Accounting for deductions from wages: postings and examples

According to the law, various deductions can be made from employees' wages. For proper deduction, you need to know the nuances of the types of deduction and their accounting.

Let's consider an example of calculating deduction from wages, as well as accounting entries generated when withholding personal income tax, according to writs of execution, when repaying a loan issued to an employee and withholding union dues.

Grounds and procedure for deduction from wages

Types of possible deductions from an employee’s salary:

Income not subject to withholding

These types are established by Art. 101 of Law No. 229-FZ. The main types of such income:

- Compensation for damage caused to health or in connection with the death of the breadwinner;

- Compensation for injury to an employee and family members if they die;

- Compensation from the budget as a result of disasters (man-made or radiation);

- Alimony;

- Amounts of business travel, moving to a new place of residence;

- Financial assistance in connection with the birth of a child, marriage, etc.;

Deduction order

Deductions from an employee's salary are made in the following sequence:

- personal income tax;

- Writs of execution for alimony for minor children, for compensation for harm to health, death of the breadwinner, crime or moral harm;

- Other writs of execution in the order of receipt (other mandatory deductions);

- Retentions at the initiative of the manager.

Limiting the amount of deductions

The amount of mandatory deductions cannot exceed 50% of the wages due to the employee. In some cases, the amount of deductions may be increased. For example, deductions based on writs of execution. These deductions are subject to a 70% limit:

- On alimony for minor children;

- Compensation for damage caused to health, death of the breadwinner;

- Compensation for criminal damage.

Also, when calculating deductions, you should take into account:

- If the amount of mandatory deductions exceeds the limit (70%), then the amount of deductions is distributed in proportion to the mandatory deductions. No other deductions are made;

- The amount of limitation on deductions initiated by the employer is 20%;

- At the request of the employee, the amount of deductions is not limited.

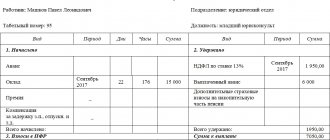

Example of calculating salary deduction

In the name of employee Vasilkov A.A. 2 writs of execution were received: alimony for the maintenance of 3 minor children - 50% of earnings and compensation for damage to health in the amount of 5,000.00 rubles. The salary amount was 15,000.00 rubles. The personal income tax deduction for 3 children amounted to RUB 5,800.00.

We will calculate deductions based on writs of execution:

- Personal income tax tax base = 15,000.00 – 5,800.00 = 9,200.00 rubles;

- Personal income tax = RUB 1,196.00;

- Amount of earnings for calculating deductions = 15,000.00 – 1,196.00 = 13,804.00 rubles;

- Limit amount = RUB 9,662.80.

Get 267 video lessons on 1C for free:

Deductions in the amount of =11,902.00 rubles, of which:

- For alimony = 6,902.00 rubles. (58% of the total withholding amount);

- Compensation for damage = 5,000, rub. (42% of the total withholding amount).

As a result, deductions are made according to writs of execution in the amount of:

- For alimony – 9,662.80 *0.58 = 5,604.42 rubles;

- Compensation for damage – 9,662.80 *0.42 = 4,058.38 rubles.

Mandatory deductions

Personal income tax is withheld from each employee’s salary at the following rates:

- 13% - if the employee is a resident of the Russian Federation;

- 30% - if a non-resident of the Russian Federation;

- 35% - in case of winning, savings on interest, etc.;

- 15% - from dividends of a non-resident of the Russian Federation;

- 9% - from dividends until 2015; interest on mortgage-backed bonds until 2007, from the income of the founders of the trust management of the mortgage coverage.

It does not matter in what form the income was received, cash or in kind. Let's look at an example:

Employee Vasilkov A.A. wages of 30,000.00 rubles were accrued, personal income tax was withheld from it at a rate of 13%, since Vasilkov A.A. is a resident.

Postings for mandatory withholding of personal income tax:

| Dt | CT | Amount, rub. | Operation description |

| 26 | 70 | 30 000,00 | Salary accrued |

| 70 | 68 | 3 900,00 | Personal income tax withheld |

According to executive documents

The amount under the writ of execution is withheld from wages, taking into account personal income tax. The amount of additional expenses under the writ of execution (for example, transfer fees) is debited from the employee.

Let's look at an example:

Employee Vasilkov A.A. wages were accrued in the amount of 20,000.00 rubles, of which 25% was withheld according to the writ of execution. Amount of deduction under the writ of execution = (20,000.00 – 13%) * 25% = 4,350.00 rub.

Deduction from wages of Vasilkov A.A. according to the writ of execution is reflected by posting:

| Dt | CT | Amount, rub. | Operation description |

| 26 | 70 | 20 000,00 | Salary accrued |

| 70 | 68 | 2 600,00 | Personal income tax withheld |

| 70 | 76.41 | 4 350,00 | The amount under the writ of execution was withheld |

| 76.41 | 50 | 4 350,00 | The amount according to the writ of execution was transferred from the cash register |

At the initiative of the employer

Deductions for the purpose of debt repayment are regulated by the Labor Code and other federal laws. In this case, it is necessary to issue an order no later than a month from the date of payment and obtain written permission from the employee.

If upon dismissal the amount of deductions is not completely written off, then, by agreement with the employee, the amount can be repaid:

- Judicially;

- By depositing funds into the cash register;

- Gift to an employee (in this case, expenses are not taken into account when calculating income tax);

- At the request of the employee, write off 20% of the salary monthly.

