4-FSS reporting in 2021

In 2021, the following must be submitted to the FSS divisions:

- calculation of 4-FSS for 2021. See “4-FSS for the 4th quarter of 2021”;

- calculation of contributions to the 4-FSS for periods starting from 2021 (the 4-FSS calculation form was approved by FSS Order No. 381 dated September 26, 2016).

Form 4-FSS is submitted only for contributions from accidents. For all other types of contributions, you must report to the Federal Tax Service.

At the same time, the deadline for submitting 4-FSS calculations in 2021 depends on the form in which the reports are submitted: “on paper” or in electronic format.

Paper 4-FSS: deadlines

If the average number of employees does not exceed 25 people, then 4-FSS reports on contributions “for injuries” can be submitted “on paper”. The deadline for submitting 4-FSS in 2021 on paper expires 20 calendar days after the reporting (calculation) period:

- for the first quarter—April 20, 2021;

- for the first half of the year - July 20, 2021;

- for 9 months - October 20, 2021;

- for the year - January 20, 2021.

However, January 20 and October 20, 2021 fell on a Saturday. In this regard, the deadline for 4-FSS for 2021 and for 9 months of 2021 has been postponed to January 22 and October 22, respectively.

| Reporting period | On paper | Electronic |

| for 2021 | until January 22, 2018 | until January 25, 2018 |

| for the first quarter of 2021 | until April 20, 2018 | until April 25, 2018 |

| for the first half of 2021 | until July 20, 2018 | until July 25, 2018 |

| for 9 months of 2021 | until October 22, 2018 | until October 25, 2018 |

Deadline for submitting the FSS for the first half of 2019 (4-FSS for the 2nd quarter)

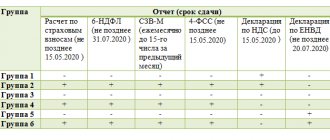

The calendar for an accountant for the 4th quarter of 2021 is compiled according to the deadlines for submitting reports of legal entities and individual entrepreneurs who:

- work on OSN or on simplified tax system;

- pay UTII,

- pay transport and property taxes.

It is necessary to report and make payments for the 4th quarter of 2021 during the period from January to March 2021, including paying contributions for injuries, and submitting the 4-FSS calculation. See Table 2 for the accountant’s calendar for non-tax reporting.

Table 2. Deadlines for submitting reports for the 4th quarter of 2021 table to the Social Insurance Fund and the Pension Fund of the Russian Federation

During the period from January to March 2021. need to report:

- For income tax.

- According to VAT.

- According to UTII.

- According to personal income tax.

- For transport tax.

- For land tax.

- For insurance premiums.

For the accountant's tax calendar by reporting deadlines for the 4th quarter of 2021, see Table 3.

Table 3. Tax reporting for the 4th quarter of 2021 reporting deadlines table

| Date in 2021 | Duty | Who should do | Explanation |

| January 9th | Pay personal income tax | Employers are legal entities and entrepreneurs who paid vacation and sick pay in December 2021. | Transfer personal income tax from December vacation and sick pay Check KBK Fill out the payment form |

| Refuse to pay VAT | Legal entities and entrepreneurs under the general tax regime | Submit an application for waiver of VAT benefits under paragraph 3 of Article 149 of the Tax Code of the Russian Federation. | |

| January 15th | Pay contributions to pension, health and social insurance | Legal entities and individual entrepreneurs from whom individuals received remuneration in December 2021:

| Pay contributions to the Federal Tax Service for December 2021. Ready payment for contributions: Check KBK Fill out the payment form |

| Pay an advance on personal income tax | Entrepreneurs, notaries, mediators, lawyers, who do not have employees, arbitration managers, patent attorneys and other private practitioners | Transfer the advance payment for October - December 2021 upon notification from the tax office | |

| January 21st | Notify the tax office about the number of employees | Legal entities reorganized in September 2021, employing individuals under employment and GP contracts | Send a message to the tax office using the form from the order dated March 29, 2007 No. MM-3-25/ [email protected] |

| Submit a single report for 2021. | Legal entities and entrepreneurs who did not have:

| Send a single declaration to the Federal Tax Service Draw up a declaration | |

| Hand over the account journal - | VAT non-payers - commission agents, attorneys, agents under contracts with VAT payers | Submit to the tax office in the form of a file according to the TCS a journal of invoices with transactions for the 4th quarter of 2021. Fill out the journal | |

| Submit UTII declaration | Legal entities and entrepreneurs – payers of UTII | Submit your declaration for the 4th quarter of 2021. Draw up a UTII declaration | |

| January 25th | Submit a VAT return |

| Submit your declaration for the 4th quarter of 2021. Prepare a VAT return |

| Pay VAT | Transfer 1/3 of the payment amount for the 4th quarter of 2021. Check KBK Fill out the payment form | ||

| Pay UTII | Legal entities and entrepreneurs who pay UTII | Transfer payment for the 4th quarter of 2021. Check KBK Fill out the payment form | |

