Organizations must confirm their main type of activity in the Social Insurance Fund in 2021 no later than April 15, 2021. Has the confirmation process changed in 2021? What documents are required to be submitted to the Social Insurance Fund and have their forms changed? Such questions concern almost all accountants. The answers to them, as well as sample documents, are given in this article. We will also talk about the tightening of liability since 2017 for failure to submit documents confirming the type of business activity on time.

Introductory information

Since 2021, pension and health insurance contributions have come under the control of the Federal Tax Service. However, insurance premiums for insurance against accidents and occupational diseases (that is, “injury” contributions) remained under the control of the Social Insurance Fund. This state of affairs remains in 2021. Also in 2021, the requirement for annual confirmation of the main type of activity of organizations remained. Accordingly, it is also necessary to confirm the main type of economic activity in 2021. Let us recall that the rate of insurance premiums “for injuries” directly depends on the main type of activity of organizations and entrepreneurs. And the more dangerous the activity from the point of view of labor protection, the higher the insurance rate. See “Insurance premium rates for injuries will not change in 2021.”

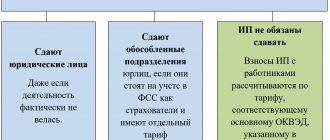

Who confirms the type of activity

The obligation to confirm the main type of activity with the Social Insurance Fund is imposed on the insured organizations. We are talking specifically about legal entities - individual entrepreneurs are exempt from confirmation. In accordance with paragraph 10 of Resolution No. 713 of December 1, 2005, the main type of activity of an individual entrepreneur is indicated in the Unified State Register of Individual Entrepreneurs and does not require annual confirmation.

As for organizations, an exception is made only for new ones. That is, companies that registered at the beginning of 2021 (before the deadline for submitting a certificate to the Social Insurance Fund) do not have to confirm their activities.

Who must confirm the type of activity in 2018

To begin with, we will tell you which of the organizations and individual entrepreneurs must confirm the main type of their business with the Social Insurance Fund.

Organizations

All organizations registered in 2021 and earlier must confirm their main activity in 2021. Moreover, this also applies to those organizations that did not have any income in 2021, as well as those that ran only one type of business.

If an organization is registered (opened) in 2021, then it does not need to confirm its main activity. The new company will pay contributions “for injuries” during 2021 based on the main type of activity declared when registering the company and indicated in the Unified State Register of Legal Entities as the main one (clause 6 of the Procedure approved by order of the Ministry of Health and Social Development of Russia dated January 31, 2006 No. 55, hereinafter - Order).

Individual entrepreneurs

Individual entrepreneurs are not required to confirm their established “injury” contribution rate every year. Individual entrepreneurs choose their main activity only once – upon registration. This type of activity is listed in the Unified State Register of Individual Entrepreneurs and according to it, controllers from the Social Insurance Fund set the entrepreneur the rate of contributions for insurance against accidents and occupational diseases. The entrepreneur does not need to confirm this type of activity annually. This is directly stated in paragraph 10 of the Rules, approved by the Decree of the Government of the Russian Federation of 01.12. 2005 No. 713. Therefore, in 2021, individual entrepreneurs, as before, may worry about this procedure.

Let us remind you that in 2021, as before, contributions “for injury” to individual entrepreneurs must be paid from the earnings of employees working under employment contracts. If the individual entrepreneur has entered into a civil contract with the “physicist,” then it is necessary to pay contributions “for injuries” only if such an obligation has been specified by the parties in the contract (Clause 1, Article 20.1 of the Federal Law of July 24, 1998 No. 125-FZ). And individual entrepreneurs without employees pay “injury” contributions “for themselves” only on a voluntary basis.

If an individual entrepreneur, on his own initiative, changes the main type of his activity in the Unified State Register of Individual Entrepreneurs, then he should be set a new rate of contributions “for injuries”, corresponding to the new class of professional risk. In such a situation, it is better for an entrepreneur to confirm his new type of activity for 2021. After all, the new tariff may be less than the previous one. The FSS of Russia will not take into account the changes on its own and will maintain the maximum tariff established earlier.

Who needs confirmation of the type of economic activity in the Social Insurance Fund

For 2021, all organizations must confirm the main type of their business, and it does not matter whether the company had income in 2017. Confirmation is also necessary for those who work in only one single direction.

Confirmation of the type of economic activity is not required in 2021:

- organizations newly created in 2021, because for them, the profit class is determined according to the type of activity indicated in the Unified State Register of Legal Entities as the main one when registering a company, and until the end of 2021 the corresponding tariff is applied to them. But in 2021, these companies will already have to confirm the activities that are recognized as core based on the results of 2021.

