What to do if an employee is overpaid - step-by-step instructions for 2021

General accountant with 15 years of experience. Now that I’m retired, in order not to become sour, I study what has changed in the industry and collect materials that are interesting to me.

I hope they will be useful to you in your work - as long as the economy is working, you cannot do without accounting.

There are situations when, when receiving a salary (especially if this happens not through a cash register, but to a bank card), an employee sees a huge overpayment, and many questions about this immediately arise. Of course, getting more than your due is always nice, but most often such cases are a technical error, so the overpaid funds have to be returned to the organization. It should be remembered that if such an error occurs, the entire amount of the overpaid salary belongs to the company, so any attempts to hide this may lead to the dismissal of the employee under a serious charge.

Contents You can recover overpaid wages from an employee if:

- the overpayment occurred as a result of a counting error. In this case, a counting error is understood as an arithmetic error, that is, an error made during arithmetic calculations (letter of Rostrud dated October 1, 2012 No. 1286-6-1, ruling of the Supreme Court of the Russian Federation dated January 20, 2012 No. 59-B11-17) ;

- the employee has been proven guilty of failure to comply with labor standards or idle time (these circumstances must be established by the labor dispute commission or the court);

- the error was caused by the unlawful actions of the employee himself.

Free legal advice online

The involvement of lawyers in legal disputes is due to the need to fully protect the personal interests of citizens. As practice shows, citizens avoid legal assistance in order to save money, but in practice this is associated with high costs.

Even citizens with a lawyer's education do not always keep up with current changes in legislation, so it would be advisable to consult a qualified specialist. The convenience is that consultation with a lawyer is free and online. Where and how to get free legal advice?

is provided throughout the Russian Federation. Citizens, residents of the state, as well as non-residents of the country who temporarily reside in the Russian Federation can take advantage of the support.

Moreover, lawyers can advise interested parties outside Russia, but only within the framework of domestic legislation. Legal advice is provided free of charge online around the clock, regardless of weekends and holidays.

The response time from specialists on the website is up to 15 minutes.

There is no need to register on the Internet portal and you can send a personal appeal anonymously.

Accountant's Directory

02/01/2021 Contents I Neg Did you transfer personal income tax in advance while you have money, and then pay your salary/vacation pay within a month?

Attention! The online lawyer provides answers to questions and continues to support the client in the event of further difficulties. Legal advice can be obtained in the following ways: use the online chat service; draw up a contact form for the feedback service; call the hotline.

What should I do now? Thank you. PS: That's what the accountant said...

Neg and this has been going on since the 1st quarter.

hhhh (0) do not show it in any way, there is no such field at all. the question is unclear. Yohoho there was something about the fact that payment in advance is not considered payment of personal income tax, they were just throwing away money in vain, i.e. by law you have a debt. a) Go to the tax office, repent, get a certificate about the status of your payments. b) repay it accrued on some date and start paying normally.

It’s unlikely they’ll get to the bottom of it. pavlika The Federal Tax Service will thank you for the erroneous payment - there cannot be advance payments for personal income tax.

CepeLLlka I watched in some webinar that if you transfer personal income tax in advance, the Federal Tax Service will not accept it. You will need to write a letter about the erroneously transferred funds. pavlika https://www.nalog.ru/rn77/service/complaint_decision/6092021/ pavlika Inspectors punish companies for early transfer of personal income tax Document: decision of the Federal Tax Service of Russia dated 05.05.16 No. SA-4-9/ [email protected] on the company’s complaint Consequences : tax authorities will more often charge penalties and fines for personal income tax. Personal income tax paid ahead of time is not a tax, since the organization transferred it unlawfully.

This decision was made by the Federal Tax Service of Russia based on the company’s complaint (decision dated 05.05.16 No. It is posted on the website of the tax department (https://www.nalog.ru/rn77/service/complaint_decision/6092021/).

We overpaid the salary of a dismissed employee, what should we do?

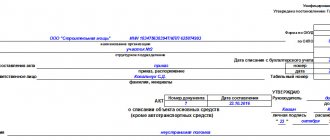

Contents Accountants often have to recalculate employee salaries after dismissal. In this case, a lot of questions arise: what entries to make, in what period to reflect adjustments to insurance premiums, whether it is necessary to submit an updated form 2-NDFL, etc.

In this article we will tell you what an accountant should do both in case of overpayment and underpayment of salaries. Most often, excessive salary payments are caused by one of two reasons.

