From January 1, 2021, the responsibility for administering insurance premiums for compulsory pension and health insurance is transferred from the Pension Fund of Russia to the Federal Tax Service. At the same time, the list of reporting will radically change, a new type of fine will be added, and the procedure for determining the taxable base for insurance premiums will change. How the legislative framework

on insurance premiums in 2021?

What's new about paying insurance premiums in 2021.

READ ON THE TOPIC:

From January 1, 2021, the Federal Tax Service of Russia will administer insurance premiums for compulsory pension and health insurance.

In 2021, organizations and individual entrepreneurs who make payments to individuals will submit calculations of insurance premiums to the tax office.

This calculation replaces the usual forms RSV-1 and 4-FSS. A single deadline for submitting calculations has been established - no later than the 30th day of the month following the billing (reporting) period. The calculation contains both sections and appendices that are mandatory for all, as well as sections, subsections and appendices that are filled out only if the employer made the appropriate payments or calculated insurance premiums at reduced rates. On July 3, 2021, Federal Law No. 243-FZ “On amendments to parts one and two of the Tax Code of the Russian Federation in connection with the transfer to tax authorities of powers to administer insurance contributions for compulsory pension, social and medical insurance” (hereinafter referred to as Federal Law No. 243-FZ). According to this regulatory act, from 2021, the administration of insurance premiums will be carried out by tax authorities. What should insurance premium payers – employers – take into account in this regard?

The legislative framework

The changes are due to the adoption of Federal Laws No. 243-FZ of July 3, 2016 and No. 250-FZ of July 3, 2016.

Thanks to the first of them (No. 243-FZ dated 07/03/2016), starting from the new year, chapter 34 “Insurance contributions” will appear in the Tax Code. It contains articles 419-432, which spell out new rules for the calculation and payment of contributions. The first part of the Tax Code has also been adjusted. The main essence of the amendments is that all the basic principles applied to taxes will also apply to insurance premiums from 2021.

The second Federal Law No. 250-FZ of July 3, 2016 introduces a number of amendments, thanks to which the transfer of functions for the administration of insurance premiums is transferred from the Pension Fund of the Russian Federation to the Federal Tax Service:

- Federal Law No. 212-FZ dated July 24, 2009 will cease to apply as of January 1, 2017;

- a new version of the Federal Law dated April 1, 1996 No. 27-FZ “On individual (personalized) accounting in the compulsory pension insurance system” will come into force;

- from 01/01/2017, a new version of the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity” will be in force;

- from the new year, a new version of the Federal Law of July 24, 1998 No. 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases” will come into force.

What has changed in 2021 when calculating contributions for injuries

Despite the fact that since 2021, changes have been made to the procedure for transferring insurance contributions to the Pension Fund, Social Insurance Fund and Federal Compulsory Medical Insurance Fund, the algorithm for calculating transfers for injuries has not changed. However, the reporting form submitted quarterly to the Social Insurance Fund will now contain only information on injury calculations. Accident insurance premiums maintained previously adopted rates ranging from 0.2% to 8.5%. The contribution rate must correspond to the new classification of professional risks approved by the Ministry of Labor.

The forms of some documents that must be used when offsetting or returning contributions in cases of payment in excess of the standards have changed. From 2021, new forms will be introduced for these purposes:

- 22 ― FSS ― used to offset overpayments;

- 23 ― FSS ― used when returning overpaid amounts;

- 24 ― FSS ― for the return of excessively collected amounts.

Functions of the Pension Fund in relation to the administration of insurance premiums from January 1, 2021

From January 1, 2021, the Pension Fund of the Russian Federation in relation to insurance premiums will deal with the periods preceding 01/01/2017, namely:

- acceptance and processing of payments, including updated ones, for insurance premiums;

- carrying out inspections - desk and on-site, including repeated ones - and making decisions based on their results;

- making decisions on the return of overpaid or overcharged insurance premiums;

- writing off uncollectible amounts of arrears on insurance premiums, penalties and fines on grounds that arose before January 1, 2021;

- administration of mandatory insurance contributions paid by citizens for the insurance pension, as well as voluntary contributions for the funded part of the pension.

As before, the Pension Fund will accept for periods occurring after 01/01/2018:

- information about individual personalized accounting in the SZV-M form;

- information about the length of service of the insured persons;

- registers of insured persons for whom additional insurance contributions were transferred to the funded part of the pension (contributions were paid by the employer);

- copies of payment documents from citizens about the additional insurance contributions they paid for the funded part of the pension.

