Confirmation of the type of activity in the Social Insurance Fund in 2021 must be made no later than April 15. This is Wednesday, so this year we will not have to resolve the traditional issue of postponing a deadline that falls on a weekend.

Let us remind you that the law does not contain provisions on “exit” transfers, but the FSS allows it.

To confirm OKVED, you need to submit to the fund (subparagraphs “b”, “c” of paragraph 3 of the Confirmation Procedure, approved by order of the Ministry of Health and Social Development dated January 31, 2006 No. 55):

- statement confirming the main type of activity;

- certificate confirming the main type of activity;

- a copy of the explanatory note to the balance sheet for the previous year (small businesses may not attach it).

Confirmation of the type of activity in the Social Insurance Fund is necessary for the organization as a whole, as well as for each individual enterprise registered with the Social Insurance Fund, and for the individual enterprises specified in clause 7 of Procedure No. 55). This is the essence of confirming the type of activity in the Social Insurance Fund.

The main activity will be the type of activity whose income from the previous year has a greater share. It is according to this that you will be assigned the rate of “unfortunate” contributions for the current year.

Documents confirming the main type of activity can be submitted to the FSS on paper or sent electronically, including through the government services portal or the policyholder’s personal account on the FSS website.

If you do not do this within the prescribed period, the tariff will be assigned to the most dangerous type of activity you declared in the Unified State Register of Legal Entities.

NOTE! Even if you are late, still send the documents to the FSS. If the fund receives them before sending you a tariff notice, it will have to take into account your actual type of activity.

How are contribution rates and types of activities related?

Insurance premium rates are tied to occupational risk classes (Article 21 of the Law “On Compulsory Social Insurance...” dated July 24, 1998 No. 125-FZ), which, in turn, depend on a comprehensive assessment (Clause 4 of the Decree of the Government of the Russian Federation dated December 1. 2005 No. 713) inherent in each type of activity:

- injury level;

- risks of occupational diseases;

- volumes of insurance costs.

That is, the main type of economic activity determines not only the presence to a greater/lesser extent or absence of each of the listed factors, but also the share of its participation in the assessment of the profrisk class. Each type of activity carried out is correlated with its code given in the OKVED-2 classifier.

Profrisk classes are assessed separately:

- for the policyholders themselves;

- their separate (structural) divisions engaged in activities different from the main one.

It is allowed not to change the profit insurance class (and, accordingly, the tariff) established for the year if the policyholder during this year changed the direction of activity that was his main one. But from the beginning of next year, this change will be taken into account by the Social Insurance Fund and will be reflected in the tariff.

How will the Social Insurance Fund receive information about changes in its main activities? From the data provided after the next year by the policyholder himself (clause 11 of resolution No. 713). Submission of such information is mandatory for the policyholder and, in case of failure to provide it, there is a risk that the Social Insurance Fund will independently set a tariff, choosing it according to the highest of the pro-free insurance classes for the types of activities listed in relation to such policyholder in the Unified State Register of Legal Entities (clause 13 of Resolution No. 713).

ATTENTION! New minimum wage.

Who must submit information about the type of activity to the Social Insurance Fund

For those who need to submit information on the type of activity to the Social Insurance Fund, see the diagram.

If the separate entity previously separately confirmed the type of activity and then ignored this obligation, it automatically be assigned the same tariff as the parent company.

If the company did not actually work , it is still advisable to submit a confirmation - with zero certificate. Data for the Social Insurance Fund are valid for 1 year . If the company did not submit information and resumed work within a year, then by the end of this year it will have to pay the highest possible tariff for all its OKVED at the time of renewal.

The individual entrepreneur applies a tariff corresponding to the main OKVED specified in his registration documents. If this OKVED changes, then the individual entrepreneur needs to make timely changes to the Unified State Register of Individual Entrepreneurs. After which the Federal Tax Service will transfer the information to the Social Insurance Fund, where individual entrepreneurs will set a new tariff for a new type of main activity.

