The declaration under the simplified tax system is quite easy to fill out. In this article we talk about filling out this tax document line by line. To avoid any difficulties, we will give examples for the main lines of the declaration.

The declaration under the simplified tax system is quite easy to fill out. Reporting persons will have to fill out a cover page and several sections. Below we will talk about filling out this tax document line by line. To avoid any difficulties, we will give examples for the main lines of the declaration. There are problems with solutions and calculations for both individual entrepreneurs and companies.

Recommendations for filling out the declaration are set out in Order of the Federal Tax Service of Russia dated February 26, 2016 No. ММВ-7-3/99.

All cost indicators (tax, income, losses) must be written in full rubles, using mathematical rounding. For example, income of 40,600.51 rubles is rounded up to 40,601 rubles. But the income of 40,600.38 rubles is rounded down to 40,600 rubles.

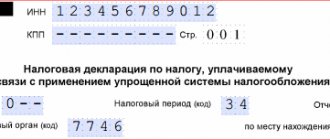

The declaration must be numbered - each page is assigned a serial number, starting from the title page. The first sheet will have a number like “001”, and the eleventh sheet should be designated as “011”. Under no circumstances should corrections be made using a “stroke” (clerical putty). In the top field of each page above the section title, you must enter your Taxpayer Identification Number and Taxpayer Identification Number, if available.

Submit reports using the simplified tax system and take advantage of all the features of Kontur.Externa

Send a request

Title page

In particular, the title page must include the following information:

- Correction number. The number “0” indicates that the declaration is primary. A clarification can be identified if the field contains a number other than zero (for the fourth clarification the number is “4”, for the third – “3”, etc.).

- Tax period code (for companies that continue to operate, you need to select code “34”).

- Tax office code (take it from the registration notice. If the notice is not at hand, the tax authority code can be found on the Federal Tax Service website).

- Code for the place of submission of the declaration (120 - for individual entrepreneurs; 210 - for organizations).

- Full name of the enterprise or full name of the businessman (Limited Liability Company "Elka", Individual Entrepreneur Artemy Stepanovich Senkin).

- OKVED code. It can be easily found in an extract from the Unified State Register of Legal Entities (USRIP) or determined using the OKVED classifiers. An extract from the Unified State Register of Legal Entities can be obtained by sending a request to the Federal Tax Service via the Internet or by coming in person. Persons combining several modes must indicate the OKVED code corresponding to their type of activity on the simplified tax system.

- Numerical code of the reorganization or liquidation form (leave it blank if there were no specified circumstances).

- TIN/KPP of the reorganized organization (if there were appropriate circumstances).

- Phone number.

- How many pages does the declaration have?

- How many sheets are there in supporting documents?

All possible codes involved in the declaration are included in the appendices to the filling procedure.

For signatories of the declaration, codes are assigned: “1” - if the signature is placed by a manager or individual entrepreneur, “2” - if the signature in the declaration belongs to a representative of the taxpayer.

When a declaration under the simplified tax system is submitted at other times

The declaration under the simplified tax system must be submitted once a year. In general, organizations need to do this by March 31, and entrepreneurs by April 30. If the deadline for submitting reports falls on a weekend or non-working day, submission is postponed until the next working day. There will be no shift in deadlines in 2021.

There are exceptional cases in which reporting must be submitted earlier.

The organization or individual entrepreneur has completed its activities . The declaration must be submitted by the 25th day of the following month after the closure of the company. Provided that a notice of termination of activity has been submitted to the tax office. In this case, when filling out the declaration, on the title page in the “Tax period” column, enter code 50 “Cessation of activity.”

An organization or individual entrepreneur was forced or deliberately switched to OSNO this quarter . The declaration must be submitted by the 25th day of the month after the quarter in which the right to “simplified” was lost. For example, you violated the criteria for applying the simplified tax system in August, which means you must submit a simplified declaration before October 25th. On the title page of the declaration, in the “Tax period” column, enter code 95 “Transition to a different taxation regime.”

