It is necessary to check payment orders in 2021

It is necessary to indicate new details of the Federal Treasury. Although I didn't notice any changes in the details.

You need to fill out detail “15” of the payment order - the account number of the recipient’s bank, which is part of the single treasury account (STA).

The details can be checked using the service of the Federal Tax Service website.

Attention! Starting from 2021, the new KBK and the new recipient of contributions are not the Pension Fund of Russia but the Federal Tax Service. Even contributions for December must be transferred according to the new BCC to the Federal Tax Service (except for contributions to the Social Insurance Fund for injuries). Here you can find out the details of your Federal Tax Service.

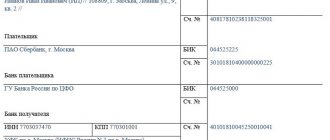

Starting from 2021, someone else can pay taxes for an individual entrepreneur, organization or individual. Then the details will be as follows: “TIN” of the payer - TIN of the one for whom the tax is being paid; “Checkpoint” of the payer – checkpoint of the one for whom the tax is transferred; “Payer” – information about the payer who makes the payment; “Purpose of payment” – INN and KPP of the payer for whom the payment is made and the one who pays; “Payer status” is the status of the person whose duty is performed. This is 01 for organizations and 09 for individual entrepreneurs.

From February 6, 2021, in tax payment orders, organizations in Moscow and Moscow Region will have to enter new bank details; in the “Payer’s bank” field, you need to put “GU Bank of Russia for the Central Federal District” and indicate BIC “044525000”.

A payment order or payment document is a document to the bank on behalf of the owner (client) of the current account: transfer money to another account (pay for a product or service, pay taxes or insurance premiums, transfer money to the account of an individual entrepreneur or pay a dividend to the founder, transfer wages to employees, etc. .everything is below)

A payment order can be generated (and sent via the Internet) in Internet banking (for example, Sberbank-online, Alpha-click, client bank). Internet banking is not needed for small organizations and individual entrepreneurs because... it is complicated, expensive and less safe. It is worth considering for those who make more than 10 transfers per month or if the bank is very remote. Payments can also be generated using online accounting.

Where can I get a payment order for free? How to fill out a payment order? What types of payment orders are there? I will post here samples of filling out payment slips in Excel for 2019-2020, made using the free Business Pack program. This is a fast and simple program. In addition to payment slips, it also contains a bunch of useful documents. I recommend to all! Especially useful for small organizations and individual entrepreneurs who want to save money. Some additional functions in it are paid, but for payment orders it is free.

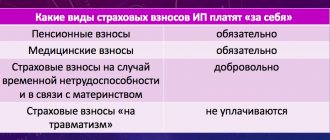

Pension Fund FFOMS and FSS (except NSiPZ)

Purpose of payment: Insurance contributions to the Pension Fund for compulsory pension insurance for March 2021 Reg. No. 071-058-000000

Purpose of payment: Insurance premiums for compulsory health insurance, credited to the FFOMS budget March 2021 Reg. No. 071-058-000000

Purpose of payment: Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity to the budget of the Social Insurance Fund of the Russian Federation for March 2021 Reg. No. 6100000000

Purpose of payment: Insurance contributions for compulsory social insurance against industrial accidents and occupational diseases to the budget of the Federal Social Insurance Fund of the Russian Federation for March 2021. Registration number - 7712355456

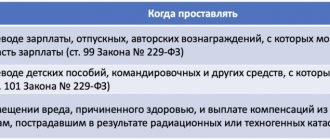

Payer status: 01 - for organizations / 09 - for individual entrepreneurs (If payment of insurance premiums for employees) (letter of the Federal Tax Service dated 02/03/2017 No. ZN-4-1 / [email protected] ) (Order of the Ministry of Finance dated April 5, 2021 No. 58n) .

TIN, KPP and OKTMO should not start from scratch. OKTMO must be 8-digit.

In field 109 (date, below the “reserve field”, on the right) enter the date of the declaration on which the tax is paid. But under the simplified tax system and all funds (PFR, FSS, MHIF) they set 0.

Attention! Starting from 2021, the new KBK and the new recipient of contributions are not the Pension Fund of Russia but the Federal Tax Service. Here you can find out the details of your Federal Tax Service.

Also, starting from 2021, it is necessary to indicate the period for which contributions are paid - for example MS.12.2018.

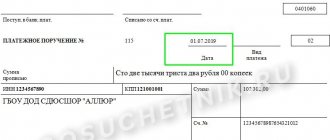

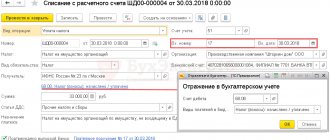

Rice. .

Fig. Sample of filling out a payment order (PFR, Social Insurance Fund contributions for employees) in Business Pack.

Payment order for VNiM contributions: sample 2021

You can fill out a payment form for the payment of insurance premiums for VNiM on paper or using special programs. When filling out a document manually, you must follow the rules approved by:

- By Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n;

- Regulation of the Bank of the Russian Federation dated June 19, 2012 No. 383-P.

