What forms to use

All Russian companies and private entrepreneurs operating vehicles are required to maintain waybills. Freight transport is no exception. “Voucher” is a document confirming the expenses incurred for the operation and maintenance of the vehicle, and fuel consumption. The completed form is the basis for calculating wages to the driver.

For each type of vehicle, individual forms of a unified form have been developed and approved (Decree of the State Statistics Committee of November 28, 1997 No. 78). According to Law No. 402-FZ of December 6, 2011, it is not necessary to use the approved forms; the organization has the right to independently develop and approve the form, taking into account the special specifics of the enterprise’s activities. In practice, the vast majority of institutions and individual entrepreneurs use unified forms.

For trucks, there are two forms of vouchers approved by the State Statistics Committee: No. 4-S (OKUD 0345004) and No. 4-P (OKUD 0345005). Truck waybills (form 2020) of form No. 4-C are used by organizations in which drivers are paid on a piece-rate basis, and form 4-P is used for time-based payment. It is possible that both forms may be used in one institution.

Requirements for sheet design

If material assets are transported during the voyage, waybill should be entered in the waybill form 4-M and a copy of it should be attached to the sheet. This is necessary for the subsequent calculation of the driver’s wages based on the transported cargo tonnage. The tear-off coupon contained in the waybill is used to present an invoice for payment for services provided to the customer. The customer's representative enters information into the waybill and tear-off coupon, on the basis of which an invoice for payment for transportation services is issued. It is prohibited to correct or change the information included in the voucher, so as not to create problems when crossing international borders, since during customs inspection the actual contents of the cargo are inspected, comparing it with what is stated in the documents.

According to the Order of the Ministry of Transport of the Russian Federation dated December 21, 2021, it is no longer necessary to put a stamp when adding medical examination data performed before and after the trip waybill for intercity transportation It is enough that authorized persons sign for them and indicate their full names. Instead of the term “permanent parking,” the wording “parking” should now be used. And if you need to issue waybills for several drivers of one car, then the departure data is indicated on the ticket of the driver who leaves the parking lot first, and the car’s arrival data is indicated on the sheet of the driver who enters the parking lot last.

New filling rules

IMPORTANT!

As of March 1, 2019, changes to the rules for filling out vouchers for all types of transport came into force. The Ministry of Transport of Russia introduced innovations by Order No. 467 of December 21, 2018 into the main regulations on vouchers - Order No. 152 of September 18, 2008.

Previously, legislators established a list of mandatory details, without which a document can be considered void. In addition, the relevant orders have abolished the mandatory affixing of a company's official or round seal on a voucher, if the charter of a budgetary organization does not provide for the use of a seal.

If the document does not contain all the required details, then traffic police officers have the right to fine the owner of the car and the driver. Tax officials will also not accept the document as proof of expenses; they will recalculate the tax base and issue a fine.

Information required to be filled out in the 2021 truck voucher form:

- Name and number of the document, date of formation (extract). The chronological order should be strictly observed when numbering vouchers.

- The validity period of the document, that is, the period for which it was issued, but not more than one flight or work shift.

IMPORTANT!

From 03/01/2019 the validity period of the voucher has been changed. Previously, the document was issued for a period of up to 1 month inclusive. Now issue a ticket for only one flight, regardless of how many days this flight lasts. Or for one work shift, regardless of the number of flights made during the working period.

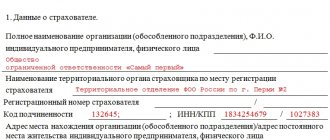

- Full details of the owner of the vehicle, including OGRN (OGRNIP - for private owners).

- Car driver details: Full name and a valid driver's license number.

- Information about transport: license plate, make.

- Odometer data before leaving and upon returning to the garage.

IMPORTANT!

As of March 1, 2019, it is no longer necessary to certify odometer readings with a seal or stamp. The signature of the responsible employee is sufficient.

- The exact date and time of the start of the flight and return to the garage.

- Signature, full name and the position of the responsible employee who took and recorded the odometer readings, date and time.

- Date and time of the driver's medical examination before departure and upon return.

- Signature and full name the medical professional who performed the examination. If available, a stamp is affixed, but it became optional as of 03/01/2019. All you need is the signature of a health worker.

- Information about passing a technical inspection before departure on a flight in DD/MM/YYYY format, as well as hours and minutes.

IMPORTANT!

Such inspection has become optional for passenger vehicles operated for the company’s own needs. A note on pre-trip, pre-shift and post-trip control is optional. But for commercial carriers and enterprises operating buses and trucks for their own purposes, it is mandatory.

- Signature and full name person responsible for vehicle inspection (mechanic, inspector, foreman).

The document is always drawn up in a single copy. The completed form is certified by the manager and a round stamp is placed (if available). The completed ticket is handed over to the driver. At the end of the trip (fulfillment of the task), the driver hands over the document to the responsible person of the budget organization for signature. A new sheet should not be issued until the driver reports on the previous one.

Below you will find a ready-made sample of filling out a truck waybill 2021.

