Who is the payer of the tax collection fee?

According to Art. 16.1 of Federal Law No. 7-FZ of January 10, 2002 “On Environmental Protection” all organizations and individual entrepreneurs that have the following impact on the environment:

- emit pollutants into the air through stationary sources;

- or release pollutants into water bodies;

- or are engaged in the storage and disposal (disposal) of waste,

are required to pay for negative impacts on the environment.

Please note the following points:

- Only emissions from stationary sources are taken into account; mobile sources of emissions have not been taken into account for a long time.

- If an organization only generates waste and has a contract for waste removal, then ownership of this waste does not transfer anywhere. Those. the organization must pay the NVOS for its own waste placed at the landfill. The exception is the payment for solid waste if there is an appropriate agreement with the regional operator.

- The obligation to pay the NVOS arises regardless of whether the organization is the owner of the production facility or leases it.

Legislation

- Federal Law No. 7-FZ of January 10, 2002 “On Environmental Protection”;

- Federal Law No. 89-FZ of June 24, 1998 “On production and consumption waste”;

- Decree of the Government of the Russian Federation No. 632 of August 28, 1992 “The procedure for determining fees and their maximum amounts for environmental pollution, waste disposal, and other types of harmful effects”;

- Order of the Ministry of Natural Resources of the Russian Federation No. 1043 dated December 10, 2020 “On approval of the procedure for submitting a declaration on payment for negative impact on the environment and its forms and on the recognition as invalid of the Orders of the Ministry of Natural Resources and Ecology of the Russian Federation dated January 9, 2017 No. 3 and dated December 30. 2019 No. 899"

- Decree of the Government of the Russian Federation No. 1029 of September 28, 2015 “On approval of criteria for classifying objects that have a negative impact on the environment as objects of categories I, II, III and IV”

- <Letter> Rosprirodnadzor No. AS-06-02-36/5194 dated March 15, 2017 “On offset, return of overpaid fees for negative environmental impact

- <Information> Rosprirodnadzor dated 04/19/2017 <Information on the resulting overpayment under the NVOS>

- <Letter> Rosprirodnadzor No. AA-06-02-36/6198 dated March 27, 2017 “On document forms”

- <Letter> Rosprirodnadzor No. AS-06-02-36/19116 dated 08.29.2017 “On the application of coefficients”

How to calculate the amount of the tax assessment?

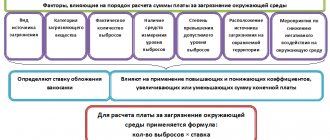

Calculation of the amount of payment for negative environmental impact depends on the following factors:

- nature of the source of pollution;

- type of pollutant (or its hazard class);

- volumes of actual emissions;

- the fact that there are no means of measuring emissions;

- presence of excess pollution above established standards;

- the fact that the contaminated object or territory is under special protection;

- expenses incurred on measures to reduce negative impacts.

Based on the first 2 indicators, the rate used in the calculation is determined. By multiplying it by the volume of actual emissions (if it does not exceed the maximum permissible) the amount of payment for pollution is determined. The following odds are applied to the bet amount:

- increasing, if we are talking about the lack of means of measuring emissions, exceeding permissible pollution standards, or the location of an object (territory) under special protection;

- reducing, depending on the hazard class of the disposed waste, the method of its generation and disposal.

To calculate the amount of payment for the environmental impact assessment, the following methodology is used (approved by Decree of the Government of the Russian Federation dated 03.03.2017 N 255 “On the calculation and collection of fees for negative impacts on the environment.”

The amount of payment for the NVOS can be calculated in the Natural Resources User Module.

Responsibility for failure to file a declaration and changes in 2021

If business owners do not timely submit reports for the IEE, they may be subject to administrative liability. This point is clarified by Article 19.7 of the Code of Administrative Offenses of the Russian Federation. Penalties for this violation range from 3 to 5 thousand rubles.

Officials working in the violating company will pay a fine of 300 to 500 rubles. For concealment, as well as distortion of information for the NVOS, the legislation establishes the following penalties:

- Officials can be fined from three to six thousand rubles.

- Owners of organizations formed as a legal entity will receive a fine in the amount of 20 to 80 thousand.

