Variable business expenses

Return to Selling expenses

Variable selling expenses are a type of cost, the value of which, unlike fixed costs, changes with changes in production volumes. Variable and fixed costs add up to total costs. The main feature that determines variable costs is their disappearance when production stops.

Examples of business expenses:

• Costs of raw materials and materials. • Costs of energy and fuel consumed during the production process. • Wages of workers involved in production.

As a first approximation, we can assume that variable costs grow in direct proportion (linearly) with an increase in production volumes and sales of products. Thus, when calculating the break-even point, a proportional increase in variable costs with increasing volume is assumed.

The break-even point in physical terms is 20 units of some products. With such a volume, profit (green line) is equal to 0. With a smaller volume (to the left), the enterprise’s activities are unprofitable, and with a larger volume (to the right), it is profitable.

The increase in variable costs does not always occur in proportion to the increase in volumes; for example, if a night shift is introduced when production volumes increase, then the pay for the night shift is higher than for the day shift.

There are proportional variable, regressive variable and progressive variable costs:

• Proportional costs - increase at the same rate as the volume of production and sales of products. For example, if production volume increases by 10%, proportional costs will increase by 10%.

• Regressive variable costs - Their growth rate lags behind the volume growth rate.

Fixed production costs: examples

Fixed costs are those expenses that remain unchanged regardless of the volume of products produced, even during downtime these expenses are incurred. When summing up fixed and variable costs, the total costs are obtained, which form the cost of manufactured products.

Examples of fixed costs:

- Rental payments.

- Property taxes.

- Office staff salaries and others.

But fixed costs are such only for short-term analysis, since over a long period costs may change due to an increase or decrease in production, changes in taxes and rents, and so on.

Management expenses of a trade organization

A trading organization, like any other, incurs commercial and administrative expenses in the process of conducting business. In general, for the former in accounting, account 44 “Sales expenses” is intended, for the latter - account 26 “General business expenses”. However, as practice shows, trading organizations (we are talking about companies that are engaged exclusively in the purchase and sale of goods) often reflect not only commercial, but also administrative expenses on account 44. Is this approach correct?

The rules for the formation in accounting of information on the expenses of commercial organizations, including those engaged in trading activities, are established by PBU 10/99 “Expenses of an organization” <1>. According to paragraph 4 of this document, the expenses of the organization, depending on their nature, conditions of implementation and areas of activity of the organization, are divided into expenses for ordinary activities and other expenses (that is, those expenses that are not expenses for ordinary activities).

<1> Approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 33n.

Expenses for ordinary activities are considered to be expenses related to:

- with the manufacture and sale of products;

- with the purchase and sale of goods;

- with the performance of work (provision of services).

Based on this classification, for an organization engaged in trading activities (purchase and sale of goods), expenses for ordinary activities include expenses associated with the acquisition and sale of goods . In other words, all expenses (unless they are other) should be considered associated with the acquisition and sale of goods.

Based on clause 7 of PBU 10/99, expenses for ordinary activities are added up:

- from expenses associated with the acquisition of raw materials, supplies, goods and other inventories;

- from expenses arising directly in the process of processing (refinement) of inventories for the purposes of production (performance of work, provision of services) and their sale, as well as sale (resale) of goods. These are expenses for the maintenance and operation of fixed assets and other non-current assets, as well as for maintaining them in good condition, commercial expenses, administrative expenses, etc.

In the profit and loss statement, expenses are reflected subdivided into the cost of goods sold (products, works, services), selling expenses, administrative expenses and other expenses (clause 21 of PBU 10/99). In p.

The role of cost accounting when developing a business plan

Planning the expenditure side of a project is one of the most time-consuming parts of business planning. When drawing up a business plan, you will need to specify not only the amount of fixed and variable expenses , but also take into account investment investments, which to some extent are also associated with fixed expenses.

Let us explain how this relationship manifests itself. Investments are, as a rule, one-time capital investments, the value of which is also indirectly included in the cost of finished products through depreciation charges. Thus, investment investments, as well as fixed expenses, are “stretched” as part of the cost over a certain payback period.

Taking into account all expenses when planning a project is also fundamentally important because the relationship between the amount of expenses, investments and income from the project is the basis for determining the possible amount of profit and the feasibility of the project.

