Who signs the invoice?

The issue of who signs invoices should be resolved by the seller in a timely manner.

If this function in the company is not assigned to anyone, the buyer may suffer: an unsigned invoice leaves him without a tax deduction. The same result awaits the buyer if the invoice received from the seller contains the signatures of unauthorized persons. The Tax Code does not strictly establish who signs invoices, and does not prohibit invoices from being signed by other persons in the company (managers, financial specialists, etc.). But the names and positions of the employees authorized to sign invoices must be reflected in the order - then the question of who signs invoices in this company will be resolved.

An invoice can be signed not only by authorized representatives of an organization or individual entrepreneur, but also by a specialist accountant or employees of another company. Typically, this occurs when bookkeeping, including signing invoices, is delegated to these individuals under an accounting services contract. In order for a specialist accountant or employees of an accounting company working under a contract to sign invoices, it is also necessary to either issue a power of attorney for them, or draw up a separate annex to the contract indicating the persons whom the parties authorize to sign the invoices.

ConsultantPlus experts explained by whom and how an electronic invoice is issued and signed. Study the material by getting trial demo access to the K+ system.

Let’s take a closer look at how to properly issue a power of attorney to sign invoices.

About signatures

According to the current rules, a paper invoice is signed by the head and chief accountant of the selling organization. At the same time, the question often arises: who can sign an invoice for the chief accountant or the head of the organization? After all, these employees may not be at the workplace when the need arises to sign a document. Employees, for example, may be on sick leave or on annual leave.

Indeed, an invoice can be signed not only by managers and the chief accountant, but also by other persons authorized to do so by order of the director or by power of attorney on behalf of the organization. Here is an example of such a power of attorney:

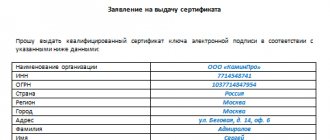

Power of attorney

Moscow city March sixth two thousand nineteen

Limited Liability Company “Astra” (OGRN 1127785134567, INN 7722311234) represented by General Director Alexander Ivanovich Pushknin, acting on the basis of the Charter, authorizes Elena Alekseevna Lobanova with this power of attorney, passport 46 06 727511, issued 05/03/1991 OVD “Northern Tushino” Moscow, on behalf of Astra LLC, sign invoices for the manager, as well as primary documents issued to counterparties.

The power of attorney is valid until March 6, two thousand and twenty-one, without the right of substitution.

Signature E.A. Lobanova I certify Lobanov

General Director of Astra LLC Pushkin Pushkin A.I.

When it comes to organization, everything is clear, but who can sign an invoice for an individual entrepreneur? This can be done by the businessman himself, or by the person to whom the businessman has issued the appropriate power of attorney. Usually this is an accountant who keeps records of the activities of the individual entrepreneur. In both the first and second cases, the invoice must indicate the details of documents on the state registration of the entrepreneur. Now you know who can sign an invoice for the director and chief accountant when issuing a paper document.

How to draw up a power of attorney to sign invoices: sample

Any employee of the company cannot sign invoices, because in clause 6 of Art. 169 of the Tax Code of the Russian Federation states that this document must contain the signatures of the manager and chief accountant or other authorized persons. As for the individual entrepreneur, he must sign the invoice himself or entrust this work to a trusted person.

In large companies with a complex management structure, the manager may delegate some of the authority to his deputies, full-time employees, or even third parties.

In companies with little document flow, the invoice is signed, as a rule, by the director and chief accountant; an individual entrepreneur often has to fulfill this responsibility alone. But if he decides to save himself from this work, he will need to be given the right to sign invoices by documenting the authority through a power of attorney certified by a notary (letter of the Ministry of Finance of Russia dated April 25, 2017 No. 03-02-08/24718). In this case, the invoice will contain the details of two documents at once - the issued power of attorney and the certificate of state registration. IP registration.

Power of attorney forms do not relate to strictly normative documents, and therefore are not defined by law. But you can draw up a sample power of attorney yourself, focusing on standard forms and thereby determining who signs invoices in the absence of management.

A power of attorney for signing invoices, a sample of which you can view on our website.

On company letterhead

POWER OF ATTORNEY No. _______

mountains ____________________ "___"____________ ___ G.

_______________________________________________________________________

(Company name)

represented by _________________________________, acting on the basis of ____________,

(Full name of the manager, his position)

hereby authorizes _____________________________________________________

(F.I.O. and position held)

passport: series and number ________ issued by ___ ___ ______ by _________________________,

registered at: ______________________

sign invoices for the director (chief accountant).

