What to spend money on

The organization's expenses are not always paid with funds from its current account. In some cases, it may be necessary to issue funds to the employee on account. Such cases include:

- Economic needs of the organization (for example, purchase of goods, work or services);

- Business trip (when the employee is given daily allowance, as well as money for travel and accommodation);

- Entertainment expenses.

The basis for issuing funds from the cash register is one of the following documents:

- an employee’s application containing a director’s visa containing the amount of issue, as well as the period for which it is allowed to be issued;

- the manager's order to issue funds will be reported.

In order for the organization to be indicated as the buyer in the documents issued to the accountable employee when purchasing goods, in addition to the accountable funds, the employee must be given a power of attorney.

To whom can accountable money be issued?

Money can be issued from the organization's cash desk only to those employees with whom the organization has entered into an employment contract or a civil contract. Thus, you can issue an advance for future expenses not only to a full-time employee, but also to your contractors. For example, an organization hired workers under a civil contract to perform a certain amount of work. To complete them you will need to purchase materials. Accordingly, it is possible to provide such employees with funds for the purchase of materials (

Order for the release of money for reporting

Since employees are not required to write statements for the issuance of accountable amounts, they must be replaced with an order (instruction) from the head of the company.

The procedure for issuing an order is not specified in the Central Bank Instructions, but it is stated that the order must contain:

- Full name of the employee to whom accountable funds are issued;

- The amount of money that must be issued to the employee;

- Deadline for issuing funds to the accountable.

Important! If the manager’s order for the issuance of accountable funds contains inaccurate wording, the Federal Tax Service has the right to regard this as a violation of the rules for storing cash. For this, the company faces administrative punishment in the form of a fine of up to 50,000 rubles.

Let's consider the wording options in the order for the issuance of accountable amounts.

For example, the following wording: “I order in the future to extradite O.P. Petrova.” funds up to 30,000 rubles without statements” or such “I order that Petrova O.P. be extradited. funds without statements until the advance amount reaches 30,000 rubles” does not contain precise wording, which means it can be regarded as a violation.

Let's give an example of wording that will allow you to issue accountable funds to an employee without fear of inspection authorities: “issue O.P. Petrova on account of 30,000 rubles for 5 working days for the purchase of stationery.”

The order may also contain an order to issue accountable funds to several employees at once, for example, when sending several employees on a business trip.

We attach a sample order for the issuance of accountable funds to several employees when they are sent on a business trip.

Sample order for issuance for reporting 2021

Can they be punished for this?

First of all, it is worth recalling that paragraph 1 of Article 15.1 of the Code of Administrative Offenses of the Russian Federation punishes an ordinary organization only for:

- for cash settlements with other organizations or entrepreneurs in amounts exceeding those established by the Directive of the Bank of the Russian Federation No. 3073-U dated 07.1013. cash payment limit – i.e. 100 thousand rubles (in Russian currency) and an amount equivalent to 100 thousand rubles if payments are made in foreign currency. It should be borne in mind that this limit applies to settlements under any civil contracts concluded between organizations and (or) entrepreneurs;

- for complete or partial failure to receive cash to the cash register, any money, not just revenue;

- for violating the procedure for storing available funds. According to paragraph 7, clause 2 of Bank of Russia Directive No. 3210-U dated March 11, 2014. free cash means cash that exceeds the cash limit established by the enterprise and is actually in the cash register. And such funds should only be stored in a bank account;

- for the accumulation of cash in the cash register in excess of the cash limit established at the enterprise. The exception is the accumulation of funds on days when salaries, scholarships and other remunerations are paid that are included in the wage fund (according to the methodology used to fill out statistical observation forms), and when social funds are paid. On these days, when paragraph 8 of clause 2 of Directive No. 3210-U is allowed to exceed its limit at the cash desk, they also include the day of withdrawal of cash from the bank account to make the specified payments. In addition, it is allowed to store money in excess of the limit in the cash register on non-working holidays and weekends, but only if organizations and entrepreneurs conduct cash transactions on these days.

Among the above violations, there is no liability for violations of the rules for issuing accountable funds .

In particular, this is confirmed by the conclusions made in the Resolution dated March 26, 2014 of the Seventh Arbitration Court of Appeal of the Russian Federation in case No. A67-5875/2013.

