How are the deadlines for submitting 3-NDFL related to the deadlines for paying taxes?

What are the deadlines for filing a 3-NDFL declaration?

If you need to calculate and pay personal income tax for the next tax period (year), submit the 3-NDFL declaration after its end - before April 30 of the next year (clause 1 of Article 229 of the Tax Code of the Russian Federation). If April 30 falls on a weekend, then the deadline for filing the 3-NDFL declaration is shifted to the working day following this weekend (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). Taking into account these rules, the deadline for submitting 3-NDFL in 2021 falls on 04/30/2021, because it's a working day. This deadline for submitting 3-NDFL is valid for:

- individual entrepreneurs, private practitioners;

Step-by-step instructions for filling out 3-NDFL by an entrepreneur were prepared by ConsultantPlus experts. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

- foreign citizens working in the Russian Federation under a patent;

- citizens who received income:

- from tax agents who did not withhold tax upon payment;

- entrepreneurial activity;

- rental of property;

- sale of property owned for up to 3 years, securities, shares in the authorized capital;

- donations;

- remuneration of copyright heirs.

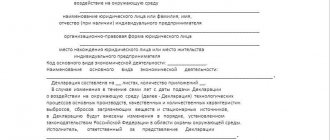

NOTE! The declaration for 2021 must be submitted using the new form from the order of the Federal Tax Service dated August 28, 2020 No. ED-7-11/ [email protected] You can download the form by clicking on the picture below. And in this article you will find detailed explanations about filling out the report and a sample.

Document submission deadline

Before moving on to considering the deadlines for submitting documentation for a personal income tax refund, it is necessary to understand what types of deductions exist in tax legislation, since each of them has its own statute of limitations.

Types of tax discounts

Today, individuals who are taxpayers can reduce the size of their tax base by applying for one of four types of deductions, and in some cases several at the same time. Tax discounts are usually classified into the following categories:

- Standard type. First of all, these are certain material compensations provided to the preferential category of the population listed in the first two paragraphs of Article 218 of the Tax Code, as well as children's deductions.

- Social type. Article 219 describes in detail for what social expenses individuals are entitled to a personal income tax refund. Often these are costs for medical services, charitable contributions, education, and some other social needs.

- Property type. In cases of purchasing certain property objects, such as apartments, houses, separate rooms and land plots, as well as spending money on their repairs, an individual can reduce the size of his tax base. Exactly how to do this is written in Article 220 of the Tax Code.

- Professional looking. Income that taxpayers receive as a result of performing certain types of activities enshrined in Article 221 also implies a refund of income tax. For example, this could be the creation of an art object for a fee - a painting, sculpture, piece of music, etc.

Once the taxpayer has decided what type of tax credit he is dealing with, he can proceed to the process of completing the required documentation package, but do not forget about the established submission deadlines.

ATTENTION! If an individual has previously used a property-type deduction, then it is pointless to prepare documentation for the same type of tax discount, since the law allows you to return personal income tax for property only once.

Deadlines for filing a declaration

To receive any type of tax discount, you must fill out and submit a document such as a tax return to the tax office for verification. Using this paper, the taxpayer reports on all transactions related to his income and expenses. The document is usually drawn up according to the 3-NDFL model.

The declaration must be submitted to the tax authority for consideration no earlier than next year, which comes after the year the taxpayer paid for a certain service, giving him the right to a personal income tax refund.

Thus, if an individual spent money on a child’s education in 2021, then he should file a tax return no earlier than 2021, since this document must contain information for the entire tax period.

Deadline for filing 3-NDFL upon termination of activity

Upon termination of activity for 3-NDFL, the deadline for submission is determined depending on which category of individuals the taxpayer belongs to. According to the standards contained in paragraph 3 of Art. 229 of the Tax Code of the Russian Federation, it is established as follows:

- within 5 days after the end of the month when this activity was terminated - this is the filing deadline for individual entrepreneurs and private practitioners under 3-NDFL;

Attention! The day of termination of activity is considered to be the date of making the corresponding entry in the Unified State Register of Individual Entrepreneurs, and not the date of filing the application for deregistration (letter of the Federal Tax Service of Russia dated January 13, 2016 No. BS-4-11 / [email protected] ).

