Who, when and on what basis can exercise this right?

As already mentioned, only organizations that are registered as individual entrepreneurs and operate on PSN or UTII will be able to purchase the deduction.

Today, the initial costs of purchasing a sample online device can be reduced by about eighteen thousand rubles (this is stated in Article 346.32, clause 2.2 of the Tax Code of the Russian Federation). In order to obtain a deduction, a business representative must notify about the installation of equipment and register it within a regulated period of time:

- When working on UTII:

- until July 1, 2021 (in the absence of employees);

- businessmen with staff conducting their activities in accordance with Art. 346.32 clause 2 clauses 6-9, provided that the cash registers are registered before July 1, 2021.

In this situation, one quarter is considered to be a tax period. The form will reflect the costs of purchasing cash registers incurred at this time. The tax deduction will be calculated after writing and submitting an explanatory note to it.

- Working on the basis of PSN. As for individual entrepreneurs operating under a patent, the principle of deduction is not fundamentally different from that established for UTII, with the exception of some points:

- if there are employees - until July 1, 2021;

- a reduction in the amount of duty payments, in the absence of employees, is made for reporting periods that begin in 2018-2019, until the end of fixing online cash registers;

- The reduction of the duty if the individual entrepreneur has employees is carried out for the reporting period, which began in 2021 and ends at the end of the registration of cash registers.

Under the PNS, the tax period ranges from 1 month to a year.

It is necessary to submit an application or notification to the authorized bodies of the Russian Federation, and, if necessary, provide accompanying documents (this includes an explanatory note).

Step-by-step instructions for preparing an explanatory note for a tax return

When submitting an application (declaration) to the tax office, an explanatory note (EP) must be drawn up, which includes a number of the following attributes. A deduction is applied for each individual cash register unit:

- Sample name.

- Serial number of this unit.

- The registration number of this unit as assigned by the authorized body.

- Date of registration of the sample in the tax structure.

- The amount of costs for the purchase of one sample of CCP, which reduces UTII (it must be remembered that the amount for 1 sample cannot exceed 18,000 rubles according to clause 2.2 of Article 346.32 of the Tax Code of the Russian Federation).

- The final figure covering the costs of purchasing a cash register (or several) that will need to be paid into the treasury for the reporting period.

Please note that the figure reflecting the purchase of an online cash register should be entered in line 040 of section No. 3 of the declaration. It is not written anywhere else - it is enough to indicate it once. It should also be noted that the number of cash register units is not regulated by law. In case of purchasing several copies, the entrepreneur will receive compensation for each individual unit of equipment.

As for the tax period, quarters are displayed in the PP as follows:

- code 21 – 1st;

- code 22 – 2nd;

- code 23 – 3rd;

- code 24 – 4th.

This is interesting: How to properly file a written complaint - sample

Regulatory regulation

Conditions for applying deductions for cash registers

From 01/01/2018, individual entrepreneurs have the opportunity to reduce the imputed tax on the costs of acquiring cash registers - in the amount of 18,000 rubles. for each online cash register (clause 2.2 of article 346.32 of the Tax Code of the Russian Federation). Organizations cannot take advantage of the deduction.

But not all entrepreneurs have access to the deduction; the following conditions must be met:

- The cash for which the deduction is applied must be used in activities subject to UTII.

- The cash register must be in the cash register register.

- The cash desk must be registered with the Federal Tax Service before the start date for the use of cash register established by law for the type of activity of the individual entrepreneur.

Costs included in the deduction

The costs of purchasing a cash register, which reduce the tax on imputed income, include (paragraph 3, clause 2.2, article 346.32 of the Tax Code of the Russian Federation):

- costs for purchasing the cash register itself, fiscal drive, software;

- costs of performing work on setting up the cash register and other services to bring the cash register into compliance with the requirements of Federal Law dated May 22, 2003 N 54-FZ.

How to get a deduction

In order to claim a deduction, you must submit a UTII return, in which the amount of the deduction must be taken into account when calculating the tax. However, the current declaration form (approved by Order of the Federal Tax Service of the Russian Federation dated July 4, 2014 N ММВ-7-3/) does not provide lines for deduction by cash register.

