Refunds of personal income tax from the state budget are made in the following cases: in case of overpayment and collection by the Federal Tax Service of the Russian Federation of the excess (excess) amount of tax, as well as in the provision of a deduction. Next we will talk about the situation when an excess amount of tax has been paid (or collected) and must be returned to the payer (individual). In this situation, according to Art. 79 of the Tax Code of the Russian Federation, the return procedure provides for:

- Submitting an application using a standard form on behalf of an individual to the Federal Tax Service of the Russian Federation (individually, through TKS or through a personal account).

Important! You can submit an application within 3 years after the day on which the applicant learned that he was charged (or paid) an excess amount of tax.

- Consideration of the application, documenting the decision on it and sending a written response to the applicant within up to 10 working days. days

- If the decision of the Federal Tax Service is positive, the excess tax amount will be refunded in Russian. rubles (with interest) for a month. The countdown starts from the day the application is received.

In a similar way, not only excess amounts of taxes are refunded, but also fees, penalties, fines, as well as generally obligatory insurance contributions. All that is required from the individual payer is to write the application correctly, submit it to the Federal Tax Service of the Russian Federation and wait for a response.

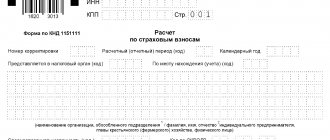

Standard application form for personal income tax refund

It should be noted that when returning excess amounts paid by an individual or withheld by the Federal Tax Service, as well as for the purpose of refunding amounts, the same standard application form is used. It was introduced by Order of the Federal Tax Service of the Russian Federation No. ММВ-7-8/ [email protected] dated 02/14/2017 (as amended on 11/30/2018) and is presented in Appendix No. 8 to it. This form is called, literally: “Application for the return of the amount of overpaid (collected, subject to reimbursement) tax (fee, insurance premiums, penalties, fines).”

In connection with the adoption of a new order of the Federal Tax Service of the Russian Federation of 2017, the previously existing Order of the Federal Tax Service of the Russian Federation No. ММВ-7-8 / [email protected] dated 03.03.2015 has lost force and is no longer applied today. Accordingly, the previous application form, which was introduced by order dated March 3, 2015, is no longer used in 2021.

The current application form (see link to Appendix No. 8 to Order No. ММВ-7-8 / [email protected] dated 02/14/2017) can be downloaded directly from the original source in PDF format. As noted in Appendix No. 8, the presented form (according to KND 1150058) is available for filling out in Adobe Reader. The form currently used includes 3 pages, each of which must be filled out.

| Model application form for tax refund in 2021 | ||

| Excel | Word | |

| Personal income tax refund application form (PDF). | Personal income tax refund application form (Excel). | Personal income tax refund application form (Word). |

The order of the Federal Tax Service of the Russian Federation of 2021 does not contain the procedure and rules for filling out the application form. However, at the bottom of the form there are some footnotes with tips on how to correctly fill out a particular line.

How to apply for a credit or refund of overpaid taxes

The register is submitted in the manner and form approved by Order of the Federal Tax Service of Russia No. ММВ-7-8 / [email protected] dated 02/14/2017.

The accountant chooses one of three existing methods for filing an application for a tax offset or refund:

- personally or through a representative - with the obligatory execution of a power of attorney;

- by post, enclosing in the letter an inventory of the package of documents provided;

- via electronic communication channels, signing the file with an enhanced qualified electronic digital signature.

The application is drawn up in two copies (two forms are needed) - one is submitted to the Federal Tax Service, the other remains with the taxpayer. The printed register is signed by the manager or other responsible person, and the date of compilation is indicated. The application is certified by a seal if the institution uses it.

Step-by-step filling out a standard personal income tax refund application form

The applicant will need to fill out, in fact, only 2 pages of the form, since the 3rd page is intended only for those individuals who still do not have a TIN. Visually, the filling process will look like this:

- The application must be assigned a unique serial number for the current year. And regardless of the type of application. If, for example, earlier in the same year an application for a standard deduction with one number was submitted, then the subsequent application will have, accordingly, the next serial number.

- Next, the applicant (individual) writes down: the Federal Tax Service code (where the application is sent), his own FI, as well as his status - code “1”, which means “taxpayer”.

- Then you need to indicate the basis for the refund of the tax amount - one of the following articles of the Tax Code of the Russian Federation: 78, 79, 176, 203 or 333.40. When choosing the right article, you should take into account their content and scope.

Art. 78: offset and return of excess amounts paid for taxes (fees, contributions, penalties, fines). Art. 79: return of excessively collected similar amounts. Art. 176: tax refund. Art. 203: refund of excise tax. Art. 333.40: refund (offset) of state duty.

- The applicant, using the appropriate code, must indicate how much he is asking to return. For example: “1” – overpaid, “1” – tax. All code options with decryptions are written next to the lines. All he has to do is select the required option from them.

- The amount to be refunded is written in numbers in Russian. rub.

