When does the employer pay the December salary?

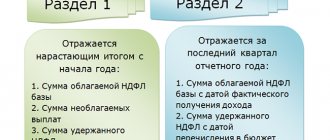

Data on income paid to employees and the tax withheld from it is disclosed by the employer in a report on Form 6-NDFL. The form consists of a title page and two sections. The calculation is submitted to the regulatory authority quarterly. From the first quarter of 2021, the form and filling out rules are regulated by Federal Tax Service Order No. ED-7-11 / [email protected] dated 10/15/2020.

Organizations practice several options for paying wages for the last month:

- in December, which is technically an advance;

- 31st;

- in January next year.

Depending on the day the funds are transferred and the deadline for paying the tax, sections 1 and 2 of the form will be filled out differently. Regardless of the date of actual payment of wages, the date of accrual of income is December 31, 2020. The date of deduction of the calculated tax is the day of payment of funds, the deadline for transfer is the next business day.

ConsultantPlus experts discussed how to correctly fill out 6-NDFL according to the new rules that will come into force in 2021. Use these instructions for free.

to read.

Specific examples of reflecting December salaries in 6-NDFL

Example. There are five people in the organization. They are not entitled to the standard deduction. Every month, the accountant accrues income of 150,000 rubles for all employees. Personal income tax – 19,500 rubles. Salaries for December 2019 were paid on December 30.

The accountant included the December 2021 salary in section 1.

Section 2 can be completed in two ways. They differ in the date of receipt of income in line 100.

Method 1. Date of receipt of income - salary payment day

However, in separate clarifications, representatives of the Federal Tax Service indicate that the date of personal income tax withholding cannot precede the date of income, therefore in line 100 it is not December 31, but the day of salary payment

Method 2. Date of receipt of income - last day of the month

According to the Tax Code, the date of receipt of salary income is always the last day of the month. According to the Labor Code of the Russian Federation, the organization is obliged in this case to accrue and pay wages in advance, therefore line 110 indicates an earlier date than line 100

Both methods of filling out section 2 as part of the annual 6-NDFL are acceptable, and the Federal Tax Service is obliged to accept the calculation. However, with the second method, the tax withholding date is earlier than the date the income was received, so the inspection may require clarification.

Example . There are five people in the organization. They are not entitled to the standard deduction. Every month, the accountant accrues income of 150,000 rubles for all employees. Personal income tax – 19,500 rubles. Salaries for December 2019 were paid on December 31.

Section 1 must be completed as in the previous example. In section 2 for 2021, do not show wages paid on December 31st. This income must be included in section 2 of the calculation for the first quarter of 2021.

Read also

17.06.2017

How to fill out a report if money was paid in December

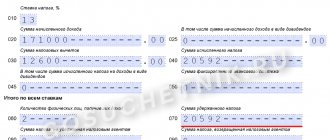

If the salary is transferred in advance, the payment is reflected in both sections of the form for 2021. Let’s say the employer paid income on December 30, 2020 in the amount of 800,000 rubles. Deductions in the amount of 104,000 rubles were transferred to the inspectorate on the same day. Report 6-NDFL, if the salary in December was paid before the 31st, looks like this:

If the payment for the last month was transferred to employees on December 31, then this payment will be included in the report for 2021 and for the first quarter of 2021. This happens as a result of the fact that the deadline for paying tax deductions is postponed to 01/11/2021. Here is a sample of how to fill out 6-NDFL if wages were paid on December 31, 2021 for the current period:

Section 2 of the calculation remains blank, since the deadline for transferring income tax falls on the first quarter of 2021, and the indicators for the last calendar month will be reflected in the report for this period as follows:

Deadlines for paying December salaries in 2019

How to fill out 6-NDFL based on the results of 2021? This depends on whether you paid your salary in December 2021 or January 2021. If you set the deadline for paying salaries at the end of the month from the 1st to the 8th, you need to pay the salary for December on the eve of the holidays (Part 8 of Article 136 of the Labor Code). If the deadline is from the 9th to the 15th, there is no need to issue wages in advance.

For more information about this, see “ Payment dates for December salaries according to the Labor Code of the Russian Federation .”

How to fill out the calculation if the money was transferred in the first quarter

When paying the December salary in January, the amounts of income and mandatory payments will be included in the calculation for 2021 and for the 1st quarter of 2021. Let us assume that management decided to pay wages on January 11, 2021 in the amount of 800,000 rubles. Deductions in the amount of 104,000 rubles were transferred to the inspectorate on the same day. The deadline for transfer according to law is 01/12/2021. In the report for the fourth quarter, only lines 020 and 040 of the first section are completed.

