The UTII declaration for the 3rd quarter of 2021 is filled out by all impostors. The 3rd quarter is ending and tax reporting period is approaching. Recently, the Federal Tax Service recommended using an updated UTII declaration form. What has changed in him? Who can use the previous form, and who should use the recommended form? How to fill out an updated declaration? We will answer these questions in our material.

Declaration on UTII for the 3rd quarter of 2021: which form to use?

The Federal Tax Service of Russia, in a letter dated July 25, 2018 No. SD-4-3/, explained that for reporting for the 3rd quarter of 2021, you can use one of 2 UTII declaration forms:

- Currently in force (it was approved by order of the Federal Tax Service of Russia dated July 4, 2014 No. ММВ-7-3/) ─ it can be used as before by those companies and individual entrepreneurs that do not declare a cash register deduction in the reporting quarter.

- The form recommended by the Federal Tax Service (the form was approved by order dated June 26, 2018 No. ММВ-7-3/, which is being registered with the Ministry of Justice) ─ this form allows you to reflect the cash register deduction of an individual entrepreneur on UTII (clause 2.2 of Article 346.32 of the Tax Code of the Russian Federation).

The Federal Tax Service allows the taxpayer to choose a form for the report and instructs lower tax authorities to correctly select the template for a particular declaration during the reporting campaign.

Thus, if before the start of the reporting period the new declaration form is not officially approved, you can report both on the form familiar to taxpayers and on the one recommended by the Federal Tax Service. An individual entrepreneur on UTII declaring a deduction using CCP, it is better to use the recommended form.

On September 25, the new form was officially published

A new UTII declaration form has been officially published on the portal of regulatory legal acts.

The updated declaration form provides for the possibility for entrepreneurs to reduce the “imputed” tax by the amount of expenses for the purchase of an online cash register.

To implement this possibility, line 040 “Amount of expenses for the purchase of cash registers, reducing the amount of UTII” has been added to section 3 “Calculation of the amount of UTII for the tax period.”

In addition, a new section 4 appeared in the declaration, “Calculation of the amount of expenses for the acquisition of cash registers, which reduces the amount of the single tax on imputed income for the tax period.” For each copy of the cash register for which the entrepreneur wants to receive a “cash” deduction, you will need to fill out a separate section 4.

Let us remind you that an individual entrepreneur on UTII has the right to reduce the amount of tax on expenses associated with the purchase of cash register equipment, provided that the purchased cash register is registered with the Federal Tax Service in the period from 02/01/2017 to 07/01/2018 (for some individual entrepreneurs - until 07/01/2019) . The maximum amount of “cash” deduction is 18 thousand rubles. for one copy of CCT.

You can report using the new form for the 3rd quarter of 2021. After all, the Federal Tax Service previously recommended using this particular declaration form, even before it was officially published.

Results of the 3rd quarter in the declaration: when to submit and in what form?

The deadline for submitting the UTII declaration for the 3rd quarter is regulated by clause 3 of Art. 346.32 of the Tax Code of the Russian Federation - the code allocates 20 calendar days:

- to calculate the amount of imputed tax;

- registration of UTII declaration;

- its submission to the tax authorities.

Thus, it is necessary to submit a declaration for the 3rd quarter of 2021 before October 20, 2020 inclusive.

Read about the procedure, conditions and nuances of using UTII here.

The UTII declaration form was approved by order of the Federal Tax Service dated June 26, 2018 No. ММВ-7-3/ [email protected] You will find a line-by-line algorithm for filling it out in the Ready-made solution from ConsultantPlus. A free trial of full access to the legal system is available.

How the new declaration form differs from the previous one: comparison table

Let us immediately reassure taxpayers: you won’t have to spend a lot of time studying the new form and how to fill it out. The declaration, to which everyone has become accustomed, has not changed fundamentally. Moreover, the usual form in its entirety, with minor adjustments, migrated to the new declaration form and was supplemented with section No. 4. But this section does not need to be filled out by all deductors, but only by individual entrepreneurs who apply for a cash register deduction.