Deadlines for filing reports from 01/01/2017

Form RSV-1 for 2021 in paper form should be submitted to the Pension Fund of the Russian Federation before February 15, 2021 (Clause 3 of Article 431 of the Tax Code of the Russian Federation). It must be submitted electronically by February 20, 2021. Contributions are also paid in rubles and kopecks.

Starting next year, the deadline for submitting the SZV-M form will change. From 01/01/2017 it must be submitted by the 15th day of the month following the reporting month. If the specified date falls on a non-working day or a weekend, then the deadline is moved to the next working day.

READ ON THE TOPIC:

There will be no increase in insurance premiums in 2021.

Data on the length of service of insured persons for the past year are submitted to the Pension Fund by March 1 of the next year.

The report form has not yet been approved - for the first time it will need to be submitted to the Federal Tax Service at the beginning of 2021. Registers of insured persons for whom additional insurance contributions were transferred to the funded part of the pension (employer contributions were paid) are provided to the Pension Fund of the Russian Federation within 20 days from the end of the next quarter .

Copies of payment documents confirming the fact that citizens have paid additional insurance contributions for the funded part of the pension for the past quarter are provided by participants in the state pension co-financing program themselves no later than 20 days from the end of the reporting period.

For periods after 01/01/2017, quarterly calculations will need to be submitted to the Federal Tax Service, which will replace the forms RSV-1, RSV-2, RV-3 and 4-FSS. The deadline for submitting this form is no later than the 30th day of the month following the billing or reporting period (clause 7 of Article 431 of the Tax Code of the Russian Federation).

It is necessary to ensure that the total amount of pension contributions is exactly equal to the amount of contributions for each individual insured person. If there are discrepancies, the calculation will not be considered accepted.

Reporting on contributions “for injuries” to the Social Insurance Fund (SIF) will still be provided until the 20th day of the month following the reporting month if the document is sent on paper, and before the 25th day if in electronic form.

For all types of reporting with an average headcount of more than 25 people - both for legal entities and individual entrepreneurs - documents are provided electronically via telecommunication channels. Other payers will be able to report on paper (Clause 10, Article 431 of the Tax Code of the Russian Federation).

Calculation method

Accident insurance premiums in 2021 are calculated by an accountant monthly by multiplying the premium base by the tariff rate.

The contribution base is the amount of money that the employee received during the reporting month. This may include not only wages, but also other monetary rewards discussed above. It is calculated as the difference between payments under the employment contract and non-taxable contributions.

Example. The Krasny Luch enterprise is engaged in the extraction of cobalt ore - 07.29.22. This is risk class 32. For this group, a tariff of 8.5 is assigned, since this is a dangerous type of activity; injuries received at work can have serious consequences, entailing large financial expenses. The salary fund for employees in March 2021 is 2.4 million rubles. Some employees were paid financial assistance in the amount of 17 thousand rubles. Based on this:

- contribution base = 2400000-17000 = 2383000 rub.;

- amount of deductions = 2383000 * 8.5% = 202555 rub.

The received amount is transferred by the company to a special account in the Social Insurance Fund.

Changing payment details

Since the administration of insurance premiums has been transferred to the Federal Tax Service, payments from January 2021 should be sent through the Treasury to the account of the local tax service, i.e. The details of the payee will change in payment documents:

- the values of the TIN and KPP of the territorial tax authority on whose account the payer is registered are indicated;

- when filling out the “Recipient” field, write the abbreviated name of the Federal Treasury, and next to it in parentheses - the abbreviated name of the corresponding tax authority;

- in the KBK, when paying contributions, the first three digits must be “182”, which corresponds to the Federal Tax Service. When filling out the payment order details (104), indicating the BCC, you must especially carefully enter the codes of the subtypes of income, because these will vary depending on the period for which the payment is made.

Contribution payers have the right to pay insurance premiums for December 2021 ahead of schedule, i.e. until December 31, 2016. Then payments must be sent to the Pension Fund, Social Insurance Fund, and Federal Compulsory Medical Insurance Fund, respectively. They will also act as recipients of payments if the arrears are paid during the specified period. The payment documents indicate the “old” KBK.

Contributions “for injuries” will also be collected by the Social Insurance Fund, i.e. its BCC will remain unchanged.