Typical entries for deductions from wages at the initiative of the employer:

| Dt | CT | Operation description |

| 26 | 70 | Salary accrued |

| 70 | 68 | Personal income tax withheld |

| 70 | 73.2 | The amount of compensation for the shortage is withheld |

| 70 | 71 | Unreturned accountable amount withheld |

| 70 | 73.1 | Repayment of the issued loan |

Let's look at an example:

From employee Vasilkov A.A. RUB 1,500.00 was deducted from wages to repay the loan. The salary amounted to 10,000.00 rubles. The limit amount is = 8,700.00 * 0.2 = 1,740.00 rubles.

Posting the deduction of a loan from the salary of Vasilkova A.A.:

| Dt | CT | Amount, rub. | Operation description |

| 26 | 70 | 10 000,00 | Salary accrued |

| 70 | 68 | 1 300,00 | Personal income tax withheld |

| 70 | 73.1 | 1 500,00 | Deduction for loan repayment |

According to the employee

At the request of the employee, the manager can deduct the necessary amounts from wages, but the manager can also refuse such deductions. At the same time, the amount of deductions at the request of the employee is not limited.

Deduction from wages at the request of an employee posting:

| Dt | CT | Operation description |

| 70 | 76 | Amount withheld at the request of the employee |

Let's look at an example:

Employee Vasilkov A.A. wrote an application to withhold union dues in the amount of 2%. The salary amounted to 10,000.00 rubles. The amount of the union contribution is (10,000.00 – 1,300.00) *2% = 174.00 rubles.

Withholding of trade union dues from the wages of Vasilkova A.A. wiring:

| Dt | CT | Amount, rub. | Operation description |

| 26 | 70 | 10 000,00 | Salary accrued |

| 70 | 68 | 1 300,00 | Personal income tax withheld |

| 70 | 76 | 174,00 | Union dues withheld |

Source: https://BuhSpravka46.ru/buhgalterskie-provodki/uchet-uderzhaniy-iz-zarabotnoy-platyi-provodki-i-primeryi.html

Purposes for which deductions can be made

At the employee’s initiative, amounts can be withheld from his salary for any purpose.

These may be payments to repay a loan, for goods purchased on credit, to pay for insurance premiums and cellular communication services, for membership fees, etc. The specified amounts are not considered deductions within the meaning of Articles 137 and 138 of the Labor Code of the Russian Federation, since It is about the employee’s will to dispose of the accrued salary. In this case, the employee must confirm his desire to withhold with a written statement. Similar conclusions follow from the letter of Rostrud dated September 16, 2012 No. PR/7156-6-1.

Situation: is it possible to withhold loan debt from an employee’s salary? The organization provided the employee with a loan, which he refuses to repay.

The answer to this question depends on what procedure for repaying the loan obligation is provided for in the agreement between the organization and the employee.

If the agreement states that the loan is repaid by deducting amounts from the debtor’s salary, the organization can collect them without the employee’s consent. After all, he confirmed his willingness to repay the loan through salary deductions by signing the agreement. If the agreement provides for another method of repaying the loan (for example, depositing money into the cash register), then amounts can be withheld from the employee’s earnings only upon his written application.

This procedure follows from paragraph 1 of Article 810 of the Civil Code of the Russian Federation.

Situation: is it possible to deduct alimony from an employee’s salary upon his written request? The employee did not present a writ of execution or a notarized agreement on the payment of alimony signed by the spouses.

Answer: yes, you can.

At the employee’s initiative, amounts can be withheld from his salary for any purpose, including alimony. The only condition: the employee must confirm his desire for voluntary retention with a written statement. The presence of a writ of execution or an agreement to pay alimony is not a condition for carrying out this operation. The explanation is this.

According to Article 109 of the Family Code of the Russian Federation, alimony is a mandatory deduction from an employee’s income (regardless of his wishes), which is carried out on the basis of a writ of execution or a notarized agreement on the payment of alimony. These documents can be received by the organization from a bailiff (usually by mail) or from the claimant himself (for example, from the former spouse of an employee with a requirement to pay alimony). The amount of deduction under the writ of execution is limited to 50 (70) percent of the employee’s monthly income (Parts 2–3 of Article 99 of the Law of October 2, 2007 No. 229-FZ).

At the same time, the employee has the right to pay alimony on a voluntary basis, withholding any amount from income.

Moreover, if the employer receives a writ of execution or a notarized agreement to pay alimony in relation to this payer, it is first necessary to make deductions on them by notifying the employee (Article 109 of the Family Code of the Russian Federation, Article 98 of the Law of October 2, 2007 No. 229-FZ, letter of Rostrud dated December 19, 2007 No. 5204-6-0).

An employee who pays child support on his own initiative can stop doing so whenever he wants. To do this, he must write a new application asking not to withhold part of his income from a certain date.

Situation: how to withhold additional insurance contributions from an employee’s salary to the Pension Fund of the Russian Federation to finance a funded pension?

There is a special procedure for deducting additional insurance contributions for a funded pension from an employee’s salary.

In order to pay these contributions, the employee must first inform the Pension Fund of the Russian Federation of his intention to enter into a pension insurance relationship in order to pay additional contributions. He can do this independently or through an organization until December 31, 2014 (Part 1, Article 12 of Law No. 56-FZ of April 30, 2008).