It will not be possible to distinguish the old and new declaration forms by the KND (tax document code) indicated on the title page of the declaration - both declarations have KND 1152016.

How exactly does the new form differ from the previous one? In addition to the new section No. 4, the forms have the following differences:

| Props | New form (approved by order of the Federal Tax Service of Russia dated June 26, 2018 No. ММВ-7-3/) | Valid form (approved by order of the Federal Tax Service of Russia dated July 4, 2014 No. ММВ-7-3/) |

| Title page | ||

| Barcode | 0291 4015 | 0291 6019 |

| Section 1 “UTI amount subject to payment to the budget” | ||

| Barcode | 0291 4022 | 0291 6026 |

| Page 010 | OKTMO code | |

| Page 020 | Amount of UTII payable | |

| Section 2 “Calculation of the amount of UTII for certain types of activities” | ||

| Barcode | 0291 4039 | 0291 6033 |

| Page 010 | Business activity code | |

| Page 020 | Address of place of business activity | |

| Page 030 | OKTMO code | |

| Page 040 | Basic profitability per unit of physical indicator per month | |

| Page 050 | Correction coefficient K1 | |

| Page 060 | Correction coefficient K2 | |

| Page 070 | Tax base in the 1st month of the quarter | |

| Page 080 | Tax base in the 2nd month of the quarter | |

| Page 090 | Tax base in the 3rd month of the quarter | |

| Page 100 | Total tax base | |

| Page 105 | Tax rate | |

| Page 110 | The amount of calculated UTII | |

| Section 3 “Calculation of the amount of UTII for the tax period | ||

| Barcode | 0291 4046 | 0291 6040 |

| Page 005 | Taxpayer attribute | |

| Page 010 | The amount of UTII calculated for the tax period | |

| Page 020 | The amount of insurance premiums by which UTII can be reduced | |

| Page 030 | The amount of insurance premiums paid by individual entrepreneurs in a fixed amount | |

| Page 040 | The total amount of UTII payable for the tax period | The amount of expenses for the purchase of cash registers, which reduces the amount of UTII |

| Page 050 | — | The total amount of UTII payable for the tax period |

| Section 4 “Calculation of the amount of expenses for the purchase of cash registers, which reduces the amount of UTII for the tax period” | ||

For UTII payers who do not use cash register deductions in the reporting quarter, a new declaration is drawn up taking into account the following:

- Sections 1 and 2 are filled out according to the previous rules.

- In section 3, the total amount of UTII payable to the budget is reflected not on page 040 (as in the previous version of the form), but on page 050 ─ this is a new line, but its purpose is similar to page 040 of the previous version of the form.

- On page 040, dedicated to the amount of cash register deduction, you need to put a dash.

- Section 4 is not completed.

An individual entrepreneur on UTII, who declares a CCP deduction in the UTII declaration, fills out all sections of the declaration. We will tell you how to do this further.

How to generate a UTII declaration for the 3rd quarter of 2021?

Today we will take a closer look at this process in the 1C Accounting 3.0 program.

The program must include the corresponding option in the organization’s card in the tax system section and fill in the types of activities for which UTII and information about the tax office are paid.

You can proceed to the preparation of the declaration by opening Regulated reports in the Reports section. In the workplace, click Create and select the appropriate report type.

A window will open for you to fill in the data. It requires you to specify the reporting period, select the organization and edition of the form, and then start generating reports.

As a result, the screen will display the completed Tax Declaration for UTII for certain types of activities, consisting of a title page, sections 1, 2 and 3 proposed for it and an explanatory note.

Sample of filling out the title page

Let's talk about the procedure for filling out the UTII declaration for the 3rd quarter of 2018 using an example.