The indicators of financial calculations also depend on the correct distribution of expenses among variable and fixed items. At the same time, if the business plan has an automatic financial model, it will be possible to easily trace the change in the share of fixed expenses in the cost of production, the change in the total amount of expenses depending on the change in the volume of manufactured products.

Our company is developing standard business plans, including a business plan for a bottled beverage store. In it you will find calculations of all financial and investment indicators.

Selling expenses

Selling expenses (also called selling expenses) are expenses associated with the sale of finished products (non-manufacturing expenses), the acquisition and sale of goods (distribution costs). In accordance with the Instructions for using the Chart of Accounts, account 44 “Sales expenses” is intended to summarize information on expenses associated with the sale of products (goods, works and services). The comments to this account indicate that organizations engaged in trading activities can reflect expenses (distribution costs) on account 44:

- for the transportation of goods (transportation costs). This may include:

- expenses associated with payment for transport services of third-party organizations for the transportation of goods (payment for transportation, delivery of wagons, weighing of goods);

- expenses for payment for the services of organizations for loading goods into and unloading vehicles, fees for forwarding operations and other similar services;

- the cost of materials spent on vehicle equipment (shields, hatches, racks, shelving) and insulation (straw, sawdust, burlap);

- expenses for temporary storage of goods at stations, piers, ports, airports, etc.;

- expenses associated with the maintenance of access roads and non-public warehouses;

- for remuneration of the main trade and production personnel of the organization, taking into account bonuses for production indicators, incentive and compensatory payments and payment of insurance premiums;

- for the rental and maintenance of buildings, structures, premises, equipment and inventory. Such expenses include:

- rental costs of trade and warehouse buildings, buildings and premises, structures, equipment and inventory and other individual fixed assets;

- costs for heating, lighting, water supply, sewerage and other utilities;

- expenses for keeping premises clean, cleaning adjacent areas (yards, streets, sidewalks), garbage removal;

- the cost of items and means for maintaining the premises (lime, mastic, burlap, brushes, brooms, brooms, etc.);

- the cost of electricity consumed to drive lifts, elevators, conveyors, vending machines, cash registers, etc.;

- expenses for checking and marking scales, water meters, electric gas meters and other measuring instruments;

- expenses for maintenance and repair of alarm devices;

- expenses for fire safety measures;

- payment to third-party organizations for fire and security guards (warehouses, shops, etc.);

- expenses for maintenance by third parties of lifting and transport mechanisms and other equipment;

- for storage, part-time work, sub-sorting and packaging of goods. This includes:

- the actual cost of materials (wrapping paper, bags, glue, twine, nails, shavings, sawdust, straw, wire) consumed during part-time work, processing, sorting, packaging and packaging of goods;

- fees for the services of third-party organizations for packaging and packaging of goods;

- expenses for the maintenance of refrigeration equipment (cost of electricity, water, lubricants, etc.), payment for the services of third-party organizations for the maintenance of refrigeration equipment;

- actual cost of ice consumed to cool goods;

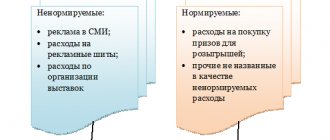

- for advertising:

- for the design of shop windows, exhibitions, sales exhibitions, product sample rooms;

- for the development and printing of advertising publications (illustrated price lists, catalogues, brochures, albums, prospectuses, posters, posters, advertising letters, postcards, etc.);

- for the development and production of sketches of labels, samples of original and branded bags, packaging, etc.;

- for advertising events through the media (ads in print, broadcasts on radio, television);

- for illuminated and other outdoor advertising;

- for the acquisition, production, copying, duplication and demonstration of advertising films and videos, etc.;

- for the production of stands, dummies, billboards, signs;

- for markdowns of goods that have completely or partially lost their original quality during display in shop windows, sales areas of stores and at exhibitions;

- entertainment expenses;

- other expenses similar in purpose.

