5,00

5

| Reviews: | 0 | Views: | 12259 |

| Votes: | 1 | Updated: | n/a |

File type Text document

Document type: Statement

?

Ask a question Remember: Contract-Yurist.Ru - there are a bunch of sample documents here

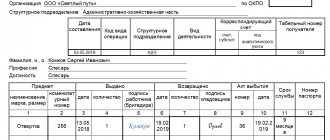

Form No. MB-7 Approved by Decree of the USSR State Statistics Committee dated December 28, 1989 No. 241 +———-+ OKUD code ¦ ¦ +———-+ RECORDING REPORT FOR THE ISSUANCE (RETURN) OF SPECIAL CLOTHING, SPECIAL FOOTWEAR AND SAFETY DEVICES +——————————————-+ ¦ Number ¦ Month,¦Type code¦Workshop, department,¦ ¦ ¦document¦ year ¦operation¦ site ¦ ¦ +———+——+———+————+——¦ +——————— ———————-+ +———————————————————————+ ¦ Number ¦Fami-¦Ta- ¦Workwear, ¦ Unit ¦Co- ¦Date ¦Term ¦Submission, ¦linen-¦safety shoes and ¦measurements¦or- ¦post- ¦service¦sign ¦ ¦order¦name, ¦safety ¦honest¦stupid ¦ ¦ in ¦ ¦ ¦ in ¦ in ¦ ¦ in ¦ ¦ in ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ in ¦ ¦ ¦ ¦ ¦ in ¦ +——— —-+———¦ ¦splu-¦ ¦(delivered- ¦ ¦ ¦ ¦name-¦nomen-¦code¦nai- ¦ ¦ata- ¦ ¦che) ¦ ¦ ¦ ¦ ¦new- ¦clatu-¦ ¦ change ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦rn ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦No. ¦ ¦ ¦ ¦ ¦ ¦ ¦ +——-+——+——+——+——+—+——+——+——+——+——¦ 1 ¦ 2 ¦ 3 ¦ 4 ¦ 5 ¦ 6 ¦ 7 ¦ 8 ¦ 9 ¦ 10 ¦ 11 ¦ ¦ ¦ +——¦ +——+—¦ +——+——+——¦ ¦ +——-+——+——+—— +——+—+——+——+——+——+——¦ +——-+——+——+——+——+—+——+——+——+— —+——¦ +——-+——+——+——+——+—+——+——+——+——+——¦ ¦ ¦ ¦ ¦ ¦etc. ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +——+ +———-+ +——————+ ¦ Financially responsible person __________________________________ Print with the back without the heading part. Signature printed on the back. COMMENTS: ———— Used to record the issuance of workwear, safety shoes and safety equipment to enterprise employees for individual use according to established standards and their return during automated processing of credentials. It is filled out in two copies by the storekeeper of the workshop (department, section) separately for the issuance and return of workwear, safety shoes and safety equipment and is documented with the appropriate signatures. One copy is transferred to the accounting department, the second remains with the storekeeper of the workshop (department, section). The same form is used to keep records of workwear accepted from employees for washing, disinfection, repair and summer storage.

Download the document “Sample. Record sheet for the issuance (return) of workwear, safety footwear and safety equipment. Form No. MB-7"

Regulatory regulation of the issuance of personal protective equipment

| Normative act | Scope of regulation |

| Labor Code of the Russian Federation Art. 221 | Providing workers with PPE |

| Order of the Ministry of Health and Social Development of Russia dated June 1, 2009 N 290n | Defines the rules for issuing PPE |

| Resolution of the State Statistics Committee of the Russian Federation dated October 30, 1997 N 71a | Approves form MB-7 |

| Order of the Ministry of Finance of the Russian Federation dated December 26, 2002 N 135n | Approves accounting maintenance |

From 01/01/2013, primary documentation forms do not have to be used directly in the form established by law , that is, organizations have the right to independently develop and apply forms that are convenient for themselves, but they must be approved in the organization’s local documents.

Use of Form N MB-7 in an organization

A statement in form N MB-7 is necessary to correctly reflect in accounting the movement of these items in the enterprise through their issuance for individual use by employees.

Due to the fact that at the regulatory level it is mandatory and necessary to provide specialized protective equipment to employees, which are provided by the employer depending on the harmfulness and danger of the organization’s activity (there are free standards for issuing), it is necessary to ensure correct accounting of their movement.

Providing workers with masks and gloves: who is obliged to do this and on what basis

Before talking about the register for registering the issuance of masks to employees during coronavirus and the rules for its registration, it is necessary to determine who is obliged to provide workers with such protective equipment. For most employers, now that the high alert regime has been lifted in the regions, there is no requirement to provide masks and gloves to all subordinates. But there is Art. 25 of the Federal Law of March 30, 1999 No. 52-FZ “On the sanitary and epidemiological welfare of the population,” which, although it does not explain in detail how to issue masks to employees during coronavirus and in what quantity, obliges individual entrepreneurs and organizations to provide safe working conditions for subordinates, in including the purchase of personal protective equipment to prevent infectious diseases.