To avoid unpleasant consequences and penalties, business owners are recommended to submit all necessary reports in a timely manner. The NVOS declaration for 2021 must be sent to the authorized body by March 10, 2020. It is worth noting that the declaration should not contain errors or omissions.

In 2021, some changes have been introduced that are related to payment. There is a document on the official Government portal that contains indexed fee rates.

The previous rates from 2021 have been retained, but a coefficient of 1.04 has been introduced.

This means that the fee for the NVOS will increase by the amount of inflation. As of today, the inflation rate for 2021 is taken into account. According to simple calculations, the contribution will increase by 4%.

The changes contained in the new legislative act also affected the rate of payment for NWTP when disposing of solid waste belonging to hazard class IV. The contribution amounts will be valid until 2025.

For 2021, a businessman will have to pay 95 rubles for one ton of garbage. For 2021, the contribution amount will increase and amount to 194.5 rubles.

To summarize, we note that the declaration for payment of the fee for the IEE is filled out electronically. The document must be submitted by March 10 of each year for the previous 12 months. All businessmen (owners of individual entrepreneurs and organizations forming a legal entity) are required to submit reports.

If a company removes waste on its own, this does not exempt you from preparing reports and paying a fee for the NVOS. Owners of office premises are exempt from payment. To fill out the document, a special form is established, fixed at the legislative level.

The document must not have errors, blots or other corrections. If the data is entered incorrectly, you must fill out the form again. Registration is carried out on the basis of certain rules. For late submission of reports, punishment (administrative liability) is provided in the form of fines.

In 2021, the payment for the NVOS increased by the amount of inflation and the amount will increase every year. The changes are enshrined at the legislative level in the Government Decree.

Rates applied for calculation for 2021

Decree of the Government of the Russian Federation No. 913 dated September 13, 2016 approves the rate for calculating the fee for the NVOS.

| Sources of environmental pollution | Criteria for setting a bid |

| Stationary sources of pollution producing emissions into the atmosphere | For each pollutant |

| Discharges into water bodies | For each pollutant |

| Disposal of production and consumption waste | Waste hazard class |

Please note that Regulation 913 provides rates for 2016, 2021 and 2021. At the same time, by Decree of the Government of the Russian Federation dated June 29, 2018 No. 758, the rates of payment for the negative impact on the environment when disposing of solid municipal waste of hazard class IV for 2021 are indexed.

If you are using the Environmental User Module, be sure to update the program version to take into account the latest changes in legislation.

When to pay for the NVOS in 2021: payment dates and BCC

Payments for the NVOS must be made no later than 01.03 of each calendar year for the previous 12 months. The deadline for transferring fees for 2021 is 03/01/2020.

The advance is transferred by the 20th day of the month following the 1st, 2nd and 3rd quarters. Deadlines for transferring advance payments in 2021:

- for quarter No. 1 – until 04/20/2020;

- for quarter No. 2 – until July 20, 2020;

- for quarter No. 3 – no later than 10/22/2020.

Owners of small and medium-sized businesses do not pay an advance. This point is explained in Article 16.4 of Federal Law No. 7.

KBC for payment of pollution fees in 2021:

- when placing waste – 048 1 1200 120;

- for air pollution – 048 1 1200 120;

- when sending waste to water bodies - 048 1 12 01030 01 6000 120.

When and how to pay?

Payment is made annually before March 1 of the year following the reporting year (Clause 3, Article 16.4 of Law No. 7-FZ of January 10, 2002). The amount of payment is determined as the amount of the annual fee minus advances paid and expenses for measures to reduce the negative impact.

Who pays advances and how?

According to paragraph 3 of Art. 16.4 of Federal Law No. 7-FZ of January 10, 2002 “On Environmental Protection” small businesses do not pay advances; other enterprises and organizations pay advances quarterly during the reporting year no later than the 20th day of the month following the next quarter. The advance amount is calculated as ¼ of the total amount of the negative impact fee for the previous year.

Such accrual of advance payments often leads to significant overpayments to the budget. Therefore, back in 2021, a draft Government Resolution was published, which proposed two other options for calculating the advance payment:

- Pay an advance in the amount of 1/4 of the fee amount calculated on the basis of established standards for permissible emissions, discharges of pollutants, temporarily agreed upon emissions, temporarily agreed upon discharges and limits on the disposal of production and consumption waste.