The power of attorney was issued for a period of ______________ without the right of substitution.

Signature ______________________________ ___________________________ I certify.

(full name of the authorized representative) (signature of the authorized representative)

_______________________________ _________________ _______________

(manager position) (signature) (full name)

M.P.

You can download the finished sample:

Transfer of signature rights

Situation: how to correctly transfer the right to sign invoices from the manager and chief accountant to other employees of the organization?

The transfer of the right to sign invoices can be formalized by a power of attorney from the organization or by order (instruction) of the manager (clause 6 of Article 169 of the Tax Code of the Russian Federation).

There are no standard samples for orders (instructions), so these documents can be drawn up in any form. The main thing is that they contain information about to whom the right to sign is transferred, and samples of signatures of these employees. In addition, the order (instruction) can set a period during which an authorized employee has the right to sign invoices. You can also provide for who is given the right to sign instead of an authorized employee during the period of his illness or absence for other reasons.

Authorized employees certify invoices with their signatures. At the same time, when filling out the details “Head of the organization or other authorized person” and “Chief accountant or other authorized person,” they put personal signatures, and indicate their last names and initials in the transcript. You can do it another way: add additional lines to the invoice and indicate in them the real positions of authorized persons and the decoding of their surnames and initials. Both options do not contradict the law and cannot be grounds for refusal to deduct VAT. Similar clarifications are contained in letters of the Ministry of Finance of Russia dated April 10, 2013 No. 03-07-09/11863, dated April 23, 2012 No. 03-07-09/39.

Situation: is it necessary to indicate in the invoice the position of the employee authorized to sign this document instead of the manager (chief accountant)?

No no need.

The composition of the mandatory invoice details is established by Article 169 of the Tax Code of the Russian Federation, therefore changing them is unacceptable. This also applies to such invoice details as “Head of the organization or other authorized person” and “Chief accountant or other authorized person.” Thus, if the invoice is signed by an authorized employee, then his position should not be indicated in this document. But to identify the person who actually signed the invoice, his last name and initials must be indicated after the signature. This procedure for issuing an invoice signed by an employee authorized to do so by an order (instruction) of the manager or a power of attorney on behalf of the organization is recommended by the Ministry of Finance of Russia in letters dated April 23, 2012 No. 03-07-09/39, dated February 6, 2009. No. 03-07-09/04, Federal Tax Service of Russia in letter dated June 18, 2009 No. 3-1-11/425.

At the same time, if the employee authorized to sign invoices indicated his position in it, such a document is not drawn up in violation of the established procedure. Neither the Tax Code of the Russian Federation nor the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137 prohibits indicating additional details (information) in invoices, including the names of positions of persons authorized to sign these documents. Similar clarifications are contained in letters of the Ministry of Finance of Russia dated April 23, 2012 No. 03-07-09/39 and dated February 6, 2009 No. 03-07-09/04.

Situation: should the seller (executor) provide the buyer (customer) with copies of documents indicating the authority of employees (who are not the manager or chief accountant) to sign invoices?

No, you shouldn't.

The law does not assign such an obligation to sellers. However, when checking the legality of the application of VAT deductions by the buyer (customer), the tax office may request from the seller (executor) documents about his employees authorized to sign invoices (clause 8 of Article 88, clause 12 of Article 89, Article 93.1 Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia dated August 9, 2010 No. ШС-37-3/8664). If it turns out that these documents are missing, the inspection will recognize invoices signed by unauthorized persons as having been drawn up in violation of the established procedure. For such invoices, the buyer will not be able to deduct VAT (clause 2 of Article 169 of the Tax Code of the Russian Federation). Therefore, it is better to provide copies of documents confirming the right of employees to sign invoices to counterparties.

The impossibility of deducting input VAT due to the lack of documents confirming the authority of employees to sign invoices is recognized by most arbitration courts (see, for example, Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated November 11, 2008 No. 9299/08, determinations of the Supreme Arbitration Court of the Russian Federation dated January 16, 2009 No. VAS-17445/08, dated January 15, 2009 No. VAS-17093/08, dated October 16, 2008 No. 13259/08, resolution of the Federal Antimonopoly Service of the Moscow District dated April 28, 2008 No. KA-A40/2274- 08, dated February 26, 2009 No. KA-A40/13170-08-P, West Siberian District dated September 24, 2008 No. F04-5092/2008(10144-A46-42), Far Eastern District dated September 4, 2008 No. F03-A73/08-2/3591, Volga-Vyatka District dated February 24, 2009 No. A28-5306/2008-148/23, dated November 21, 2008 No. A28-8965/2007-384/11, dated July 25, 2008 No. A43-13960/2007-40-532, East Siberian District dated December 3, 2008 No. A19-2109/08-50-52-F02-5812/08, dated November 5, 2008 No. A19-4298/08-56-F02-5273/08, North Caucasus District dated December 16, 2008 No. F08-7618/2008, dated December 15, 2008 No. F08-7582/2008).

