Expenses in foreign currency (cu)

Expenses that are expressed in currency or in conventional units should be taken into account in conjunction with expenses expressed in rubles. The amounts of such expenses must be converted into rubles at the official rate of the Bank of Russia established on the date of their recognition or the rate of a conventional unit agreed upon by the parties to the transaction. This is provided for in paragraph 5 of Article 252 of the Tax Code of the Russian Federation. Due to the recalculation, exchange rate differences (positive, negative) may arise, which are included either in non-operating income or in non-operating expenses (clause 11 of Article 250, subclause 5 of clause 1 of Article 265 of the Tax Code of the Russian Federation).

Under what circumstances is VAT taken into account as an expense?

Value added tax (VAT) is an independent tax liability. In most cases, VAT is not included in income tax expenses (Clause 19, Article 270 of the Tax Code of the Russian Federation).

However, under certain circumstances, the law allows the amount of this tax to be included in costs:

There is another situation when VAT is included in expenses: it was accrued, but was not presented to the buyer. Then the income tax base for such VAT will be reduced as part of other expenses (subclause 1, clause 1, article 264 of the Tax Code of the Russian Federation). The Ministry of Finance does not object to this approach (letter dated January 20, 2017 No. 03-03-06/1/3257).

Costs associated with production and sales

Costs associated with production and sales include:

- expenses for production, storage and delivery of goods, performance of work or provision of services;

- expenses associated with the acquisition and sale of purchased goods;

- expenses for maintenance, operation, repair and maintenance of fixed assets, as well as for maintaining them in good condition;

- expenses for the development of natural resources;

- R&D expenses;

- expenses for compulsory and voluntary insurance;

- expenses associated with the acquisition of rights to state (municipal) land plots on which buildings are located or capital construction will be carried out (Article 264.1 of the Tax Code of the Russian Federation);

- other expenses.

This is stated in paragraph 1 of Article 253 of the Tax Code of the Russian Federation.

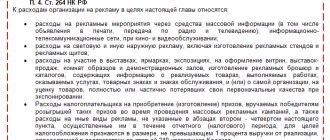

Advertising expenses

Advertising can be distributed in different ways: through radio announcements or broadcasting a commercial on television (using the media), placed on advertising stands or various types of transport.

Not all types of advertising expenses are standardized. Some of them can be recognized when calculating income tax in full, and some - according to a special standard, calculating them based on the revenue received in the reporting period:

Tax authorities do not always agree with taxpayers regarding the inclusion of advertising expenses in income tax expenses in full (without standardization). Disagreements are caused by unclear wording of the legislation, which does not detail certain nuances important for taxation. Then taxpayers are forced to defend their position in court.

For example, in the ruling of the Supreme Court of the Russian Federation dated May 30, 2019 No. 305-ES19-4394, the judges did not agree with the tax authorities that advertising on transport should be regulated. Among the reasons for such conclusions, the judges named the lack of legislation:

- definitions of outdoor advertising, which can be used as a guide when calculating income tax;

- the impact on tax calculations of the nuances of advertising distribution on stationary structures and vehicles.

The following articles will tell you how legislators limit the spread of certain types of advertising:

- “Advertising of custom-made diplomas has been outlawed”;

- “For the word “loan” in advertising, an organization faces a fine of up to 500,000 rubles.”

Insurance costs

Situation: is it possible to take into account, when calculating income tax, the costs of insuring an organization’s liability for non-fulfillment (improper performance) of a contract concluded with a government (budget) institution?

No you can not.

When calculating income tax, you can take into account the costs of all types of compulsory insurance, as well as those types of voluntary property insurance that are specified in paragraph 1 of Article 263 of the Tax Code of the Russian Federation.

Types of compulsory insurance are established by separate federal laws. These laws should determine the conditions and procedure for the implementation of such insurance. This is stated in paragraph 4 of Article 3 of the Law of November 27, 1992 No. 4015-1.

The mandatory conditions for concluding a contract with a government (budgetary) institution are given in Law No. 44-FZ of April 5, 2013. One of these conditions is the provision by the organization of security for the performance of the contract. In this case, the forms of security can only be those methods that are directly established by law, namely:

- depositing funds into the customer's account;

- provision of a bank guarantee.

This is stated in Part 3 of Article 96 of the Law of April 5, 2013 No. 44-FZ.

Therefore, liability insurance is not a prerequisite for entering into a contract.

