Many multi-storey buildings today are maintained and operated by management companies, which must provide high-quality utilities and carry out cosmetic and major repairs. Accounting in a management company is carried out with specific features, which will be discussed below.

How to conduct accounting in a management company

Accounting entries in the housing and communal services management company often concern only two actions:

- Purchasing resources from supply companies.

- Sale of resources to residents of houses.

In the first action, accountants form accounts payable and expenses of the management company, in the second - accounts receivable and profit. Therefore, it is better to conduct accounting in housing and communal services in the following way - create an accounting policy. This refers to the nuances of accounting for assets and liabilities, profits and losses. The more correctly and accurately the accounting entries are drawn up, the more elementary the work of accountants will be. Why this is needed is clear, but what it should include in a little more detail. This is an accounting of the following transactions:

- settlements with companies providing resources;

- consumption of materials;

- settlements with tenants-buyers of utilities;

- income and expenses;

- performers' salaries;

- tax calculations;

- settlements under other counterparty agreements.

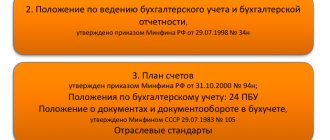

All the basic provisions that help to correctly conduct the accounting policy in the housing and communal services management company regarding expenses and income are in the Accounting Regulations 1/2008. In addition to accounting, the management company also maintains tax accounting in public utilities, the policy of which complies with the criteria of the Tax Code of Russia.

The chart of accounts is necessary directly for accounting, therefore such activities are approached with full responsibility. The work plan is created on the basis of a legislative act of the Ministry of Finance. It is necessary to enter into the plan only accounts that are actually used by the management company. And, for example, postings related to animals and other similar ones should not be included.

In many cases, management companies use a unified form for accounting purposes, which is approved by Goskomstat. But since 2013 it may not be used. In any situation, management companies approve their forms in their accounting policies. Samples can be found for free on the Internet.

The accounting policy, chart of accounts and accounting forms must be drawn up in one order, which is signed by the management of the management company and the chief accountant. Such an act should be rewritten every year, since laws change and accounting policies become outdated.

The accounting records of enterprises must be maintained without interruption, regularly, all actions are reflected in the postings, which will be discussed below, and in primary documents. Accountants must prepare reports in accordance with the required standard, which is written in the Federal Law “On Accounting”. In addition, statistics are also calculated. The accounting policy processes described above are mandatory in the accounting department of the management company.

OSNO or simplified

The general tax system (OSNO) is more suitable because of its simplicity for all management companies. But the rather large amount of income tax - 20 percent and VAT make this type not very profitable. When paying VAT to OSNO, management companies have benefits in comparison with other commercial organizations, since, in accordance with tax legislation, utility bills that are provided to residents and repair work with hired accounting personnel are not subject to VAT.

But legal standards in reality do not provide any economic benefits to utility management organizations. When purchasing resources, this is impossible, since the purchase is carried out at a single tariff, so the tax base for VAT is zero. When providing paid services to owners and tenants, VAT is not charged only in a situation where the profit is equal to the costs to the contractors.

Therefore, it is often beneficial to use a simplified taxation system, but there are also restrictions on its use:

- if the profit exceeds 60 million rubles, then simplification is impossible;

- if a utility company has more than 100 people on its staff, then such a simplified tax system is also impossible;

- You cannot use the simplification even if the cost of fixed assets is less than 100 million rubles.

But in reality, most criminal codes correspond to the data for the simplified tax system. You can make the simplified form the main form for taxation at the tax service; you just need to write a proper application before the end of the year. Under the simplified tax system, companies are exempt from VAT and income tax, but at the same time they pay the tax that is necessary for this regime.

For the “income” section, the amount of this tax is 6 percent, and for the “income minus expenses” section - 15 percent. A feature of this form of taxation is the establishment of profit using the cash method, which means that income is determined only by the inflow of money and its outflow from the management account.

To select a system, the income and expenses of utility management companies should be taken into account and compared by the accounting service. When they are often in the red, it is more profitable to use the simplified taxation system “income minus expenses”, because you will only need to pay minimal fees in the amount of one percent of the profit for a specific period of time. But it is also worth considering that such figures may differ greatly from income and expenses using the accrual method.

Adjustment of mutual settlements

Adjusting mutual settlements changes personal account balances by agreement.

You can find it in the Service Charges

Adjustment of mutual settlements offers us three types of operations:

- debt transfer;

- debt write-off;

- other adjustments.

To determine which type of adjustment of mutual settlements is suitable for our case, let’s ask ourselves the question: “Does the old owner have a debt or overpayment under his agreement?”

⇨ For the answer, let’s turn to the Universal Report.

We will build a report that will help us check current personal account balances by agreement, and in the future will be able to tell us whether adjustments to mutual settlements were made correctly.

To build a report, go to Reports

—

Universal report

.

Let's build a report on the accumulation register with settings as in the screenshot below

For example, let's look at personal account 002. We changed the owner in it and using this report we will check the balances on it.

We see that there are balances under the old and new agreements.

The owner has changed, but the debt on the old agreement remains.

This situation could arise for various reasons. The main reasons include:

- The old owner did not pay his debt (or we did not pay the resulting advance);

- The debt was paid, but the payment fell on the new contract.

