Amount of insurance premiums for 2018-2021

Starting from 2021, the procedure for calculating fixed contributions for individual entrepreneurs, lawyers, heads and members of peasant farms, etc. is changing. Article 430 of the Tax Code of the Russian Federation provides for the values of fixed contributions that do not depend on the minimum wage, as in 2015-2017.

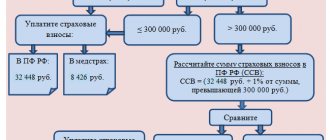

Contributions to the Pension Fund for income exceeding RUB 300,000. will be calculated as 1% of the excess amount, but not more than the maximum permissible value.

Fixed individual entrepreneur contributions for 2018-2021

| Insurance contributions to the Pension Fund, FFOMS | 2018 | 2019 | 2020-2021 |

| Mandatory contribution to the Pension Fund for income not exceeding 300,000 rubles. | RUB 26,545 | RUB 29,354 | RUB 32,448 |

| Maximum allowable amount of contributions to the Pension Fund | RUB 212,360 (RUB 26,545 × | RUB 234,832 (RUB 29,354 × | RUB 259,584 (RUB 32,448 × |

| Contributions to the Compulsory Medical Insurance Fund | RUB 5,840 | RUB 6,884 | RUB 8,426 |

Deadline for payment of “pension” contributions on income exceeding RUB 300,000. starting with reporting for 2021, you must pay no later than July 1 of the following year for the reporting year.

So for 2021, insurance contributions to the Pension Fund for the excess amount must be paid no later than July 2, 2021 (since July 1, 2018 is a day off).

Insurance premiums for the heads of peasant farms and their members are also fixed and correspond to the minimum amount of insurance contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund.

Changes

The main change since last year was that the responsibility for collecting fixed payments was transferred to the Federal Tax Service, i.e. By and large, this function was returned to them, because until 2013 it was they who collected all payments. So, when you pay contributions for yourself, be sure to change the details of the recipient and the KBK , otherwise you will send the money to the Pension Fund the old fashioned way.

You should get new details from your tax authority or update your accounting program through which you pay mandatory fixed payments.

Fixed payments

Fixed payments are mandatory pension and health insurance premiums paid by sole proprietors and other private practice groups. You are required to pay them in any case, regardless of:

- whether you have employees;

- business activity is or is not carried out;

- the applied taxation system.

If you are an individual entrepreneur and an employee under an employment contract at the same time, then you still need to pay contributions for yourself as an individual entrepreneur, even if your employer paid the contributions for you. Many people mistakenly believe that since they have already paid for them, they have the right not to transfer insurance premiums.

More on the topic: How to make good money selling used cartridges.

Fixed payments for yourself for individual entrepreneurs consist of two parts:

- contributions for compulsory insurance to the Pension Fund and the Federal Compulsory Medical Insurance Fund;

- contributions to the Pension Fund of the Russian Federation, which are paid by individual entrepreneurs who have received an income of over 300 thousand rubles.

Calculation of the amount of contributions paid

The amount of fixed payments he pays depends directly on the minimum wage and the interest rate of insurance contributions to extra-budgetary funds.

As of January 1, 2021, the minimum wage remained the same as in 2021 (Law No. 82-FZ as amended by Federal Law No. 164-FZ dated June 2, 2016) and is equal to seven thousand five hundred rubles (7,500 rubles). The increase in the minimum wage is planned to take place on July 1, 2021 and will be 7,800 rubles (Federal Law dated December 19, 2016 No. 460-FZ).

Insurance rates:

- Pension Fund - 26%

- FFOMS - 5.1%

So the final calculation will look like this:

- Contributions for yourself to the Pension Fund: 7500 × 0.26 × 12 = 23,400

- Contributions to the FFOMS: 7500 × 0.051 × 12 = 4,590

- Total for 2021: 23400 + 4590 = 27,990

In total, for the entire 2021, individual entrepreneurs must pay 27,990 rubles . To determine the quarterly amount, simply divide by 4:

- 23400 / 4 = 5850 rubles per pension for one quarter;

- 4590 / 4 = 1147.5 rubles for health insurance per quarter.

Please note: the minimum wage for calculations is the one that was at the beginning of the year. Those. Even if the minimum wage changes in July 2021, then by the end of the year exactly 7,500 rubles will be charged when paying insurance premiums. The new minimum wage in calculations will be applied only from next year, unless it changes on January 1, 2021.

Insurance premiums for individual entrepreneurs for themselves in 2021 are fixed

Until December 31, 2021 inclusive, each individual entrepreneur registered before January 1, 2021 is required to pay the following fixed insurance premiums for 2017 (for those who became entrepreneurs during the year, there are amounts by month and day):

- Fixed insurance contributions to the Pension Fund budget: 23,400.00

- Fixed insurance contributions to the FFOMS budget: 4,590.00

- not paid for 2021

The amount of contributions is calculated based on the minimum wage of 7,500 rubles applied since July 1, 2016, the value of which has not changed since January 1, 2017.

Pension Fund: 7500 * 26% * 12 months. = 23,400.00 rubles.

