Who makes up

An invoice is issued by the seller (contractor, performer) to the buyer or customer. Drawing up this form is mandatory for business entities engaged in the sale of goods, performance of work or provision of services.

Why an invoice is needed has already been said (let us repeat briefly: it confirms the issuance and payment of VAT), accordingly, you need to fill out such a form:

- individual entrepreneurs and enterprises subject to the general taxation system (unless their services fall under the exceptions established by clause 2 of Article 149 of the Tax Code of the Russian Federation);

- Individual entrepreneurs and companies that partially work on OSN (for relevant types of activities), also combining it with UTII.

Taxpayers who have chosen UTII, the simplified tax system, or the patent system as their taxation system are exempt from paying VAT, with the exception of certain cases.

Why do you need an invoice if companies and individual entrepreneurs do not have to pay VAT? This may be required if there is commercial interaction with organizations and individual entrepreneurs that are VAT payers. In addition, the parties may decide to apply the invoice on their own initiative.

When is an invoice issued?

There are some situations in which firms are required to generate this documentation. These include:

- regular shipment of goods or provision of services related to electricity supply, gas circulation or oil products;

- provision of communication services;

- work in the catering industry, and services are provided repeatedly and daily.

When drawing up the invoice, the need to comply with the deadline of 5 days is taken into account. In the current month, the account number must be entered in the registration book. The specifics of cooperation and transfer of documents are specified in the agreement drawn up between the two companies.

If a supplier sells many products to one customer in 30 days, then he can process the delivery process using one invoice.

Procedure for issuing invoices:

- the document is transmitted in person or sent via electronic communication channels;

- it is prohibited to use a free form, since there is a unified model approved by law;

- the electronic form is used only with approval from the second participant, since companies must use the same software;

- When issuing an invoice online, operators recommended by the Federal Tax Service are involved, and their list is provided on the inspection website.

Electronic document management is available exclusively to companies and individual entrepreneurs who have a qualified digital signature.

Exposure deadlines

The general rule is as follows: an invoice is issued within 5 days from the date of transfer (shipment) of goods, performance of work or provision of services. In this case, calendar days are taken into account. This norm is enshrined in paragraph 3 of Art. 168 Tax Code of the Russian Federation. The rules are the same for both paper and electronic invoices. Also, according to paragraph 3 of Art. 168 of the Tax Code of the Russian Federation, when preparing advance documents, this form must be issued within the same 5 calendar days, but from the moment of receipt of payment for future deliveries, performance of work, provision of services.

In what cases is it necessary to issue an invoice to the buyer?

Companies that carry out transactions subject to VAT, including those exempt from paying this tax, as well as organizations that have received advances from their buyers (customers), must issue invoices...

Companies that carry out transactions subject to VAT, including those exempt from paying this tax, as well as organizations that have received advances from their buyers (customers), must issue invoices (Article 145, paragraphs 1, 3 of Article 168 , clause 3 of article 169 of the Tax Code of the Russian Federation).

In addition to these organizations, invoices must also be issued by companies that sell goods (work, services) on their behalf under an intermediary agreement. Of course, provided that the principal (principal) applies the OSNO (clause 1 of Article 169 of the Tax Code of the Russian Federation, clause 20 of Section II of Appendix 5 to Resolution of the Government of the Russian Federation of December 26, 2011 No. 1137).

In practice, situations arise when, in addition to primary invoices, organizations should issue adjustment invoices. For example, such documents must be provided to buyers if there has been a shortage of goods or the cost of shipped goods (work, services) has changed in the concluded contract (clause 3 of Article 168 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated May 12, 2012 No. 03-07-09/48 , dated March 12, 2012 No. 03-07-09/22).

Attention

If the buyer (customer) is not a VAT payer or is exempt from paying this tax, then the seller (executor) may not issue him invoices, provided that an agreement on non-issuance of invoices has been signed between them. This conclusion was reached by the Ministry of Finance (clause 3 of Article 169 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated March 16, 2015 No. 03-07-09/13808).