| January 28th | Pay an advance on “profitable” tax | Legal entity on OSN, transferring tax monthly based on the profit of the previous quarter | Transfer the first advance in the 1st quarter of 2021. Ready payment order: Check KBK Fill out the payment form |

| January 30th | Submit a calculation of insurance premiums | Submit RSV for 2021 Make up RSV | |

| January 31st | Pay personal income tax | Employers are legal entities and entrepreneurs who paid vacation and sick pay in January 2021. | Transfer personal income tax from January vacation and sick pay Check KBK Fill out the payment form |

| February 1st | Submit a transport tax return | Companies with taxable transport | Submit your declaration for 2021. Prepare a declaration |

| Submit a land tax return | Firms with taxable plots of land | Submit your declaration for 2021. Prepare a declaration | |

| February 15th | Pay contributions to pension, health and social insurance | Legal entities and individual entrepreneurs from whom individuals received remuneration in January 2021:

| Pay contributions to the Federal Tax Service for January 2021. Ready payment for contributions: Check KBK Fill out the payment form |

| February 20th | Notify the tax office about the number of employees | Legal entities reorganized in January 2021, employing individuals under employment and GP contracts | Send a message to the tax office using the form from the order dated March 29, 2007 No. MM-3-25/ [email protected] |

| February 25th | Pay VAT |

| Transfer 1/3 of the payment amount for the 4th quarter of 2021. Check KBK Fill out the payment form |

| February 28th | Pay an advance on “profitable” tax | Legal entity on OSN, transferring payments monthly based on the profit of the previous quarter | Transfer the second advance in the 1st quarter of 2021. Ready payment order: Check KBK Fill out the payment form |

| Submit a “profitable” tax return | Legal entity on OSN, transferring payments monthly based on actual profit | Submit a declaration for January 2021 Draw up a declaration | |

| Pay an advance on “profitable” tax | Transfer an advance on profits for January 2021. Ready payment order: Check KBK Fill out the payment form | ||

| February 28th | Pay personal income tax | Employers are legal entities and entrepreneurs who paid vacation and sick pay in February 2021. | Transfer tax from February vacation and sick leave Check KBK Fill out the payment form |

| March 1st | Pass SZV-STAZH | Firms and entrepreneurs who entered into contracts in 2021 labor and GP contracts with individuals | Report on remuneration to individuals for 2021. Fill out SZV-STAZH |

| Submit 2-NDFL | Firms and entrepreneurs – tax agents for personal income tax | Report on the income of individuals for 2021. Fill out 2-NDFL | |

| March 15th | Pay contributions to pension, health and social insurance | Legal entities and individual entrepreneurs from whom individuals received in February 2021. rewards:

– holders of exclusive rights – under licenses and upon alienation, payment of exclusive rights | Pay contributions to the Federal Tax Service for February 2021. Ready payment for contributions: Check KBK Fill out the payment form |

| March 20th | Notify the tax office about the number of employees | Legal entities reorganized in February 2021, employing individuals under employment and GP contracts | Send a message to the tax office using the form from the order dated March 29, 2007 No. MM-3-25/ [email protected] |

| March 25th | Pay VAT |

| Transfer 1/3 of the payment amount for the 4th quarter of 2021. Check KBK Fill out the payment form |

| March 28th | Submit a “profitable” declaration | Organizations on OSN | Submit your declaration for 2021. Draw up a declaration |

| Transfer “profitable” tax | Pay annual income tax for 2021. Fill out the payment form | ||

| Pay an advance on “profitable” tax | Legal entity on OSN, transferring payments monthly based on the profit of the previous quarter | Transfer the third advance for the 1st quarter of 2021. Ready payment order: Check KBK Fill out the payment form | |

| Submit a “profitable” tax return | Firms on a general taxation system that transfer payments monthly based on actual profits | Submit your declaration for February 2021. Draw up a declaration | |

| Pay an advance on “profitable” tax | Transfer an advance on profits for February 2021. Ready payment order: Check KBK Fill out the payment form |

The deadline for submitting 4-FSS for the first half of 2021 is 07/22/2019, electronically – 07/25/2019.

4-FSS on paper for 9 months of 2021 must be submitted to the FSS no later than October 21, 2019.

In electronic form, the deadline for submitting the Social Insurance Fund for the 3rd quarter of 2021 (for 9 months) is October 25, 2019.

Calculations in Form 4-FSS must be submitted at the end of each reporting period. There are only four such periods: the first quarter, half a year, nine months and a year. At the same time, the deadline for submitting reports is influenced by the method of its presentation:

- “on paper” 4-FSS should be submitted no later than the 20th day of the month following the reporting period;

- in electronic form - reports are transmitted no later than the 25th day of the month following the reporting period.