- Pay an advance in an amount equal to the amount of payment calculated for the actual negative impact on the environment in the past quarter based on industrial environmental control data.

Payment for negative environmental impact is carried out according to the following BCC:

| Payment name | KBC in 2018-2019 |

| Payment for emissions of pollutants into the atmospheric air by stationary facilities, with the exception of those generated during flaring and (or) dispersion of associated petroleum gas | 048 1 1200 120 |

| Payment for discharges of pollutants into water bodies | 048 1 1200 120 |

| Fee for disposal of industrial waste | 048 1 1200 120 |

| Fee for disposal of municipal solid waste | 048 1 1200 120 |

| Payment for emissions of pollutants generated during flaring and (or) dispersion of associated petroleum gas | 048 1 1200 120 |

Environmental Impact Declaration Form with Comments

Section 1 should have something in common with updating information about NDCs.

Table 3.1. If you were not caught red-handed, then it is better to show dashes.

Table 3.2. Similar to filling out Table 3.1.

Section IV is completed based on the calculation of permissible emission standards, which is attached to the Declaration.

To be completed separately for each emission source.

Section V is completed based on the calculation of permissible discharge standards, which is attached to the Declaration.

- name of the water body - the name of the river where the discharge goes;

- name of pollutant - filled in for all pollutants for which permissible discharge standards were calculated;

- hazard class - in the calculation of permissible discharge standards, there is a hazard class for each discharged substance;

- source of discharge - wastewater treatment plants;

- concentration—shows the maximum annual concentration;

- mass of pollutant discharges - the actual amount of pollutants discharged (within the VAT limits or in excess of the VAT).

Column 6 shows the maximum concentration per year.

The mass of pollutant discharges (t/year) is determined by summing up the pollutant discharges (t/month), which are reflected in your logbook for recording the quality of discharged wastewater.

The list of pollutants for which state regulatory measures in the field of environmental protection are applied was approved by Decree of the Government of the Russian Federation dated July 8, 2015 N 1316-r

The hazard classes of pollutants in the emissions of pollutants into the atmospheric air are approved by the Decree of the Chief State Sanitary Doctor of the Russian Federation dated December 22, 2017 N 165 “On approval of hygienic standards GN 2.1.6.3492-17 “Maximum permissible concentrations (MPC) of pollutants in the atmospheric air of urban and rural settlements".

Table 6.1 . filled in based on waste accounting data.

Table 6.2. is filled out according to the draft standards for waste generation and waste disposal limits (calculation of waste generation standards and limits for their disposal), which is mandatory for development for objects of negative impact of category II, regardless of whether the enterprise is a small and medium-sized business or not.

Waste generation - the maximum possible amount of waste generation must be entered in this column; this figure can be reached by looking at waste accounting data for the period of validity of the draft waste generation standards and limits on their disposal.

This column states precisely -

declared mass of generated and disposed waste.

NVOS Declaration

In addition to paying for the NVOS, it is necessary to annually draw up a corresponding declaration (see Order No. 3 of 01/09/2017) and submit it no later than March 10 of the year following the reporting year.

Order No. 3 of the Ministry of Natural Resources of Russia dated January 09, 2017 presents in detail the rules for filling out the declaration, and also contains the necessary coefficients and methods for checking the correctness of data entry for each section of the declaration. In addition, the calculation procedure for each type of polluting object is described in detail in Decree of the Government of the Russian Federation dated March 3, 2017 No. 255.

The declaration can be filled out using the Nature User Module. Once again we attach the corresponding instructions (it was also above) and additional files.

Deadlines for submitting the NVOS declaration in 2020

As mentioned above, the declaration of payment for the tax assessment, according to the general rules, must be sent to the authorized bodies no later than March 10 of each year for the previous year. Therefore, for 2021, payers are required to submit reports by February 10, 2020.

It is worth noting that established deadlines cannot be rescheduled. This point is fixed in paragraph No. 4 of Article 193 of Federal Law No. 7.

Important: in case of untimely submission of the declaration, the legislation of the Russian Federation provides for administrative liability, which is regulated in Article 8.5 of the Code of Administrative Offenses of the Russian Federation.