Sample form of a truck waybill

There are 2 forms of waybill issued in relation to a vehicle with a permissible maximum weight of more than 3500 kg:

- 4-C – used for cargo transportation if the customer pays for the work of the truck based on piece rates;

- on the contrary, Form 4-P is used when paying for auto work on a time schedule and is designed for simultaneous execution of tasks for 2 different customers within 1 working day (shift).

Both forms are presented in Resolution of the State Statistics Committee No. 78 of November 28, 1997 “On approval...”.

Directly filling out blank forms is carried out in accordance with Order of the Ministry of Transport No. 152 of September 18, 2008 “On approval...” (hereinafter referred to as the Order), which, among other things, talks about mandatory details.

Some features:

- the forms of these primary documents contain tear-off coupons - they are filled out by the customer of cargo transportation;

- The organization that owns the truck, in order to receive payment for the services performed for the transportation of goods, presents the customer with an invoice with a tear-off coupon attached;

- when filling out form 4-P (when paying for time-based services for the operation of a truck), the numbers of the waybills are entered in the PL + 1 copy of this documentation is attached as a copy;

- both forms - 4-C and 4-P, as a rule, are issued for 1 working day (shift) and only on the condition that the truck driver has submitted a waybill for the previous working day (shift);

- in some cases, registration of a DP is allowed for a period not exceeding 1 month;

- mandatory requirement - the PL must contain the date of issue, stamp and seal of the company that owns the truck;

- The storage of waybills is carried out in the organization that owns the truck together with the shipping documentation in such a way that they can be checked simultaneously.

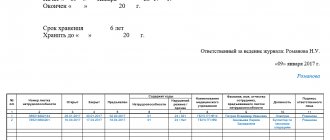

Photo: sample form 4C

.

Photo: sample form 4P

.

Features of accounting and storage of documentation

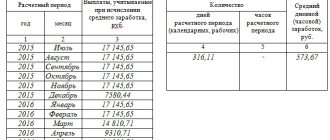

Vouchers should be taken into account in the voucher registration log. The form of the form can be developed independently and approved in the accounting policy. Or use unified documentation in Form No. 8 (OKUD 0345008), approved by Resolution of the State Statistics Committee of November 28, 1997 No. 78.

The procedure for filling out the travel voucher log is based on the chronological registration of all issued forms in the organization. In a separate order, assign someone responsible for compiling the journal. If a budget organization uses its own journal form, then the procedure for filling it out should also be approved. The responsible person should be familiarized with this procedure and signed.

Keep vouchers and registration logs for at least 5 years - such requirements are specified in Order of the Ministry of Transport of Russia dated September 18, 2008 No. 152. For the lack of documentation, tax authorities can fine you 200 rubles for each document.

Required details

The company that owns the truck has every right to develop and approve its own waybill form.

It is recognized as valid only if it contains the mandatory details required by law.

In Part 1 of Art. 6 Federal Law No. 259 dated November 8, 2007 “Charter...” (hereinafter referred to as Federal Law No. 259) states that such details are approved by the federal executive agency exercising powers to develop federal policy and legal regulation in the field of transport (that is, the Ministry of Transport).

Clause 2 of the Order states that the mandatory details apply to:

- individual entrepreneurs;

- legal entities.

Their full list is presented in paragraph 3 of the Order:

| Required details | A comment |

| Name and number of waybill | Everything is simple here - the number is indicated internally in accordance with the numbering adopted by the organization that owns the truck |

| Information about its validity period | The date during which the PL can be used must be indicated, and if the sheet is issued for a period of more than 1 day, the start and end dates of validity |

| Information about the organization or individual owner of the truck | Legal entities indicate their name, legal form, location address, contact telephone number and OGRN, individual entrepreneurs indicate their full name, postal address, telephone number and OGRNIP |

| Data about the truck itself | Vehicle type (truck), model, license plate, odometer readings and dates of leaving and entering the garage, date of pre-trip inspection (if a trailer is also used, its model must be indicated) |

| Information about the driver directly involved in cargo transportation | Full name, date and time of the pre-shift and post-shift medical examination of the driver of the vehicle |

In addition to the mandatory ones, an individual entrepreneur or an organization that uses its own form in its work may include additional details in the waybill form due to the specific nature of the activity.

Liability and penalties

The manager, as well as responsible employees, are responsible for the correctness, reliability and completeness of the information specified in the documentation. A correctly drawn up voucher is not only the basis for writing off expenses, but also confirmation that the vehicle is in good working order, the driver has the right to drive the car, has passed a medical examination, etc.

A traffic police officer will issue a fine in the amount of 500 to 3,000 rubles for an unprovided or incorrectly compiled waybill (Article 12.3 of the Code of Administrative Offenses of the Russian Federation). And if Federal Tax Service employees discover significant errors in filling out vouchers, they will exclude expenses incurred on them, recalculate the income tax base and issue a fine. Also, if you do not submit documents for a desk audit to the Federal Tax Service, the organization faces a fine of 200 rubles for each document.