See also: Sample application for the standard child tax deduction 2019

Before amending the declaration, the Federal Tax Service of the Russian Federation recommends:

- Indicate the amount of UTII in page 040 “The amount of the single tax on imputed income payable for the tax period” of Section 3, taking into account the deduction on the cash register. Moreover, the amount in it should not be negative.

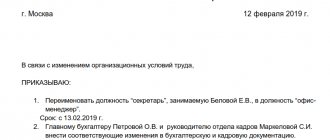

- Along with the declaration, submit an explanatory note, which should reflect the details for each cash register to which the deduction is applied: cash register model,

- factory number,

- registration number assigned by the tax authority,

- date of registration with the Federal Tax Service,

- the amount of expenses for CCP, but not more than 18,000 rubles.

- the amount of tax reduction for the tax period.

The tax service recommended the form of the explanatory note in Letter dated February 20, 2018 N SD-4-3/

If the amount of the calculated tax for the quarter turns out to be lower than the costs of the cash register, then the remainder of the deduction is transferred to the following quarters, but within the period established for a given entrepreneur in paragraphs 4 and 5 of clause 2.2. Art. 346.32 of the Tax Code of the Russian Federation (Letter of the Federal Tax Service of the Russian Federation dated April 19, 2018 N SD-4-3/).

New form of declaration of imputation

The UTII declaration must be submitted quarterly

. The due date is no later than the 20th day of the month following the quarter.

The Tax Service, by letter dated July 25, 2018 No. SD-4-3/ [email protected] , recommended using the new UTII report form. This declaration form must be used before the entry into force of the order that does not recommend, but approves a new declaration - until November 24, 2018.

And finally, by order No. ММВ-7-3/ [email protected] , which comes into force on November 25, 2018, a new form of declaration for UTII is established.

The new form has added a section where an entrepreneur can reflect the costs of purchasing a cash register. It is recommended to use this form starting from the submission of the UTII declaration for the 3rd quarter of 2018.

Until the 3rd quarter, in order to receive a cash register deduction, entrepreneurs had to submit a declaration and an explanatory note to the tax office

Thus, for the third quarter of 2021, two forms are valid simultaneously:

- Approved form - this form can be used by organizations and individual entrepreneurs that do not declare a cash register deduction in the reporting quarter (valid until November 24, 2021).

- Recommended form - this form is recommended for entrepreneurs to fill out to apply for a cash deduction (valid until November 24, 2021).

Starting from November 25, 2021, the declaration form approved by Order No. ММВ-7-3/ [email protected]

Declaration forms for UTII

The tax authorities were a little too clever with the recommended and approved forms for UTII. Therefore, we suggest using the following table.

Cancels all previously approved and recommended forms

From 10/01/2018 (Q3 2021)

From 01/01/2017 (1st quarter of 2021)

Approved Form - Valid at the same time as Recommended Form

From 10/01/2015 (1st quarter of 2021)

To submit updated declarations

Cash deduction

Let us remind you that from 2021, individual entrepreneurs can reduce the imputed tax on expenses associated with the transition to online cash registers, subject to a number of conditions.

- Deduction only for individual entrepreneurs

. - CCP is included in the register.

- The cash register is used in activities subject to UTII.

- The deduction amount is no more than 18,000

rubles for each copy of the cash register. - The cash register was registered

with the tax authority within the established time frame: from 02/01/2017 to 07/01/2018 for individual entrepreneurs - employers in trade and catering services, from 02/01/2017 to 07/01. 2021 – for other entrepreneurs. - The tax can be reduced for tax periods

, but not earlier than the period in which the cash register is registered: the periods of 2018 - for individual entrepreneurs in the field of trade and public catering with the involvement of employees, the periods of 2021 and 2021 - for other entrepreneurs.

The unaccounted amount of the cash deduction can be transferred to the following quarters without exceeding the deadlines specified in paragraph 6.

How to fill out a new UTII form?

Completing the recommended form is no different from the new approved declaration form.