The first is the so-called vacation overexpenditure, when the employee was given vacation for a period not yet worked. He received vacation pay and then quit, while the period for which the vacation was granted remained unworked. In this case, the amount of vacation pay becomes an excessively paid salary, that is, the employee’s debt to the employer.

The second reason is an unpaid advance, when the employee received a certain amount in the middle of the month and then quit.

Further, during the final calculation, it turned out that the salary actually earned in a given month was less than the advance received.

Then the “unclosed” part of the advance will be listed on the debit of account 70, as the employee’s debt.

In such a situation, the employer should invite the former employee to voluntarily repay the debt. If he refuses, the organization will only have to file a lawsuit, or forgive the debt and write off the debit balance.

Let's look at each of these options.

If the employee voluntarily returns the unpaid advance, the debit balance on account 70 will be automatically repaid.

Filling out form 6-NDFL: Settlements with dismissed workers (dates and amounts)

The company paid the employee on the day of dismissal - gave him a salary and compensation for unused vacation. Upon dismissal, the employee receives income in the form of salary on the last working day (clause

2 tbsp. 223 of the Tax Code of the Russian Federation). Compensation for unused vacation days is not a salary. The date of receipt of income is the day of payment. Since the company paid the employee on the last working day, the dates in line 100 match. Tax on both payments must be withheld on the same day. Compensation for unused vacation is not vacation pay.

The deadline for transferring personal income tax on this amount is the day following the payment, as for salary. All three dates in lines 100–120 match.

This means that compensation and salary should be reflected in one block of lines 100–140. For example. The employee resigned on June 16. On this day, the company gave him a salary for June - 28,000 rubles, and withheld personal income tax from it - 3,640 rubles.

(RUB 28,000 × 13%). The company also transferred vacation compensation - 18,000 rubles, and withheld personal income tax - 2,340 rubles. (RUB 18,000 × 13%). The date of receipt of salary income is the last working day. That is June 16th. For vacation compensation - the day of payment. Also June 16th. The deadline for transfer is June 17. The dates on lines 100–120 are the same, so the company reported them together.

The amount of income is 46,000 rubles. (28,000 + 18,000), personal income tax - 5980 rubles. (3640 + 2340). The company filled out Section 2 as in sample 84.

Sample 84. How to fill in the calculation of payments on the day of dismissal: The company issued wages and compensation for unused vacation days the day before dismissal.

Reflection of wage recalculation in form 6-NDFL

October 29, 2021: Webinar “Solving current issues related to personnel in times of crisis”

(Question from a listener of the webinar “Salaries in 2021” to the presenter - Yulia Khachaturyan, General Director of Nika, risk plan)

Question: how to reflect the recalculation of wages for the previous period (August) in the calculation of 6-NDFL for the fourth quarter of 2018?

Presenter's response:

Unfortunately, the author of the question did not specify whether the question was about overpayment in the corresponding month or about the fact that the employee was not paid extra. When indicating specific lines of the report, I will proceed from the fact that we are still talking about an underpayment of a certain amount.

There are two completely different points of view on this matter. The first is based on Letter of the Federal Tax Service dated January 27, 2017 N BS-4-11 / [email protected] (in clause 2, under clause 1 there is information on a different topic, you should skip it when reading the document) and involves making changes to section 1 forms for the previous period. Those. additionally accrued wages should be included in line 020, and additionally accrued personal income tax in line 040. The payment itself must be displayed in section 2 of form 6-NDFL in the present period when the additional payment was made.

Those. in calculations for 12 months in section 2 - you should indicate the date of receipt of income (line 100) - 08/31/2018 (i.e. the last day of the month for which wages were accrued); tax withholding date - the day you actually paid wages in the fourth quarter (line 110); the tax payment deadline is the day following the payment of income (line 120); on line 130 (amount of income received) - the amount of the additional payment; on line 140 – the amount of additionally accrued personal income tax from the surcharge.

However, guided by this approach, it will be necessary to make changes to the calculation of insurance premiums for the corresponding period, otherwise the control ratios may be violated (Letter of the Federal Tax Service dated April 20, 2021 No. BS-4-11 / [ email protected] , for example, discusses the situation when wages for the previous year are recalculated).

