Who should pay for negative environmental impacts?

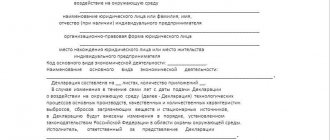

Legal entities and individual entrepreneurs operating on the territory of the Russian Federation, the continental shelf of the Russian Federation and in the exclusive economic zone of the Russian Federation must pay for the negative impact on the environment:

emissions of pollutants into the atmospheric air from stationary sources (hereinafter referred to as emissions of pollutants);

discharges of pollutants into water bodies (hereinafter referred to as discharges of pollutants);

storage, burial of production and consumption waste (waste disposal).

Part 1 of Article 16 of the Federal Law “On Environmental Protection”

Exception: Objects of negative impact on the environment of category 4 (Part 1 of Article 16.1 of the Federal Law “On Environmental Protection”).

Moreover, if a legal entity or individual entrepreneur simultaneously has objects of category IV and objects belonging to other categories defined by law (I, II, III), payment for the negative impact on the environment is calculated and paid for all objects, including objects of IV categories.

<Letter> of Rosprirodnadzor dated January 11, 2019 N AA-06-02-31/370 “On payment for environmental assessment”*

If you generate waste from the MSW group, then in this case your enterprise is not a payer of fees for negative impact on the environment. In this case, the payer is the regional MSW management operator, MSW management operators carrying out disposal activities (Article 16.1 of the Federal Law “On Environmental Protection”).

When should I pay advance payments for the NVOS in 2021? Ecological fee.

February 26, 2021 Advance payments for the new tax assessment in 2021 are subject to the same rules as in 2021 in terms of timing. Let's look at what these rules are, and also figure out how to determine the amount of payment and what order to follow when paying.

The procedure for determining the amount of advances according to the tax assessment

The main document defining the key points of calculation and procedure for making payments for pollution is the Law “On Environmental Protection” dated January 10, 2002 No. 7-FZ. It provides for the obligation for legal entities that are not classified as small and medium-sized businesses to pay advance payments for negative environmental impact (NEI) during the current year. At the end of the year, the amount of these payments will reduce the total amount of fees accrued for the year in the tax return.

Advance payments are required to be accrued and paid 3 times a year, at the end of the 1st, 2nd and 3rd quarters, before the 20th day of each month occurring after the end of the corresponding quarter (Clause 3, Article 16.4 of Law No. 7-FZ).

How to determine the amount of advance payment? Each of the payments will be equal to ¼ of the total volume of payments for NVOS paid (this wording is present in the law) for the previous year.

Although talking here about payments made last year is not entirely correct. For the amount from which the amount of advances is calculated, it is more correct to take the total amount of payments accrued for payment in the declaration for the year, since it is not uncommon for the amount of advances paid to be greater than the entire payment accrued in fact for the same year. And it is precisely the issues of using the amounts of the resulting overpayment that are discussed in the letters of Rosprirodnadzor dated March 15, 2017 No. AS-06−02−36/5194 and dated March 27, 2017 No. AA-06−02−36/6198.

In addition, precisely because the occurrence of overpayments is not uncommon, options for changing the algorithm for calculating advances on pollution payments are being considered.

However, according to the current procedure, the amount of advances paid quarterly in 2021 will determine the total amount of payments under the NVOS made (more precisely, accrued) for 2017.

How to calculate fees for 2021?

The calculation of the pollution fee for the year is made in the declaration, which includes:

- title page;

- a section with summary results of calculations, in which accrued amounts are reduced due to expenses that reduce the negative effect of polluting impacts, and due to advances paid during the year;

- 3 special sections (according to the number of main types of pollution sources), each of which is a table with the parameters necessary to calculate the payment for the corresponding pollution source, and is filled out only if the payer has such a source.

Calculation in special sections occurs according to the rules described in detail in the order of the Ministry of Natural Resources of Russia dated 01/09/2017 No. 3 (in the notes to the declaration form) and in the Decree of the Government of the Russian Federation dated 03/03/2017 No. 255. Both of these documents also contain the necessary values used in the calculations coefficients

Deadlines for pollution charges

Legal entities obligated to make such payments make advance payments 3 times a year. Calculations for the year are completed with one more payment - payment of the total amount received in the section of the declaration allocated to summary data, as a result of arithmetic operations performed on the amount calculated in special sections.