Payment order form 2020

The procedure for filling out each field of the payment order is presented in the table:

FSS NSiPZ

Purpose of payment: Insurance contributions for compulsory social insurance against industrial accidents and occupational diseases to the budget of the Federal Social Insurance Fund of the Russian Federation for March 2021. Registration number - 7712355456

Payer status: 08 (only here 08, because this is the only contribution that we pay not to the Federal Tax Service).

TIN, KPP and OKTMO should not start from scratch.

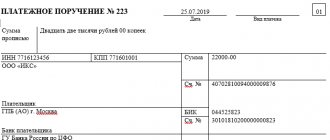

Rice. Sample of filling out a payment order (FSS NSiPZ) in Excel (download).

How long should payments be kept?

Within 6 years after the end of the year in which the document was last used for calculating contributions and reporting (Clause 6 of Part 2 of Article 28 of the Federal Law dated July 24, 2009 No. 212-FZ) or 5 years (clause 459 Order of the Ministry of Culture of Russia dated August 25 .2010 N 558)

Fig. Sample of filling out a payment order (FSS NSiPZ) in Business Pack.

KBK contributions from the Pension Fund of the Russian Federation, Social Insurance Fund for employees

Current for 2019-2020.

| Payment type | BCC for contributions for December 2021 | BCC for contributions for the months of 2017-2019 |

| Contributions to compulsory pension insurance | ||

| Contributions of organizations for compulsory pension insurance | 182 1 0200 160 | 182 1 0210 160 |

| Penalties on contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0210 160 |

| Penalties for contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0210 160 |

| Additional pension contributions according to list 1, if the tariff does not depend on the special assessment | 182 1 0210 160 | 182 1 0210 160 |

| Penalties on contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0200 160 |

| Penalties for contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0200 160 |

| Additional pension contributions according to list 1, if the tariff depends on the special assessment | 182 1 0220 160 | 182 1 0220 160 |

| Penalties on contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0200 160 |

| Penalties for contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0200 160 |

| Additional pension contributions according to list 2, if the tariff does not depend on the special assessment | 182 1 0210 160 | 182 1 0210 160 |

| Penalties on contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0200 160 |

| Penalties for contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0200 160 |

| Additional pension contributions according to list 2, if the tariff depends on the special assessment | 182 1 0220 160 | 182 1 0220 160 |

| Penalties on contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0200 160 |

| Penalties for contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0200 160 |

| Individual entrepreneur contributions to compulsory pension insurance (26% of the minimum wage) | 182 1 0200 160 | 182 1 0210 160 |

| Penalties on contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0210 160 |

| Penalties for contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0210 160 |

| Individual entrepreneurs' contributions to compulsory pension insurance with income over 300 thousand rubles. | 182 1 0200 160 | 182 1 0200 160 |

| Penalties on contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0210 160 |

| Penalties for contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0210 160 |

| Contributions for compulsory health insurance | ||

| Contributions of organizations for compulsory health insurance | 182 1 0211 160 | 182 1 0213 160 |

| Penalties on contributions for compulsory health insurance | 182 1 0211 160 | 182 1 0213 160 |

| Penalties for compulsory health insurance contributions | 182 1 0211 160 | 182 1 0213 160 |

| Individual entrepreneurs' contributions to compulsory health insurance | 182 1 0211 160 | 182 1 0213 160 |

| Penalties on contributions for compulsory health insurance | 182 1 0211 160 | 182 1 0213 160 |

| Penalties for compulsory health insurance contributions | 182 1 0211 160 | 182 1 0213 160 |

| Contributions to compulsory social insurance | ||

| Contributions for disability and maternity | 182 1 0200 160 | 182 1 0210 160 |

| Penalties for contributions in case of disability and maternity | 182 1 0200 160 | 182 1 0210 160 |

| Penalties for contributions in case of disability and maternity | 182 1 0200 160 | 182 1 0210 160 |

| Contributions in case of industrial injuries and occupational diseases | 393 1 0200 160 | 393 1 0200 160 |

| Penalties on contributions in case of industrial injuries and occupational diseases | 393 1 0200 160 | 393 1 0200 160 |

| Penalties on contributions in case of industrial injuries and occupational diseases | 393 1 0200 160 | 393 1 0200 160 |

Deadline for transferring insurance premiums in 2020

Here is a table with the deadlines for paying pension insurance contributions in 2020. They must be listed according to the details of the Federal Tax Service. Please note that for May-July there are new payment deadlines due to coronavirus, quarantine and non-working days in 2021.