FFOMS: 7500 * 5.1% * 12 months. = 4,590.00 rubles.

Contributions in the above amounts can be paid as a lump sum, or they can be transferred every month or quarterly.

In the latter case, the amounts paid during the reporting period (for simplified taxation system 6%) or tax period (for single income tax) can significantly reduce the amount of tax payable under these special regimes, especially if the individual entrepreneur does not have employees. The table below breaks down contribution amounts by quarter, month and day. Amounts of fixed insurance premiums for individual entrepreneurs for themselves in 2021

| Type of insurance premiums | In year | Per quarter | Per month | In a day |

| Fixed contributions to the Pension Fund | 23400,00 | 5850,00 | 1950,00 | 64,1096 |

| Fixed contributions to the FFOMS | 4590,00 | 1147,50 | 382,50 | 12,5753 |

| Total fixed contributions: | 27990,00 | 6997,50 | 2332,50 | 76,6849 |

Throughout the year, you can pay any amounts greater or less than those indicated in the table above. The law does not provide for penalties or fines for this; the main thing is to pay the entire required amount by the end of 2017. And when you transfer the last payment, first add up all the previously paid contributions on the calculator. From the amounts indicated in the “Per Year” column of the table, subtract the amounts obtained by addition, and indicate in the payment order or receipt to Sberbank exactly the remaining amounts for both the Pension Fund and the Federal Compulsory Medical Insurance Fund.

Please note that the amendments made to Article 22.2 of the Federal Law of December 15, 2001 No. 167-FZ “On Compulsory Pension Insurance in the Russian Federation” only consolidated the previously applied rule on the payment of fixed contributions to the Pension Fund budget. As before, the entire amount of contributions credited to the Pension Fund of the Russian Federation is transferred in one payment document, using the KBK for the payment of an insurance pension . Moreover, in 2021, the BCC is the same for all fixed insurance premiums , including in the amount of 1% of the amount of income in excess of 300 thousand rubles (applies to income in 2021). Of course, we indicate the Federal Tax Service as the recipient of the insurance premiums.

Calculation of contributions for individual entrepreneurs’ income over 300 thousand rubles.

If the annual income of an individual entrepreneur exceeds three hundred thousand rubles, and I hope that this will be the case for you, then he will have to pay an additional 1% of the income exceeding 300 rubles to the pension fund.

More on the topic: Step-by-step instructions on how to open an individual entrepreneur in 2021 on your own without intermediaries

Don’t get confused, you will need to pay 1% not of your total income, but of the difference between your actual income and 300,000.

Let's look at an example:

If in 2021 an individual entrepreneur earns 700,000 rubles, then in addition to the fixed 23,400 rubles to the Pension Fund, he will have to pay another 4,000 rubles on top.

1% in the Pension Fund: (700,000 - 300,000) × 0.01 = 4,000

In total, our individual entrepreneur will pay 27,400 (23,400 + 4,000) rubles to the Pension Fund. And the total amount of his insurance premiums will be equal to 31,990 (27,400 + 4,590) rubles.

Please note that insurance premiums to the Federal Compulsory Medical Insurance Fund remain unchanged regardless of annual income.

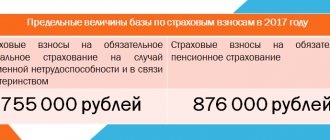

There is a maximum amount of the contribution paid to the Pension Fund; its size also depends on the minimum wage and is calculated using the formula:

8 × minimum wage × 0.26 × 12

Thus, the maximum contribution to the pension fund in 2021 will be 187,200 rubles (8 × 7500 × 0.26 × 12)

For example, you earn 30 million rubles in 2021, then your contribution to the Pension Fund could be equal to:

(30,000,000 - 300,000) × 0.01 + 23,400 = 320,400 rubles.

But since there is a limit on the contribution, you will in any case pay 187,200 rubles.

The income of an individual entrepreneur is determined depending on the chosen taxation system.

Unified report on contributions to the tax office

You will have to report on contributions for employees (except for contributions for injuries) to the tax office. Now you are submitting two different reports - RSV-1 to the pension fund and 4-FSS to social insurance. In 2021, they will be replaced by a single report, the form of which is promised to be approved by October of this year. It must be submitted at the end of the quarter by the 30th of the next month. You'll first encounter the new form in April 2017.

For a report not submitted on time, the tax office will impose a fine for each month of delay - 5% of the unpaid contributions, but not less than 1,000 rubles and not more than 30%.

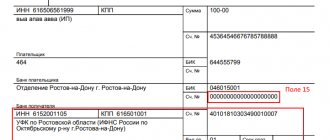

New KBK for payment of contributions

When paying insurance premiums, you must be careful with the KBK codes, as they have changed. Also, as of 2021, there is no separate BCC for paying 1% to the Pension Fund of the Russian Federation on income exceeding 300,000, which you will pay in 2021.

- 182 1 0210 160 - fixed contributions to the Pension Fund of Individual Entrepreneurs for themselves (according to this BCC you will pay 1%);

- 182 1 0213 160 - fixed contributions to the FFOMS for individual entrepreneurs for themselves.