Also, an invoice does not need to be issued if the seller (executor), who is an interdependent person with his buyer (customer), increases the price of goods (work, services), while adjusting the VAT tax base. This is explained by the fact that with such an adjustment of the tax base, the amount of VAT is not presented to the buyer (customer), and therefore there are no grounds for issuing invoices with the adjusted tax base and tax amount (letter of the Ministry of Finance of Russia dated March 1, 2013 No. 03-07- 11/6175).

An invoice can be issued to the buyer (customer) both on paper and in electronic form (Resolution of the Government of the Russian Federation dated December 26, 2011 No. 1137, order of the Ministry of Finance of Russia dated April 25, 2011 No. 50n, order of the Federal Tax Service of Russia dated March 4, 2015 No. MMV- 7-6/93). Moreover, the buyer needs to issue an electronic invoice through an authorized organization - an electronic document management operator (clause 1.3 of the Procedure, approved by order of the Ministry of Finance of Russia dated April 25, 2011 No. 50n). The list of such operators is published on the official website of the Federal Tax Service of Russia www.nalog.ru.

Please note that it is possible to issue an invoice in electronic form only if the buyer agrees (clause 1 of Article 169 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated 01.08.2011 No. 03-07-09/26).

As for the timing, the invoice must be issued to the buyer (customer) no later than 5 calendar days from the date of shipment of goods (work, services) or receipt of an advance payment for upcoming deliveries (clause 3 of Article 168 of the Tax Code of the Russian Federation). Moreover, the calculation of the period begins from the next day after shipment (receipt of the advance payment) (clause 6.1 of the Tax Code of the Russian Federation).

Diadoc is easy to customize to suit your business processes.

Generate documents and send them to contractors or colleagues. Connect

When an invoice is not needed

The legislation specifies cases when an invoice is not a mandatory document, and the completion and execution of a transaction is confirmed by other data: an invoice, an invoice for payment. Based on the regulations, the invoice is not filled out under the following circumstances:

- the transaction is not subject to VAT (Articles 149 and 169 of the Tax Code of the Russian Federation);

- when selling goods for cash (in this case, a check or a strict reporting form is sufficient);

- when applying simplified taxation regimes;

- a legal entity - an employer transfers goods to its employee without providing counterpayment, that is, free of charge (according to Letter of the Ministry of Finance of the Russian Federation dated 02/08/2016 No. 03-07-09/6171);

- when sending goods for export, taxed at a zero rate, if the buyer is not a VAT payer, if the shipment took place no later than 5 calendar days from the date of receipt of the advance payment (according to Letter of the Ministry of Finance of Russia dated January 18, 2017 No. 03-07-09/1695).

Express check of invoice availability

In general, for VAT payers in the accounting system the following rules must be observed:

- each completed sales document must be accompanied by a posted document: Invoice issued for sales (except for certain situations);

- Each posted receipt document received from a VAT payer counterparty must correspond to the posted document Invoice received for receipt.

It was possible to control the availability and processing of issued and received invoices in previous versions of 1C: Accounting 8 using the Express check of accounting processing (section Reports - Express check). To do this, set the following flags in the report settings:

- Maintaining a sales book for value added tax - Completeness of issuing invoices for sales documents;

- Maintaining a book of purchases for value added tax - Completeness of receipt of invoices based on receipt documents.

As a result of performing an express check with the specified settings, a report is generated that displays (Fig. 1)

- subject of control;

- result of checking;

- possible causes of detected errors;

- recommendations for troubleshooting;

- detailed error report, from where you can access the underlying document and register the missing invoice.

Rice. 1. Express check of record keeping and availability of issued and received invoices

For more information about the express check of the status of tax accounting for VAT in 1C: Accounting 8, see the article Express check of the status of tax accounting for VAT in 1C: Accounting 8

Meanwhile, the absence of an invoice does not always indicate an error. So, for example, the seller does not issue invoices (clause 1, clause 3, article 169 of the Tax Code of the Russian Federation):

- for transactions that are not subject to VAT in accordance with Article 149 of the Tax Code of the Russian Federation;

- if its counterparty is a VAT non-payer or a taxpayer exempt from the obligation to pay VAT (in accordance with Article 145 of the Tax Code of the Russian Federation), with whom a written agreement has been reached on the failure to prepare invoices.