Thus, there are 2 types of deadlines for payment:

1. for advance payments - in 2021 they will expire on April 20, July 20 and October 20, but in October the payment will have to be made no later than October 19, 2018, since October 20 is a day off, and Law No. 7-FZ does not provide for postponement of deadlines;

2. for the final payment for the year - the deadline for this period corresponds to March 1 of the year following the reporting year, i.e. payment for 2021 will need to be made no later than 03/01/2018, and payment for 2021 - no later than 03/01/2019.

Those organizations that are not obligated to pay advances, make payments to the NVOS 1 time (at the end of the year), i.e., the deadline for them is only 1 (March 1).

Common to all legal entities, regardless of the scale of their business, is the deadline established for submitting a declaration on the NVOS, which expires on March 10 of the year following the reporting year.

Where and how to pay advances for NVOS?

Regarding the place of payment, the pollution fee is linked as follows (Clause 1, Article 16.4 of Law No. 7-FZ):

- for emissions and discharges it is paid to the budget at the location of the source of pollution;

- for disposed waste it is paid where the waste is disposed of.

That is, OKTMO for payment carried out for different types of polluting objects may turn out to be different. And this must be taken into account not only when drawing up a declaration, but also when paying advance payments. Depending on the type of source of pollution, the values of the BCC indicated in the payment document will also differ.

What distinguishes payments under NVOS from environmental payments?

In addition to payments under the NVOS, there is one more payment of an environmental nature, which has the official name “environmental fee”. It is regulated by another regulatory act - the Law “On Industrial and Consumption Waste” dated June 24, 1998 No. 89-FZ.

It has many differences from pollution charges:

- the circle of payers represented by persons producing or importing products that require their disposal upon completion of use;

- tax base, defined as the volume of recycled goods, adjusted to the recycling standard;

- rate depending on the type of product being disposed of;

- the deadline established for payment and being the only one, coincides with the deadline for submitting collection reports and corresponds to the date of April 15 of the year following the reporting one.

The legislation does not provide for advance payment of environmental fees. Thus, there is no need to make advance environmental payments in 2018.

Results Advance payments for NVOS must be paid by legal entities that are not classified as small or medium-sized businesses. Such payments are made three times a year, upon completion of the 1st, 2nd and 3rd quarters, no later than the 20th day of the month following the end of the corresponding quarter. The amount of each advance is equal to ¼ of the amount of payments for the NVOS accrued for payment according to the declaration for the year preceding the year of payment of the advances.

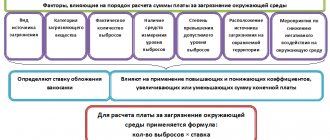

How is the fee for negative environmental impact calculated?

Payment for negative impact on the environment is calculated based on the actual amount of emitted pollutants, discharged pollutants, disposed waste (Article 16.2 of the Federal Law “On Environmental Protection”) for the reporting period.

- Emissions of pollutants are taken into account for each operated source during the reporting period, according to the emissions logbook.

- Discharges of pollutants - according to the wastewater quality logbook. I would like to draw your attention to the fact that if the discharge occurs into centralized wastewater systems, then the payment is made by the organization receiving the wastewater from your enterprise. And you are already paying this organization its expenses.

- Placed waste - according to the waste logbook. Payment is not made for waste accumulated at the enterprise, for waste transferred for recycling or neutralization.

When calculating the negative impact fee, you must take into account the available permitting documentation:

- within the limits of emissions, discharges and above;

- within the limits of temporarily permitted emissions, discharges and above;

- within the limits for the disposal of production and consumption waste and above.

Who is required to pay for the NVOS?

NVOS is, in fact, one of the main measures of state control over harm to nature. By law, this tax must be paid by any entity whose work worsens the state of the environment.

This category includes both Russian and any foreign companies operating in the Russian Federation.

Until 2010, state budgetary organizations were exempt from this tax. Now they too are required to pay for the NVOS.

Only those enterprises where hazard class IV is established are exempt from this duty, that is:

- the enterprise produces no more than 10 tons of waste per year;

- has no radioactive emissions;

- will not pollute underground or surface water bodies.

To establish the hazard class, special commissions of Rosprirodnadzor work (https://rpn.gov.ru/). It should be understood that concluding a waste removal agreement with the relevant organization does not exempt you from paying for the NWOS.

