General provisions of accounting policies in trade

Regardless of the specialization of a trading company (for example, wholesale or retail), the accounting policy (hereinafter - UP) must contain some introductory information:

- the applied taxation system;

- methods of organizing accounting and tax accounting;

- possible deviations from generally established accounting rules allowed by regulations (for example, small businesses can apply a simplified procedure for reflecting expenses on loans and borrowings in accounting and reporting, and also not apply retrospective adjustments if errors are detected);

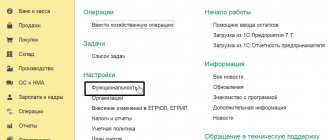

- information about the used accounting accounts, accounting and tax registers;

- other similar provisions formulated on the basis of generally established accounting rules and methods.

In addition to the listed data, the UP of a trade organization should separately disclose the procedure and methods used by this particular organization for accounting for goods, trade margins, transportation and procurement costs (hereinafter referred to as TPP) and the nuances of taxation associated with them.

NOTE! For accounting and taxes, an enterprise can have two separate unitary enterprises or one common one. In the information below, the mandatory points for UE are considered taking into account both BU and NU.

Accounting policy of the simplified tax system

The nuances of tax accounting policy when “simplified” depend on the selected object: , or .

When applying the simplified tax system “income”, tax policy should reflect:

- in what order and at what rate are taxes and advance payments calculated,

- indicate how the paid insurance premiums reduce the tax base,

- income accounting procedure,

- tax register - .

With the object “income minus expenses”, special attention should be paid not only to income, but also to expenses, indicating:

- the procedure for accounting for fixed assets, the method of calculating depreciation,

- composition of material costs,

- procedure for calculating and paying the minimum tax,

- procedure for accounting for sales costs (if any),

- recognition of past losses in the current period,

Otherwise, the tax policy points will be similar to those indicated for the simplified tax system for “income”.

Determining the procedure for accounting for goods and trade margins

Goods in trade organizations can be taken into account:

- at actual cost;

- at sales prices.

Accounting is always kept on account 41, but in the first case, goods go to it at the purchase price, and in the second - at the sales price. In this case, the trade margin on goods accepted for accounting is calculated by posting Dt 41 Kt 42.

When selling goods, the share of the markup corresponding to the goods sold is reflected by posting Dt 90 Kt 42 reversal to form the correct amount of the financial result.

IMPORTANT! Trade mark-ups are allowed only to retail trade enterprises. If the company has both sales options, the UP must determine the procedure for dividing goods into those intended for wholesale or retail sale, indicating the accounting methodology for each group, or establish the accounting method for all goods at actual cost (without using account 42).

In the work of wholesale trade organizations, a moment often arises when goods have already been shipped from the warehouse, but have not yet reached the buyer (for example, they are transferred to a transport company or transferred to an intermediary for sale). For such goods, a separate account 45 “Goods shipped” is provided. The posting for actual release from the seller’s warehouse looks like this: Dt 45 Kt 41.

If account 45 is used, upon completion of the sale (receipt of goods to the buyer), the writing off of goods from account 45 occurs in the same way as writing off from account 41: Dt 90 Kt 45.

Results

Drawing up accounting policies for management accounting purposes is important for a company seeking to reach a new market level or strengthen its position now. After all, based only on accounting/financial reports, management will not be able to make those decisions that will lead the company to growth in the long run.

See also “How to draw up an organization’s accounting policy (2021)?”

Therefore, the organization needs to understand that the management accounting policy must fully cover all aspects relating to the preparation of such reports - from organizational and technical (working chart of accounts, responsible departments, reporting forms and document flow, etc.) to methodological aspects (definition applied pricing methods, accounting for fixed assets and intangible assets, grouping of expenses, etc.).

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Method of writing off cost of goods sold

The cost of goods sold is written off using methods that are also suitable for other groups of inventories:

- according to FIFO;

- average cost;

- the cost of each unit.

Read more about methods for estimating inventories here.

