In the commercial activities of many manufacturing enterprises, there is such a thing as material costs. It is no secret that manufactured products do not appear out of nowhere. For its production, various materials, raw materials and energy resources are used. Such expenses are included in the balance sheet of the enterprise, and the final cost of manufactured products depends on material costs. Let's try to figure out what material costs are and how such resources are accounted for.

What are material costs

This definition refers to costs that are directly or indirectly involved in the production of goods or the provision of services. These types of material costs include the cost of electricity, the purchase of raw materials, value added tax, and amounts transferred to counterparties.

There can be quite a lot of material costs, but such amounts are invariably reflected in the financial statements of the enterprise. Enterprises determine the list of such expenses independently, depending on the specifics of their professional activities. In accounting, these amounts are reflected in accounts 20 and 29.

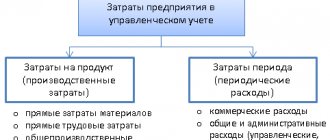

Production cost structure

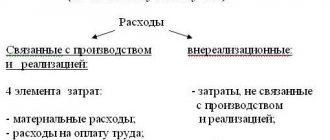

Production costs are grouped according to different criteria depending on the final goal. The chosen classification method is important in order to maintain correct records and obtain reliable data when determining the cost of products/services. In particular, production and sales costs can be divided into:

- Method of attribution to the cost of products - direct, indirect.

- The accounting feature is element-by-element, item-by-item.

- Degrees of involvement in the production process – basic, overhead.

- The volume of accepted costs is specific, workshop, product units, full or production cost.

- The influence on the production volume of products - constant, variable.

- Place of origin or areas of responsibility - separate divisions, sections, workshops, departments, teams, individual workplaces, the enterprise as a whole.

Costs of newly produced means of production

Profitable production is a continuous process that requires regular internal investment. The main part of the production forces of an enterprise are the means of production. Business costs for newly produced capital goods (buildings, machinery, work tools, machinery and equipment) are called gross private domestic investment or GNP (Gross national product). The indicator is used in complex calculations of business expenses.

What is included in material costs

This includes money spent on the purchase of:

- Raw materials and necessary materials;

- Fuels and lubricants;

- Semi-finished products and components;

- Electricity and water resources;

- Packaging materials.

In addition, the following financial costs are included in this expense item:

- Salaries of employees, including mandatory contributions to social and pension funds;

- Control of technological processes and quality of finished products;

- Purchase of personal protective equipment, workwear and footwear;

- Transportation costs associated with the transportation of semi-finished and finished products;

- Depreciation of fixed assets;

- Maintaining equipment in technically sound condition.

Without going into details, the concept of material costs covers all types of costs associated with the production of products and delivery from the place of manufacture to points of warehouse storage and retail sales.

Material costs include

Direct and indirect costs

To allocate direct and indirect costs, a company must determine whether a certain cost item can be attributed to a specific product or not.

Direct costs

Direct costs can be directly attributed to the cost of each unit of production. For example, the cost of water, sugar and syrup for making lemonade can be easily calculated for each unit. Direct costs include:

- costs of raw materials and supplies;

- costs of purchasing semi-finished products;

- sometimes electricity costs;

- salaries of working personnel and so on.

Indirect costs

Indirect costs are associated with production in general and cannot be attributed to a specific product. For example, to make lemonade you need to repair equipment, clean the workshop, and so on. Indirect costs include:

- rent;

- costs of repairing equipment and buildings;

- managers' salaries;

- and most of the fixed costs.

To calculate costs, indirect costs are distributed relative to some base. For example, regarding material costs or wages.

Direct and indirect costs are very closely intertwined with variable or fixed costs. In many ways they are even similar, but not always. For example, the cost of delivering finished products is a variable cost item. But if there are many items, you cannot allocate shipping costs to an individual product. Therefore, delivery is a variable indirect cost.

Types of material costs

Such expenses are classified according to several criteria. Let's look at each of the groups in more detail.

Direct

This category includes all material costs directly involved in the production of finished products. For example, this includes the purchase of materials and payment of employees.

Variables

This is a type of cost, the value of which directly depends on the volume of products produced. This item of material costs can be considered direct costs, but there is one feature. Variable costs disappear when production is suspended.

This may include:

- Energy consumption;

- Bonus payments to workers for fulfilling the plan;

- Costs for transportation of raw materials and finished products.

Indirect

These are costs that are not directly involved in the production of products, but contribute to the production process or sales of products. For example, here you can include the costs of advertising, rent of office space, and salaries of business personnel.

Refundable

This includes the remains of resources that participated in the production process, but are unsuitable for further use for their intended purpose. Essentially, this is industrial waste that can be used after recycling. Return expenses do not include inventories transferred to branches of the enterprise for further use and by-products obtained as a result of main production.

Read also: Time sheet for 2021

Classification of production costs

Production costs are grouped according to the following criteria:

- The economic role in the production process is basic (have a direct connection with the manufacture of goods) and overhead (related to maintenance and management of the production process).