The deadline for submitting the report to the Social Insurance Fund for the 4th quarter of 2021 depends on the method of submitting the report:

- If the average number of individuals is 25 people or less, employers have the right to submit a 4-FSS report for the 4th quarter on paper (Clause 1, Article 24 of Law No. 125-FZ). The deadline is January 21, 2021. Since the 20th falls on a Sunday, the transfer is made to the next working day according to the general rules.;

- If the number of insured employees is 26 or more, then the report must be submitted via TSC (electronically). Deadline: January 25, 2019.

In the fourth quarter of 2021 The “injury” contributions must be reported in October, and these contributions must be transferred every month. See Table 2 for all dates for 4 FSS for the 4th quarter of 2021.

Table 2. 4 FSS for the 4th quarter of 2021: due date

All employers are required to report to the Social Insurance Fund in Form 4-FSS. For the 3rd quarter of 2021, the deadline for submission depends on the method of compiling the report. For violating the deadline for sending the report, not only the organization, but also its leader will be fined.

All employers provide a report on Form 4-FSS. First of all, these are organizations. Individual entrepreneurs and separate divisions of companies can also report to social security, but not always.

Legal entities

Organizations are required to report to the Social Insurance Fund from the moment of their state registration until the entry into the Unified State Register of Legal Entities about the termination of activities. In other words, as long as the company exists, it is required to pass 4-FSS.

It happens that a company has nothing to indicate in the 4-FSS report. For example, a new company does not yet have a single employee. Or the organization’s activities are suspended, and staff are fired or sent on leave without pay.

Then you need to submit a zero report to 4-FSS; you cannot not submit reports to social security at all.

Fine for late submission of reports to the Social Insurance Fund in 2021

If the 4-FSS is not submitted on time in 2021, the organization or individual entrepreneur may be held liable under Art. 26.30 of the Federal Law of July 24, 1998 No. 125-FZ. That is, 5% of the amount of contributions accrued for the last three months of the reporting or billing period, for each full and partial month from the date established for submitting the calculation. In this case, the fine should not exceed 30% of this amount and be less than 1,000 rubles.

In addition, for violation of the procedure for submitting reports - for example, when the number of employees at the enterprise is more than 25 people, but the report was submitted in paper form - a fine of 200 rubles is provided.

Read also

31.08.2018

How to prepare any reports online

4-FSS consists of:

- title page;

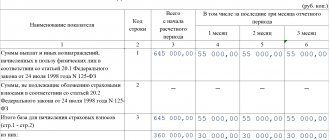

- Table 1 “Calculation of the base for calculating insurance premiums”;

- Table 1.1 “Information necessary for calculating insurance premiums by policyholders specified in paragraph 2.1 of Article 22 of the Federal Law of July 24, 1998 No. 125-FZ” (here we are talking about employers temporarily sending their employees under an agreement on the provision of labor for workers/personnel) ;

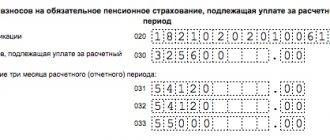

- Table 2 “Calculations for compulsory social insurance against accidents at work and occupational diseases”;

- Table 3 “Expenses for compulsory social insurance against accidents at work and occupational diseases”;

- Table 4 “Number of victims (insured) in connection with insured events in the reporting period”;

- Table 5 “Information on the results of a special assessment of working conditions (results of certification of workplaces for working conditions) and mandatory preliminary and periodic medical examinations of workers at the beginning of the year.”

Absolutely all employers must include in the submitted calculation the title page, tables 1, 2 and 5 (clause 2 of the Procedure for filling out the calculation, approved by Order of the Social Insurance Fund of September 26, 2016 N 381 (hereinafter referred to as the Procedure)). Tables 1.1, 3 and 4 are included only if relevant indicators are available.

You can compile, check and submit reports on taxes and other obligatory payments to the inspectorate using the BukhSoft program. For details on reporting for the 4th quarter of 2021, see Table 1.

Table 1. Reporting for the 4th quarter of 2021 online

Lack of time to correct inaccuracies identified during report monitoring leads to negative consequences for the insured and material losses. The amounts of such losses are determined as follows:

- The amount of the fine (SS) is calculated using the formula:

SS = 5% × TVn,

where TVn is the amount of injury contributions accrued over the last 3 months of the billing period.

The penalty amount calculated using this formula is collected for each full or partial month. The deadline begins the next day after the deadline.

- The minimum amount of punishment is 1000 rubles.

It will be paid by companies and individual entrepreneurs who were late in submitting zero 4-FSS, as well as by those policyholders whose fine amount was lower than the specified minimum fine.

- The maximum fine is 30% of TVn.

A fine above the specified limit cannot be collected by law, even if the amount of sanctions calculated on the basis of TVn exceeds the maximum level.

Example

PJSC "Kamenny Vek" submitted 4-FSS on July 25, 2019. This means that the submission of 4-FSS for the 2nd quarter of 2021 took place on the last day allowed for an electronic report. According to the report TVn = 156,700 rubles.

SS = 5% × 156,700 = 7,835 rubles.

We talk about one of the recently introduced methods of passing the 4-FSS at the link.