There is another, more practical approach to solving this issue, which is not based on letters from the Federal Tax Service, but is expressed in professional literature, let’s say, under the slogan “How to make the work of an accountant easier.” I will not advise its use, nor, on the contrary, criticize it - because, perhaps, there is a practical meaning in it, but to support the main theses of this approach with documents issued by the Federal Tax Service? impossible. The point of the approach is not to edit form 6-NDFL for the period in which the error occurred, but to show the amount of the surcharge in section 1 of this period, including the surcharge in line 020, and showing the personal income tax from the surcharge in lines 040 and 070. In section 2 of the report in lines 130 and 140 show, respectively, the amount of additional payment and personal income tax on it, but in line 100 (date of payment of income) - show not the last day of the month for which wages were accrued, but the day when the payment was actually made, the same day will be the day of tax withholding (line 110), and the next day (line 120) is the date of its transfer. Those. the difference in the design of section 2 of the 6-personal income tax form of this period lies only in line 2 (date of payment of income).

You can find out when the next seminar or webinar by Yulia Khachaturyan on wages is scheduled from the seminar schedule:

Seminars on taxes, tax planning (for accountants, financial directors, managers and company owners)

They overpaid and then fired personal income tax 6

In the letter of the Ministry of Finance of Russia dated October 30, 2015 N 03-04-07/62635, it was stated that in the case when an employee returns to the employer the amounts actually paid to him previously, such amounts will not be recognized as his income. As we understand from the situation under consideration, until August 2021, the organization believed that the income in the disputed amount was paid to the employee correctly, and personal income tax was also withheld on the basis of current legislation. As a result of adjusting the amount of income intended for payment in 2021, the employee returned the overpaid amount of income (which does not contain a tax component).

Since the amount returned by the employee and the personal income tax related to it are not recognized as his income, this amount is overpaid by the tax agent or paid from his own funds (and not excessively withheld personal income tax).

Important Therefore, we will look at how to enter compensation of various types into 6-NDFL upon dismissal.

For example, this could be money for the remaining days of the required rest.

Let us immediately note that no official explanations or recommendations have yet been issued on how to correctly enter into the calculation of 6-NDFL the amounts paid to an employee during his dismissal.

It is important not to forget about exactly when the employer must make these payments.

If we are talking about remuneration for a resigning employee, then the money must be given to him on his last working day.

We recommend reading: Explanatory letter to the manager regarding lack of sales

If an accountant does not know exactly how to fill out compensation upon dismissal in 6-NDFL, he must understand the general principle: for each type of payment made, you need to fill out a separate block in the 2nd section of the calculation.

Overpayment of wages in 6-NDFL

Describe why you are complaining about this answer

Complaint

Cancel

Since the amount of erroneously paid wages was not actually accrued in the accounting records at the time of the formation of the Calculation in Form 6-NDFL, then, in our opinion, this amount should not be reflected in lines 020 “Amount of accrued income.” Also, lines 040 “Amount of calculated tax”, 070 “Amount of withheld tax” in section 1 of this Calculation are not filled in.

However, since the erroneous amount was paid to the employee and personal income tax was actually withheld from it, then this information should, in our opinion, be reflected in section 2 of the Calculation for the relevant dates (date of actual receipt of income (line 100), date of tax withholding (line 110) , tax payment deadline (line 120)):

- on line 130 “Amount of income actually received” - in the amount of income received by the employee in terms of the erroneously paid advance;

- on line 140 “Amount of tax withheld” - in the amount of personal income tax withheld from the erroneously paid advance.

These conclusions follow from the explanations of the Federal Tax Service of Russia on the recalculation of vacation pay (Letters of the Federal Tax Service of Russia dated October 13, 2016 N BS-4-11/ [email protected] , dated May 24, 2016 N BS-4-11/9248).

Justification for the position:

The employing organization, which makes payments to the employee in accordance with the employment contract, by virtue of clause 1 of Art. 226 of the Tax Code of the Russian Federation is recognized as a tax agent and is obliged to calculate, withhold from the employee and pay to the budget the amount of personal income tax (hereinafter also referred to as tax) calculated in accordance with Art. 224 of the Tax Code of the Russian Federation (taking into account the features provided for in Article 226 of the Tax Code of the Russian Federation).

As defined in clause 1.1 of the Procedure, 6-NDFL is filled out on the basis of accounting data for income accrued and paid to individuals by a tax agent, tax deductions provided to individuals, calculated and withheld personal income tax contained in tax accounting registers.

The Calculation form consists of:

— Title page;

— Section 1 “Generalized indicators”;

— Section 2 “Dates and amounts of income actually received and withheld personal income tax.”