If an employee submits an application through an organization, then within three working days it must redirect this application to the territorial office of the Pension Fund of the Russian Federation at the place of registration as an insurer of its employee or transfer it through a multifunctional center. Moreover, some organizations are required to submit such statements in electronic form. This applies to organizations whose average number of employees for the previous year exceeds 25 people, as well as newly created (including through reorganization) organizations whose number of employees exceeds 25 people.

Such rules are established by Article 4 of the Law of April 30, 2008 No. 56-FZ.

The employee must confirm his desire to have contributions deducted from his salary in a written statement. In this statement, the person reports the amount of the monthly payment, which can be determined:

- in a fixed (fixed) amount;

- as a percentage of the base from which contributions to compulsory pension insurance are paid.

This is stated in Part 2 of Article 5 of the Law of April 30, 2008 No. 56-FZ.

Starting from the 1st day of the month following the month of receiving the application from the employee, the organization must begin to withhold from the salary the amount specified in the application and transfer it to the Pension Fund of the Russian Federation in a single payment and a separate payment order. Pay additional insurance contributions to the Pension Fund of the Russian Federation within the same deadlines as mandatory pension contributions.

The organization paying the contributions must form a register of insured persons in form No. DSV-3, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated November 12, 2008 No. 322p. Submit the register to the territorial office of the Pension Fund of the Russian Federation no later than 20 days from the end of the quarter during which contributions were transferred (Part 6, Article 9 of Law No. 56-FZ of April 30, 2008, clause 1.3 of the Procedure approved by the resolution of the Board of the Pension Fund of the Russian Federation dated November 12, 2008 No. 322p). It should be noted that the procedure for determining the terms specified in days is not provided for by the Law of April 1, 1996 No. 27-FZ and the resolution of the Board of the Pension Fund of the Russian Federation of November 12, 2008 No. 322p. Therefore, it is unclear which days to take into account (working or calendar days). There are no clarifications from regulatory agencies on this issue. In this regard, it is advisable to calculate the deadline for submitting the register in calendar days (for example, the register for the first quarter of 2015 should be submitted no later than April 20, 2015).

The procedure for submitting the register in form No. DSV-3 depends on how many people work in the organization. If the average number of employees for the previous year exceeded 25 people, then the register must be submitted only electronically. If the average number of employees for the previous year did not exceed 25 people, then the organization is given the right to choose. At its discretion, it may submit the register either electronically or on paper. This procedure follows from paragraph 7 of Article 9 of the Law of April 30, 2008 No. 56-FZ.

Indicate the amount of additional insurance contributions withheld and paid to the Pension Fund of the Russian Federation on the employee’s pay slip.

Such rules are established in Articles 7 and 9 of the Law of April 30, 2008 No. 56-FZ.

Stop withholding and paying additional insurance premiums if an employee requests this, as well as upon dismissal of the employee (Part 3 of Article 5, Part 2 of Article 7 of the Law of April 30, 2008 No. 56-FZ).

Personal income tax withheld: posting tax withholding from wages

When personal income tax is withheld, the posting is made to the credit of account 68 in correspondence with the debit of one of the accounts for settlements with individuals. The article contains correspondence of accounts and examples, free reference books and useful links.

The following reference books will help you pay salary taxes without any problems; you can download them:

In the most common case of tax calculation, when personal income tax is withheld from wages, accounting entries are made to the personnel payroll account in correspondence with the budget settlement account.

In other cases, when less common income of individuals is subject to taxation, the correspondence of accounts may differ. For example, tax agents withhold personal income tax not only from wages, but also from financial aid, dividends, benefits, bonuses, etc.

Further in the article - details about frequently encountered transactions for accrued personal income tax.

Other tax references

After familiarizing yourself with the personal income tax transactions, do not forget to look at the following reference books, they will help in your work:

Personal income tax reporting – online

Traditionally, the most problematic form of income tax reporting for employers is the calculation on the 6-NDFL form. It was approved in 2015, but starting with the reporting for 2021, changes were made to the title page and the procedure for filling out the calculation.

It is possible that these amendments are not the last, since tax legislation is constantly being improved. In order not to track all changes and save time on filling out the report, it is more convenient to prepare it automatically - in the BukhSoft program.

Calculation according to form 6-NDFL can be generated in the BukhSoft program in 3 clicks. It is always drawn up on an up-to-date form, taking into account all changes in the law. The program will fill out the calculation automatically. Before sending to the tax office, the form will be tested by all Federal Tax Service verification programs. Try it for free:

6-NDFL online

Personal income tax accrued: posting

The accrual of personal income tax is reflected in the accounting records of the tax agent upon the fact of tax withholding from the income of an individual. In what amount should personal income tax be accrued, posting involves the application of a certain formula for calculating tax. If personal income tax is withheld from the income of an individual resident of Russia, then the following formula is applied:

When calculating tax, account 68 for settlements with the budget is credited. By debit for transactions in which personal income tax is accrued, the posting will be made to the accounts that reflect the taxable income of individuals. For example:

- if the tax agent withholds personal income tax from the salary, then account 70 of wage settlements is debited;

- if tax is withheld from an employee’s non-productive income, then the transaction is reflected in the debit of account 73 of settlements with personnel for other transactions.

Read more about personal income tax withholding in Table 1.

Table 1.

Personal income tax accrued: posting

| Dt | CT | Source of tax withholding |

| 70 | 68 | Withholding by the employer from the following payments to the employee:

|

| 73 | 68 | Withholding by the employer from other payments to hired employees, except for amounts reflected in account 70 |

| 75 | 68 | Withholding by a tax agent paying dividends to an individual |

Let us illustrate the correspondence of accounts from Table 1 with a numerical example.