Application and confirmation certificate: form and procedure for submission to the Social Insurance Fund

The information submitted to the Social Insurance Fund at the end of each year no later than April 15 consists of (clause 3 of the order of the Ministry of Health and Social Development of Russia dated January 31, 2006 No. 55):

- from an application with a request for confirmation of activity, in which, in addition to the registration data of the policyholder, the OKVED code that he considers to be his main one is indicated;

- confirmation certificate reflecting information about the insured (name, TIN, dates of registration and start of activity, number and place of registration, address, full name of the manager and chief accountant, data on the average number of employees) and information on the distribution by type of activity performed income received over the past year and the number of employees (in absolute numbers and percentages);

- copies of the reporting document confirming the information specified in the certificate (an explanatory note to the balance sheet, from the submission of which small businesses are exempt).

A similar set is formed for structural units allocated for the purpose of paying “unfortunate” contributions to independently accounted units. This allocation occurs in agreement with the fund (clause 9 of order No. 55) provided that (clause 7 of order No. 55):

- the activities carried out by the division differ from the main one;

- the division maintains separate records of data;

- Separate reporting on contributions to the Social Insurance Fund is generated for the division;

- the policyholder has no debts to pay premiums.

Within 2 weeks from the date of submission of a set of documents to confirm the activities being carried out, the FSS must inform the policyholder of its decision on establishing the amount of the insurance premium rate.

If the policyholder does not submit documents for confirmation, the fund will select the maximum possible tariff corresponding to those types of activities that were declared by the policyholder in the Unified State Register of Legal Entities during registration, and will notify the latter about this by May 1. If confirmation is not made in relation to a division, then this division will be assigned the same occupational risk class (and therefore the same tariff) that is established for the main activity.

NOTE! In some cases, policyholders still manage to challenge the maximum tariff.

Forms of documents submitted to the Social Insurance Fund to confirm the activities carried out by the policyholder can be downloaded on our website:

- statements;

Statement

Determining the main OKVED of the organization and filling out a certificate for the Social Insurance Fund

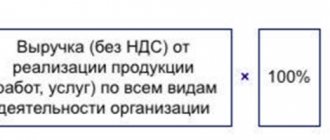

Each Russian organization, as a rule, has more than one OKVED code. Moreover, a legal entity has the right to engage in several areas at once from those specified in the ERGUL. But in the application expected by social insurance, only one code is given. It is quite easy to determine. From the rules approved by Decree of the Government of the Russian Federation dated December 1, 2005 No. 713, it follows that the main type of activity of the organization is that which has the largest share in the total amount of income for the year. This indicator is determined using a special formula:

If there are several such directions, then you should choose the one that corresponds to the highest risk class. The FSS of Russia explained that since new classifiers of types of economic activity >OKVED2 have been put into effect since January 1, 2017, they are indicated in the documents. Policyholders can find the new codes in the notification that social insurance sent in response to submitting documents last year.

In the confirmation certificate, policyholders indicate all types of activities from which they received income during the reporting period. But in the application you need to select the code that accounted for the largest amount of revenue over the past year.

Let's look at how to fill out a certificate confirming the main type of activity. Sample of a completed application from Primer LLC:

In the certificate form, all the basic data of the organization are traditionally indicated first:

- full name;

- TIN;

- legal address;

- average number of employees;

- date of commencement of business activities;

- FULL NAME. manager and chief accountant.

The main part of the certificate is a table in which you must enter the amount of revenue excluding VAT for the year for each OKVED code and indicate the code itself according to the current classifier, and in line 10 provide the full name of the type of activity corresponding to this code. The sixth column of the report is filled out only by non-profit organizations.

The completed certificate looks like this:

Along with the certificate, the legal entity must submit to the Social Insurance Fund an explanation of the balance sheet for 2021. This is necessary to confirm the data specified in it. All documents are certified by the manager with his signature.

Deadlines for confirming the main activity in 2020

The company must confirm the type of activity in the Social Insurance Fund before April 15 of the year following the reporting year (clause 3 of the order of the Ministry of Health and Social Development of Russia dated January 31, 2006 No. 55).

April 15, 2021 - Wednesday. This means that this year the question of the possibility of postponing the deadline will not arise for policyholders. And yet, just in case, we will tell you whether the confirmation period is postponed if the reporting date falls on a weekend or holiday.