Watch the video: Brief description of calculations - Calculation of fees for negative impact

Excessive environmental pollution

Above-limit environmental pollution is a familiar term in everyday life, meaning exceeding standards and limits.

Permits for the emission of pollutants into the atmospheric air, limits for the emissions of pollutants, permits for the discharge of pollutants into the environment, limits for the discharge of pollutants, waste generation standards and limits for their disposal (hereinafter referred to as permits and documents) obtained by legal entities and individual entrepreneurs carrying out economic and (or) other activities at facilities that have a negative impact on the environment and are classified, in accordance with the Federal Law of January 10, 2002 N 7-FZ “On Environmental Protection,” as objects of categories I and II, up to January 1, 2021, are valid until the day of expiration of such permits and documents or until the day of receipt of a comprehensive environmental permit or submission of an environmental impact statement during the validity period of such permits and documents.

Article 11 of the Federal Law of July 21, 2014 N 219-FZ “On Amendments to the Federal Law “On Environmental Protection” and Certain Legislative Acts of the Russian Federation”

In essence, this provision of the law, after receiving a comprehensive environmental permit or declaration of environmental impact for ENVOS categories 1, 2, these documents are permits.

At facilities of categories I and II, until comprehensive environmental permits are obtained and an environmental impact declaration is submitted, temporarily permitted emissions/discharges are recognized as limits on emissions/discharges

Article 11 of the Federal Law of July 21, 2014 N 219-FZ “On Amendments to the Federal Law “On Environmental Protection” and Certain Legislative Acts of the Russian Federation”

Explanations for ENVOS category 3 - what I found:

With regard to emissions of pollutants, with the exception of radioactive ones, for objects of category III in accordance with Article 22 of the Federal Law of January 10, 2002 N 7-FZ “On Environmental Protection”, it is necessary to calculate the standards of permissible emissions for highly toxic substances, substances that are carcinogenic, mutagenic properties (substances of hazard class I, II). If it is impossible to comply with the standards for permissible emissions of such substances, an environmental protection action plan is developed and temporarily permitted emissions are established (Article 23.1 of Law No. 7-FZ).

Letter of the Ministry of Natural Resources of Russia dated September 20, 2019 N 12-47/22755 “On the implementation of industrial environmental control in the field of atmospheric air protection”

When calculating fees for the negative impact on the environment by legal entities and individual entrepreneurs carrying out economic and (or) other activities at category III facilities , the volume or mass of emissions of pollutants, discharges of pollutants, indicated in the report on the organization and on the results of the implementation of industrial environmental control are recognized as being carried out within the limits of permissible emissions standards, permissible discharge standards, with the exception of radioactive substances, highly toxic substances, substances with carcinogenic, mutagenic properties (substances of hazard class I, II).

Federal Law of July 21, 2014 N 219-FZ 19) “On Amendments to the Federal Law “On Environmental Protection” and Certain Legislative Acts of the Russian Federation” (as amended and supplemented, entered into force on January 1, 2020)

It turns out that for category 3 ENVOS the following rule applies:

- The amount of emissions and discharges of pollutants shown in the PEC report (with the exception of substances of hazard classes 1 and 2) is recognized as an amount within the limits of the standards.

- For substances of hazard classes 1 and 2, ENVOS of category 3 have calculations of standards; therefore, for these substances, excesses of standards are established based on these calculations.

Who pays the environmental fee

The environmental fee is paid by organizations and individual entrepreneurs (individual entrepreneurs):

- Manufacturers of goods

- Importers of goods

Payment and settlement are made for each group of goods, group of packaging of goods according to the list approved by the Government.

If the product in the package is not a ready-to-eat product, then the environmental tax must be paid only in relation to the packaging itself.

If goods and packaging of goods are exported from the territory of the Russian Federation, then the environmental tax is not paid.

If manufacturers or importers provide waste disposal, then the environmental fee is not paid.

Environmental tax rates are approved by the Government of the Russian Federation.

Recycling standards are approved by the Order of the Government of the Russian Federation. (current standards for 2021)

Payment for negative impact on the environment - terms

The fee for negative impact on the environment, calculated based on the results of the reporting period, taking into account the adjustment of its amount, is paid no later than March 1 of the year following the reporting period.

Art. 16.4 Federal Law “On Environmental Protection”

Wherein:

- Quarterly advance payments are made no later than the 20th day of the month following the reporting quarter.

- For the 4th quarter, advance payments are not made - the already adjusted annual fee minus 3 quarters is paid.