We told you under what conditions and in what order companies switch from the simplified tax system to the OSNO.

An organization or individual entrepreneur ceases business on a simplified basis . If an organization or entrepreneur changes the type of activity and stops working on a simplified basis, two documents are submitted to the tax office: a notice of termination of activity on the simplified tax system within 15 working days and a declaration on the simplified tax system no later than the 25th day of the month following the one in which the activity ceased .

Section 1.1

Although sections 1.1 and 1.2 of the declaration go directly after the title page, they must be completed after the data is reflected in subsequent sections. This is explained by the fact that these sections are, as it were, summary and collect the final data from the remaining sections.

Section 1.1 will only be needed by taxpayers working on the simplified tax system for “income”.

In line 010, as well as in lines 030, 060, 090, OKTMO is supposed to be indicated. The last three lines indicated are filled in only when the address changes.

OKTMO occupies eleven cells in the declaration. If there are fewer digits in the code, dashes are placed in unoccupied cells (to the right of the code).

In line 020, the accountant enters the amount of advance tax for the first three months of the year.

The payer enters the advance payment for the half-year in line 040. Do not forget that the advance payment for the first quarter must be subtracted from the amount of the advance payment for the half-year (otherwise there will be an overpayment). By the way, the advance must be paid no later than July 25th.

During a period of crisis or downtime, it is likely that the advance payment for the first quarter will be greater than that calculated for the first half of the year (due to a decrease in income). This means that the amount to be reduced will be written down in the line with code 050. For example, for the first quarter, Elka LLC sent an advance of 2,150 rubles, but at the end of the six months, the advance was only 1,900 rubles. This means that you don’t need to pay anything, and in line 050 the accountant of Elka LLC will write down 250 (2,150 - 1,900).

The algorithm for filling out line 070 is similar to the algorithm for line 040, only information is entered here for 9 months. Line 080 stores information about the tax to be reduced for 9 months.

Line 100 summarizes the year and records the amount of tax that needs to be written off from the current account in favor of the Federal Tax Service. Line 110 is useful if advances exceed the tax amount for the year.

Based on the results of 2021, Elka LLC must send a “simplified” tax in the amount of 145,000 rubles to the budget. However, during the quarters advances were made in the amounts of RUB 14,000, RUB 18,500 and RUB 42,300. This means that in total Elka LLC will have to pay an additional 70,200 rubles (145,000 - 14,000 - 18,500 - 42,300).

Section 1.2

Fill out Section 1.2 if your object is “income minus expenses.”

The principle of filling it out completely repeats the principle of filling out section 1.1.

Lines 010, 020, 060, 090 contain OKTMO.

Tax advances are recorded in lines 020, 040, 070. The timing of their payment does not depend on the object of taxation - it is always the 25th.

Entries are made in lines 050 and 080 if prior payments to the budget exceeded the advance for the current period.

The only difference between the described section and section 1.1 is line 120. In it you need to indicate the amount of the minimum tax (1% of income). For example, with an annual income of 10,000 rubles and expenses of 9,500 rubles, the tax payable by Elka LLC will be only 75 rubles ((10,000 - 9,500) x 15%). If you calculate the minimum wage, you get 100 rubles (10,000 x 1%). Elka LLC must pay exactly the minimum tax, naturally reducing it by the amount of advances. If the company had advances in the amount of 30 rubles, then in line 120 the accountant will indicate 70 (100 - 30).

If advances based on the results of three quarters of the year exceed the minimum tax, line 120 is crossed out.

Section 2.1.1

It is needed as part of the declaration only for those categories of payers who pay income tax. Please note that persons paying a trade tax in addition to tax will not need this section.

So, it is advisable to fill out a declaration under the simplified tax system starting from this section.