- no later than a month before leaving the Russian Federation - this is how 3-NDFL determines the filing deadline for foreign citizens.

Until what date do you have to submit 3-NDFL in 2021?

The income declaration must be sent to the tax office at the place of residence, and if this is not the case, then at the place of residence of the individual. 3-NDFL can be brought to the Federal Tax Service in person, sent by mail (necessarily with a list of attachments and notification of receipt), or sent through the “Taxpayer Personal Account” on the website of the Federal Tax Service of Russia.

Individuals who are required to declare their income submit a 3-NDFL declaration before April 30 of the following year (clause 1 of Article 229 of the Tax Code of the Russian Federation). The last day for submitting 3-NDFL in 2021 has been postponed to May 2, since April 30 fell on a day off, and also due to the spring holidays. During this period the following must report their income for 2021:

- Individuals who calculate and pay personal income tax on their income independently - individual entrepreneurs, privately practicing lawyers and notaries (Article 227 of the Tax Code of the Russian Federation).

- Individuals who have received income under employment and other contracts (including rent and hire) from organizations and citizens who are not tax agents (clause 1 of Article 228 of the Tax Code of the Russian Federation),

- Foreign citizens who work in Russia for hire on the basis of a patent (Article 227.1 of the Tax Code of the Russian Federation).

All others who wish to declare their income voluntarily must also do so within the period established by law.

In 2021, the deadline for submitting 3-NDFL for 2021 is postponed, since the delivery day falls on a weekend - this time on May 2 (Resolution of the Government of the Russian Federation dated August 4, 2016 No. 756).

In the case when an individual entrepreneur or a private practitioner decides to stop his business, a different deadline applies for reporting income. They should submit the 3-NDFL declaration within five days from the date of termination of activity, without waiting for the end of the tax period (clause 3 of Article 229 of the Tax Code of the Russian Federation).

Deadline for filing 3-NDFL for tax deductions

If you need to receive social or property tax deductions not at work, but through the Federal Tax Service, fill out 3-NDFL and submit it at the end of the calendar year. When is the 3-NDFL declaration submitted in this case? The deadline until April 30 does not apply. That is, you can submit a return just to receive a deduction at any time throughout the year. In this situation, there is no need to focus on the deadline for submitting the 3-NDFL declaration.

The statute of limitations for filing a 3-NDFL declaration when applying for tax deductions is not established by law. But only 3 years are allotted for filing an application for a tax refund, counted from the moment this payment is made (clause 7 of Article 78 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated November 17, 2011 No. 03-02-08/118).

Please note that if you declare in 3-NDFL both income subject to declaration and the right to tax deductions, then you are required to submit such a declaration no later than April 30.

For example, when selling property owned for less than 5 (and in certain situations - 3) years, you need to report before April 30 of the year following the year of sale (clause 1 of Article 229 of the Tax Code of the Russian Federation). Therefore, if you decide to reduce the income from the sale of housing by expenses associated with its acquisition, and at the same time apply to it the deduction provided for the purchase of housing, then the declaration must be submitted no later than April 30.

How to fill out the 3-NDFL declaration when selling and buying apartments during the year? The answer to this question is in ConsultantPlus. To do everything correctly, get trial access to the system and go to the material. It's free.

Read more about the impact of the period of ownership of property on the taxation of income from its sale in the material “Sale of real estate below cadastral value - tax consequences.”

Deadline for filing a declaration in 2020

As you know, in order to reimburse overpaid tax associated with a certain type of expense (for example, paying for expensive treatment in a medical clinic), the taxpayer must draw up and submit a 3-NDFL form for verification.

However, when exactly an individual will carry out this process is also important, since most tax deductions are subject to statutes of limitations, the essence of which is that after their expiration the right to accrue a deduction ceases to apply.

Attention! The starting point from which the statute of limitations should be counted is the day on which the individual officially spent the money. For example, if a taxpayer paid for a contract with an educational institution on May 16, 2021, then the same date in 2021 will be considered to have passed exactly a year.

By what date should the form be submitted?

Individuals applying for a reduction in the size of their tax base due to overpayment of income tax earlier need to understand that this type of opportunity will not always be assigned to them throughout their lives. The period during which the right to a tax deduction extends is affected only by the type to which it relates. The following tax discount options are available:

- Social compensation. If an individual who is a pensioner spent money on life insurance on a voluntary basis or contributed it to the funded part of a labor-type pension, then the tax can be returned no later than three years. The same applies to individuals who have made social expenses for charity, medical procedures and education. You can only claim such compensation for three years.

- Property compensation. This is the most flexible type of all possible tax discounts, since the Federal Tax Service does not provide for time restrictions regarding accrual. You can receive overpaid personal income tax for the purchase of real estate at any time, but only once in your entire life.

- Standard compensation. This deduction is intended for parents and consists of reducing their tax base in order to provide some kind of financial assistance in raising children from the state. A mother or father can apply for this discount from the first month of the child’s life. If this is done later, then no deduction will be accrued for the previous period, so the sooner the declaration is filed, the more profitable it is for taxpayers.

- Professional Compensation. If an individual is an entrepreneur or is engaged in the provision of private legal services and, according to the rules of the current legislation, has the right to a professional tax deduction, then he can receive it until April thirtieth of the next year (after the year in which this right arose).

The standard tax discount is provided not only for parents, but also for individuals who are beneficiaries of various types, the list of which is recorded in Article No. 218 of the Tax Code of the Russian Federation. If the beneficiary’s right to standard compensation was not from birth, but appeared at a certain moment, then the sooner he submits a declaration, the sooner he will receive a discount and make his life easier.

If the right to a standard deduction for benefits for an individual, for example, appeared in 2015, and he submitted the 3-NDFL form only in 2021, then material assets will not be compensated for the past period. Therefore, we recommend not to delay filling out the declaration.

Results

The deadline for submitting Form 3-NDFL for declaring income is set for April 30, following the reporting year. If the deadline falls on a weekend or non-working date, it is shifted to the next closest working day. But for reporting for 2021, this rule does not apply and you must report no later than 04/30/2021, because it's a working day. For late submission of a tax return, the taxpayer will face a fine of at least 1,000 rubles.

When declaring tax for deduction, a specific deadline for filing 3-NDFL is not established by law. But the tax can be returned only for the last 3 years preceding the year of filing the declaration.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service dated October 7, 2019 No. ММВ-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Special situations

When an independent income tax payer declared in 3-NDFL for 2021 both income and the right to deductions for it, he is obliged to submit such a declaration within the deadline prescribed by law for filing 3-NDFL for 2016 - no later than May 2, 2017.

Also note that 3-NDFL for 2021 can be submitted at any time throughout the year without any tax penalties when it only claims personal income tax deductions:

- standard;

- social;

- investment;

- property when buying a home.

That is, established by paragraph 1 of Art. 229 of the Tax Code of the Russian Federation, the deadline for submitting the 3-NDFL declaration for 2016 does not apply to them. Such persons have a kind of good reason - after all, the personal income tax was paid into the budget entirely and on time by their tax agent/agents. But the period for the right to file a 3-personal income tax with deductions is still set - 3 years (a housing deduction is possible later, but based on income for the last 3 years).

Read also

24.02.2017

What happens if you don't submit your return on time?

If the deadline for filing a tax return was violated by a citizen, then it all depends on the circumstances. If a citizen was obliged to pay tax along with the papers, then he will be fined for being late. If it was necessary to provide only a document, then penalties for violating the deadlines in this case are not provided.

As for the declaration drawn up in Form 3 of personal income tax for property and social deductions, it is not necessary to submit it before a certain date. This document is of unlimited duration. It is accepted by tax authorities throughout the year.

If an individual entrepreneur violates the deadline for filing a tax return, he will have to pay a fine. If the indicators given in the document are zero, then the fine will be 1 thousand rubles. If an entrepreneur not only delays submitting documents, but also refuses to pay tax, then the measures will be more severe. In such a situation, the citizen repays the tax debt, pays a fine and interest for the delay.