Bonuses in 6-NDFL: types and characteristics

Depending on the frequency, bonuses are awarded:

- systematic;

- one-time

The first type is paid based on the results of work, for the fulfillment of the production plan for a month, quarter or year, the second (as a rule) - as encouragement, gratitude or on the occasion of a significant event.

Read more about what types of bonuses and employee benefits there are, here .

How does the type of bonus affect its reflection in 6-NDFL and what errors are possible here?

When a one-time bonus is paid along with the basic salary, there is a risk when compiling 6-NDFL that the bonus and salary are considered equal components of the salary. Personal income tax on them is also transferred at the same time, so someone may forget about the different dates of actual receipt of income.

The date of receipt of income in the form of a one-time bonus is the day of its payment (letter of the Ministry of Finance of Russia dated March 27, 2015 No. 03-04-07/17028, Federal Tax Service of Russia dated June 8, 2016 No. BS-4-11 / [email protected] ), and in the form salary - the last day of the month for which it was accrued (clause 2 of article 223 of the Tax Code of the Russian Federation).

This approach can be arrived at by comparing clause 2 of Art. 223 of the Tax Code of the Russian Federation and Art. 129 Labor Code of the Russian Federation. In accordance with the Labor Code of the Russian Federation, the salary consists of:

- from remuneration for labor;

- compensation payments (for example, for work in difficult conditions, harmful to health, etc.);

- incentive payments (including bonuses).

In paragraph 2 of Art. 223 of the Tax Code of the Russian Federation provides the wording “income for fulfilled labor duties,” that is, it refers to the first component of the salary under Art. 129 Labor Code of the Russian Federation. Bonuses not related to the performance of work duties (for example, for a holiday, anniversary, etc.), under the conditions of clause 2 of Art. 223 of the Tax Code of the Russian Federation are not suitable, therefore the requirements of subsection must be applied to them. 1 clause 1 art. 223 Tax Code of the Russian Federation. Thus, the earnings date for such bonus payments is the day they are paid.

For information on the rules for taxing bonus payments with personal income tax, read the article “Are bonuses subject to personal income tax?” .

When is the bonus paid?

The employer has the right to independently set deadlines for issuing bonuses. These do not necessarily coincide with the dates on which wages are paid. Taking into account the requirements of the Labor Code of the Russian Federation (Article 136), payments of remuneration to employees are made within 15 days after accrual.

The question of whether it is possible to give a bonus to an employee in the middle of the month is resolved positively in the case of non-production and one-time payments by order of management.

Still, most employers try to calculate and issue bonuses simultaneously with salaries. This simplifies the accounting system and does not contradict labor law standards.

Annual

The terms of accrual and the amount of annual bonuses are not approved by law. In this case, the employer decides on the remuneration of employees at the end of the year based on the financial capabilities of the organization and the feasibility of spending. Management has the right to independently determine the period when the annual bonus is paid, establishing the procedure in a collective agreement, bonus regulations or order.

Typically, accruals are made on the last working or calendar day of December or after submitting annual reports.

The amount of bonus payments at the end of the year is established by the management of the organization as a percentage of the employee’s annual earnings or salary, taking into account the length of service, remuneration in the amount of the monthly payment rate, etc. The organization pays bonuses at the end of the year from the wage fund, fund material incentives or other source indicated in the documents of the enterprise. The specific deadlines for issuing an annual bonus are established in the regulations on remuneration and the regulations on bonuses, but no later than January 15 of the year following the accrual period.

Quarterly

Production bonus payments are made based on the results of the quarter worked, and the deadline for transferring the quarterly bonus is set no later than the 15th day of the month following the reporting quarter (Article 136 of the Labor Code of the Russian Federation).

Non-productive wages are not included in wages and are paid at any time specified in the employment contract or regulations on wages and other documents of the enterprise.

ConsultantPlus experts discussed how to arrange payment of a bonus to an employee after his dismissal. Use these instructions for free.

During the inter-settlement period

One-time bonus payments are not included in the basic salary. They are awarded in certain cases, for example, for the anniversary of work experience in an organization, a professional holiday, in honor of a wedding or victory in a professional skills competition, etc. The employer unilaterally determines how often an additional bonus is accrued by issuing an order from the manager for each case. The terms for such payments are not limited in any way; they are issued outside of reporting periods.

Sample order from a manager to issue a one-time incentive for production results

Monthly

Such bonuses for employees are mandatory if the concept of a monthly bonus, the procedure for its calculation and payment are enshrined in the internal regulatory documents of the enterprise and are included in the remuneration system. Then the monthly production payment is made in accordance with their provisions no later than the 15th day of the month following the worked one. Non-productive, as is the case with the payment of quarterly bonuses - at any time.