The indicators of the transferred income are included in the calculation for the first quarter of 2021 and must be filled out in a new form.

Let’s summarize how to fill out 6-NDFL and 2-NDFL if the tax for December is transferred in January 2021:

- In the calculation for the first quarter, the tax is shown in any case.

- In the report for 2021, only line 040 is filled in.

- Certificate 2-NDFL is submitted based on the results of the tax period, which reflects personal income tax on an accrual basis for January-December.

It may happen that payments to personnel are made in products or in another “commodity” way. The calculation and reflection of deductions in the report, if December income in kind is withheld in January, is similar to cash settlements with employees.

Salaries for December were issued in January

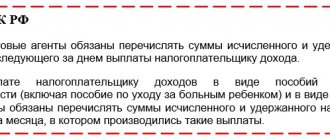

The date of receipt of income in the form of wages is the last day of the month for which it was accrued (clause 2 of Article 223 of the Tax Code of the Russian Federation).

The tax agent withholds tax on the day of actual payment of income and transfers it no later than the next working day (clauses 4, 6 of Article 226 of the Tax Code of the Russian Federation). What does it mean?

For example, wages accrued for December 2021 will be paid on January 11, 2021. The amount of personal income tax from this salary is reflected in the calculation of 6-personal income tax for 2021 only on line 040 and is not reflected on lines 070 and 080. At the same time, December personal income tax should be reflected in the calculation for the first quarter of 2021 as follows:

- according to line 070 of section 1;

- line 100 indicates 12/31/2020;

- on line 110 - 01/11/2021;

- on line 120 - 01/12/2021;

- on lines 130 and 140 - the corresponding total indicators.

That is, when paying salaries for December on January 11, 2021, personal income tax must be withheld in January and transferred to the budget no later than January 12, 2021.

General rule: if a tax agent carries out an operation in one period and completes it in another period, then in the 6-NDFL calculation the operation is reflected in the period in which it was completed. The moment of completion of the operation refers to the period in which the deadline for transferring personal income tax occurs.

Filling out 6-NDFL for 2021

When filling out the 6-NDFL calculation for 2021, this payment and the personal income tax on it are reflected as follows:

- line 020 of section 1 indicates the amount of accrued income, that is, the amount of salary for December 2021;

- in line 040 of section 1 - the amount of calculated personal income tax from wages for December 2021.

The remaining lines in this calculation are not filled in.

In the calculation of 6-NDFL for the 1st quarter of 2021, personal income tax is reflected as follows:

- line 070 of section 1 indicates the amount of personal income tax withheld;

- on line 100 – the date of actual receipt of income, i.e. 12/31/2019;

- on line 110 of section 2 – the date of personal income tax withholding, i.e. 01/10/2020;

- on line 120 of section 2 - the date no later than which the tax amount must be transferred, i.e. 01/13/2020;

This corresponds to the Procedure for filling out the 6-NDFL calculation, which was approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] , as well as clarifications of the Federal Tax Service of Russia presented in letters dated November 29, 2016 No. BS-4-11/ [email protected] , dated 07/01/2016 No. BS-4-11/ [email protected]

6-NDFL and salary for December

How to reflect your December salary in 6-NDFL depends on when you paid it: in December 2021 or January 2021. Let's consider each of the situations. We will not thoroughly explain the rules for filling out the calculation; you can read about them in numerous materials in our section “Calculation of 6-NDFL”. We will speak briefly and to the point.

Let's start with the fact that in both cases, salary calculation (line 020) and personal income tax (line 040) must be reflected in the calculation for 2021. But then there will be differences.

6-NDFL, if the salary for December was issued in January (for example, 01/11/2021)

When calculating for 2021, regarding the December personal income tax, do not fill in:

- line 070 - it reflects only personal income tax withheld as of the reporting date, i.e. as of 12/31/2020;

NOTE! After withholding personal income tax in January, there is no need to submit an update for 2021 (letter of the Federal Tax Service dated July 1, 2016 No. BS-4-11 / [email protected] ). This is the difference between 6-NDFL and 2-NDFL, for which an adjustment is required.

- line 080 - here they reflect a tax that will not be withheld;

NOTE! For this amount, you need to send the tax authorities 2-NDFL certificates with sign 2.

- section 2 - it is filled out according to the deadline for paying personal income tax, and it falls in 2021.

By the way, as of reporting for the 1st quarter of 2021, a new form 6-NDFL is in effect, and in it information about personal income tax payable is reflected in a new way:

- not in the second section, but in the first;

- in a more concise form: only the date of transfer and the amount of tax (the dates of actual receipt of income and withholding of personal income tax, as well as the amount of income no longer need to be given).