So, there are no clear instructions on when to submit documents if the deadline falls on a non-working day in the order of the Ministry of Health and Social Development dated January 31, 2006 No. 55. Because of this, it happened that territorial social insurance funds required reporting before the weekend. But in 2021, the FSS department issued a letter explaining this issue, according to which the period for confirming the type of activity is extended until the next working day (see FSS letter dated 02/08/2017 No. 02-09-11/16-07-2827).

Will there be penalties for late confirmation of the type of activity?

No, there are no penalties for failure to submit a certificate under current legislation. However, as mentioned earlier, the policyholder will pay accident premiums throughout the year at the maximum rate corresponding to the most dangerous class of activity established in his extract from the Unified State Register of Legal Entities.

Why does the FSS need information about the main type of activity?

The Social Insurance Fund continues to administer insurance premiums for occupational injuries and potential accidents at work. And in the event of an insured event - for example, an employee’s work injury - payments to him will come from these funds.

But for different types of work performed, the risk of an insured event is different . It’s one thing to sit in an office with papers, and another, for example, to work as a high-rise installer. different rates (tariffs) of insurance premiums are established for different types of activities

Calculating different types of tariffs for different works for each company and individual entrepreneur is very time-consuming and costly. Therefore, the Social Insurance Fund focuses on the main type of activity - implying that it employs the largest number of employees for whom suitable insurance will be provided in accordance with the real risk.

Risks in the workplace are distributed into classes , each of which has a corresponding contribution rate, which must be paid by the company or entrepreneur with its employees.

To establish the current tariff and check the correct payment of insurance premiums, the FSS needs to know the main type of activity. In principle, the Fund’s specialists can also find it out from the policyholder’s registration documents. But it should be remembered that most companies and individual entrepreneurs have several types of activities indicated in their documents.

Without knowing what the policyholder is actually , the FSS will calculate and collect contributions from him according to the OKVED code indicated in the documents for which the highest tariff is assigned.

To prevent this from happening, policyholders need to regularly report to the Social Insurance Fund about the main actual type of activity. This should be done when registering with the Social Insurance Fund as a payer of contributions for injuries, and then annually .

How to fill out a new OKVED confirmation certificate in 2020

Every year, the FSS authorities review the rate of “accident” insurance premiums at work in relation to each policyholder. The tariff of fees depends on the class of profrisk, which is determined by the main type of activity (BA).

To determine the rate, each legal entity employer, no later than April 15, must submit to the social insurance department an application and a certificate confirming the main type of economic activity, as well as a photocopy of the explanatory note to the balance sheet for the previous reporting period. Documents are submitted by the policyholder in person or via electronic communication channels.

In case of failure to submit a package of papers within the specified period, the FSS will assign the highest tariff, selecting the most dangerous ID from the list of Unified State Register of Legal Entities.

Attention! Individual entrepreneurs do not need to submit a certificate confirming OKVED (clause 10 of the rules for classifying types of economic activities as occupational risk, approved by Government Decree No. 713 of December 1, 2005).

What happens if you don’t confirm your main activity?

There is no responsibility for failure to submit a certificate and application confirming the main type of activity. However, do not rush to rejoice: if you do not submit these documents on time, contributions will be calculated at the maximum rate of all types of activities specified in your Unified State Register of Legal Entities. It doesn’t matter whether you did them last year or not.

Example 4

The organization has 20 types of activities listed in the Unified State Register of Legal Entities, one of which is coal mining. In fact, the company is engaged in retail trade. She did not submit documents confirming her main type of activity, so the FSS assigned the company’s tariff to the highest risk group of all OKVED contained in its Unified State Register of Legal Entities - coal mining. And despite the fact that the company conducts retail trade (1st risk group, tariff - 0.2%), it will pay contributions for “injuries” at the rate approved by the FSS of 8.5% (32nd risk group).

Where can I find a sample of filling out the OKVED confirmation certificate?

The algorithm for confirming the main VD is regulated by Order of the Ministry of Health and Social Development dated January 31, 2006 No. 55, and the certificate form is enshrined in Appendix 2 to this regulatory legal act.