Example 1

Personal income tax accrued: posting

On July 5, Symbol LLC paid the accountant an additional salary for June, the total amount of which is 60,000 rubles, and for the first time in a year, issued financial assistance for the July vacation in the amount of 10,000 rubles. If we assume that the accountant is a tax resident of Russia and does not have the right to deductions, for transactions in which personal income tax is accrued, the posting will be made as follows:

Dt 70 Kt 68 subaccount “Calculations for personal income tax”

– 7800 rub. – tax is withheld from the accountant’s salary;

Dt 73 Kt 68 subaccount “Calculations for personal income tax”

– 780 rub. ((RUR 10,000 – RUR 4,000) x 13%) – tax is withheld from the taxable part of financial assistance to the accountant.

Personal income tax is withheld from wages: posting

As you know, the employer is obliged to pay wages at least twice a month, while withholding income tax is required only upon the final payment at the end of the month. As a result, peculiarities arise in the reflection of transactions in accounting, which can be seen in example 2.

Example 2

Personal income tax is withheld from wages: posting

Trading paid the accountant an advance on his salary on June 20 in the amount of 25,000 rubles. and the remaining amount of the salary was accrued on July 5 in the amount of 35,000 rubles.

Symbol transfers payments to employees to their bank accounts with the execution of separate payment documents.

If we assume that the accountant is a tax resident of Russia and has no right to deductions, the tax amount is 7,800 rubles. ((RUR 25,000 + RUR 35,000) x 13%).

Read about tax withholding operations in Table 2.

Table 2.

Personal income tax is withheld from wages: posting

| Dt | CT | Sum | The meaning of the operation |

| 70 | 51 | 25,000 rub. | Advance payment for June salary transferred |

| 44 | 70 | 35,000 rub. | Payroll accrued for June |

| 70 | 68 | 7800 rub. | Tax withheld from the total wages for June |

| 70 | 51 | RUR 27,200 | The final settlement was made with the accountant for wages for June |

Posting: personal income tax withheld from vacation pay

Calculations for vacation pay are reflected in account 70 payroll calculations. In this case, the source of financing payments for vacation is the estimated liability reflected in account 96. As a result of which transactions the personal income tax withholding from vacation pay is posted, see example 3.

Example 3

Posting: personal income tax withheld from vacation pay

The production department accrued vacation pay to the accountant for the July holiday in the amount of 30,000 rubles. Symbol transfers payments to employees to their bank accounts. If we assume that the accountant is a tax resident of Russia and has no right to deductions, the tax amount is 3,900 rubles. (RUR 30,000 x 13%).

Read about tax withholding operations in Table 3.

Table 3.

Posting: personal income tax withheld from vacation pay

| Dt | CT | Sum | The meaning of the operation |

| 96 | 70 | 30,000 rub. | Vacation pay accrued |

| 70 | 68 | 3900 rub. | Income tax withheld from vacation pay |

| 70 | 51 | RUR 26,100 | Payment for vacation was transferred to the accountant |

Posting: personal income tax withheld from sick leave

Calculations for payment for periods of temporary disability are reflected in the debit of account 70. In this case, the source of financing for “sick leave” payments can be both funds from the social insurance fund and the employer’s own funds. As a result, personal income tax withholding from sick leave is posted as part of the following operations:

Dt 20 (26, 44, …) Kt 70

– part of the benefit is accrued at the expense of the employer;

Dt 69-1 Kt 70

– part of the benefit was accrued from the Social Insurance Fund budget;

Dt 70 Kt 68 subaccount “Calculations for personal income tax”

– income tax withheld.

Posting: personal income tax is transferred to the budget

Firms, entrepreneurs and individuals must pay taxes to the Russian budget in rubles. At the same time, according to the general rule, legal entities - tax agents for personal income tax make tax payments in non-cash form. Therefore, the posting of income tax payments to the budget is made within the framework of the following operations:

Dt 70 (73, 75) Kt 68 subaccount “Calculations for personal income tax”

– income payment is withheld;

Dt 68 subaccount “Personal Tax Payments” Kt 51

– income payment is transferred to the budget.

Source: https://www.BuhSoft.ru/article/2121-uderjan-ndfl-provodka

Reflection of deductions in the document Calculation of salaries and contributions

Calculation of deductions is made during the final calculation of wages. In the 1C: Integrated Automation 2 program, deductions can be reflected in two documents:

- Calculation of salaries and contributions.

- Calculation of deductions.

If wages are calculated using the document Accrual of salaries and contributions (Salary section), then deductions are calculated simultaneously with all accruals, contributions and personal income tax in one document.

To calculate, click Fill and go to the Deductions tab. The table displays the amounts calculated based on these deduction documents.

If accruals were made separately using the Calculation of Accruals document, then to calculate deductions, use the Calculation of Deductions document. When creating payroll documents separately, different documents are used to calculate accruals, contributions and deductions.

Click Fill. The Deductions tab will display rows for employees who have entered deduction documents.

We looked at accounting for deductions in the 1C: Comprehensive Automation 2 program. Having examined the issues of setting up deductions and generating documents on deductions, creating a new deduction will now not be difficult for you.

Accounting entries for salaries

The chart of accounts (Order of the Ministry of Finance No. 94n dated October 31, 2000) provides account 70 “Settlements with personnel for wages” to reflect the accrual, payment of wages and deductions from them. It is on this basis that salary accounting entries are generated in correspondence with other accounts.

