tax authorities and other authorized bodies comply with the legislation on taxes and fees when they carry out actions in relation to taxpayers.”

I hope the above arguments will help taxpayers in protecting their rights and legitimate interests.

Start of the topic: Overpayment: a fundamental misconception of tax authorities, or a cunning trick?!

Continuation of the topic: Reconciliation with the tax office: “pitfalls” and “ambushes”

Clause 4, Article 59 of the Tax Code of the Russian Federation

Amounts of taxes, fees, insurance premiums, penalties and fines written off from the accounts of taxpayers, fee payers, insurance premium payers, tax agents in banks, but not transferred to the budget system of the Russian Federation, are considered hopeless for collection and are written off in accordance with this article in if at the time of making the decision to recognize these amounts as uncollectible and write them off, the relevant banks have been liquidated. (As amended by Federal Law dated July 3, 2016 No. 243-FZ)

What is tax arrears?

If a legal entity or individual entrepreneur misses the deadline for paying taxes or insurance premiums, thereby violating tax legislation (paragraph 2, paragraph 1, article 45 of the Tax Code of the Russian Federation), then he will develop a debt to the budget. This is arrears in taxes (insurance contributions), that is, in this case, debt (clause 2 of article 11 of the Tax Code of the Russian Federation).

In addition, there are situations when, while checking a taxpayer, inspectors discover an excessive amount of taxes reimbursed to him from the budget, for example, for VAT. And this is a tax arrears too.

The following taxes can be reimbursed from the budget:

- VAT, when the amount of deductions exceeds the amount of calculated tax, including taking into account the amounts of tax subject to restoration (clause 2 of Article 173 of the Tax Code of the Russian Federation);

- excise taxes, when the amount of tax deductions is greater than the amount of excise tax calculated on transactions with excisable goods - objects of taxation under Art. 182 of the Tax Code of the Russian Federation (clause 1 of Article 203 of the Tax Code of the Russian Federation).

Judicial procedure for collecting arrears

If the tax authority does not exercise the right to collect the arrears at the expense of the taxpayer’s funds out of court, then he has the right to file a claim in court to collect the said arrears (Article 46 of the Tax Code of the Russian Federation). At the same time, the tax legislation does not directly regulate the question of whether the tax authority has the right to apply for judicial protection with an application for the collection of tax amounts if it had previously made a timely decision to collect it. There is no official position on this issue. An analysis of arbitration practice allows us to conclude that the tax authority does not have the right to go to court, but must independently complete the procedure for indisputable collection, namely send a collection order to the bank, and also, if necessary, make a decision to collect the tax at the expense of other property of the taxpayer (Resolutions FAS of the West Siberian District dated 03/12/2010 N A45-10407/2009, FAS of the North-Western District dated 01/13/2009 N A05-6505/2008). The application can be filed with the court within 6 months after the expiration of the deadline for fulfilling the requirement to pay the tax. A deadline for filing an application missed for a valid reason may be reinstated by the court. Neither the Tax Code of the Russian Federation nor the Arbitration Procedure Code of the Russian Federation contain a list of valid reasons. Therefore, in each specific case, the court, analyzing the specific circumstances of the case, determines whether the relevant reason is valid.

Example 1. The reason for missing the deadline is a large amount of work and a lack of specialists at the tax authority. The court granted the request of the tax authority (Resolution of the Federal Antimonopoly Service of the North-Western District dated 05.02.2009 N A13-3227/2008). The court refused to satisfy the request of the tax authority (Resolution of the Federal Antimonopoly Service of the East Siberian District dated July 23, 2008 N A19-15231/07-F02-3485/08).

Example 2. The reason for missing the deadline is the tax authority reconciling settlements with the taxpayer. The court refused to satisfy the request of the tax authority (Resolution of the Federal Antimonopoly Service of the Far Eastern District dated March 12, 2009 N F03-717/2009).

In relation to arrears that are overdue for collection, two circumstances must be noted. Firstly, the tax authority does not have the right to charge a penalty . This point of view is contained in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated September 29, 2009 N 5838/09. In support of its opinion, the Supreme Arbitration Court of the Russian Federation noted that the fulfillment of the obligation to pay penalties cannot be considered in isolation from the fulfillment of the obligation to pay tax. Therefore, after the expiration of the deadline for collecting tax debt, a fine cannot serve as a way to ensure the fulfillment of the obligation to pay tax and is not accrued from that moment on. The Russian Ministry of Finance takes the same position on this issue (Letter dated October 29, 2008 N 03-02-07/2-192). Secondly, the tax authority does not have the right to offset any other tax paid in excess . If the tax authority has missed the deadline for forced collection of arrears, then it is obliged, at the request of the organization, to return to it the overpayment incurred for another tax (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated September 15, 2009 N 6544/09). If the tax authority does not exercise the right to collect the arrears at the expense of other property of the taxpayer out of court, then he has the right to file a claim in court to collect the said arrears (Article 47 of the Tax Code of the Russian Federation). The application may be filed with the court within two years from the date of expiration of the deadline for fulfilling the requirement to pay the tax.