At the same time, in some cases, when tax inspectorates were unable to provide sufficient evidence, the courts made decisions in favor of organizations (see, for example, Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated January 16, 2007 No. 11871/06, determination of the Supreme Arbitration Court of the Russian Federation dated October 8 2008 No. 12951/08, resolution of the Federal Antimonopoly Service of the North-Western District dated January 20, 2009 No. A56-5037/2008, dated June 16, 2008 No. A42-167/2007, dated November 11, 2008 No. A52-664 /2008).

Transfer of authority to other persons, sample order for the right to sign invoices

Let's look at an example. The director of Green World LLC, R. A. Patrikeev, often goes on business trips abroad due to official needs. The company's chief accountant is responsible for overseeing accounting in regional divisions, so she is also often away. As a result, the question arose: who signs invoices in their absence?

To resolve the issue, the company issued an order “On granting the right to sign invoices” dated September 21, 2017 No. 167, after which the question “Who signs invoices?” didn't get up again. Thus, the company complied with the requirements of the law and saved itself and its customers from potential claims from controllers.

For more information about what inaccuracies are permissible in an invoice, read the material “What errors in filling out an invoice are not critical for VAT deduction?” .

IMPORTANT! Before writing an order about who has the right to sign invoices, it is better to open GOST R 6.30-2003 and familiarize yourself with the requirements for the preparation of organizational and administrative documentation.

You can view and download a sample order on our website.

Signatures on the invoice

Contents When considering disputes arising in connection with deficiencies in the preparation of invoices, many courts proceed from the fact that transcripts of signatures are necessary to establish the fact that invoices were signed by the proper persons. However, the absence of such transcripts in itself cannot serve as an unconditional basis for refusing to deduct VAT.

Such conclusions are contained, for example, in the ruling of the Supreme Arbitration Court of the Russian Federation dated August 25, 2008.

No. 10415/08, in resolutions of the Federal Antimonopoly Service of the North-Western District dated October 25, 2012, No. A26-9024/2011, dated January 22, 2008, No. A05-6472/2007, North Caucasus District dated April 15, 2011.

No. A20-939/2010, dated April 15, 2008

Do I need to sign the invoice on both sides?

Given the large amount of information that needs to be reflected in this document, it may happen that one page is not enough. The Tax Code of the Russian Federation does not contain a prohibition on issuing an invoice on several sheets.

So that the recipient does not have concerns about the reliability of the data, we recommend transferring part of the tabular form to another sheet so that it looks like a continuation of the previous one. In addition, the document originator may be required to endorse each page of the invoice.

For clarity, all information is reflected on separate sheets, stapled and numbered. You can also display the data on the back, but this is inconvenient for accountants processing documents bound for archiving. Details that determine who signs invoices in the organization (“Head of the organization” and “Chief accountant”) are indicated on the last sheet. This arrangement of signatures is not a violation if the continuous numbering is not broken.

About invoices

One of the conditions for a tax deduction is the presence of a correctly executed invoice. If the document contains errors and does not comply with the requirements of the law, then the deduction will not be issued (Clause 2 of Article 169 of the Tax Code of the Russian Federation). One of the required elements is the signatures of authorized persons. In practice, the question often arises: who can sign an invoice for a director?

Current legislation provides for the possibility of issuing invoices on paper or electronically (paragraph 2, paragraph 1, article 169 of the Tax Code of the Russian Federation).

The procedure for issuing, issuing and registering invoices is established by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137. In turn, the procedure for issuing and receiving invoices in electronic form is approved by Order of the Ministry of Finance of Russia dated November 10, 2015 No. 174n.

Results

The issue of who signs invoices must be resolved in a timely manner. If this is done by the manager (IP) or the chief accountant, no additional actions are needed, but if other persons sign, then it is necessary to consolidate their powers by issuing the corresponding local act (order, instruction) or issuing a power of attorney.

These documents will officially identify who signs the invoices, and your counterparty will not have to argue with inspectors and defend a deduction if the invoice is signed by unauthorized persons.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Does the buyer have to sign the invoice?

