We reflect in 6-personal income tax the interest paid to the employee - the lender: recommendations from the Federal Tax Service - all about taxes

To expand a business, investments are required; one of the ways to obtain them, for small enterprises, may be a loan from an individual. For the use of his funds, the lender is accrued profit, which is income for him, which means he must pay tax on it to the state. However, the transfer of fees to the budget is carried out by the tax agent, who is the enterprise - the borrower, and this responsibility is assigned to him.

How can an accountant reflect interest on loans in 6 personal income taxes? Any individual can act as a lender. person: founder, employee or third party.

Agents are required to withhold income tax at rates of 13% and 30% for residents and non-residents, respectively. Report 6 of personal income tax shows all remuneration, including income received in the form of interest on a loan, including all income that was actually paid to employees for the current period. Reporting is submitted every quarter.

The first section is filled in with a cumulative total from the beginning of the year, i.e. the calculation for 6 months will contain information on paid income from January to June.

The second section reflects the rewards received by individuals.

persons only for the current quarter.

According to explanatory letters from the Federal Tax Service, the day money is credited to a person’s bank card is the date the income is actually received.

On the same day, personal tax is withheld.

Loan interest in 6-NDFL

Copyright: Lori's photo bank Companies and entrepreneurs often need additional funds - for business development, urgent repayment of debts, etc.

The deadline for transferring the fee is the next business day after payment of the remuneration. Interest accrued in December but paid the following year is reflected only in the second section of the 1st quarter report.

The source of such funds can be not only banks or other companies, but also citizens. For example, a company can borrow money from its founder, manager, or another person who does not even work in this organization by concluding a loan agreement with him. As a rule, such agreements provide for the payment of interest to the lender.

Interest paid under a loan agreement is considered income of an individual, from whom income tax is withheld.

We’ll figure out how to reflect interest in the 6-NDFL calculation in our article.

A company or individual entrepreneur that has received a loan from an individual and pays interest to him is recognized in relation to such income as tax agents for personal income tax (Art.

226 Tax Code of the Russian Federation; letter of the Federal Tax Service dated May 26, 2017 No. BS-4-11/9974).

This means that the borrower is obliged to calculate the tax on the interest amount, withhold it when paying income and transfer it to the budget.

At the end of the year, the agent submits to the Federal Tax Service the individual lender, and during the year includes his income and tax in Calculation 6-NDFL. Loans are issued, the terms of which establish, among other things, the frequency of interest payments by the borrower.

The parties can set any payment period - monthly, weekly, quarterly, etc. In the absence of such a condition in the agreement, interest is paid monthly until the loan is repaid (clause

3 tbsp. 809 Civil Code of the Russian Federation)

Loans

To expand a business, investments are required; one of the ways to obtain them, for small enterprises, may be a loan from an individual.

For the use of his funds, the lender is accrued profit, which is income for him, which means he must pay tax on it to the state. However, the transfer of fees to the budget is carried out by the tax agent, who is the enterprise - the borrower, and this responsibility is assigned to him.

How can an accountant reflect interest on loans in 6 personal income taxes? Any individual can act as a lender.

person: founder, employee or third party. Agents are required to withhold income tax at rates of 13% and 30% for residents and non-residents, respectively. Report 6 of personal income tax shows all remuneration, including income received in the form of interest on a loan, including all income that was actually paid to employees for the current period.

Reporting is submitted every quarter.

The first section is filled in with a cumulative total from the beginning of the year, i.e. the calculation for 6 months will contain information on paid income from January to June. The second section reflects the rewards received by individuals.

persons only for the current quarter.

According to explanatory letters from the Federal Tax Service, the day money is credited to a person’s bank card is the date the income is actually received. On the same day, personal tax is withheld. The deadline for transferring the fee is the next business day after payment of the remuneration. Interest accrued in December but paid the following year is reflected only in the second section of the 1st quarter report.

Personal income tax on interest on loans in 2021

In 2021, the founder (who is also the general director) was paid interest under the loan agreement provided by him to the LLC. When submitting personal income tax-6 for 2021, it was revealed that partial personal income tax on interest paid was not withheld or transferred. The debt was repaid only in March 2021. How to reflect the amount of repaid debt for 2021 in personal income tax-6 for the 1st quarter of 2021? And is it necessary to reflect this amount at all?

How to reflect interest on loans received in 6-NDFL

Article 2 of Federal Law No. 333-FZ of November 27, 2021 provides for its entry into force after one month from the date of official publication, but not earlier than the 1st day of the next tax period for personal income tax.

