When insuring movable/immovable property, their own life or other risks, few people think about whether payments will be taxed upon the occurrence of an insured event. However, in some cases, these amounts can be regarded as income, which means that payment of personal income tax becomes inevitable. But this measure is used in exceptional situations. It is necessary to distinguish between compensation for damage incurred and profit. Only in the second case, income tax in the amount of 13% will be withheld from the transferred insurance amount.

What does the law say?

Legislative taxation norms are set out in the Tax Code of the Russian Federation. On the basis of this regulatory act, the insurance recipient may be subject to the mandatory payment of personal income tax.

Part 1 of Article 208 of the Tax Code of the Russian Federation states that insurance payments are recognized as income that is subject to taxation. But in Part 4 of Article 213 an important explanation is given that tax is levied only on profit, and not on the entire amount transferred by the company.

That is, when compensating for damage, it is important to determine its actual cost. If a house was damaged by a fire for 3 million rubles, and the insurance company paid 3.5 million, then personal income tax is paid on the difference of 500 thousand rubles. The remaining 3 million is not income, as it was spent on the restoration of real estate.

The general rule concerns:

- Mandatory types of insurance, such as compulsory motor liability insurance, etc.

- Voluntary life insurance.

- Voluntary pension insurance.

During judicial collection of insurance, personal income tax may be collected from amounts that are calculated in excess of the established damage, but do not constitute compensation for moral damage.

Accounting for insurance compensation under compulsory motor liability insurance

According to the Instructions for the application of the Chart of Accounts for accounting financial and economic activities of organizations (approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n), other income is reflected in account 91 “Other income and expenses”, subaccount 91-1 “Other income”.

We recommend reading: Veterans of Labor increased their pension by 15

In accounting, the amount of insurance compensation received from the insurance company under the MTPL agreement is recognized as other income of the organization on the basis of clauses 8 and 10.2 of the Accounting Regulations “Income of the Organization” PBU 9/99 (approved by order of the Ministry of Finance of Russia dated May 6, 1999 No. 32n) .

Are insurance payments income?

Income is money received by an individual or legal entity as a result of performing some activity over a certain period of time. Activity does not always mean performing some actions. For example, rent or lottery winnings are also considered income. But reimbursement of previously incurred expenses does not apply to this.

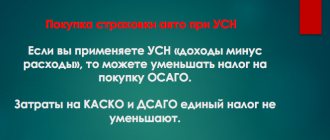

To understand the difference, you can consider two types of auto insurance - OSAGO and CASCO. OSAGO is mandatory for registration. Under this policy, the car owner is compensated only for the damage actually incurred, but no more. CASCO offers different insurance packages and, if desired, the car owner can insure it for a larger amount, which may entail a payment in excess of the damage received. The difference between the actual losses and the funds received is considered income.

Accounting for MTPL insurance in accounting and tax accounting in 2021

However, if the contract is concluded for a period of more than one reporting period and the insurance premium is paid in full at once, expenses are recognized evenly over the period of validity of the MTPL policy (clause 6 of Article 272 of the Tax Code of the Russian Federation). If the agreement is concluded for more than one reporting period and an installment plan is in effect, expenses for each payment are recognized evenly over the period corresponding to the period for payment of contributions (year, half-year, quarter, month). For any payment option, expenses are recognized in proportion to the number of calendar days of the agreement in the reporting period (clause 6 of Article 272 of the Tax Code of the Russian Federation). In this case, in each reporting period (in the situation under consideration - quarterly), part of the amount of insurance premiums is recognized as expenses, calculated based on the total validity of insurance contracts and the number of calendar days of validity of these contracts in the current reporting period. Accounting records for reflecting the transactions under consideration are made in accordance with the accounting policy of the organization in accordance with the Instructions for the application of the Chart of Accounts for accounting financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n, and are shown below in the table of transactions. At the same time, we note that there are other options for accounting for the paid insurance premium: – as a one-time expense; – as part of deferred expenses.

How are car insurance costs (MTPL, comprehensive insurance) reflected in accounting and tax accounting? Insurance premiums are considered as prepayments for the insurer's services. The organization entered into insurance contracts for a period of 12 months (365 days) and paid insurance premiums in a lump sum in the total amount of 47,450 rubles. from your bank account. Insurance contracts are valid from March 1 of the current year (the date of payment of the insurance premium) to February 28 of the following year inclusive.