- to all individual entrepreneurs, except for those who changed their main type of activity, as appropriate changes have been made to the Unified State Register of Individual Entrepreneurs.

Deadline for confirming the type of activity in 2018

Organizations are required to confirm their main type of economic activity in 2021 no later than April 15, 2021 (clause 3 of the Procedure, approved by order of the Ministry of Health and Social Development of Russia dated January 31, 2006 No. 55). However, April 15 in 2021 falls on a Sunday. On this day, FSS units do not work.

Please note that to confirm the main type of activity, it is not expressly provided for the transfer of the deadline to the first working day if the reporting date falls on a weekend or non-working holiday. Therefore, the confirmation deadline for April 16, 2021 (Monday) will not be postponed. At least, according to our information, this is what some specialists from the FSS departments believe. They believe that in 2021 the deadline to confirm the type of activity in the Social Insurance Fund is April 13 (Friday).

However, we note that there is another point of view. Some lawyers are confident that if you confirm your main activity on April 16, 2021 (Monday), this will not constitute a violation of the deadline. They refer to Article 193 of the Civil Code of the Russian Federation, which establishes a general rule for transferring deadlines from non-working days to working days. If you are guided by this article, then submitting documents to the Social Insurance Fund on April 16 is the timely fulfillment of the obligation to confirm the main type of activity.

Local controllers from the Social Insurance Fund may not agree with the postponement of the deadline for confirming the type of economic activity to April 16, 2018 (Monday). And then the organization will most likely need to defend its case in court. It’s good that there is positive judicial practice (for example, resolution of the Federal Antimonopoly Service of the Volga District dated April 24, 2007 No. A12-14483/06). However, in our opinion, it is better for organizations not to take risks and submit all documents before April 15, 2021. Then there will be no disputes within the fund.

How to fill out an application for confirmation of the main type of economic activity

Tip 1: How to fill out an application for confirmation of the main type of economic activity

Legal entities must annually confirm their main type of economic activity. There is a special form for this called “Application for confirmation of the main type of economic activity.” It is submitted to the statistical authorities by April 15 after the reporting year. How to fill it out correctly?

You will need

- certificate confirming the main type of economic activity

Instructions

- It should be noted that to fill out this form you will need an OKVED confirmation certificate, which was issued to you by the statistical authorities when registering a legal entity (usually it comes by mail)

- Before you start filling out the application, decide on the type of economic activity. Your organization can work according to several OKVED codes, but you must choose one. It should be the one that brings in more income or on which more labor is spent

- First, indicate the date in the upper right corner; it should be the first day of the year, that is, January 1 of the current year. Even if you rent in April

- Below you will see a line to indicate the name of the authority where you are submitting your application. Here you need to indicate the statistical authorities, if available, then the branch indicating the number

- After the title there is a line that begins with the words “from”, in which you indicate the full name of the organization, for example, Limited Liability Company “Vostok” (the name must correspond to the constituent documents)

- Next, write the registration number and subordination code. You can view this data in the confirmation certificate received from the statistical authorities. Next you will see text that contains information about regulations; here you need to indicate the year you are taking to calculate contributions for the current one, that is, if you submit a certificate in 2021, then indicate 2021

- Below write the main code of economic activity of your organization, which you can select from the directory

- As a rule, this application form is accompanied by attachments: a confirmation certificate, a copy of the license (if available) and a copy of the explanatory note to the balance sheet for the year. The application must indicate the number of pages of the application. The document is signed by the head of the organization

Helpful advice. If you are working for the first year, you do not need to submit this application.

Tip 2: How to fill out an application for confirmation of the main activity

To confirm the main type of economic activity of the enterprise, the policyholder, after filling out a certificate confirming the main type of economic activity, must write an application to the social insurance fund confirming the main type of economic activity. For the main type of economic activity, the social insurance fund sets the policyholder a tariff at which he will have to pay insurance premiums.

