Types of capital investments

Capital investments in an enterprise include:

- Buildings and constructions;

- Inventory that is necessary in the process of activity;

- Machine tools and equipment that are used to carry out activities at the enterprise;

- Cars, thanks to which transportation is carried out at the enterprise.

The main difference between capital investments and other expense items is that their use remains unchanged for one year or more. If investments are used for less than one year, then they cannot be classified as capital and cannot be recorded using this accounting entry. If financial expenses are made for the modernization or restoration of buildings or equipment, then such financial transactions can also be considered capital.

New concept of capital investment

The object of accounting according to FAS 26/2020 is capital investments ( previously long-term investments).

For accounting purposes:

| WHAT'S NEW | EXPLANATION |

| The concept of capital investment is associated with fixed assets | Previously – with non-current assets, i.e. fixed assets, land plots and environmental management facilities, intangible assets |

| Capital investments mean the organization’s costs for the acquisition, creation, improvement and/or restoration of fixed assets, determined in accordance with Federal Accounting Standards 26/2020. | Previously, long-term investments meant the costs of creating, increasing the size, as well as acquiring non-current durable assets (over 1 year), not intended for sale (except for long-term financial investments in government securities, securities and authorized capitals of other enterprises) |

Features of some types of capital investments

Let's look at the features in table form:

| Type of capital investment | Feature Description |

| Construction | This type includes not only newly erected buildings, but also those that will be used in the production process, as well as the real estate that is planned to be expanded. Capital investments also include costs that are associated with the restoration of damaged buildings, regardless of the amount of costs. Construction costs are divided into production and non-production: production are those premises that are associated with the production process; non-production facilities – office premises and public utility facilities. |

| Equipment | If equipment is purchased, then when accounting for the capital investment, it is necessary to clearly identify the acquired property. Equipment that requires installation is classified as requiring installation. This category includes technological or other equipment, the installation of which is carried out at a permanent place of operation. Equipment that does not require installation includes standing machines, cars and other equipment that moves. |

| Intangible assets | This category includes licenses, trademarks or permission to extract natural resources acquired on a paid basis. |

What is changing and when to apply FSBU 26/2020

Order of the Ministry of Finance of Russia dated September 17, 2020 No. 204n approved the new federal accounting standard - FSBU 26/2020 “Capital Investments”. It contains requirements for the formation in accounting of information about the organization’s capital investments.

FSBU 26/2020 was developed on the basis of IFRS (IAS) 16 “Fixed Assets”, which was put into effect in the Russian Federation by Order of the Ministry of Finance dated December 28, 2015 No. 217n.

The organization is obliged to begin applying FAS 26/2020 with financial statements for 2022 . At the same time, it is possible to make a decision on early application of this standard now.

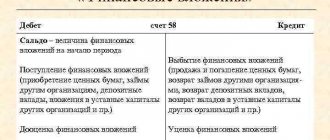

Accounting for capital investments

In accounting, capital investments are taken into account separately from current production costs. This is stated in paragraph 6 of Article 8 of the Federal Law of November 21, 1996 N 129-FZ “On Accounting”.

In order to reflect information about the costs of objects that will later be accepted in accounting as fixed assets and intangible assets, account 08 “Investments in non-current assets” is used. This account reflects the expenses that the buyer actually paid, and then they will amount to the initial cost of fixed assets or intangible assets.

Sub-accounts are opened to account 08 to account for the relevant costs:

- “Purchase of land”;

- “Purchase of natural resources”;

- “Construction of fixed assets”;

- “Acquisition of fixed assets”;

- “Acquisition of intangible assets.”

According to clause 8 of PBU 6/01, the initial cost of purchased fixed assets is formed by the total costs of their acquisition, creation and construction (less VAT and other refundable taxes). In this case, accounting is carried out object by object.

The accounting entry in this case looks like this:

Dt 08 Kt 60.

How to form the initial cost of fixed assets, the enterprise independently forms the rules, this is discussed in paragraph 26 of the guidelines for accounting of fixed assets (Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n). According to the rules, the initial cost of an asset is the actual cost of producing it.

Important!!! The procedure for accounting and forming capital costs for the production of fixed assets must correspond to the procedure that is determined for accounting for the costs of the corresponding types of products produced by the company.