The certificate in question contains information:

- about the policyholder (name, INN and Unified State Register of Legal Entities codes, address, names of the manager and chief accountant, as well as the number of employees);

- distribution of income across the company’s main internal activities;

NOTE! From 01/01/2017, the document must display new OKVED2 codes approved by the order of Rosstandart “On the adoption and implementation of the All-Russian Classifier of Types of Economic Activities (OKVED2)” dated 01/31/2014 No. 14-st.

- selected VD.

Form and sample of filling out the OKVED confirmation certificate.

OKVED confirmation form

Sample of filling out the certificate

Let's sum it up

- Confirmation of the main type of activity is necessary for organizations that have employees registered under employment contracts.

- Individual entrepreneurs and employees will need to confirm the main type of activity only if it is changed in the Unified State Register of Individual Entrepreneurs.

- Confirmation of the main type of activity is necessary until April 15, 2020

- To confirm the main type of activity, you need to fill out a certificate and application, the form of which is approved. By Order of the Ministry of Health and Social Development of the Russian Federation dated January 31, 2006 No. 55.

If you find an error, please select a piece of text and press Ctrl+Enter.

Example of defining the main type of work

The main type of entrepreneurial activity is determined by the legal entity independently. It depends on the VD with the highest share for commercial entities or on the VD with the maximum number of employees for non-profit structures. If a company maintains several VCs, and the specific weight as a result of the calculation is the same, then the highest class of profrisk is selected. Let's look at the algorithm for choosing the main OKVED using an example.

Example:

Assorti LLC carries out the following internal activities:

| Type of work | OKVED code | Sales volume for 2021 (RUB) | Income level (%) | Profrisk class |

| Production of alcoholic beverages | 11.01.1 | 7 550 000 | 40 | II |

| Wholesale trade of alcohol | 46.34.2 | 7 550 000 | 40 | I |

| Retail sale of alcohol in specialized stores | 47.25.1 | 3 740 000 | 20 | I |

| Total | 18 840 000 | 100 |

To determine the rate of “unfortunate” contributions, we select the indicator with the highest share of income. In the example conditions, this is the wholesale trade of alcohol and its production. Since the indicators are equal, we choose a higher occupational risk class, which includes the production of alcoholic beverages, that is, II. The rate of “unfortunate” contributions corresponding to risk class II is 0.3%.

How to confirm OKVED in the FSS for 2021

Eat this frog as soon as possible. What are we talking about? This famous expression by Mark Twain reads in full: “If you eat a frog in the morning, the rest of the day promises to be wonderful, because the worst of the day is over.” Eating a frog means doing some important thing that you just want to put off until later. Confirming OKVED in the FSS for 2021 is also a kind of frog. How to do this, and most importantly why, is in our article.

Why confirm OKVED in the FSS in 2021

Contributions for accidents and occupational diseases, each employer pays at a certain rate. This tariff is set by the Social Insurance Fund annually for each company based on the results of the previous year and depends on the main type of activity. Considering that the tariff can be set from 0.2% to 8.5%, we recommend that you do not ignore this report and submit it.

What happens if you don’t confirm OKVED

If the company does not confirm its main type of activity, then the Social Insurance Fund may establish a maximum tariff for contributions from those OKVED that are indicated in the Unified State Register of Legal Entities. As a result, the company will have to pay extra money to the Fund all year. But wait to be upset, because sometimes the lack of this confirmation does not entail any negative consequences.

If the organization’s OKVED lists do not contain such codes for which high tariffs are set, then there is no particular need to visit the Fund, because a tariff can only be set for the type of activity specified in the Unified State Register of Legal Entities.

When to take it

You need to confirm your OKVED ID with the FSS before April 15, 2021, but we recommend not postponing this until the last two weeks. The fact is that the closer to the end of the deadline for receiving this report, the more people want to submit it and the longer the queue at the fund.