If the organization does not approve this type of bonus as mandatory, then the employer has the right not to make payments at all or to use separate orders for the organization to reward employees if necessary.

Legal documents

- Art. 135 Labor Code of the Russian Federation

- Art. 136

Drawing up 6-NDFL when paying a one-time bonus

Let's consider the procedure for displaying the deadline for paying tax in 6-NDFL on bonuses not related to the performance of work duties in the 6-NDFL report.

| Line number | Operation | Operation time | Link to the Tax Code of the Russian Federation |

| 020 | Income accrual | On the day of payment | In accordance with the date of calculation of personal income tax |

| 040 | Calculation of personal income tax | On the day of payment | Clause 3 Art. 226 |

| 100 | Date of actual receipt of income | On the day of payment | Subp. 1 clause 1 art. 223 |

| 070, 110 | Withholding personal income tax | On the day of payment | Clause 4 art. 226 |

| 120 | Transfer of personal income tax | No later than the day following the day of payment of income to the employee | Clause 6 Art. 226 |

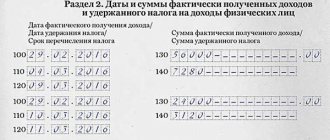

When calculating the bonus, you need to show it in a separate block of cells 100–140 in section 2.

Check whether you filled out 6-NDFL correctly using the Ready-made solution from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Let's consider the entry in the calculation of different types of one-time bonuses in a specific situation.

Example 1

On 05/08/2020XX, employees were paid a bonus for the May 9 holiday in the amount of RUB 174,000. (Personal income tax - 22,620 rubles). The tax payment deadline is the first working day, 05/12/20XX.

On 05/21/20XX, the shop manager P.O. Voronkov was paid an anniversary bonus in the amount of 9,500 rubles. (Personal income tax - 1,235 rubles). The tax payment deadline is 05/22/202XX.

Below is a fragment of the calculation showing the payment data (reporting period - 6 months).

Systematic bonuses: what is the tax payment deadline?

As for bonuses related to the performance of work duties, at first everything was ambiguous. The regulatory authorities in their explanations did not divide bonuses into those related to the performance of labor duties and those not related. The requirement to recognize the date of payment of bonuses received for the performance of job duties as the date of receipt of income led to legal disputes .

It should be noted that the courts did not agree with the regulatory authorities. Read about this in the material “When to transfer personal income tax from bonuses to employees to the budget .

But then officials developed the following approach:

- Monthly bonuses. The date of receipt of income is considered to be the last day of the month for which the bonus was accrued (letter of the Ministry of Finance dated September 29, 2017 No. 03-04-07/63400). It does not matter what month the bonus order is dated or when the bonus was issued.

Read more about this here and in this publication .

- One-time bonuses (annual, for production results). The date of income for them is the day of payment (letter from the Ministry of Finance dated September 29, 2017 No. 03-04-07/63400, Federal Tax Service dated October 5, 2017 No. GD-4-11 / [email protected] ).

Read about the nuances of bonuses issued after dismissal here .

This must be taken into account when reflecting bonuses in 6-NDFL.

How to reflect the annual bonus in 6NDFL

Hello, in this article we will try to answer the question “How to reflect the annual bonus in 6NDFL.” You can also consult with lawyers online for free directly on the website.

In fact, the money was issued on 02/06/2017. The accountant of Kolos LLC reflected the bonus in the calculation for the first quarter.

In an employment contract, you can often come across wording that determines the amount of the monthly bonus that is paid to the person.

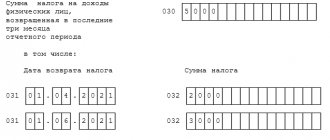

Completing sections in connection with payments

But with regard to payments for longer periods, a controversial situation may already arise. For example, an order for bonuses for a year or quarter was issued on February 1, and payment was made on February 10. Then, if we are guided by the position of the Federal Tax Service, income in the form of a bonus at the time of its transfer to employees has not yet been received.

When filling out a certificate form, many individuals make the following mistakes, which will result in the certificate being incorrect:

You must pay special attention when filling out the date field of the document. According to standards, a person must indicate the date only in numbers without using words, for example, 01/02/2019

The stamp can only be affixed in the appropriate place on the form, i.e. at the bottom of the page in the left corner, next to the inscription “M. P.”, Must be clear and bright, without scuffs or washouts. An accountant must be careful when filling out his fields, since any error or inaccuracy in the numbers may have a negative impact on the person in the future. It is definitely worth checking the presence of the accountant’s signature, which according to standards can only be done with a blue ballpoint pen, as well as the brightness, clarity and correctness of the organization’s seal.

