Legal entities and individuals who move goods across the Russian border for commercial purposes are called participants in foreign economic activity - foreign economic activity. The customs authorities of the Russian Federation control the legality of foreign economic activities of participants. In order for a business related to the export (import) or import (export) of goods across the border to be successful, participants in foreign trade activities are required to comply with the rules for preparing the relevant documentation. And first of all, this rule applies to the registration of a customs declaration - the decoding of the abbreviation means a cargo customs declaration.

Cargo manager tasks

When exporting and importing goods, the main action of a participant in foreign economic activity remains its declaration and execution of the appropriate export (import) document.

The registration of a cargo customs declaration when moving goods is carried out by the following persons:

- Declarant - the manager of the cargo.

- A customs broker who carries out the declaration on behalf of the manager.

- The declarant and (or) broker presents and presents the goods to the customs authority in accordance with the completed customs declaration.

Only Russian legal entities and individual entrepreneurs equated to them under customs legislation who move goods across the border of the Russian Federation for commercial purposes can act as declarants.

The necessary information about the product, its value, sender, recipient and other data is recorded in the declaration. Without this document, customs will not allow the cargo to move across the border.

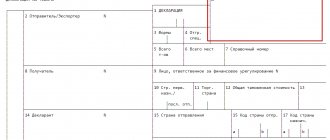

Customs declaration: decoding and example of the necessary information in the document

The list of information contained in the cargo declaration is divided into the following main blocks:

- Information about the person moving the goods, the sender.

- Name and coordinates of the cargo recipient.

- The name and codes of the country where the contract was concluded - the grounds for moving the cargo (export or import).

- Information about the country of origin and country of destination with codes adopted by the Customs Code of the Russian Federation.

- Delivery conditions, vehicle at the border, contract currency. This information is duplicated from the transaction passport, which is issued by the bank of the sender or recipient of the goods.

- Information about the cargo in accordance with the code classifier of goods (commodity nomenclature of foreign economic activity).

- Information about customs checkpoints, including the place of registration of the declaration and the place of border crossing.

- Data on the received quota for the goods (if they exist for the import or export of goods).

- Information on customs duties and fees calculated depending on the declared value of the cargo being transported.

- Other information required to fill out the customs declaration.

Important! Any discrepancy between the data declared in the declaration and the actual data will lead to a delay in customs procedures and will result in additional costs for a tidy sum.

What is a cargo customs declaration and how to fill it out correctly

Let's start with the fact that now the concept of “cargo customs declaration” does not exist. The forms that declarants previously had to fill out are also not used. Since Russia joined the Customs Union, the cargo customs declaration has been replaced by a TD (goods declaration).

They are similar, however, they are filled out in accordance with different requirements. TD confirms the legality of the transaction and is provided at border customs points, as well as points at airports and seaports - in short, wherever cargo is checked.

The document contains basic information about the product.

This document must be completed in any case if you are dealing with cargo. Participants in foreign trade activities must fill out a TD.

Why file a goods declaration?

First of all, so that the cargo can pass across the border. TD is checked at customs points in Russia and other countries. This is the main document for the cargo, which certifies the legality of the transaction. Without it, the product is considered contraband.

In the document, the inspector puts down the appropriate marks certifying the transaction’s compliance with the legislation of the Russian Federation. The number assigned to the declaration is subsequently used when preparing other documents.

How to fill out a goods declaration?

The declaration must be submitted as soon as the cargo arrives at the customs point. The maximum period given for processing the document is 14 days. The period depends on the type of product. For example, for perishable goods it is better to provide TD on the same day.

The document should include the following:

- Information about the sending and receiving parties, intermediaries;

- List of documents that confirm the information specified in the declaration;

- Country of destination or departure (origin);

- Customs value, size and type of duties and fees, transaction currency;

- Conditions of cooperation between participants in foreign trade activities;

- Type and details of the vehicle transporting the cargo;

- Quotas for goods (if any);

- Payment term for the transported cargo, method of mutual settlements;

- Location, name and other information about the customs point where the cargo will be cleared;

- The order and place of storage of goods.

Fill out the customs declaration in Russian. It is best to fill them out on the computer. Filling it out by hand is not prohibited, but if you have illegible handwriting or there are marks on the document, it may not be accepted at the customs point. In addition, it is necessary to adhere to current forms and enter only the information that is approved by law.

Errors, blots, erasures are excluded. If you made a mistake when filling out the declaration, you can cross out the incorrect data and indicate the correct data above it. Each amendment is certified by the signature and seal of the declarant.

Goods Declaration Form

A goods declaration is several sheets of A4 format, or a small brochure. The form was approved by the CU Commission. There are two forms - DT1n and DT2n. They must be filled out and presented to the customs inspector.

DT1n - main sheet shape. It is required to be submitted to customs. The document contains:

- Information about the seller, buyer;

- Declarant's details;

- Data of the intermediary - an individual or legal entity who is engaged in financial settlement;

- Names, codes of the countries where the goods are sent, from where they are brought, where they were manufactured;

- Consignment size, cargo cost;

- Data of the vehicle used to transport cargo;

- Delivery conditions;

- Nature of the transaction, currency of mutual settlements;

- Place of loading and unloading;

- Data of the customs point where the goods will be processed;

- Banking and financial data.

In addition, the document may contain other information. All of them must be indicated correctly and correspond to reality - this is checked at customs.

DT2n is an additional sheet that is used only as an additional document. It contains information:

- about cargo packages, the cargo itself;

- about the documents that are attached to the cargo;

- about the payments made.

In some countries, TD is issued temporarily, until the information is clarified. Such a preliminary document is filled out if there is no accurate information about the product before delivery to the border (airport, seaport). The temporary TD form is much simpler and shorter, and it does not need to indicate as much data as in the permanent one.

The declaration is not always submitted in printed form. Nowadays, most documents of this type are sent to customs via the Internet. Accordingly, you do not need to print it out and bring it in person. This greatly simplifies the work of the inspectors themselves and the participants in the foreign economic transaction.

After verification, the document is registered and assigned a number. Without a registration number, a TD cannot be used and has no legal force. An unregistered declaration does not give the right to transport goods.

Basic requirements for registration of a goods declaration

- Complete absence of marks of one type or another, readability. A form filled out by hand may not be accepted if the handwriting is illegible. All amendments are certified by the declarant. Without certification, the amendment will be considered a blot and the document will not be accepted.

- Credibility. If the information differs from reality, the cargo will not be allowed through.

If errors or data discrepancies are detected, the cargo is not accepted, and sometimes it is detained at the border until the circumstances are clarified.

Source: https://www.wtransports.com/2016/04/11/chto-takoe-gruzovaya-tamozhennaya-deklaraciya/

List of documents for registration of customs declaration

Transportation of goods between different states requires a mandatory package of documents presented by the participant in foreign economic activity at customs.

To pass control and register a customs declaration you will need:

- A contract (purchase/sale agreement) concluded between individuals or legal entities. Attachments to it: specifications, bills (invoices), packing lists.

- Original contract.

- Receipts for payment of customs duties after determining the value of the goods.

- List of documents confirming data on customs assessment of cargo and financial control.

- Availability of licenses, official permits from government officials, if required by the goods being moved, availability of certificates of quality and origin from the manufacturer.

- A package of documents giving the right to the cargo manager to move it - a certificate of state registration, Taxpayer Identification Number (TIN) and certificate of foreign trade participant, registration documents of an individual entrepreneur, passport.

Sample of a completed customs declaration form

After completing all the points, the customs declaration will be accepted for registration, then everything is recorded in a special journal and after the customs declaration becomes a document with legal force. After the full registration of the customs declaration is completed, it is strictly prohibited to issue it to the declaring party or to an outsider who is not a border service employee until the full registration is completed.

Amendments, additional notes or withdrawal of the customs declaration can be made only before the start of the inspection process of cargo and vehicles. A fully completed customs declaration along with the accompanying package of documents is transferred to the border service for control.

Documents for import registration

The movement of goods across the customs border of the Russian Federation can be aimed at import or export. The documents accompanying the registration of a customs declaration for foreign trade transactions are different.

To fill out the customs declaration for imports, when deciphering the fields of the declaration, you will additionally need:

- Proof of compliance of imported goods. The specification is issued to the recipient company.

- Certificate form ST-1 (certificate of the country of origin of the goods).

- Price list, invoice, invoice, which contains an indication of the customs declaration number. Deciphering product codes in the price list is not required.

- Quality certificates, operational documents issued abroad in the country of origin.

Feature: when re-exporting, you may need a Form A certificate proving the origin of the goods in Russia.

- An invoice that contains the customs declaration number. Deciphering product codes in this document is not necessary, since it indicates the final indicators of export or import. Either a proforma invoice is issued in the form of an annex to the contract, or a specification.

- Documents confirming the purchase of goods on the territory of the Russian Federation, certificate form A.

- When transporting goods by road, it is mandatory to provide the customs authorities with a TIR-carnet (carrier insurance document) and a CMR - international road consignment note.

- Technical characteristics of products reflected in the relevant acts attached to the specifications or contract invoice.

Cases when it is not necessary to issue a customs declaration

Labor Code of the Russian Federation):

- information about the goods transported and their price;

- data of the vehicle involved in the transportation of goods;

- information about the sender and recipient of the cargo.

The role and significance of the customs declaration when moving products across the border comes down to the following functions: Actual inspection of the cargo by customs authorities and its passage across the border Establishing the fact of compliance with the Requirements of the customs legislation of the Russian Federation Confirmation that the movement of cargo across the border is lawful and legal Formation of an array of information for the invoice Which subsequently become the basis for charging VAT. What you need to know As mentioned earlier, the customs declaration is a document that allows you to declare the movement across the border of any cargo and vehicles that are the objects of foreign trade transactions of entrepreneurs and organizations.

Customs declaration number on the invoice. how and when it is entered. answers on questions

Similar to the case described above, everything will be overestimated depending on whether the manufactured goods differ from the purchased raw materials. If the first four digits of the product correspond to the data of imported raw materials, then the manufactured product is considered imported, and, therefore, the customs declaration must be included in the invoice.

The same rule should be used to issue an invoice for imported goods purchased in Russia:

- if the product has been changed (replenished, modified), as a result of which its code according to the foreign economic activity classification has changed, then it is recognized as domestic, which means there is no need to enter the GDT into the invoice;

- If an imported product is purchased in the Russian Federation and resold without changes, then when issuing an invoice, the buyer must enter the details of the Russian supplier’s invoices.

Example No. 3. In March 2021, Sokol JSC imported a batch of women's shoes from Italy.

How to fill out a customs declaration (CCD) and when is it needed?

Do not indicate Import of goods not declared In certain cases, the law allows not to fill out a declaration when importing goods (the conditions are described in the Customs Code).

If the goods are imported into the territory of the Russian Federation without a customs declaration, then its number does not need to be entered into the invoice. Question and answer about the customs declaration number. Question: In November 2017, Pharaoh OA imported a batch of upholstered furniture into the territory of the Russian Federation. In the same month, the furniture was sold in favor of Pyramida LLC.

When shipping the furniture, “Pharaoh” issued an invoice to “Pyramid”, in column 11 of which the customs declaration number 53874251 is indicated.

The customs declaration must be drawn up legibly

Invoices are documents that are generated for the purpose of calculating VAT and receiving deductions for it. Since most often such operations take place in line with the movement of goods across state borders, the CCD (customs declaration) number is written in these payment papers issued by sellers to their buyers.

- General information

- Features of filling SF with gas turbine engine

In 2021, general changes in tax and customs legislation did not ignore this issue.

A cargo customs declaration or cargo customs declaration is a paper that is required for registration in the event that goods are moved across the border, regardless of whether we are talking about import or export. The main information that is prescribed in the customs declaration is (Art.

CCD (customs declaration) in the invoice in 2021

This number is necessary in order to control the legal movement of goods across the border. Is it always necessary to fill out a customs declaration and additional documents? It should be remembered that the cargo customs declaration contains both main and additional sheets.

A mandatory attachment to the customs declaration is a declaration of customs value (DTV). This document is assigned to all goods that are subject to VAT, excise taxes and customs duties.

The point regarding the registration of a customs declaration for a car has already been indicated above. But we should clarify whether it is necessary to fill out a DTS for a vehicle transported across the border? The answer, of course, will be yes.

Of course, it is mandatory to fill out a vehicle registration certificate for a car that is imported into the Russian Federation.

How and when to fill in the customs declaration number in the invoice

This written document must be drawn up in any form and contain information about the property that the owner of the vehicle intends to transport across the border.

This method is applicable only in cases where the total value of the goods available does not exceed 100 euros.

Attention You should also remember that goods should not be subject to taxation, nor have any restrictions on transportation. What you need to indicate in the application:

- The name of the person who transports the declared property across the border, as well as an indication of its legal address;

- Name of all available products.

In this case, it is mandatory to indicate their quantity and codes;

- Customs regime;

- The second method will be discussed in more detail in this article, since this is where the registration of a customs declaration will be required.

Sample filling (example) After the customs declaration number is established and reflected in the registration journal, it is important to correctly transfer it to the Federation Council. This is done as follows (Art.

169 of the Tax Code of the Russian Federation): In field 11 of the invoice, the CCD number indicated on its main and additional sheets is written down. The serial number of the goods is written next to it, which is usually contained in the 32nd column of the document. Both requirements are mandatory; any inaccuracies and errors may lead to the refusal of the customs authorities to provide VAT deductions.

Important

It should be emphasized that when a company uses the general taxation regime, it should always indicate the customs declaration number in the Federation Council, even if it is not an importer. This will save the VAT subject a lot of unnecessary questions from the tax and customs departments.

What is a cargo customs declaration and how to fill it out correctly

Documents for registration of a customs declaration Together with the cargo customs declaration, the following package of documents must be submitted to the customs authorities of the Russian Federation:

- Declarant's certificate (confirmation of the declarant's authority to submit a customs declaration on his own behalf);

- Declaration of customs value;

- Documents for the vehicle (for each, if there are several);

- Documents for monitoring the delivery of goods;

- A copy of the passport certified by a notary;

- Confirmation of payment of customs duties or their future payment;

- The original electronic copy of the customs declaration on electronic media.

If the filling rules are followed, the cargo customs declaration must be submitted to the customs authorities within 15 (fifteen) days from the date of arrival of the goods at the temporary storage warehouse or customs warehouse.

Declaration of goods: who to give and who to refuse? (Manokhova S.V.)

GTD. Not many people pay attention to this. In addition, there is often a chance of seeing this combination of three letters in some documents. In practice, every car owner can encounter these mysterious three letters, so it would be useful to find out what they are and what they represent.

- 1 How does GTD stand for and what is it?

- 2 How to declare goods transported across the border?

- 3 Features of filling out a cargo customs declaration

- 4 Customs clearance and control

- 5 Cargo customs declaration for the car

- 6 Number of cargo customs declaration

- 7 Is it always necessary to fill out a customs declaration and additional documents?

How does GTD stand for and what is it? First, we should move on to deciphering the abbreviation itself, which may simply be incomprehensible to many.

Read the article ⇒ “How to issue an invoice” The form must be filled out in Russian. It is preferable for the form to be filled out electronically, then printed and certified.

If you fill out the form by hand and enter the data illegibly, they may not be accepted for clearance at customs. It should also be taken into account that errors, blots, and corrections cannot be made in the document - such a declaration is considered invalid.

If the data in the document is entered incorrectly, then it is better to rewrite the declaration. If this cannot be done, make the necessary corrections in the document, and then have the customs declaration certified by the declarant.

The legislation establishes the time frame within which a customs declaration must be issued - no more than 14 days from the date of import/export of goods.

Cases when you do not need to issue an unl

Secondly, the number of the declaration itself, which is subsequently transferred to the invoice. The customs declaration also includes the number of goods in the batch, their cost, as well as a list of additional papers attached to the declaration (invoice, specification, quality certificate, etc.).

Specifics of the declaration The customs declaration consists of standard 4 sheets, among which TD1 is the main one, and TD2 is additional.

The procedure for filling them out is as follows (Federal Customs Order No. 1057): The first sheet Remains at customs and stored in a special archive The second is filed in a folder in the customs statistics department The third is handed over to the person declaring the cargo The fourth Acts as a shipping document If one product is moved across the border, from one shipper, in a single batch, at one time - then only the main sheet of the customs declaration is filled out for him.

If we are talking about the transportation of several consignments of goods, from different suppliers, at different times, then one sheet is filled out for each individual type. The customs declaration is usually presented not only in paper, but also in electronic form. In this case, the document should not contain blots or errors. Along with the declaration, the following accompanying papers are submitted to the customs department:

- a document confirming the powers of the declarant;

- papers establishing the customs value of the goods and certifying the vehicle;

- certificates confirming the payment of customs duties.

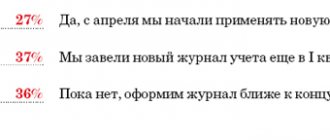

It is worth noting that the electronic customs declaration is provided on disk along with the general package of papers. After issuance, the customs declaration is registered in a special journal, which becomes the final basis for the legal crossing of the border by cargo.

Source: https://advokat-burilov.ru/sluchai-kogda-ne-nuzhno-oformlyat-gtd/

Features of documents for goods in the customs regime of export/import

Information data reflected in the customs declaration indicates the legitimacy of the transaction and the cargo being moved. They prove the absence of counterfeit products in full compliance with the rules for the import and export of goods on the territory of the Russian Federation.

The rules for filling out the declaration are regulated by Federal Law No. 113 “On customs regulation in the Russian Federation” as amended on November 27, 2010.

In its structure, the customs declaration form consists of two forms:

- TD 1 is the main sheet of the declaration; the export or import sign is affixed to it (EC, IM, respectively). Filled out for products with the same name. For example, spare parts for cars, with one code according to the Commodity Nomenclature of Foreign Economic Activity up to the ninth digit.

- TD 2 – additional bound sheets of the customs declaration. Filled out if there are goods that are not included in the main declaration sheet. No more than three different product categories can be entered here, while the total number of units of cargo cannot exceed 33 items per one main sheet of the declaration.

Important. In some cases, goods are registered according to the inventory. It replaces TD 2 and is applied in the absence of mandatory payment of duties, taxes and fees, licenses and quotas.

Registration number of the customs declaration - example

The adjustment to the rules for drawing up invoices was approved at the legislative level in Resolution No. 981 of 08/19/17. The main innovations are related to filling out individual lines and columns. In particular, the following has changed:

- A new column 1a has been added for primary (1b – for adjustment) invoices. Indicates the product type code. To be completed only when goods are exported outside the Russian Federation to a state that is a member of the EAEU. Otherwise, a dash is entered.

- The procedure for entering address data on pages 2a, 6a has been adjusted, depending on who exactly is issuing the document and to whom.

- The name of column 11, where the registration number of the customs declaration is located, has been changed - this indicator is filled in only for those goods that are produced abroad or intended for domestic consumption in the SEZ of the Kaliningrad region.

- The procedure for drawing up a document in certain situations has been expanded - for example, by developers, forwarders, customers, etc.

As it becomes clear from the analysis of innovations, column 11 has not disappeared anywhere, but has changed its name. What is the difference between a customs declaration number and a registration number? Or are these identical concepts? Let's understand the nuances.

Registration number of the customs declaration – 2021

The current customs declaration form was adopted in Appendix No. 2 of the CCC Decision No. 257 of May 20, 2010. It is this document that provides information about the sender, declarant, recipient of the cargo, countries of origin (departure, destination), goods, etc. Differences in filling out depend on whether the cargo is imported or exported and in what way.

In particular, gr. A, where the registration number of the customs declaration is indicated, is filled in by the responsible customs official (clause 42 of section XI of the Decision). The rules are the same for drawing up the main sheets of DT and additional (additional) sheets. The structure of the indicator formation is also shown here.

What does the customs declaration registration number look like?

The registration number of the cargo customs declaration consists of several parts. When encoding, generally accepted classifiers of the relevant customs institutions are used. The following scheme is currently valid:

XXXXXXX/XXXXXX/XXXXXXX

--- -- ---, Where:

1 2 3

1 is an element of the customs authority that completed the registration of the customs declaration (customs declaration) according to the Classification adopted in the EAEU. For example, declaration in Armenia requires a 2-digit code; in Belarus and Kazakhstan – 5-digit.

2 is a calendar element, namely the date of registration of the declaration in the format day, month, year (its last 2 digits). For example, encoding 120917 means that the cargo was declared on September 12, 2021.

3 is the number according to the declaration order, which is assigned by the customs authorities based on the data in the registration journal. The chronology is reset annually.

Thus, the registration number of the customs declaration, sample below, has a clearly structured scheme, written through the fraction sign “/” without spaces. To confirm the correctness of the information, the registration number must be certified with the seal and signature of the responsible customs official.

Let's look at the registration number of the customs declaration, the full customs declaration, using specific examples. The format will depend on the CU member country. Typical samples:

- 10226010/110917/0003214 – for Russia.

- 11/180817/0004781 – for Armenia.

- 06532/210717/0002487 – for Belarus.

- 50208/110417/0001245 – for the Republic of Kazakhstan.

- 10302/220317/0000874 – for the Kyrgyz Republic.

Consequently, we figured out that legal entities and individuals do not need to worry about how the registration number is encoded when importing or exporting cargo, because this is the responsibility of government officials.

Where can I find the registration number of the customs declaration to fill out invoices? To answer, let us again turn to the norms of paragraph 43 of Decision No. 257. It is clearly indicated here that according to gr. And the registration number assigned to the declaration is indicated - both on the main sheet and on the additional sheets.

If the product is resold, all data will already be indicated in the documents from the supplier.

Registration number of the customs declaration on the invoice

Having found out where the registration number of the customs declaration is indicated, the accountant needs to correctly enter the data into the invoice and other documents.

Let us recall that the regulations for the preparation of VAT-related documents (invoices, sales and purchase books) are established in Resolution No. 1137, which has been amended since October 1, 2017.

Since the previous term “TD Number” has been abolished, we can say that there are no differences left in the registration number and the simple number.

Note! What is the difference between the registration number of the customs declaration and the TD number? Nothing, since the corresponding terms in column 11 of the invoice and page 150 of the VAT declaration are replaced with “TD Registration Number”.

Data should be indicated according to gr. 11 invoices. The requirement applies to products not manufactured in the Russian Federation or released exclusively for domestic consumption in the Kaliningrad region. after completion of the free customs zone process. If the goods originate from the Russian Federation, according to gr. 11 is marked with a dash.

Registration number of the customs declaration in the sales book

The registration number of the customs declaration during export should be entered not only in the invoice, but in the sales book. To indicate information on the DT registration number, a separate column 3a is provided. This indicator is not filled in by all enterprises/individual entrepreneurs, but by those that sell goods, taking into account the following conditions:

- If, when declaring, VAT was not paid under para. 1 sub. 1.1 clause 1 stat. 151 NK.

- If, when declaring, VAT was paid according to para. 3 subp. 1.1 clause 1 stat. 151 NK.

That is, fill out the gr. 3a is required only for goods for domestic consumption in the SEZ of the Kaliningrad region.

Registration number of the customs declaration in the purchase book

The form of the purchase book has also undergone changes with the entry into force of Resolution No. 981 of 08/19/17. The adjustments will be relevant from October 1. 2021

and, among others, provide for the addition of the document form with column 13 to reflect information about the DT registration number.

This column is filled in only when the taxpayer purchases products that are subject to declaration under the EAEU during import into the territory of the Russian Federation.

If, on the basis of accompanying documents, several items of goods are simultaneously imported, with the preparation of one invoice, the data is entered using the sign “;” - that is, separated by a semicolon.

There is no need to fill out the indicator gr. 13 when reflecting information on adjustment invoices (corrected).

Registers of sales and purchase books are required to be compiled by all business entities paying VAT on transactions.

How to fill out the customs declaration registration number

It is very easy to enter data on the DT registration number into invoices and purchase and sales books. If a foreign product comes from a Russian supplier, it is enough to duplicate the data in the required columns/graphs.

If the purchase is made from a foreign partner, before the goods arrive at their intended destination, all mandatory customs procedures are carried out and a declaration is drawn up.

And after the import of products, when the full set of documents is ready, an invoice is drawn up, where the number from the gr. "A" DT.

If the registration number of the customs declaration is incorrect

What should I do if the entered number contains errors or inaccuracies? VAT taxpayers are concerned about this issue, primarily because of the legality of subsequent deductions. According to paragraph 2 of Art. 169 of the Tax Code, those errors that do not prevent the Federal Tax Service from identifying the counterparty cannot be a valid reason for refusing a tax deduction application.

VAT refund

If the accounting program “swears” when uploading data, first check whether the data is filled out correctly. If correct, try checking the number with the suppliers.

If the suppliers were not mistaken, perhaps the whole point is in the still undeveloped procedure for filling out information according to the new rules.

In this situation, it would be best to contact 1C developers and clarify the format for entering information.

Note! Many users are often also interested in the question: What is the registration number of the declaration of conformity of the customs union? And is this concept identical to the registration number of a regular customs declaration? We hasten to clarify that both terms are not equivalent.

The second indicates the declaration number when exporting or importing products. And the first is intended for unique identification of the declaration of conformity, which is what certification bodies that have passed accreditation do.

A declaration of conformity is issued in order to obtain the right to sell products in the territories of the CU member countries; the assigned number is recorded in a special register.

, please select a piece of text and press Ctrl+Enter.

Source: https://raszp.ru/nalogi/nds/reg-nomer-tamozhen-dekl.html

Requirements for gas customs declaration

The main requirements for filling out a cargo customs declaration are as follows:

- Information in the columns of the customs declaration, decoding of their contents in accordance with the classification and codes is entered in Russian.

- Records must be legible and easy to read.

- Corrections in the declaration are allowed only for numbers. At the same time, they are entered by carefully crossing out and writing the correct (updated) data.

- All adjustments are certified by the signature and seal of the declarant.

- The customs declaration is accepted by customs in printed form. It is possible to fill in cost indicators with a value of more than nine characters by hand.

- It is unacceptable to enter information that is not contained in the fields of the form. On the back indicate information that does not fit into the fields of the declaration. They write on the main form: “see. on the back."

- Codes cannot be duplicated; it is permissible to indicate previously entered data with the link “see. column no.

- The declaration is certified by the signature and seal of the declarant.

Declaration fields - correct filling

The rules for filling out the declaration fields for export and import are the same:

- The first section indicates the type of declaration, marked with the letters IM (import) or EC (export). In the case of import of goods into the customs territory of the Russian Federation without restrictions on use, the second subsection of the column is entered with code 40. If the document is issued in electronic form, then the ED marker is placed in the third subsection - electronic declaration. In our sample, the declaration is issued in paper form, and this subsection in the declaration is not completed.

- In the upper right corner of the form, in section A, the customs declaration number is indicated; the decoding includes three groups of numbers, under which the customs code, the date of drawing up the declaration and the serial number in the accounting journal are indicated.

- The leftmost section means the declaration form, where the first number 1 means that this is the main sheet - TD1, and the second indicates the number of additional sheets. If they are not issued, 1/1 is entered.

- Column 4 is completed if loading specifications are present.

- The fifth and sixth columns indicate the total imported goods and the number of cargo items. In the presented sample - 1 product, 1 place. This is an important indicator; it must correspond to actual transportation.

- The seventh column is filled in if a preliminary declaration has been carried out, and the design features are indicated. It is filled out by customs.

- 2 columns - sender, 8 columns - recipient. Full names, legal address are written, the country of departure and receipt is indicated in the form of a code in accordance with the rules of customs clearance.

- Column 9 indicates the person responsible for the finance. the settlement is usually the counterparty to the contract. May be the same as the recipient of the shipment.

- Column 12 indicates the total amount of delivery. 22 and 23 - indicate in what currency the delivery is made, with codes of the contract currency and the exchange rate on the date of registration of the declaration.

- Field of column 20 - terms of delivery - is filled in according to the information provided by the contract documents. The delivery location is recorded here. In our case, these are the CIP terms of Incoterms, which means that transportation and insurance of cargo is paid up to a certain point along the route. Maybe to the border, to a warehouse, in our case - to a customs warehouse in Moscow.

- Columns for indicating payments and duties. Each indicator is indicated in its own column: customs duties - 1010, duties - 2010, VAT - 5010.

Below is a sample of the complete filling out of the customs declaration for imports: a breakdown of the columns indicating the completed information.

More details about the rules for filling out declarations, including in electronic form, can be found in the video below.

What is a customs declaration (ready customs declaration)

If your organization imports imported goods, or you, as an entrepreneur, sell products for export, then the customs declaration is one of the main documents that you will have to prepare. The customs declaration confirms the legality of your cargo transportation. If the customs declaration is not issued by you, then the goods crossing the border of the Russian Federation will be recognized as contraband.

The document is drawn up in the prescribed form - on forms DT1n DT2n. The first form is used to enter basic data about the product, sender and recipient, the second - to reflect other additional information (packages on products, accompanying documents, payments).

If you are accepting imported goods from abroad, make sure that the following basic information is included in the declaration:

- full information about the sender: organization, legal address (for example, Mercedes-Benz, 76751, Werth, Germany);

- information about you as a recipient (Standard LLC, 412741 Tula, Lenin St., 14, building 5);

- if the goods are sent through an intermediary, then data about it must also be reflected in the declaration;

- detailed description of the product (type, name, model, serial number, manufacturer information);

- cost of goods, amount of customs duties;

- payment procedure (currency, payment information, amount of funds paid);

- place of loading and delivery of goods (country, locality, address);

- vehicle importing goods (make, model of car, license plates).

Data about the product, country of origin, sending and receiving states must be reflected not only in text format, but also in the form of special codes.

Read the article ⇒ “How to issue an invoice”

The form must be filled out in Russian. It is preferable for the form to be filled out electronically, then printed and certified. If you fill out the form by hand and enter the data illegibly, they may not be accepted for clearance at customs. It should also be taken into account that errors, blots, and corrections cannot be made in the document - such a declaration is considered invalid. If the data in the document is entered incorrectly, then it is better to rewrite the declaration. If this cannot be done, make the necessary corrections in the document, and then have the customs declaration certified by the declarant.

The legislation establishes the time frame within which a customs declaration must be issued - no more than 14 days from the date of import/export of goods.

We type correctly: customs declaration number, decoding, example of creation

Any declaration, regardless of whether an export or import is drawn up by a participant in foreign economic activity, begins with a number.

This is what it looks like in X format:

xxxxxxxxxx/xxxxxxx/xxxxxxxxxx

All elements of the declaration number are placed through a separator, and spaces between them are not allowed.

An example with numbers: let’s say the customs authority code is 10101020, the release date (import of goods) is December 6, 2012, the serial entry in the journal is 00012503. Then the declaration number for these data will be written like this:

10101020/061212/00012503

The gas customs declaration number and the decoding of its digital elements are determined by the content of information hidden in it and grouped into three blocks:

- The first block is the code of the customs department exercising control over the import of goods.

- The second is the date of registration of the declaration; the day, month, and last two digits of the current year are indicated.

- A serial number assigned according to the register of cargo customs declarations by the customs office that registers the declaration. Every year it starts anew, from one.

Will the filling of column 11 in the invoice change from October 1?

No, the content remains the same, only its name has changed.

In the new edition of Resolution No. 1137, among other changes, there is a renaming of column 11. Now it is called “Customs Declaration Number”, and from 10/01/2021 - “Registration Number of the Customs Declaration”. In this regard, many taxpayers have a reasonable question: does this mean that now other information needs to be entered into it?

Let's define the concept

A registration number is a numeric or alphanumeric designation assigned to a document when it is registered.

The registration number of the goods declaration (DT) in accordance with the requirements of the “Instructions for filling out customs declarations and customs declaration forms” (approved by the CCC Decision No. 257 of May 20, 2010) consists of three elements:

- Code of the customs authority that registered the document.

- Registration date: day, month, last two digits of the year.

- The serial number of the declaration, which is assigned by the customs authority. Each new calendar year begins with one.

These three elements are separated by the “/” character, and no spaces are allowed between them. It would seem that everything is simple and clear.

Why does the question arise

The fact is that now taxpayers enter detailed information in column 11 of the invoice: the registration number of the goods declaration, and in addition to it, through “/”, the serial number of the goods in this declaration.

They are guided by the letter of the Federal Tax Service of Russia dated August 30, 2013 No. AS-4-3/15798, which states that the customs declaration number should be considered the registration number indicating the serial number of the goods through “/”.

Since this statement is true for the “Customs Declaration Number,” it is unclear how the column called “Customs Declaration Registration Number” will be filled out.

What information in column 11 of the invoice will be considered correct and sufficient for the Federal Tax Service to accept the document without question?

Federal Tax Service opinion

The Department believes that in this case, adjusting the name of the column does not entail a change in its content; the information must be filled out as before: registration number of the DT and then through “/” the serial number of the product in this DT in the following form:

Part 1 - eight characters: customs post code;

Part 2 - six characters: date of registration of the motor vehicle;

Part 3 - seven characters: DT serial number;

Part 4 - three characters: the serial number of the product in the DT.

At the same time, according to the clarifications of the Ministry of Finance dated 18.02.

2011 (letter No. 03-07-09/06), if column 11 of the SF contains incomplete information about the DT number (there is no serial number of the goods) and such an invoice during an audit does not prevent the tax authorities from identifying the main terms of the transaction, this is not a basis for refusing a VAT deduction.

In other words, the absence in column 11 of the serial number of the goods according to the declaration is not considered an error. To date, no additional recommendations or clarifications have been received from government agencies regarding otherwise entering information in column 11 of the invoice.