We recommend reading: Sogaz How to Correctly Fill out an Insured Event Application

What are the features of taxation?

Taxation of individuals and legal entities pursues several goals:

- on the one hand, this allows us to stimulate socially significant types of insurance;

- on the other hand, it makes it possible to prevent the receipt of unjustified benefits.

When collecting taxes on insurance payments, the following are taken into account:

- Tax base determined by the insurance contract.

- Availability of social deductions for the costs of purchasing the policy.

- Refund or reinstatement of previously withheld or unpaid tax.

The payer himself must monitor the payment of personal income tax. It is he who is responsible for late paid or incorrectly calculated personal income tax. But it often happens that the insurer sends a warning about the need to make a payment. He is a tax agent and, in accordance with paragraph 5 of Article 226, is obliged to notify the taxpayer in writing of the need for personal income tax deductions.

For ordinary citizens

Citizens who do not conduct business activities pay personal income tax on insurance payments:

- exceeding the amount of actually established damage. Insurers rarely pay the insured more than the actual losses incurred, so this situation is the exception rather than the rule;

- upon termination of the contract on voluntary pension insurance and payment of the redemption amount, provided that it is greater than the insurance premiums;

- fines and penalties that are paid by the insurer by court decision are also income and therefore subject to income tax calculation.

Please note that compensation for legal expenses and moral damages of the insured is not subject to personal income tax.

Features for legal entities

Legal entities are required to pay income tax on the amount obtained as a result of calculating the difference between income received and expenses incurred.

Article 250 of the Tax Code of the Russian Federation establishes that compensation for losses is non-operating income. And Article 251 provides a list of cases when income should not be taken into account when calculating the tax base. In particular, no accounting is made if the amount of compensation is missing.

In other cases, the amount received from the insurance must be taken into account as income. In this case, all funds spent on restoring the damage caused are included in the expense item.

The positive difference is taxable.

Insurance expenses in accounting

If you decide to distribute costs over several periods, then you should use account 97 “Deferred expenses”. That part of the premium that relates to the first month of the contract is written off as shown above. The remaining premium is distributed over the months until the expiration of the policy:

- Accounting for expenses can begin only after payment of the premium to the insurer.

- You can immediately write off costs only if the contract period is “within” the reporting period for income tax, i.e. quarter. If the contract is long-term, then the costs must be distributed evenly during its validity period (Clause 6 of Article 272 of the Tax Code of the Russian Federation)

- Tax accounting contains restrictions on costs that can be recognized for compulsory types of insurance, for example, for compulsory motor liability insurance, only within the established norms - insurance tariffs (clause 2 of Article 263 of the Tax Code of the Russian Federation). For voluntary types, expenses are taken into account in the actual amount (clause 3 of Article 263 of the Tax Code of the Russian Federation).

Do I need to pay personal income tax?

Non-payment of taxes entails the imposition of administrative measures to combat non-payers - the imposition of a fine. An individual will have to not only pay the required 13% of the income received, but also compensate for the established fine.

You can determine whether you need to pay personal income tax or not on your own or by consulting the nearest tax office. In most cases, insurance payment does not entail the obligation to pay personal income tax. However, there are rare exceptions to this rule.

Income tax and VAT on insurance compensation

Thus, the holding reduced its total taxable profit by the amount of lease payments not subject to income tax. The management company invested the rent amounts either in new real estate objects needed by the holding, or in the authorized capital of the parent OJSC, purchasing its shares.

Accountants have questions regarding the taxation procedure for various types of compensation made by employees of organizations.

Civil legislation determines that insurance is carried out on the basis of property or personal insurance contracts concluded by a citizen or legal entity (policyholder) with an insurance organization (policyholder).

Income tax must be paid in the form of monthly advance payments, calculated based on profit and interest rate.

What payments are not subject to personal income tax?

Most insurance payments are not subject to income tax, since they are not a source of tax base formation. Such payments include:

- Compulsory vehicle insurance.

- Personal real estate insurance.

- Voluntary life and health insurance.

- Pension voluntary insurance.

Payments for these types of insurance do not entail the payment of personal income tax if their amount does not exceed the established damage.