How is the premium rate for accident insurance determined?

The amount of required amounts for insurance premiums for injuries directly depends on the type of activity of the employer. The rate of contribution for accident insurance is determined in accordance with the class of professional risk that applies to certain jobs. These categories combine activities with similar characteristics that affect the possibility of injury or occupational disease. Starting from 2021, the Ministry of Labor has changed the classification of types of economic activities according to profrisk classes; the department adopted the corresponding order on December 30, 2016 No. 851n. The changes are due to the fact that a new OKVED has been in effect since 2021. Both the names of some types of activities have changed, and, albeit insignificant, there are innovations in risk classes in a particular activity. Therefore, it is better to check whether anything has changed in your area.

The number of professional insurance classes has remained the same as before, with a total of 32 similar classes, insurance premiums for injuries for which range from 0.2% to 8.5%. Accordingly, as the dangerous nature of the work increases, the contribution rates also increase.

For example, class 32, which has the highest degree of professional risk (and a rate of 8.5%), includes activities such as mining of coal and enriched metal ores. Natural gas production will be characterized as an activity of hazard class 1 (minimum rate - 0.2%). In particular, retail and wholesale trade, including food products, and the activities of agents selling goods are considered the safest. But the production and processing of a number of food products will be regarded as hazard class 2 work.

The size of the contribution rates is fixed in the notice, which is issued to employers some time after registration with the Fund. Subsequently, it is necessary to annually confirm the type of economic activity that is the main one. To do this, you must submit the following documents to the Social Insurance Fund by April 15:

- application for confirmation of the main type of activity;

- certificate - confirmation;

- a copy of the explanatory note to the balance sheet (for persons not related to small businesses).

The FSS confirms the tariff for insurance premiums for injuries or sets a new one, depending on the information provided.

The obligation to annually confirm insurance premium rates is present only for legal entities. If they do not submit the application on time, the fund will assign a tariff corresponding to the existing activity with the highest hazard class.

Individual entrepreneurs do not need to annually confirm their main type of activity.

The classifier of activities by professional risk classes and contribution rates can be viewed at the link.

Registration

From 01/01/2017, payers of insurance premiums will be registered (deregistered) with the tax authorities at the location of the organization, the location of its separate divisions, for a foreign non-profit non-governmental organization - at the place of its activities in the territory of the Russian Federation through a branch, as well as an individual entrepreneur at his place of residence.

READ ON THE TOPIC:

Self-employed people providing services to other citizens will be exempt from compulsory health insurance premiums.

Registration of an international organization will be carried out on the basis of a corresponding application from authorized persons.

Registration (deregistration) of a patent attorney is carried out at his place of residence on the basis of information reported by the Federal Service for Intellectual Property.

The registration of an arbitration manager, appraiser, mediator will be made on the basis of information provided by the authorized federal executive body exercising functions of control (supervision) over the activities of self-regulatory organizations of arbitration managers, appraisers, mediators at their place of residence.

Registration (deregistration) of an individual is carried out at his place of residence on the basis of an application submitted to any tax authority of his choice.

Payers

Payers of insurance premiums are (Article 419 of the Tax Code of the Russian Federation):

1. payers making payments and providing other benefits to individuals:

- organizations;

- individual entrepreneurs;

- individuals who are not individual entrepreneurs;

2. payers who do not make payments and other remuneration to individuals:

- individual entrepreneurs;

- lawyers;

- notaries engaged in private practice;

- arbitration managers;

- appraisers;

- mediators;

- patent attorneys;

- other persons engaged in private practice in accordance with the procedure established by law.

If the payer can be simultaneously classified into several categories, he should calculate and make contributions separately for each basis. For example, for yourself as an individual entrepreneur, and as an employer for your employees.

Benefits on contributions for injuries

For a number of organizations, benefits have been established for the payment of social insurance contributions against industrial accidents. These benefits are aimed at protecting people with disabilities and apply specifically to cases of employment of people with disabilities.

Insurance premiums in the amount of 60% of the established insurance rates are paid by:

- Organizations and individual entrepreneurs - for payments in favor of employees who are disabled people of groups I, II or III.

- Public organizations or unions of disabled people, which include at least 80% of disabled people and their legal representatives.

- Organizations whose authorized capital consists entirely of contributions from public organizations of disabled people, if the average number of disabled people is at least 50%, and the share of disabled people’s salaries in the wage fund is at least 25%.