At the same time, special conditions have been defined for certain categories of employers, such as:

- pharmacies, on the basis of clause 6.4.2 of the Order of the Ministry of Health dated October 21, 1997 No. 309, issue medical masks to employees during periods of the spread of acute respiratory infections;

- public transport and any crowded places - clause 1.3 of the Decree of the Chief Sanitary Doctor dated March 30, 2020 No. 9 requires that workers be provided with masks and respirators.

Read more: Coronavirus masks

General requirements for filling out the MB-7 form

Form MB-7 is a table filled out by the responsible person. Like all primary documentation, such an accounting statement must comply with the general procedure for preparing primary documentation in accordance with Article 9 of the Federal Law of December 6, 2011 N 402-FZ :

- name of the form (in full)

- start date of statement compilation

- name of the organization and structural unit where the document was drawn up

- information reflected in the document

- quantities and units of measurement

- position, signature, transcript of the person (materially responsible) responsible for registration

- position, signature, transcript of the head of the department where the document was compiled

All cells are required to be filled out. If there is no data in individual cells, then a dash is added.

Special requirements for filling out the MB-7 form

Form MB-7 is used at the enterprise mainly when processing accounting data in an automated form.

This form must be filled out in 2 copies by the person who is materially responsible (MRO) , for example, in the person of the storekeeper of a structural unit, while 1 completed copy of the form is provided to the accounting department by the person responsible for the movement of the IBP, the second, as a fact of the accuracy of the information, remains with MOL.

Special equipment, clothing and shoes belong to the group of low-value and wearable items, which, like all property of the enterprise, are subject to inventory. Depending on the field of activity, the employee is obliged to follow special requirements, rules, instructions of occupational safety and health, that is, if he needs to use the provided personal protective equipment in his work.

By virtue of Art. 21 of the Labor Code of the Russian Federation, the employee is obliged to comply with labor protection and occupational safety requirements.

Ministry of Labor and Social Protection of the Russian Federation P.S. Sergeev

The procedure for filling out the table of form MB-7

The basic information of the form is presented in the table, where the following information is entered in order:

- serial number of issue (in chronological order)

- Full name of the employee

- employee personnel number

- identification characteristics of personal protective equipment

- Name

- nomenclature number

- unit

- code

- name of the unit of measurement

- number of items issued for each item

- date of entry (transfer) into operation

- PPE service period

- confirmation of receipt or delivery of PPE with the employee’s signature

Important! When an employee receives special protective equipment, financial responsibility is transferred to him for the period of operation. If an employee refuses to receive PPE, the employer may face disciplinary action.

Why do you need a record sheet for issuing special clothing?

A statement is an accounting document that allows you to track the movement of workwear within the company, monitor its use and safety.

Working clothes are classified as fixed assets and are included in the group of low-value and wearable items.

Each employee of the enterprise, before starting a shift, signs for the receipt of workwear, and after the end of the working day returns it. In this case, one or another set of workwear can be assigned to a specific employee.

An example of the design of a table of the MB-7 form

| Number in order | Full Name | Personnel Number | Working clothes, safety shoes and safety devices | Unit | Quantity | Date of entry into service | Life time | Signature on receipt (delivery) | ||

| Name | item number | code | Name | |||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

| 1 | Bakeev R.R. | 111 | Mittens | 012345 | 001 | PC | 1 | 01.06.2021 | 2 | Bakeev |

| 2 | Akhmerov V.V. | 123 | Mittens | 012345 | 001 | PC | 1 | 01.06.2021 | 2 | Akhmerov |

Accounting for workwear, safety footwear and special devices

In accounting, the movement of personal protective equipment is reflected in the debit of account 10 “Materials” (in this case, the sub-account “Special equipment and special clothing” is opened) and the credit of production cost accounts (accounts 20, 23, 25, etc.) at the actual cost (expenses) for its production, calculated on the basis of the cost calculation method used at the enterprise for the corresponding type of product.

Write-offs are made in accordance with the Accounting Policy adopted by the organization.

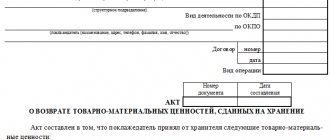

Personal clothing issuance card: and sample

The front side of the PPE issuance registration card contains the information:

- about the employee (full name, personnel number, position), place and start date of his work, moves to another position or location;

- employee parameters necessary to purchase PPE of the required size (height, size of clothes, shoes and other PPE);

- details of the document justifying the standards for issuing PPE;

- list of personal protective equipment required by the employee in accordance with the standards.

The reverse side reflects data on the actual movement of PPE for a specific employee: issuance of PPE, its return to the warehouse.

For information about the situation in which information about issued PPE may be required, read the article “Procedure for registering an industrial accident .

A sample of filling out a personal PPE card for an employee is available on our website.

If PPE is not constantly in demand, but is needed for periodic use (for example, during periodic work or visits to sites by inspectors or a manager), a card with the entry “On duty” can be created for them instead of the employee’s data.

A personal PPE card is also available on our website.

On our forum you can find out how your colleagues fill out and maintain various documentation. Here, for example, is a thread where they share their experience in filling out a personal registration card for issuing PPE .

