6-NDFL Errors when filling out

If an organization sends false 6-NDFL information to the tax office, it faces a fine of 500 rubles. Penalties will be applied if the following conditions are simultaneously met:

- An error identified in the information led to arrears;

- The rights of workers were violated, for example the right to deduction.

First, let's look at the most common mistakes:

Salaries for June were reflected in the report for the 1st half of the year

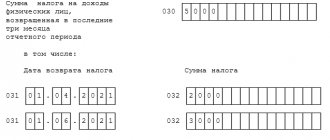

The income of the second section of information 6-NDFL includes the amounts of the period in which the deadline for tax payment falls (

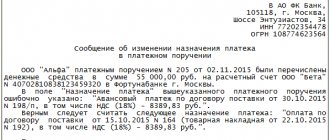

The amount of the fine for erroneous information in 6-NDFL

The fine for an error in calculating 6-NDFL is 500 rubles (clause 1 of Article 126.1 of the Tax Code of the Russian Federation). It will be imposed on a legal entity for each unreliable report, regardless of how many errors it contains - one or five. In addition, the head of the company will be punished: he will be fined 300-500 rubles (Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

The Tax Code of the Russian Federation does not provide precise instructions on what exactly is considered an error in the 6-NDFL form.