Normative base

Rosstat Order No. 404 dated July 15, 2019

Rosstat Order No. 711 dated November 27, 2019

Order of Rosstat No. 412 of July 24, 2020

Letter of Rosstat No. 07-07-2/3061-TO dated 07/08/2020

Letter of Rosstat No. 1540/OG dated 07/08/2020

in Excel

to Word

Form P-4: what kind of report is this and who submits it?

For the last few years, employers have been submitting information about the number of employees and their wages to Rosstat. This year, companies are required to use the form provided by Rosstat Order No. 404 dated July 15, 2019, and instructions for filling out the new P-4 statistics form are contained in Order No. 711 dated November 27, 2019.

Reporting on the number of employees and their wages is submitted by:

- legal entities involved in medium and large businesses, including each branch of the company;

- state organizations;

- temporarily non-working organizations - on a general basis, indicating from what time they have not been working;

- bankrupt organizations until a liquidation entry is made in the Unified State Register of Legal Entities.

There are organizations that do not need the P-4 statistical form for 2020. The document is not submitted to the statistical accounting service:

- firms engaged in small business;

- public organizations;

- cooperatives;

- IP.

IMPORTANT!

The possibility of not submitting a report must first be agreed upon with Rosstat.

When and where to go

Form P-4 “Information on the number and wages of employees” is submitted to the territorial offices of Rosstat at the following frequency:

- If the organization employs less than 15 employees, then P-4 is submitted quarterly by the 15th day of the month following the previous quarter.

- If the company has 15 or more workers, then the report is submitted monthly, before the 15th day of the month following the previous one. Every month, information is expected from legal entities that hold a license for the extraction of minerals, and companies registered (reorganized) in the current or previous year. For subsoil users and newly registered organizations, the frequency of delivery is not affected by the average number of employees.

| P-4 delivery dates in 2021 | |

| Number of employees more than 15 | Number of employees less than 15 |

| January 15 | |

| February, 15 | They don't rent |

| March 15th | They don't rent |

| April 15 | |

| May 17 | They don't rent |

| June 15 | They don't rent |

| July 15 | |

| August 16 | They don't rent |

| September 15th | They don't rent |

| October 15 | |

| 15th of November | They don't rent |

| December 15 | They don't rent |

Do you need to take P-4?

Statistical surveillance form No. P-4 “Information on the number and wages of employees” is required to be submitted by 2 groups of legal entities:

- commercial companies (except for small businesses);

- non-profit organizations (NPOs).

It doesn’t matter what form of ownership you have or what types of activities you engage in.

You will have to submit P-4 to the statistics even if the company’s activities are temporarily suspended or you are in bankruptcy proceedings as a bankrupt enterprise.

If you have separate divisions, you will need to fill out P-4 separately for each of them and for the parent company.

The form is also provided by branches, representative offices and divisions operating on the territory of the Russian Federation of foreign organizations in the manner established for legal entities.

Companies using the simplified tax system submit P-4 on a general basis (clause 10 of the Instructions, approved by Rosstat order No. 404 dated July 15, 2019).

Form P-4 from 2021

Design rules

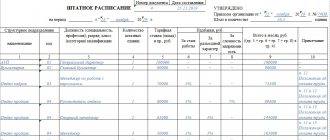

Employers use only a unified form to submit reports. The use of forms independently developed by the enterprise is not permitted. Let's look at how to fill out the P-4 report.

Title page

On the first page indicate:

- the reporting period for which information is submitted;

- full and short name of the enterprise; on the form containing information on a separate division of a legal entity, the name of the separate division and the legal entity to which it belongs is indicated;

- actual and postal addresses of the organization;

- OKPO code;

- identification number - for the head and separate divisions of the legal entity.

Filling out the tables

The second page of the document contains two tables that reflect information about the number of employees, the wages accrued to them and the time they worked.

First table by columns:

- A (lines 02 to 11) is intended to indicate the types of activities of the enterprise;

- B - code according to OKVED2;

- 1 is the sum of the values of columns 2, 3 and 4;

- 2 - average number of workers; to calculate this indicator, we add up the number of employees for each calendar day of the month and divide by the number of days in the month; when submitting the report for the 4th quarter, we first count the number of employees for each of the 12 months (information is transmitted to Rosstat from the beginning of the year), then we divide the result by 12, and write down the final figure; if the report is submitted for the 2nd quarter, calculate the number of employees for each of the 6 months and divide by 6; in our example, the report is for a month, so we don’t enter anything;

- 3 - average number of external part-time workers (use the calculation method described in the Rosstat instructions);

- 4 - the average number of employees who performed work under civil contracts (a similar algorithm is used for calculation).

Second table of the form:

- 5, 6 - the number of man-hours actually worked by payroll employees and external part-time workers; This does not take into account the time a worker is on vacation, on off-the-job training courses, or during periods of illness, but it is necessary to take into account employees who perform job duties remotely (see Rosstat letter No. 07-07-2/3061-TO dated 07/08 .2020);

- 7–10 - data on the accrued salary fund, which is taken from accounting documents; include in columns 7, 8 and 9 incentive payments that employees are paid for special working conditions in the fight against coronavirus (see letter of Rosstat No. 1540/OG dated 07/08/2020);

- 11 - social payments.