- The tax (settlement) period code is indicated taking into account the decoding and explanations presented at the bottom of the form in a footnote. If the refund is made for a month, then they write “ms”, for a quarter – “qv”, for a half-year – “pl”, and for a year – “gd”. After this, the required number of the month (from 1 to 12), quarter (1, 2, 3 or 4), half-year (1 or 2). Finally, the current year is written down.

For example: “MS.09.2021”, which means: refund for September 2021.

- OKTMO is recorded according to the code according to OK 033-2013, and KBC according to the purpose of the application (i.e. for the return of personal income tax or other purposes).

- If 2 pages are completed, then, therefore, the applicant still indicates that he compiled it on three pages with attachments (or without).

- In the section where it is necessary to confirm the accuracy of the submitted data, the applicant must o (payer) or “2” (if the application is submitted by his authorized representative). Along the way, they are given a contact phone number and the corresponding date is entered in numbers, for example: “09/10/2021”.

- If the interests of the applicant are represented by his authorized representative, then the name and details of the document that will confirm his authority should be immediately written down.

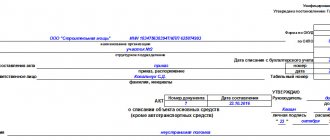

- On the second page of the form you need to write down the necessary bank information (name of the credit institution, identification code, type and account number). The recipient is an individual, so you should write code “2” in the appropriate line.

Those individuals who need to fill out the third page of the form write down their full name, identification document code with its details (series, number, by whom and when issued). The application must be signed personally by the applicant.

The section intended for the Federal Tax Service and located on page 1 does not need to be filled out by the applicant. It is filled out by the responsible tax officer when registering the received application.

Title page

On the title page of the application, the taxpayer fills in all the necessary details, except for the section “To be completed by a tax authority employee”

.

In the "Application number"

The serial number of the application from the applicant for the current year is indicated.

In the field “Submitted to the tax authority (code)”

The code of the tax authority to which the application is submitted is reflected. This code is indicated in the documents on registration with the tax authority (certificate of registration with the tax authority, notice of registration with the tax authority of a legal entity as the largest taxpayer). By default, the field is automatically filled with the code that was specified when the client registered in the system.

In the field “Full name of the organization (responsible participant of the consolidated group of taxpayers) / last name, first name, patronymic of an individual”

the name of the organization is reflected, corresponding to that indicated in the constituent documents or the full name of the individual in accordance with the identity document.

In the “Based on article”

the number of the article of the Tax Code of the Russian Federation is selected, in accordance with which the refund is made.

Next, select the code for the amount that the applicant requests to return:

- “1” – overpaid;

- “2” - overcharged;

- “3” – subject to compensation.

Then select the appropriate payment code: “1” - tax, “2” - fee, etc. and the amount of overpayment that the applicant requests to be returned from the budget is indicated.

In the field “Tax (calculation) period (code)”

The code of the tax (settlement) period is indicated in accordance with the established requirements:

- to fill in the first 2 digits of this indicator, select the appropriate code: “MS” - monthly, “QV” - quarterly, “PL” - semi-annual, “GD” - annual, “Date” - the specific date of tax payment;

- in the 4th and 5th digits of the indicator the following is indicated: month number (from 01 to 12) – for “MS”, quarter number (from 01 to 04) – for “KV”, half-year number (from 01 to 02) – for “PL”, for “GD” - “00”;

- The year is indicated in 7-10 digits.

In the “OKTMO code”

a code is selected for the place where the tax or fee is paid. You can find out your OKTMO code using the electronic services of the Federal Tax Service of Russia “Find out OK” (https://nalog.ru, section “All services”).

In the “Budget classification code”

The KBK of the tax or fee for which the overpayment is recorded is selected.

In the field “The application is drawn up on ____ pages”

The number of pages on which the application is drawn up is automatically indicated.

When filling out the field “with supporting documents or their copies on ___ sheets”

the number of sheets of supporting documents and (or) their copies (if any) is reflected. Such documents may be: the original (or a certified copy) of a power of attorney confirming the authority of the taxpayer’s representative (if the application is submitted by the taxpayer’s representative).

In the section of the title page “I confirm the accuracy and completeness of the information:”

indicated:

- 1 - if the application is submitted by the taxpayer,

- 2 - if the application is submitted by a representative of the taxpayer.

In this case, the full name of the head of the organization or representative is indicated, as well as the name and details of the document confirming his authority.

In the "Phone"

The telephone number of the taxpayer or his representative is reflected.

The date is also automatically indicated on the title page.

Example 1. Sample of filling out a standard tax refund application form

The proposed option for filling out the form is in Excel format. The statement uses the following conditional data.

The applicant (Saveliy Vsevolodovich Bortsov), a citizen of the Russian Federation, applies to his Federal Tax Service in order to return the excess amount of tax paid by him in the previous year 2021. The basis for the return is Art. 78 of the Tax Code of the Russian Federation, the amount to be returned is 15,000 Russian rubles. rub. Tax (calculation) period: “GD.00.2018”. The applicant submits the application independently, without an authorized representative.

