The Pension Fund has developed the SZV-STAZH report, which is intended to collect data on the insurance experience of individuals. This report must be provided after the end of the year or at the time the employee retires. Below, in this article, you can familiarize yourself with the features of generating a special SZV-STAZH report.

Please note that the SZV-STAZH report for the past year must be submitted before March 1 of the next year. If the enterprise was liquidated before the end of the current year, then the report must be provided for the period of existence of the organization (that is, for an incomplete year). In addition, the form can be provided earlier than the deadline if, for example, an employee of the company is about to retire. In this case, the report must be made and submitted within the next three days from the moment the employee contacts the policyholder.

In the SZV-STAZH report under consideration in the 1C 8.3 ZUP program, data must be generated on all citizens with whom not only civil law, but also employment contracts were concluded. Information regarding length of service is filled in automatically by the program on the basis of various documents generated in 1C 8.3 ZUP (we are talking about documents drawn up during hiring, upon dismissal, personnel transfer of employees, upon going on vacation, on sick leave, and so on ).

The special report must always include Form EDV-1. It should be noted that it is not an independent form. This form accompanies the experience report and a host of other types of reporting. This EFA-1 form includes five different sections. When submitting it simultaneously with the SZV-STAZH form, the following sections must be completed:

- List of documents included in the report.

- Reporting period (code is indicated here).

- Exact details of the policyholder who submits the documents.

If your company employs people who are applying for early retirement, then in the EDV-1 form Section 5 “Basics for reflecting data on the periods of work of the insured person under conditions that give the right to early pension assignment” must be completed.

Checking the organization's details to generate the SZV-STAZH report

It is first necessary to find out whether the details of the organization and the Pension Fund in which the enterprise was registered were filled out correctly. To do this, you need to go to the “Settings” section in the 1C 8.3 ZUP program. Next, you need to click on the “Organizations” link. After this, a list of companies will appear in front of the user.

In the window that just opens, you need to double-click on your company. Next, the user will see a detailed company card.

Next, you need to find the “Main” tab and check the name, INN, OGRN.

After this, the user needs to go to the “Funds” tab and check:

- Registration number of the Pension Fund in which the specific organization was registered.

- Name of the Pension Fund.

- The exact code of the territorial body of the Pension Fund.

SZV-KORR

SZV-KORR in 1C 8.3 - where to find

To submit an adjustment based on information about insured persons after accepting the initial SZV-STAZH report, go to the section:

- Reports – Regulated reports;

- Salaries and personnel – Accounting documents.

SZV-KORR in 1C 8.3 - how to fill out

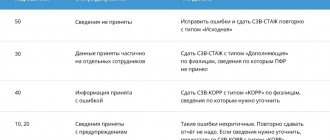

Indicate the current reporting and adjusted periods. Specify what adjustments are entered in the Information type :

- Corrective - if the period was indicated incorrectly, etc.;

- Cancelling - cancels any data;

- Special - they forgot to provide information about the employee.

To reflect the employee for whom information is being adjusted, use the Selection .

To change and check data, double-click on the Employee and go to Edit employee data .

The entered deviations will be reflected automatically; if necessary, correct the data manually.

Be sure to check your report before uploading and submitting.

After accepting the Pension Fund report, check the appropriate box. After this, the document will close from editing.

Check the SNILS of employees to form SZV-STAZH in 1C 8.3

To generate the SZV-STAZH report, it is necessary to indicate SNILS for all individuals for whom information was submitted. To enter or correct SNILS in the 1C 8.3 ZUP program, you need to go to the “Personnel” section and click on “Personnel reports”. Next, a report window will appear in front of the user.

In the window that just appears, you need to click on the link “Personal data of employees.” Next, a window will appear for creating reports to verify the information.

Next, the user needs to select the relevance date, company and press the “Generate” button. After this, a report with personal information will be generated.

If during the check errors were identified in the SNILS information for a particular employee, then you need to double-click on it. This will help open his personal card.