The list of types of voluntary insurance specified in paragraph 1 of Article 263 of the Tax Code of the Russian Federation also does not include liability insurance for non-fulfillment (improper execution) of a contract. An organization cannot take advantage of the provisions of subparagraph 10 of paragraph 1 of Article 263 of the Tax Code of the Russian Federation, since in the situation under consideration such insurance is not a mandatory condition of its activities.

Situation: is it possible to take into account the costs of insuring the liability of the airport owner for damage to the property of air carriers when calculating income tax?

Yes, it is possible, provided that the airport owner's liability insurance is subject to Russia's international obligations (generally accepted international requirements).

When calculating income tax, you can take into account the costs of all types of compulsory insurance, as well as those types of voluntary property insurance that are specified in paragraph 1 of Article 263 of the Tax Code of the Russian Federation.

Types of compulsory insurance are established by separate federal laws. These laws should determine the conditions and procedure for the implementation of such insurance. This is stated in paragraph 4 of Article 3 of the Law of November 27, 1992 No. 4015-1.

The activities of airports are regulated by the Air Code of the Russian Federation. However, compulsory liability insurance is provided for by the Air Code of the Russian Federation only for:

- aircraft owners before third parties (Article 131 of the Air Code of the Russian Federation);

- carriers to passengers, cargo owners and shippers (Articles 133, 134 of the Air Code of the Russian Federation);

- operators (owners or lessees of aircraft) when performing aviation work (clause 3 of article 61, article 135 of the Air Code of the Russian Federation).

The Air Code of the Russian Federation does not provide for mandatory insurance of liability of airport owners for damage to property of air carriers. If the obligation to insure does not follow from the law, but is based on a contract, such insurance is recognized as voluntary (Clause 4, Article 935 of the Civil Code of the Russian Federation).

When calculating income tax, the airport's expenses for voluntary insurance of liability for damage to third parties can be taken into account in the only case: if such insurance is a mandatory condition for the airport's activities in accordance with the international obligations of Russia or generally accepted international requirements (subclause 8, clause 1, article 263 Tax Code of the Russian Federation). If these requirements are not met, the costs of insuring the liability of the airport owner for damage to the property of air carriers are not taken into account when calculating income tax.

Situation: is it possible to take into account, when calculating income tax, the amount of insurance and membership fees that an organization pays for its employees to a self-regulatory organization of appraisers (SRO)?

Yes, you can, but only in terms of contributions for property liability insurance to the customer.

An organization that intends to conclude an assessment agreement with a customer must have at least two employees on its staff - members of a self-regulatory organization of appraisers (SRO) (paragraph 2 of article 15.1, part 2 of article 24 of the Law of July 29, 1998 No. 135-FZ).

In turn, the SRO member is obliged to:

- pay fees (entrance, membership) established by the SRO (paragraph 4 of article 15 of the Law of July 29, 1998 No. 135-FZ);

- make a contribution of no less than 30,000 rubles to the compensation fund formed by the SRO. (paragraph 3, part 3, article 24.6 of the Law of July 29, 1998 No. 135-FZ);

- insure your liability (Article 4, 24 of the Law of July 29, 1998 No. 135-FZ).

The illegality of including in expenses the contributions paid by the organization for its employees to the SRO is explained as follows. Other expenses associated with production and sales include deposits, contributions and other mandatory payments, subject to the following conditions:

- the organization pays contributions to the non-profit organization;

- payment of fees, deposits, and other obligatory payments is a mandatory condition for the organization’s activities;

- The organization must pay fees, deposits and other obligatory payments for itself.

This procedure is established by subparagraph 29 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation.

SRO operates on the basis of membership of appraisers and belongs to non-profit organizations (Article 22 of the Law of July 29, 1998 No. 135-FZ). However, the organization pays the fees on behalf of the assessing employee and not on its own behalf. In addition, the payment of such fees is not a mandatory condition for the activities of the organization that is engaged in valuation activities. Therefore, the costs of paying membership and other fees that the organization pays to the SRO for appraiser employees cannot be taken into account when taxing profits (subclause 40 of article 270 of the Tax Code of the Russian Federation).

The Ministry of Finance of Russia adheres to a similar opinion in letters dated February 12, 2008 No. 03-04-06-02/9 and dated August 2, 2007 No. 03-03-06/1/536.