Even though the seller is not legally issuing invoices in these situations, the Recordkeeping Express Check report will indicate errors. The user has to open and review all the implementation documents to ensure that there are, in fact, no errors.

Kinds

There are three main types of invoice:

- ordinary, shipping. This document confirms that the goods have been transferred. This is the most common type of invoice, but legislation provides for more than just one;

- advance payment, written out and drawn up upon concluding a contract and receiving an advance payment for work performed or services rendered. This form does not confirm the fact of transfer;

- adjustment, filled in when the price or quantity of shipped products changes.

Requisites

What does an invoice look like? This is a table with columns about the product and a header providing information about the parties to the contract.

Required details:

- number and date;

- name, address and tax identification number, checkpoint of the buyer and seller, as well as the shipper and consignee, if any (please note, according to the new rules, the address must be written strictly as it is indicated in the Unified State Register of Legal Entities, you can check it on the Federal Tax Service website in the “Check yourself and the counterparty” section) );

- number of the payment document if an advance was received for future deliveries;

- product name and unit of measurement;

- quantity;

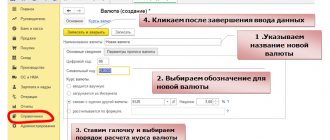

- currency (ruble code - 643, US dollar - 840, euro - 978);

- price per unit of measurement;

- full cost;

- excise tax amount;

- tax rate;

- the amount of tax to be paid;

- total cost including taxes;

- country of origin of the goods (codes are set in accordance with the OK classifier (MK (ISO 3166) 004-97) 025-2001); if goods are produced in Russia, a dash is added;

- customs declaration number (if the goods were not produced in Russia);

- signatures of the manager and chief accountant (or an authorized person - by order or power of attorney) - on a paper document; enhanced qualified digital signature - on electronic.

Among the latest changes is the line

“Identifier of a government contract, agreement (agreement).” Applies to deliveries under government contracts. The Filling Rules specifically indicate that the line is filled only if there is an identifier. If absent, the line remains blank (there is no need to put a dash).

Mandatory invoice details

The basic requirements for filling out an invoice are specified in Article 169 of the Tax Code of the Russian Federation. The invoice must contain the required details (for its acceptance in tax accounting and approval by the tax authority):

- serial number and date of compilation.

Serial numbers can be in any form in which the seller wants to see them. The main thing is that they should be increasing and end-to-end. If the organization violated the serial number system (for example, after 66.67 it issued an invoice numbered 15). This fact will not affect the tax deduction.

An invoice is issued within five calendar days from the date of shipment of goods or provision of services. This rule is spelled out in Decree of the Government of the Russian Federation of December 26, 2011 No. 1137 in subparagraph “a” of paragraph 1 of Appendix 1 and in paragraph 3 of Article 168 of the Tax Code of the Russian Federation.

- seller's name, address and identification numbers;

- name of the buyer (customer), his address and identification numbers.

The name of the seller (buyer) is written in full or abbreviated form in accordance with the constituent documents. The address is written in full with an index as it is stated in the company's Charter.

- name of the shipper and consignee, his address.

Data on the consignor and consignee are recorded only in case of sale of goods. If the consignor is the seller, then the full address of the consignor does not need to be entered; it is enough to indicate in the “aka” line. If you nevertheless write down the full or abbreviated name and postal address, this will not be an error.

The data on the consignee must be indicated in full: name, address in accordance with the statutory documents. Regardless of whether the consignee and the buyer are the same person or not.

- the name of the goods sold or description of the services provided, their unit of measurement.

- the number of goods sold or the volume of services provided;

- document currency.

The invoice must indicate the currency code of the document, in accordance with the All-Russian Currency Classifier.

a) 643 - Russian ruble, if the price of the document is in rubles;

b) 840 - US dollar, if the price of the document is in dollars;

c) 978 euros, if the price of the document is in euros.