You will need

application form for confirmation of the main type of economic activity, pen, constituent documents, certificate confirming the main type of economic activity, copy of the explanatory note to the balance sheet, computer, Internet, printer

Instructions

- statements confirming the main type of economic activity

- Indicate the date you filled out the application (date in Arabic numerals, month in words and year in Arabic numerals)

- Enter in the appropriate field the name of the executive body of the Social Insurance Fund of the Russian Federation, i.e. name of the social insurance authority at your place of residence

- Write the full name of your organization in accordance with the constituent documents

- Please indicate the registration number of your organization that is the policyholder

- Fill out the “Subordination Code” column in the application. The subordination code is assigned to the policyholder depending on the regional branch of the social insurance fund. The subordination code consists of five digits. The first four digits of the code correspond to the code of the regional social insurance fund, the fifth indicates the reason for registration. Indicate the code of the fund where you are registered as a policyholder. If your company is registered at your location, enter the number “one”

- If your organization belongs to budgetary institutions, check the box in the “Budgetary institution” column. If this does not apply, leave the column blank.

- In accordance with the constituent documents and the law, enter the reporting year and type of main economic activity

- Enter the code in accordance with the All-Russian Classifier of Economic Activities

- Attach to this application a certificate confirming the main type of economic activity and a copy of the explanatory note to the balance sheet, indicate how many sheets the application consists of

- The head of your organization must sign and enter a transcript of the signature (last name and initials)

- The last column of the application is filled out by the body that accepted this application from you, so you do not need to write anything in it

Tip 3: How to choose OKVED codes for an organization

You should select OKVED codes for an organization by moving from general sections to those classes, subclasses, groups and subgroups of activities that you plan to engage in. However, there are no restrictions on the number of codes indicated during registration.

When registering, any organization or individual entrepreneur is required to indicate the types of activities they plan to engage in. To classify and systematize these types of economic activities, the All-Russian Classifier (OKVED) is used. It is there that you need to look at the names and digital codes of specific types of business activities. After registration, an organization can also always change the types of its economic activities, add or exclude some codes and names, for which a special application is submitted to the tax authority.

How to find the necessary OKVED codes?

The All-Russian Classifier is a fairly large document, so without knowing its structure, searching for the types of activities of interest will take a lot of time. In total, OKVED includes 17 sections, each of which has its own meaning. Within each section, activities are divided into classes, subclasses, groups, and subgroups. The minimum unit is a specific type of activity, it is indicated by six digits. Classes are designated by two numbers, subclasses by three, groups by four, subgroups by five. In the application for registering an organization, it is necessary to indicate at least three numbers for each type of activity, that is, you can choose subclasses or more detailed designations. The choice of subclasses gives greater freedom in the future activities of the organization, since new areas of activity may appear in the process of ongoing work.

How to determine a specific OKVED code?

When filling out an application for registration of an organization or registering changes made to the register, you should determine the codes in OKVED by going from general to specific. Initially, it is necessary to determine a specific field of activity, which will allow you to choose one of seventeen sections. After this, you should carefully study all the classes in this section, find a suitable class, and explore its subclasses. We can stop here, since three-digit subclass codes are allowed in the application. If you wish, you can also continue to study OKVED, which will allow you to more specifically define your own types of activities and secure them in the register. But it should be remembered that indicating specific types of activities or subgroups (five or six numbers) significantly limits the organization with subsequent changes in areas of work, since the data in the register will constantly need to be changed.

Tip 4: Types of legal activities

Political and economic activities are decisive for any society, but legal activities are no less important. Legal activity is an indicator of the civil maturity of society and the readiness of the state to fulfill its direct responsibilities, including providing legal protection to its citizens.

What is legal activity

Legal activity has those characteristic features that are inherent in any social activity: objectivity, expediency, orderliness, systematicity, selectivity, etc. Its object is law in various manifestations of legal norms, legal relations, legal consciousness and legal regulation, therefore legal activity is the basis for the existence of legal systems of society and state. It is recognized as such not only because its object is law, but also because its results are legally significant and make it possible to create new precedents that correspond to changing legal realities, or, conversely, to keep legal reality unchanged.

Legal activities are carried out on the basis of legal knowledge, experience and a way of thinking, which makes it possible to build a logically sound chain from the selection, analysis and assessment of legal information to the selection of optimal options for solving a legal problem. This activity contains both a rational component and a moral one.

Types of legal activities

Currently, Russian legal scholars, in their works devoted to the content and functions of legal activity, present different points of view on its types. Some of them separate legal activity and legal practice, the other part considers them inseparable from each other and proposes to consider the entire set of socio-legal phenomena as legal activity. One thing is certain: legal activities must be carried out by lawyers who have the appropriate professional education, qualifications and experience. In this case, there is a guarantee that such activities will be aimed at creating socially useful legal norms and benefits necessary both for society as a whole and for the individuals of its components.