You need to correct the required information in your personal card and click on the “Record and close” button.

Personnel accounting and payroll calculation in 1C 8.3 ZUP 3.1

In 2021, for the second time, we will prepare the annual report of SZV-Stazh. It replaced data on length of service, which was filled out quarterly until 2021 in RSV-1.

And in this publication we will look at where exactly the information in 1C 8.3 ZUP 3.1 comes from for filling out the SZV-Stazh , so that if necessary, you can quickly and easily correct the initial information and automatically fill out the report.

✅ Seminar “Lifehacks for 1C ZUP 3.1”

Analysis of 15 life hacks for accounting in 1C ZUP 3.1: Find out more ->>

✅ CHECKLIST for checking payroll calculations in 1C ZUP 3.1

VIDEO - monthly self-check of accounting: Find out more ->>

✅ Payroll calculation in 1C ZUP 3.1

Step-by-step instructions for beginners: Find out more ->>

✅ All free seminars on 1C ZUP 3 ->>

Video version

VIDEO CONTENT:

00:20 — loading full name/SNILS into the report; 01:03 - the principle of determining periods of service in 1C ZUP 8.3; 04:59 - principle of filling out service period codes 07:13 - a feature of reflecting absenteeism in the SZV-Existence of Absenteeism ; 09:10 - filling out territorial conditions and related information during periods of service; 12:30 - filling out the SZV-Experience for employees with harmful/difficult working conditions ; 15:00 - filling out the “ Early assignment of pension ” tab in the SZV-Experience form in 1C ZUP 3.1; 17:11 - a feature of accounting in SZV-Experience of employees under a GPC agreement .

Full article:

Let's start with the fact that the report is generated in the 1C-Reporting report log (menu section Reporting, references - 1C-Reporting ). When selecting reports by recipient, it is located in the Pension Fund folder; when selecting by category, in the “Reporting by Individuals” folder.

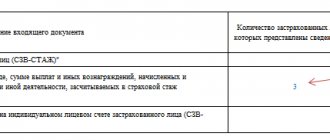

Filling out your full name and SNILS in SZV-STAZH

The report is filled out by all individuals with whom an employment contract or civil servants' agreement has been concluded. Filling out the full name and SNILS in the report comes from the data in the directory of individuals, so if an error is found in these details, you need to correct them in the directory and refill the report.

It is also worth noting that for the annual report, the Information Type is indicated: Initial.

Filling out information about the employee's length of service

Information about the length of service of employees can be viewed by double-clicking on the line with this employee. A separate window will open. The information here in 1C ZUP 3 is filled out from the information register Parameters of PFR service periods . And this register is filled out on the basis of documents: Hiring, Dismissal, Personnel transfer, Vacation, Sick leave, Vacation at your own expense and other documents that determine the parameters of employee periods of work .

For example, employee Karpov S.S. was on vacation from 07/24/2017 to 08/06/2017. The Vacation document was registered, which made the corresponding movement in the Pension Fund of Russia Service Period Parameters , which in turn determined the completion of the period of service in the report.

Completing codes for work periods Some periods (like vacation in the previous example) are distinguished by special codes, which are defined in the rules for filling out SZV-Stazh. In 1C ZUP 3, these codes are set in the settings of accrual types on the tab Time tracking in the props Type of Pension Fund experience and can be redefined if necessary.

For example, for the accrual type Absenteeism By default, the type of experience “Not included in the insurance experience” is indicated. And the length of service for such an employee will be interrupted.

of experience of a self-employed worker may not be edited. It was used previously (until 2014) to fill out reports to the Pension Fund during that period.

If you specify “Unpaid period” in the accrual type settings and repost the documents that reflected absenteeism, then the period of absenteeism will be highlighted with the code UNOPL.