- price per unit of goods or services excluding tax;

- the full cost of goods sold, services provided;

- tax rate;

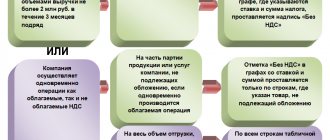

The VAT tax rate can be 0%, 10%, 20%. If the organization operates on a simplified basis or is exempt from paying VAT for any other reasons, this value is filled in with the words “Without VAT.”

- tax amount;

- the full cost of goods, services provided, taking into account the amount of tax;

- country of origin of the goods and customs declaration number - only for imported goods.

Filling by lines

Rules for filling out an invoice line by line:

- the first line is the serial number of the document in accordance with the established document flow rules;

- the date of preparation should not be earlier than the date of the original document;

- date and correction number are filled in if necessary;

- in the line “Seller” the full or abbreviated name is indicated in accordance with the constituent documents;

- the postal address is indicated in the “Address” line;

- in line 3, “same person” is entered if the seller and the shipper are the same person. Otherwise, you must provide the shipper's mailing address. When filling out an invoice for services and property rights, a dash is placed in this line;

- in term 4, according to the same rules, the data of the consignee is written;

- in line 5 “to the payment and settlement document” a dash is placed if the form is drawn up upon receipt of payment, partial payment or for upcoming deliveries using a non-cash form of payment;

- for line 7, the currency codes are given above.

The columns are filled in as follows:

- Column 1 indicates the name of the product or service provided;

- in column 2 - unit of measurement, if possible. A dash is placed upon receipt of payment or partial payment for upcoming deliveries. Columns 2 and 2a are filled out taking into account the All-Russian Classifier of Units of Measurement, introduced by Decree of the State Standard of the Russian Federation dated December 26, 1994 No. 366;

- Column 3 indicates the quantity or volume of the goods. If this indicator is not defined or is missing, you must put a dash. A dash is also added when payment or partial payment is received for upcoming deliveries;

- Column 4 (product price) is filled out according to similar rules;

- in column 6, if there is no excise tax amount, a corresponding note is made;

- in column 7 (tax rate) for transactions specified in paragraph 5 of Article 168 of the Tax Code of the Russian Federation, an entry “without VAT” is made;

- Column 8 is filled out according to similar rules;

- columns 10-12 are filled in if the country of origin of the goods is not Russia, in accordance with the OK of the world (MK (ISO 3166) 004-97) - 025–2001.

This is what the completed document looks like.

If the form is an advance or correction form, this must be indicated, as well as what changes are being made to the form and on what basis. The signature of authorized persons is required: manager (trustee), chief accountant. A seal is not a mandatory requirement, but can be supplied (for example, at the buyer’s request).

All forms are stored in chronological order for at least 4 years, recorded in the Journal of received and issued invoices, in the Book of Purchases and Sales in order to be able to verify the calculation and payment of VAT.

Summary invoice

It is represented by a document that is formed on the basis of several primary papers, and not just on the basis of one report or other documentation. Often several invoices are used to compile this document. The rules for forming paper are regulated by the following regulations:

- Art. 158 NK. It states that consolidated invoices are drawn up when an enterprise is sold as a property complex. Therefore, different types of property are distinguished as separate items. Accounts receivable, share price and other assets are separated.

- PP No. 1137. This resolution contains rules for filling out invoices. The basic requirements for documentation are listed here, as well as the situations in which they need to be set.

- Explanations from the Federal Tax Service and the Ministry of Finance. They are published quite often, and with their help you can find answers to numerous questions regarding the formation and issuance of invoices in different situations. The rules for using documentation during shared construction of houses or when making agency transactions are described.

Important! It is recommended that you entrust the preparation of documents to experienced accountants who are well versed in legal requirements.