Such activities of professional lawyers are based on current legislation, legal and moral norms and have legally significant consequences. Its main types include:

- legal assessment of the presented facts and information

- development of an algorithm for searching and verifying these facts and information

- search and analysis of legal information related to these facts

- selection of current legal norms that allow making an unambiguous legal conclusion

- development and formulation of position

- preparation of legal documents: certificates, decisions, etc.

- control over the legal process and activities of both organizations and citizens, allowing them to remain within the legal framework

How to confirm the type of activity in 2018: step-by-step instructions

Next, we present to your attention step-by-step instructions on the procedure for confirming the main type of activity in 2021. The instructions, in particular, contain samples of all the necessary documents.

Step 1. Determine your main activity

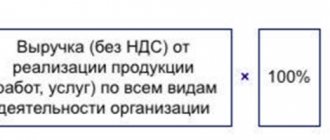

Determine the basis for the type of activity of the organization or individual entrepreneur based on the results of 2017 (clause 11 of the Rules, approved by Decree of the Government of the Russian Federation of December 1, 2005 No. 713). To do this, calculate how much income from the sale of products (works, services) for each type of activity was in 2021. After this, determine the share of each type of activity in the total amount of income from sold products (works, services). The formula will help you with this:

The activities that have the largest share will be considered core for 2021. However, keep in mind that several types of activities listed in the Unified State Register of Legal Entities may have the same share at the end of 2021. And then the main activity should be considered an activity that corresponds to a higher class of professional risk (according to the Classification, approved by Order of the Ministry of Labor of Russia dated December 25, 2012 No. 625n).

If in 2021 an organization was engaged in only one type of business, then this type will be the main one. Moreover, regardless of what types of activities were indicated in the Unified State Register of Legal Entities when registering an LLC or JSC.

Let's give an example of calculating the definition of the main type of activity of an organization in 2021.

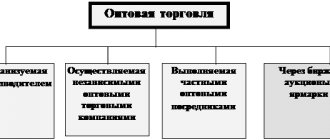

Example. Cosmos LLC uses a simplified approach. In 2017, the company was engaged in wholesale and retail trade in products. According to accounting data for 2021, the company received income in the total amount of 7 million rubles, including from wholesale trade - 5.2 million rubles, from retail trade - 1.8 million rubles. The accountant of Cosmos LLC calculated the share for each type of activity. For wholesale trade, the share was 74% (RUB 5,200,000 / RUB 7,000,000 × 100%), for retail – 26% (RUB 1,800,000 / RUB 7,000,000 × 100%). Thus, the main activity for Cosmos LLC will be wholesale trade, since the share of this type of activity is greater. It must be confirmed no later than April 16, 2021.

Step 2: Prepare your documents

Based on the above calculations, generate documents for submission to the territorial office of the Social Insurance Fund no later than April 16, 2021, namely:

- certificate confirming the main type of economic activity;

- statement confirming the main type of economic activity.

In addition, if the organization is not small, additionally prepare a copy of the explanatory note for the balance sheet for 2021. Arrange it in any form - in tabular or text form. If the company is a small enterprise, a copy of the note is not needed. See “Criteria for small businesses from August 1, 2021: what has changed”, “Register of small entrepreneurs”.

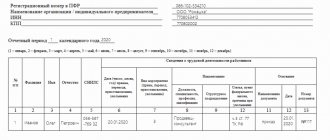

Help confirmation: sample

A certificate confirming the main type of economic activity must be filled out in the form specified in Appendix No. 2 to the Procedure, approved. By Order of the Ministry of Health and Social Development of Russia dated January 31, 2006 No. 55. A new form of certificate was not developed or approved. Therefore, the indicated form should be used in 2021. . You can also .

Application for confirmation of the main type of economic activity: sample

An application for confirmation of the main type of economic activity must be filled out in the form specified in Appendix No. 1 to the Procedure, approved. by order of the Ministry of Health and Social Development of Russia dated January 31. 2006 No. 55. A new application form for 2021 has not been approved, so the above form must be used to fill it out. . Download and review the sample application to be submitted to the Social Insurance Fund no later than April 16, 2021.

Which OKVED code should be indicated in the documents?

You can determine which class your activity belongs to using the Classification approved by Order of the Ministry of Labor of Russia dated December 30, 2021 No. 851n. It lists the types of activities and their corresponding OKVED codes. Activities are grouped into 32 occupational risk classes

Step 4. Submit documents to the Social Insurance Fund

Submit the prepared documents to the FSS department no later than April 16, 2021. Documents can be submitted “on paper” (in person or by mail). Also, documents in 2021 can be transmitted electronically through a single portal of public services. For these purposes, we recommend that you familiarize yourself with the information on the FSS website.