For individual entrepreneurs who claim a cash register deduction

, the new declaration is filled out as follows.

- In section 3 “Calculation of the UTII amount” in line 040 you need to reflect the amount of the cash register deduction;

- It is necessary to fill out section 4 “Calculation of the amount of expenses for the purchase of a cash register device”: on line 010 - the name of the cash register device model included in the register

- on line 020 – serial number of the cash register

- on line 030 – cash register registration number assigned by the tax authority

- on line 040 – date of registration of the cash register with the inspection

- on line 050 – expenses for the purchase of cash registers. The amount should not exceed 18,000 rubles.

If the cash register model is not in the register, then we recommend that you first indicate the model from the cash register registration card, and then (with a dash) the name of the model from the sales documents

For UTII payers who do not apply

deduction by cash register, fill out the new declaration form as follows.

- In section 3 “Calculation of the amount of UTII”, put a dash on line 040, on line 050 – the amount of tax payable to the budget;

- Do not complete Section 4.

This is interesting: Sample application to Rosgosstrakh for KBM

New form of declaration of imputation

The UTII declaration must be submitted quarterly

. The due date is no later than the 20th day of the month following the quarter.

The Tax Service, by letter dated July 25, 2018 No. SD-4-3/ [email protected] , recommended using the new UTII report form. This declaration form must be used before the entry into force of the order that does not recommend, but approves a new declaration - until November 24, 2018.

And finally, by order No. ММВ-7-3/ [email protected] , which comes into force on November 25, 2018, a new form of declaration for UTII is established.

The new form has added a section where an entrepreneur can reflect the costs of purchasing a cash register. It is recommended to use this form starting from the submission of the UTII declaration for the 3rd quarter of 2018.

Until the 3rd quarter, in order to receive a cash register deduction, entrepreneurs had to submit a declaration and an explanatory note to the tax office

Thus, for the third quarter of 2021, two forms are valid simultaneously:

- Approved form - this form can be used by organizations and individual entrepreneurs that do not declare a cash register deduction in the reporting quarter (valid until November 24, 2021).

- Recommended form - this form is recommended for entrepreneurs to fill out to apply for a cash deduction (valid until November 24, 2021).

Starting from November 25, 2021, the declaration form approved by Order No. ММВ-7-3/ [email protected]

Declaration forms for UTII

The tax authorities were a little too clever with the recommended and approved forms for UTII. Therefore, we suggest using the following table.

How to reduce tax on PSN

- Print and fill out a notification about the reduction in the amount of tax paid in connection with the use of PSN.

- Submit a notification to the tax office.

Filling out the notification

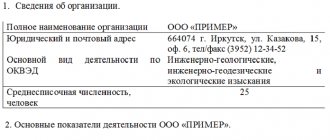

A notice of a reduction in “patent” tax on expenses for the acquisition of cash register devices can be drawn up in any form. In this case, it is necessary to indicate the following information listed in the article of the Federal Law of November 27, 2017 No. 349-FZ:

- Full name and tax identification number of the taxpayer;

- the number and date of the patent in respect of which the amount of tax is reduced, the timing of payment of the reduced payments and the amount of expenses for the acquisition of cash register systems by which the payments are reduced;

- model and serial number of the cash register;

- the amount of expenses incurred to purchase the cash register.

You can also use the recommended form of notification, which is given in the letter of the Federal Tax Service of Russia dated April 4, 2018 No. SD-4-3 / [email protected] (see “Deduction for online cash register: the recommended form of notification of a tax reduction for PSN has been approved”). This form consists of three sheets:

1. The title page contains information about the taxpayer.

2. Sheet A includes information about CCP.

Please note that in line 050 “Amount of expenses for purchasing a cash register in rubles” you can indicate an amount of no more than 18,000 rubles, even if the online cash register costs more.

3. Sheet B reflects the reduction in the amount of tax on PSN by the amount of expenses for the acquisition of cash registers.