Common Mistakes

Errors that are most often encountered when filling out an invoice and their consequences:

- if the name, TIN, and address of the organization are incorrectly indicated or missing, it is difficult to establish the authorship and addressee of the document, so it may be declared invalid;

- if it is impossible to determine from the document what goods were transferred or service was provided, VAT will not be refunded;

- incorrect indication of currency, incorrect indication of the quantity of goods, errors in prices, incorrect calculation of cost lead to the fact that the exact cost of the goods cannot be determined. Thus, the document becomes uninformative;

- incorrect calculation of VAT. The absence of a VAT amount may also raise questions from regulatory authorities.

Minor errors in the form of missing characters, capital letters, or inaccuracies in payment details are usually not pursued by the tax authorities. It is also possible to abbreviate names if such an abbreviation allows you to identify the enterprise or product.

Responsibility for violation of terms for issuing invoices

Businessmen are required to submit various reports and declarations to the Federal Tax Service within strictly established deadlines. Invoices are issued within 5 days from the date of the transaction for which VAT is required to be paid. Only if such conditions are met will the buyer be able to exercise the right to receive a deduction for this fee. If deadlines are violated, then according to the law, sellers are rarely held accountable and pay fines, but disagreements arise with the other party to the transaction.

If the invoice is issued in advance, this will not negatively affect the possibility of VAT refund, since the document is active even until the moment when goods are delivered or services are provided.

If the date indicated in the documentation precedes the moment of dispatch of the goods, then this is not considered a violation or a serious error, therefore representatives of the Federal Tax Service do not have the right to refuse to provide a deduction to the buyer. A fine is imposed only if there is no invoice or documents are submitted late. Liability in the form of a sanction occurs if information about accounts is not entered in the registration book, which must be maintained by all VAT payers.

If the company delays the deadline, it becomes the reason for the imposition of a fine by tax inspectors. If the goods are delivered at the end of the current period, and the document is drawn up at the beginning of the next period. The fine starts from 10 thousand rubles, and if repeated mistakes on the part of the company are detected, the sanction increases to 30 thousand rubles.

If an unscrupulous entrepreneur deliberately refuses to issue invoices in order to reduce the tax base, then the fine is 20% of the debt, but not less than 40 thousand rubles. The second party to the transaction may additionally file a claim in court, since he will not be able to count on a deduction. Judges usually in such cases decide to collect from the defendant an amount that is equal to the possible deduction. Therefore, representatives of organizations are obliged to take a responsible approach to the process of issuing invoices on time.

Adjustment invoice

When making adjustments, the following rules must be observed:

- changes are made to both copies;

- changes must be endorsed by the seller’s manager or an authorized person (the signature of the chief accountant is not required) and certified by a seal;

- it is necessary to set a date for making corrections;

- erroneous data is crossed out and new ones are entered, indicating the column, and the explanation “Corrected” must be included.

If there are too many errors, it is better to make a new document. The norms of the Tax Code of the Russian Federation do not contain a ban on such an action.

Relevance

The 2021 sample invoice is a transfer document that must be drawn up taking into account the above rules. It must take into account changes made since 10/01/2017.

Let's summarize: invoice - what is it in simple words? In short, this is confirmation of payment and payment of VAT. There are peculiarities of filling out this form, advance or corrective, but the essence does not change. It is in this form that there are signatures of authorized persons who actually confirm the execution of the contract. Therefore, this is an extremely important document that it is advisable to include in contractual obligations. Payers on the general taxation system will also need proof of payment of value added tax.

Sample invoice without VAT

An invoice without VAT has the same form and the same fields to fill out as a regular document used by taxpayers on the general system. The only difference is filling out columns 7 and 8. Such documents do not need to be entered into the accounting program, because their execution, by and large, does not make much sense.

By the way, there is no specific indication that such invoices should not be reflected in the purchase book. There are subtle hints that make it clear that such reflection is inappropriate.

