How to correctly indicate code 327 in 3-NDFL

A taxpayer who makes voluntary contributions to the above funds has the right to a refund of the tax paid through the Federal Tax Service.

It belongs to the section of social tax deductions. To do this, a citizen must fill out a 3NDFL declaration. Where should I put this code? It should be indicated on sheet E1 intended for deductions:

- standard benefits for parents for children up to an income of 350 thousand rubles. indicated in lines 030-060;

- social deductions (327) are recorded in lines 150, 160;

- contributions stipulated by insurance contracts must be indicated in line 140;

- Contributions to non-state pension funds should be reflected in line 150, and voluntary contributions to a funded pension are also summed up here.

In addition, the declaration must also fill out sheet E2, where you need to decipher the expenses reflected on sheet E1. That is, by filling out line 150, in subsection 1.1 you will have to indicate the details of your agreement with the NPF, and in 2.2 - all contributions paid to this fund.

This data must be filled out if you prepare reports in the Declaration program. The details of the insurance company are also indicated here - name, tax identification number, checkpoint, contract number.

The deduction is indicated in 2NDFL, how to reflect it in 3NDFL

Here you check the box to provide a standard deduction and indicate the number of children. Let there be one child. Then the number is set to one. What is the result? When you go to sheet E1, you can see the number 7000 rubles. You can trust the program or calculate it yourself.

It is this information that is displayed in the 3-NDFL declaration. You should know how else you can manipulate the number of children. If, for example, there are two children, then in this case it turns out 1,400 rubles for each.

Please note that only two children can be indicated in the first tab, since it is for the first two children that a tax benefit of 1,400 rubles per month is provided for each child. For every third child, a tax deduction of 3,000 rubles is provided, so all other children, starting from the third, are entered separately. If a citizen, for example, has four children, two are indicated in the first line, two more are indicated in the second line.

The amount of the deduction is determined by multiplying the amount of accepted expenses by the tax rate (13%). The result of the product in rubles and kopecks is transferred to line 3.4. sheet E1. Deduction 327 in the Declaration program Using the Declaration program is the most convenient way to fill out the report.

In order to enter data on expenses 327, you need to go to the “Deductions” section on the “Social deductions” tab. Pension and life insurance contracts are entered in the lower block. Information is entered:

- type of contract;

- name of the fund or organization;

- TIN;

- checkpoint;

- contract number;

- agreement date;

- the amount of the deduction used by the employer;

- amount of contributions.

The amount of contributions is written in full.

If there are three children, but the first two are no longer deductible, that is, they are over 18 years old and are not studying, in this case you should uncheck the box for the first two children. And for the third child it is indicated that he is one third child. In this case, the program will calculate everything correctly. There are situations when a citizen gives birth to a child.

In this case, the standard deduction for him is provided precisely from the month of his birth. Then it will be necessary to indicate in which month this event occurred. For example, a child was born in September. In this case, this month is indicated and a unit is entered each month until the end of the year.

Explanation of situations related to code 327

Procedure for receiving a deduction

The procedure for returning taxes under codifier 327 from a tax agent or the Federal Tax Service raises a lot of questions. The most common question taxpayers ask is how can they take advantage of the contribution cost relief? You need to act according to the instructions:

- Fill out the declaration, indicating personal information, information about income received and all expenses, as well as contributions made to funds;

- Take a 2-NDFL certificate from your employer for the previous year, which indicates the taxes withheld;

- Prepare a copy of the agreement with the fund; when insuring, this document may not be present; its role is played by the policy;

- Take checks or receipts that contain the actual expenses incurred - they can be paid either one-time or annually (the second option is preferable if the total amount of insurance compensation exceeds 15,600);

- Provide the tax authority with a package of documents - do not forget to take the originals with you for the inspector to review. This must be done at the territorial department at your place of residence.

If the deduction agreement is drawn up for a close relative, documents confirming the relationship will be required.

The excess tax amount withheld will be returned after verification of the information. If you don’t want to wait for the end of the calendar period, you can take a notice from the Federal Tax Service and apply for a social deduction directly from the employer.

Several social deductions in one year

Another situation related to receiving a deduction arises if the taxpayer wants to take advantage of several benefits at once in one period. The maximum amount for reducing the tax base is limited to 120 thousand rubles, that is, to return over 15,600 rubles. per year will not work. Even if you paid contributions to a non-state pension fund, underwent paid treatment and at the same time spent money on educational services.

Thus, information on code 327 will be useful to taxpayers who have entered into agreements with insurance companies or for voluntary pension provision. You must indicate the amount of expenses incurred in the declaration to refund part of the taxes, and if the benefit is provided by the employer, you can find this information in the 2-NDFL income certificate.

