The procedure for concluding a loan agreement is quite simple. The most important issue when drawing up a document is the amount of accrued interest, which is usually charged by the lender for giving his money to another person for use. There are several ways to calculate interest under a loan agreement. Information about this must be reflected in the document. Every borrower should know how to calculate the amount of interest and how it will be calculated under the loan agreement.

According to what scheme can interest be calculated on a loan?

The main document establishing the procedure for calculating and paying interest is the loan agreement. It is there that both parties reflect the terms on which one party lends the other a certain amount of money.

In widespread practice, several interest calculation schemes are used. Let's take a closer look at each of them:

- The loan agreement assumes that the money will be repaid in installments rather than in a lump sum. Then a scheme is used in which first the interest on the loan is calculated relative to the full amount of the debt, and then payments are established on the balance. This scheme has its advantages, since it allows you to reduce the amount of interest if you manage to pay off part of the debt.

- A method in which interest is collected based on the full amount of the debt, regardless of how much the borrower has already repaid. In this case, provided that there are no delays in payments, the borrower and lender immediately know the exact amount of the overpayment on the microloan.

- There may also be an option when the loan agreement does not specify the interest rate. This does not mean that the borrower will not pay interest to the lender. This option is only possible when concluding a gratuitous loan agreement, which is a completely different category of financial transactions. The interest rate, in the case where it is not specified in the document, will be calculated based on the refinancing rate of the Bank of Russia.

Each option has a number of advantages and disadvantages. Methods for calculating interest on a loan must be selected individually in each individual case.

For each accrual scheme, special calculations are made. Nowadays there are convenient calculators freely available. They will automatically calculate the amount you will overpay when taking out a loan. Such tools can be very helpful for those people who are not very versed in credit calculations. It is enough to enter information about the loan into the appropriate fields of the calculator, and in just a few clicks the necessary calculations will be made.

Question answer

Why is the interest rate indicated per day and not as an annual percentage?

The loan is usually issued for a period of less than 1 month. It is more convenient to make financial calculations using the daily interest rate. Bank loans are issued for a longer period - up to 3-5 years, so interest on them is calculated at the annual rate.

Do IFC and MCC offer loans on the same terms for everyone?

The loan rate is calculated individually. Its size depends on a number of parameters. If you have a good credit history, you can count on an interest rate in the “green” or “yellow” zone. The company offers even more favorable conditions to its regular customers.

My credit history is damaged. The company offers me a loan at 2% per day. Is this really normal?

A bad credit history does affect the interest rate on the loan. However, you were offered a loan on unfavorable terms. Try contacting another microfinance organization. Perhaps you will be offered more favorable conditions.

How can you reduce your loan rate?

MFCs and MCCs offer minimum rates to loyal clients and preferential categories of borrowers. A reduced interest rate is provided for loans for large amounts and for a long period.

How to choose an MFC or MCC with normal conditions?

The normal daily rate for using a loan is 1%. To select the best offers, you can use our rating, which takes into account the interest rate when calculating.

How to determine the first and last day for which interest should be calculated?

Calculating the amount of interest under a loan agreement has many features. In some cases, it is not always clear from what day to start calculating accruals.

If the contract is drawn up correctly, it will reflect the exact dates for which payments should be made. Unfortunately, in practice this does not always happen. Most concluded agreements for the transfer of borrowed money for use by another person reflect information about the period for which the loan was issued.

According to current legislation, the date of conclusion of the loan agreement is the day when one party transferred funds to the other party. It is important to consider that interest accrual should begin from the next calendar day, and not from the date on which the document came into force.

The last day for which interest accrues is usually determined as the date on which the full amount of the debt is repaid. The wording of the laws in force today is not precise enough, so there is disagreement as to whether interest on the last day should be paid or not. The practice of calculating interest on a loan tends to include the last day in those periods that are subject to interest.

Calculation of interest for late repayment of debt

In addition to the contractual interest, the lender has the right to demand a fine from the borrower for violating the repayment deadline - a penalty or penalty. The parties indicate the amount of the penalty in the contract.

If the penalty is not specified, it is calculated at the average bank interest rate on deposits of individuals published by the Central Bank. Rates vary by region, and the Bank reviews them periodically. Therefore, when calculating the penalty, you can use not just one rate, but rates corresponding to the calculation periods.

The amount of interest for late repayment of debt is calculated using the formula:

Penalty = (Amount x Term x Rate) / 360

- Amount - the loan amount or part thereof that the borrower did not repay on time.

- Rate - the average bank interest rate on deposits of individuals.

- Term - the number of calendar days for which the borrower delays the money.