In accordance with clause 3.3 of the Procedure, section 1 of the Calculation indicates, in particular:

- on line 020 - the amount of accrued income generalized for all individuals on an accrual basis from the beginning of the tax period;

- on line 040 - the amount of personal income tax calculated cumulatively for all individuals on an accrual basis from the beginning of the tax period;

- on line 070 “Amount of tax withheld” - the total amount of tax withheld on an accrual basis from the beginning of the tax period.

According to clause 4.2 of the Procedure, section 2 of the Calculation indicates:

- on line 100 - the date of actual receipt of income reflected on line 130;

- on line 110 - the date of tax withholding on the amount of income actually received reflected on line 130;

- on line 120 - the date no later than which the tax amount must be transferred;

- on line 130 - the generalized amount of income actually received (without subtracting the amount of withheld tax) on the date indicated in line 100;

- on line 140 - the generalized amount of tax withheld on the date indicated in line 110.

As follows from the explanations of the Ministry of Finance of Russia, set out in letter dated October 30, 2015 N 03-04-07/62635 (communicated to the lower tax authorities by letter of the Federal Tax Service of Russia dated November 11, 2015 N BS-4-11 / [email protected] ), in If the employee returns to the employer the advance amounts actually paid to him earlier, such amounts will not be recognized as his income.

Thus, since the amount of the erroneously paid advance was not actually accrued in the accounting records at the time of the formation of the Calculation in Form 6-NDFL, then, in our opinion, this amount should not be reflected in lines 020 “Amount of accrued income”.

It appears that line 070 sums up the total amount of withheld personal income tax related to all income reflected on line 020 of form 6-NDFL, and line 140 reflects the amount of personal income tax calculated in relation to the income indicated in line 020.

For the reasons stated above, we believe that the amount of personal income tax related to an erroneously paid advance should not be included in the formation of the indicator on line 040 “Amount of calculated tax”, as well as when forming the indicator on line 070 “Amount of withheld tax”.

However, since the erroneous amount was paid to the employee and personal income tax was actually withheld from it, then such information should, in our opinion, be reflected in section 2 of the Calculation for the relevant dates (date of actual receipt of income (line 100), date of tax withholding (line 110), tax payment deadline (line 120)):

- on line 130 “Amount of income actually received” - in the amount of income received by the employee in terms of erroneous payment of vacation pay;

- on line 140 “Amount of tax withheld” - in the amount of personal income tax withheld from the amount of erroneously accrued vacation pay.

In this case, the personal income tax amounts indicated in line 140 of section 2 of the Calculation (in total) will differ from the personal income tax amount indicated in line 070 of section 1 of the same Calculation by the amount of personal income tax withheld from erroneously paid vacation pay.

Taking into account the explanations of the financial department, set out in our letter from the Ministry of Finance of Russia dated October 30, 2015 N 03-04-07/62635, the tax amounts withheld and transferred to the budget from an erroneously paid advance are overpaid by the tax agent. Accordingly, the amount of the employee’s tax liability for personal income tax for the tax period must be adjusted. In this case, the tax agent—the employer—incurs an overpayment of personal income tax. The specified overpayment can be returned to the tax agent under Art. 78 of the Tax Code of the Russian Federation, which determines the procedure for offset or refund of amounts of overpaid tax, on the basis of clause 14 of Art. 78 Tax Code of the Russian Federation.

However, in this letter we were talking about a resigning employee, in your case the employee will continue to work and the organization expects to recalculate him in subsequent months, when calculating wages after leaving leave. Then, in our opinion, the overpayment of personal income tax to the budget can be settled during the subsequent calculation of wages. That is, personal income tax calculated from subsequent payments will be transferred to the budget in a smaller amount.

How to fill out line 130 of form 6 personal income tax if the employee was overpaid

// 04/18/2018 614 Views Personal income tax is a new quarterly form of reporting on personal income tax.

All employers must submit it in addition to the usual annual 2-NDFL certificates. Even though the form consists of only two sections, it is not that easy to fill out.

So that you can cope with it quickly and without errors, we suggest reading our material.

We analyzed the most important situations and explained the rules for filling out 6-NDFL with examples.

Categories for 6-NDFL

- General filling procedure

- When to Present

- Situation 1. Employees are paid next month

- Who should take it?

- Situation 3.

- Situation 2. Employees are paid until the end of the month

- How to design a title page

- How to fill out section 2

- Where should I submit it?

- How to submit

- How to fill out section 1

The tax service brought the explanations to the attention of local inspectorates, so they will be guided by them in their work.

It is important for companies to know how and for what the tax authorities will consider a fine if it made a mistake when submitting personal income tax reports.

Attention There are several violations that may result in a fine or account blocking.