What does deduction code 327 mean?

The Federal Tax Service has assigned codes to all deductions and income included in the personal income tax database. The deduction codes are given in the order dated September 10, 2015 No. ММВ-7-11/ [email protected] (as amended on October 24, 2017). These codes are indicated by employers when filling out 2-NDFL certificates.

Code 327 indicates a deduction in the amount paid by a citizen during the tax period:

- pension contributions under non-state pension agreements concluded with non-state pension funds in their favor, in favor of family members or close relatives, disabled children under guardianship (trusteeship);

- insurance premiums under voluntary pension insurance contracts concluded with an insurance organization in its favor, in favor of a spouse (including a widow, widower), parents (including adoptive parents), disabled children (including adopted children under guardianship (trusteeship) );

- insurance premiums under voluntary life insurance contracts for a period of at least five years, concluded with an insurance organization in its favor, in favor of a spouse (including a widow, widower), parents (including adoptive parents), children (including adopted children, under guardianship (trusteeship).

In this case, the amount of the benefit is equal to the taxpayer’s expenses, but cannot be more than 120,000 rubles. (Clause 2 of Article 219 of the Tax Code).

- How to fill out and submit half-year reports

- reportingNew milestones for semi-annual

- for VAT How to convince the inspectorate to accept reports

- for the half-year How to fill out section 3 in the calculation of contributions

- to the tariff Why is it dangerous to lie to 4-FSS about a special assessment for the sake of a discount

- salary How to show early and rolling salary in 6-NDFL

Thus, if you receive a social deduction for pension insurance from your employer based on a notification from the Federal Tax Service, when you withhold personal income tax, the tax base is reduced. And the 2-NDFL certificate for the year is filled out with code 327. Then the accountant indicates income, amount and type of deduction (code). See a fragment of the 2-NDFL certificate below.

Fragment of certificate 2-NDFL

Deduction 327 in the Declaration program

Using the Declaration program is the most convenient way to fill out a report. In order to enter data on expenses 327, you need to go to the “Deductions” section on the “Social deductions” tab.

Pension and life insurance contracts are entered in the lower block. Information is entered:

- type of contract;

- name of the fund or organization;

- TIN;

- checkpoint;

- contract number;

- agreement date;

- the amount of the deduction used by the employer;

- amount of contributions.

The amount of contributions is written in full. The program itself will calculate the amount of the required deduction.

In a person’s life, various circumstances may arise due to which he...

Sberbank Online is a system that allows you to carry out hundreds of banking transactions.

A loan refusal can occur due to various circumstances, but 5 can be distinguished.

Money transfer operations between banks and clients are regulated by the laws of the country. That's why.

With the development of mobile technologies, the number of methods of luring is calculated.

A potential borrower must apply for a loan to purchase an apartment.

Attracting money and getting rich quickly is what millions of people dream about. Does this apply to many people?

Bank loans have become one of the most accessible today.

Most people lend money to relatives or...

This is important to know: Alimony and personal income tax from salary

High cost of real estate on the primary level.

The words “loan” and “credit” are heard in advertising slogans, on television and radio. However, not everyone.

Banks are not always limited to transferring the right to collect debt. Many.

Where to indicate social deduction with code 327 in the 3-NDFL declaration

You submit a 3-NDFL declaration if you want to receive a social deduction from the tax office. Then fill out deduction code 327 in the 2021 3-NDFL declaration in the following order.

Take the tax return form 3-NDFL, which was approved by order of the Federal Tax Service dated December 24, 2014 No. ММВ-7-11 / [email protected] (as amended on October 25, 2017). Fill in it:

- title page;

- sections 1 and 2. They are completed by all individuals;

- sheet A. On it, write down all income (main at the main place of work and all additional ones), as well as personal income tax calculated and withheld by the employer;

- sheet E1. On it you will indicate the social deduction with code 327.

Let's look at sheet E1 in more detail. Here you will indicate standard and social deductions.

If you have a child, you receive a standard personal income tax deduction for up to the month in which the amount of income exceeds 350,000 rubles. (subparagraph 3, paragraph 1, article 218 of the Tax Code). Indicate such a benefit in lines 030 – 060 of sheet E1.

For social deductions, the Federal Tax Service has allocated lines 080 – 180 on sheet E1. You will write deductions with code 327 in lines 150 or 160 of sheet E1.

If you paid insurance premiums under voluntary personal insurance contracts, as well as under voluntary insurance contracts for your spouse, parents or children (wards under the age of 18), write down the amount in line 140.

If you transferred pension and insurance contributions under contracts of non-state pension provision, voluntary pension insurance and voluntary life insurance, as well as additional contributions to a funded pension, fill out line 150.