For independently created assets, accounting entries will look like this:

Dt 08 Kt 10, 02, 07, 10, 23, 26, 60, 69, 70, 71, 76…

Assets that are created independently include equipment that requires installation or is simply impossible to operate without prior installation. Such assets are reflected in account “07”. And the wiring will be as follows:

Dt 07 Kt 15, 23, 60, 71, 75, 76, 79, 86, 91.

If the property is transferred for installation, then the equipment will be transferred from account 07 to account 08. And the postings will look like this:

Dt 08 Kt 07.

The process of creating a new object can take a very long time. This is due, in particular, to the phased method of accepting work, the long-term implementation of trial operation, which is carried out until the planned design parameters are achieved, and many other specific objective factors that take place in construction.

This entire process may require large capital expenditures, in which case the company will simply be forced to apply for borrowed funds. Consequently, interest on the payment of borrowed funds will increase the book value of capital investments in assets:

Dt 07, 08 Kt 66, 67.

IMPORTANT! This rule applies only to those interests that were accrued before the asset was accepted for accounting. After this event, interest is charged to operating expenses (clause 11 of PBU 10/99).

After all capital costs for the facility are fully collected on account “08”, it is considered ready for operation, and its cost is transferred to account “01”:

Dt 01 Kt 08.

Tax accounting

The initial cost of assets formed through capital investments does not include VAT and other refundable taxes of a similar nature.

Expenses attributed to depreciable property are not included in the calculation of income tax (Tax Code of the Russian Federation, Article 270-5), including the gratuitous transfer of capital investments (ibid., clause 16). Similarly, if there is an unfinished construction project that is subject to liquidation, the costs of this project are not taken into account in the income tax base (Tax Code of the Russian Federation, Art. 265).

When selling capital investments in the form of property (this should clearly follow from the sales agreement), its value is taken into account in the tax base. NU rules are set out in Art. 268 Tax Code of the Russian Federation. The cost of fixed assets is written off according to the rules of Art. 258, 259, 272 of the Tax Code of the Russian Federation.

The most important

- Capital investments are the costs of purchasing and any other reproduction of the operating system, including manufacturing, construction, etc.

- These costs before commissioning of the facility are taken into account on account 08 or 07, if we are talking about equipment and its preliminary installation.

- After the costs are collected on the debit of the account. 08 (or with the participation of account 07), they are reflected as the initial cost on the account. 01. The facility is put into operation.

- In the general case, such costs fall into the NU through depreciation charges after the commissioning of the OS.

- VAT and other refundable taxes are not taken into account in the capital investment and initial cost of the asset.

List of entries in accounting for capital investment

Let's look at the wiring as an example. So:

The company purchased warehouse space in March 2021 under a purchase and sale agreement, the cost of which was 1,184,000 rubles (including 18% VAT - 180,000 rubles). To purchase this premises, the company took out a loan from the bank in the amount of 500,000 rubles at 15% per annum for a period of one month. A month later, the company returned the borrowed funds to the bank and paid the required interest for using the loan. Interest amounted to 6,250 rubles.

In April 2021, the company incurred costs for registering ownership of the purchased warehouse space in the amount of 8,000 rubles. And in April the premises were put into operation.

Consequently, the following entries were made in accounting:

| Wiring name | Amount in rubles | Debit | Credit |

| March 2017 | |||

| Reflection of the cost of warehouse premises as part of capital investments | 1 000 000 | 08 | 60 |

| VAT charged to the buyer | 180 000 | 19 | 60 |

| Received borrowed funds from the bank | 500 000 | 51 | 66 |

| Cost of warehouse space | 1 180 000 | 60 | 51 |

| April 2017 | |||

| Payment for state registration of ownership of warehouse premises | 8000 | 76 | 51 |

| Inclusion in actual costs for the acquisition of fixed assets | 8000 | 09 | 76 |

| Interest debt | 6250 | 08 | 66 |

| Return of borrowed funds to the bank | 500 000 | 66 | 51 |

| Transfer of accrued interest to the bank for using the loan | 6250 | 66 | 51 |

| Warehouse put into operation | 1 041 250 | 01 | 08 |

The procedure for accounting for unfinished construction projects

Expenses for unfinished objects in accounting are shown as cumulative totals. The cost of constructed facilities includes:

- amounts spent on installation and construction work;

- the price of purchasing equipment for installation in a building under construction;

- costs for the development of built-up areas;

- rent payments for land;

- payment for services for preparation of design and survey documentation;

- costs directly related to construction activities for a specific task.