The organization writes off the expenses accumulated on the debit of account 44 to the debit of account 90 “Sales”:

- or completely. This is also stated in paragraph 9 of PBU 10/99: commercial expenses can be recognized in the cost of sold products, goods, works, services in full in the reporting year of their recognition as expenses for ordinary activities. Note that the same goes for management expenses;

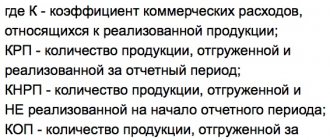

- or partially. With this method of writing off commercial expenses from trading organizations, transportation costs are subject to distribution (between the goods sold and the balance of goods at the end of each month). It turns out that the organization classifies transportation costs as semi-variable expenses. The remaining expenses (conditionally fixed) associated with the sale of goods are charged monthly to the cost of goods sold.

Let us emphasize that commercial expenses are written off to the debit of account 90, because it is there that the cost of goods sold is formed (when revenue from the sale of goods is recognized in accounting, their cost is written off from account 41 “Goods” to the debit of account 90). The only thing: you need to decide whether they are written off monthly in full or distributed (in terms of transportation costs) taking into account the balance of goods.

Impact of expenses on production costs

So, you have listed all the expenses of your business. Now let's see what role fixed and variable costs play in cost. It is necessary to go through all the fixed costs and see how the structure of the enterprise can be optimized so that less management personnel are involved in production during the production process.

The breakdown of fixed and variable expenses above shows where to start. You can save on energy resources either by switching to alternative sources, or by modernizing in order to increase the level of equipment efficiency.

After this, it’s worth going through all the variable costs, tracking which of them are more or less dependent on external factors, and which can be calculated with confidence.

Once you understand the cost structure, you can easily transform any business to suit the needs and requirements of any owner and his strategic plans.

If your goal is to reduce product costs in order to win several positions in the sales market, then you should pay more attention to variable costs.

Of course, as soon as you understand what constitutes fixed and variable expenses, you will be able to easily navigate and quickly understand where you need to “tuck your tails between your legs” and where you can “loose your belts.”

General running costs

Now let's talk about management costs, which mean expenses associated with managing and maintaining an organization. These costs do not depend on sales volume, but on the structure of the organization, the activity of the administration’s business policy, and the duration of the reporting period. How should the sales organization classify these costs?

In accordance with the Instructions for using the Chart of Accounts, account 26 “General business expenses” is used to summarize information about expenses for management needs not directly related to the production process (these are management expenses). This account may reflect:

- administrative and management expenses;

- expenses for maintaining general business personnel not related to the production process;

- depreciation charges and expenses for repairs of fixed assets for management and general economic purposes;

- rent for general business premises;

- expenses for payment of information, auditing, consulting, etc. services;

- other administrative expenses similar in purpose.

The comments to account 26 indicate that the expenses recorded on this account are written off, in particular, to the debit of accounts 20 “Main production”, 23 “Auxiliary production” (if auxiliary production produced products and work and provided services to the outside), 29 “Service industries and farms” (if service industries and farms performed work and services outsourced). There is a second option for writing off general business expenses: as semi-fixed expenses, they are written off in full to the debit of account 90.

Please note: the above recommendations apply to organizations that are involved in the production process. On account 26, such companies record expenses that are not directly related to this process (these are so-called overhead costs). However, we are considering a situation where the company is engaged in trading activities (not involved in the production process).

The instructions for using the Chart of Accounts contain some exception to the general rule. Organizations whose activities are not related to the production process (commission agents, agents, brokers, dealers, etc., except for organizations engaged in trading activities) , use account 26 to summarize information on the costs of conducting this activity. These organizations write off the amounts accumulated on this account as a debit to account 90. Thus, the Instructions, in essence, indicate that trade organizations cannot use account 26 to summarize information on expenses for their activities that are not related to production process.

How production costs affect the cost of goods

After a financial model of the future enterprise has been created, it is necessary to analyze the influence of variable and fixed costs on the cost of manufactured goods. This allows you to reorganize the company's activities in order to optimize the production process. Such an analysis will help you understand how many personnel will be required to complete a particular task.

Dividing costs into fixed and variable is one of the most important tasks of financial departments of companies

Such a plan allows you to determine the required level of investment in the development of the organization. You can reduce the cost of energy resources by using alternative sources, as well as by purchasing more modernized equipment that has a high efficiency. Next, it is recommended to analyze variable expenses in order to determine their dependence on external factors. These actions will help identify those costs that can be calculated.