In line 102 you must indicate one of two characteristics of the taxpayer:

- code “1” - for companies and individual entrepreneurs with employees;

- code “2” - exclusively for individual entrepreneurs without employees.

Lines 110–113 collect information about income for the first quarter, six and nine months, and the year. The main principle: all income and expenses are recorded on an accrual basis. Using the example of Elka LLC, we will show what income is on an accrual basis. Initial income data: I quarter - 13,976 rubles, II quarter - 24,741, III quarter - 4,512 rubles, IV quarter - 23,154 rubles. To fill out lines 110–113, the accountant at Elka LLC will add the current value to the previous value. So, in line 110 the accountant will write 13,976, in line 111 - 38,717 (13,976 + 24,741), in line 112 - 43,229 (38,717 + 4,512) and in line 113 - 66,383 (43,229 + 23,154 ).

The tax rate is fixed in lines 120–123.

Line 130 records the tax advance for the first quarter. Lines 131–133 reflect advances and tax. How to calculate them is indicated directly on the declaration form to the left of the corresponding line.

In lines 140–143, entries are made about the amounts of insurance premiums, sick leave and payments for voluntary personal insurance. An accountant of any company must remember that the amount of tax and advances can be legally reduced by the amount of these expenses, but not more than 50%. Elka LLC has calculated the annual tax, and it is equal to 74,140 rubles. Contributions for employees amounted to 68,324 rubles, and the sick leave of director Stas Igorevich Kopeikin amounted to 17,333 rubles. Total expenses amounted to 85,657 rubles (68,324 + 17,333). The accountant of Elka LLC decided to take advantage of the legal right and reduced the tax. For this, accountant Olkina S.T. calculated half of the amount of expenses, which turned out to be 42,829 rubles (85,657: 2). The amount received is more than half the tax (74,140: 2 = 37,070). This means that Olkina S.T. can reduce the tax by only 37,070. Elka LLC will have to pay 37,070 (74,140 - 37,070) to the budget. In line 143, the accountant will enter the amount 37,070, not 42,829.

Let us add that individual entrepreneurs in lines 140–143 reflect contributions for themselves. Single entrepreneurs have a special advantage - they can reduce taxes by 100% of contributions transferred to the budget. Individual entrepreneur Semechkin V.O. (without employees) for the year, according to preliminary calculations, should send 36,451 rubles to the budget, the contributions paid amounted to 17,234 rubles (this is exactly the amount Semechkin paid). Individual entrepreneur Semechkin V.O. reduced the tax on contributions (by 17,234) and transferred 19,217 rubles (36,451 - 17,234) to the Federal Tax Service.

IP on OSNO

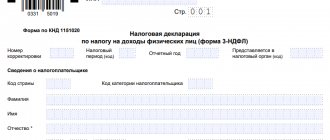

An individual entrepreneur who has not submitted a notification to the tax office about the transition to a certain regime automatically switches to the OSNO regime. Individual entrepreneurs in the general taxation system are required to report on income received in VAT and 3-NDFL declarations.

VAT declaration

The VAT report is submitted to the Federal Tax Service every quarter. If the registration of an individual entrepreneur occurred less than 10 days before the end of the quarter, the first report should be submitted only at the end of the next quarter.

That is, if an individual entrepreneur opened on December 24, 2021, the report is submitted at the end of the first quarter - until April 25, 2021 inclusive, indicating transactions for December.

If an individual entrepreneur is registered more than 10 days before the end of the quarter, the first report is submitted before January 25.

Declaration 3-NDFL

3-NDFL is due every year until April 30. An entrepreneur who registered an individual entrepreneur at the end of the year transfers personal income tax only at the end of the next year.

Section 2.1.2

If you pay a trading fee, then this section is for you.

All income is noted in lines 110–113. Definitely on a cumulative basis. For which period to record income, the explanation for the line indicated in the declaration form will tell you.