As for contributions for property liability insurance of appraiser employees, these expenses also do not reduce taxable profit. After all, an organization concludes an agreement to conduct an assessment on its own behalf, and not on behalf of its employees. Consequently, the organization, and not its employees, bears responsibility for the reliability of the assessment to the customer. The appraiser in the situation under consideration is the organization as a legal entity. This means that it must insure its own property liability, and not the liability of its employees. This follows from the provisions of paragraph 11 of part 2 of article 10 and article 24.7 of the Law of July 29, 1998 No. 135-FZ.

Thus, the organization has no reason to reduce taxable profit through contributions for liability insurance of its appraiser employees.

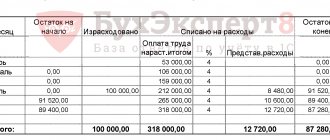

An example of how insurance and membership fees to SROs paid by an organization for its employees are reflected in accounting and taxation. The organization determines income and expenses using the accrual method

In January, Alpha LLC transferred to the SRO for its appraiser employees: – entrance fees in the amount of 22,000 rubles; – membership fees in the amount of 100,000 rubles; – contributions to the compensation fund in the amount of 96,000 rubles; – contributions for property liability insurance in the amount of RUB 93,000.

Entry and membership fees, as well as contributions to the compensation fund when an employee leaves the SRO are not refunded. Therefore, such expenses are reflected in accounting at a time. Such expenses are not recognized in tax accounting. As a result, on the date when these expenses are reflected in accounting, permanent differences arise and corresponding permanent tax liabilities arise.

Contributions for property liability insurance are included in accounting expenses on a monthly basis. Such expenses are not taken into account when taxing profits.

The following entries were made in Alpha's accounting.

January:

Debit 76 Credit 51 – 311,000 rub. (RUB 22,000 + RUB 100,000 + RUB 96,000 + RUB 93,000) – entrance, membership and insurance fees for appraiser employees are listed;

Debit 26 Credit 76 – 218,000 rub. – admission, membership and insurance fees for appraiser employees were expensed;

Debit 99 “Continuous tax liabilities” Credit 68 “Calculations for income tax” - 62,200 rubles. ((RUB 22,000 + RUB 100,000 + RUB 96,000 + RUB 93,000) × 20%) – a permanent tax liability has been accrued on the amount of contributions not taken into account when taxing profits.

Monthly:

Debit 26 Credit 76 – 7750 rub. (RUB 93,000: 12 months) – insurance premiums for the current month were expensed.

Situation: is it possible to take into account the amount of membership fees that an organization pays to the chamber of commerce and industry when calculating income tax?

No you can not.

The Chamber of Commerce and Industry (CCI) is a non-governmental non-profit organization that unites Russian organizations and entrepreneurs (Clause 1, Article 1 of Law No. 5340-1 of July 7, 1993). One of the sources of financing the activities of the Chamber of Commerce and Industry is the entrance and membership fees of its participants (clause 3 of article 13 of the Law of July 7, 1993 No. 5340-1). The costs of maintaining such associations in the form of voluntary contributions (membership, admission) are prohibited from being taken into account when calculating tax. This is directly stated in paragraph 15 of Article 270 of the Tax Code of the Russian Federation.

Which expenses reduce income tax and which do not?

Expenses in the income tax return are the amounts of costs that, in the taxpayer’s opinion, legally reduce the tax base, that is, comply with the requirements of tax legislation. These requirements are quite strict, and inspectors cling to literally every little detail: the expense is not economically justified, is not aimed at generating income, there are shortcomings in its documentary evidence, etc. Tax authorities are also trying to exclude expenses from the tax base due to their irrationality, ineffectiveness or inexpediency, although the Ministry of Finance does not support them in this (letter dated 04/19/2019 No. 03-03-07/28232).

Thus, any expense, after being examined by controllers, can instantly move from the group of recognized to the category of unrecognized tax expenses. In paragraph 49 of Art. 270 of the Tax Code of the Russian Federation directly states that when determining the tax base, expenses that do not meet the legally established criteria are not taken into account. The remaining 48 positions of this article contain specific types of expenses not recognized for income tax purposes - for charity, payment of dividends, fines and other sanctions transferred to the budget or extra-budgetary funds, payment of other similar obligations and expenses. All these expenses can be made exclusively from net profit.

Some expenses are included in tax calculations only occasionally (for example, VAT). The other part is recognized when calculating income tax according to the norms strictly established in the code, that is, not always in the full amount (read more about this below).

Compensation payments

Situation: can a sports club take into account compensation paid to another club under a transfer contract? Was the contract concluded in connection with the athlete’s transfer to another club?