More details in the article

“From a fine to blocking an account: how they will be punished for 6-NDFL”

. Tax officials check personal income tax calculations very carefully. Therefore, it is better to double-check before submitting.

You will find errors that are safer to correct before inspectors find them in the articles: “Seven mistakes in 6-NDFL”, “How your colleagues pass a desk audit on 6-NDFL”, “How to correct 6-NDFL if children’s taxes have been overstated” deductions" Next, check the indicators of the 6-NDFL report and 2-NDFL certificates with characteristics 1 and 2.

Features of calculating personal income tax from an advance

When paying wages, personal income tax is calculated, withheld and transferred once a month. The fact is that the date of actual receipt of income, based on clause 2 of Art. 223 of the Tax Code of the Russian Federation, is the last day of the month for which it is accrued. Therefore, there is no need to calculate personal income tax on the advance payment. As part of the salary, it is reflected in form 6-NDFL along with the remaining payment for the month.

An exception to this rule is when the advance payment is made on the last day of the month. This is realistic if the payment deadline for the advance payment in the organization is the 30th day, and salaries are the 15th day of the next month. Then, in fact, the advance becomes payment for the month and, therefore, the source of payment, which is the employer, is obliged to calculate and withhold tax from it.

This position, in addition to the Tax Code, is enshrined in the Ruling of the Supreme Court of the Russian Federation dated May 11, 2016 No. 309-KG16-1804. This is the only situation in which tax must be withheld from the advance payment, and the payment itself must be shown as a separate line in the 6-NDFL calculation.

In this case, in section 2 of the form, in lines 100 and 110, the last day of the month for which the advance is transferred is indicated, and in line 120 - the next working day after this date - clause 7 of Art. 6.1, clause 6 of Art. 226 of the Tax Code of the Russian Federation, clauses 4.1, 4.2 of the procedure for filling out the 6-NDFL calculation.

If the payment deadlines for advance payment and salary fall on the 30th and 15th, you will have to withhold tax twice. By doing this only once when paying salaries on the 15th, the organization risks being fined for untimely withholding and transfer of personal income tax. This is stated in the letter of the Ministry of Finance of the Russian Federation dated November 23, 2016 No. 03-04-06/69181. The Supreme Court of the Russian Federation agrees with this approach. In Determination No. 305-ES19-27749 dated February 19, 2020, the highest authority indicated that the Federal Tax Service legitimately fined the organization for failure to withhold and transfer to the budget personal income tax from an advance paid on the last day of the month. In addition, tax authorities can punish for providing false information under paragraph 1 of Art. 126.1 Tax Code of the Russian Federation.

The exact dates of salary payment for the first and second part of the month must be specified in the company’s local regulations - labor or collective agreements. You cannot indicate any time periods instead of specific dates. This is the requirement of Part 6 of Art. 136 of the Labor Code of the Russian Federation, confirmed by the Ministry of Labor of the Russian Federation in letter dated November 28, 2013 No. 14-2-242.

2155317.ru

Cases of overpayment of personal income tax are not uncommon.

Some enterprises agree to set off, and some ask for the overpaid differences to be returned to them. How to correctly reflect an overpayment in the report? Content

- 2 Excess amounts of tax were withheld from the employee

- 4 Conclusion

- 1 When to submit a report

- 3 Overpayment of personal income tax from own funds

When to submit a report Every employer who has employees on its staff is required to calculate income tax on all “labor” income of individuals.

In this case, the employer acts as a tax agent.

His responsibilities include not only accrual and deduction, but submission of reports on these indicators in accounting by the time the calculation is generated.

Important Forgot your password Lost your password?

Please enter your email address. You will receive a link and be able to create a new password via email.

Email* Add a question You must register to Forgot your password Remember Go... Home/ Personnel/Overpayment of wages in 6-NDFL Overpayment of wages in 6-NDFL Complaint Question Describe the reason for your complaint Complaint Cancel Question Good afternoon!

In October, the employee was on vacation for 3 weeks.

Vacation pay was paid at the beginning of the month and the personal income tax withheld from it was paid.

The employee was mistakenly transferred an advance in the amount of 40%, but at the end of the billing period it turned out that there was an overpayment to the employee in October in the amount of 4,000 rubles (due to the advance).

According to

Overpaid personal income tax: indicate or not

There is no need to separately notify tax authorities about the refund of overpaid tax. This is not provided for by current tax legislation. After all, the refund is actually made against upcoming payments.

