What should be in the VAT accounting policy

VAT accounting policies may include:

- description of synthetic and analytical VAT accounts used in the company;

- document flow technology for VAT accounting;

- a list of documents confirming the legality of VAT deductions and requirements for their execution, including forms (invoice, UPD, UKD, etc.);

- forms of used accounting certificates and calculations (for calculating tax deductions, VAT amounts to be restored, etc.);

- the order of numbering of invoices in the presence of separate divisions;

- formulas and algorithms for separate VAT accounting;

ConsultantPlus experts explained in detail how to describe the methodology for maintaining separate VAT accounting in the accounting policy. If you do not have access to the K+ system, get a trial online access for free.

- algorithm for confirming the legality of applying the zero VAT rate (responsible persons, list of documents submitted to tax authorities, etc.);

- list of persons authorized to sign invoices (UPD, UKD);

- list of responsible persons for processing and sending VAT returns via TCS;

- algorithms for preparing and signing documents related to VAT calculations (purchase books, sales books, etc.);

- other aspects (the procedure for filing and storing invoices and other documents related to the calculation of VAT).

Separate VAT accounting - examples, 1C, 5 percent rule

According to the Tax Code, if an organization or individual entrepreneur conducts its activities in several areas, some of which are subject to payment of tax, and some are not, separate VAT accounting should be maintained.

The basic concept of separate VAT accounting

This is, first of all, a type of accounting. If an organization carries out different types of activities: both with VAT and without VAT, it is already necessary to maintain separate VAT accounting. That is, several factors can be identified that influence separate accounting:

- Managing organizations of several types of activities.

- The organization provides services and sells goods at several tax rates.

- If an organization sells goods without a tax rate.

- Separate VAT accounting is carried out at a rate of 0%.

However, the legislation does not provide clear instructions on maintaining separate VAT accounting. All operations are carried out in accordance with the accounting policies of the organization itself and must be entered into a certain register.

Watch a detailed video about separate VAT accounting from GlavBukh.ru:

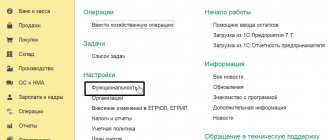

Separate VAT accounting in 1C

Let's look at how separate accounting is reflected in 1C accounting 8.3. This is necessary when an organization reflects transactions carried out with and without VAT in one period.

First of all, we set up the program. We indicate that separate accounting will be maintained in this reporting period. Place the required checkboxes on the tabs. The program displays two fields indicating what needs to be done:

- Separate accounting is maintained - check the box.

- Separate accounting for account 19 – check the box.

In the VAT tab, check the box “By accounting methods.”

When creating a new invoice from a supplier, an organization with separate accounting parameters is selected. In the settings of counterparties that maintain separate accounting, check the “Show accounting accounts in documents” box.

The distribution of VAT during separate accounting is formed according to account 19. Account 19 has several sub-accounts, and there it is already possible to determine by what accounting method the account has not been closed.

There is also such a type of tax as separate accounting of VAT on exports.

Why do you need accounting when exporting?

This is primarily necessary for organizations that export goods. They are required to reflect the 0% rate.

This is done in order to reflect these operations in a separate article, since they differ from other operations.

For all companies selling goods for export, the state reimburses VAT amounts. Essentially, they are not subject to the tax rate, that is, they are exempt from tax.

This allows exporters to reduce their costs for shipping goods.

The main condition here is documentary evidence that the goods are actually sold for export. Organizations conducting multiple VAT transactions, which include both taxable and non-taxable VAT, need to carry out separate accounting, as discussed above.

What does a sample VAT accounting policy look like for 2021?

VAT does not belong to the category of mandatory tax payments paid by all firms and entrepreneurs without exception.

For example, if an individual entrepreneur or company applies a special regime and does not perform the duties of a tax agent for VAT, there is no need to pay attention to value added tax issues in the accounting policy.

Considering the specificity of working with VAT for different companies and entrepreneurs, information about the procedure, accounting methods, reporting and other VAT-related nuances can be formatted in different ways, for example:

- separate accounting policy - this option can be used by VAT taxpayers if there are numerous nuances in calculating this tax (complex structure of branches, working with foreign counterparties, combining taxation regimes, etc.);

- annex to the accounting policy - usually in this form the methodology for separate VAT accounting is drawn up, without which it is difficult to confirm the legality of tax deductions when carrying out activities subject to and non-taxable for VAT and in other cases;

Our section on separate VAT accounting will help you to correctly implement this method.