N.V. Sokolov did not receive any income other than salary (it is paid monthly on the 11th day), so personal income tax from the January MV can only be withheld in February, on the day the salary is paid (a similar principle applies in subsequent months 1 th quarter).

- The day of acquisition of goods (work, services) and purchase of securities (subclause 3, clause 1, article 223 of the Tax Code of the Russian Federation).

- The day of payment for the value of securities, if their payment occurred after the transfer of ownership of them to the taxpayer (subclause 3, clause 1, article 223 of the Tax Code of the Russian Federation).

- The last day of each month during the period of using borrowed money (subclause 7, clause 1, article 223 of the Tax Code of the Russian Federation).

We recommend reading: List of Documents for Privatization of an Apartment in 2021

Material benefits from saving on interest (sample of filling out lines 100–140)

- from saving on interest for the use of borrowed funds issued to him by a legal entity or individual entrepreneur at a low interest rate;

- purchase of securities (securities) at a price below the market price;

- acquisition of goods (works, services) from interdependent persons.

According to explanatory letters from the Federal Tax Service, the day money is credited to a person’s bank card is the date the income is actually received. On the same day, personal tax is withheld. The deadline for transferring the fee is the next business day after payment of the remuneration.

6-NDFL: interest on loan

Question: An organization received funds under an interest-bearing loan agreement from an individual (company employee).

Monthly interest payments are made to an individual's income. How to reflect in the 6-NDFL certificate accrued for 1 quarter. 2021, but unpaid interest under a loan agreement to an individual?

Accordingly, personal income tax was not withheld. Answer: Section 1 of the calculation in form 6-NDFL is filled out with an accrual total for the first quarter, half a year, nine months and a year. In Sect. Table 2 provides generalized indicators only of those incomes from which personal income tax was withheld and transferred to the budget during the last three months of the period for which the calculation is submitted.

That is, in Sec. 2 there is no need to show the amounts of income on an accrual basis from the beginning of the year (Letter of the Federal Tax Service dated March 24, 2016 N BS-4-11/5106). Thus, interest under the loan agreement will be reflected in section 1, and you have the right not to fill out section 2, because there were no payments or tax withholding, based on the Federal Tax Service letter dated February 25, 2016 No. BS-4-11 / [email protected] by analogy with wages paid in April.

We recommend reading: Countries to which state security officials can travel

- (87 kB) (73 kB) (342 kB) (2 MB) (551 kB)

A Russian organization wants to issue an interest-free loan to an employee.

But it’s very tricky to give it away. In the Loan Agreement, the Khitrost organization writes that the loan is issued in rubles.

But if the dollar exchange rate is higher than... (6-NDFL). Personal income tax has been transferred, but the salary has not yet been paid, therefore, personal income tax has not been withheld. How to reflect this? ✒ The Federal Tax Service believes that in such a situation, the amount transferred to the budget in advance is not taxable....

In our company, the founder is a citizen of the People's Republic of China.

Payment of personal income tax on interest on a loan from an individual 2021

Thus, in accordance with the Order of the Ministry of Finance of the Russian Federation dated At the same time, it is necessary to remember that the payment of personal income tax to the budget of the Russian Federation is carried out by the tax agent no later than the next day after the individual receives income. Thus, in the case of calculating personal income tax on the material benefit received by an individual from saving interest when using borrowed credit funds, payment of personal income tax is made no later than the 1st day of the month following the month of use of borrowed funds, Art.

Personal income tax on interest under a loan agreement with an individual

You need to enter into an additional agreement to the Loan Agreement, which will indicate the purpose of obtaining and providing the loan. In addition to the additional agreement, it is necessary to receive a notification from the Federal Tax Service about the emergence of the right of property deduction in connection with the construction of a new house. Our organization provided its employee with an interest-free loan, which was later forgiven.

Important Section 1 of the calculation in form 6-NDFL is filled out with an accrual total for the first quarter, half a year, nine months and a year. Section 2 of the calculation in Form 6-NDFL for the corresponding reporting period reflects those transactions that were carried out over the last three months of this reporting period.

6-NDFL: interest on loan

Home » Consultations » Almost every company (IP) at certain stages of its activities needs additional cash injections. Perhaps they will be used to establish or develop a business, purchase expensive equipment, maintain and improve the financial condition of the enterprise, etc.

d. At the same time, the sources of raising funds are different. The most commonplace of them is a bank loan. However, not only a credit institution, but also a private person (for example, a founder, director, employee or even a stranger) can borrow money under a loan agreement.