Also, as in section 2.1.1, taxpayers who have ceased operations or lost the right to work on a simplified basis duplicate income for the last reporting period in line 113, and the tax is repeated in line 133.

Similar to section 2.1.1, in line 130 you need to indicate the tax advance for the first three months of the year, and in lines 131–133 - payments for the following periods. The accountant will see the calculation formula directly under the specified lines in the declaration form.

In lines 140–143 you need to indicate the amounts of payments, the list of which is presented in clause 3.1 of Art. 346.21 Tax Code of the Russian Federation. It is on these payments that the tax can be significantly reduced. But there is a limitation here: it is legal to reduce the tax by no more than 50% of the specified payments. Elka LLC has calculated the annual tax, and it is equal to 74,140 rubles. Contributions for employees amounted to 68,324 rubles, and sick leave for director Stas Igorevich Kopeikin amounted to 17,333 rubles. Total expenses amounted to 85,657 rubles. The accountant of Elka LLC decided to take advantage of the legal right and reduced the tax. For this, accountant Olkina S.T. calculated half of the amount of contributions and sick leave, which turned out to be 42,829 rubles (85,657: 2). The amount received exceeds half the tax (74,140: 2 = 37,070). This means that Olkina S.T. can reduce the tax by only 37,070. Elka LLC will have to pay 37,070 (74,140 - 37,070) to the budget. In line 143, the accountant will enter the amount 37,070, not 42,829.

Enter the trading fee directly in lines 150–153. Enter the fee here if it has already been paid. Lines 160–163 will tell you about the amount of the trade fee, which reduces the tax and advances on it. Depending on the indicators, these lines can take different values. Which ones exactly, the formula under the lines in the declaration will tell you.

Section 2.2

If you pay tax on the difference between income and expenses, then this section is for you. Let us briefly describe the lines to be filled in. Remember that we count and record data on an accrual basis.

Lines with codes 210–213 are income for the reporting periods.

Lines with codes 220–223 are expenses, the list of which is given in Art. 346.16 Tax Code of the Russian Federation.

Line with code 230 - loss (part of it) for past tax periods. By declaring a loss, you can legally reduce your tax base.

Lines with codes 240–243 are the tax base. Let’s say the income of OOO “Sova” amounted to 541,200 rubles, expenses - 422,000 rubles, and the loss of the previous period - 13,400 rubles. The accountant of Sova LLC calculated the tax base: 541,200 - 422,000 - 13,400 = 105,800 rubles.

If at the end of the year the amount turned out to be a minus sign, the amount of the loss should be indicated in lines 250–253. Let’s say the income of OOO “Sova” amounted to 422,000 rubles, expenses - 541,200 rubles. The accountant of SOVA LLC calculated the tax base: 422,000 - 541,200 = - 119,200 rubles. The result was a loss.

Lines with codes 260–263 are the tax rate (usually 15%).

Lines with codes 270–273 are tax advances.

Line with code 280 is the amount of the minimum tax. It is not paid if it turns out to be lower than the tax itself according to the simplified tax system. LLC "Sova" in 2021 received income of 470,000 rubles, confirmed expenses amounted to 427,300 rubles. Accountant Filina A. Yu. calculated the tax: (470,000 - 427,300) x 15% = 6,405 rubles. Next, Filina A. Yu. calculated the minimum tax: 470,000 x 1% = 4,700 rubles. As we can see from the calculations, the minimum tax is less than the accrued tax. Therefore, the accountant of Sova LLC will transfer 6,405 rubles to the Federal Tax Service account (provided that there were no advances previously).

Declaration for individual entrepreneurs on the simplified tax system

Reporting under the simplified system consists only of a declaration according to the simplified tax system. It is submitted annually, the report for 2021 must be sent by April 30, 2021 inclusive. The declaration is submitted every year, and advance payments are paid quarterly.

We recommend reading: Taxes and reporting of individual entrepreneurs on the simplified tax system 6% + what is considered income and how to work with primary documents.