However, when filling out the calculation of the amounts of personal income tax calculated and withheld by the tax agent (Form 6-NDFL), these data must be indicated, the explanation emphasizes. Section 1 of form 6-NDFL should be filled out with a cumulative total for the first quarter, half a year, nine months and a year. Consequently, the total amount of personal income tax returned by the tax agent to the payer in accordance with the provisions of Article 231 of the Tax Code of the Russian Federation should also be reflected on an accrual basis from the beginning of the tax period on line 090 “Amount of tax returned by the tax agent.”

In turn, in section 2 of form 6-NDFL for the corresponding reporting period, you need to indicate only those transactions that were carried out over the last three months of this period.

Example:

The employee’s income in the organization for July, August and September 2016 amounted to 200 thousand rubles. The amount of personal income tax calculated from his salary for the 2nd quarter turned out to be equal to 26 thousand rubles (200,000 x 13%). The tax agent actually paid 25 thousand rubles to the budget, since he returned 1 thousand rubles to the payer as excessively withheld in the previous period.

Section 2 of the calculation of 6-NDFL for 9 months in this situation should be filled out as follows:

Lines 100-120 are the corresponding dates;

Line 130 “Amount of income actually received” - 200,000;

Line 140 “Amount of tax withheld” - 26,000.

The amount of 1000 that was returned to the employee is reflected on line 090 of section 1 of the calculation for the same period.

Let us remind you that the tax agent is obliged, upon a written application from the taxpayer, to return to him the overpaid amount of personal income tax. The law provides a three-month period for this.

Recalculation of the salary of a dismissed employee 6 personal income tax

— — Article: Reporting for the first half of 2021: problematic situations (“Information bulletin “Express Accounting”, 2021, N 24) {ConsultantPlus}} How to fill out section 3 of the 2-NDFL certificate Amounts of income are reflected in section. 3 certificates in chronological order, broken down by month and income code.

In this case, the amounts of income are shown in the month in which the corresponding income is considered actually received (section.

V Procedure for filling out the certificate).

For example, if the salary for December 2015

the employee received in January 2021, then its amount must be reflected in the certificate for 2015 as part of income for December (Letter of the Federal Tax Service dated 02/03/2012 N ED-4-3/).

After all, income in the form of wages is considered to be actually received on the last day of the month for which it was accrued (clause 2 of Article 223 of the Tax Code of the Russian Federation). (Glavnaya Kniga Publishing House, 2017) {ConsultantPlus}} Vacation pay for vacation in January 2021 Any employer is faced with the dismissal of employees for various reasons.

But not every manager knows how to reflect dismissal in 6-NDFL. All rules and features are in our consultation. Subscribe to the accounting channel in Yandex-Zen!

- 4 Example

- 2 Filling rules

- 3 Reflection of payments upon dismissal

- 1 Payment procedure

Payment procedure During dismissal, the employer pays its employees:

- wages (calculated depending on the form of remuneration, as well as based on the number of days or hours worked, work performed);

Features of reflecting operations for processing sick leave in 6-NDFL

It is worth considering this in more detail so that the accountant can clearly assess how everything is happening.

Table 1. Filling in with reference to the lines of the report form

| Line | Action | Deadline | Norms of the Tax Code of the Russian Federation (article) |

| 020 | Income accrual | On the day of the transaction | 223 |

| 040 | Calculation of personal income tax | On the day of the transaction | 226 p.3 |

| 100 | Transferring money to an employee | On the day of the transaction | 223 |

| 070, 110 | Withholding personal income tax | On the day of the transaction | 226 paragraph 4 |

| 120 | Transfer of personal income tax to the treasury | Last day of the month in which the benefit was issued | 226 paragraph 6 |

Scheme of working with sick leave

Let's look at an example: suppose that a specialist was sick from September 10 to September 23, 2021. That is, he returned to work on September 24, immediately giving the ballot to the accountant. Accordingly, the benefit amounted to 18,500 rubles. And the next salary payment is only on October 7, 2018. In the report, everything will be displayed taking into account the link to previous months, but further we will consider only the main lines that relate to the preparation of a certificate of temporary incapacity for work.

Table 2. Example of filling out the main lines of the 6-NDFL report

| Line | Meaning |

| 020 | 18 500 |

| 040 | 2 405 |

| 070 | 2 405 |

| 100 | 07.10.2018 |

| 110 | 07.10.2018 |

| 120 | 31.10.2018 |

| 130 | 18 500 |

| 140 | 2 405 |

In principle, everything is quite simple. You just need to follow the instructions and fill everything out correctly.