New uniform in 2021

In connection with the increase in the basic VAT rate to 20%, a new form of invoice was introduced in accordance with the order of the Federal Tax Service of the Russian Federation dated December 19, 2018 No. ММВ-7-18/ [email protected] Changes were made to the electronic format of documents used for exchange via telecommunications communication channels. The order of the Federal Tax Service provides for a long transition period; until December 31, 2019, the right to apply the old format remains. Documents created using old formats must be accepted until December 31, 2022. Tax authorities recommend switching to the new format now in order to improve work efficiency.

Invoice form in Word format

WHO DOES NOT ISSUE AN INVOICE AND IN WHAT CASES

From January 1, 2021 art. 169 of the Tax Code of the Russian Federation was supplemented with clause 3.2. See paragraph 3 of Art. 2, art. 4 of the Federal Law of July 3, 2016 N 244-FZ.

From the provisions of paragraphs. 1 clause 3 art. 169 of the Tax Code of the Russian Federation it follows that for transactions that are not subject to taxation, there is no need to charge VAT and prepare invoices.

In addition, invoices are not generated:

1) for transactions that are not subject to VAT in accordance with Art. 149 of the Tax Code of the Russian Federation (clause 1, clause 3, article 169 of the Tax Code of the Russian Federation).

Norm pp. 1 clause 3 art. 169 of the Tax Code of the Russian Federation is addressed to taxpayers. It does not mention tax agents. However, we believe that the provisions under consideration apply to tax agents due to the following. In paragraph 5 of Art. 168 of the Tax Code of the Russian Federation there is no requirement to prepare invoices without highlighting VAT in relation to transactions exempt from this tax. In addition, in paragraph 3 of Art. 168 of the Tax Code of the Russian Federation established that the tax agents listed in paragraphs 2, 3 of Art. 161 of the Tax Code of the Russian Federation, prepare invoices for calculating VAT. However, it does not indicate that tax agents must issue an invoice for a VAT-exempt transaction for which tax is not calculated.

Please note that when performing certain operations provided for in Art. 149 of the Tax Code of the Russian Federation, you will still have to draw up an invoice. These include operations for the sale of goods exported from the territory of the Russian Federation to the territory of a member state of the EAEU, specified in Art. 149 of the Tax Code of the Russian Federation. Such conclusions follow from the analysis of paragraphs. 1, 1.1 clause 3 art. 169 Tax Code of the Russian Federation;

2) organizations and entrepreneurs who are engaged in retail trade, public catering, performing work (providing services) for the population in cash, subject to the issuance of a cash receipt or other document of the established form (clause 7 of Article 168 of the Tax Code of the Russian Federation).

If goods (work, services) are paid for by individuals by bank transfer, the seller is not relieved of the obligation to draw up an invoice (Letters of the Ministry of Finance of Russia dated 04/01/2014 N 03-07-09/14382, dated 11/23/2012 N 03-07-09 /153).

At the same time, in paragraphs. 1 clause 3 art. 169 of the Tax Code of the Russian Federation provides for the possibility not to draw up invoices with the written consent of the parties to the transaction if the buyer is not a VAT payer (exempt from taxpayer obligations). Taking into account the above provisions, as well as the fact that individuals are not payers of VAT and do not accept it for deduction, the Federal Tax Service of Russia clarified the following: when providing passenger transportation services on the basis of an air ticket paid by individuals by bank transfer, in which the amount of VAT is highlighted in a separate line , the airline may not issue invoices (Letter dated May 21, 2015 N GD-4-3/8565 (clause 1)).

In addition, the Ministry of Finance of Russia on the issue of drawing up invoices in the case of sales of goods (work, services) to individuals indicated the following in Letter dated October 19, 2015 N 03-07-09/59679. Taking into account the fact that individuals are not payers of VAT and do not accept it for deduction, in case of sale of goods (works, services) to these persons, it is possible to draw up an accounting statement or summary document containing summary (summary) data on such transactions for a certain period of time. period (day, month, quarter).

For law enforcement practice on the issue of whether a taxpayer must draw up invoices when selling goods (work, services) to individuals for cashless payments, see the Encyclopedia of VAT Disputes;

3) organizations and entrepreneurs who apply special tax regimes in the form of unified agricultural tax, simplified tax system, UTII or a patent taxation system (with some exceptions), since they are not VAT payers (clause 3 of article 169, clause 3 of article 346.1, p. clauses 2 and 3 of Article 346.11, clause 4 of Article 346.26, clause 11 of Article 346.43 of the Tax Code of the Russian Federation).