The choice of method depends on the specifics of the goods being sold. An enterprise can choose any one, as well as several for different product groups. However, all selection results must be written down in the UE.

From 2021, FAS 5/2019 “Inventories” comes into force, the norms of which must be taken into account when drawing up accounting policies. ConsultantPlus experts explained in detail how to do this correctly. To do everything correctly, get trial access to the system and go to the review material.

Accounting

For accounting purposes, the procedure for drawing up and the principles for forming in this part of the accounting policy in the simplified tax system “income” are exactly the same as in the general regime. Therefore, compiling this section usually does not cause any difficulties. It's quite simple. But there are several important aspects that need to be taken into account when creating the document. In particular:

- it is important to understand whether the company uses standardized document forms or generates their own samples;

- how the company determines the level of materiality (for example, when the accountant will have to take additional action);

- criterion for the value of objects as fixed assets;

- determine what method is used to calculate depreciation;

- methodology for assessing inventories for their write-off.

Also see “Accounting on the simplified tax system”.

Accounting for containers and packaging

Many products require specific packaging for transportation, storage and sale. In this case, packaging can:

- have properties more suitable for packaging materials (for example, a reusable cardboard box);

- have properties that are more suitable for an object of fixed assets (for example, packaging equipment: special containers, pallets, containers for liquid and bulk products in which goods are packaged by the manufacturer/supplier so that the acquirer subsequently sells the goods from the same container);

- have the property of being inseparable from the product at the time of sale (for example, a glass bottle).

Depending on which of the listed groups containers and packaging belong to, it can be counted as:

- MPZ (on a separate subaccount of account 10 or 41),

- an object of fixed assets (on account 01), with a division into purchased and produced on its own;

- goods (on account 41), and in most cases the cost of packaging is included in the selling price of the goods.

Reusable containers are classified into returnable and non-returnable. Moreover, according to agreements between the supplier and the buyer, the transfer of expensive packaging can occur with a deposit.

The selected options for the use and accounting of containers must be detailed in the accounting policies of the trading organization.

In addition, in appropriate cases, the accounting for transportation costs associated with reusable containers is additionally specified separately.

A sample accounting policy for a trade organization using the general taxation system was prepared by ConsultantPlus experts. Read the document after receiving trial demo access to the system, and check whether you took into account all the nuances when drawing up the UE for 2021. It's free.

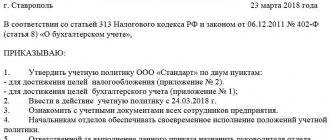

Order on accounting policy

The Tax Code of the Russian Federation allows the taxpayer to choose a taxation system (for example, LLC, simplified tax system or UTII).

However, to determine the tax base for the chosen taxation regime, various application options are provided.

Which of the acceptable options to use in practice is decided by the management, the organization’s accountant or individual entrepreneur.

In this case, the final decision should be written in the accounting policy for tax purposes and approved by order on the accounting policy. There are no standard models of accounting policies, so you can draw up an order for approving the accounting policies in any form. Moreover, the provisions of the accounting policy can be included either in the text of the order or issued as an appendix to it (the order).

The newly created organization and those that emerged as a result of the reorganization must approve the accounting policy within 90 days from the date of state registration. This document must be applied from the moment the new organization (successor organization) is created. This procedure is established by paragraph 2 of clause 9 of PBU 1/2008.

At the same time, there are no penalties for violating the deadlines for approving accounting policies.

The adopted accounting policy can and should be applied consistently from year to year (Part 5 of Article 8 of the Law of December 6, 2011 No. 402-FZ). That is, there is no need to approve a new document every year.

Procedure for accounting for transport costs

The procedure for accounting and distribution of TZR for accounting purposes is determined in the order of the Ministry of Finance of the Russian Federation dated December 28, 2001 No. 119n. It also provides several possible options for accounting for TRP:

- using a separate calculation and distribution account 15 “Procurement of materials and materials” for goods and materials;

- using a subaccount on the accounts for incoming goods (for example, on account 41);

- with the inclusion of TZR in the cost of goods.