The account is passive, and its loan balance reflects the amount of wages the organization owes to its employees. The credit of the account reflects the accrual of payment for the performance of labor duties.

The debit reflects the transfer from the current account or the payment of wages from the cash register, a posting reflecting the amount of deductions.

Analytical accounting should be organized for each employee separately. This will allow you to obtain up-to-date information on the accruals and debts of each individual company employee at any time.

https://www.youtube.com/watch?v=2EOLdMNg7UI

The main stages of organizing payroll accounting include:

- Calculation of wages.

- Calculation and accounting of deductions from salaries.

- Calculation of insurance premiums.

- Payment of wages.

- Transfer of personal income tax and insurance premiums.

The accountant repeats all stages every month. And for each case, its own wiring is formed. Below are the correspondence accounts that are used most often.

Payroll entries

The accrual of wages is reflected in the credit of account 70. Corresponding accounts when calculating wages reflect the direction of cost accounting depending on the labor functions performed by the employee. Also, on the credit of account 70, accruals of payment for the time the employee is absent due to illness or vacation are reflected.

Debit Credit

| Wages accrued to employees of main production, posting | 20 | 70 |

| Workers of auxiliary production | 23 | 70 |

| Employees of departments serving the main production received wages, posting | 25 | 70 |

| Employees of the management and general business units were accrued salary, posting | 26 | 70 |

| The construction work of the new administrative building is being carried out on our own: salaries and wiring have been calculated | 08 | 70 |

| Calculated salaries of employees of a trade organization | 44 | 70 |

| Calculated payment for sick leave at the expense of the employer (first three days) | 20, 25, 26, 44 | 70 |

| Calculated payment for certificates of incapacity for work at the expense of the Social Insurance Fund | 69 | 70 |

| Reflects accrued payments that are not directly related to work activities (for example, an employee’s anniversary bonus) | 91 | 70 |

| If a reserve is formed for vacation pay | ||

| A deduction was made to the reserve on the date when wages were accrued to employees, posting | 20, 25, 26, 44 | 96 |

| Vacation pay accrued | 96 | 70 |

Deduction from wages: postings

Deductions from wages are reflected in the debit of account 70. The main ones are:

- personal income tax;

- alimony, other deductions under writs of execution;

- contributions to a trade union organization;

- compensation to the enterprise for damage or loss.

Debit Credit

| Personal income tax calculated | 70 | 68 |

| Payments under writs of execution (alimony, fines) are withheld | 70 | 76 |

| Amounts of compensation for shortages and damages due to the fault of the employee are withheld | 70 | 73 |

| Upon dismissal, payment for unworked vacation days is withheld, reversal | 96 (20, 25, 26, 44) | 70 |

Salary issued: posting

At the request of the employee, wages can be given to him in cash or by bank transfer. Regardless of whether the PO is transferred to the card or issued from the cash register, the posting is generated by the debit of account 70.

Debit Credit

| Salaries issued from the cash register, posting | 70 | 50 |

| Salaries were paid from the bank account to employee cards, posting | 70 | 51 |

| Alimony and other deductions under writs of execution have been paid | 76 | 51 |

Personal income tax and insurance premiums: calculation and payment

From payments to employees, employers are required to calculate and transfer to the state:

- personal income tax (rate for residents - 13%);

- insurance premiums (22% - compulsory medical insurance, 5.1% - compulsory medical insurance, 2.9% - compulsory social insurance).

The Chart of Accounts uses account 68 for accounting for tax payments, and account 69 for calculating and accounting for insurance premiums.

| Debit | Credit | |

| Personal income tax calculated | 70 | 68 |

| Insurance premiums have been calculated | 20, 23, 25, 26, 44 | 69 |

| The withheld personal income tax was transferred to the budget | 68 | 51 |

| Insurance premiums transferred to the budget | 69 | 51 |

Postings for PO: reflection in accounting registers

Forms of registers for recording business transactions are developed and approved by a commercial organization independently. They must ensure that they can obtain up-to-date information about the company's assets and liabilities at any time.

As mentioned above, the salary register must provide detailed data for each employee. It is also advisable to detail the data on the types and amounts of charges, deductions and payments.

You can organize such detailed accounting in an independently developed form, or you can use Form T-54, approved by the State Statistics Committee in Resolution No. 1 of 01/05/2004.

The basis for calculating wages and filling out registers for its accounting may be:

- time sheets;

- employment contracts;

- bonus orders;

- vacation orders;

- writs of execution and statements of deductions;

- other documents on labor standards and remuneration.

Form T-54

Also, according to Article 136 of the Labor Code of the Russian Federation, the employer is obliged to notify staff about accruals and deductions before transferring wages. This can be done by issuing a pay slip to the employee.

Its form should allow the employee to learn in an understandable form about accruals, deductions and amounts to be received.

You can inform the employee both on paper and in electronic form, for example, by sending a payslip by email.

Payroll example: calculation and postings

Let's look at an example of the procedure for generating transactions for payment of remuneration to employees. LLC "Company" employs two people. The organization is engaged in wholesale trade and the salaries of all employees are included in account 44. Salaries are paid on the 10th of the next month. On the same day, personal income tax and alimony are transferred. Insurance premiums were transferred on December 14, 2018.