All of the above actions allow us to better understand the cost structure of the enterprise, which allows us to modify the organization’s activities in accordance with the chosen development strategy. The main goal is to reduce the cost of manufactured goods in order to increase the number of products sold.

Drawing conclusions

Considering that the organization we are interested in is engaged exclusively in trading operations, all expenses, except for the cost of purchasing goods, should be considered related to the purchase and sale of goods and must be taken into account in accounting on account 44. Such an organization will use account 26 only if it begins to carry out other activities related to the production process.

At the same time, this does not mean that all these expenses should be indicated as business expenses in the income statement. An enterprise may well decide to reflect both commercial and administrative expenses in this form if this information is important to users of the statements (to be more precise, relevant). Where does this come from?

In accordance with clause 6.1 of the Concept of Accounting in the Market Economy of Russia <2> the information generated in accounting should be useful to users.

Information is considered useful if it is relevant, reliable and comparable. From the point of view of interested users, information is relevant if its presence or absence has or is capable of influencing the decisions (including management) of these users, helping them evaluate past, present or future events, confirming or changing previously made assessments. In turn, the relevance of information is influenced by its content and materiality.

<2> Approved by the Methodological Council on Accounting under the Ministry of Finance of Russia, the Presidential Council of the IPB RF on December 29, 1997.

Since Russian accounting legislation is rapidly moving closer to the requirements of IFRS, we consider it appropriate to look at IAS 1 “Presentation of Financial Statements” <3>, in which we are interested in the section “Information to be presented in the statement of comprehensive income or in the notes”. In accordance with paragraph 99 of this Standard, an entity must present an analysis of expenses recognized in profit or loss using a classification based on either the nature of the costs or their function within the entity, whichever provides reliable and more relevant information . That is, we find the same requirement - relevance.

<3> Put into effect on the territory of the Russian Federation by Order of the Ministry of Finance of Russia dated November 25, 2011 N 160n.

In IAS 1, enterprises are offered a choice of one of two options for disclosing information about expenses in the statement of comprehensive income for the period (for us this is the profit and loss statement) (company management chooses the most appropriate and reliable way of presenting information).

The first form of analysis is the “cost nature” method. It aggregates expenses based on their nature (for example, depreciation of fixed assets, purchases of materials, transportation costs, employee benefits, and advertising costs). This method is considered easy to implement because costs are not reassigned based on their functional classification.

The second form of analysis is the cost function or cost of sales method, which classifies costs according to their function as a component of cost of sales or, for example, distribution or administrative costs. When using it, an enterprise must, at a minimum, disclose its cost of sales separately from other expenses. An example of classification based on the cost function method is as follows:

| Indicator name | ||

| Revenue | X | |

| Cost of sales | (X) | |

| Gross profit | X | |

| Other income | X | |

| Sales costs | (X) | |

| Administrative expenses | (X) | |

| other expenses | (X) | |

| Profit before taxes | X | |

As we can see, it is this form of analysis that is used by Russian companies when reflecting expenses in the income statement. IAS 1 paragraph 103 describes this method as providing users with more relevant information than classifying expenses by nature. However, its use may require arbitrary allocation and significant professional judgment.

O.V. Davydova

Journal expert

"Trade:

Accounting

and taxation"

Conditional classification of production costs

In fact, it is quite difficult to draw a clear line between variable and fixed costs with some certainty. If production costs change regularly during the operation of the enterprise, it is recommended to consider them semi-fixed and semi-variable costs. Do not forget that almost every type of cost has elements of certain expenses. For example, when paying for Internet and telephone communications, you can find out the constant share of the required costs (monthly package of services) and the variable share (payment depending on the duration of long-distance calls and minutes spent in mobile communications).

Examples of basic expenses of a conditionally variable type:

Subtypes of expenses

- Variable expenses in the form of components, necessary materials or raw materials in the manufacture of finished products are defined as conditionally variable costs. Fluctuations in these costs are possible due to rising or falling prices, changes in the technological process, or reorganization of production itself.

- Variable costs related to piecework direct wages. Such costs change in quantitative terms and due to fluctuations in wage payments when daily standards increase or decrease, as well as when the incentive share of payments is updated.

- Variable costs, including a percentage share to sales managers. These costs are always changing, since the size of payments depends on sales activity.