Often such an agreement provides for the payment of interest to the “physicist” - the lender for the use of borrowed funds, as a result of which he receives taxable income. From this consultation you will learn how to reflect loan interest in 6-NDFL. But first, a little background information.

Concept and general characteristics of a loan agreement Borrowing relations are regulated by civil law (§ 1 Chapter 42 of the Civil Code of the Russian Federation).

They are formalized, as a rule, by a loan agreement - a bilateral agreement between the lender and the borrower, according to which the first transfers ownership of the loan item (money or other things defined by generic characteristics), and the second undertakes to return an equivalent item (i.e., such a thing) within a specified period of time. the same amount of money or an equal number of other things received by him of the same kind and quality) (paragraph 1, paragraph 1, article 807 of the Civil Code of the Russian Federation, paragraph 1, article 810 of the Civil Code of the Russian Federation). The contract is recognized as real (i.e.

How to reflect the founder’s income in the form of interest on a loan in the 6-NDFL report?

In this situation, the Organization is a tax agent for personal income tax (clause 1, clause 1, article 208 of the Tax Code of the Russian Federation, clause 1, article 226 of the Tax Code of the Russian Federation). Income paid in the form of interest is subject to personal income tax at a rate of 13%.

Income code is 1011. In addition, interest can be taken into account in expenses in NU as part of non-operating expenses (clause 2, clause 1, article 265 of the Tax Code of the Russian Federation). As a rule, the entire amount of accrued interest is taken into account. There is no need to standardize interest: there are restrictions on accepting the amount in expenses under NU only for controlled transactions (clause.

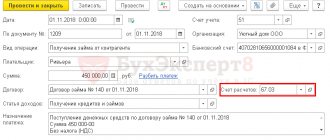

2-13 tbsp. 269 of the Tax Code of the Russian Federation, paragraph 2 of Art. 105.14 Tax Code of the Russian Federation). In 1C Accounting 3.0, operations can be completed as follows. For personal income tax accounting, the example data looks like this: Bank and cash desk – Bank – Bank statements – Receipt button – Receipt to current account – transaction type Receiving a loan from a counterparty.

Agreement Postings Transactions – Accounting – Transactions entered manually – Create button – Transaction.

- Debit - 91.02:

- Subconto 1 - item Other income and expenses has the form:

- Subconto 2 Counterparties - select a founder.

- Subconto 1 - item Other income and expenses has the form:

- Loan - 66.04 “Interest on short-term loans.”

- Subconto 2 Counterparties - select a founder.

Operations – Accounting – Operations entered manually – Create button – Operation.

Fill out the document according to the sample below: Salary and personnel – Personal income tax – All documents on personal income tax – Create button – Personal income tax accounting operation.

Fill out the document according to the sample below:

- Income tab – Add.

The income code is 1011.

- Tab Calculated at 13 (30%) except dividends – Add.

The Federal Tax Service reported how to fill out 6-NDFL if the interest due to an individual under a loan agreement was accrued in one reporting period and paid in another

October 26, 2021 October 26, 2021 An organization that has received a loan from an individual is recognized as a tax agent for personal income tax in relation to interest under the loan agreement.

How to reflect the interest payment transaction if it is accrued in one quarter, and personal income tax is transferred in the next quarter?

The answer to this question is contained in a recently published letter from the Federal Tax Service of Russia. Let us recall that the calculation of 6-NDFL is completed on the reporting date (respectively, March 31, June 30, September 30, December 31). Section 1 of the calculation is compiled on an accrual basis for the first quarter, half a year, nine months and a year. Section 2 of the calculation for the corresponding reporting period reflects only those transactions that were carried out during the last three months of this period.

Line 100 is filled out taking into account the provisions of the Tax Code of the Russian Federation; line 110 - taking into account the provisions of paragraph 4 and paragraph 7 of the Tax Code of the Russian Federation; line 120 - taking into account the provisions of paragraph 6 and paragraph 9 of the Tax Code of the Russian Federation. According to the general rule established by paragraph 1 of the Tax Code of the Russian Federation, the date of actual receipt of income is considered the day the income is paid, including the transfer of funds to the taxpayer’s account. Clause 4 of the Tax Code of the Russian Federation obliges tax agents to withhold the accrued amount of personal income tax upon actual payment of income.

In this case, the tax must be transferred no later than the day following the day of payment of income (clause 6 of the Tax Code of the Russian Federation). Thus, the date of actual receipt of income in the form of interest on a loan issued to an organization is the day of payment of this interest.