Manager Petrov P.P. pays alimony according to the writ of execution - 25% of the salary. All are tax residents, that is, the personal income tax rate for everyone is set at 13%. The organization pays insurance premiums at regular rates (22% - OPS, 5.1% - Compulsory Medical Insurance, 2.9% - OSS). All employees are paid salaries via bank cards.

Information on accruals and deductions for November 2019

| FULL NAME. | Job title | Accrued based on salary | Sickness benefit (all payment at the expense of the Social Insurance Fund) | Personal income tax | Alimony | To payoff | Insurance premiums | |

| OPS | Compulsory medical insurance | OSS | ||||||

| Ivanov I.I. | Director | 40 000 | 10 000 | 6500 | 43 500 | 8800 | 2040 | 1160 |

| Petrov P.P. | Manager | 30 000 | 3900 | 6525 | 19 575 | 6600 | 1530 | 870 |

| Total | 70 000 | 10 000 | 10 400 | 6525 | 63 075 | 15 400 | 3570 | 2030 |

The accountant will generate the following entries:

Amount Debit Credit

| November 30, 2019 | |||

| Salary accrued | 70 000 | 44 | 70 |

| Disability benefits | 10 000 | 69 | 70 |

| Personal income tax withheld | 10 400 | 70 | 68 |

| Child support withheld | 6525 | 70 | 76 |

| Insurance premiums accrued (15,400 + 3570 + 2030) | 21 000 | 44 | 69 |

| December 10, 2019 | |||

| Salary paid | 63 075 | 70 | 51 |

| Alimony payments listed | 6525 | 76 | 51 |

| Personal income tax paid to the budget | 10 400 | 68 | 51 |

| December 14, 2019 | |||

| Insurance premiums listed | 21 000 | 69 | 51 |

Source: https://clubtk.ru/bukhgalterskie-provodki-po-zarplate

Setting up holds in 1C:KA 2

Step 1. To set up deductions, open the Master data and administration section - Salary.

Step 2. Follow the hyperlink Setting up the composition of charges and deductions.

Step 3. On the Deductions tab, check the boxes for the types of deductions that you plan to maintain in the program.

As a result of the setup, in the Salary – Deductions section the marked types of deductions will become available in the form of documents. For example, we have made available the document journal Writs of Execution and Trade Union Dues. The relevant documents are entered into them. The journal Alimony and other deductions is a general journal of documents on deductions; it displays all entered documents. You can enter them both from the general journal and from individual deduction journals.

After setting up the composition of deductions, the corresponding types will be added to the Detentions directory. The deduction can be made as a fixed amount or as a percentage of earnings. For correct calculation, check the composition of the calculation base of deductions. If the composition of the calculation base of deductions is not defined, then when calculating wages, deduction is not calculated and the document table will be empty. When entering additional allowances by the user, check whether the new types of calculation are included in the deduction or not. Otherwise, the calculation will be performed incorrectly.

Accounting for payroll deductions: entries and examples – Business Ideas

According to the law, various deductions can be made from employees' wages. For proper deduction, you need to know the nuances of the types of deduction and their accounting.

Let's consider an example of calculating deduction from wages, as well as accounting entries generated when withholding personal income tax, according to writs of execution, when repaying a loan issued to an employee and withholding union dues.

- 2.1 Mandatory deductions

Deduction amount

Situation: how much can be withheld from an employee’s salary on his initiative?

Make deductions from an employee’s salary on his initiative without restrictions.

The Law on Enforcement Proceedings limits the amount of deductions for enforcement documents (Article 99 of the Law of October 2, 2007 No. 229-FZ). The Labor Code of the Russian Federation establishes the grounds and standards for deductions by order of the organization (Article 130 of the Labor Code of the Russian Federation). The legislation does not impose other restrictions on the amount of deductions.

Therefore, at the initiative of an employee, up to 100 percent of income can be withheld from his earnings, but only after personal income tax is withheld from the amount of income (paragraph 2, paragraph 1, article 210 of the Tax Code of the Russian Federation).

Similar conclusions follow from the letter of Rostrud dated September 16, 2012 No. PR/7156-6-1.

Postings for deduction from wages. Accounting for deductions from wages: postings and examples

Deductions from wages are divided into three groups: mandatory (prescribed by law), at the initiative of the employer (also regulated by labor law), at the request of the employee. Let's look at the main typical entries for salary deductions.

Mandatory withholdings include taxes on employee income - personal income tax. Different categories of employees have their own tax rate.

Reflected by wiring:

Is issued by the entry:

Payment of withheld obligations in favor of the claimant is made in a writ of execution or within three days and is recorded by recording:

Transfer costs are borne by the employee (bank commission, etc.).

Example of postings: personal income tax withheld from wages

In the amount of 35,000 rubles. He is a resident, the personal income tax rate is 13%. Alimony in the amount of 7,000 rubles is withheld from him monthly.

Postings:

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 35 000 | ||||

| 68 personal income tax | 4550 | Payroll statement | ||

| 76 | Child support withheld | 7000 | Performance list | |

| 66 | Monthly repayment of loan debt | 112 500 | Payment order ref. |

Employer-initiated deductions

Occurs in case of damage or loss of property (Debit Credit 73.2), debt on accountable amounts (Debit Credit 71). The employer can also deduct part of the funds from the employee’s salary to repay a previously issued loan (Debit Credit 73.1).

Sometimes an employer may mistakenly pay a larger salary. Then part of the overpayment is withheld from the employee.