There are small exceptions to the rules. Companies employing more than 15 people and which are not small businesses:

- in the monthly report for columns 1, 2, 3, 4, 7, 8, 9, 10, columns 5, 6, 11 are omitted;

- in the quarterly P-4, all columns are filled in, but the indicators in columns 5, 6, 11 must reflect data for the period from the beginning of the year.

Even if the company is not a small business, but it employs less than 15 people, all fields must be filled out. But the data in columns 5–11 is needed not for the quarter, but for the period from the beginning of the year.

How to make changes to reporting

In order to clarify the data previously submitted to the territorial department of Rosstat for January - December of the reporting year, you should send changes in an official letter no later than January 15 of the year following the reporting year to generate final data on the number and salary of employees.

If you need to change information for July, November or another month, you should officially notify the territorial department of Rosstat. This can be done no later than the 15th day of the month following the reporting month.

Let's sum it up

- From 2021, statistical observation form No. P-4 “Information on the number and wages of employees” is presented: on a new form, approved. By Order of Rosstat dated July 15, 2019 No. 404;

- according to the updated rules, approved. By Order of Rosstat dated November 27, 2019 No. 711.

If you find an error, please select a piece of text and press Ctrl+Enter.

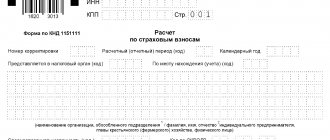

Form P-4 (NZ)

In contrast to the procedure for filling out P-4, which is submitted both monthly and quarterly, the instructions for filling out form P-4 (NZ) state that it should be submitted once a quarter. The report form on underemployment and movement of workers for 2021 was approved by Rosstat order No. 404 dated July 15, 2019.

Information is submitted by commercial and non-profit organizations (except for small companies included in the Unified Register of Small and Medium-Sized Enterprises) whose average number of employees exceeds 15 people, including those who perform part-time work or under GPC agreements. The type of activity and form of ownership do not play a role. Information is also expected from all organizations created in the reporting year (except for small businesses), regardless of the number of employees.

Companies report quarterly, and the reporting deadlines for P-4 (NZ) statistics in 2021 and in 2021 are as follows:

- for the 4th quarter of 2021 - until 01/11/2021;

- for the 1st quarter of 2021 - until 04/08/2021;

- for the 2nd quarter of 2021—until 07/08/2021;

- for the 3rd quarter of 2021 - until 10/08/2021;

- for the 4th quarter of 2021 - until 01/10/2022.

Which regulatory act approved the new form of the P-4 statistics form for 2021

The new form of statistics form P-4 for 2021 was approved by Rosstat order No. 412 dated July 24, 2020, and instructions for filling out the form are contained in Rosstat order No. 711 dated November 27, 2019. The new form is used from reporting for January 2021.

When filling out form P-4, consider the following features:

- Column 10 does not include payments to the self-employed;

- when calculating the average headcount, pregnant employees who are released from work for a period of time until they are provided with another job without adverse production factors are taken into account;

- employees working under the GPD are not taken into account from the date of conclusion of the contract, but the period of validity of the contract is considered to be the period of task completion.

Next, we will study the features of working with the document, taking into account the provisions of current regulations.

How to fill out form P-4 (NZ)

The same Rosstat instructions from Order No. 404 contain instructions for filling out P-4 (NZ) statistics in 2021; officials have not developed any other recommendations.

Like the P-4 form, the P-4 (NZ) form consists of two pages and has a similar structure. View the completed sample quarterly report P-4 (NZ) based on the results of the 4th quarter of 2021.

Title page

Here they indicate:

- the reporting period for which information is submitted;

- full and short name of the enterprise;

- actual and postal addresses of the organization;

- OKPO code.

Table

The table consists of three columns and 22 numbered lines; they record information about employees who:

- work part time;

- are involved in the watch;

- scheduled to be released;

- are on vacation at their own expense;

- provided to other organizations or sent by other organizations.

Each row of the last column contains data corresponding to the information in the first column.

If there are no indicators

Rosstat emphasizes that everyone is required to submit reports. If the company has not worked for some time or there is no data that should be entered, for example, there are no employees who work part-time, it is acceptable to submit the forms with zeros. It is also possible to submit a blank report if the organization did not operate during the reporting period.

IMPORTANT!

Previously, Rosstat asked to send an official letter stating that the P-4 (NZ) or P-4 report was not submitted because there were no indicators in the reporting quarter. But by order No. 412 of July 24, 2020, this rule was canceled; it is enough to submit only the zero form with a completed title page.

Zero P-4

If during the reporting period you did not have indicators that are included in P-4, you are allowed to submit to the statistics body (clause 3 of the Instructions, approved by Rosstat Order No. 711 dated November 27, 2019):

- or a P-4 signed in the prescribed manner with blank values of indicators (“blank” report on the P-4 form);

- or an official information letter about the absence of indicators presented in P-4 in the reporting period.

If you decide to submit a blank P-4, you only need to fill out the title section of the form. The remaining sections should not contain any data values, including zeros and dashes.