Then in the first case there is an obligation to pay tax at customs (or to the tax authorities - when importing goods from Belarus), in the second - to withhold the tax from the seller and transfer it to the budget

The department explains its position in detail.

but even in these situations the “special regime” does not issue> What happens if the person applying the special regime violates the requirements of the Code and issues an invoice to the buyer with the allocated amount of VAT?

As follows from paragraph 5 of Art. 173 of the Tax Code of the Russian Federation, such a person must transfer to the budget the amount of tax indicated in the invoice. Meanwhile, the violator will not have the right to deduct the “input” tax, since such a privilege is provided exclusively for VAT payers. Contents: Should the buyer sign an invoice? This procedure for issuing an invoice signed by an employee authorized to do so by an order (instruction) of the manager or a power of attorney on behalf of the organization is recommended by the Ministry of Finance of Russia in letters dated April 23, 2012 No. 03-07-09/39, dated February 6, 2009 No. 03-07-09/04, Federal Tax Service of Russia in letter dated June 18, 2009 No. 3-1-11/425.

Invoice for services

The obligation to transfer an invoice for services performed must be fulfilled by the customer no later than the 5th day from the date of signing the act by the parties . Days are calculated in calendar days. Violation of this deadline is not permissible, and the date of the issued s/f may fall on any of the days of the allotted period.

These fields should not be left empty; they must be filled in with dashes. The absence of dashes will not result in non-acceptance of the tax invoice, but in such a situation it is possible that incorrect data may be entered illegally into empty fields.

Invoice by proxy: sample

Not only the director and chief accountant, but also the authorized representative has the full right to sign the invoice. This is directly stated in paragraph 6 of Art. 169 of the Tax Code. To acquire such powers, an authorized person must have a corresponding order or power of attorney. The order is most often issued in relation to employees who are on the company’s staff, that is, working under employment contracts. Power of attorney is issued both to full-time employees and to persons cooperating with the organization under civil law contracts. It is not necessary to affix a seal to the power of attorney: clause 4 of Article 185.1 of the Civil Code does not mention a seal as a mandatory requisite.

As for individual entrepreneurs: they can also delegate the authority to sign invoices issued by them to other persons, but only on the basis of notarized powers of attorney (clause 3 of Article 29 of the Tax Code of the Russian Federation).

The representative can also issue an electronic signature, with which he has the right to sign electronic invoices. There is always only one electronic digital signature (EDS): the director or representative. In the case of drawing up an electronic signature, it is advisable to draw up a power of attorney and at the same time an order conferring the right to sign.

The representative must sign the invoice correctly: in the “Manager or other authorized person” and “Chief accountant” columns, sign and indicate his own surname with initials. It often happens that the director performs the functions of the chief accountant, then it is advisable to have a confirming order assigning the duties of the chief accountant to the director.

Accounting info

Let's turn to the source: paragraph 6 of Article 169 of the Tax Code of the Russian Federation states: “The invoice is signed by the head and chief accountant of the organization or other persons authorized to do so by an order (other administrative document) for the organization or a power of attorney on behalf of the organization. When issuing an invoice by an individual entrepreneur, the invoice is signed by the individual entrepreneur indicating the details of the certificate of state registration of this individual entrepreneur.”Thus, to fulfill this point, it is necessary that invoices are signed by the head of the organization and the chief accountant, or the manager must issue an order, the text of which indicates that such and such a person is signing for the manager, and the same or another person is signing for the chief accountant. An approximate form of an order could be as follows:

Please note that when transferring the authority to sign invoices to other employees of the organization, an order must be drawn up or a power of attorney must be available. Quite often, organizations forget about these “formalities” and sign invoices, for example, in branches, the manager and chief accountant of the branch, although they do not have such a right. Such forgetfulness can lead to the fact that counterparties will have problems with deducting VAT and the organization may lose clients. Moreover, the buyer has the right to ask for a copy of the document certifying the authority of the persons signing the invoices.

In those organizations where the position of chief accountant is not provided, accounting services are performed by an outsourcing company with which an agreement has been concluded, which is permitted by paragraph 2 of Article 6 of the Federal Law “On Accounting” dated November 21, 1996 No. 129-FZ. In this case, the invoice is signed instead of the chief accountant by the one who is entrusted with the duties of the chief accountant - either the head of the organization, or a specialist accountant with whom a civil law contract has been concluded, or an authorized representative of a specialized company that conducts accounting in the organization.