- Institutions whose property owners are public organizations of disabled people.

Responsibilities of insurance premium payers

Payers of insurance premiums are obliged (clause 3.4 of Article 23 of the Tax Code of the Russian Federation):

- pay insurance premiums in accordance with the Tax Code of the Russian Federation;

- keep records of objects subject to insurance premiums, the amounts of calculated insurance premiums for each individual in whose favor payments and other remuneration were made;

- submit calculations of insurance premiums to the Federal Tax Service at the place of registration;

- submit to the Federal Tax Service the documents necessary for the calculation and payment of insurance premiums;

- submit to the Federal Tax Service information about insured persons in the individual (personalized) accounting system;

- keep documents necessary for calculating and paying insurance premiums for 6 years;

- inform the tax authority at the location of the Russian organization that pays insurance premiums about vesting a separate division with the authority to charge payments and rewards in favor of individuals within 1 month from the date of vesting it with the corresponding powers.

Procedure and terms of payment, reporting

Payment of insurance premiums for industrial injuries

Insurance premiums are paid by transferring funds to the appropriate account of the Federal Treasury (the administrator of these payments is still the Federal Social Insurance Fund of the Russian Federation).

Contributions must be paid monthly no later than the 15th day of the month following the month for which they were accrued. If this deadline falls on a weekend or non-working holiday, it is transferred to the next working day. If an organization has branches (separate divisions), then they pay contributions to their local Social Insurance Fund of the Russian Federation.

Reporting of Injury Contributions

Insureds paying premiums for insurance against industrial accidents and occupational diseases are required to submit reports to the Federal Social Insurance Fund of the Russian Federation. This reporting was previously provided in Form-4 by the FSS, approved by Order of the FSS of the Russian Federation dated 02.26.2015 No. 59. However, this form of report loses force with reporting for the 1st quarter of 2021 in connection with the publication of Order of the FSS of the Russian Federation dated 09.26.2016 N 382. This document a new Calculation Form 4 - FSS and the procedure for filling it out were approved.

Deadlines for submitting Calculations according to FSS Form-4 in 2021:

Calculation on paper is submitted no later than the 20th day of the month following the expired quarter, in electronic form - no later than the 25th day. In 2021 these will be the following dates:

- For 2021 - no later than January 20 (paper) or January 25 (electronic).

- For the 1st quarter of 2021 - no later than April 20 (paper) or April 25 (electronic).

- For 6 months of 2021 - no later than July 20 (paper) or July 25 (electronic).

- For 9 months of 2021 - no later than October 20 (paper) or October 25 (electronic).

Please pay attention!

Electronic reporting on accrued and paid insurance premiums is required to be submitted by:

- payers of insurance premiums whose average number of individuals in whose favor payments and other remunerations are made for the previous billing period exceeds 25 people;

- newly created organizations in which the number of specified individuals also exceeds 25 people.

In other cases, reporting is provided on paper.

More information about submitting electronic reporting can be found here.

Taxable object and taxable base

The rules that must be followed when determining pension, medical contributions, as well as contributions to the Social Insurance Fund (excluding contributions for injuries) have remained almost unchanged.

READ ON THE TOPIC:

List of professions falling under the bill on exempting self-employed citizens from paying tax in 2021.

Payments and other remuneration to individuals accrued under employment and civil law contracts are still considered a taxable object.

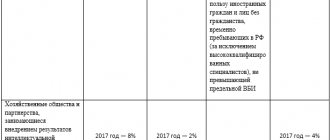

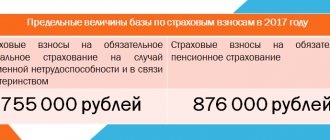

Its value is determined separately for each insured person on an accrual basis from the beginning of the year. The concept of the maximum value of the base for contributions in case of temporary disability and in connection with maternity remains unchanged. However, the size of the limit is indexed annually. For pension contributions, a reduced rate will remain for payments calculated in excess of the limit. The amounts of all tariffs and benefits will remain the same.

Important: the amount of “daily allowance” exempt from these contributions will change (clause 2 of Article 422 of the Tax Code of the Russian Federation). From 01/01/2017, these payments will not be charged only for 700 rubles per day for business trips within Russian territory and no more than 2,500 rubles for foreign business trips.