That is, in this case in Sect. 1 calculation for the 1st quarter of 2021 must indicate:

ConsultantPlus experts have already provided comments on the procedure for filling out the new Form 6-NDFL from 2021 and have prepared a completed sample. You can view the materials by getting trial access to K+. It's free.

6-NDFL, if the December salary was issued on 12/31/2020

Calculated for 2021:

- show personal income tax withholding on line 070;

- In section 2, do not show salary payments.

Since the deadline for paying personal income tax to the budget falls on the first working day of 2021 (01/11/2021), the payment must be included in the calculation already in the 1st quarter of 2021:

NOTE! This must be done even if you paid personal income tax immediately in December (letters from the Federal Tax Service dated November 1, 2017 No. GD-4-11 / [email protected] , dated February 25, 2016 No. BS-4-11 / [email protected] ).

6-NDFL, if the salary for December was issued before 12/31/2020

In general, if a salary is paid earlier, it is incorrect to withhold personal income tax from it. In this case, it is considered an advance for December, and tax is subject to withholding when paying an advance for January (see, for example, letter of the Ministry of Finance dated October 3, 2017 No. 03-04-06/64400).

At the same time, officials promised not to impose fines for such premature transfer of personal income tax.

Therefore, if you withheld tax when paying, for example, December 30, fill out section 2 in the calculation for 2020: You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

When to pay salaries before the New Year

The Federal Tax Service regulations indicate whether December should be included in 6-personal income tax for the 1st quarter - yes, be sure to include December accruals in the report.

IMPORTANT!

Please note that the Federal Tax Service of Russia, by order No. ED-7-11/ [email protected] dated October 15, 2020, approved a new form 6-NDFL, which is valid from reporting for the 1st quarter of 2021. The rules for filling it out have changed.

Before the New Year holidays, many employers are thinking about the question of when to pay employees wages for the second half of December:

- in January;

- December.

Most often, management leans towards the second option. Firstly, in order not to leave workers without money before the holidays, and secondly, in order not to violate the requirements of labor legislation on the terms of payment (twice a month with an interval of no more than 15 days). If the employment contract states that the payday is, for example, the 5th day of each month, then if this date coincides with a weekend or holiday, the employer is obliged to pay the day before, on the last working day before this date. In the case of January 5, this last working day falls in December, and there are no other options. Such a postponement is formalized by order of the organization.

IMPORTANT!

Even if the salary is in December, in 6-NDFL we reflect the tax accrual upon the fact. It is prohibited to calculate personal income tax before the end of the month (letter of the Ministry of Finance No. 03-04-06/64400 dated 10/03/2017).

When to pay salaries for December 2020

For organizations that have set a date from the 1st to the 10th of the next month as their payday, it becomes difficult to pay salaries for December 2021. The period from January 1 to January 10 is non-working according to the all-Russian production calendar, so the question arises: when should wages be paid for December 2020?

In addition, it must be taken into account that in a number of regions, by order of local authorities, December 31, 2021 has been declared a day off for civil servants and a recommendation has been given to commercial workers to also make this day a day off.

For organizations in which December 31, 2020 is declared a holiday, the optimal date for payment of salaries is December 30, 2021 . In organizations where December 31, 2020 was not made a day off, it is logical to pay wages on December 31, 2021 .

If an organization has a payment deadline set after January 10, then salaries for December should not be paid in December.

If you make a payment later than January 10 (for organizations where the payment period is set from 1 to 10), then the following will be violated:

- Standards for the timing of salary payments established in the organization;

- Art. 136 of the Labor Code of the Russian Federation: “...If the payment day coincides with a day off or a non-working holiday, wages are paid on the eve of this day ...”

Salaries were paid in December

If an organization has fully paid its employees for December on the last working day (in 2021 this is December 30 in many regions, but December 31 at the federal level), it does not have the right to withhold personal income tax and transfer it to the budget. The salary becomes the taxpayer’s income only on the last day of the month worked (Article 223 of the Tax Code of the Russian Federation). The taxpayer must show in 6-NDFL the December personal income tax withheld in January: December 31 is the last working day, and it is allowed to withhold personal income tax on this day, but transfer it under Article 230 of the Tax Code of the Russian Federation on the next working day - 01/11/2021.

If December 31 is a holiday, the deadline is postponed not as with payment - to the last working day before that - but to the first weekday of the next month. It is absolutely impossible to withhold personal income tax before the last date (letter of the Federal Tax Service No. BS-3-11/2169 dated May 16, 2016).

ConsultantPlus experts gave examples of how to reflect the December salary in accounting. Use these instructions for free.