- Composition – single-element (include only one element) and complex (include several elements at once).

- The method of inclusion in the price of a product is direct and indirect.

- The relationship to the volume of production of products is variable (their change is carried out in proportion to the change in the volume of production of goods), conditionally variable (they are not proportionally dependent on the production volume) and conditionally constant (changes in production volumes do not have any effect on them).

- Cyclicity of appearance – current and one-time.

- Participation in the manufacturing process - production (related to the production of goods), non-productive and commercial (related to the sale of goods).

- Productivity – productive and unproductive.

- Possibility of plan coverage – planned and unplanned.

- Relation to finished goods - expenses on finished goods and expenses on work in progress.

Accounting for material costs in the balance sheet

If you look at the reporting form, the material costs line is missing here. However, other accounts are used to calculate such expenses.

| Account number | Expense item |

| 20 | Main production costs |

| 21 | Semi-finished products accounting line |

| 23 | Auxiliary production costs |

| 25 (26) | Costs for general production and business processes |

| 29 | Service accounts |

Here it is necessary to clarify that according to accounting rules, accounts with indexes 25 and 26 cannot create a balance, therefore they are closed according to the financial result of each reporting period. Therefore, formulas for calculating material costs are built on the basis of the remaining accounts indicated in the table. In the assets section, inventories for material costs are reflected in line 1210.

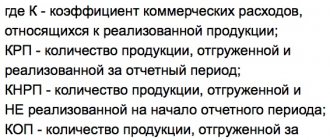

Composition of indirect costs

Other costs that arise in the course of the business activity of the entity and are not related to direct costs are classified as indirect. Their total amount is included in the costs of the current period. The exception is non-operating expenses, which are recorded as a separate line item.

Indirect costs may be associated with the production of products (rendering services), but it is not possible to specifically attribute their entire amount to costs for a certain type of goods (services). For this reason, indirect costs are distributed proportionally. General and other general production expenses are taken into account here.

When determining indirect costs, organizations are guided by the list of direct costs fixed in the accounting policy. All others, except non-operating ones, can be classified as indirect.

It is more profitable for taxpayers to include as many indirect expenses as possible, since they can be completely written off in the tax (reporting) period. While direct costs can be taken into account only partially, depending on the goods sold (services provided), the balance of products in the warehouse and work in progress. Increasing expenses towards indirect ones allows them to be fully taken into account, saving on tax payments.

For organizations providing services, it is possible to classify all costs as indirect. But they should also enshrine this right in the accounting policies of the enterprise. According to the Ministry of Finance, enterprises engaged in performing certain types of work do not have the right to fully qualify their expenses as indirect.

Not all indirect expenses when written off follow the general rule:

- Research and development expenses are recorded in the period in which they are completed.

- Expenses for voluntary insurance are taken into account in the period when there was a fact of transfer of funds to the funds.

Indirect expenses in trade organizations are the maintenance of premises (including payment of utilities), entertainment expenses, labor costs, costs of other taxes and fees. This may include transportation costs if they are not directly related to the delivery of goods to customers.

Analytics of enterprise performance efficiency

The following criteria are taken into account here:

- The ratio of costs and profit received - here the income from the sale of finished products is taken into account based on each ruble spent on its production;

- Material intensity - the ratio of material costs for each unit of production;

- Material productivity - calculated by dividing the cost by the materials and resources spent for production;

- Cost ratio - demonstrates the dynamics or decrease in production volumes and the profitability of the use of material costs.

Ways to reduce material costs

Such expenses usually amount to 50-60% of the cost of finished products.

Therefore, all manufacturing companies are interested in reducing such costs. During the operation of such enterprises in market conditions, a certain strategy was developed aimed at reducing production costs. These include the following decisions:

- Introduction of modern technologies aimed at waste-free production;

- Use of innovative materials;

- Optimization of production processes;

- Encouraging employees to use enterprise resources more carefully;

- Do not neglect scientific research in the manufacturing industry;

- Effective use of production waste.

The assessment of the efficiency of using material costs is determined by the method of substituting economic indicators. Let's assume that a company is engaged in the production of woodworking machines. Component parts are also produced by the structural division of this company. However, among competitors, such parts are 30% cheaper. In such a situation, it is more profitable to liquidate an unprofitable structural division and buy components from other manufacturers. Transport costs are also taken into account according to a similar scheme.

In addition, material costs for production can be reduced by reducing the number of defects and increasing the volume of products.

The main purpose of grouping costs by element

In order for the management and managers of a company at various levels to make correct and effective management decisions, it is customary to identify various classification characteristics of costs and make an analysis based on them. And dividing costs into elements allows you to determine the structure of costs for the production of products of an economic entity, allowing you to divide costs into cost elements.

Thus, the purpose of grouping costs by economic elements is to determine their structure. It is the same for all sectors of the economy and makes it possible to understand how much and what kind of funds have been spent. Moreover, regardless of where they were produced and what they were spent on.

In particular, the classification of costs by economic elements is used to prepare production cost estimates.

Also see “What does an estimate (list) of production costs look like.”