IMPORTANT! Assets under construction cannot be depreciated. When receiving primary documentation, the accountant summarizes all cost items for the constructed building or structure

In general, expenses are reflected in the cost of inventory, raw materials, finishing materials, wages for workers, and fuel for equipment. If a defect is discovered during an inspection of an object, it is included in the costs

When receiving primary documentation, the accountant summarizes all cost items for the constructed building or structure. In general, expenses are reflected in the cost of inventory, raw materials, finishing materials, wages for workers, and fuel for equipment. If a defect is discovered during an inspection of an object, it is included in the costs.

Before putting the facility into operation, its readiness is checked. Based on its results, an Act is drawn up. The document is signed and verified with the customer. After recognizing a structure as a tangible asset in accounting, the management of the enterprise can dispose of it in the following ways:

- sell to a third party;

- make a gratuitous transfer in favor of an individual or other institution;

- initiate mothballing of an asset if it will not be used for a long time (due to seasonality of production or a forced reduction in production volumes);

- transfer for temporary use under a lease agreement.

NOTE! When deciding on the method of using the constructed objects, it is necessary to coordinate the operation with the members of the commission created at the enterprise. The procedure for transferring an object from the category of unfinished construction to completed involves signing an Asset Acceptance and Transfer Certificate and reflecting its value in accounting

The forms of acts are given in the resolution of the State Statistics Committee dated November 11, 1999 under No. 110. The next step is to stop recording business transactions for this facility at the stage of construction in progress. All amounts accumulated on the account are transferred to the cost of the new fixed asset put into operation

The procedure for transferring an object from the category of unfinished construction to completed involves signing an Asset Acceptance and Transfer Certificate and reflecting its value in accounting. The forms of acts are given in the Goskomstat decree of November 11, 1999, No. 110. The next step is to stop recording business transactions for this facility at the stage of construction in progress. All amounts accumulated in the account are transferred to the cost of the new fixed asset put into operation.

Procedure for freezing unfinished construction

Temporary suspension of the construction of a building or structure must be documented. The decision on the need for this operation is made by the customer; it is recorded in an order indicating the timing of the inventory. At the next stage, the developer is notified of the upcoming conservation of the property.

Before freezing construction at the site, an inventory is carried out. For this procedure, a commission body is created from representatives of the customer and the contractor. After inspecting the unfinished structure, members of the commission draw up an inventory list. The document reflects:

- name of the property;

- list of structural elements;

- construction stage.

After the inventory activities, a Temporary Stop of Construction Act is signed.

Sale of an unfinished asset

Only an object whose construction has been suspended can be sold. Before completing a transaction, it is necessary to register ownership of the structure being constructed. To do this, a set of title documentation for the land plot and a previously issued permit to begin construction work are submitted to Rosreestr (Article 40 of the Law of July 13, 2015 No. 218-FZ). The registration authority will need additional information:

- type of property asset being built;

- percentage of completion of the structure;

- purpose of the building according to the project.

In accounting, completed work is accepted into the balance sheet, and the contract agreement is terminated.

Which line of the balance sheet shows account 08?

Line 1120 shows data on expenses for completed research, development and technological work (R&D). Let us remind you that they are accounted for in a separate subaccount of account 04. Thus, to line 1120 of the balance sheet you need to transfer the debit balance of account 04 “Intangible assets” to the subaccount “R&D expenses”. The data in line 1120 is not reduced by count indicator 05.

They form accounts receivable, which are reflected in the corresponding asset lines of the balance sheet (see commentary on line 240 of the balance sheet on page 410).

This requirement is established by paragraph 52 of the Methodological Instructions for Accounting for Fixed Assets. Therefore, when drawing up a balance sheet, the value of such real estate items accounted for on account 08 should be reflected minus the amounts of depreciation accrued on these objects on account 02. Consequently, when drawing up a balance sheet, the value of such real estate items accounted for on account 08 should be reflected minus the amounts depreciation accrued for these objects on account 02.

The cost of the organization's fixed assets is repaid by calculating depreciation over their useful life.

Prize in accordance with Part 1 of Art. 129 of the Labor Code of the Russian Federation is an incentive payment and is included in wages. Bonus systems...

The audit is carried out on the basis of documents that are located on the unfinished construction site. Such documents include work logs, hidden work logs, reports of financially responsible persons, reports on the write-off of materials for work, acts of work completed, accounting registers.