If an entrepreneur draws up a deduction for several patents, then you need to fill out the corresponding number of sheets B. In particular, this situation may arise if the individual entrepreneur has received several patents and the costs of acquiring the cash register (taking into account the limit of 18,000 rubles) exceed the cost of one patent. In this case, the individual entrepreneur has the right to reduce the amount of tax calculated for other patents by the amount of such excess (clause 1.1 of Article 346.51 of the Tax Code of the Russian Federation). The amount of expenses for the purchase of cash registers that exceeds the amount of tax (line 210 of sheet B) must be reflected only on the last completed sheet B. In previous sheets B, dashes should be placed on this line.

Sending a notification

Since the notification can only be made in writing on paper, the document must be brought in person to the tax office, where the entrepreneur is registered as a taxpayer under the PSN and to which the amount of tax to be reduced is paid (must be paid). The notification can also be sent by Russian Post or by courier delivery.

Note that a notice of tax reduction on “CCP expenses” can be submitted simultaneously with an application for a new patent (letter of the Ministry of Finance of Russia dated March 13, 2018 No. 03-11-09/15275, see “How can an individual entrepreneur on PSN reduce the cost of a patent on price of the online checkout").

Submit an application for the application of PSN using a new form via the Internet Submit for free

In which tax period can the tax on PSN be reduced?

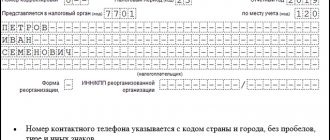

| IP on PSN | Retail or catering | All types of activities, except retail and catering | |

| With employees | No employees | Regardless availability of employees | |

| When a cash register is registered with the tax office | From February 1, 2021 until July 1, 2021 | From February 1, 2021 until July 1, 2021 | |

| For which tax period can the tax be reduced? | For the tax period that begins in 2021 and ends after registration of the cash register | For tax periods that begin in 2021 and 2021 and end after registration of the cash register | |

When can they request clarification from the tax office regarding UTII?

The UTII declaration is submitted to the inspectorate no later than the 20th day of the month following the reporting quarter. This is established in paragraph 3 of Article 346.32 of the Tax Code of the Russian Federation.

The declaration is filled out in the form approved by order of the Federal Tax Service dated June 26, 2018 No. ММВ-7-3/414. Here is the calculation of the imputed tax by month, as well as the amounts by which the tax is reduced. These are insurance premiums, benefits and payments under voluntary personal insurance contracts. If there are inaccuracies in the declaration, inspectors may ask you for clarification.

How to submit clarifications to the tax office regarding UTII

Let's consider different situations.

Situation: you submitted zero reports to the inspectorate

If a company or entrepreneur does not have physical indicators on the imputation, then it is necessary to withdraw from tax registration as a UTII payer.

Until you do this, the imputed tax is calculated for the corresponding type of business activity based on the “former” physical indicators and basic monthly profitability. You cannot submit zero returns to the tax office. If you submitted a zero, inspectors will ask for clarification.

Situation: you incorrectly reflected the value of the physical indicator in the declaration

UTII is calculated on the basis of a physical indicator that is established for a given type of activity (clause 3 of Article 346.29 of the Tax Code of the Russian Federation). This is either the number of workers employed in the imputed activity or the area of the facility. Let's say you made a mistake with the area of the sales floor. Then submit a clarification with explanations, in which you write about the error. But before you go to the inspectorate, pay additional taxes and penalties. There will be no fine.

This is interesting: Application for removal of encumbrance on an apartment: sample

Sample explanations to the tax office regarding UTII

Situation: you made a mistake with expenses that can be counted towards UTII

UTII is reduced by the following amounts (clause 2 of Article 346.32 of the Tax Code of the Russian Federation):

- insurance premiums paid in a given quarter;

- contributions under voluntary personal insurance contracts concluded in favor of employees in case of illness;

- sick leave at the expense of the organization for the first three days.

How to write an explanatory note to the tax office

Not a day without instructions × Not a day without instructions

- Services:

An explanatory note to the Federal Tax Service is a document in which the taxpayer explains the current circumstances.

and 20,000 rubles, UTII is allowed to be reduced by 33,000 rubles.