The trading company chooses the accounting method itself and necessarily reflects it in the UP.

IMPORTANT! For tax purposes in trade, there is a unified procedure for recording and distributing goods and materials. It is set out in Art. 320 Tax Code of the Russian Federation.

more about it in the article “Distribution of transport costs for the remaining goods” .

What elements of the management accounting system should be recorded in the accounting policy?

The management accounting organization system must be described by the company in the technical and organizational sections of the accounting policy.

In particular, they must contain the following elements:

- working chart of accounts;

- form of management accounting;

- directly the organization of management accounting.

When developing a working chart of accounts for a company, it is important to understand that for management purposes some other synthetic accounts may be used that differ from those used for accounting purposes. For example, in accounting, a company’s expenses can be grouped into accounts 20–29 or 20–39. Moreover, in the case of using accounts 20–39, the last 10 accounts are usually needed to detail expenses by element.

If such detail is suitable for management purposes, the company may limit itself to the specified accounts. If not, you can enter any new accounts, while assigning free codes to them.

PAY ATTENTION! For management tasks, new accounts can be created both for the purpose of greater detail, and, conversely, to enlarge accounting elements.

Further. The form of management accounting is, as in accounting, accounting registers. Therefore, the company, after it has decided on the goals, objectives and types of management reporting, must specify in its accounting policy exactly which registers will be used for this. In this case, it is necessary to stipulate not only the list of registers, but also the order of their maintenance (making entries, adjustments, etc.).

About registers in accounting, see the article “Accounting registers (forms, samples)”

The organization of management accounting itself represents the distribution of powers for maintaining such records and preparing the necessary reports between responsible structural units. Therefore, in the management accounting policy, the company must indicate what kind of divisions/divisions/departments these will be, what functions and responsibilities each of them will have, and also in what order the information/reporting will be exchanged between them.

Procedure for accounting for sales expenses

For trading companies, the list of costs that can be attributed to selling expenses is significantly expanded compared to enterprises engaged in manufacturing. At the same time, there are such expenses for which you should decide on accounting options, disclosing them in the UP:

- Costs for delivery of goods to the warehouse of a trading company during purchases. This type of TZR can be taken into account:

- in the cost of goods (more on this in the previous section);

- as part of sales expenses on account 44 (if, according to business conditions, it is advisable to take such expenses into account separately from the purchase price of goods).

In this case, the costs of delivering goods to customers are considered selling expenses in any case.

NOTE! TKR included in the cost of goods are taken into account for tax purposes upon the sale of this product, and TKR reflected in the cost of sales are accepted for tax purposes one-time in the amount received by calculation for a certain period.

- Writing off sales expenses after a period (usually a month) can occur in 2 ways:

- in the amount accumulated during the period in full;

- with the distribution of the accumulated amount of expenses: the part related to the goods actually sold is written off, and a balance is formed on the 44th account, corresponding to the share of expenses attributable to the balance of goods in the warehouse.

- The costs of packing and packing goods on your own have the same accounting options as the costs of delivering goods to the warehouse:

- included in the cost;

- included in selling expenses.

To learn about what determines the difference in accounting for goods and materials and transportation costs for sales, read the material “Are transportation costs direct or indirect costs?”

Approximate structure of accounting policies for management accounting purposes

The specificity of the accounting policy described above for the purposes of management accounting determines the content of specific provisions of such a policy.

In general, the structure of management accounting policies can be presented as follows:

- Organizational section.

- Technical section.

- Methodological section.

Let's look briefly at each of these sections.

The 1st section is organizational. In it, it is advisable for the company to fix 3 basic points:

- provide information about the accounting principles on which management accounting will be built, show the terminology used, and also, if necessary, refer to any regulatory documents that govern management accounting;

- describe the organizational structure of the company: who is responsible for what, what is the system of subordination in the company, which division is responsible for drawing up the accounting policy in question and maintaining management accounting in general;

- state what the system of financial support for the company’s activities is.