The company calculated personal income tax on material benefits and withheld from the next salary

The company issued an interest-free loan to the employee. At the end of the month, the company calculated the material benefit and withheld personal income tax from the next salary.

Material benefits from savings on interest are subject to personal income tax (Clause 1, Article 210 of the Tax Code of the Russian Federation). The tax base for such income is calculated according to the rules of Article 212 of the Tax Code of the Russian Federation. Take the Central Bank rate on the date of receipt of income.

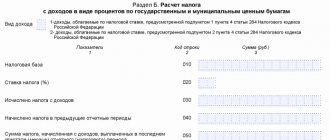

The date of receipt of income for material benefits is the last day of the month (subclause 7, clause 1, article 223 of the Tax Code of the Russian Federation). Therefore, calculate the benefit monthly during the contract period. On the last day of the month, calculate personal income tax on material benefits. Tax must be withheld from the nearest monetary income (clause 4 of article 226 of the Tax Code of the Russian Federation). If the company withheld the calculated salary tax during the reporting period, fill in the material benefit in sections 1 and 2 of the calculation. In section 1, fill out the benefit in a separate block of lines 020–050.

If the employee received wages and income in the form of material benefits during the period, count this employee once in line 060.

As for section 2, the date of receipt of salary income is also the last day of the month. Therefore, benefits and salary can be combined into one block of lines 100–140. It does not matter that income is subject to personal income tax at different rates (letter of the Federal Tax Service of Russia dated April 27, 2016 No. BS-4-11/7663).

If the company withheld tax from the advance part of the salary, reflect the benefit separately in section 2. In line 100 put the last day of the month, in line 110 - the date when the company was able to withhold personal income tax, in line 120 - the next working day.

For example

On April 1, the company issued an interest-free loan of 300,000 rubles to an employee. As of April 30, she calculated the material benefit - 1803.28 rubles. (RUB 300,000 × 2/3 × 11%. 366 days × 30 days). On the same date I calculated personal income tax - 631 rubles. (RUB 1,803.28 × 35%).

The company withheld personal income tax from the April salary, which was issued on May 5. Salary - 38,000 rubles, personal income tax - 4940 rubles. (RUB 38,000 × 13%). The date of receipt of salary income is April 30. The tax withholding date and the deadline for transferring personal income tax coincide. So the company combined salary and benefits into one block of lines 100–140. Income - 39,803.28 rubles. (38,000 + 1803.28). The amount of personal income tax is 5571 rubles. (4940 + 631).

In total, the company paid salaries for the six months to 15 employees - 1,230,000 rubles, provided deductions - 97,000 rubles, calculated and withheld personal income tax - 147,290 rubles. ((RUB 1,230,000 - RUB 97,000) × 13%). In total, the company withheld 147,921 rubles. (147 290 + 631).

The company showed material benefits as in sample 51.

Sample 51. How to fill out the calculation if the company withheld tax on profits in the current quarter:

Top

Reflection in 6-NDFL of interest paid under the loan agreement

Contents » Consultations » Almost every company (IP) at certain stages of its activities needs additional cash injections.

Perhaps they will be used to establish or develop a business, purchase expensive equipment, maintain and improve the financial condition of the enterprise, etc. At the same time, the sources of raising funds are different.

The most commonplace of them is a bank loan. However, not only a credit institution, but also a private person (for example, a founder, director, employee or even a stranger) can borrow money under a loan agreement. Often such an agreement provides for the payment of interest to the “physicist” - the lender for the use of borrowed funds, as a result of which he receives taxable income. If an individual accrued interest on a loan provided in the first quarter of 2021, but will be paid only in the second quarter of 2021, then this operation is reflected in lines 020, 040 of section 1 of the calculation in form 6-NDFL for the first quarter 2021. Important!

This position of the Federal Tax Service contradicts their own explanations on the payment of “rolling” sick leave, which should be reflected in a similar way. According to the letter from the Federal Tax Service, “rolling” sick leave is shown in the report on the actual payment, i.e. In the photo Svetlana Skobeleva Question from a reader of Clerk.Ru Galina (Oktyabrsky) Please tell me, the organization (OSN) took a loan from an individual, charges him interest monthly and, if possible, pays it to him.

Personal income tax on interest on a loan from an individual 2021

If, in the case of issuing an interest-bearing loan to the founder or manager, personal income tax can be avoided by constantly extending the contract, that is, by making the debt indefinite, then the monthly payment of personal income tax by the borrower who has issued an interest-free loan is clearly stated in the law.