- Small and medium-sized businesses do not make quarterly advance payments.

Persons obligated to pay a fee have the right to choose one of the following methods for determining the amount of the quarterly advance payment for each type of negative environmental impact for which a fee is charged:

1) in the amount of one-fourth of the amount of the fee for negative environmental impact payable for the previous year - the simplest option ;

2) in the amount of one-fourth of the amount of payment for negative impact on the environment, in the calculation of which the payment base is determined based on the volume or mass of emissions of pollutants, discharges of pollutants within the limits of permissible emission standards, permissible discharge standards, temporarily permitted emissions, temporarily permitted discharges, limits on disposal of production and consumption waste;

3) in the amount determined by multiplying the payment base, which is determined on the basis of industrial environmental control data on the volume or weight of emissions of pollutants, discharges of pollutants, or the volume or weight of industrial and consumption waste disposed in the previous quarter of the current reporting period, by corresponding rates of payment for negative impact on the environment using the coefficients established by Article 16.3 of this Federal Law.

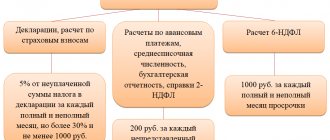

The deadline for submitting a declaration on payment for negative environmental impact is no later than March 10 of the year.

Environmental fee in 2018–2019. Is this a tax?

In order to understand what an environmental fee is, let’s turn to the legislation. The current federal law of June 24, 1998 N 89-FZ (as amended on December 25, 2018) “On production and consumption waste” contains Article 24.5 on environmental collection. The article was introduced in 2014 and clearly establishes that the environmental fee is non-tax income. But the obligation to pay it, as a fulfillment of the recycling standard, is directly established by federal legislation. Therefore, this payment is as mandatory as all tax payments.

The legislation describes point by point how the environmental fee is paid. Thus, Decree of the Government of the Russian Federation dated October 8, 2015 N 1073 (as amended on August 23, 2018) established both the procedure and rules for paying the fee. The right to choose to provide information to the territorial bodies of Rosprirodnadzor is given both on paper and in electronic form. Goods exported outside our country are not subject to environmental tax. This is expressly established by the rules. Order of Rosprirodnadzor dated August 22, 2016 N 488 approved the form for calculating the amount of environmental fees. The deadline for payment of the environmental fee has been established - until April 15 of the year following the reporting year (for 2021, payment must be made before April 15, 2021).

Waste Management Technical Report 2021

The obligatory submission of this reporting includes objects of categories I and II of the NVOS. The technical report must be developed based on the company's NLR. In paragraph 3 of Art. 18 of Federal Law N 89-FZ and Art. 31.1 of Federal Law No. 7-FZ explains the need to obtain a comprehensive environmental permit (IEP) for category I facilities and to prepare standards for waste generation and limits on their disposal. The standards are an integral part of the IER.

Objects of category II must submit a technical report based on the NVOS declaration no later than the expiration of the previously received permits.

If permits are received before 2021, it is possible to submit an application for an IEP or an NVOS declaration before the expiration of these permits. Previously received documents will be valid until the IER is received or the NVOS declaration is submitted in accordance with Federal Law dated December 25, 2018 N 496-FZ.

Currently, the NREP is approved for 5 years if the NVOS facility submits a technical report annually. The deadline for submitting the report is annually from the date of approval of the standards within 10 days. If a document within the framework of environmental reporting is not submitted on time, then a fee will be charged for excess waste disposal (Letter of Rosprirodnadzor dated May 17, 2011 N KT-08-03-36/6068).

Note! If the organization does not have an NVOS category of object, the development of a NFLR is not required according to the clarifications of the Letter of the Ministry of Natural Resources of Russia dated January 23, 2020 N 12-47/1347

An environmental tax will increase budget revenues, but will not save nature, experts say

MOSCOW, August 14 - PRIME, Alexander Kozhemyakin. The Ministry of Finance proposes to replace the current fee for negative impact on the environment with an environmental tax. The new tax, as stated in the draft amendments to the Tax Code, is expected to be introduced in 2021.

The Ministry of Finance justified the need for an environmental tax by the weak administration of fees for environmental pollution.

Revenues from fees for negative environmental impacts to the consolidated budget in 2021 amounted to 14.2 billion rubles. For 2021, the figure is planned at 11.6 billion rubles. The Ministry of Finance expects a significant increase in revenue from the environmental tax.