Collection of interest under a loan agreement

The borrower benefits from transferring his funds for use to another person or legal entity. Most people value their reputation, therefore, if they have debt, they try to pay the principal amount of the debt on time, as well as all interest charges on it. However, sometimes the borrower avoids fulfilling the obligations that are specified in the loan agreement or receipt. There are several options to solve this problem:

- Resolving issues at the pre-trial stage. This tactic has a number of advantages, since there is no need to spend money, time and effort on filing a lawsuit. However, such a solution is not always possible, since unscrupulous borrowers will do their best to avoid paying the debt and interest.

- Going to court. Litigation, of course, will negatively affect the borrower's credit history. Banks and microfinance organizations will avoid cooperation with such a client, which means that the likelihood of loan refusal will be much higher. Every lawsuit comes with many costs. If the applicant is right and wins the case, then the borrower will have to pay all legal costs. In some cases, when the borrower is able to prove (documented) that he was unable to repay the loan on time, a decision may be made to reduce penalties for late payment. This practice is quite common, so the creditor cannot always be sure that he will receive compensation in full.

- Resolving the issue through a collection service. Many companies and microfinance organizations for which issuing loans is their main activity prefer not to deal with the court and resell debts to a collection service. Unfortunately, debt collectors can use rather radical methods of debt collection. They regularly visit the debtor at home and at work, thereby undermining his authority.

Important! A peaceful resolution of the issue should always be a priority as it will be most beneficial for both parties.

We draw up a loan agreement: transfer and return of money, accrual of interest

Let's move on to consider other rules that need to be taken into account when drawing up a loan agreement. In particular, these include rules governing the transfer and return of money. And here too there have been changes.

Thus, according to the new edition of paragraph 3 of Article 810 of the Civil Code of the Russian Federation, unless otherwise provided by the agreement, the loan is considered repaid at the moment the money is received by the bank in which the lender’s account is opened, and not to the lender’s account itself, as was the case before June 1. Accordingly, if the lender is not confident in his bank and wants to transfer to the borrower the risks associated with the possible bankruptcy of the credit institution, then the agreement must indicate that the loan is considered repaid only after the money is credited to the lender’s account. Note that the Civil Code of the Russian Federation does not contain a similar rule regarding the moment the borrower receives money. Therefore, the corresponding condition should be agreed upon in the text of the contract.

The date of transfer and repayment of the loan is closely related to the procedure for calculating interest. According to the new edition of paragraph 3 of Article 809 of the Civil Code of the Russian Federation, interest is paid up to and including the day the loan is repaid. But legislators again ignored the start date for interest accrual. Therefore, in order to avoid disputes, the condition about whether interest is accrued on the day the money is transferred (or whether it begins to “drip” only from the next day) must be reflected in the contract.

Let us dwell on the norm that regulates the obligation to pay interest itself. The general rule is this: if there is no interest clause in a loan agreement, this does not mean that it is interest-free. An exception is the situation when two conditions are simultaneously met: the agreement is concluded between individuals (including individual entrepreneurs), and the loan amount does not exceed 100 thousand rubles. In this case, an agreement that does not contain an interest clause is recognized as interest-free (new edition of clause 4 of Article 809 of the Civil Code of the Russian Federation).

In all other cases, you will need to pay for a cash loan, unless the contract specifically states that it is interest-free. Moreover, if the parties have not agreed on the amount of interest in the contract, then they are calculated based on the key rate of the Central Bank of the Russian Federation in force during the loan period (new edition of clause 1 of Article 809 of the Civil Code of the Russian Federation).

Select a bank guarantee for free under 44-FZ and 223-FZ online

Calculation of interest on a loan in case of delay in payments

Sometimes the borrower’s financial situation deteriorates so much that he is unable to repay the existing loan or microcredit. It is important to know how interest is calculated in such a situation.

Most often, the procedure for interaction between the parties in the event of a delay in payment or interest payments should be reflected in the concluded agreement. There may be several options for the development of events:

- The lender refuses to extend the loan term to its borrower. In this case, interest is accrued on the loan according to the terms reflected in the agreement. During the period of delay in debt payment, a penalty is accrued, which is much higher than the interest rate. The amount of penalties must be indicated in the receipt, so both parties know these conditions even at the time of signing the contract. This outcome, of course, is beneficial to the creditor, since if there is a long delay, the amount of the fine may even exceed the amount of the principal debt. If the borrower does not pay the debt and penalties, then the individual or legal entity that issued the loan has the right to go to court. However, lenders in this case must take into account the fact that the judge may take into account evidence of the borrower's dire situation and exempt him from paying part of the fine. That is why many microfinance organizations prefer to turn to collection offices for help.