- a special chapter (section, subsection) of the accounting policy - if the obligation to pay VAT must be fulfilled due to the requirements of the Tax Code of the Russian Federation and standard accounting and settlement approaches are applied (there is no need for separate accounting of VAT, there are no benefits, etc.).

View a sample VAT accounting policy on our website:

VALUE ADDED TAX AND ACCOUNTING POLICIES, INCLUDING SEPARATE ACCOUNTING

If an organization is a VAT payer, then when developing an accounting policy for tax purposes (hereinafter referred to as tax policy), a separate section of this internal regulation of the company must be devoted to this tax. At the same time, it is absolutely not necessary to “rewrite” Chapter 21 of the Tax Code of the Russian Federation in tax policy; it is important to take into account only those aspects of the calculation and payment of VAT in respect of which this chapter gives the taxpayer the right to choose or does not contain a directly established procedure. Due to the fact that companies traditionally have quite impressive VAT obligations, this will allow the taxpayer to reduce the level of their tax payments in a completely legal way.

Value added tax taxpayers

| Note! From 01/01/2019, the changes made to paragraph 3 of Article 346.1 of the Tax Code of the Russian Federation by Federal Law of November 27, 2017 N 335-FZ will come into force, according to which organizations and individual entrepreneurs using the Unified Agricultural Tax will be recognized as VAT payers. The Ministry of Finance of Russia also draws attention to this in Letter dated 02/07/2018 N 03-07-11/7258. |

At the same time, from 01/01/2019, firms and merchants using the Unified Agricultural Tax, on the basis of paragraph 1 of Article 145 of the Tax Code of the Russian Federation, will be able to receive an exemption from the performance of taxpayer obligations related to the calculation and payment of VAT, if any of the following conditions listed in the paragraph are met 2 paragraph 1 of Article 145 of the Tax Code of the Russian Federation.

Moreover, unlike other taxpayers who can use such an exemption for a year, organizations and entrepreneurs using the unified agricultural tax will be able to use it indefinitely. True, if the right to apply the exemption is lost (due to exceeding the income limit or when selling excisable goods), then the VAT for the month in which the above circumstances took place will have to be restored. At the same time, a company or businessman using the Unified Agricultural Tax will no longer be able to take advantage of this tax exemption again!

— a simplified taxation system, as indicated by paragraph 4 of Article 346.11 of the Tax Code of the Russian Federation; — taxation system in the form of a single tax on imputed income (hereinafter referred to as UTII). However, when using UTII, an organization is not recognized as a VAT payer only in relation to taxable transactions carried out within the framework of “imputed” activities.

| Note! All provisions of tax legislation regarding VAT apply equally to both organizations and individual entrepreneurs. Note that, unlike organizations, merchants can use such a special tax regime as the patent taxation system provided for by Chapter 26.5 of the Tax Code of the Russian Federation (hereinafter referred to as PSN). If a businessman uses PSN, then in terms of “patent” activities he is not recognized as a VAT payer. Import VAT, a tax paid when carrying out types of business activities for which the PSN is not applied, as well as when carrying out transactions taxed in accordance with Articles 161 and 174.1 of the Tax Code of the Russian Federation, is paid by individual entrepreneurs in the general manner. |

Right to VAT exemption

If an organization or businessman has the right to be exempted from fulfilling taxpayer obligations related to the calculation and payment of tax (hereinafter referred to as exemption) under Article 145 of the Tax Code of the Russian Federation, then it (he) should note in its accounting policies whether this right is used or not.

Note that when using this right, the taxpayer generally will not have to actually pay tax to the budget for 12 months. In addition, taxpayers using the exemption may avoid receiving invoices, maintaining a purchase ledger, and (subject to certain conditions) no longer need to file VAT returns.

Note. Access to the full contents of this document is restricted.

In this case, only part of the document is provided for familiarization and avoidance of plagiarism of our work. To gain access to the full and free resources of the portal, you just need to register and log in. It is convenient to work in extended mode with access to paid portal resources, according to the price list.