If such organizations and individual entrepreneurs sell goods (work, services) through an intermediary, then the intermediary does not calculate VAT on the sales amounts and does not issue invoices to buyers (see, for example, Letter of the Ministry of Finance of Russia dated May 31, 2011 N 03-07-11 /152);

4) in the presence of appropriate written consent of the parties to the transaction when selling (goods, works, services, property rights) to persons who are not VAT payers or are exempt from fulfilling the duties of a taxpayer in accordance with Art. Art. 145, 145.1 of the Tax Code of the Russian Federation (clause 1, clause 3, article 169 of the Tax Code of the Russian Federation).

Please note that when selling goods (work, services), transferring property rights, invoices are issued both when shipping goods (performing work, providing services), transferring property rights, and when receiving advance payments for upcoming deliveries of goods (performing work, provision of services), transfer of property rights (clause 3 of Article 168 of the Tax Code of the Russian Federation). Consequently, the rule on failure to draw up invoices to a buyer who is not a VAT payer (exempt from paying VAT in accordance with Articles 145, 145.1 of the Tax Code of the Russian Federation), with the written consent of the parties to the transaction, applies, among other things, to advance invoices . The Russian Ministry of Finance also pointed out the possibility of not drawing up advance invoices with the written consent of the parties to the transaction in accordance with paragraphs. 1 clause 3 art. 169 of the Tax Code of the Russian Federation (Letter dated March 16, 2015 N 03-07-09/13808).

Note

In the case of free sales of goods to employees or children of employees, the financial department considers it acceptable not to issue invoices to them. This conclusion follows from Letter of the Ministry of Finance of Russia dated 02/08/2016 N 03-07-09/6171.

See additionally:

— is an invoice drawn up for the free sale of goods to employees and their children?

Thus, if there is a written consent of the parties to the transaction not to draw up invoices, then the seller does not issue either advance or shipping invoices to the buyer who is not a VAT payer (exempt from paying VAT in accordance with Articles 145, 145.1 of the Tax Code of the Russian Federation). invoices.

The invoice issued by the seller is used for the purposes of VAT calculations and is the basis for a deduction for the buyer - the VAT payer (clause 1 of Article 169, clause 1 of Article 172 of the Tax Code of the Russian Federation). Buyers who are not recognized as VAT payers cannot take advantage of the deduction, and therefore they do not need an invoice. As for “simplified” buyers with the object of taxation “income minus expenses”, if the parties to the transaction agree to not draw up invoices, they can attribute the VAT amount on purchased goods (work, services) to expenses on the basis of payment and settlement documents, cash registers checks or strict reporting forms with the tax amount highlighted in a separate line (Letters of the Ministry of Finance of Russia dated 09/08/2014 N 03-11-06/2/44863, dated 09/05/2014 N 03-11-06/2/44783).

We believe that the regulatory authorities will adhere to a similar point of view in relation to buyers - payers of the Unified Agricultural Tax. After all, the object of taxation under the Unified Agricultural Tax is income reduced by the amount of expenses, and VAT on purchased goods (work, services) is one of the types of expenses that reduce the tax base for agricultural tax (Article 346.4, paragraph 8, paragraph 2, Article 346.5 of the Tax Code of the Russian Federation ).

The seller must consider the following when obtaining the buyer's consent to not issue invoices. Sales of goods (works, services, property rights), which are recognized as an object of taxation under VAT and are not exempt from tax in accordance with Art. 149 of the Tax Code of the Russian Federation, must be reflected in the sales book by registering an invoice, a cash register control tape, a strict reporting form (clause 1, clause 3, article 169 of the Tax Code of the Russian Federation, clauses 1, 3 of the Rules for maintaining the sales book). Therefore, if the seller has no reason to issue a cash register receipt or issue a strict reporting document, we can recommend that he draw up a single copy of the invoice for such an operation and register it in the sales book. The Ministry of Finance of Russia agrees with this approach (Letter dated 09.10.2014 N 03-07-11/50894).