The amount of the penalty in this situation will be:

- for an official – from 3 to 6 thousand rubles;

- for individual entrepreneurs and owners of organizations - from 20 to 80 thousand rubles.

Details

Description of the module “VOS Declaration”

Demo version of the module

- Buy the module “VOS Declaration”

| in MURPN for the Krasnodar Territory and the Republic of Adygea |

(name of the federal executive body/executive body of the constituent entity of the Russian Federation authorized to accept the environmental impact statement)

DECLARATION

about environmental impact

| 03-0111-001111-P |

code of an object that has a negative impact on the environment

| Limited Liability Company "Primer" |

name of a legal entity or last name, first name, patronymic (if any) of an individual entrepreneur

| Limited Liability Company |

organizational and legal form of a legal entity

| 350032, Krasnodar region, Krasnodar city, Krasnaya st., 12 d, 2 buildings, 45 sq. |

location of a legal entity or place of residence of an individual entrepreneur

| Code of the main type of economic activity: | 14.12 |

Name of the main type of economic activity:

| Production of workwear |

The declaration is drawn up on ____ sheets, the number of attachments is ____.

In the event of changes within seven years from the date of filing the Declaration of Environmental Impact (hereinafter referred to as the Declaration) in the technological processes of the main production facilities, qualitative and quantitative characteristics of emissions, discharges of pollutants and stationary sources, changes will be made to the Declaration in the manner established by the legislation of the Russian Federation. Federation in the field of environmental protection.

Executor responsible for submitting the Declaration:

| Head of the HSE department Maria Ivanovna Petrova, [email protected] |

position, surname, first name, patronymic (if available), telephone, fax, email address

General Director of Primer LLC Ivanov Ivan Ivanovich

| "01" April 2021 |

M.P. (in the presence of)

Section I. Types and volume of manufactured products (goods)

| No. | Name of manufactured product (product) | Product (product) code | Unit | Volume of manufactured products (goods) |

| 1 | 2 | 3 | 4 | 5 |

| 1 | Clothing made of genuine or composite leather | 14.11.10 | Ton; metric ton (1000 kg) | 2,4 |

Section II. Information on the implementation of environmental measures

| No. | Event name | Deadline | Amount of financing, thousand rubles | Sources of financing | Event result | |

| Start | End | |||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 1 | Event 1 | 01.01.2018 | 01.03.2018 | 100000 | emissions reduction | |

| 2 | Event 2 | 01.03.2018 | 01.05.2018 | 140000 | reduction of waste generation | |

| 3 | Event 3 | 01.05.2018 | 01.07.2018 | 90000 | reduction of discharges | |

Section III. Data on accidents and incidents that caused a negative impact on the environment that occurred between 2013 and 2019

3.1. Data on accidents that caused a negative impact on the environment that occurred between 2013 and 2021

| No. | Date of accident occurrence | Date of liquidation of the consequences of the accident | Brief description of the accident, causes of occurrence | Brief description of the negative impact on the environment during an accident | Amount of damage caused to the environment, thousand rubles. | Main measures to localize and eliminate the consequences of the accident |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 1 | 22.11.2018 | 12.12.2018 | Fire in the finished products workshop due to faulty wiring. | Release of toxic substances from the combustion of plastic, leather and other materials. | 2500 | Dismantling and removal of burnt structures, repair of premises. |

3.2. Data on incidents that caused a negative impact on the environment that occurred between 2013 and 2021

During this period, there were no incidents that resulted in a negative impact on the environment.