What is arrears?

Tax debt or arrears are the obligations of a business entity or individual that:

- were not executed in a timely manner;

- were excessively reimbursed by decision of the Federal Tax Service (for example, excise taxes, VAT amounts).

Arrears are the amount of tax or fee on which penalties are charged for each day of delay. This is a kind of compensation charged by the budget for delay. If a business entity does not pay its obligations on time, the amounts will be forcibly collected.

Collection of arrears at the expense of taxpayer funds

If the taxpayer has not repaid the arrears within the period specified in the request, then the tax authorities, within two months after the specified period, have the right to make a decision to collect the amount of the debt from the taxpayer’s bank account . Moreover, collection can be applied to funds located in the current account, even if these funds are received from the budget for specific purposes under government contracts (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated November 17, 2009 N 8580/09). The judicial body, in support of its position, noted that, as a general rule, foreclosure on funds from the budgets of the budget system of the Russian Federation is not carried out. But in the case under consideration, the collection is carried out not at the expense of budgetary funds, but at the expense of the taxpayer’s own funds, which are funds received to the organization’s current account from the budget recipient. The decision on collection is brought to the attention of the taxpayer within 6 days after the decision is made. If it is impossible to deliver the decision on collection to the taxpayer against receipt or transfer it in another way indicating the date of its receipt, the decision on collection is sent by registered mail and is considered received after six days from the date of sending the registered letter. It is necessary to pay attention to the fact that a decision made after missing the specified period is invalid and, therefore, cannot be executed by employees of credit institutions. The tax authority's order to transfer tax amounts to the budget is sent to the bank in which the taxpayer's accounts are opened, and is subject to unconditional execution by the bank in the order established by the civil legislation of the Russian Federation. At the same time, the deadline for sending this order to the bank has not currently been established. In relation to situations that arose before September 2, 2010, the deadline for sending the specified order to the bank was equal to one month from the date of the decision to collect the arrears. Often, a decision to collect tax from funds in bank accounts is made by the tax authority before the expiration of the period specified in the request for tax payment. In this case, the rights of the organization are violated and funds that it planned to use to fulfill its obligations to counterparties may be debited from its account. The specified cash flow planning may take into account the deadline for payment of arrears specified in the requirement and not lead to a violation of the law. There is no uniform arbitration practice regarding the legality of such a decision of the tax authority. On the one hand, the decision is illegal, since the procedure for collecting arrears goes through several interrelated stages. For each stage, which has independent legal significance, tax legislation provides for a certain procedure and terms for the forced collection of taxes (penalties), failure to comply with which entails legal consequences in the form of declaring a non-normative act of the tax authority invalid (Resolution of the Federal Antimonopoly Service of the West Siberian District dated April 23, 2010 N A46 -21966/2009). On the other hand, the decision is legal, since tax legislation does not contain such a basis for unconditionally recognizing the decision to collect debt as illegal, such as failure to comply with the deadline for voluntary fulfillment of the requirement (Resolution of the Federal Antimonopoly Service of the Far Eastern District dated December 20, 2010 N F03-9322/2010). A relevant issue is related to the possibility of tax authorities issuing a repeated collection order , for example, if the taxpayer closes the account in the bank to which the collection order was sent and opens an account in another credit institution. Tax legislation does not regulate the issue of issuing a repeated order. An analysis of arbitration practice has shown that in most cases, judicial authorities recognize the right of tax authorities to these actions (Resolutions of the Federal Antimonopoly Service of the West Siberian District dated January 14, 2009 N F04-8140/2008(18774-A81-34), FAS Volga District dated December 25, 2008 N A65-10152/2008). The court indicated that the legislation does not contain a prohibition on issuing a repeated collection order. The opposite position is set out in the Resolution of the Federal Antimonopoly Service of the Central District dated October 25, 2010 N A09-3231/2010. The court found that the tax authority, after the bank returned the collection order in connection with the closure of the current account, issued a new order to write off funds from the taxpayer’s account in another bank. The court indicated that, having begun the procedure for indisputable collection, the tax authority is obliged to complete it, including making a decision to collect the tax at the expense of other property of the taxpayer. The bank's return of a collection order is not grounds for re-issuing a new order.