Another situation: an employee took full paid leave, but quit before the end of the period for which it was taken. Amounts of vacation pay for those days to which the employee is not entitled are withheld (Debit Credit 73).

The employee has funds withheld from his salary (RUB 000) to repay a loan in the amount of RUB 5,500.

Postings:

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| Employee salary accrued | 000 | Payroll statement | ||

| 68 personal income tax | Personal income tax withheld | 3640 | Payroll statement | |

| 73.1 | Loan amount withheld | 5500 | Loan agreement Accounting certificate |

Deductions initiated by the employee

The employee may request that a certain amount be withheld from his salary each month. These could be amounts to repay a loan from an employer, for charity, voluntary insurance or trade union dues (Debit

Operations for withholding personal income tax, the entries below, are formed in the accounting accounts of the employing enterprises. For calculations, the Chart of Accounts provides an account. 68 “Calculations with the budget”, to which sub-accounts are opened depending on the purpose. Let's look at examples of generating income tax entries when reflecting various situations - payment of wages, dividends, benefits, etc.

According to stat. 226 clause 4 of the Tax Code, tax agents (employers) are required to withhold tax when paying any types of income to employees. Non-taxable transactions are listed in stat. 217 of the Tax Code and include benefits under the BIR, other types of state benefits, pensions, compensation payments for personal injury and others.

It is mandatory to withhold personal income tax from the following payments:

- Employees' salaries.

- Vacation and sick leave, except those excluded.

- Amounts for writs of execution.

- Amounts of travel allowances - for Russian trips from 700 rubles, for foreign trips - from 2500 rubles. in a day.

- Financial assistance over 4000 rubles. employee, 50,000 rub. at the birth of a child.

- Income in kind.

- Dividends.

- Credit interest.

- Payments for material benefits (the procedure for determination in Article 212 of the Tax Code).

– wiring is performed in various ways, examples are given below. The credit of the account will always be 68, the debit changes depending on the types of deduction.

Analytical accounting is carried out according to tax rates, employees, and payment grounds.

Personal income tax – postings:

- Personal income tax is withheld from wages - posting D 70 K 68.1 is carried out when making payments to employees employed under employment contracts. The deduction for vacation pay is reflected in the same way.

- Personal income tax withheld under GPA agreements - posting D 60 K 68.1

- Personal income tax was accrued for material benefits - posting D 73 K 68.1.

- For financial assistance, personal income tax is assessed - D 73 K 68.1.

- Personal income tax is withheld on dividends - posting D 75 K 68.1, if the individual is not an employee of the company.

- Personal income tax is withheld on dividends - entry D 70 K 68.1, if the recipient of the income is an employee of the company.

- For short-term/long-term loans provided, the accrual of personal income tax is reflected - D 66 (67) K 68.1.

- Personal income tax was transferred to the budget - posting D 68.

1 K 51.

An example of calculating income tax and generating standard transactions:

Employee Pankratov I.M. Earnings for January were accrued in the amount of 47,000 rubles. An individual is entitled to a deduction for one minor child in the amount of 1,400 rubles. We will calculate the amount of tax to be withheld and make accounting entries.

Personal income tax amount = (47000 – 1400) x 13% = 5928 rubles. There are 41,072 rubles left to hand over to Pankratov.

Postings:

- D 44 K 70 for 47,000 rubles. – earnings for January have been accrued.

- D 70 K 68.1 for 5928 rub. – personal income tax withholding is reflected.

- D 70 K 50 for 41072 rub. – reflects the cash payment of earnings from the company’s cash desk.

- D 68.1 K 51 for 5928 rubles. – the tax amount has been transferred to the budget.

Let's add the conditions of the example. Suppose Pankratov I.M. provided a loan to his organization in the amount of 150,000 rubles. with interest payment in the amount of 8,000 rubles. We will charge personal income tax on interest at an estimated rate of 13%.

Personal income tax amount = 8000 x 13% = 1040 rubles.

Postings:

- D 50 K 66 for 150,000 rubles. – the loan is reflected.

- D 91 K 66 for 8000 rubles. – interest is reflected.

- D 66 K 68.1 for 1040 rubles. - tax charged.

- D 66 K 50 for 151040 rub. – taking into account the due interest, the loan is repaid in cash.

Conclusion - calculating personal income tax using postings is a mandatory procedure for paying any income to individuals, with the exception of non-taxable transactions. Tax rates are regulated at the legislative level and vary by employee category.

, please select a piece of text and press Ctrl+Enter

.

The chart of accounts and instructions for its use for accounting for all payments made by the organization to its employees are provided.

Maintaining salary on account 70

It takes into account all settlements with personnel:

- on wages, including basic and additional wages, as well as incentive and compensation payments;

- for, benefits and compensations;

- for payment of vacation pay and compensation for unused vacation;

- on deductions from wages to compensate for losses from marriage, shortages, theft, damage to material assets, etc.;

- on payment by employees of trade union dues, utilities and other services;

- based on a court decision, etc.

By credit, the entries in account 70 display the amount of debt of the enterprise/organization to the employee, by debit - the reduction of such debt due to the payment of wages or other amounts due to employees in accordance with the law, or the occurrence of debt by the employee to the enterprise.

Analytical accounts for account 70 can be opened for groups of employees (by divisions) and for each employee separately.

The main corresponding accounts to account 70 when calculating salaries are determined by the type of activity of the enterprise (organization):

- in production – (for workers in main production), (for workers in auxiliary production), 25 (for workers involved in the management and maintenance of workshops and/or sections), 26 (for employees of plant management and specialists), 29 (for workers in service production and farms);

- in trade and service sector - .