Section IV. Mass of pollutant emissions

| No. | Name of pollutant | Hazard Class | Emission Source Data | Mass of pollutant emissions | |||

| g/sec | t/year | ||||||

| Total | including within the limits of permissible emissions | exceeding permissible emission standards | |||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 1 | Nitrogen dioxide | 3 | 0001, Furnace pipe PT 16/150 | 0,0501944 | 0,356683 | 0,356683 | — |

| 2 | Nitrogen oxide | 3 | 0001, Furnace pipe PT 16/150 | 0,0081566 | 0,057961 | 0,057961 | — |

| 3 | Benz(a)pyrene (3,4-benzopyrene) | 1 | 0001, Furnace pipe PT 16/150 | 0,00000001 | 0,0000000168 | 0,0000000168 | — |

| 4 | Soot | 3 | 0001, Furnace pipe PT 16/150 | 0,038889 | 0,0015 | 0,0015 | — |

| 5 | Carbon monoxide (carbon oxide) | 4 | 0001, Furnace pipe PT 16/150 | 0,144033 | 1,12416 | 1,12416 | — |

| 6 | Nitrogen dioxide | 3 | 0002, Torch | 0,4577778 | 0,0172 | 0,0172 | — |

| 7 | Nitrogen oxide | 3 | 0002, Torch | 0,0743889 | 0,002795 | 0,002795 | — |

| 8 | Sulfuric anhydride (sulfur trioxide), sulfuric anhydride (sulfur dioxide), sulfuric acid | 3 | 0002, Torch | 0,0611111 | 0,00225 | 0,00225 | — |

Section V. Mass of pollutant discharges

| No. | Name of water body | Name of pollutant | Hazard Class | Discharge source data | Concentration mg/cu. dm 3 | Mass of pollutant discharges, t/year | ||

| Total | including within the limits of permissible discharge standards | exceeding the permissible discharge standards | ||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| 1 | River, Laba | BOD full | — | Issue 1 | 0,50 | 0,075891 | 0,075891 | — |

| 2 | River, Laba | Suspended solids | — | Issue 1 | 7,00 | 0,22901928 | 0,22901928 | — |

| 3 | River, Laba | Iron | IV | Issue 1 | 0,40 | 0,0607128 | 0,0607128 | — |

| 4 | River, Laba | Petroleum products (petroleum) | III | Issue 1 | 0,05 | 0,001635852 | 0,001635852 | — |

Section VI. Mass or volume of waste generation and disposal

6.1. Mass or volume of waste generated and disposed of

| No. | Waste code according to FKKO | Name of waste according to FKKO | Waste hazard class according to FKKO | Formed, t/year | Placed at our own waste disposal sites, t/year | Transferred for placement to other individual entrepreneurs or legal entities, t/year | ||

| quantity | number of the waste disposal facility in GRRORO | quantity | number of the waste disposal facility in GRRORO | |||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| 1 | 73310001724 | unsorted waste from office and domestic premises of organizations (excluding large-sized ones) | 4 | 4,638 | — | — | 4,638 | 23 |

| 2 | 73510002725 | waste (garbage) from cleaning the territory and premises of wholesale and retail trade in industrial goods | 5 | 97,272 | — | — | 97,272 | 23 |

| 3 | 73339002715 | estimates from the territory of the enterprise are practically harmless | 5 | 57,75 | — | — | 57,75 | 23 |

6.2. Mass or volume of generated and disposed waste

| No. | Waste code according to FKKO | Name of waste according to FKKO | Waste hazard class according to FKKO | Education, t/year | Disposal at own waste disposal sites, t/year | Transfer for placement to other individual entrepreneurs or legal entities, t/year | |||

| quantity | number of the waste disposal facility in GRRORO | quantity | number of the waste disposal facility in GRRORO | ||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | |

| 1 | 73310001724 | unsorted waste from office and domestic premises of organizations (excluding large-sized ones) | 4 | 14,63 | — | — | 14,63 | 23 | |

| 2 | 73510002725 | waste (garbage) from cleaning the territory and premises of wholesale and retail trade in industrial goods | 5 | 306,88 | — | — | 306,88 | 23 | |

| 3 | 73339002715 | estimates from the territory of the enterprise are practically harmless | 5 | 182,20 | — | — | 182,20 | 23 | |

Section VII. Information about the industrial environmental control program

The industrial environmental control program has been approved

Ivanov Ivan Ivanovich

last name, first name, patronymic (if any) of the official

"10" September 2021.

Name of the territorial body of the Federal Service for Supervision of Natural Resources or the executive body of the constituent entity of the Russian Federation to which a report on the organization and results of industrial environmental control is submitted:

MURPN for the Krasnodar Territory and the Republic of Adygea

Date of submission of the last report on the organization and results of industrial environmental control: February 25, 2021.