general information

Our work records are kept like the apple of our eye in the personnel department of each organization in which we carry out labor activities. Look at your work book - you see how carefully the entries, various signatures and notes are made in it.

Many legislative acts require personnel personnel to carefully access In fact, this is a kind of face of the organization, which the resigned employee will take to show in a new place.

But sometimes the correctness and accuracy of maintaining and storing work books does not depend on personnel officers.

Various natural phenomena, old age and other factors are merciless to scraps of paper and sometimes, some labor ones that cannot even be restored are sent to the trash can.

Why this happens, and even if it happens, then in what order, we will look at in our material.

This information will be useful to personnel officers, employees, and employers.

Write-off procedure

So, if work books need to be written off and destroyed, then a special commission should be created for this. It is necessary to confirm that the books really need to be written off. The composition of this commission is not fixed by law, so the organization’s management has the right to independently select employees. As a rule, this is a personnel employee, an accountant, or the manager himself.

Members of the commission must carry out an inventory of the forms of work books and inserts for them, confirm the legality of destruction, be present during the procedure for liquidation of documents and sign the act of writing off the work books.

In what cases can you write off?

The practice of maintaining labor books knows many cases in which labor was simply written off from the register .

Various natural phenomena can contribute.

Floods, earthquakes, fires...

All this does not have the best effect on paper, which means that documents damaged as a result of natural disasters may be written off.

But in addition to natural disasters, there are also man-made disasters. As a result of a collision with them, a person risks being left without any mention of where he worked. Man-made disasters include nuclear explosions and other emergencies.

Despite the fact that the modern work book received its usual form back in 2004, many still have old-style work books. For example, an employee with a work book from the late nineties probably cannot provide the document with the proper appearance. Over the years, the paper frays and becomes unusable, and such work books must also be written off.

In addition to old age, the basis for writing off is other damage to documents - dampness in the premises, careless handling - all this indicates that the fate of the work record book is decided - it can only be written off.

Careless filling out of the work book by an employee of the HR department is also grounds for write-off.

As you can see, many cases can affect the fate of your employment document.

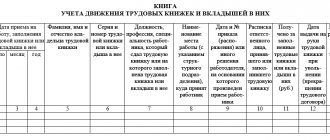

Accounting of work books

Home / Work book

Business transactions for the acquisition and write-off of work book forms and inserts in them are subject to reflection in the organization’s accounting records.

The accounting procedure for these forms is currently not established by law. Over the years, the Ministry of Finance has repeatedly issued clarifications on this issue, which contradicted the current regulations, each other and more misled taxpayers than actually helped to keep records correctly.

As a result, today there are 2 options for recording work record forms:

- as assets sold to employees of the enterprise;

- as employer expenses.

The organization determines the method of accounting for forms independently and enshrines it in its accounting policies.

Work book is an asset of the organization

1) As a product for resale using account 41

The Ministry of Finance considers this accounting procedure in letter dated May 19, 2017 No. 03-03-06/1/30818.

It should be noted that most experts strongly disagree with this point of view of officials, because:

- the goods are property that is sold within the framework of contractual relations at the will of the parties, and the transfer of the work book occurs due to the requirements of the Labor Code of the Russian Federation and the employer cannot evade this obligation of his own free will;

- sales of forms are carried out exclusively by the GOZNAK Association or its authorized representatives; other persons have no right to sell forms;

- the employer charges the employee a fee for the form in the same amount that was previously paid to the official supplier, i.e., the costs incurred are actually reimbursed, and such an operation is not recognized as a sale.

2) How to materials using count 10

In this case, the forms are included as materials used for the management needs of the enterprise. This accounting procedure is considered more correct.

Since the costs of purchasing the forms are economically justified, they are recognized as expenses when calculating income tax (letter of the Federal Tax Service dated June 23, 2015 No. GD-4-3 / [email protected] ).

Funds received from employees in payment for forms are considered income of the organization (letter of the Federal Tax Service dated September 26, 2007 No. 07-05-06/242) and are also taken into account as part of the tax base for income tax.