Taxation of personal income tax on income under a loan agreement

About taxation when repaying a loan to an individual Description of the situation: Our organization took out an interest-bearing loan from an individual for a period of one year. The return date is suitable, as well as the interest on it. How should we reflect the repayment of the loan when taxing profits?

Section 1. The company increased income in line 020 by interest - RUB 10,021,500. (9,786,500,235,000). And also personal income tax in lines 040 and 070 - 1,302,795 rubles. (1,272,245 + 30,550). In line 060 (18 employees and 1 founder).

Loans

To expand a business, investments are required; one of the ways to obtain them, for small enterprises, may be a loan from an individual. For the use of his funds, the lender is accrued profit, which is income for him, which means he must pay tax on it to the state.

However, the transfer of fees to the budget is carried out by the tax agent, who is the enterprise - the borrower, and this responsibility is assigned to him. How can an accountant reflect interest on loans in 6 personal income taxes?

Any individual can act as a lender. person: founder, employee or third party.

Agents are required to withhold income tax at rates of 13% and 30% for residents and non-residents, respectively. Report 6 of personal income tax shows all remuneration, including income received in the form of interest on a loan, including all income that was actually paid to employees for the current period.

Reporting is submitted every quarter. The first section is filled in with a cumulative total from the beginning of the year, i.e.

the calculation for 6 months will contain information on paid income from January to June. The second section reflects the rewards received by individuals. persons only for the current quarter.

According to explanatory letters from the Federal Tax Service, the day money is credited to a person’s bank card is the date the income is actually received. On the same day, personal tax is withheld. The deadline for transferring the fee is the next business day after payment of the remuneration.

Interest accrued in December but paid the following year is reflected only in the second section of the 1st quarter report.

Is it necessary to show interest paid on a personal loan?

person in 6 personal income tax

Reporting is submitted every quarter. The first section is filled in with a cumulative total from the beginning of the year, i.e.

the calculation for 6 months will contain information on paid income from January to June. The second section reflects the rewards received by individuals. persons only for the current quarter. According to explanatory letters from the Federal Tax Service, the day money is credited to a person’s bank card is the date the income is actually received.

On the same day, personal tax is withheld. The deadline for transferring the fee is the next business day after payment of the remuneration.

Interest accrued in December but paid the following year is reflected only in the second section of the 1st quarter report. However, if profit is accrued in March and transferred in April, it is reflected in both reports.

For the first quarter only in section 1, for the six months in addition to the first and in the second section.

Important! Such

How to reflect interest on a loan agreement in 6 personal income taxes

Free consultation by phone: +7(499)495-49-41 Contents In this case, the loan agreement is drawn up in writing if:

- one of the parties to the loan agreement is a legal entity or individual entrepreneur (clause 3 of Article 23 of the Civil Code of the Russian Federation, clause 1 of clause 1 of Article 161 of the Civil Code of the Russian Federation, clause 1 of Article 808 of the Civil Code of the Russian Federation);

- an agreement is concluded between citizens for an amount exceeding 10 minimum wages (clause 1 of Article 808 of the Civil Code of the Russian Federation).

(Recall that in accordance with paragraph 2 of Article 5 of the Federal Law of June 19, 2000 No. 82-FZ, to calculate payments for civil obligations, the basic minimum wage amount of 100 rubles is used.

This means that an individual draws up a transaction on paper for a loan amount of 1000 rubles.

and above.) By the way! Failure to comply with the written form does not make the loan agreement invalid.

True, in the event of a dispute, the parties will no longer be able to refer to witness testimony to confirm the transaction and its terms (clause 1 of Article 162 of the Civil Code of the Russian Federation). By the way, the income of an individual is subject to personal income tax at a rate of 13% in accordance with clause 1 of Article 224 of the Tax Code RF (including interest on loans), can be reduced by standard tax deductions for yourself and/or your children (clause 3 of Article 210 of the Tax Code of the Russian Federation, clause 1 of Article 218 of the Tax Code of the Russian Federation).

Therefore, the lender (a resident of the Russian Federation) has every right to contact the borrower for deductions, and he, in turn, will have to provide them. Date of actual receipt of income in the form of interest on the loan For the purpose of calculating personal income tax, the date of actual receipt of income in the form of interest on the loan is determined:

- How

- as the day of payment of such income to an individual - if interest is paid in cash (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation);