Let's define the concept

A registration number is a numeric or alphanumeric designation assigned to a document when it is registered.

The registration number of the goods declaration (DT) in accordance with the requirements of the “Instructions for filling out customs declarations and customs declaration forms” (approved by the CCC Decision No. 257 of May 20, 2010) consists of three elements:

- Code of the customs authority that registered the document.

- Registration date: day, month, last two digits of the year.

- The serial number of the declaration, which is assigned by the customs authority. Each new calendar year begins with one.

These three elements are separated by the “/” character, and no spaces are allowed between them. It would seem that everything is simple and clear.

Why does the question arise

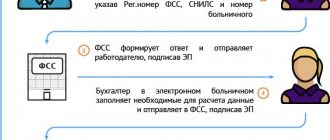

The fact is that now taxpayers enter detailed information in column 11 of the invoice: the registration number of the goods declaration, and in addition to it, through “/”, the serial number of the goods in this declaration.

They are guided by the letter of the Federal Tax Service of Russia dated August 30, 2013 No. AS-4-3/15798, which states that the customs declaration number should be considered the registration number indicating the serial number of the goods through “/”. Since this statement is true for the “Customs Declaration Number,” it is unclear how the column called “Customs Declaration Registration Number” will be filled out. What information in column 11 of the invoice will be considered correct and sufficient for the Federal Tax Service to accept the document without question?

Multi-page invoices

Situation: is an invoice considered correctly executed if it is drawn up on several sheets? Is there no space on one sheet to include all the necessary information?

Yes, it counts.

After all, there are no requirements that the invoice must be drawn up on one sheet. On multi-page invoices, the details “Head of the organization” and “Chief accountant” are indicated only on the last sheet. In this case, number all pages of the document.

This follows from Article 169 of the Tax Code of the Russian Federation and is explained in the letter of the Ministry of Finance of Russia dated May 15, 2006 No. 03-04-09/11.

Federal Tax Service opinion

The Department believes that in this case, adjusting the name of the column does not entail a change in its content; the information must be filled out as before: registration number of the DT and then through “/” the serial number of the product in this DT in the following form:

Part 1 - eight characters: customs post code;

Part 2 - six characters: date of registration of the motor vehicle;

Part 3 - seven characters: DT serial number;

Part 4 - three characters: the serial number of the product in the DT.

At the same time, according to the clarifications of the Ministry of Finance dated February 18, 2011 (letter No. 03-07-09/06), if column 11 of the Federation Council contains incomplete information about the DT number (there is no serial number of the goods) and such an invoice is not prevents the tax authorities from identifying the main terms of the transaction, this is not a basis for refusing a VAT deduction. In other words, the absence in column 11 of the serial number of the goods according to the declaration is not considered an error. To date, no additional recommendations or clarifications have been received from government agencies regarding otherwise entering information in column 11 of the invoice.

Buyer information

In line 6 “Buyer”, write down the full or abbreviated name of the buyer. In line 6a “Address” – the address of the buyer. Indicate the name and address of the buyer in the same way as in its constituent documents. In line 6b, indicate the buyer’s tax identification number and checkpoint.

If you are selling something to a separate division of a client, then in line 6b “TIN/KPP of the buyer” put down its KPP, not the head unit. The TIN will be common for the organization (letter of the Ministry of Finance of Russia dated September 1, 2009 No. 03-07-09/43).

This is stated in subparagraphs “i”–“l” of paragraph 1 of Appendix 1 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

Situation: who should the buyer indicate on the invoice if the goods are shipped to one organization and paid for by another?

The buyer should indicate in the invoice the organization with which the contract for the supply of goods was concluded.

Indeed, in such situations, the payer does not become the owner of the goods. He only fulfills the agreement with the buyer. And the seller who received payment from a third party does not have any obligations to it. Therefore, issue the invoice and delivery note in the name of the buyer in accordance with the contract. In the invoice, reflect the information specified in the constituent documents:

- in line 6 “Buyer” – full or abbreviated name;

- in line 6a “Address” – the address of its location (legal address);

- in line 6b “TIN/KPP of the buyer” - identifying numbers assigned to him.

This follows from the provisions of subparagraphs “g” and “i”–“l” of paragraph 1 of Appendix 1 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137, as well as Article 313 of the Civil Code of the Russian Federation.

Technical side of the issue

The structure and format of the field “Registration number of the customs declaration” in the electronic document has not been subject to any changes since 10/01/2017. It allows you to enter from 1 to 29 characters. Thus, the electronic invoice format allows for a DT number in either four or three parts.

In Diadoc in printed form, which, we recall, is not a legally significant document, the name of column 11, in accordance with the new edition of Resolution No. 1137, will be changed to “Registration number of the customs declaration.” It will reflect the value that was entered when generating the electronic invoice.

How to fill out every column in a new invoice journal without errors

How this article will help:

You will learn which invoices must be registered in the new accounting journal, and which documents do not need to be reflected there. And also about how to correctly fill out the columns of this tax register.

What it will protect you from:

From claims from tax authorities due to errors in the accounting journal.

If your

VAT is usually not paid.

From April 2012, all companies must apply the new invoices. Its form and rules for filling out were approved by the Government of the Russian Federation by Decree No. 1137 of December 26, 2011. The same document approved the mandatory form of the invoice journal. And this is a very important change. After all, not only did the previous rules provide for two journals: one for received, the other for exposed documents. There was also no standard form for them. Therefore, in practice, accounting journals were often simply a file of invoices.