How to submit

Confirmation of the main type of activity in the Social Insurance Fund is the only report at the end of the year that cannot be submitted under the TKS. You can submit it either during a personal visit to the fund, or through the State Services portal, or by mail. The easiest way is to confirm the main type of activity through the State Services portal, but for this you must have a confirmed account and digital signature of a legal entity.

Important! To confirm, the director of the organization does not have to be present at the FSS. This can be done by any employee with a power of attorney from the director.

Is it necessary to confirm OKVED in the FSS IP

All legal entities are required to submit confirmation. But individual entrepreneurs do not have such an obligation. The fund determines the type of activity based on information from the unified register and sets the tariff only for individual entrepreneurs who are employers. If the entrepreneur has changed his main type of activity, then the fund’s specialists still recommend submitting this report and individual entrepreneur.

Documents to confirm OKVED for 2021

You only need to provide two documents to the Social Insurance Fund:

- Statement;

- The confirmation certificate itself

If your company is not a small business, then you must also provide a copy of the explanatory note to the balance sheet.

Important! When submitting an application and certificate in person to the Social Insurance Fund, a fund specialist will immediately issue a notification with the specified tariff. If the documents were sent by mail, the notification will also be sent by mail.

conclusions

In order not to overpay contributions for injuries, we recommend that all companies do not ignore the confirmation of the main OKVED. Our accountants will prepare an application and a certificate, and all you have to do is submit these documents to the Social Insurance Fund. To make this easy, remember a few important rules:

- There is no need to go to the Social Insurance Fund in the last week if you do not want to get into a large queue of directors submitting this report;

- You can entrust the submission of the report to a responsible employee, not forgetting to issue a simple power of attorney for him;

- Provide the documents in two copies so that the FSS inspector can mark your copy with an acceptance mark.

And yet - there are situations when the lack of confirmation will not entail an increase in contributions; our experienced accountants will check whether there is a risk of establishing an increased tariff or not and will always report this to the director. Because the director’s job is to run a business, and the accountant’s job is to help him and protect him from wasting unnecessary time in government agencies.

Rate the article on a 5-point scale

5 out of 5 based on 4 ratings

Why confirm OKVED and who should do it in 2021

The main code according to the All-Russian Classifier of Types of Economic Activities (OKVED) is important for calculating contributions to the Social Insurance Fund. Different types of activities have their own rates of contributions for injuries and occupational diseases. Their size depends on the occupational risk class. There are 32 such classes in total, all of them are designated in the order of the Ministry of Labor of Russia dated December 30, 2016 N 851n. The higher the class, the larger the contributions, and their size ranges from 0.2 to 8.5% of the total amount of payments due to employees.

In 2021, the Social Insurance Fund remains the administrator of contributions for industrial injuries and occupational diseases

When registering, the founders of the organization and entrepreneurs have the right to choose an unlimited number of OKVEDs and indicate them in the application for registration. But the main one will be only one at the applicant’s choice. So it needs to be confirmed by the FSS.

The amount of contributions is calculated according to the main OKVED. In other words: an individual entrepreneur or company has the right to engage in different types of activities and have several codes. But contributions for injuries and occupational diseases will be calculated only according to the basic amount. If, among others, OKVED will be with a higher or, conversely, low risk class, this does not matter.

Who is required to confirm OKVED in the FSS

Legal entities are clearly required to confirm their main OKVED. Moreover, they should do this annually.

The obligation to register with the Social Insurance Fund arises for an individual entrepreneur as soon as he has at least one employee, including under a civil law contract

But with entrepreneurs the situation is different. They are obliged once after passing the state registration procedure to notify the FSS about the code of their main activity, and further actions in this regard are required of them only if they change this OKVED. In other cases, the FSS determines the contribution rate for individual entrepreneurs based on publicly available data from the Unified State Register of Individual Entrepreneurs (USRIP).

There is a widespread belief that individual entrepreneurs with employees must annually confirm the main OKVED in the FSS. But this conclusion is wrong. The presence of employees does not impose additional responsibilities on entrepreneurs, which follows from clause 1 of Order No. 55 of the Ministry of Health and Social Development of Russia dated January 31, 2006, which establishes the procedure for confirming the main type of activity of the insured - namely a legal entity.