Individual entrepreneur Nadezhda Arkadyevna Kuleshova provides hairdressing services (OKVED 96.02). In the hairdressing salon of N.A. Kuleshova. 4 employees work under employment contracts (total number ─ 5 people including individual entrepreneurs). In July 2021, she registered a cash register with the tax authorities. The cost of purchasing a new generation cash register (online cash register), setting it up and connecting it amounted to RUB 12,480.

To prepare a declaration for UTII Kuleshova N.A. I used the form recommended by the Federal Tax Service.

She filled out the main block of the title page as follows:

Filling out the title page of the updated UTII declaration form follows the usual rules - there have been no changes to it (except for the barcode). The sections are formatted according to the following scheme:

- First, the amount of UTII for the quarter is calculated (Section 2).

- Then the amount of expenses included in the cash register deduction is determined (Section 4).

- The amount of tax to be transferred to the budget is determined, taking into account the contributions paid and the amount of cash deduction (Section 3).

- The final data is transferred to Section 1.

You can also use another approach: first make all the necessary calculations (prepare the initial data), and then sequentially fill out all sections of the declaration with them.

Changes in the UTII tax return form

In the new form of tax return for UTII, Federal Tax Service specialists took into account the opportunity for individual entrepreneurs to reduce the amount of the single tax by the amount of expenses incurred by the individual entrepreneur for the purchase of an online cash register. This possibility is provided for in Article 346.32 of the Tax Code of the Russian Federation, which stipulates a tax deduction for individual entrepreneurs on UTII in the amount of up to 18,000 rubles for the cost of purchasing a cash register with an online data transfer function. In the letter in which the tax authorities provide the recommended form, this is, in particular, stated as follows:

According to the second paragraph of paragraph 2.2 of Article 346.32 of the Tax Code of the Russian Federation, individual entrepreneurs carrying out business activities provided for in subparagraphs 6 - 9 of paragraph 2 of Article 346.26 of the Tax Code of the Russian Federation, and having employees with whom employment contracts were concluded on the date of registration of the cash register in respect of which the tax amount is reduced, have the right reduce the amount of the single tax by the amount of expenses specified in paragraph one of this paragraph, subject to registration of the corresponding cash register equipment from February 1, 2021 to July 1, 2021.

In order to implement the specified provisions of the Tax Code of the Russian Federation, by order of the Federal Tax Service dated June 26, 2018 N ММВ-7-3/ [email protected] “On approval of the tax return form for the single tax on imputed income for certain types of activities, the procedure for filling it out, as well as the format submission of a tax return for a single tax on imputed income for certain types of activities in electronic form”, a new form of a tax return for a single tax on imputed income for certain types of activities was approved (for registration with the Ministry of Justice of Russia).

Section 4, which was added to the reporting, looks like this:

It can indicate several copies of cash register equipment with the amounts of expenses for their purchase. Section 3 of the UTII declaration has also changed, to which line 040 was added:

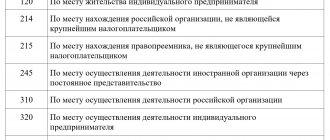

Section 1 of the declaration

This section is usually filled out last and reflects the taxpayer’s obligations to the budget for UTII tax:

The accuracy of the information specified in Section 1 must be confirmed by the signature of the taxpayer. In other sections of the declaration, a signature is not required (with the exception of the signature placed on the Title Page).

How to report on UTII for the 3rd quarter of 2021?

The recommended form of the UTII declaration can be submitted starting with reporting for the 3rd quarter of 2021. But tax officials do not have the right not to accept the old reporting form until the new one comes into effect. Therefore, the Federal Tax Service of Russia ordered the tax authorities to take into account the use in one period of two forms of tax returns that have one KNI with a different composition of indicators. To do this, tax authorities must:

- take into account that for this KND for the 3rd quarter of 2021 there are two forms;

- take into account the barcode of the title page of the form;

- take into account the correspondence of the template to the title page of the declaration.

Thus, taxpayers can submit a UTII return for the 3rd quarter using both the “old” form (currently in force) and the recommended new form (not yet in force). Neither will be considered a violation. In this case, updated tax returns for UTII should be submitted to the Federal Tax Service in the form in which they were originally submitted.