The methodology for determining the amount of the taxable base in relation to income received in kind will also change: from next year, the provisions of Art. 105.3 of the Tax Code of the Russian Federation, that is, based on market prices including VAT.

When determining the amount of contributions “for injuries”, daily allowances are completely exempted, and income in kind is taken into account according to contract prices.

Conditions for deduction of contributions to the Social Insurance Fund for injuries

The employer transfers contributions to the Social Insurance Fund, regardless of whether the employee has Russian citizenship or not, if the following has been signed with the employee:

- civil contract (if it contains such a provision);

- employment contract (always).

Thus, the insurer is the Social Insurance Fund, and the policyholders can be:

- individuals (when signing an employment agreement with another person);

- legal entities (type of ownership does not matter);

- business owners.

Let us remind you that contributions to the Social Insurance Fund are made from such income as:

- wage;

- bonus;

- allowance;

- compensation for vacation that was not used.

The following funds are not subject to taxation:

- government benefits;

- payments in case of staff reduction (liquidation of a company);

- financial assistance in force majeure circumstances;

- compensation for work in hazardous (especially difficult) health conditions;

- tuition fees for advanced training courses.

Reimbursement of social insurance expenses

In 2021, the employer will retain the right to reimburse the costs of paying benefits from the Social Insurance Fund. The exception is the first three days on “non-maternity leave” sick leave. Organizations and individual entrepreneurs have the right to transfer due contributions reduced by the amount of accrued benefits. If the result is negative, then in the next period, when determining the amount of transfers to the Social Insurance Fund, they can be reduced by the balance of the fund’s “debt”.

The correctness of the calculation of benefits will be checked according to the following scheme:

- Having received a single quarterly calculation, the Federal Tax Service will transfer the necessary information to the Social Insurance Fund;

- The Social Insurance Fund will verify the correctness of the calculations as a result of a desk or on-site audit;

- the report will be sent to the Federal Tax Service;

- if the inspection reveals problems, the Federal Tax Service will send the policyholder a demand for payment of the missing contributions. If the report is found satisfactory, then there will be either an offset of payments or, if necessary, a refund.

The described scheme will be valid until December 31, 2018 only in those regions where the scheme for paying contributions directly to the Social Insurance Fund is not yet in effect. From January 1, 2019, the reimbursement procedure will be abolished, and all regions will receive benefits directly from social insurance.

On labor protection training for workers at hazardous production facilities

In 2021, organizations that are classified as hazardous production facilities have the right to pay for labor protection training for workers at the expense of the Federal Social Insurance Fund of the Russian Federation. Such an organization must have a copy of the certificate of registration in the state register of production facilities (paragraph “c”, paragraph 3, paragraph “c”, paragraph 4 of Rules No. 580n). The FSS clarified that such an object can be not only the organization as a whole, but also its structural divisions.

In this case, the following is not entirely clear. If a structural unit is registered in the register as a hazardous production facility, is it possible to reimburse the costs of training in occupational safety issues for any employee or only an employee of this unit?

We believe that financial support for costs should be provided regardless of the department of which the student is an employee. The main thing that:

- there was a certificate of registration of a hazardous production facility in the state register of such facilities;

- training took place under the occupational safety program.

Sanctions

In 2021, the practice of imposing sanctions against policyholders continues, but they will be assigned and implemented by the Federal Tax Service on the basis of reports submitted by the Pension Fund.

READ ON THE TOPIC:

How the tax system will change in 2021.

Important amendments to the legislation Violations in the payment of insurance premiums are now equated to violations in the payment of taxes, respectively, and will be punished for them on the same grounds.

So, for failure to submit a calculation of contributions, you will be fined on the basis of Art. 119 of the Tax Code of the Russian Federation, and for gross violation of the rules for accounting the base for contributions - under Art. 120 Tax Code of the Russian Federation. Violations in the payment of contributions “for injuries” will also remain under the jurisdiction of the FSS, and possible types of sanctions in this area are given in Federal Law No. 125-FZ of July 24, 1998.

The Pension Fund of Russia will be able to operate with two types of sanctions: for failure to provide annual information about the length of service (500 rubles in relation to each insured person), and for violation of the procedure for submitting reports in the form of electronic documents (1,000 rubles) (Article 17 of the Federal Law No. 27-FZ dated 04/01/1996).