Difference between arrears and debt

The legislation of the Russian Federation uses two concepts that are similar in meaning - arrears and debts. What are their specifics?

articles

By arrears , the legislation of the Russian Federation understands the amount of an established tax or fee that is not paid to the Federal Tax Service or another competent government body by a citizen or organization obligated to pay them on time. That is, within the period established by the provisions of regulatory legal acts. Amounts of insurance contributions to state funds - Pension Fund, Social Insurance Fund, Federal Compulsory Medical Insurance Fund - are also recognized as arrears.

Arrears is also the amount of tax, fee or contribution that is underpaid or accrued in excess of what a citizen or organization paid, for example, as a result of an audit or by a court decision.

Thus, arrears are a debt to a government organization. As a rule, upon detection by the regulatory authority, the payer undertakes to repay it. In cases provided for by the legislation of the Russian Federation, a penalty is charged for the arrears.

What is debt?

Debt means :

- the amount of tax, fee or contribution that a person or company is obliged to pay to the state has not yet paid it, but, in principle, manages to do it on time;

- the amount of money that a citizen or organization must pay to another person or company in accordance with the law or the terms of a private agreement (in this case, the debt is called accounts payable);

- the amount of money that a person or organization expects to receive from another person or company in accordance with the law or the terms of a private agreement (this, in turn, is a receivable).

Thus, debt is the amount of a tax, fee or contribution before the delay and their transformation into arrears or any other funds that must be paid by the obligated party in favor of the entitled party.

The debt may be current or past due. In the first case, it is formed by virtue of a law, contract or legally significant actions of the subjects of legal relations - for example, when one party provided services or supplied goods to the other.

Overdue debt appears when the party that is obliged to pay (for example, for services rendered) does not do so on time.

In this case, the debt may be increased, if provided by law or contract, by the amount of the penalty.

Comparison

The main difference between arrears and debt is that the first term has a much narrower range of application and denotes only the amount of tax, fee or contribution that a citizen or organization owes to the state represented by individual bodies or funds. In addition, arrears most often indicate a unilateral obligation - to the state.

Debt is a much broader concept. It can mean, in principle, any amount of money that one individual, organization or government entity owes to other entities. Or, on the contrary, they expect to receive from them. Debt is a tax, fee or contribution that has not turned into arrears, but which a citizen or company still manages to pay on time.

The term "debt" is often used to refer to an amount that must be paid by a government agency (usually the one that collects taxes, fees, or assessments) to those individuals who typically pay the payments themselves. So, if a company overpaid taxes, then it receives the right to return them from the budget - and in this case, the Federal Tax Service forms a debt to it.

There are two types of debt: current and overdue. In the first case, it is not accompanied by the accrual of penalties. In the second, the obligated party may also be forced to pay a penalty.

Having determined what the difference is between arrears and debt, we will reflect the conclusions in the table.

Table

| Arrears | Debt |

| What do they have in common? | |

| The debt of a citizen or company for a tax, fee or contribution that is not repaid on time turns into arrears | |

| What is the difference between them? | |

| Represents the amount of tax, fee, or contribution that an individual or organization is required to pay to the government by law | Represents the amount of money that an individual or organization must pay to (or be entitled to receive from) another entity by law or by virtue of a contract |

| As a rule, it is unilateral in nature - when a private person or organization owes the state | Can be mutual in nature, can be creditor and debtor |

| Formed only upon delay in payment of the amount | Is current upon occurrence by virtue of law or contract, becomes overdue upon failure of the obligated party to transfer payment on time |

| The government agency authorized to collect arrears may impose a penalty on it | Overdue debt may be accompanied by the accrual of a penalty by force of law or contract |

Source: https://TheDifference.ru/chem-otlichaetsya-nedoimka-ot-zadolzhennosti/

How are arrears discovered?

Debt to the budget can be detected by the taxpayer himself or by employees of the Federal Tax Service. In the first case, a business entity notices arrears at the moment:

- control over the correct completion of payment orders;

- checking the correctness of calculation of the amounts of budget obligations;

- reconciliation with the budget.

Arrears are the amount of tax that must be paid as soon as possible so that no penalties are charged on it. If the debt arose due to errors in calculations, an updated declaration is submitted to the Federal Tax Service.

Tax authorities discover arrears of citizens and organizations during inspections, reconciliations with taxpayers, and other control measures.

Identification of a taxpayer's debt is documented. If arrears are discovered during the audit, a decision is drawn up indicating the exact amount to be repaid. Information about unfulfilled obligations is entered into the budget settlement card, which is maintained by the Federal Tax Service for each economic entity.