Technical side of the issue

The structure and format of the field “Registration number of the customs declaration” in the electronic document has not undergone any changes since 10/01/2021. It allows you to enter from 1 to 29 characters. Thus, the electronic invoice format allows for a DT number in either four or three parts.

In Diadoc in printed form, which, we recall, is not a legally significant document, the name of column 11, in accordance with the new edition of Resolution No. 1137, will be changed to “Registration number of the customs declaration.” It will reflect the value that was entered when generating the electronic invoice.

Why did the column name change?

The customs legislation establishes and uses the concept of “registration number of the customs declaration”. Decree of the Government of the Russian Federation No. 981, which introduced changes to the form and procedure for filling out invoices, brings into line the concepts of customs and tax law.

Summarize

So, after October 1, 2021, column 11 of the invoice is filled out as before: the DT registration number indicating the serial number of the product or simply the DT registration number (without the serial number of the product) is entered into it.

In addition, goods can be released by the customs authority before the submission of the DT. This has been a fairly common practice lately. In this case, in column 11 of the invoice, it is recommended to indicate the number of the obligation to file a customs declaration, in accordance with which the goods were released (letter of the Ministry of Finance dated 02/06/2015 No. 03-07-08/5026).

The format of the obligation number looks like this - XXXXXXXX/XXXXXX ABOUT XXXXXX.

Element 1 - eight characters: customs post code.

Element 2 - six characters: date of registration of the obligation, space.

Element 3 - eight characters: the letters “OB”, meaning “obligation”, a space, six digits of the serial number of this obligation.

Source: https://www.diadoc.ru/blog/7782

xxxxxxxxxx/xxxxxxx/xxxxxxxxxxx/xx

As stated in the format provided, the invoice number consists of the following elements:

- The number of the cargo customs declaration, which is prepared for the corresponding accounting document. In this case, the decoding of the customs declaration in the invoice is identical to the set of elements when generating the declaration number.

- Commodity item: the serial number of the product from column 32 of the main or additional sheet of the customs declaration is indicated through a slash sign in the invoice.

If the goods are issued as a list, this element of the invoice number indicates the quantitative ordinal item from the list of goods. Spaces between number elements are not allowed.

There are cases when the customs declaration number does not need to be entered into the invoice, for example, in the case of importing goods from the EAZU (Eurasian-Asian Union) countries.

Secrets of the Commodity Nomenclature of Foreign Economic Activity, or how to correctly determine the product code

The cargo customs declaration indicates various indicators characteristic of each specific case of movement of goods across the customs border of the Russian Federation. The indicators must correspond to the actual cargo transported.

During customs clearance, importance is attached to the correct declaration of goods and their compliance with the commodity nomenclature of foreign economic activity - TN FEA. Customs duties, fees and payments depend on how accurately the selected code matches the product.

Commodity Nomenclature for Foreign Economic Activity are systematized cargo codes that are accepted for circulation in international trade.

Sections, subsections and positions of product groups

In the Commodity Nomenclature of Foreign Economic Activity, goods are systematized into categories and types, provided with a short name and description.

Product indicators are formed by:

- sections;

- groups;

- subgroups.

For those goods that are not classified in sections or groups, the following code decoding is used in the customs declaration: “other” and “other of other” items of the product nomenclature.

For example, when filling out a declaration in the product description column, you need to perform the following sequence of actions:

| Description | |

| HS codes | indicate a four-digit code separated by commas or specify up to ten characters |

For example, the query “oil sensor” will find examples of declarations with several types of product descriptions of the form: “... pressure sensor...” “... pressure measuring device - special sensor...”

From the proposed options for answering the request, you must select the greatest match for keywords that relate to the target product group for the declared cargo in the declaration. For example, for the word “tractor,” the HS search engine can return codes for an agricultural tractor, as well as a toy tractor. Carefully deciding on the product group is the key to successful declaration. The more complete the request, the more accurate the codes of the cargo being processed.

And, of course, don’t forget about the “other” goods position. In customs slang, such groups are called “baskets”. Used when your cargo is not in the named product sections and positions. Then the description uses the chain “other-other-other”.

Statistics, accounting and control

A cargo customs declaration is required when crossing the border in 98 countries with which Russia has trade relations. In addition, the customs declaration is used as a state accounting and statistical document. This is done by separating the declaration sheets. They are distributed in the following directions:

- The first one remains in the customs department for the archive of the declaration issue.

- The second sheet of the customs declaration is sent to the statistics department.

- The third is given to the declarant for reporting by the foreign trade participant to the tax office and the bank.

- When exporting, the fourth sheet is attached to the accompanying documents and sent to the checkpoint at the border; when importing, it remains in the cost department of the customs office that inspected the imported cargo.

The passed control is certified by permitting marks on the customs declaration, as a result of which it becomes a kind of passport of the goods, which has legal force in the management and customs structures of foreign countries.