Example for writing off personal protective equipment

To perform a labor function during the summer period, employee A.A. Andreev. issued 04/01/2021:

- light jacket - 1 piece, service life 18 months, cost 5,000 rubles.

- gloves - 1 pc., service life 6 months, cost 300 rubles.

And accepted for storage at the winter workwear warehouse on 04/01/2021:

- insulated jacket - 1 pc., service life 18 months (used for 4 months: December-March), cost 9,000 rubles.

- fur gloves - 1 pc., service life 6 months, cost 300 rubles.

Due to the specialization of the organization, subaccounts were opened on account 10: Special clothing in warehouse and Special clothing in use. The following transactions will be made in the organization:

| Debit | Credit | Operation | Amount, rub. |

| 10 / “Special clothing in use” | 10 / "Special clothing in stock" | Special clothing issued | 5300 |

| 10 / "Special clothing in stock" | 10 / “Special clothing in use” | Workwear put into storage | 9300 |

| 25 | 10 / “Special clothing in use” | The cost of the insulated jacket was partially written off | 2000 |

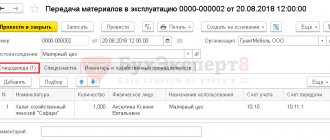

Accounting for workwear in software "1C: Enterprise Accounting 8" edition 3.0

and accounting policies of the enterprise. Third category: workwear included in fixed assets (useful life of more than 12 months, costing more than 40,000 rubles). Workwear belonging to the first category is taken into account as part of inventories, regardless of cost (clause

2 Guidelines). At the same time, it can be written off to cost accounting accounts at a time in order to reduce the labor intensity of accounting work ().

Workwear, which belongs to the second category, is taken into account as part of inventories, but cannot be written off at a time to cost accounts. Its cost is repaid in a straight-line manner based on the useful life stipulated in the standard industry standards for the free issuance of workwear, as well as in the rules for providing workers with workwear (clause

26 Guidelines). To ensure control over the safety of workwear after its commissioning, it is recorded on an off-balance sheet account (clause

23 Guidelines). In the 1C: Accounting 8 program, for these purposes, the off-balance sheet account MTs.02 “Working clothes in use” is used. Workwear, which belongs to the third category, is accounted for in the manner used for accounting for fixed assets. The cost of workwear belonging to the first and second categories is included in material costs at a time as they are put into operation (clause

3 p. 1 art. 254 of the Tax Code of the Russian Federation). Please note: As a result of taking into account the second category of workwear, a temporary difference arises, because

in accounting, the cost of such workwear is written off gradually (in a linear manner), and in tax accounting, the write-off is performed at a time (material expenses). The third category of workwear is reflected as part of depreciable property.

Answers to common questions

Question No. 1 : How to formalize the issuance of special clothing that was rendered unusable by an employee through his own fault?

Answer : If an employee, who is obliged to treat his workwear with care, as well as all the property of the organization, has intentionally rendered it unusable, then it is necessary to contact the manager, and a commission is appointed that decides to write off the cost to the employee, but during the investigation it is necessary provide an available spare kit. If the investigation does not establish intentional damage, but poor quality, then the cost of PPE is not written off to the employee.

Question No. 2 : Is it possible to issue workwear to an employee for the summer and winter periods without taking it into storage?

Answer : Working clothes, as a rule, require special storage conditions. Therefore, some types of clothing cannot be given to employees for storage at home, as well as for washing or cleaning. Features of storage and care of special devices are regulated by GOSTs for protective equipment. And the movement of clothing is reflected in the MB-7 form and the personal card of the employee for issuing special equipment

Workwear: everything about issuance, accounting and write-off

We will show in the table what you may face for the identified violations. Violator For failure to provide workers with personal protective equipment that is subject to declaration of conformity (first risk class); ; For failure to provide workers with PPE, which are subject to mandatory certification (second risk class); ; For a repeated similar offense Organization

- warning;

- fine from 50,000 to 80,000 rubles.

Fine from 130,000 to 150,000 rubles.

- fine from 100,000 to 200,000 rubles;

- suspension of activities for up to 90 days

IP

- warning;

- fine from 2000 to 5000 rubles.

Fine from 20,000 to 30,000 rubles.

- fine from 30,000 to 40,000 rubles;

- suspension of activities for up to 90 days

Supervisor

- fine from 2000 to 5000 rubles.

- warning;

Fine from 20,000 to 30,000 rubles.

- fine from 30,000 to 40,000 rubles;

- disqualification for a period of 1 to 3 years

The employer must issue workwear according to the standard standards that are provided for its type of activity. Only if the professions or positions of your employees are not included in the relevant standard standards, workwear is issued according to the standards for cross-cutting professions (positions) of all sectors of the economy.

You will find standard standards for the free issuance of special clothing, special shoes and other personal protective equipment to employees: And if in these standards the employer does not find the corresponding professions (positions), then you need to be guided by the standard standards for workers whose professions (positions) are typical for those performed by your work employees. In addition, the employer can establish its own standards for issuing workwear, but on the condition that they improve the protection of workers compared to the standard ones (for example, they provide a higher quality of protection). Your own increased standards must be approved by order (or other local regulatory act).