Representatives of the Federal Tax Service quite often request clarification, especially in cases where the enterprise’s reporting shows a significant decrease in fiscal payments. We tell you how to correctly write an explanatory note. October 18, 2021 Author: Natalya Evdokimova When conducting an inspection, the inspector has the right to request written explanations.

Situations in which it is mandatory to provide an explanatory note to the tax office upon request (we offer a sample for NPOs) are specified in paragraph.

We recommend reading: What passports looked like in the USSR

3 tbsp. 88 Tax Code of the Russian Federation: Errors in submitted reports.

For example, inaccuracies or inconsistencies are identified in the declaration. In this case, tax authorities require you to provide justification for these discrepancies.

poyasnitelnaya.jpg

Related publications

The draft new declaration is being discussed, but has not yet been approved. Therefore, individual entrepreneurs on UTII use the previous form for reporting, based on the recommendations of tax officials made in letter No. SD-4-3/3375 dated February 20, 2018. After calculating the UTII and adjusting its value by the amount of insurance contributions, you should take into account the amount of costs for purchasing the cash register. Thus, it is reflected directly in the tax amount (line 040 of the third section of the UTII declaration).

The tax can be reduced to 0; there should not be negative values of this indicator in the declaration. If there is an unaccounted balance of the tax deduction, its amount is taken into account in the declaration for the next tax period. But, since this method of reflecting costs in the tax amount does not allow the Federal Tax Service to see the amount of expenses incurred on cash registers, it is obligatory for businessmen claiming the right to apply a deduction to confirm its amount. Such a supporting document is an explanatory note to the UTII declaration. Let's get acquainted with this document and the procedure for filling it out.

Explanatory note to the tax return for UTII

So, before the approval of the new version of the UTII declaration, entrepreneurs-payers fill out the current form, submitting along with it to the Federal Tax Service an application in the form of an explanatory note approved by the Federal Tax Service letter No. SD-4-3/3375. This document accumulates information about the cash registers used by the businessman that have passed the appropriate registration with the Federal Tax Service. Please note that only those models of online cash registers that are available in the special state register of cash registers and the register of fiscal drives are subject to registration. The tax office will not register models not named in it, so before purchasing a cash register, you need to check the registry to see if the version of the device you like is available.

The explanatory note to the tax return for UTII is filled out for all units of cash register and has a set of the following details:

- CCP model name;

- Serial number of the KKT model;

- Registration number of the cash register, which is assigned by the Federal Tax Service;

- Date of registration of the cash register with the Federal Tax Service - the cash register must be registered during the period from 02/01/2017 to 07/01/2019;

- The total costs of purchasing the specified cash register model, reducing the amount of the calculated tax (their amount cannot exceed the established maximum deduction for one copy - 18,000 rubles);

- The total amount of costs for the purchase of several online cash registers (each of which was registered with the Federal Tax Service and is included in the explanatory note), which reduces the total amount of UTII payable to the budget for the tax period.

You can check the control figure for the tax payable, which appears in line 040 of the third section of the declaration, by reducing the amount of the calculated tax by the amount of insurance contributions, and then subtracting the amount of costs for the purchase and maintenance of the cash register.

Let's give an example

Deduction for online cash registers of individual entrepreneurs on UTII in 2018

Individual entrepreneurs on UTII can receive a deduction for expenses at online cash registers. This deduction summarizes:

- price of a cash register, fiscal drives, software;

- services for setting up cash register systems and other related services;

- costs for modernization of CCP.

The amount of deduction is no more than 18,000 rubles. for each cash register. If two cash registers cost 15,000 rubles. and 20,000 rubles, UTII is allowed to be reduced by 33,000 rubles. (RUB 15,000 + RUB 18,000).

See also: Eleventh Arbitration Court of Appeal of Kazan

To receive a deduction, the following conditions must simultaneously exist:

- The online cash register is included in the official cash register register.

- An individual entrepreneur uses cash registers in activities subject to UTII.

- The Federal Tax Service registered the cash register in the period from February 1, 2021 to July 1, 2021, and if an individual entrepreneur with hired employees is engaged in retail trade or catering - from February 1, 2021 to July 1, 2018.