| Type of insurance premiums | For what period is it paid? | Payment deadline |

| Contributions from payments to employees/other individuals to OPS | For December 2021 | No later than 01/15/2020 |

| For January 2021 | No later than 02/17/2020 | |

| For February 2021 | No later than 03/16/2020 | |

| For March 2021 | No later than 05/06/2020 (transfer) No later than 10/15/2020 (transfer for micro-enterprises) | |

| For April 2021 | No later than 05/15/2020 No later than 11/16/2020 (transfer for micro-enterprises) | |

| For May 2021 | No later than 06/15/2020 No later than 12/15/2020 (transfer for micro-enterprises) | |

| For June 2021 | No later than 07/15/2020 No later than 11/16/2020 (transfer for micro-enterprises) | |

| For July 2021 | No later than 08/17/2020 No later than 12/15/2020 (transfer for micro-enterprises) | |

| For August 2021 | No later than September 15, 2020 | |

| For September 2021 | No later than 10/15/2020 | |

| For October 2021 | No later than 11/16/2020 | |

| For November 2021 | No later than 12/15/2020 | |

| For December 2021 | No later than 01/15/2021 |

KEEP IN MIND

Federal Law No. 172-FZ of 06/08/2020 for organizations and individual entrepreneurs affected by coronavirus canceled (reset to zero) insurance premiums for the 2nd quarter of 2020 - from payments to individuals accrued for April, May and June 2020. For more information, see “Features of payment of insurance premiums by organizations and individual entrepreneurs for the 2nd quarter of 2020.”

All payments

See the full list of payment orders:

- For a description of the fields and rules for payment orders, see here.

- Sample of filling out a payment order for payment of the simplified tax system in Excel and in Business Pack

- Sample of filling out a payment order (personal income tax for employees) in Excel and in Business Pack

- Sample of filling out a payment order for VAT payment in Excel and Business Pack

- Sample of filling out a payment order for payment of Property Tax in Excel and in Business Pack

- A sample of filling out a payment order for the payment of Income Tax in Excel and in Business Pack

- A sample of filling out a payment order for payment of the Fixed Contribution of Individual Entrepreneurs (PFR and FFOMS) in Excel and in Business Pack

- Sample of filling out a payment order (PFR, Social Insurance Fund contributions for employees) in Excel and in Business Pack

Related documents

- Invoice form for payment

- Balance sheet (form 1) (OKUD 0710001)

- Cash flow statement (form 4) (OKUD 0710004)

- Profit and loss statement (form 2) (OKUD 0710002)

- Statement of changes in capital (form 3) (OKUD 0710003)

- Invoice

- Act on write-off of materials for current repairs

- Act report on the consumption of alcohol from the warehouse

- Books of accounting of income and expenses of organizations and individual entrepreneurs using a simplified taxation system

- Payment order for payment of imputed tax

- A completed sample payment order for an individual entrepreneur to himself

- Act (invoice) of acceptance and transfer (internal movement) of fixed assets (form No. os-1, approved by Decree of the USSR State Statistics Committee dated December 28, 1989 No. 241)

- Acceptance certificate for repaired, reconstructed and modernized facilities (form No. os-2, approved by Decree of the USSR State Statistics Committee dated December 28, 1989 No. 241)

- Receipt for the hotel parking lot. Form No. 11-g

- Receipt for refund. Form No. 8-g

- Car wash receipt

- Receipt for the provision of additional paid services by the hotel. Form No. 12-g

- Travel certificate

- Sample of filling out receipt form No. PD-4 for payment of state duty when applying to the arbitration court of the Russian Federation if the account owner is a tax authority

- A sample of filling out a payment order filled out by a credit institution when submitting payment orders from clients to the settlement network of the Bank of Russia (letter of the Central Bank of the Russian Federation dated September 5, 1996 No. 323)

- A sample of filling out a payment order filled out by the payer in the case when payments between the payer and the recipient are carried out through the settlement network of the Bank of Ossia (letter of the Central Bank of the Russian Federation dated 09/05/96 No. 323)

- A sample of filling out a payment order to be completed by the payer, if the payer and the recipient make payments through nostro accounts of credit institutions using the settlement network of the Bank of Russia (letter of the Central Bank of the Russian Federation dated September 5, 1996 No. 323)

- A sample of filling out a payment order filled out by the payer if the recipient is a client of a non-resident bank (letter of the Central Bank of the Russian Federation dated 09/05/96 No. 323)

- A sample of filling out a payment order for payment of state duty if the dispute is subject to consideration in the Supreme Arbitration Court of the Russian Federation

- A sample of filling out a payment order for the payment of state duty when applying to an arbitration court in the event of a dispute between enterprises of the Russian Federation (in regions where the tax authorities operate as the owner of the tax account

- A sample of filling out a payment order for payment of state duty when applying to an arbitration court in the event of a dispute between enterprises of the Russian Federation (in regions where federal treasury authorities operate)

- A sample of filling out a payment order for the payment of state duty when applying to an arbitration court in the event of a dispute between parties from the CIS or the Baltics (in regions where the tax authorities operate as the owner of the income tax account

- A sample of filling out a payment order for payment of state duty when applying to an arbitration court in the event of a dispute between parties from the CIS or the Baltics (in regions where federal treasury authorities operate)

- A sample of filling out a reference sheet for a customs receipt order when placing goods under the temporary import regime (letter of the State Customs Committee of the Russian Federation dated July 1, 1996 No. 01-15-11722)

- A sample of filling out a customs receipt order when calculating periodic payments in connection with the extension of the period of temporary import (letter of the State Customs Committee of the Russian Federation dated 01.07.96 No. 01-15-11722)

- Sample of filling out a customs receipt order when calculating customs duties levied at a single rate (letter of the State Customs Committee of the Russian Federation dated July 1, 1996 No. 01-15-11722)