The essence of the issue considered in this Resolution was that the enterprise periodically issued, on account to its manager, funds that exceeded the established cash limit. The head of the company did not provide a report on the accountable funds he had previously received.

The tax inspectorate considered this behavior to fall under Article 15.1 of the Code of Administrative Offenses of the Russian Federation. But the court expressed the opinion that in the actions of the head of the company there are violations only in the procedure for issuing cash on account, but there are no violations, which are provided for in paragraph 1 of Article 15.1 of the Code of Administrative Offenses of the Russian Federation, i.e. there is no reason to believe that in this way the enterprise accumulated money in excess of the limit and violated the procedure for storing available funds.

Moreover, the Court concluded that cash is free until it is issued for reporting to an authorized person for the purpose of the company’s activities.

Thus, after these funds are issued for reporting, they lose their “free” status, which means that these amounts are not subject to the obligation to store them in the company’s bank account and the punishment provided for in paragraph 1 of Article 15.1 of the Code of Administrative Offenses of the Russian Federation does not apply.

However, it is too early to rejoice . The court in the considered Resolution rejected the tax inspectorate only because it charged a violation in the form of accumulation of excess funds by issuing an endless sub-account, but in fact proved that the enterprise did not have the right to issue money to its manager on account without providing a report on previously issued amounts.

But there are decisions in favor of the tax authority . For example, the Decision of the Moscow City Court dated August 14, 2013 in case No. 7-1920/2013. In this case, an infinite sub-account was also identified, i.e. the head of the company handed over the accountable money to the cashier and immediately received it in a larger amount again on account. These transactions were documented with incoming and outgoing cash documents.

The tax authority concluded that the company was violating the procedure for storing available funds. And the court supported this conclusion, citing the fact that:

- cash issued on account was not spent, including on the needs listed in Directive No. 3073-U of the Bank of Russia;

- the head of the company did not submit advance reports, from which the very fact of spending funds and their intended or inappropriate use would be visible;

- the funds “left” the cash register for a short period of time and were returned in full.

Thus, the head of the company, in the opinion of the court , when registering the excess balance of money as issued on account for business needs, acted fictitiously and actually replaced himself with a credit institution, keeping free funds (i.e., above the limit) at home. As a result, the company and its director were punished on the basis of clause 1 of Article 15.1 of the Code of Administrative Offenses of the Russian Federation .

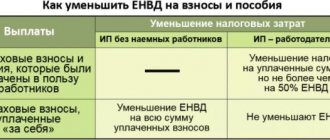

Why aren't entrepreneurs punished for such offenses ? Because they do not allow them: unlike a legal entity, an entrepreneur can write off for his own needs at the end of the day all the cash from the cash register, down to the penny! And he doesn’t need to file endless reports. Moreover, Bank of Russia Directive No. 3073-U does not even provide for a limit when issuing cash to an entrepreneur for personal purposes.

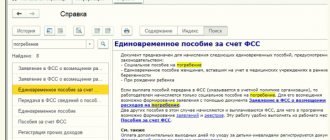

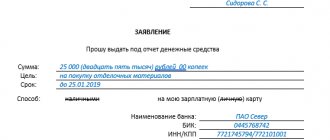

Application for the release of money for reporting

Despite the fact that statements are not required to be written according to the rules for issuing accountable funds, some organizations find it more convenient to work with statements. In this case, the previous application form can be somewhat simplified. For example, remove the clause that the employee has already submitted an advance report on accountable funds issued to him earlier. This requirement is no longer valid; now it is possible to give money to the accountable even if he has not yet paid off the previous advance received.

However, if a company wants to maintain such a requirement, then it can simply change the wording. For example, you can indicate that a new advance is issued only if the employee has reported on the old one. Such a rule should be written down in the enterprise’s Regulations on accountable employees.

Here is an example of an employee’s application for the issuance of accountable funds.

Sample application for the issuance of funds (form 2021)

If the provision on accountable employees does not contain wording that funds are issued only at the request of the employee, or after a full report on the funds received from the previous advance, then they must be paid. If, in addition, the manager wants to limit the amount of accountable funds, then the Regulations must provide wording according to which the size of a one-time payment, or the total amount of the employee’s debt, cannot exceed a certain limit.