Legal documents

- Article 346.32 of the Tax Code of the Russian Federation

- Article 346.26 of the Tax Code of the Russian Federation

Section 2 of the declaration

It must be filled out separately:

- for each type of activity,

- for each location of a specific type of business activity (for each OKTMO).

In our example, IP Kuleshova N.A. carries out only one type of activity in a single hairdressing salon, so she only needs to complete one Section 2.

Procedure for filling out this section:

| Section line number 2 | What to indicate? | Where to get the data? |

| 010 | Code of the type of activity performed (for households) | Appendix No. 5 to the Procedure for filling out the declaration |

| 020 | Full address of the hairdressing salon (place of business) | The code of the subject of the Russian Federation must be taken from Appendix No. 6 to the Procedure for filling out the declaration |

| 030 | OKTMO code of the place of activity | OK 033-2013 All-Russian classifier of municipal territories |

How to fill out the remaining lines of Section 2 according to the example data is shown in the example:

Column 3 (on pages 070-090) for this example does not contain numerical values (dashes are inserted), since individual entrepreneur N.A. Kuleshova was not registered/deregistered with the tax authority in the reporting quarter. If this happened in one of the months of the quarter, in column 3 we would indicate the number of calendar days from the date of registration to the end of the month in which the individual entrepreneur (or company) registered as a UTII payer. In this case, when calculating UTII, the number of calendar days of actual activity in the month the taxpayer is registered will be taken into account.

Section 2

This section must be completed separately for each type of activity subject to imputed tax. In addition, 1 sheet of section 2 is filled out in the context of one OKTMO. That is, the report should contain as many sections 2 as the subject has types of activities subject to UTII and/or objects in territories with different OKTMO.

The first block states:

- on line 010 - activity code from Appendix No. 5 to the Procedure. For veterinary services it is 02;

- on line 020 - the region code from Appendix No. 6 and the address of the facility, in our example, a veterinary clinic;

- on line 030 - OKTMO.

The following is a block with the calculation of the tax base and UTII:

- Line 040 includes the basic profitability per unit of physical indicator (clause 3 of Article 346.20 of the Tax Code of the Russian Federation). For veterinary services this is 7,500 rubles per 1 employee per month;

- line 050 indicates the K1 coefficient for UTII payers. From 2021 it is 1.915. The amount was approved by order of the Ministry of Economic Development dated October 30, 2021 No. 595. The coefficient is recalculated annually;

- in line 060 - coefficient K2, which must be found in the regulations of the municipal authorities. In the above example, K2 is equal to 1.0 (decision of the Council of Deputies of Noginsk dated November 6, 2013 No. 143/16).

Lines 070-090 indicate information for each month of the quarter:

- in column 2 - the value of the physical indicator. In the example, this is 6 - the number of employees together with individual entrepreneurs (clause 3 of Article 346.20 of the Tax Code of the Russian Federation);

- in column 3 - the number of days during which the activity was carried out this month. The field is filled in only if it was started or terminated during the reporting period;

- Column 4 reflects the tax base for the month: Basic profitability x Physical. exponent x K1 x K2. The imputed monthly income for our individual entrepreneur will be: 7,500 x 6 x 1,915 x 1 = 86,175 rubles.

In line 100, the quarterly base is calculated - it is equal to the sum of column 4 lines 070-090: 86,175 + 86,175 + 86,175 = 258,525 rubles.

The tax rate of -15% is entered in line 105. Municipal authorities have the right to reduce the rate to 7.5% for certain types of activities, but this is not our case.

In line 110, the amount of UTII before deductions is calculated: Base * Rate / 100. For the data from the example, the calculation is as follows: 258,525 * 15 / 100 = 38,778.75 rubles. Only whole values can be entered into the fields of the declaration, so we round the amount to 38,779 rubles.