It would seem that the issue has been settled, but in practice there are many pitfalls that the taxpayer needs to be aware of.

1. Lack of decoding of the signature of the manager and chief accountant.

Paragraph 6 of Article 169 of the Tax Code of the Russian Federation, given in full above, does not mention this. However, repeated clarifications from the Russian Ministry of Finance indicate that decoding signatures is a mandatory requirement. The letter dated April 5, 2004 No. 04-03-1/54 gives the following instructions: “the “Signature” requisite includes both a personal signature and its decoding (initials, surname), which is confirmed by a number of regulatory and advisory documents, including Methodological guidelines for accounting of fixed assets, approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n (registered with the Ministry of Justice of Russia on November 21, 2003 No. 5252) and developed on the basis of the Federal Law of November 21, 1996 “On accounting”, as well as GOST R 6.30-2003 “Unified documentation systems. Unified system of organizational and administrative documentation. Requirements for the preparation of documents”, adopted by Decree of the State Standard of Russia dated 03.03.2003 No. 65-st.

Thus, the addition made to the invoice form by Decree of the Government of the Russian Federation dated 02.16.2004 No. 84 “On amendments to Decree of the Government of the Russian Federation dated 02.12.2000 No. 914” on the need to decipher the signatures of the head and chief accountant of the organization or an individual entrepreneur does not contradict the above norm of paragraph 6 of Article 169 of the Tax Code of the Russian Federation. According to paragraph 2 of Article 169 of the Tax Code of the Russian Federation, invoices drawn up and issued in violation of the procedure established by the specified paragraphs 5 and 6 of Article 169 of the Tax Code of the Russian Federation cannot be the basis for accepting VAT amounts presented to the buyer for deduction or reimbursement.

Paragraph 6 of Decree of the President of the Russian Federation dated May 23, 1996 No. 763 “On the procedure for publication and entry into force of acts of the President of the Russian Federation, the Government of the Russian Federation and regulatory legal acts of federal executive bodies” provides that acts of the Government of the Russian Federation affecting the rights freedoms and responsibilities of man and citizen, establishing the legal status of federal executive authorities, as well as organizations, come into force simultaneously throughout the entire territory of the Russian Federation seven days after the day of their first official publication. Taking into account the above, and also taking into account that the said Decree of the Government of the Russian Federation dated 02.16.2004 No. 84 was officially published in the Collection of Legislation of the Russian Federation on 02.23.2004, the VAT amounts indicated in the invoice issued after 01.03. 2004 and in which there are no transcripts of the signatures of the head and chief accountant of the organization or individual entrepreneur, should not be accepted for deduction.” All subsequent clarifications contain the same point of view (letters dated January 11, 2006 No. 03-04-09/1, dated July 12, 2005 No. 03-04-11/154). There is ambiguous judicial practice on this issue. Therefore, the buyer should still take care of the presence of the necessary details in the invoices submitted for deduction in order to avoid litigation. Thus, in the resolution of the Federal Arbitration Court of the North Caucasus District dated September 7, 2005 No. F08-4127/05-1643A, the court recognized the refusal of the tax inspectorate to provide a tax deduction to the taxpayer as justified, since the invoices were signed by unidentified persons, the signatures of officials have no transcripts. Documents containing false data and signed by unauthorized persons do not comply with legal requirements. The motivation was as follows: according to Article 3 of the Federal Law of November 21, 1996 No. 129-FZ “On Accounting,” the main task of accounting is the generation of complete and reliable information about the activities of the organization and its property status, necessary for internal and external users of financial statements .

In accordance with paragraph 1 of Article 9 of the Federal Law “On Accounting,” all business transactions carried out by an organization must be documented with supporting documents.

Clause 2 of Article 9 of the Federal Law “On Accounting” and clause 13 of the Regulations on Accounting and Financial Reporting in the Russian Federation, approved by Order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n, establishes a list of mandatory details of primary accounting documents. This list, in particular, includes the names of officials responsible for the execution of a business transaction and the correctness of its execution, their personal signatures with a transcript. The court also rejected the organization’s argument that the norms of accounting legislation are not applicable to relations regarding the preparation of invoices, since an invoice also belongs to the category of accounting documents, but serves as a tax control tool. Moreover, the emphasis is placed on the fact that when carrying out business activities, which, by virtue of Article 2 of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation), is carried out at one’s own risk, a person must exercise sufficient caution and, when concluding transactions, check the legal capacity of the counterparty and whether he has the necessary registration , meeting the requirements of current legislation. The adverse consequences of insufficient diligence in business activities fall on the person who entered into such transactions and cannot be transferred to the federal budget in the form of unreasonable payments.