The 2nd section is technical, since in it the company should regulate aspects of the technical plan. In particular, it is necessary to provide for the procedure for management document flow (and interaction between business units), prescribe a working chart of accounts, and also determine the main elements of management reporting (composition of reports, presentation format, deadlines for generation, etc.).

Section 3 is the most informative. In it, organizations reveal the methodological component of maintaining management accounting at an enterprise and drawing up the necessary reporting. Namely, they reflect the following aspects:

- methods for valuing assets and liabilities (including depreciation, write-off of materials, etc.);

- a system for grouping expenses in an enterprise (direct and indirect, overhead and basic, etc.);

- the procedure for distributing indirect expenses (defining the basis for such distribution, methods of distribution), as well as writing off deferred expenses;

- mechanisms for calculating the cost of a company's products, determining the types of costs depending on the purpose of generating a specific report (for example, planned, actual, forecast, etc.);

- methods of formation, rules and situations when a company should apply transfer prices;

- the methods used to form prices for goods, as well as the percentage of profit included in the price;

- management analysis system, i.e., what indicators are control indicators, how forecast plans are built based on such indicators, etc.

All components of the management accounting methodology selected above can be used by the company from January 1 of the year following the year when the accounting policy for management accounting purposes is approved. Approval occurs through the issuance of a special order, regulation, etc.

The accounting policy for tax purposes also has important features. And ConsultantPlus experts talk about them in detail. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure. In the same material you can download samples of accounting policies for different taxation systems.

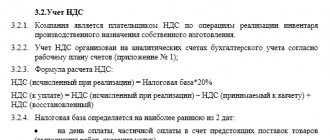

Nuances of VAT accounting

In terms of VAT, the UP of a trading enterprise should include at least:

- Application (or non-application) of VAT exemption on the list of goods in accordance with Art. 149 of the Tax Code of the Russian Federation. As well as the procedure for maintaining separate accounting for groups of goods with different VAT taxation.

Read more about this in the article “Which goods not subject to VAT are enshrined in the Tax Code” .

- If there are transactions taxed at a rate of 0% (in particular, exports), the procedure for maintaining separate accounting for goods taxed at a rate of 0% and taxed at regular rates.

- Basic aspects of document flow, for example:

- principle of invoice numbering;

- the procedure for maintaining records of received and issued invoices, the purchase book and the sales book (for example, the method of entering data by department).

Date of order

By order on the accounting policy, the manager determines the date from which this document comes into force and also approves it. The new enterprise has 90 days to form and consolidate the UP (para.

2 clause 9 PBU 1/2008). But it may be necessary to approve an existing one after making changes to it. Such a process can be initiated by the organization itself, for example, as a result of changes in any accounting method.

In this case, the amended version will come into force on January 1 of the following year.

But changes do not always depend on the desires and needs of a budgetary organization; they can be initiated by legislators by publishing a new legal act or making changes to an existing one. If new provisions directly affect the activities of a budgetary enterprise, it is necessary to formalize the changes.

In this case, approve the order to amend the accounting policy from the date of entry into force of the new provisions of the law. These dates are established for accounting purposes.

And although the tax code does not contain clear information about the dates of approval of the document, the deadlines are not established by law; the UE should be formed and approved as quickly as possible. Important! The law does not require the creation of two separate documents for accounting and tax accounting, but accounting methods can be combined.

Certain questions regarding inventory

The nuances that will need to be included in the UE will depend on the specifics of the trading activity. For example:

- Those who sell food products need to stipulate in the UP that the frequency of inventory is more frequent than for those who sell non-food products. It is necessary to provide for nuances associated with such specific issues as natural loss rates. In addition, it is necessary to establish a procedure for promptly identifying and writing off expired goods that have lost their consumer properties.

More details about this can be found in the article “Procedure for writing off expired goods .

- For pharmacy organizations, it is necessary to provide in the UP both the procedure for identifying and writing off medical products by expiration date, and compliance with certain conditions for the storage and release of certain goods.

More about the nuances of pharmacy trade - in the material “Rules for accounting in a pharmacy (nuances)” .