Example: How to reflect social deduction with code 327 in the 3-NDFL declaration

A.I. Ivanov paid contributions under a voluntary personal insurance agreement in the amount of 15,000 rubles. There were no other standard and social deductions in 2021. We will show how Ivanov will reflect the amount of the benefit in the 3-NDFL declaration.

See below for a fragment of the 3-NDFL declaration.

Deduction by code 327 in 3-NDFL

- New clarifications from officials!

- Correct the primary report in a new way - tax authorities have tightened the rules

- Officials have changed their requirements for those accountable: how to calculate personal income tax and contributions now

- Who will the bank block the VAT account to please the Central Bank?

Errors when filling out the 3-NDFL declaration

If this is the case, it means that you were definitely provided with either a standard deduction or financial assistance. What should you do to enter the deduction data into your declaration? After you have filled out the “Work” section, you must select the type of deduction (the program will prompt you to make this choice) “Standard deductions”.

If the application is not submitted, the accounting department will perform the following calculations:

The main thing that any physical person needs to remember. For a person who is a resident of the Russian Federation, only a person who has officially accrued income subject to taxation at a rate of 13% can apply for deductions.

In addition, the calculation group must contain supporting documents, on the basis of which the accountant will perform correct calculations and issue a personal income tax certificate 2 with the corresponding deduction codes at the end of the year.

Tax system

The tax and fee system is a certain set of basic elements that determine this type of mandatory payments. It includes the definition:

- taxes;

- payers;

- objects;

- legislative acts;

- tax elements.

The entire set of fees is divided into groups depending on various reasons. So, they can be (depending on the level of budget revenue):

- federal;

- regional;

- local;

- mixed.

Types of social tax deductions.

Depending on the object:

- profitable;

- property;

- others.

Depending on the subject:

- from citizens;

- from law firms and individual entrepreneurs.

Depending on the collection procedure:

- straight;

- indirect.

The subjects of legal relations are:

- payers – individuals, organizations and businesses;

- the state – as the main recipient of funds;

- tax departments - as the main regulatory body acting on behalf of the state.

The latter are accountable to the main branch of the Federal Tax Service, the activities of which, in turn, depend on the Ministry of Finance.

The Tax Code is the main collection of laws in this area.

All actions of participants, their rights and obligations are contained in the following legislative acts:

- constitution;

- Tax code;

- Presidential Decrees;

- Government Decrees;

- Orders of the Federal Tax Service;

- other legal acts.

In addition to compliance with the laws, for the normal functioning of the system it is necessary to ensure the presence of basic features: legality, proportionality, equality, legality and others.

What has been changed in the list of deduction codes?

The adjusted table of deduction codes has retained the main set of codes used in the old table, but at the same time a number of codes have been excluded from it, new ones have been added, old codes have been replaced with new ones, and deduction description texts have been adjusted.

We invite you to familiarize yourself with the Property Rights and Obligations of Spouses

Broken down by type of deduction, the changes look like this:

- Standard codes - excludes codes 114-125. Codes 126–149 have been introduced instead. Now they differ depending on who the deduction is provided to: natural parents (adoptive parents) or persons who replace them.

- Reducing the base according to Art. 214.1 of the Tax Code of the Russian Federation (transactions with securities and financial instruments of forward transactions) - in codes 205–207, instead of expenses on operations with financial instruments of forward transactions, expenses on operations with derivative financial instruments are now indicated, and codes 209–210 reflect no loss on operations with financial instruments of futures transactions, and losses on transactions with derivative financial instruments. Additionally, code 208 was introduced, which reflects losses on transactions with derivative financial instruments.

- Reducing the tax base for securities lending transactions in accordance with Art. 214.4 - instead of code 221, which was used to reflect the amount of expenses on transactions with securities accounted for in an individual investment account, codes 225–252 were introduced. Codes 250–252 have been added, reducing the tax base for transactions accounted for on an individual investment account in accordance with Art. 214.9 Tax Code of the Russian Federation.

- From investment tax deductions provided for in Art. 219.1 of the Tax Code of the Russian Federation, code 617 is excluded.

What does code 327 mean?

In accordance with the established rules, tax deductions are entered into the 2-NDFL certificate under digital codes indicating their type.

Code 327 is intended to account for the expenses specified in subparagraph. 4 paragraphs 1 art. 219 of the Tax Code of the Russian Federation. Includes payments for non-state pension provision (insurance) or life insurance made by the taxpayer for himself or his relatives. This is a social deduction.

You can receive social deductions using code 327 from the tax office at the end of the year or from your employer. However, a tax reduction at the place of work is only possible if there is a notification from the tax authority.