According to paragraph 11 of Art. 76 of the Tax Code of the Russian Federation, the rules for blocking accounts also apply to payers of insurance premiums. But in paragraph 3 of this article, where legislators listed all the permissible grounds for blocking, payment of contributions not submitted on time is not listed, i.e. Until this point is clarified, disputes may be resolved, including in court.

Devices for safe work - what does not apply to them

From 2021, when calculating contributions “for injuries”, you can take into account the costs of purchasing devices intended for (paragraphs “l”, “m”, paragraph 3 of Rules No. 580n):

- ensuring the safety of workers and (or) monitoring the safe conduct of work;

- training workers on safe work practices (in particular, mining operations), as well as providing video and audio recording of briefings and other forms of employee training.

The FSS of the Russian Federation noted that such instruments and devices do not include:

- personal computers for labor protection engineers, since the responsibility to train employees in safe methods of performing work is not the responsibility of the labor protection engineer;

- installation of video surveillance systems.

Specifics of payment of contributions by separate divisions

Currently, separate divisions pay contributions and provide reporting at their location only when they have their own current accounts and separate balance sheets.

READ ON THE TOPIC:

Salary insurance premiums may increase

From 01/01/2017, the requirement to have an account and balance will be abolished.

This means that separate divisions located in Russia and calculating remuneration and other payments in favor of individuals will have to transfer contributions (except for contributions “for injuries”) and submit calculations at the place of their registration (clause 11 of Article 431 of the Tax Code of the Russian Federation). Starting next year, policyholders who began making payments to individuals in 2021 and later will be required to report to the Federal Tax Service at the location of the parent organization that the Russian division has the authority to accrue payments and rewards to individuals (clause 7, clause 3.4, article 23 of the Tax Code RF).

There were no changes regarding the payment of “injury” contributions for separate units.

Rules for payment of insurance premiums for injuries in 2020-2021

Payment of insurance premiums for injuries in 2020-2021, as in previous years, must be made monthly, transferring the amount accrued for the past month to the fund. The deadline for such a payment expires on the 15th day of the month following the month for which the payment was made (Clause 4, Article 22 of Law No. 125-FZ). Due to the coincidence with general weekends, it may be postponed to a later date corresponding to the nearest weekday.

Upon payment, the payment document will be issued to the address of the regional branch of the Social Insurance Fund in which the payer of contributions is registered. That is, the recipient’s data will contain the name, TIN, checkpoint of the corresponding FSS branch and its details in the treasury.

Mandatory information will also be the payment code, contribution payer status code, OKTMO, codes for the period and nature of payment, and a description of the purpose of the transfer.

When paying contributions for injuries in 2021, the BCC is the same as in 2020, i.e. 39310202050071000160. Other values of this code may arise when paying a penalty (393 1 0200 160) or a fine (393 1 0200 160).

For self-employed citizens

Anyone who works for themselves will also pay fixed fees for health insurance. Contributions in case of temporary disability and in connection with maternity remain voluntary. They do not need to pay “injury” contributions.

When paying pension contributions, the only change is provided: everyone whose income exceeds 300,000 rubles will be required to pay 1% of the amount exceeding the specified contribution in excess of the fixed contribution amount.

Data on income will be received by the Federal Tax Service from tax returns. But the rule according to which contributions in the maximum amount are charged if a declaration is not submitted will be abolished.

Entrepreneurs and other “individuals” were not burdened with the obligation to submit calculations for fixed contributions. But the heads of peasant (farm) households will have to submit calculations no later than January 30 of the year following the billing period.

The amount of expenses by which contributions can be reduced

Financial support for preventive measures is carried out by the insured at the expense of the amounts of insurance premiums “for injuries” payable in the current year (clause 2 of Rules No. 580n).

The FSS of the Russian Federation draws the attention of policyholders to the following:

1. The amount of contributions “for injuries” payable in the current year means the contributions accrued for the current year minus expenses in the current year for the payment of temporary disability benefits in connection with industrial accidents or occupational diseases and for vacation pay (in excess of the annual paid) for spa treatment.

2. The calculation does not include amounts of money that the fund transferred to the organization due to insufficient funds to pay temporary disability benefits.

In this case, the maximum amount of costs that can be taken into account when calculating contributions “for injuries” in the current year is determined by the formula (clause 2 of Rules No. 580n):

The maximum amount of costs by which contributions are reduced = 20% x (injury premiums accrued over the past year - insurance coverage paid last year).