Yes maybe.

When a professional football player moves from one club to another, a transfer contract is concluded between the clubs. It, in particular, stipulates the conditions and amount of mandatory compensation payments associated with the transfer of a football player. This is stated in Article 18 of the Regulations, approved by Resolution of the Executive Committee of the Russian Football Union dated March 5, 2011 No. 141/4.

The expenses that the club incurs in connection with the conclusion of a transfer contract are considered non-operating. When calculating income tax, they should be taken into account on the basis of subparagraph 20 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation. The tax treatment of these expenses depends on the type of transfer contract.

A transfer contract can be one-time or ongoing (on a loan basis).

In the first case, the club for which the athlete previously played terminates his employment contract and receives a one-time compensation for this. From this moment, the transaction is considered completed, therefore the paid compensation can be included in expenses at a time in the reporting (tax) period to which it relates (paragraph 1, clause 1, article 272 of the Tax Code of the Russian Federation).

In the second case, the transfer contract includes elements of a lease agreement. A mandatory condition of such a contract is the return of the player to his former club upon expiration of the contract. If this period covers several reporting (tax) periods for income tax, the compensation paid should be written off as expenses evenly throughout the entire rental period of the football player (paragraph 3, clause 1, article 272 of the Tax Code of the Russian Federation).

A similar point of view is shared by the Russian Ministry of Finance in letter dated March 22, 2006 No. 03-03-04/1/272.

Situation: is it possible to take into account the personal income tax compensation that an organization pays to citizens who receive new housing from it in connection with the demolition of their residential buildings on a land plot?

No you can not.

When receiving new housing free of charge, a citizen receives income in kind, the amount of which is determined as the market value of the new housing. This follows from the provisions of paragraph 1 of Article 210 and paragraph 1 of Article 211 of the Tax Code of the Russian Federation.

The source of income payment is the developer organization, which at its own expense provides the citizen with new housing. In this situation, the developer organization is recognized as a tax agent for personal income tax. Consequently, she is obliged to withhold and transfer to the budget the amount of this tax calculated from the market value of new housing (clause 1 of Article 226 of the Tax Code of the Russian Federation).

If an organization does not pay a citizen income in cash, it is impossible to withhold personal income tax from the cost of housing. In this case, the tax agent is obliged to inform the tax inspectorate at the place of his registration within a month (clause 5 of Article 226 of the Tax Code of the Russian Federation).

If personal income tax was not withheld by the tax agent, the citizen must pay it independently at his own expense. This follows from the provisions of paragraphs 1 and 2 of Article 45 of the Tax Code of the Russian Federation (determination of the Constitutional Court of the Russian Federation of January 22, 2004 No. 41-O). Moreover, the payment of personal income tax at the expense of tax agents is expressly prohibited by law (clause 9 of Article 226 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia for Moscow dated November 22, 2007 No. 28-11/111282). Payment of additional compensation, with which the developer covers citizens' expenses for paying personal income tax on the cost of housing received free of charge, essentially means a violation of this requirement.

The costs of purchasing housing for resettled citizens are included in the initial cost of new construction (clause 5 of article 270 and clause 1 of article 257 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated January 25, 2006 No. 03-03-04/1/56, dated February 20, 2007 No. 03-03-06/1/103, dated February 27, 2006 No. 03-03-04/1/145). After putting a new facility into operation, they will reduce the taxable profit of the developer organization through depreciation. However, when forming the initial cost of a new construction project, the organization has the right to take into account only those expenses that meet the criteria established by Article 252 of the Tax Code of the Russian Federation. These expenses must be economically justified, documented and related to activities aimed at generating income. It is impossible to recognize compensation as such expenses, the purpose of which is to illegally exempt citizens from paying personal income tax at their own expense.

Thus, if an organization reimburses displaced citizens for the cost of paying personal income tax on the cost of housing provided free of charge, this compensation cannot be taken into account when calculating income tax.

Situation: when calculating income tax, is it possible to include interest on a monetary obligation in expenses if the agreement does not specify the procedure for their calculation?

Yes, you can, if the contract does not contain the instruction: “no interest to be charged.”

Debtors (buyers, customers) are obliged to pay creditors (sellers, executors) legal interest on monetary obligations. This is a fee for using the lender's money.

Interest is called legal because the right to receive it is directly provided for by the Civil Code of the Russian Federation and does not require confirmation of this in contracts. For example, under a contract for the sale of goods, the obligation to pay legal interest by default will arise from the buyer if he pays for the goods after shipment: the next day or later.