Experts interviewed by the Prime agency believe that the introduction of an environmental tax will improve the quality of administration and increase budget revenues. The effective spending of the “increased revenues” remains questionable.

ECOLOGICAL CHARGES WILL INCREASE

“I think the transformation of the environmental fee into a tax should be positively received by conscientious taxpayers. According to the plans of the Russian government, after adjusting the tax system, it will not change for the next 6 years, thus, given the significant increase in non-tax payments in recent years, business can be more calm about this expense item,” says Kirill Kukushkin, head of the NRA corporate sector ratings department. .

According to him, the state will also benefit, since the introduction of an environmental tax, while maintaining the current load, will improve the quality of administration and increase budget revenues.

The Ministry of Natural Resources intends to create a company through which it will collect environmental fees

Finam expert Alexey Kalachev believes that after the introduction of the new tax, the burden on business will still increase.

“As always, this “coin” has two sides. On the front - the inclusion of non-tax payments in the Tax Code will streamline and increase collection. It is easier for the tax service to administer any fees, since there is strict liability for non-payment of taxes. This will increase the responsibility of enterprises for the environmental situation and provide funding for environmental programs,” says Kalachev.

“On the flip side is an increase in the tax burden on enterprises. Although it is stated that the amount of fees will not increase, objectively the tax burden on business will increase. Firstly, payments, which often had to be scraped out through the courts, will now be collected in advance. And, secondly, the circle of payers of the new tax will increase compared to payments for harmful emissions. An increase in the tax burden against the backdrop of rising VAT rates and proposals to withdraw “windfall profits” generally has a negative impact on the business climate,” explains the expert.

WHERE WILL THE ENVIRONMENTAL TAX GO?

According to Kukushkin, the main thing is that the new tax goes to regional budgets and is distributed directly for its intended purpose - to compensate for environmental damage.

From the bill presented by the Ministry of Finance, the future distribution of tax revenues between the federal and local budgets is not clear. Currently, 95% of the negative impact fee goes to local authorities and is spent on compensation for environmental damage.

The financial and economic justification for the bill only assumes maintaining the current proportions of distribution of environmental tax amounts among budgets of different levels: 5% to the federal budget revenue, 95% to the budget revenue of the constituent entities of the Russian Federation.

THE MONEY WILL BE RAISED, BUT THE ECOLOGY WILL REMAIN

Environmental experts, commenting on the Ministry of Finance's bill, noted that it does not motivate entrepreneurs to comply with environmental requirements. In addition, there is confusion in the departments responsible for the environment in the use of funds allocated for environmental programs.

“This tax, in my opinion, does not in any way motivate entrepreneurs to independently solve environmental problems, since this money will be taken away anyway. The entrepreneur will understand that no matter what he does, this money will still be taken away. Therefore, there is no point in dealing, for example, with cleaning activities, wastewater, or separately collecting plastic in production and sending it for recycling. I will lump everything into one pile, because I will still pay the state for it,” says Natalya Samoilova, a representative of the interregional public environmental movement “Otpor”.

The most environmentally friendly regions of Russia have been named based on the results of spring 2018

According to her, the environmental responsibility of the manufacturer should be regulated in such a way as to motivate him to carry out all environmental measures independently and significantly reduce fees for environmental impact.

“If you are a lazy entrepreneur, then pay the state more, and it will direct the money to the restoration activities that need to be carried out. If you are a non-lazy, responsible entrepreneur, and you count your money, you will do everything to not harm the environment and protect nature from harmful effects,” says Samoilova.

General Director of the Center for Environmental Initiatives Vladimir Kuznetsov believes that the appearance of the bill on environmental tax indicates that the Ministry of Ecology and Rosprirodnadzor are not able to exercise their powers to collect fees for negative impacts on the environment.

“The Ministry of Ecology and Rosprirodnadzor sign that they are not able to implement these powers. Obviously, they do not have enough resources,” says the expert.

He noted the existence of confusion in the distribution of environmental responsibilities and resources allocated to environmental programs.

“We need to change the entire system, take away from these 12-15 departments, which have about 100 powers in the field of waste management and natural resources, and create a functional body for 5 years, which, as an emergency commission, will nullify all legislation and start everything from scratch. Otherwise, we will not change anything in terms of environmental pollution,” concluded Kuznetsov.