Assets, liabilities, balance sheet model

Essence and classification of resources and capital

Topic 8. Financial capital of the enterprise

In modern financial language, the concepts of “money”, “cash”, “financial resources”, “monetary funds”, “capital”, etc. are often used.

Money -

macroeconomic category - a special product used as a general equivalent, through which the value of other goods is compared and the circulation of the commodity mass is carried out.

Cash -

a term that is used to designate that part of the property and property rights of an enterprise that is in the form of cash balances in the cash register and on the current account at the moment, i.e. This is a collection of funds represented by cash or non-cash banknotes.

Cash funds

(monetary funds) - part of the enterprise’s funds that has a designated purpose (repair fund, material incentive fund, vacation pay fund, etc.). This part is purposefully planned in advance and is relatively stable.

Financial means

are currently at the disposal of the enterprise, have monetary units of measurement and can be used by the enterprise to conduct financial transactions. These include: money (in cash and in accounts), securities, currency, precious metals and stones, shares in authorized capital, etc.

Financial resources -

a more capacious concept, including, along with financial resources, potential resources that can be obtained if necessary. Thus, the concept of “financial resources” includes current and potential funds that, if necessary, can be attracted and used to carry out current operations or investments.

Category "capital"

– one of the most developed in modern economic theory[9] and is often applied to various objects. The following main interpretations of the category can be distinguished:

1) part of the financial resources that are actually attracted and used to generate income. This means not only the size of these resources, but also the sources and conditions of attraction (own and borrowed, long-term and short-term capital);

2) funds invested in the property of an enterprise that is operated for the production of goods, provision of services, performance of work (fixed and working capital);

3) in a broader interpretation – resources used in business activities (material, human, financial, information, intellectual, etc.).

The classification of capital is shown in Figure 8.1.

| CAPITAL |

| by affiliation |

| by investment |

| by form of existence |

| by type of ownership |

| by investment |

| 1) own; 2) borrowed; 3) temporarily involved. |

| 1) non-negotiable; 2) negotiable. |

| 1) monetary; 2) production; 3) commodity. |

| 1) state; 2) joint stock; 3) share; 4) individual. |

| 1) intangible; 2) material; 3) financial. |

| by purpose of use |

| 1) productive; 2) loan; 3) speculative. |

Rice. 8.1. Capital classification

Equity

– funds of a special purpose nature, created by an enterprise at the expense of the owners (investors, shareholders), through the accumulation of profits, as well as through targeted contributions from the state budget and extra-budgetary funds.

Borrowed

– funds raised by an enterprise on a temporary basis on terms of urgency and payment.

Temporarily attracted

– various types of debt that an enterprise has in the process of carrying out business operations: to suppliers for received raw materials, to employees for wages, to the state for tax payments, etc.

Non-negotiable

– property and property rights that are at the disposal of the enterprise for a long time (more than a year) and at the same time retain their form: intangible assets (trademarks, patents, rights to leased property, etc.), unfinished capital investments (the cost of unfinished objects construction, etc.), long-term financial investments (stocks, shares, bonds), fixed assets (buildings, equipment, etc.).

Negotiable

– property and property rights used in the production process once, constantly changing their material form (stocks of raw materials, materials, containers, finished products, debt from customers for shipped products, cash in the cash register and current account).

Monetary

– funds of funds that can be used for their intended purpose.

Industrial

– various types of property that is used to produce goods, provide services, and perform work.

Commodity

– stocks of finished products in the warehouse and goods for resale.

State

– the indivisible right of ownership is held by federal, regional or local authorities.

Joint Stock

– divided into parts, the ownership of which is certified by a security – a share. The number of shares determines the share in the total share capital and the ability to influence management decisions. As a rule, the owner of shares can sell them without the consent of other owners.

Share

– divided into parts (shares), with the owner of each part having equal rights regardless of the size of the share. Decisions are made jointly at a meeting of shareholders.

Individual

– indivisible, 100% belongs to one person.

Intangible

– without physical form – these are rights to trademarks, licenses, patents, software, lease agreements, etc.

Material

(physical) – has a material form – these are different types of property.

Financial

– in monetary form.

Productive

– used in the production process; provides income in the form of the difference between the selling price and costs.

Loan

– intended for transfer for temporary use on terms of urgency and payment; income – interest received.

Speculative

– used for short-term speculative transactions, usually the purchase and sale of goods, currency, securities, and valuables. Income is generated from the difference between the purchase and sale prices.