The amount of expenses included in the social tax deduction is limited to 120 thousand rubles (except for fees for children’s education and expensive treatment).

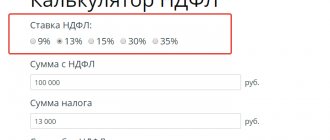

Social deduction limit = 120 thousand rubles. * 13% = 15.6 thousand rubles.

You can receive a deduction only if you have taxable income. The deduction is valid during the tax period in which the contributions were paid. Does not carry over to subsequent years.

If the employer's tax has not decreased during the year, the citizen has the opportunity to receive a deduction by submitting a declaration to the inspectorate at the place of registration.

You can see whether expenses for pensions and life insurance were deducted when calculating tax and in what amount in certificate 2 of personal income tax. If deductions were not made or were made incompletely, you should submit a 3-NDFL report to the tax service.

Social tax deduction from an agent

A tax refund is a government preference that gives citizens the right to return part of the money spent for certain purposes. These include: purchasing housing, paying for educational and medical services, contributions to charitable purposes, to non-state pension funds (as a voluntary additional pension) and insurance companies. To return part of the expenses, you must fill out the 3rd personal income tax declaration or contact your employer.

Important! To receive a deduction, you need an official source of income from which tax is withheld and transferred to the budget. Failure to do so will result in the inability to receive a refund.

In addition, the above production methods can be combined. However, one deduction can only be used once. For example, reimbursement of voluntary pension contributions can be obtained from the employing organization, and for reimbursement of medical expenses you should contact the tax authority.

The employer provides compensation based on an application from the employee and notification from the tax department. To obtain the latter, the employee must contact the inspectorate with the established list of documents. In general, this is an application to receive notification and paper confirming the right to return: contracts, checks, certificates, etc.

The procedure for providing deductions by the employer

If the employee was provided with a deduction at work, then this fact is reflected in the 2nd personal income tax certificate. There is a special section on the form for this. A particular type is indicated using certain combinations of numerical values. The list of such code values is established and adjusted by legislative acts of government departments.

For example, social payments have code 327 in personal income tax certificate 2, which means receiving compensation for contributions to non-state pension funds or insurance organizations. The following code values also include social ones - 320, 321, 324, 325, 326 and 328. However, it is necessary to check the values from year to year to ensure the relevance of the data, since along with the new form of certificate 2 personal income tax, changes may be made to the digital values, used for data encryption.

How to fill out 3 personal income taxes

When filling out a declaration, the question arises, if the certificate indicates social deductions provided by the tax agent, what to write. To do this, we will figure out when it is necessary to fill out 3 personal income taxes if there are social tax deductions provided by a tax agent.

This need may arise:

- if the employer provided only one type of deduction;

- if the employer did not provide compensation in full.

Even if there are proper reasons, a refund cannot be made:

- if the amount of expenses is greater than total earnings.

Important! Social deductions are not carried over to the next year.

So, let’s figure out, having deduction code 327 in the personal income tax declaration 3, how to put your details and fill out the declaration.

If a declaration is filled out using a special program, then first all the necessary data is filled in, reflecting general information about the applicant and his income.

Deduction code 327 in personal income tax certificate 2 means that it belongs to the social category, so we select the desired section.

In the voluntary insurance column, we indicate the total amount of contributions for checks (even if it exceeds the limit).

This is important to know: Recalculation of vacation pay in 6 personal income taxes: example

Next, you need to select the type of agreement from those presented by the system, the name of the organization (including INN and KPP), number and date of the agreement, the amount used with the employer, the total amount of contributions. The amount of deduction 327 is indicated in the personal income tax certificate 2 next to the code.

Procedure for filling out 3 personal income taxes

In the printed personal income tax declaration 3, code 327 is contained on sheets E1 and E2. On sheet E1 in clause 3.6.1 in 3 personal income tax, the amount of social deduction received from the agent is indicated. Sheet E2 reflects the data of the organization - a fund or an insurance company, as well as details of the agreement on the basis of which contributions and all the amounts described above are paid. Therefore, when filling out 3 personal income taxes in 2021 manually, you need to pay special attention to sheets E1 and E2.

Tax deduction 328 is provided for additional insurance contributions for a funded pension. When filling out the declaration, you need to select the type of contract, the amount of deduction from the employer and the amount of contributions. Entering information about the company or the basis agreement is not required.

On a note! When drawing up a return declaration using your personal account on the official website of the service, code 327 is automatically transferred to the personal income tax declaration 3 from the income certificate available in the unified system.

Thus, the state gives the taxpayer the right to choose a convenient method for receiving paid expenses for established purposes. At the same time, when receiving a deduction through the employer, do not forget that when submitting the declaration to the inspectorate, it must be reflected there.