In order to submit documents electronically through the government services portal, the organization must have an enhanced qualified electronic signature on a physical medium (for example, on a USB). You can obtain it from one of the certification centers accredited by the Russian Ministry of Telecom and Mass Communications. Also, a cryptoprovider program must be installed on the computer from which documents will be sent.

Step 5. Get the FSS decision

Based on the documents received no later than April 16, 2021, the Social Insurance Fund division will assign the “injury” contribution rate for 2021. The applicant will have to be notified of this within two weeks from the date of submission of the package of documents. That is, until the end of April 2021 (clause 4 of the Procedure, approved by Order of the Ministry of Health and Social Development of Russia dated January 31, 2006 No. 55). If you send documents through the unified portal of public services, then you can view the notification of the assigned tariff for 2021 in the personal account of the legal entity.

Until a notification has been received from the Social Insurance Fund about setting the tariff for 2018, contributions “for injuries” should be calculated at the rate that you used in 2021. If the Social Insurance Fund establishes an increased class of professional risk for 2021, then you will need to recalculate contributions for 2021 at the new rate and pay the arrears (without penalties and fines). If the tariff turns out to be lower, an overpayment will occur. And it can be offset against future payments or returned. In this case, you will need to submit an updated calculation of 4-FSS for the 1st quarter of 2021.

How is the main activity determined?

Each type of activity in the All-Russian Classifier is assigned its own OKVED code - it is this code, corresponding to the main activity of the company, that is needed to confirm the main type of economic activity of the FSS insurer. Let us recall that in 2017 new classifier codes “OK 029-2014” began to operate (approved by order of Rosstandart dated January 31, 2014 No. 14-st), the so-called. OKVED2, in accordance with which the “Classification of activities according to pro-free classes” was brought into compliance (approved by order of the Ministry of Labor of the Russian Federation dated December 30, 2016 No. 851n).

According to clause 2 of the “Procedure for confirming the main activity” (approved by order of the Ministry of Health and Social Development of the Russian Federation dated January 31, 2006 No. 55), the main type of business is recognized as having a greater weight in the total volume of products produced and services provided. Non-profit organizations focus on the type that employs the largest number of workers.

The OKVED code of the insurer's main activity is correlated with the corresponding pro-frisis class according to the rules approved. Decree of the Government of the Russian Federation dated December 1, 2005 No. 713. If a company has several types of products that have an equal share in total revenue, the main one is considered to be the one with the higher profit class.

If documents are not submitted

If the organization does not submit documents on the main type of activity to the Social Insurance Fund within the prescribed period, the fund will independently determine the main type of activity of the policyholder for 2018. In such a situation, the FSS has the right to assign the highest risk class of all OKVED codes in the Unified State Register of Legal Entities. This right is officially assigned to the FSS in connection with the entry into force of Decree of the Government of the Russian Federation dated June 17, 2016 No. 551 on January 1, 2021. Note that the FSS bodies acted this way until 2021. However, this caused a lot of litigation. The judges believed that the fund does not have the right to choose the most “risky” type of activity arbitrarily from all the types specified in the Unified State Register of Legal Entities. When setting the FSS tariff, according to the judges, the FSS should take into account only those types of activities that the organization actually engaged in in the previous year (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 5, 2011 No. 14943/10). As of 2021, this approach will no longer be applied. If supporting documents are not submitted no later than April 16, 2021, the fund will increase the rate of contributions “for injuries” to the maximum possible from the Unified State Register of Legal Entities. It does not matter whether the organization actually conducts this activity or not. And it is apparently useless to argue with this in court. There are no separate monetary fines for failure to submit documents to the Social Insurance Fund.

In a similar manner, in 2021 it is necessary to determine and confirm the main type of activity of each separate division at the location of which the organization is registered with the Social Insurance Fund. That is, each separate unit that the organization has identified as an independent classification unit, as well as an OP, in respect of which the following conditions are simultaneously met (clause 8 of the Procedure, approved by Order of the Ministry of Health and Social Development dated January 31, 2006 No. 55):

- the division is allocated to a separate balance sheet;

- a current account has been opened for the division;

- The division independently calculates payments in favor of employees.