The form also indicates: INN, OKTMO code 45358000 (Ostankino municipal district), corresponding to the KBK tax refund. Bank details: Sberbank PJSC (its identification code), account type “2” (current), bank no. accounts. Since the applicant S.V. Bortsov has a TIN, on page 3 he writes only his full name.

It should be noted that in this example, the option of filling out the text part of the application (i.e. digital, text, numerical indicators) is proposed. Whereas in the final version of the application, in addition to this, it is also required to put dashes in empty spaces.

Refund of overpaid tax: sample

Based on the information presented above, we will formulate a sample application for overpayment of taxes using an example.

Example

In November 2021 Condor LLC identified an overpayment of income tax that was excessively transferred to the federal budget in October 2020. in the amount of 36,000 rubles. Since the company has no other debts, it was decided to file a claim with the Federal Tax Service for the refund of overpaid taxes. An application for the return of these funds to the company’s bank account will be drawn up as follows:

Common mistakes when drawing up an application for a personal income tax refund

Error 1. The application form for the return of excess amounts is not divided page by page, and its pages are not submitted separately. Therefore, if the applicant fills out only the first two pages, he still needs to submit all three sheets together to the Federal Tax Service. On page 3, he simply writes down his initials without filling it in, and then attaches it to the first two.

Error 2. An authorized representative of an individual representing his interests may be a third party. But this person has the right to perform the necessary actions and sign documents on behalf of the applicant only if two conditions are met.

First: he must always have with him the appropriate power of attorney, executed in accordance with the established procedure and certified by a notary. Second: information about its availability and about the authorized representative must be specified in the application (page 1).

Mandatory requirements for the form and content of the application

Since March 31, 2017 (Order No. ММВ-7-8/ [email protected] ), there have been significant changes to the formal plan in the forms for credit or refund. The main news was the addition of insurance contributions to extra-budgetary funds to the main group of taxes subject to refund and offset.

Legislators have developed a unified application form for the offset of tax overpayments and for a refund:

- return of funds - KND form 1150058;

- offset of overpaid amounts - KND form 1150057.

There is an application form for offset of overpayment of taxes and for refund both on the official website of the Federal Tax Service and on our portal.

Each document must have the signature of the head of the institution and a seal.

A number of local Federal Tax Service Inspectors of Russia accept requests in any form. In the letter please indicate:

- addressee of the appeal;

- from whom it is performed;

- what is necessary: to offset or return the overpaid amount;

- exact amount;

- KBK and OKTMO.

Answers to frequently asked questions

Question No. 1: How can a payer find out that the Federal Tax Service of the Russian Federation has collected an excess amount of tax from him?

According to paragraph 4 of Art. 79 of the Tax Code of the Russian Federation, having discovered the fact of collection of an excess amount, is obliged to independently notify the individual about this within 10 working days. after this fact has been established. Especially for this purpose, Order of the Federal Tax Service of the Russian Federation No. ММВ-7-8/ [email protected] dated 02/14/2017 (as amended on 11/30/2018) approved a standard message form (according to KND 1165069). It is presented in Appendix No. 2 to this Order and looks as follows.

Question No. 2: Where and how can I clarify the code of my Federal Tax Service?

This can be done through the service “Determining the details of the Federal Tax Service” (see link to the request form https://service.nalog.ru/addrno.do).

To do this, just fill out and send the electronic request form offered on the website of the Federal Tax Service of the Russian Federation. So, for example, you can indicate the address and use it to find out the code of the Federal Tax Service and the municipality. Information is provided automatically upon request.

When an application for offset of overpayment is submitted (KND 1150058)

It is worth noting that this form can be used no later than three years after its release. This is evidenced by Article 78 of the Tax Code of Russia. There are three main ways to submit such a document:

- Initially, each head of the structure or an authorized representative contacts the tax office independently. Filling is taken into account.

- You can use the post office by sending the form by registered mail.

- Also, secure email is used. But here it is necessary to pay attention to the quality of the signature when filling out.

The response to such a statement comes no later than 10 days. The countdown begins from the moment the form is officially accepted for consideration. The result usually comes in written form. The Federal Tax Service may insist on conducting an audit. To clarify the completion of the KND form and the accuracy of all reports.

In what case can an overpayment be refunded?

An application for a refund of overpaid tax can be submitted only in a situation where the inspectors agree with this and the company knows about it. If the fact of overpayment of tax was revealed by the inspector, he must inform the company about this within 10 days. In this case, the organization receives a tax refund letter from the Internal Revenue Service. When the company itself declares the occurrence of excess amounts paid, it must be ready to provide all the documents necessary for confirmation.

When making a decision, the tax office also takes into account that the refund of erroneously paid tax must be made within the deadlines established by law.

If the overpayment was due to the fault of the taxpayer, he must file an application for a refund of the overpaid amount of tax within three years from the date of making this payment.

If the tax authorities incorrectly wrote off tax amounts, then in this case there is a deadline for filing an application within one month from the date when the taxpayer became aware of this.

Attention! The Federal Tax Service will not refund funds if the claim deadlines are violated. The only way in this situation to return the money is to try to prove through the court that the date when the company became aware of the overpayment refers to later periods.