In these cases, balances on two contracts for one person can lead to a number of difficulties.

For example, when calculating penalties. If we are left with an old contract with a balance, a situation may arise in which we have a debt on the old contract, and an overpayment arises on the new contract.

In such a situation, offset of advances for housing and communal services

will not be able to offset the debt and overpayment. This is due to the fact that the balances are on different contracts.

Important!

In the payment card or in the report on accruals and debts, we will not see the debt on the personal account. In the report we will see the total balance of the personal account, that is, in our case, we will see an overpayment on the personal account.

At the same time, according to the old agreement, the personal account has a debt, and the program will accrue penalties for this debt.

This situation can also cause difficulties when loading GIS housing and communal services: duplication of contracts will lead to duplication of services when uploading payment documents.

To avoid these and many other difficulties, it is necessary to correctly determine the required type of adjustment.

Thus, based on the report, we determined that there is a balance under the old owner in our example.

Now, using the diagram below, we will determine what to do next.

Transfer of debt

Let's consider adjusting mutual settlements with the type Transfer of debt

.

Let's create a document Adjustment of mutual settlements

and select the type of operation

Debt Transfer

, as in the screenshot below.

Such an adjustment allows you to transfer a debt from one personal account to another or transfer balances within one personal account from one agreement to another.

In the line Debtor

in the document we establish the personal account from which the balances will be transferred.

In the line Creditor

indicate the personal account to which the balances need to be transferred.

If we transfer balances within one personal account from an old agreement to a new one (as now), then the Debtor

and

Creditor

will be filled in with one personal account.

Next to the line Creditor

We also indicate the contract to which we want to transfer the balances. In our case, this is the New Agreement (screenshot below).

After all the data is filled in, click the Fill

.

The document will be filled with data on the tabs . Magnification

and/or

Debt reduction

.

In our example, the document was filled out on two tabs.

Next, if we need to transfer the entire balance, we post the document and re-check the balances.

If you need to transfer only part of the balance, you need to delete the extra lines and leave what you want to transfer. In this case, the amount can be edited manually.

After the transfer is completed, we will build a Universal report and check the balances.

Important!

A universal report must be built for the month in which the adjustment was made.

At the beginning of the period, you must indicate the day following the day the adjustment was made

We see that the remainder of the old contract has been transferred to the new one and is equal to the report on accruals and debts.

After adjustment, we see one agreement on the personal account.

Postings in the accounting of the management company

Now let's look at the accounting entries, the number of which exceeds other calculations in the management company. To make it more convenient, we will divide them into two subsections, which we outlined earlier:

Purchasing resources:

- D20 K60 – purchase of electricity, water and gas from resource supply organizations;

- D19 K60 – VAT on purchased resources is reproduced;

- D68 K19 – VAT is omitted for deduction;

- D60 K51 – money was transferred as payment for purchased resources.

Providing services to residents of apartment buildings:

- D62 K90/1 – invoicing of utility organizations;

- D 90/2 K20 – displays the cost of the provided CG;

- D90/3 K68 – VAT calculated by the company;

- D51 K62 – payment from residents;

D60 K62 – transfer of money transferred from residents to resource supply companies.

This posting example is effective for management companies that use OSNO. When accounting using simplified accounting, the third and seventh points are excluded. VAT benefits under the general system are reflected in calculations in the following way:

- D20 K19 – VAT on purchased resources is reflected in the cost price.

The third and seventh points are also excluded. All these operations occur more often than others at the management company, but other transactions also occur. If such cases arise, please refer to the instructions for the chart of accounts, which is included in Order No. 94n of the Ministry of Finance.

OKVED

When a management company is registered, you need to select a code in the All-Russian Classifier of Types of Economic Activities (OKVED). This is necessary so that regulatory authorities are aware of the company’s activities. For management companies, this is code 70.32.1 (Management of housing stock activities). But often management companies set the value 70.32 (Real estate management), which connects three subtypes of activity.

To summarize, let's say that the accounting policies of the housing and communal services management company do not cause difficulties in calculations, since they are the same type of operations. The main thing is to maintain order and conduct housing and communal services and accounting at enterprises regularly without interruptions, and also act in accordance with the regulations and current laws. Then the controlling organizations will not ask any questions.

You can save money for owners in 2 ways:

1. Prescribe in the management agreement a different fate for savings, and not the one prescribed by the Housing Code of the Russian Federation.

In case No. A39-6129/2019, the court recognized that the management organization from Mordovia does not have the right to save: The management agreement stated that the management company has the right to spend the saved funds to reimburse expenses associated with the payment of additional expenses and services for maintenance, current repair of common property of an apartment building, compensation for losses, acts of vandalism, penalties. The court assessed this as identifying the earmarked nature of the money, which prevents the company from counting the savings as its profit.

2. Justify the inadequate quality of work.

It is better to do this as prescribed in Rules No. 491 - through acts. But the results of inspections by regulatory authorities can also help in court.

In case No. A28-6072/2019 from the Kirov region, residents’ money helped preserve the orders of the housing inspection.

One of them required the old management company to repair the roof and eliminate leaks in the hot water supply pipeline in the basement. There were also protocols on administrative violations, which indicated a violation of licensing requirements when carrying out the function of maintaining and repairing common property.

The old company did not refute this evidence and did not provide information about eliminating the violations.