- The party that issued the microloan agrees to extend the loan term. In this case, interest on the loan is calculated according to the scheme that was used previously and is specified in the loan agreement. This outcome is naturally more advantageous for the borrower. He will not have to pay a fine, and his credit history will not be spoiled, which in the future may affect the issuance of another loan.

If problems arise with timely repayment of the loan, the borrower in any case should try to resolve the issue peacefully. This will reduce the overpayment on the loan and will not affect your credit history.

If the loan was taken not from an individual, but from a company providing lending services, then you should urgently contact the organization’s employees, inform them of your situation and ask for an extension of the loan.

Important! MFOs often meet their clients halfway and extend the loan. If the borrower contacts the company more than once and has a positive credit history, he has a better chance of prolonging the contract.

We calculate the interest on the loan: the first day, the last day (Moshkovich M.G.)

Article posted date: 09.20.2016

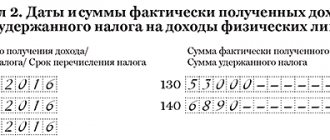

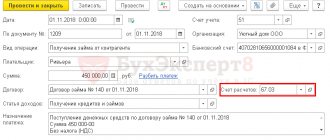

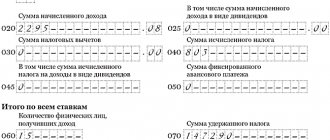

An accountant often has to calculate the amount of interest for the use of borrowed funds. And here it is important to correctly calculate the number of days for which fees for using money are charged. Not only to avoid disputes between the parties. Tax issues depend on this calculation - accounting for the amount of interest in “profitable” income (expenses) and withholding personal income tax on income in the form of material benefits (if the loan is issued to an individual). Accountants often have difficulty determining the first and last day of the borrowing period. Let's figure out what these days are.

First day

Let us immediately make a reservation that the parties have the right to determine any procedure for calculating interest for using the loan <1>. Look at your contract - if it clearly states from which day to count, then act in accordance with the provisions of this document. But, as a rule, the contracts indicate only the interest rate and the loan repayment period. Therefore, in other matters one must be guided by general rules. The loan agreement is considered concluded from the moment the money is transferred <2>. But there is no need to take this day into account for the purposes of calculating interest, since according to the general rule of the Civil Code, the course of a period defined by a period of time begins the next day after the calendar date or the occurrence of an event that determines its beginning <3>. Thus, unless the agreement states otherwise, interest must always be accrued from the day following the day of transfer (transfer) of money. This point is especially important when the day the loan was received and the day the interest began to accrue fall in different months. Let’s assume that an employee was given an interest-free loan on March 31, 2016. According to the rules in force from 01/01/2016, income in the form of financial benefits from savings on interest arises on the last day of each month during the term of using the loan <4>. Since, according to the Civil Code, the term of using the loan must be counted from 04/01/2016, there is no need to calculate the financial benefit and withhold personal income tax from it for March. ——————————— <1> Clause 1 of Art. 809 of the Civil Code of the Russian Federation. <2> Clause 1 of Art. 807 Civil Code of the Russian Federation. <3> Article 191 of the Civil Code of the Russian Federation. <4> Subclause 7, clause 1, art. 223 Tax Code of the Russian Federation.

Last day

As for the last day, everything is somewhat more complicated. As stated in the Civil Code, unless otherwise agreed, interest is paid monthly “until the day the loan amount is repaid” <5>. The preposition “do” from the point of view of the Russian language is perceived rather as an instruction not to include the day of return. At least according to Ozhegov’s dictionary, “before” indicates the limit of something in the sense of “before something” <6>. At the same time, another provision of the Civil Code, which deals with early repayment of a loan, refers to the accrual of interest “up to and including the day of repayment of the loan amount in full or part thereof” <7>. Here it is already obvious that the last day is included. And there cannot be different rules for calculating interest for early and regular loan repayment. Since the rule on the procedure for early return was introduced later, it can be assumed that the legislator deliberately clarified the wording in order to avoid disputes. Please note that Bank of Russia documents relating to Bank of Russia loans also require interest to be accrued up to and including the day the loan is repaid <8>. The Bank of Russia has the right to determine its own procedure for calculating interest <9>; it cannot be considered a general rule. However, the position of the Bank of Russia can be considered as an example of a common approach. We sought advice on this issue from a civil law expert, and this is what was explained to us.

From authoritative sources Svetlana Mikhailovna Petrova, retired judge of the Supreme Arbitration Court of the Russian Federation, associate professor of the Russian State University of Justice, Ph.D. n. “According to paragraph 2 of Art.