In addition, the official authorities admit that in cases where, on the grounds provided for in paragraphs. 1 clause 3 art. 169 of the Tax Code of the Russian Federation, an invoice is not drawn up, the seller can reflect the following details in the sales book:

- primary accounting documents confirming the fact of the relevant business transactions (Letters of the Ministry of Finance of Russia dated 01/22/2015 N 03-07-15/1704, dated 10/09/2014 N 03-07-11/50894, Federal Tax Service of Russia dated 01/27/2015 N ED- 4-15/ [email protected] );

— other documents containing summary information on the transactions in question performed during a calendar month or quarter. Such a document could be, for example, an accounting statement (Letters of the Ministry of Finance of Russia dated January 22, 2015 N 03-07-15/1704, Federal Tax Service of Russia dated January 27, 2015 N ED-4-15 / [email protected] ).

If the cost of shipped products (work performed, services provided) changes downward or upward, the seller can issue an adjustment invoice in a single copy and register it in the prescribed manner.

In addition, according to the explanations of the official bodies, in the event of a decrease in the cost of shipped goods (work performed, services provided) for the purpose of applying a VAT deduction, the seller can register in the purchase book primary accounting documents confirming the consent (fact of notification) of the buyer to such a decrease (Letters from the Ministry of Finance of Russia dated 02/03/2015 N 03-07-15/4062 (brought to the attention of taxpayers and tax authorities by Letter of the Federal Tax Service of Russia dated 02/27/2015 N GD-4-3/ [email protected] ), dated 01/20/2015 N 03-07-05/ 1271).

We believe that in the event of an increase in the cost of shipped goods (work performed, services provided), primary documents confirming the buyer’s consent (fact of notification) to the change in cost can also be registered in the sales book without issuing an adjustment invoice.

The parties may provide for consent to not prepare invoices, for example, in a contract or an additional agreement to it.

If an agreement on the sale (of goods, works, services, property rights) has already been concluded, then, in our opinion, it is necessary to draw up an additional agreement to it. It must indicate that the parties agreed on the fact that invoices were not drawn up. In addition, it is advisable to reflect why invoices are not drawn up (use by the buyer of the simplified tax system (UTI, Unified Agricultural Tax, PSN) or exemption from the duties of a taxpayer in accordance with Articles 145, 145.1 of the Tax Code of the Russian Federation). We also recommend that you additionally provide a list of documents that will confirm the fact of sale of goods (work, services, property rights).

If the parties are just planning to enter into an agreement, then it is advisable to include a condition on the non-drafting of invoices in the text of the agreement at the stage of preparing its draft.

Let us note that, according to the Ministry of Finance of Russia, the written consent of the parties to not prepare invoices can be issued electronically if it is signed with an electronic signature or another analogue of a handwritten signature (Letter dated October 21, 2014 N 03-07-09/52963);

5) upon receipt of an advance amount for upcoming deliveries of goods (performance of work, provision of services) (clause 17 of the Rules for maintaining a sales book used in calculations of value added tax, approved by Decree of the Government of the Russian Federation of December 26, 2011 N 1137):

- the duration of the production cycle of which is more than six months in the cases provided for in paragraph 1 of Art. 154 Tax Code of the Russian Federation;

— which are taxed at a VAT rate of 0% in accordance with clause 1 of Art. 164 of the Tax Code of the Russian Federation (clause 1 of Article 154 of the Tax Code of the Russian Federation);

- which are not subject to taxation (exempt from taxation) according to Art. 149 of the Tax Code of the Russian Federation (clause 1 of Article 154 of the Tax Code of the Russian Federation);

- which will be shipped (transferred) by taxpayers using the right to exemption in accordance with Art. Art. 145, 145.1 Tax Code of the Russian Federation.

See additionally:

— when an “advance” invoice is not issued.