Please note: companies using the simplified tax system will not be able to include the cost of purchased forms as expenses when calculating the single tax, since such costs are not included in the closed list given in paragraph 1 of Art. 346.16 Tax Code of the Russian Federation.

At the same time, it is recommended to include funds received for forms from employees as part of non-operating income in order to avoid claims from tax authorities.

The transfer of a work book form or an insert to it to an employee is subject to VAT (if the employer is a payer of this tax), and the amount of VAT previously presented by the seller of the forms is subject to deduction if there is correctly completed primary documentation.

Note:

Currently, there are decisions of the Supreme Arbitration Court with positive decisions in favor of taxpayers (FAS of the North-Western District dated 10/01/2003 No. A26-5317/02-28, 03/02/2007 No. A56-44214/2006), confirming the following position: issuing labor forms to employees . books, the employer does not aim to make a profit, but to fulfill the obligations imposed by legislative acts. Consequently, such transactions are not entrepreneurial activities and are not subject to VAT.

Purchased work forms and inserts for them, stored in the organization, are recorded in off-balance sheet account 006 as strict reporting forms.

Please note: you can write off the work book form (insert) on the day it is issued to the employee. In this case, the date of issue should not be considered the day of dismissal, but the day when the form was issued in the name of the employee.

Accounting entries:

| Dt | CT | Contents of operation |

| 10 (41) | 60 | Purchased forms are accounted for as inventories |

| 19 | 60 | VAT presented by the seller of the forms is reflected |

| 006 | The forms are accepted for storage as BSO | |

| 91 (90) | 10 (41) | The cost of completed forms is included in expenses |

| 91 (90) | 68 | VAT is charged on the cost of issued work book forms (inserts) |

| 006 | Work books (inserts) issued to employees were written off | |

| 73 | 91 (90) | The cost of the forms is reflected, subject to reimbursement by company employees |

| 70 (50) | 73 | The debt for the issued forms has been repaid from the employee’s salary (payment was paid by the employee to the company’s cash desk) |

If a local act of the organization establishes that compensation for labor forms. books and inserts for them are not charged to employees or emergency circumstances have occurred as a result of which the employer is obliged to issue the forms free of charge, write-off is carried out using the following entries:

| Dt | CT | Contents of operation |

| 91 | 10 (41) | The cost of forms issued free of charge has been written off |

| 91 | 68 | VAT is charged on the free transfer of the form to an employee |

| 006 | The work book form (insert) has been written off |

If the work book form (insert) was damaged by a company personnel employee during the filling out process, the following entries are made in accounting:

| Dt | CT | Contents of operation |

| 91 | 10 (41) | The cost of the damaged form has been written off |

| 19 | 68 | VAT, which was previously deductible, has been restored |

| 91 | 19 | Recovered VAT written off |

| 006 | The damaged form of the work book (insert) was written off |

In situations where a fee for the form is not charged to the employee, the enterprise does not have the right to take into account as income tax expenses either the cost of the forms or the VAT calculated on the gratuitous transfer of the form to the employee.

Thus, a difference arises between tax and accounting accounting, which is reflected as a permanent tax liability:

| Dt | CT | Contents of operation |

| 99 | 68 | A permanent tax liability for income tax is reflected |

In addition, if the form was transferred free of charge, then its value is recognized as the employee’s income in kind, and the employer, as a tax agent, is obliged to calculate and withhold personal income tax (letter of the Ministry of Finance dated November 27, 2008 No. 03‑07‑11/367).

Note: there is a different point of view on this issue, according to which a work book, as a personal document, cannot participate in civil circulation (this rule applies to a passport, education diploma, etc.). It turns out that when a form is issued in the name of an employee, the employer loses ownership rights, but the employee does not acquire it.

At the same time, since the employee cannot buy the form on his own, bypassing the employer, it is not possible to assess the economic benefit received, which could be recognized as a citizen’s income, in accordance with the Tax Code of the Russian Federation. Consequently, the object of personal income tax does not arise in this case.

There is a safer option: to qualify the gratuitous transfer of labor. books to an employee as a gift. The agreement can be concluded either in writing or orally. At the same time, income in the form of a gift worth up to 4,000 rubles. per year is not subject to personal income tax.