More on the topic: Ideas for business with minimal investment 2021 - small business for beginners

BCC for fixed contributions of individual entrepreneurs for themselves in 2017

From January 1, 2021, the administrator of all payments for insurance premiums , with the exception of contributions to the Social Insurance Fund from the National Tax Service and the Pension Fund, is the Federal Tax Service of the Russian Federation . Accordingly, the KBK of insurance premiums on the left now begins with the numbers “182”, as in the KBK for taxes and fees. However, the numbers in other categories have also changed, as well as the text that is indicated in the “Purpose of payment” field. But these are not all the changes that have occurred.

Separately, BCCs have been appointed for insurance premiums, which must be paid only for 2021. For periods starting from 01/01/2017, for exactly the same insurance premiums, KBK is already different. Moreover, for different reporting periods of previous years: before 12/31/2009 and from 01/01/2010 to 12/31/2012, for which the debt arose, now also have their own budget classification codes.

And most importantly! From 2021, there are no longer separate BCCs for regular fixed payments, which are paid by all individual entrepreneurs, and for contributions in the amount of 1% on the amount of income exceeding the limit (300 thousand rubles in 2015 - 2021). We now pay all fixed contributions according to a single BCC for an insurance pension.

We did not give the full name of the budget classification codes here, but immediately brought the texts into the form in which we recommend writing them in the “Purpose of payment” details of payment orders. However, for your convenience, we have divided the BCC by reporting periods into different tables.

KBC for payment of fixed insurance premiums in 2021 for the periods from 01/01/2013 to 12/31/2016

KBK for filling out payment orders for fixed payments of individual entrepreneurs in 2021 to the Pension Fund of Russia (only for paying debts for 2013 - 2016).

| Code | Name of KBK |

| 18210202140061100160 | Reg No. 000-000-000000 Insurance contributions for compulsory pension insurance in a fixed amount, credited to the Pension Fund budget for the payment of an insurance pension (calculated from the amount of the payer’s income not exceeding 300,000 rubles) for 2021. |

| 18210202140061200160 | Reg No. 000-000-000000 Insurance contributions for mandatory pension insurance in a fixed amount, credited to the Pension Fund budget for payment of the insurance part of the pension (from the amount of the payer’s income received in excess of 300,000 rubles) for 2016. |

| 18210202140062100160 | Reg No. 000-000-000000 Penalties on insurance premiums for compulsory health insurance in a fixed amount, credited to the Pension Fund budget for the payment of insurance pensions for 2021. |

| 18210202140062200160 | Reg No. 000-000-000000 Interest on insurance contributions for compulsory pension insurance in a fixed amount, credited to the Pension Fund budget for the payment of insurance pensions for 2021. |

| 18210202140063000160 | Reg No. 000-000-000000 Fine on insurance contributions for compulsory health insurance in a fixed amount, credited to the Pension Fund budget for the payment of insurance pensions for 2021. |

KBK for filling out payment orders for fixed contributions of individual entrepreneurs in 2021 to the FFOMS (only for paying debts for 2012 - 2016).

| Code | Name of KBK |

| 18210202103081011160 | Reg No. 000-000-000000 Insurance premiums for compulsory medical insurance in a fixed amount, credited to the FFOMS budget (insurance premiums for compulsory medical insurance for the working population for 2021) |

| 18210202103082011160 | Reg No. 000-000-000000 Penalties on insurance premiums for compulsory medical insurance in a fixed amount credited to the FFOMS budget (penalties on insurance premiums for compulsory medical insurance for the working population for 2021) |

| 18210202103083011160 | Reg No. 000-000-000000 Fine on insurance premiums for compulsory medical insurance in a fixed amount, credited to the FFOMS budget (fine on insurance premiums for compulsory medical insurance for the working population for 2021) |

Reduction of tax on the amount of contributions

The good news is that even during the crisis, the government did not cancel the opportunity to reduce insurance premiums by no more than 50% of the tax. All individual entrepreneurs can take advantage of this opportunity, except those who use the patent tax system.

For example, let’s take an individual entrepreneur on the simplified tax system “Income” with a total turnover of 2 million rubles per year, then he will be able to reduce his tax by the amount of contributions paid:

- amount of mandatory contributions: 27,990 + ((2,000,000 - 300,000) × 0.01)) = 44,990 rubles

- tax on the simplified tax system “Income”: 2,000,000 × 0.06 = 120,000 rubles.

In this case, our individual entrepreneur will actually pay tax0 = 75,010 rubles.

But in the end, for the year he will pay the same 120,000 rubles (tax + contributions);

The minimum wage has increased, will individual entrepreneur contributions increase?

In the summer of 2021, the minimum wage increased by 300 rubles from 7.5 thousand rubles to 7.8 thousand rubles. But this will not affect the insurance premiums of individual entrepreneurs this year, because Usually, to calculate contributions, the minimum wage at the beginning of the year is taken. But this means that in 2021 the amount of fixed insurance premiums will definitely increase. And if we take into account the government’s plans to raise the minimum wage to the subsistence level, then we can expect that insurance premiums for individual entrepreneurs in 2021 will increase in proportion to the change in the minimum wage.