Examples of basic expenses of a semi-fixed type:

- Fixed expenses for payments for renting space vary throughout the entire period of operation of the organization. Costs can either increase or decrease, depending on the increase or decrease in rental costs.

- The accounting department's salary is considered a fixed cost. Over time, labor costs may increase (which is associated with quantitative changes in staffing and expansion of production), or they may decrease (when accounting is outsourced).

- Fixed costs can change when they are moved to variable costs. For example, when an organization produces not only goods for sale, but also a certain proportion of components.

- The amounts of tax deductions also vary. Property tax may increase due to rising costs of space or due to changes in tax rates. The size of other tax deductions considered fixed expenses may also change. For example, transferring accounting to outsourcing does not imply the payment of salaries, and accordingly, there will be no need to accrue unified social tax.

The above types of semi-fixed and semi-variable costs clearly demonstrate why these costs are considered conditional. During his work, the owner of the enterprise tries to influence changes in profits. For example, to reduce costs and increase profits, at the same time the market and other external conditions also have a certain impact on the activities of the enterprise.

As a result, costs regularly change under the influence of certain factors, taking the form of costs of a semi-fixed or semi-variable type.

It is advisable to maintain a balance between expenses from the very beginning of the enterprise. Remember, in order not to need to take out a loan or bank loan, you need to rationally approach the analysis of fixed and variable expenses. Since it is precisely this that allows you to build the most effective financial plan for the company.

Top

Write your question in the form below

Business expenses include expenses for the following operations:

— packaging and packing of finished products;

— delivery of products to the departure station;

— loading into vehicles;

— commissions to intermediary organizations;

— maintenance of premises for storing products at points of sale;

— remuneration of salespeople in production organizations;

— carrying out analyzes of products during their release;

— advertising;

— entertainment expenses;

— procurement, delivery and transportation of goods in trade organizations;

— wages in trade organizations;

— rental of retail premises and finished product warehouses;

— maintenance of retail premises and finished product warehouses;

— storage of goods;

— insurance of shipped goods and commercial risks;

— covering shortages of goods within the limits of natural loss;

— maintenance of procurement and receiving points;

— keeping livestock and poultry at reception points and bases;

- other expenses similar in purpose.

Commercial expenses are monthly fully or partially written off from account 44 “Sales expenses” to the debit of account 90 “Sales”, subaccount 90-2 “Cost of sales”. The write-off procedure is established by the organization's accounting policy.

Variable expenses

Such costs are those that vary in direct proportion to the volume of products produced or services provided.

For example, in the balance sheet there is such a line as raw materials and materials. They indicate the total cost of those funds that the enterprise needs for production activities.

Let's assume that you need 2 square meters of wood to produce one wooden box. Accordingly, to create a batch of 100 such units of product you will need 200 sq.m of material. Therefore, such costs can be safely classified as variable.

Wages can relate not only to fixed, but also to variable expenses. This will happen in cases where:

- the changed volume of production requires a change in the number of employees employed in the manufacturing process;

- workers receive percentages that correspond to deviations in the working standard of production.

Under such circumstances, it is quite difficult to plan the amount of labor costs in the long term, since it will depend on at least two factors.

Also, in the process of production activities, fuel and various types of energy resources are consumed: light, gas, water. If all these resources are used directly in the manufacturing process (for example, the production of a car), then it would be logical that a large batch of products would require an increased amount of energy consumption.

useful links

►Economic literature◄ ►Methodology of financial analysis◄ ►Manual on financial statements◄ ►Largest joint stock companies in Russia◄

The main measures to reduce costs (costs associated with production) are:

1. Stopping unprofitable production;

2. Introduction of innovative, resource-saving, low-waste (or non-waste) technologies. For example, switching from heating using electricity to heating with gas; replacement of gasoline engines in cars with gas equipment; firing office workers and hiring freelancers; installation of IP telephony; transferring employees from regular computers to laptops (or netbooks); use of energy-saving lamps, etc.