Reflection of insurance compensation in accounting

Consequently, the check should be carried out strictly according to the identified criteria, as this is necessary for the analysis of insurance activities, adequate calculation of insurance reserves and, ultimately, for the preparation of reporting.

In relation to the same item, insurance contracts with different insured parties may be in place at the same time: for example, the seller who dispatches it to the buyer and the carrier who carries out the actual delivery can insure property liability in relation to the same consignment of goods.

09 Feb 2021 jurist7sib 37

Share this post

- Related Posts

- If You Have Not Received a State Act on the Land, Can the Certificate of Lifetime Inheritable Darege's Right to the Land Be a Document of Title?

- How to buy an apartment without a mortgage

- Single Mother Benefits According to Ip

- Transport tax in 2021 for pensioners in Tver

When will personal income tax still have to be paid?

Obtaining insurance by court order is most often accompanied by a written notice of the need to pay tax. It is not necessary to pay personal income tax on all amounts. The bulk of the damages recovered are not subject to taxation. But you will have to pay tax for:

- a penalty that is awarded for missing the due date for insurance payment;

- a fine issued as punishment for failure to comply with a pre-trial claim.

If the insured is awarded compensation for moral damages, then this money is not considered income and therefore not subject to taxation.

Do I need to pay tax on insurance payments (osago and comprehensive insurance)?

Thus, insurance payments under the MTPL agreement are not subject to taxation, because This contract is a mandatory type of insurance. As for the taxation of fines, penalties and moral damages collected through the court, the following judicial practice has currently emerged.

On October 21, 2021, the Presidium of the Supreme Court of the Russian Federation in the “Review of the practice of courts considering cases related to the application of Chapter 23 of the Tax Code of the Russian Federation” (hereinafter referred to as the “Review of Practice” of the Supreme Court of the Russian Federation) indicated its position on this issue.

Payments to individuals intended to compensate in monetary form for moral damage caused to them do not relate to the economic benefit (income) of the citizen, which, in accordance with Articles 41, 209 of the Tax Code of the Russian Federation, means the absence of an object of taxation.

So, we need to understand whether insurance payment is subject to taxation in 2021. But the fact is that it consists of different targeted payments:

- directly the basic amount of compensation for material damage,

- payment under compulsory motor liability insurance for loss of commodity value (TCV),

- amount of damages for moral damages,

- payment in the form of a penalty (for delay in the main payment),

- fine for failure to fulfill a pre-trial claim for compensation.

The first 2 points are compensated in a pre-trial manner - upon the application of the victim to the company or upon a pre-trial claim. The last 3 are appointed only by a judge in the course of a civil claim by the victim against the insurer.

So, you got into an accident, where you were recognized as a victim, you turned to the insurance company for payment and the latter paid you the amount according to the calculation using a unified methodology without any problems.

We invite you to read: When should sick leave be submitted to the employer, and when should payment be calculated and transferred?

Thus, payment under compulsory motor liability insurance is not subject to personal income tax. And this is logical, because the essence of the payment is compensation for damage. And if the car owner also pays tax, then there will not be enough to compensate for the damage, which would make the essence of insurance not insurance at all.

Tax rate

Individuals who are residents of the Russian Federation calculate personal income tax at a rate of 13% of the amount of income received. If the insured does not have Russian citizenship and is not recognized as a resident of the country, then upon receipt of insurance recognized as income, he is obliged to pay 30%.

Don’t forget about the possibility of obtaining tax deductions. Thus, when applying for voluntary pension insurance, a citizen has the right to receive a deduction in the amount of 13% from an amount not exceeding 120,000 rubles per year. A personal income tax refund is possible only if you have official employment.

In case of early termination of the pension insurance agreement, the policyholder automatically withholds the tax deduction amount for each reporting year. If the policyholder has not received compensation, it is necessary to take a certificate from the tax office and provide it to the insurer so that deductions are not made.

Insurance claims are recognized in accounting

On January 1, 2021, Article 15.2 of the Federal Law of December 30, 2004 No. 214-FZ “On participation in shared construction of apartment buildings and other real estate” (hereinafter referred to as the Law on Shared Construction) came into force. Now, in the event of a developer’s failure to fulfill its obligations to construct and transfer apartments in apartment buildings to shareholders, insurance compensation will serve as a measure to ensure compensation for damage caused, along with a pledge and a bank guarantee.