Work book is an expense of the organization

In this case, the opinions of the Ministry of Finance are reflected in the following official explanations:

- letter dated June 10, 2009 No. 03-01-15/6-305;

- letter dated January 29, 2008 No. 07-05-06/18 (recommendations to audit organizations),

according to which the employer does not purchase the forms for further sale, but acts as an intermediary between the employee and the seller of the forms. Thus, the employer does not have ownership of the forms.

At the same time, the provision of a work book (insert) to an employee cannot be qualified as the provision of a service.

Therefore, it is proposed to immediately take into account the cost of the forms as part of other expenses, and the compensation received for the forms from employees should be included in other income.

Consequently, the following entries will be made in the organization’s accounting records:

| Dt | CT | Contents of operation |

| 006 | The forms were accepted into the off-balance sheet account as BSO | |

| 91 | 60 | The cost of the forms is accepted as expenses |

| 19 | 60 | VAT reflected |

| 006 | Forms issued to employees written off | |

| 73 | 91 | The cost of the forms is reflected, subject to reimbursement by company employees |

| 91 | 68 | VAT is charged on the cost of issued forms |

| 70 (50) | 73 | The debt for the issued forms has been repaid from the employee’s salary (payment is made by the employee to the organization’s cash desk) |

Read in more detail: Accounting for work records (2 methods)

Did you like the article? Share on social media networks:

- Related Posts

- Extract from the work book

- Entries in the labor report about dismissal at the initiative of the employee

- Application for an insert in the work book

- Certificate of acceptance and transfer of work books

- How to check a work record for authenticity

- Application to establish the fact of ownership of the work book

- How to calculate length of service using a work book

- Insert in the work book

Leave a comment Cancel reply

How to write off a damaged form?

How to write off a damaged work book? In order to do this in accordance with all the rules established in the legislation, namely in the government decree on the storage and maintenance of work books, it is necessary to perform a number of step-by-step actions.

All of them require the participation of several personnel department employees , as well as the employer himself.

Each action must be carried out at a precise time, following the stated plan, only then the accuracy of the work you carry out will be at the highest level.

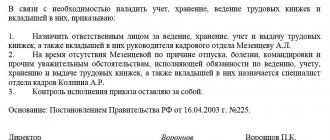

In order to write off a damaged form, the organization must issue an appropriate order that would allow the creation of commissions and the write-off.

Only after this can you begin to act.

First of all, you need to re -register your work records . Inspect all documents you have in your possession. There is no need to touch copies that have a presentable appearance; put them aside.

But outdated work books, frayed, stained or crossed out inside, should be sent for inspection.

The head of the personnel department must create a specialized commission from his subordinates. The legislator dictates the following name for us - inventory commission . This commission reviews the copies left for write-off and once again approves them for write-off.

Now you need to draw up a corresponding write-off act . We will talk about how to correctly compose this document in the next paragraph.

Later, a completely different commission is formed. The legislator calls it liquidation .

This commission consists of the same members as the previous one, but the fact of its creation is formalized by a separate order.

The commission attaches to the drafted act all employment forms that were not used for any reason.

Next, the documents are destroyed. This must be done in such a way that not a single work book survives and someone does not have two documents on work.

For what reasons can work books be written off?

Everything related to maintaining a work record book is described in the following legislative documents:

- Rules for maintaining work books approved by the Post. Government of the Russian Federation dated April 16, 2003 No. 225;

- Instructions for filling out work books contained in Post. Ministry of Labor of the Russian Federation dated 10-10-2003 No. 69.

An employee, when joining an organization, is obliged to submit a work report to his employer. When a person is employed for the first time, such a document is created by the employer himself.

The personnel officer is forced to write off the work book in the following cases:

- Damage to the form due to the fault of the personnel officer. For example, when filling out an employee made a mistake and immediately discovered it. Then he must destroy the damaged form, drawing up a corresponding act.

- Damage as a result of accidents and natural disasters, such as flood, fire, sewer pipe break, building collapse, etc.

Such situations arise infrequently, but nevertheless it is necessary to know what to do in such cases, how to correctly write off a work book and draw up an act.

Write-off act

The act of writing off the work book is an extremely important document, although there is not a single mention in the legislation of what it should actually look like.