Is it necessary to change the VAT accounting policy for 2021?

According to current legislation, changes to the company's accounting policy are made, including when regulations governing the calculation and payment of tax are changed.

Thus, from January 2021, the VAT rate in the Russian Federation was increased to 20%. In this regard, the taxpayer, in the order to change the accounting policy, should have specified the procedure for calculating tax, as well as the algorithm for accounting for transitional advances. Because Having received an advance in 2018 and calculating tax on it at a rate of 18/118, the taxpayer upon shipment in 2021 had to present the buyer with a tax calculated at a rate of 20%.

Read how to calculate VAT during the transition period here.

It is necessary to make changes to the accounting policies from 2021 (or from any new tax period 2020-2021) if:

- the company plans to carry out operations exempt from VAT (for example, issue loans to counterparties) - a separate VAT accounting methodology must be developed and included in the accounting policy;

We talked about how separate accounting for VAT is carried out - principles and methods - in this material.

- the current accounting policy details the specifics of tax calculation or VAT reporting, which will change from next year due to legislative innovations (for example, if the accounting policy specifies the applicable form of the VAT return and specifies the algorithm for filling it out, and the form of the VAT return changes);

Read about what other legislative innovations regarding VAT need to be taken into account in your accounting policies in our review of VAT changes.

A sample VAT accounting policy for 2021 is also available in ConsultantPlus. Get free demo access to K+ and learn the nuances of compiling this document.

Main directions of accounting policy regarding income tax

The company's Accounting Policy should not prescribe the procedure for recording facts of economic life, assets, etc. that are not carried out (not used) by it.

1) Companies must secure the right to apply an increasing coefficient (Article 259.3 of the Tax Code of the Russian Federation).

Starting from January 1, 2021, the list of property that can be depreciated using an increasing factor of no more than 2 has been expanded. We are talking about fixed assets related to the main technological equipment operated in the case of the use of the best available technologies, according to the list approved by the Government of the Russian Federation (paragraph .5 clause 1 of article 259.3 of the Tax Code of the Russian Federation).

If the company decides to use a smaller ratio, then its size must be reflected in the accounting policy (clause 4 of Article 259.3 of the Tax Code of the Russian Federation).

2) The company must reflect the method and procedure for calculating depreciation.

For example, the use of a depreciation bonus in relation to fixed assets (clause 9 of Article 258 of the Tax Code of the Russian Federation, clause 4 of Article 259 of the Tax Code of the Russian Federation) and the depreciation method. With the linear method, the amount of deductions from the company will be the same throughout the entire period (clause 2 of Article 259.1 of the Tax Code of the Russian Federation).

3) List of direct and indirect costs.

4) The method of distribution of expenses, if a company combines the main taxation regime and a special regime (for example, UTII), applies different income tax rates.

For example, a company maintains separate accounting of income and expenses for the following types of activities, for which a different procedure for accounting for profits and losses is provided for:

for operations of service industries and farms for which losses are accepted for tax purposes;

for operations of service industries and farms for which losses are not accepted for tax purposes;

from the sale of depreciable property (including separately for fixed assets and intangible assets).

5) Creation of reserves.

For example, a company decides to create a reserve for upcoming expenses to pay for vacations, a reserve for the payment of annual remuneration for long service in accordance with Article 324.1 of the Tax Code of the Russian Federation. Expenses for creating a reserve are included in labor costs (clause 2 of Article 324.1 of the Tax Code of the Russian Federation) and are recognized in tax accounting on a monthly basis (clause 4 of Article 272 of the Tax Code of the Russian Federation).

6) Accounting for individual transactions.

Companies should adjust the accounting treatment of certain expenses for which the recognition procedure has changed in 2021 (if they occurred previously and were specified in the accounting policy).

Thus, from January 1, 2021, when calculating income tax, a company has the right to take into account as expenses the entire amount of payment calculated based on the results of the reporting (tax) period in relation to vehicles with a permissible maximum weight of over 12 tons, in full.

Previously, the amount of payment by which the transport tax was reduced in the reporting (tax) period in accordance with clause 2 of Art. 362 of the Tax Code of the Russian Federation, was not taken into account when calculating income tax (clause 48.21, Article 270 of the Tax Code of the Russian Federation).