3. Purchasing raw materials and supplies at lower prices and on more favorable terms, as well as optimizing the scheme for their purchase and transportation;

4. Reducing costs associated with storage and ownership of inventories (rental of warehouse premises and their maintenance, logistics costs, insurance, etc.) and equipment. For example, choosing a room with optimal characteristics (ceiling height, flat floor, convenient location)

at the lowest price; proper placement of equipment and supplies; more complete use of production capacity (including the transition to three-shift work); optimization of costs for equipment maintenance and repair. If possible, it is suggested to save on finished products if you can work to order; on work in progress, if the production process is not too long; on raw materials and materials, if the speed of their acquisition does not cause downtime.

5. Automation of enterprise activity planning by purchasing or creating appropriate computer programs. As a result, the planning process will be cheaper, a system for rationing all operations in production activities will be introduced, the registration and inventory of inventories will be automated, the enterprise will get rid of excess inventory and will not allow downtime in production.

6. Reducing inventory losses due to obsolescence, damage (rotted, burned, physically damaged)

, theft and uncontrolled use.

Variable and fixed costs of an enterprise in examples and explanations

If there is a stock that will soon spoil, it is proposed to return it to the supplier, reduce the price on it, set a premium for its sale, sell it to a competitor, intensify an advertising campaign for its sale, throw it away to free up space in the warehouse.

7. Reducing the number of defective products. For example, the introduction of quality control for raw materials and materials, increasing the level of responsibility of the organization’s personnel, compliance with technology and production regulations, timely and high-quality debugging and cleaning of equipment, etc.

8. Tightening control. For example, installation of electricity, water and gas meters for all main areas of activity; compiling maps of energy costs per shift and comparison with other shifts and previous reporting periods; justification of the need for each type of expense, implementation of control over the physical and moral condition of inventories; increasing control over the timely execution of planned expenses.

The main measures to manage commercial expenses (costs associated with the sale of products (usually when they are reduced, sales volume also decreases, so all measures to manage them must be fully justified)

) are:

1. Optimization of the enterprise personnel motivation system. Namely, the division of salaries into permanent and bonus parts. In this case, the share of the bonus should be from 30% to 80% of the total salary (depending on the position). Introduction of a point-rating system that provides for the awarding of points for the performance of job duties (depending on the quality and quantity of work performed). As a result, if an insufficient number of points is collected, fines, reprimands and dismissals of employees should follow; if their number is in an acceptable range, only the main part of the salary should be paid, and if it is exceeded, the bonus part.

2. Using only those advertising measures that bring profit to the company.

3. Application of the most profitable product distribution schemes. For example, closing retail space and selling goods from a warehouse or delivering them to order; purchasing retail space instead of renting it; leasing or subleasing of unused retail space; improving the quality of customer service; location of retail space in the most advantageous places; correct placement of goods on display windows; creating an appropriate sound background; and so on.

The main measures to reduce management costs (costs not directly related to the production and sales of products) are:

1. Reducing costs for non-production buildings and structures;

2. Elimination of unreasonable costs for the management apparatus;

3. Reducing bureaucratic barriers;

4. Increasing the speed of information flow;

5. Refusal of the social package and external social programs. The social package includes: flexible working hours; training employees at the expense of the enterprise and purchasing educational literature; provision of a company car, cell phone, payment for gasoline, communications, free access to the Internet and the ability to print an unlimited number of documents; “subscription” maintenance of employees’ personal vehicles at the service center; providing them with targeted interest-free loans ( car, apartment

);

congratulating them on personal holidays and gifts from the company; organizing corporate events and sports activities ( paying for the gym

), etc.

Date added: 2014-01-03; ; Copyright infringement?;

How to calculate fixed costs (formula of the corresponding indicator and its components)

As we noted above, fixed costs include those costs that do not depend on the volume of production of goods and services. Their calculation will actually be an operation of adding up the corresponding costs. We have already identified their 2 most common types: staff salaries and premises rental.

However, there are also a number of other key components of fixed costs , namely:

- depreciation;

- property taxes;

- advertising and promotion expenses;

- security costs;

- others.

Thus, the formula for calculating fixed costs will look very simple - like an operation of adding up the amounts spent on staff salaries, rent, depreciation, property deductions, advertising expenses, etc. for the reporting period (for example, a month).

Costs such as interest payments on loans and wages under bonus schemes have a special status. The fact is that most often they are classified as so-called semi-fixed costs. Let's study their specifics in more detail.