Everyone draws up this act by hand and arbitrarily .

We have derived only a number of rules that should be inherent in this document:

- it must contain the full name of the organization;

- the name of the act itself should be written in large letters in the center;

- We also do not forget to enter the very date when the act was written;

- the act should briefly outline the entire process regarding the write-off of labor;

- the number of written off documents is indicated, as well as the reasons for writing off each one;

- do not forget to list the composition of the inventory and liquidation commissions;

- The document must end with the seal and signatures of all participants in writing off the work books.

It is worth noting that this act is drawn up on A4 sheets, in duplicate . Written with a black or blue pen in the absence of a form.

Act on writing off work books.

How documents on professional activities are written off

A document on professional activity must be written off in the following cases.

If the sample document is already outdated

The last time the appearance of the work book changed was in 2004. This version of the document is still used today. But a situation may well arise when a person comes to find a job with an old version of a professional activity document. For example, if for some reason he had a huge break in his experience or worked all this time without proper registration. In such a situation, the citizen should be issued a new document with all the records from the old one transferred to it. The procedure is long, but still necessary.

If the document is damaged

The most common case of writing off a work book. Of course, all shortcomings and blots should be corrected, following certain rules.

- Firstly, you cannot correct mistakes made on the title page of the document. In this case, you will have to create a new document and destroy the old one.

- Secondly, a large number of corrections in the document itself or its inserts is also a good reason for writing it off.

- Thirdly, an emergency situation that has arisen in an organization can also lead to damage to work records. Of course, such important documents must be kept in a safe, but anything can happen. This is the worst option for the employer, because you will have to destroy and restore at your own expense not just one, but a large number of documents at once.

If the document is no longer in demand

The organization may retain the work book of a deceased employee if close relatives do not take it. There are cases when an employee dismissed on the basis of a certain article decides not to take away a document with a record discrediting him. Such work books are stored by law for 50 years in the company’s archives, and after this period they must also be destroyed.

How does destruction occur?

Today in large cities there are many services that are ready to help you get rid of documents for money.

This is not done for free, but quickly and efficiently.

If you have no desire to pay for work that you can easily do yourself, then go for it.

There are two ways to get rid of labor. Firstly, such documents can easily be torn into pieces and set on fire .

As a rule, a similar action is carried out on the territory of the enterprise so that everyone can make sure that the documents are destroyed.

The second method is shredding . A special machine shreds the paper to a state where it is simply impossible to read the contents in it.

How to draw up an act for writing off work books

The document is drawn up in any form, but must contain a number of mandatory details.

The act is drawn up on A4 paper. You can write it by hand (if the company has not developed a special form), but for better readability they resort to printing.

The structure of the document is as follows:

For your information!

It is not prohibited to use a table in the text in which you can indicate data for each work: series, number, reasons for damage to the form.

What to do if an employee does not show up for work?

If an employee does not show up for a work book and there is a work document lying around in your archives, do not rush to get rid of it. The Labor Code suggests sending the work report by mail to the address indicated therein by registered mail. If such action is not possible, find a way to contact the owner of the work permit or his relatives.

If the connection is lost, do not rush to part with the document. According to the provisions of labor regulations, the book must remain at the enterprise until either the former employee himself or one of his relatives or representatives comes to collect it.

The occurrence of emergency situations in the organization and actions with work books

If there is a massive loss of documents on the professional activities of employees during a fire, flood or other emergency situations, the head of the organization must record the scale of this disaster.

To do this, you need to obtain certificates from the Ministry of Emergency Situations or from the utility service confirming the fact of the emergency. It is necessary to independently film the consequences of the incident at the enterprise on a photo or video camera. This data will help you communicate with regulatory authorities if they have questions regarding the loss of work books and other documents.

A special commission is created to restore documents on the professional activities of employees of the affected company. It includes members of trade unions, representatives of employers and other labor organizations. The commission is collecting documents and drawing up an act according to which the manager will be able to issue the employee a duplicate document on professional activities.

The process of writing off issued work books is quite complicated. Therefore, you need to be more serious about filling out such important documents so that errors and corrections do not occur.