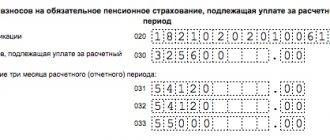

Section 3 of the declaration

Here you need to combine the data from sections 2 and 4 to calculate the total amount of tax to be transferred to the budget. The tax must first be reduced by the insurance premiums paid (but not more than 50%), and then by the cash register deduction.

IP Kuleshova N.A. paid insurance premiums in the 3rd quarter of 11,500 rubles. This does not exceed 50% of the calculated UTII tax (25,218 rubles x 50% = 12,609 rubles), therefore the entire amount of contributions is included in page 020 of section 3. The remaining amount of tax in the amount of 13,718 rubles. (RUB 25,218 ─ RUB 11,500) can be reduced by CCP deduction:

RUB 13,718 ─ 12,480 rub. = 1,238 rub.

This amount must be indicated in Section 1 and transferred to the budget.

IMPORTANT!

The indicator p.050 can be zero, but cannot take a negative value. This means that if the CCP deduction exceeds the tax after deducting insurance premiums paid, nothing needs to be transferred to the budget at the end of the reporting quarter. And the balance of the cash register deduction can be transferred to the 4th quarter.

Let's explain with an example.

Expenses of IP Rodygina S.A. in the 3rd quarter for the purchase and connection of an online cash register amounted to RUB 20,180. And the calculated tax for this period (taking into account its reduction by the amount of insurance premiums) amounted to 12,780 rubles. In the declaration for the 3rd quarter of IP Rodygin S.A. will reflect:

- on page 050 of Section 4 ─ the amount of the cash register deduction is 18,000 rubles. (this is the maximum that is allowed under clause 2.2 of Article 346.32 of the Tax Code of the Russian Federation for a cash deduction);

- on page 050 of Section 3, a zero will be entered (RUB 12,780 ─ RUB 18,000 = – RUB 5,220 <0).

The balance of the cash register deduction is in the amount of 5,220 rubles. the entrepreneur will reflect in the declaration for the 4th quarter. In this case, the amount of the remaining deduction is determined not on the basis of the actual costs of CCP (20,180 rubles), but on the basis of the permissible maximum (18,000 rubles).

Tax return UTII

Home / Tax returns

Zero declaration on UTII

The opinion of the Ministry of Finance on this matter is clear: Chapter 26.3 of the Tax Code of the Russian Federation does not provide for the submission of “zero” declarations on UTII (letter of the Ministry of Finance dated July 3, 2012 No. 03-11-06/3/43).

The absence of economic activity under the imputed regime is the basis for deregistration under UTII in the manner prescribed by current legislation.

If the taxpayer was not deregistered under UTII, then stopping business activities, even if there is no physical indicator, is the basis for paying imputed tax and filing full (not zero) reporting.

In this case, the tax is calculated based on the size of the individual. indicator reflected in the reporting for the previous period in which activities were still ongoing (letter of the Ministry of Finance dated October 24, 2014 No. 03-11-09/53916).

Failure to fulfill tax payment obligations will entail the collection of arrears on UTII, as well as the accrual of fines and penalties.

However, there are clarifications from the Federal Tax Service, published on the official website of the tax service on September 19, 2016 (https://www.nalog.ru/rn32/news/activities_fts/6167481/), based on the decision of the Supreme Arbitration Court of the Russian Federation, according to which the submission of a zero declaration is possible .

This situation arises if the use or ownership of property, without which it is impossible to carry out the imputed activity, is terminated. The precedent under consideration is the termination of the lease agreement for retail space by the lessor.

But, if the taxpayer nevertheless decides to submit a zero return, with a high degree of probability he will have to defend his position in court.

Therefore, if a business entity does not want to incur additional expenses for paying taxes and submitting unnecessary reports in cases where activities for some reason were suspended or terminated completely, the most reliable way to avoid claims from regulatory authorities is to submit an application for deregistration under UTII.