How to report to social security

A certificate confirming the main type of activity in the Social Insurance Fund, which is valid in 2021, was approved by order of the Ministry of Health and Social Development of the Russian Federation dated January 31, 2006 No. 55. Moreover, the certificate is only an attachment to the policyholder’s application (Appendix No. 1 to the order), and therefore is not submitted separately.

| ✏ In the application, the entrepreneur reports that he asks to consider a certain type of his activity (indicating the OKVED code) as the main one, and in the certificate he provides a calculation of the specific share of income from different areas of business. In the certificate for each OKVED code under which the individual entrepreneur carried out real activities in the reporting year, it is necessary to indicate income in rubles, the number of employees and the share of income in total revenue. |

You can contact social insurance in person, send documents by mail or through the government services website. Having received a certificate from the policyholder, social insurance employees change the rates of contributions for injuries and occupational diseases. The FSS must notify the FSS in writing within two weeks from the date of submission of the certificate about the premium rate assigned to the policyholder. These rates will remain in effect until the entrepreneur changes the field of business again.

Discounts and surcharges in the tariff

Discounts

The FSS of Russia can set a tariff for an organization taking into account a discount or surcharge. To do this, labor safety indicators in the organization are compared with industry average values. Industry averages for 2021 were approved by Resolution of the Federal Social Insurance Fund of Russia dated May 31, 2021 No. 67. Specialists from the Social Insurance Fund take into account (clause 3 of the Rules approved by Resolution of the Government of the Russian Federation dated May 30, 2012 No. 524):

- the ratio of the expenses of the Federal Social Insurance Fund of Russia for the payment of all types of provisions for all insured events with the employer and the total amount of accrued contributions for insurance against accidents and occupational diseases;

- number of insurance cases per 1000 employees;

- number of days of temporary disability per insured event.

In addition to the main indicators specified in paragraph 3 of the Rules, approved by Decree of the Government of the Russian Federation of May 30, 2012 No. 524, when determining the amount of a discount or allowance, the results of a special assessment of working conditions are also taken into account.

The discount amount is calculated based on the results of the organization’s work over three years.

Allowances

The Federal Social Insurance Fund of Russia can independently establish a tariff premium if the employer’s injury rate over the previous three years was higher than the industry average (Clause 1, Article 22 of Law No. 125-FZ of July 24, 1998).

The FSS also establishes a premium if the policyholder in the previous year had a group accident (2 people or more) with a fatal outcome not due to the fault of third parties. The FSS calculates the bonus for the next year taking into account the number of deaths. This is provided for in paragraphs 6 and 6.1 of the Rules, approved by Decree of the Government of the Russian Federation of May 30, 2012 No. 524.

The premium cannot exceed 40 percent of the tariff established for the employer (paragraph 2, paragraph 1, article 22 of the Law of July 24, 1998 No. 125-FZ).

Read also

24.12.2018

Results

- All organizations with employees must send confirmation of their main type of economic activity to the Social Insurance Fund. Individual entrepreneurs and employees confirm the main OKVED code voluntarily.

- The deadline for submitting documents for 2021 is no later than April 15, 2021.

- Within two weeks from the date of confirmation, the Social Insurance Fund sends a notification about the amount of tariffs for contributions for injuries and occupational diseases for the current year.

- If confirmation is not submitted in a timely manner, then contributions will be calculated at the maximum rate from all OKVED codes of the organization specified in the Unified State Register of Legal Entities.

If you still have questions about filling out documents, we recommend that you contact 1C specialists for a free consultation:

Free tax consultation

Stages of the procedure for confirming the direction of work

To notify government agencies about the business profile, a certificate is provided reflecting the essence of the main type of economic activity, a statement and a duplicate of the explanation to the balance sheet. possible below. The procedure itself takes place in several stages.

Confirmation form for the main type of activity in the Social Insurance Fund for 2018

Sample of filling out an application for confirmation of the type of activity

Drawing up a document

Filling out a confirmation certificate for the main type of activity online is described in detail on the civil service website. In the paper version of the document:

- A title page is drawn up indicating the company details.

- Indices of the enterprise's work profile according to OKVED are prescribed.

- The main business direction is indicated.

- The total amount of profit for 2021 for each of the areas is entered.

- Based on the calculations, a table is filled out with the ratio of profit from a specific activity to the total amount of income.

- Its name and OKVED code are written down.

All data must be entered in separate columns.

Submission of documentation

A form reflecting the type of activity in 2021 is submitted to the FSS branch at the place of registration of the organization. Documents can be submitted on the government services website. The filling scheme is indicated in detail on the portal.

The answer comes within 14 days - you can check it in your personal account. The Fund sends a notification about the tariffing of insurance premiums. If an enterprise submits documentation online, a request for a paper version of the notice is allowed.