Information about territorial conditions in SZV-Stazh

✅ Seminar “Lifehacks for 1C ZUP 3.1”

Analysis of 15 life hacks for accounting in 1C ZUP 3.1: Find out more ->>

✅ CHECKLIST for checking payroll calculations in 1C ZUP 3.1

VIDEO - monthly self-check of accounting: Find out more ->>

✅ Payroll calculation in 1C ZUP 3.1

Step-by-step instructions for beginners: Find out more ->>

✅ All free seminars on 1C ZUP 3 ->>

This information is loaded into the report from the Organization and/or the Division . If an employee is accepted or transferred to an Organization/Division where Territorial Conditions are specified in the settings, then from the date of acceptance/transfer until the end of the period of work in this territory, the employee’s length of service will be highlighted with the appropriate code.

For example, employee Afanasyev A.P. transferred for a month (September 2017) to a separate unit, which has the territorial conditions of the ISS. In this case, the experience for September will be highlighted with the ISS code.

It is also worth noting that if an employee is transferred or accepted into such a Division/Organization on a part-time basis, then the SZV-Stazh position will still be filled.

It should be understood that the number of rates for the SZV-Experience report is determined not by the number of rates that is indicated in the Personnel Transfer , but is calculated as the ratio between the length of the working week established for the part-time schedule of this employee to the length of the working week of the schedule according to which is considered the norm (it is indicated in the settings of the part-time work schedule).

In addition, for such employees in SZV-Stazh it is necessary to manually fill in information about the time actually worked .

It is also worth noting that territorial conditions can also be set in the Territories directory if you use the accounting mechanism by territory.

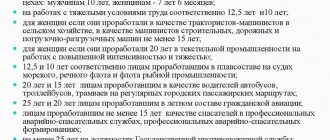

Special working conditions and list position code in SZV-Stazh This information is filled out for employees working in harmful or difficult working conditions. They are selected from the position of the staffing table , if the staffing table is maintained in the program. If maintaining the staffing table is disabled, then from the Positions .

By the way, here, if necessary, the Grounds for early assignment of a pension , which are also filled out in SZV-Stazh.

Also, the list of positions with early assignment of pensions is listed on the Early assignment of pensions the SZV-STAZH report. Information for filling it out is also taken from the Staffing Schedule . The column Number of jobs determines the number of positions with early pension assignment planned in the staffing table. And in the column Number of employees is the number that is actually employed by employees. The columns Nature of work performed , as well as Primary documents, are filled out on the basis of the data filled in in the details of the same name at the level of staffing positions.

It is worth noting that if the staffing table is not maintained in ZUP 3, then the Number of jobs will have to be filled in manually, since the program will have nowhere to get information about the number of planned positions.

Features of filling employees working under a GPC agreement

For employees working under a GPC agreement in SZV-Stazh, the period is highlighted by the code - CONTRACT. In this case, the length of service is determined by the period of validity of the contract, based on the period in the Contract (work, services) document.

For example, an employee has been issued a civil service contract for the period from 12/01/18 to 01/31/19. This is indicated in the Contract (work, services) document.

When filling out SZV-Stazh, it is on the basis of this information that the reporting period will be filled in. In this case, when filling out reports for 2021, the period from 12/01/18 to 12/31/18 will be shown using the code CONTRACT .

The period from 01/01/2019 to 01/31/2019 will be shown in the reporting for 2021.

However, if the contract began in one period, and accrual occurred in another, then the length of service in the period when there were no accruals for the employee must be reflected with the code - NEOPLDOG . For example, if for the employee in question the accrual occurred only in January 19 (i.e. there were no accruals in 2021), then the period from 12/01/18 to 12/31/18 in the report for 2021 for this employee must be marked with the code NEOPLDOG. This is done manually in the program.

To be the first to know about new publications, subscribe to my blog updates:

or join groups on social networks, where all materials are also regularly published:

- in contact with;

- YouTube channel;

- classmates.

- facebook;

Best regards, Dmitry Gerasimov!

If you liked the publication, you can save a link to it on your page on social networks. To do this, use the “Share” located just below.