Penalty for late submission of declaration

If the taxpayer does not submit the declaration on time, then the sanctions will range from 5% to 30% of the amount of unpaid tax reflected in the report for each full or partial month of delay, but not less than 1,000 rubles.

Moreover, if the imputed tax itself is paid on time, then failure to submit a declaration within the prescribed period will result in a fine of 1,000 rubles.

Responsibility for the delay in the UTII report imposed on the head of the legal entity of the Code of Administrative Offenses of the Russian Federation can range from 300 to 500 rubles.

Moreover, if the deadline for submitting the declaration is exceeded by more than 10 working days, the regulatory authorities may suspend operations on the current account of the business entity.

Programs and services for report preparation

A UTII declaration can be prepared using the following software and online services:

| Software name | Website |

| “Taxpayer Legal Entity” (free program from the Federal Tax Service) | https://www.nalog.ru/rn77/program/5961229/ |

| "Taxpayer PRO" | https://online.nalogypro.ru |

| "Bukhsoft" | https://online.buhsoft.ru |

| "1C" | 1c.ru |

| "Kontur.Accounting" | https://www.b-kontur.ru/lp/envd |

| "Sky" | nebopro.ru |

| "My business" | https://www.moedelo.org/landingpage/reporting-ednvd/ |

Did you like the article? Share on social media networks:

- Related Posts

- Explanatory note to the tax return for UTII

- Sample declaration of the simplified tax system “income minus expenses”

- Sample of filling out the UTII declaration for individual entrepreneurs

- Zero declaration of the simplified tax system in 2021

- Sample of filling out the Unified Agricultural Tax declaration for an LLC

- Sample of filling out a UTII declaration for an LLC

- Sample of filling out the simplified taxation system “income” declaration

- Tax return for simplified tax system in 2021

Discussion: 3 comments

- andrey:

04/20/2018 at 13:43Has the new UTII declaration been approved yet?

Answer

Alexei:

04/23/2018 at 03:34

Hello. Not yet, they took it using the old form (Letter of the Ministry of Finance dated February 20, 2018 No. SD-4-3/ [email protected] ).

Answer

01/10/2019 at 19:21

Hello, can you tell me in the new declaration form, in section 4, if you didn’t buy a cash register, do you need to put dashes everywhere or can you not fill it out at all?

Answer

Leave a comment Cancel reply

Section 4 of the declaration

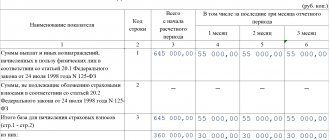

Lines 010-050 of Section 4 must be completed for each copy of the cash register purchased for UTII activities and registered with the tax authorities within the established time frame.

Let's continue with our original example. According to its terms, IP Kuleshova N.A. On July 17, 2018, I registered a cash register with the tax authorities. The cost of purchasing a cash register and connecting it amounted to 12,480 rubles. In section 4, to receive a cash register deduction, the entrepreneur filled out one block of lines 010-050:

The amount of expenses for purchasing a cash register reduces the UTII tax and is reflected in section 2 of the declaration.

Who can submit a EUD for the 3rd quarter of 2021 to the tax office?

The EUD form was developed by the Ministry of Finance and formalized by its order No. 62n dated July 10, 2007 in order to simplify the reporting campaign for those taxpayers who:

- for various reasons, no activity was carried out throughout the reporting period;

- there were no objects of taxation for taxes corresponding to the selected regimes;

- there were no payments/receipts from the cash desk and/or to the cash desk and no transactions on current and other accounts in banking (credit) institutions.

Only if all the listed requirements are met, an organization or individual entrepreneur has the right to report in the EUD form. This declaration can be submitted by organizations to the OSN, organizations and entrepreneurs to the simplified tax system and unified agricultural tax.

ATTENTION! Entrepreneurs who operate under the general regime have the right to submit the EUD only for VAT. The 3-NDFL declaration must be submitted as zero.