We recommend reading: How to get a free plot of land in the Moscow region

How is the receipt of insurance compensation in connection with damage to the leased asset insured by the lessor reflected in the accounting records? The leased asset, under the terms of the leasing agreement, is taken into account on the balance sheet of the lessor and is insured by it at its own expense.

Payers of premiums under an insurance contract

The tax rate is set at 20%. For example, if:

- the amount of insurance compensation under compulsory motor liability insurance was 50 thousand rubles;

- and the actual costs of repairing the car amounted to 45 thousand rubles;

- then the object of taxation for income tax will be the difference in the amount of 5 thousand rubles;

- and the tax payment will be 1 thousand rubles.

If the insurance amount exceeded the funds needed for repair work, or the insurer paid legal costs when the lawsuit was resolved, you must fill out a tax return and send it to your local tax authority.

N 82n, the Ministry, unless otherwise established by the legislation of the Russian Federation, does not consider on the merits appeals from organizations to conduct examinations of contracts, constituent and other documents of organizations, as well as to assess specific economic situations.

In accordance with the standards of the Tax Code and laws of regional significance, since the beginning of 2009, the subjects of the Federation have been vested with the right to establish differentiated tax rates. They are determined by the category of taxpayers and range from 5-15%.

You can reduce taxes with the help of a non-profit organization

When receiving an insurance payment, the victim does not receive an economic benefit in cash or in kind; he receives a sum of money to compensate for losses in connection with the occurrence of an insured event.

We invite you to familiarize yourself with Maternity leave: registration, payments, rules of care

According to Art. 247 of the Tax Code of the Russian Federation, the object of taxation for corporate income tax is the profit received by the taxpayer.

Also, when calculating and paying the mandatory payment in question, you should act in accordance with the rules established by Article 286 of the Tax Code of the Russian Federation. Thus, income tax is paid by transferring monthly advance payments, calculated based on taxable profit and rate.

How much and when will you need to pay?

The income tax rate for 2021 is 13% of income. It is paid the next year after the year in which the payment was made and only for the income points indicated above (roughly speaking, for everything except compensation for basic damage and loss of marketable value).

Also, you will not need to pay for those payments that were made as part of your expenses - for postage, legal services and any others that you can prove with checks, receipts or other supporting documents.

Practical examples

To better understand the essence of the matter, let's look at several examples indicating specific amounts.

Payment from the insurer was received immediately

The car owner had an accident, wrote a statement and submitted documents to the insurance company. As a result, she paid the money within the deadline set by law. In addition, the insurer has the right to compensate for the damage by repairing the car.

Amounts paid:

- 30 thousand rubles calculated for damage.

- 3 thousand rubles for loss of the car’s presentation.

At the same time, the owner of the car who received the money does not need to pay tax, since these amounts are insurance. They are exempt from personal income tax under Article 213.

Payment by court order

The driver also got into an accident on the road, but received a refusal from the insurer, or received money that is not enough to restore the car. As a result, I wrote a statement of claim to the court and did an independent examination in the amount of 10 thousand rubles. He also turned to the services of a lawyer to participate in court, for which he paid 12 thousand rubles.

In the application, the driver requests to recover the following amounts of money from the insurer:

- 50 thousand rubles. – for the damage caused;

- 10 thousand rubles. – for penalties for late payment;

- 4 thousand rubles. – for loss of value of the car;

- 12 thousand rubles. – for the services of a lawyer;

- 32 thousand rubles. – fine for pre-trial litigation;

- 10 thousand rubles. – for independent examination;

- 1 thousand rub. – for sending postal letters, telegrams, claims, invitations;

- 1 thousand rub. - for moral damage.

As a result, the driver's claim was satisfied by the court. In such a situation, the victim must pay the following taxes:

- Loss of value of the car is not subject to taxes.

- Damage of 5 thousand is also not taxed.

- Fine 32 thousand - tax is paid, it does not apply to insurance.

- 10,000 rubles - you also need to pay personal income tax.

- There is no tax for the lawyer, it will be confirmed by a cashier's check.

- There is also no need to pay tax for the examination.

- There are no taxes paid for postage, these are the driver's expenses.

- The amount of moral damage is taxed.

As a result, in our example, the tax amount is: 5590 rubles. This amount is calculated at 13% of the taxes described above.