The term “balance” is used in practice in the following meanings:

1) in accounting as equality of results when making entries in accounts;

2) the amount of sources of funds or the amount of funds (“balance sheet currency”);

3) financial reporting form No. 1, representing the financial model of the formation and use of capital.

The enlarged structure of the balance sheet, highlighting the main items, is presented in Table 8.1.

Table 8.1.

Enlarged balance sheet diagram

| Assets | Passive |

| 1 section. Non-current assets 1.1. Intangible assets 1.2. Long-term material and financial investments 1.3. Unfinished capital investments 1.4. Fixed assets | Section 3 Capital and reserves 3.1. Authorized capital 3.2. Additional capital 3.3. Reserve and other types of capital 3.4. retained earnings |

| Section 4 Long-term liabilities 4.1. Long-term loans 4.2. Long-term loans | |

| Section 2 Current assets 2.1. Reserves 2.2. Accounts receivable 2.3. Cash and equivalents | |

| Section 5 Short-term liabilities 5.1. Short-term loans and borrowings 5.2. Accounts payable |

The logic of the balance sheet model is as follows. To start business activities, an enterprise must have some start-up (authorized) capital, which is formed from the funds of the owners (founders). Then the company can raise funds in the form of a variety of loans and borrowings on the side - these sources are divided into 2 groups: long-term (available for more than 1 year) and short-term (attracted and returned within a year).

Attracted resources appear at the enterprise in the form of various funds. The formation of enterprise funds begins from the moment of organization of an economic entity and continues throughout its life. All funds are divided into 2 sections: non-current and current.

The balance sheet is compiled as of a certain date.

The left side of the balance sheet is called “asset”, the right side is called “liability”.

Category "asset"

has two meanings:

1) composition, placement and intended use of the enterprise’s funds, in other words, an asset - a list of property and property rights;

2) the costs of the enterprise incurred to generate income in the future, i.e. These are expenses that have not yet generated income.

Assets are arranged in order of increasing liquidity—the rate at which they are converted into cash. Let's look at the main sections and articles.

Non-current are assets that retain their form for more than one year. They include 4 groups of articles.

Intangible – various types of rights arising from: 1) copyright and other agreements on works of science, literature, computer programs; 2) certificates for trademarks; 3) patents for inventions; 4) “know-how”, etc.

Long-term material investments - the cost of material assets provided by the enterprise under a lease agreement. Financial investments are long-term investments in income-generating assets (securities) of other organizations, authorized capitals of subsidiaries and other organizations, government securities, etc.

Unfinished capital investments - the amount of actual costs for the purchase, construction, installation, preparation for operation of fixed assets that have not yet been put into operation. Upon completion of the work, these costs are added to the cost of fixed assets.

Fixed assets are a set of material assets used as means of labor or for managing an enterprise for a period exceeding 12 months. Current assets constantly change their material form during each production cycle. Among them, there are 3 key groups of articles.

Inventories - the cost of raw materials, auxiliary materials, fuel, purchased semi-finished products, containers, work in progress, finished goods, goods for resale, etc.

Accounts receivable is the debt of legal entities and individuals to a given enterprise.

Cash – balances in the cash register, in current and foreign currency accounts, in check books and other payment documents.

"Passive"

balance also has two interpretations:

1) a list of the enterprise before owners, creditors, employees, suppliers, the state, etc.;

2) a set of sources of funds, behind each of which there is a specific person who provided the resources.

The liability consists of 3 large sections.

Capital and reserves – data on own sources of funds (discussed in more detail in the next paragraph).

Long-term liabilities - data on funds provided to the enterprise: 1) not by the owners; 2) for temporary use; 3) on a paid basis; 4) on a long-term basis – more than 1 year. Loans usually refer to funds received from banks under loan agreements; under loans – from other legal entities and individuals.

Short-term liabilities are various types of debt, the repayment terms of which occur in the current calendar year: 1) to banks for loans received; 2) to suppliers for received raw materials; 3) wage workers; 4) to the state for taxes and fees.

It is quite obvious that assets are equal to liabilities, because We are talking about the same transactions that are reflected twice. In practice, various ways of expressing this equality are used, but the most common are the following two:

1) Asset = Equity + Liabilities

2) Equity = Asset - Liabilities

The second form of entry allows you to determine the amount of funds that the owners can count on during the liquidation of the enterprise. In other words, “equity capital” characterizes the amount that will remain at the disposal of the enterprise if all external obligations are paid off at once.