When calculating benefits, accounts intended for settlements with extra-budgetary funds are used (). When calculating vacation pay and amounts of remuneration for long service, it is used, etc.

All listed accruals are made on the debit of the indicated accounts and on the credit of account 70.

See step-by-step instructions for calculating and paying salaries in 1C 8.3:

Postings: wages accrued

Basic payroll calculations:

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 20 (23, 25, 26, 29) | 70 | Posting: wages accrued to employees of the main production (auxiliary, maintenance, management and maintenance workers of workshops and the enterprise as a whole) | 150000 | Help-calculation |

| 44 | 70 | Salaries accrued to employees of a trade or service enterprise | 60000 | Help-calculation |

| 69 | 70 | (due to illness, work injury, pregnancy and childbirth, etc.) | 20000 | Help-calculation |

| 91 | 70 | Wages accrued to employees engaged in activities not related to the usual for the enterprise (for example, maintenance of leased facilities) | 30000 | Help, calculation, lease agreement |

| 96 | 70 | Payments to employees are accrued from the reserve for upcoming expenses and payments (vacation pay, long service benefits, etc.) | 40000 | Help-calculation |

| 97 | 70 | Wages were accrued to employees engaged in work classified as deferred expenses (development and testing of new products, scientific research, market research, etc.) | 35000 | |

| 99 | 70 | Salaries have been accrued to employees of the enterprise involved in eliminating the consequences of emergencies, disasters, accidents, natural disasters, etc. | 15000 | Certificate of calculation, certificate of completion of work |

An enterprise (organization), in the event of a shortage of funds, can partially pay employees in kind, but such payments should not exceed 20% of the accrued amount of wages.

When paying for labor with products of own production, it is taken into account at market prices in accordance with Art. 40 Tax Code of the Russian Federation.

Personal income tax and unified social tax on payments to employees in kind are paid on a general basis based on the market value of products or other material assets issued to employees.

Creating a new hold type

Step 1. In the Holds directory, click the Create button.

Step 2. Specify the name and set the calculation procedure.

For example, let’s create a type of deduction – Material damage, entered as a fixed amount, purpose – deduction in favor of third parties.

Having saved a new type of deduction in the journal, when you click the Create button, a new type of deduction will become available - Permanent deduction in favor of third parties.

When creating other types of retention, indicating the purpose - Permanent retention in favor of third parties, they are combined and entered in one document.

Step 3: Select Permanent Third Party Lien.

Step 4. Fill out the header of the document. The deduction field will display the name of the created calculation type – Material damage. Specify the withholding period and the third party in whose favor the withholding is made.

Step 5. Select an employee and indicate the amount to be withheld.

Step 6. Save the document – Post and close.

All created deduction documents are reflected in the Alimony and other permanent deductions journal.

Let's look at how deductions are reflected in the document when calculating wages.

Nuances of withholding in favor of legal entities and individuals under executive documents

Amounts of money from the income of employees on the basis of a writ of execution can be withheld without a corresponding order from the manager. The employee's consent is not required. Article 7 of the Federal Law “On Enforcement Proceedings” defines the list of enforcement documents:

- Writs of execution, which are issued by courts on the basis of judicial acts, decisions of arbitration and foreign courts, International Commercial Arbitration, interstate bodies for the protection of human rights and freedoms.

- Court orders.

- Agreements on payment of alimony certified by a notary.

- Certificates of the labor dispute commission, which are issued on the basis of its decisions.

- Requirements that have been formalized in accordance with the established procedure by the authorities that carry out control functions. Such demands must be marked by the bank or credit organization regarding partial or complete non-fulfillment of penalties due to the lack of money in the debtor’s account.

- Resolutions of bodies that are authorized to consider cases of administrative violations.

- Resolutions of the executor - bailiff.

- Resolutions of other bodies, if provided for by federal law.

If the original of the writ of execution is lost, the basis for recovery may be its duplicate, which is issued by the court or body that issued the relevant act in accordance with federal law.

Payroll accruals

Now let's move on to the wages themselves. In order for an enterprise to pay wages, an accountant needs to make the necessary deductions and charge taxes. Let's find out how and when this is done. In this regard, there are two main concepts:

Payroll accrual

is a tax paid by the employer. This tax applies to almost all payments to employees.

Salary is no exception. In our country, this tax is called the single social contribution (hereinafter referred to as SSC). It includes a full social package legally provided for by our state. This package consists of pension insurance (pension payment), insurance in case of temporary disability (sick leave pay, child care, etc.), insurance related to the occurrence of accidents at work (compensation for complete or partial disability). Its value depends on the occupational risk class, which is established by the Social Insurance Fund for Industrial Accidents, according to information about the enterprise provided to it by the Pension Fund. There is a special table that provides 67 classes of professional risk, developed in accordance with the resolution of the Cabinet of Ministers of Ukraine No. 1423 dated September 13, 2000, where each class corresponds to a certain tax rate as a percentage. It goes without saying that the higher the likelihood of injury on the job, the higher the rate, and vice versa. The rate of this tax ranges from 36.76% for class 1 to 49.7% for class 67. If a disabled person works at an enterprise, then a special (reduced) rate of this tax is applied to his income, in the amount of 8.41%. Also, a reduced rate is provided for payment of sick leave - 33.2%.