From September to October, young and ambitious residents of the Kemerovo region who wanted to start their own business went through the “Path of the Entrepreneur.”

If two separate divisions are registered with the same Federal Tax Service, but they have different OKTMO codes (belong to different municipalities), then 6-NDFL is submitted separately for each of them.

At the everyday level, the employee understands the date of receipt of income simply. If the card received a payment from the employer, it means that income was received on that day.

Form 6-NDFL contains generalized information about the tax paid on employee income and is submitted based on the results of the first quarter of six months, 9 months and a year. It must reflect the amounts of income, as well as the amounts of tax calculated and paid on them.

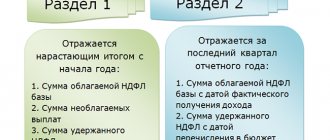

A number of indicators are formed on an accrual basis, the rest relate to payments made in the reporting quarter. The formation of incentive payments is carried out in stages:

- Creation of internal documents at the enterprise confirming the legality of the operation.

- Issuance of a bonus order.

- Calculation of the remuneration amount.

- Setting a payment deadline.

- Tax calculation.

- Transfer of the amount of the obligation.

In this section, information is indicated on an accrual basis for the entire reporting period. Line by line filling is presented in the following table.

Reflection of the bonus in 6-personal income tax in 2021: who fills it out, deadlines, how to reflect

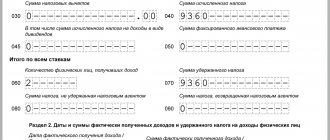

Bonuses in 6-NDFL are reflected differently depending on the section. In the first part of the form, incentive payments are not highlighted in any way, since they are subject to personal income tax at the same rate of 13% as a regular salary. Therefore, data on the amounts of bonuses and personal income tax accrued from them are combined with wages in one block of lines 010–050 of section 1.

Payment of bonuses with basic salary: example of reflection in 6-NDFL

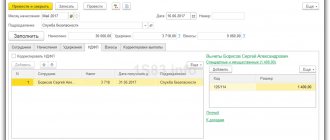

Now let’s look at an example when a bonus related to the performance of job duties is paid along with the basic salary.

Example 2

On 11/09/2020, employees were paid the basic salary for October in the amount of RUB 578,400. (Personal income tax - RUB 75,192)

On the same day, the monthly bonus based on the results of work, accrued for September 2021 in accordance with the order dated October 23, 2020, was paid in the amount of RUB 356,700. (Personal income tax - RUB 46,371)

Below is a fragment of the second section of the calculation of 6-NDFL when paying a bonus, indicating the lines in which the remuneration data should be displayed (reporting period - year).

New form 6-NDFL

On January 18, 2021, the Federal Tax Service, by its order No. ММВ-7-11/ [email protected], approved a new form 6-NDFL, but it will come into force only on March 26, 2018 . For now, you need to report using the old form, approved by order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/ [email protected]

However, for the next quarter, in any case, you will have to submit a new form, so let’s look at what has changed in it.

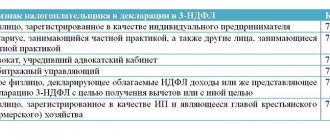

Innovations mainly concern reorganized legal entities . From January 1 of the current year, if the company fails to file 6-NDFL before the reorganization, its legal successor must do so. In this regard, changes to the form and the procedure for filling it out are as follows:

- Appeared fields for the legal successor's details on the title page:

- field for indicating the form of reorganization, in which you need to put the appropriate code: 1 - transformation,

- 2 - merger,

- 3 - separation,

- 5 - connection,

- 6 - separation with simultaneous joining,

- 0—liquidation;

- field for indicating the TIN/KPP of the reorganized company (the rest are filled with a dash).

- Introduced codes for assignees, which must be indicated in the field “at location (accounting)”:

- 216 - for successors who are the largest taxpayers;

- 215 - for everyone else.

- In the field to confirm the accuracy and completeness of the information, an indication of the legal successor of the tax agent has appeared (code “1”).

- When submitting the form by the legal successor, in the “tax agent” field you must indicate the name of the reorganized organization or its separate division.

In addition, minor changes will affect all tax agents , namely:

- in the field “at location (accounting)”, taxpayers who are not large ones must indicate code “214” instead of code “212” ;

- To confirm the authority of the authorized person, you will need to indicate the details of the document , not just its name.