In the Resolution of the Federal Arbitration Court of the North Caucasus District dated March 20, 2006 No. F08-921/06-403A, the court also states that the need to decipher the signatures on the invoice arises from the requirements of the rule of law aimed at establishing the fact that the invoice the invoice must be signed by an appropriate person. It is the taxpayer who has the responsibility to accept properly executed invoices for tax accounting.

If, nevertheless, the organization has not deciphered the signatures of officials, then the buyer has a chance to defend the right to deduction in court. The Federal Arbitration Court of the Moscow District, taking the side of the taxpayer (ruling of November 2, 2004 in case No. KA-A40/10090-04, of August 30, 2005 in case No. KA-A41/8169-05) is guided by the following arguments: „ According to clause 13 of the Regulations on maintaining accounting and financial reporting in the Russian Federation, approved by Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n, primary accounting documents must contain the following mandatory details: name of the document (form), form code; date of compilation; name of the organization on behalf of which the document was drawn up; content of a business transaction; business transaction indicators (in kind and in monetary terms); names of positions of persons responsible for carrying out a business transaction and the correctness of its execution, personal signatures and their transcripts (including cases of creating documents using computer technology).

The said Regulations determine the procedure for organizing and maintaining accounting records, drawing up and presenting financial statements, therefore it is not applicable to controversial legal relations regarding VAT reimbursement.

Paragraph 6 of Article 169 of the Tax Code of the Russian Federation establishes a special requirement for an invoice, that is, for a specific primary accounting document presented to the buyer to pay value added tax, namely, the invoice is signed by the manager and chief accountant. There is no indication of the availability of transcripts of signatures of officials.”

When signing invoices by authorized persons, it should be borne in mind that in this case the surnames and initials of the manager and chief accountant are also indicated on the invoices, since such invoice details as “Head of the organization” and “Chief accountant” are formalized indicators. Changes and (or) additions to the invoice details “Head of organization” and “Chief accountant” of the Tax Code of the Russian Federation are not provided for. However, the tax authorities will not find fault if the invoice is signed by an authorized person indicating his position directly, since such an invoice should not be considered as drawn up in violation of the requirements of paragraph 6 of Article 169 of the Tax Code of the Russian Federation. Such clarifications were given in the letter of the Federal Tax Service dated May 20, 2005 No. 03-1-03/838/8. It is also worth citing the letter of the Ministry of Finance of the Russian Federation dated July 12, 2005 No. 03-04-11/154, which strongly recommends deciphering the indicated signatures in invoices to identify authorized persons in order to eliminate the possibility of unlawful deduction of value added tax.

2. Use of a facsimile signature on an invoice.

The position of the financial and tax departments is clear: it is impossible to use facsimiles when signing invoices. Since Article 169 of the Tax Code of the Russian Federation does not provide the possibility of using facsimile signatures of the head and chief accountant of the organization, the taxpayer does not have the right to register in the purchase book invoices issued by the seller that do not comply with the established standards for their completion and to claim for deduction or reimbursement the amount of value added tax paid to the supplier, on the basis of an invoice certified by a facsimile signature of the head and chief accountant of the organization (letter of the Federal Tax Service dated April 7, 2005 No. 03-1-03/557/11, dated February 14, 2005 No. 03-1-03/210 /11, letter of the Ministry of Finance of Russia dated May 26, 2004 No. 04-02-05/2/28). There are also court decisions taken in favor of the tax authorities. For example, resolutions of the Federal Antimonopoly Service of the Far Eastern District of February 2, 2005 No. F03-A51/04-2/3404, of the Northwestern District of January 24, 2005 No. A13-6464/04-19. They reject the arguments that paragraph 3 of Article 75 of the Arbitration Procedural Code of the Russian Federation actually reproduces verbatim the disposition of paragraph 2 of Article 160 of the Civil Code of the Russian Federation, according to which it is allowed to use a facsimile reproduction of a signature or an analogue when making transactions (and presenting documents as written evidence) handwritten signature. And the fact that there is no procedure and cases in the current legislation in which the use of facsimile reproduction of signatures on invoices is allowed is interpreted by the court as a ban on these actions.

In any case, the organization chooses independently whether to use facsimile signatures when issuing invoices or not, without excluding the possibility of defending its position, different from the position of the inspection authorities, in court.

Comments:

- In contact with

Download SocComments v1.3

| Next > |