If the parties initially agree not to accrue legal interest, then the contract says: “legal interest is not accrued” or “interest on monetary obligations is not accrued.” Of course, you also won’t have to pay interest if no debt has arisen. For example, if the buyer paid for the goods on the day of shipment.

How to calculate interest when the contract is silent about waiving it

When there is no express clause in the contract that interest is not accrued, the debtor determines the amount of interest for the entire period of use of the creditor's funds. The calculation is based on the refinancing rates in force during this period. That is, changes in rates must be taken into account.

Interest is calculated on the entire amount of the debt from the next day after its occurrence until the day of its repayment, inclusive. It does not matter whether the payment is overdue or not. For example, under a purchase and sale agreement, determine the period for calculating legal interest (by default) as follows:

| Condition in the contract | Execution of obligations | Period for calculating legal interest |

| Pay for the goods within five calendar days from the date of shipment | paid on the day of shipment | 0 days (no interest accrued) |

| paid on the fifth calendar day from the date of shipment | 5 days | |

| paid on the 10th calendar day from the date of shipment | 10 days (including 5 days of delay) |

This follows from the provisions of Article 317.1 of the Civil Code of the Russian Federation.

How to take interest into account when calculating income tax

When calculating income tax, include the amount of accrued legal interest as part of non-operating expenses. These are normal expenses in the form of interest on debt obligations.

Under the accrual method, recognize interest as an expense for the month to which it relates. Possible options for recognizing income depending on the actions of the debtor, see the table:

| Interest payment procedure | At what point should interest be calculated and recognized as an expense? |

| The debtor repays the debt over a long period of time (more than one month) | Until the debt is repaid, interest is recognized on the last day of each month. Interest for the last month is recognized on the day of full repayment of the debt |

| The debtor does not pay interest in principle | On the last day of every month |

Under the cash method, include legal interest on a monetary obligation as an expense at the time it is actually paid.

This follows from the provisions of subparagraph 2 of paragraph 1 of Article 265, paragraphs 1 and 8 of Article 272, paragraph 3 of Article 273 of the Tax Code of the Russian Federation. Similar clarifications are contained in letters from the Ministry of Finance of Russia dated December 9, 2015 No. 03-03-RZ/67486 and the Federal Tax Service of Russia dated March 4, 2021 No. SD-4-3/3618.

An example of how to take into account legal interest on a monetary obligation as an expense when calculating income tax

In February 2021, a contract for the supply of furniture sets was concluded between Hermes LLC and Alpha LLC. Under the terms of the agreement, Alpha is obliged to pay 100 percent of the cost of the goods within five calendar days after shipment. There is no clause in the agreement that legal interest is not accrued.

Delivery of five headsets for a total amount of RUB 1,180,000. (including VAT - 180,000 rubles) is scheduled for February 5.

On February 5, Hermes shipped the goods. Alpha paid for the goods on May 10.

The refinancing rate for the period from February 5 to May 10 is 11 percent.

Alpha pays income tax monthly and uses the accrual method.

The amount of legal interest was:

- 8535 rub. (RUB 1,180,000 × 11%: 365 days × 24 days) – for February;

- RUB 11,024 (RUB 1,180,000 × 11%: 365 days × 31 days) – for March;

- RUB 10,668 (RUB 1,180,000 × 11%: 365 days × 30 days) – for April;

- 3556 rub. (RUB 1,180,000 × 11%: 365 days × 10 days) – for May.

When calculating income tax, Alpha’s accountant included the corresponding amount of interest in non-operating expenses on the last day of each month (February 29, March 31, April 30). Interest for the last month (May) in the amount of 3556 rubles. The accountant took into account the day the debt was fully repaid (May 10).

Entertainment expenses

Income tax on entertainment expenses is reduced based on the following norm:

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

A specific list of such expenses is not established in the Tax Code of the Russian Federation. The Ministry of Finance of Russia, in letter No. 03-03-06/1/3120 dated January 22, 2019, clarified that the amount of entertainment expenses may include both food for organizing breakfasts, lunches and other similar events, and alcoholic beverages. The main condition: expenses must be supported by documents and economically justified.

To protect yourself from claims from tax authorities, write down the cost norms for alcohol in your internal local act. Then inspectors will have no reason to find fault with excessive volumes of purchased alcohol or the purchase of expensive vintage wine for meetings with partners.