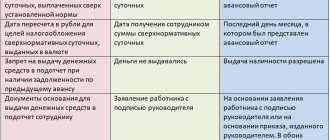

Important changes from 08/19/2017

Amendments dated August 19, 2017, introduced into Bank of Russia Directive No. 3210-U dated March 11, 2014, established a number of changes in the procedure for settlements with accountants. Now, according to the Directive of the Central Bank of the Russian Federation dated June 19, 2017 No. 4416-U, the accountable person no longer needs to write a statement. The main basis for an advance will be an order or other administrative document of the head of the institution.

Other innovations are also significant:

- new advance funds can be received without reporting the previous ones;

- old-style checks have been accepted into the list of documents confirming payment;

- accountable money can be transferred to any bank card, including salary;

- you can pay with a personal bank card even if the funds were issued in cash (letter of the Federal Tax Service dated June 22, 2011 No. ED-4-3/9876). This point must be included in the order on the organization’s accounting policy (letter of the Ministry of Finance of the Russian Federation dated August 25, 2014 No. 03-11-11/42288).

In connection with all legislatively adopted innovations, organizations also need to make changes to orders on accounting policies, collective agreements and provisions on conducting cash transactions and settlements with accountable persons.

Money is accountable to the employee’s card

When an organization transfers days to an employee by bank transfer, then writing an application or issuing an order is not required. The above procedure applies only to cash payments. But it would still be a good idea for the company to issue one of these documents. This way she will protect herself from unnecessary proceedings by inspection bodies. In addition, in the company’s local act it is better to include a condition according to which the organization has the right to transfer accountable money to the employee on the card. And in the payment order by which funds will be transferred to the employee’s card, it must be indicated that the money is issued on account.

Important! Accountable funds can be transferred to the employee’s salary card or to his personal card. To do this, the employee needs to write a statement with the corresponding request and specifying the details for the transfer.

Normative base

Accountable funds are issued from the cash register to employees only to meet the needs of the organization.

This is not an easy procedure. To implement it, there is a certain algorithm (we talked about it in the article on how to organize settlements with accountants), any deviation from which will lead managers and responsible persons to inspections by regulatory tax authorities and subsequent administrative liability. Therefore, when wondering what the maximum amount can be reported, you must be guided only by the current legislation and the accounting policies of the organization. The maximum amount to be reported in 2021 is regulated by local regulations: accounting policies and regulations on settlements with accountable persons. The legislative basis for these documents for a budgetary institution should be the Directive of the Bank of the Russian Federation dated March 11, 2014 No. 3210-U, taking into account the amendments made by the Directive of the Central Bank of the Russian Federation dated June 19, 2017 No. 4416-U, as well as the Order of the Ministry of Finance of Russia dated August 26, 2004 No. 70n, Order Ministry of Finance of the Russian Federation dated February 10, 2006 No. 25n and the Budget Code of the Russian Federation.

How to report money to the account?

The head of the organization sets a deadline after which the employee must account for the funds received. For example, an accountant was given an advance for the purchase of stationery for a period of 5 days. After this period, the accountant must provide a report within 3 days. If the report is drawn up on travel expenses, then the employee must report within 3 days from the date of return from the trip.

If an employee receives accountable money on a card, they can report on it later than the established three-day period. The rules of “cash” restrictions do not apply to non-cash payments, so the manager has the right to set the deadlines for the report independently. The main thing is that this is recorded in the Regulations on the issuance of accountable funds of the company (

The procedure for issuing and returning accountable money

Accountable money is paid to an employee in several ways. You can issue money on account through the cash desk of a business entity. In this case, an expense cash order is used.

When issuing cash, any employee, regardless of position, must draw up a statement in the established form indicating the purpose of the issuance and the deadline. If it is missing, then during inspection a fine of 50 thousand rubles may be imposed. The written document is endorsed by the head of the company with his signature.

Attention! The director's statement differs in wording, since he does not ask for an account, but establishes the fact of such a need.

In addition, the application must contain an empty field for the accountant, in which he must make a note - whether or not this employee has a debt on previously received amounts. It is forbidden to give an employee a report if he has not yet distinguished himself the previous time! Otherwise, regulatory authorities can also issue a fine of up to 50 thousand rubles for this.