Thus, a single simplified declaration for the 3rd quarter of 2020 is submitted only by those who met all of the above conditions for 9 months in 2021. If at least one of them is not complied with (for example, money was given from the cash register to the accountant for the purchase of stationery), business entities cannot report on the EUD - they will need to send zero declarations for each tax to the inspectorate.

Deadlines for filing UTII returns and paying taxes

And again, there is nothing to worry about - the deadline for submitting the UTII declaration on the new form remains the same. As a general rule, after the end of the quarter, special regime officers using UTII (both individual entrepreneurs and companies) have 20 calendar days to prepare a report and submit it to the tax authorities. If you look at paragraph 3 of Art. 346.32 of the Tax Code of the Russian Federation, nothing has changed there, although the Federal Tax Service recommended using the updated declaration form.

Please note that to prepare UTII reports for the 3rd quarter of 2021, taxpayers will have more than 20 calendar days ─ the final reporting date of 10/20/2018 falls on a Saturday. This means that according to paragraph 7 of Art. 6.1 of the Tax Code of the Russian Federation, the UTII declaration can be legally submitted on Monday, October 22. This will not be considered late and there is no need to fear a fine.

The tax payment deadline for the 3rd quarter is no later than October 25. Nothing has changed on this issue either.

New form of declaration for UTII - in the report for the 3rd quarter

Tax officials strongly recommend using the new declaration form when reporting for the 3rd quarter of 2021. This is necessary both for the convenience of taxpayers and so that the Federal Tax Service takes into account the amount of deductions for cash registers. At the same time, the order with a new form of UTII declaration in accordance with paragraph 5 of Article 5 of the Tax Code of the Russian Federation will come into force only 2 months after official publication. While the deadline for submitting UTII declarations for the 3rd quarter of 2021 expires on October 22, 2021 (according to the rules - October 20, but this is Saturday). Therefore, in this case, tax officials do not have the right to demand a report using the new form. However, if an individual entrepreneur needs to receive a deduction for the purchase of a cash register, he still needs to apply a new form, which has a section for indicating information for deduction.

Where to find a sample EUD for the 3rd quarter

The structure of the EUD form is quite simple. It consists of one page, where the business entity provides:

- your data (TIN, KPP, name of organization / Full name IP, OKTMO code),

- reporting year,

- name and code of the tax service.

It should also indicate whether the declaration is being submitted initially or repeatedly. In the second case, the correction number is indicated.

The table below is intended to indicate:

- a tax for which the corresponding tax reporting is not submitted, but instead a EUD is submitted;

- the number of the chapter of the Tax Code devoted to this tax;

- code of the reporting/tax period for which the EUD is submitted, and, if necessary, the quarter number.

If the tax reporting period is a quarter (VAT), then code 3 is indicated and then the quarter number, in our case - 03. If the tax reporting period is nine months, then code 9 is given.

Download a sample of a single tax return for the 3rd quarter of an organization on the OSN from the link below.

What are the deadlines for sending EUD to controllers?

The 20th day of the month following the end of the reporting period (quarter, half-year, 9 months, year) is the deadline for submitting the specified declaration to the tax service. However, the deadline may be moved to the next working day - the one following the 20th - if the 20th suddenly falls on a weekend or holiday. As already mentioned, tax authorities need to send a single simplified tax return for the 3rd quarter by October 20, 2021. It's a working Tuesday. This means there will be no transfers.

For the 3rd quarter, a single tax return can be submitted to the inspectors:

- personally;

- by mail;

- according to TKS.

If a taxpayer misses the last day for submitting a single simplified return for the 3rd quarter. 220, then he will most likely have time left to send zeros. After all, their due date falls on a later date.

But if you are late with zeros, then there will be no fine, even a minimal one - in the amount of 1000 rubles.

Read more information about minimum fines in the Ready-made solution from ConsultantPlus. Here you will learn all the nuances of the procedure for submitting the EUD, as well as a list of situations when tax returns cannot be replaced with a single simplified declaration. If you do not have access to the legal reference system, get temporary demo access for free.