Purpose and content of the document

An invoice for payment is a recommendation document, not a mandatory one. Its main goal is to fix the obligation to reimburse funds for the goods taken and the amount of the required payment.

There is no set writing regulation. When checking out, information about the product and the parties to the agreement is displayed. In special cases, the time period during which the obligation must be fulfilled is additionally noted.

Regardless of the situation, the document should display the following information:

- Information about the seller: full name, legal address, checkpoint and tax identification number;

- Buyer information: similar to the previous paragraph;

- List of goods or services provided, indicating their final cost;

- Total amount to be paid;

- Details for crediting funds;

- Date of document creation.

How to prepare an invoice for payment

It is exhibited by the seller. Payment is the responsibility of the buyer or his representative.

It is completed both before and after the purchase of a product or service - everything will depend on the agreements between the participants. The completed sample is sent to the customer.

Who issues invoices for payment?

The accountant is in charge of the preparation. The form is then submitted to the director of the company for approval.

Two copies are made: one for each participant. It is printed on plain paper or on the company’s letterhead (this option is better because it eliminates the need to write down the company’s details each time). Corrections are not allowed.

When to exhibit

If there is a cooperation agreement between the participants, then the terms of delivery and payment are usually specified in the text.

When parties work together only periodically, and the size and cost of supplies differ, each transaction is shown separately. The contract is concluded later; only general provisions are stated in its text. This happens if delivery is required urgently.

In a situation where the buyer only needs a one-time purchase of goods, there is no agreement between the companies - there is simply no need for it. The invoice for the provision of services is issued in the usual manner.

Note: if no agreement has been concluded between the counterparties, then the document can act as a public offer, provided that it contains all the required terms of the agreement (based on Article 435 of the Civil Code of the Russian Federation). Making payment is acceptance of the offer (Article 438, paragraph 3 of the Civil Code of the Russian Federation). And the paper itself, with confirmation of the sending of funds, will be evidence of a completed transaction between its participants (Article 434, paragraph 3 of the Civil Code of the Russian Federation). This will be a “plus” in the event of a possible trial.

About the invoice form

The law does not require the seller to create an invoice - it is drawn up for the convenience of the parties to the transaction. Therefore, its form is not approved by any regulatory act. However, invoices have been used in the business environment for many years; its pattern has been around for a long time and has become familiar to everyone.

You can create an account in different ways:

- and fill it out in a text editor;

- use accounting programs;

- issue an invoice online using special services.

Prepare an invoice online

The invoice in its usual form should contain:

- required details for any document - name, number and date;

- information about the person who issues the invoice;

- information about the payer;

- information about what goods or services are paid for, what their price, quantity and total cost are.

What is the difference between invoices for payment from LLC and individual entrepreneur

The sample received from the “private owner” has one signature. The LLC will issue a paper containing two “autographs” - the chief accountant and the director. Besides:

- Individual entrepreneurs indicate only full name, companies - the name recorded in the charter;

- The individual entrepreneur form contains only the TIN, the organization - TIN and KPP.

Read also: Is it possible to refuse an electronic work book?

There are no other fundamental differences.

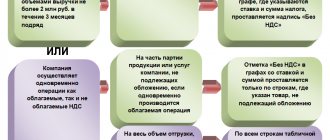

Differences when issuing with VAT and without VAT

VAT payers show the tax amount separately.

If the supplier is exempt from the contribution due to the use of a special tax regime (simplified system, single tax, patent), then the VAT amount is not included when writing the document. However, the corresponding mark is still affixed. And the reason must be given. For example, under the simplified tax system it is written:

- for individual entrepreneurs - paragraph 2 of Article 346.11 of the Tax Code of Russia;

- organizations - paragraph 3 of this regulatory act.

Note: if a buyer operating under a preferential tax regime is issued an invoice with VAT, then the entire amount must be paid, but then o.

On what amount should I pay the simplified tax system?

Pay the simplified tax system on the remaining amount after deducting VAT.

For example, you received 10 thousand rubles from a client, but 1,666.67 rubles of this was VAT, which you transferred to the tax office. Pay the simplified tax system on the remaining amount - from 8,333.33 rubles.

Submit reports in three clicks

Elba - online accounting for individual entrepreneurs and LLCs. She will help you issue invoices, generate a VAT return and reporting according to the simplified tax system.

Try 30 days free Gift for new entrepreneurs A year on “Premium” for individual entrepreneurs under 3 months

List of forms for issuing an invoice for payment

There are several known options, which can sometimes lead to confusion.

What are the features of each type:

- Invoice-agreement is identical to the “usual” one, but additionally contains contract details. This type records the terms of delivery and payment (prepayment or postpayment, cash or non-cash payment), the procedure for complaints, exchanges, and other issues. Usually it replaces the standard agreement (if the transaction amount is small).

- Invoice - indicates the fact of purchase of goods (services), records the presence of VAT. Used by individual entrepreneurs and companies operating under the general taxation regime.

Samples of filling out invoices

Example 1—filling inclusive of tax.

Example 1 - with VAT

Example 2 - without taking into account.

Example 2 - without taking into account

Instructions for preparing an invoice for payment

There are no clear rules for writing.

However, a specific order of completion is usually followed. At the top are the buyer and seller details. Below are recorded:

- Bank data;

- form number (numbering starts from January 1 of the current year);

- date of issue;

- a list of goods (works, services), fixing their quantity, price and final cost, including or excluding VAT;

- upon request - other conditions.

The signature of the authorized person is placed below.

Requisites

This section is required when completed. What is indicated:

- name of the participants (for example, individual entrepreneur Svetlana Igorevna Minina, Stroyservis LLC);

- TIN for individual entrepreneurs, for companies - TIN and KPP;

- bank data (for example, Sberbank of Russia OJSC Anapa, BIC 1234567, account No. 454773777, account No. 57585998696);

- addresses of participants (individual entrepreneurs indicate the actual address). For example: 353440, Anapa, st. Astrakhanskaya, house 12, tel.;

- signatures (position, full name, transcript).

Important: if a representative signs instead of an individual entrepreneur, then the details of the power of attorney must also be indicated.

Invoice registration

It is allowed not to register, since all expenses are taken into account using invoices, and income – based on the actual crediting of funds.

Only invoices are subject to registration - they are entered in the “sales book” or “purchase book”. Only those companies that operate under the OSN are required to do this.

Firms operating under the simplified tax system do not pay VAT, but they cannot claim its reimbursement from budget funds.

The need for certification with a seal

From 2021, having a seal is not a mandatory attribute. This rule applies to individual entrepreneurs and organizations. To certify the invoice, the signature of the responsible person is sufficient.

Advantages of our service

- It's absolutely free. Come in and use as much as you need.

- Allows you to create an invoice quickly. All details do not have to be retyped manually; you can copy, for example, from your company’s website. Our online account calculates the amounts itself. If you enter the quantity and price, the total order amount will be calculated automatically, as well as the amount of accrued VAT.

- Eliminates the need to use templates in Word or Excel formats.

- All you need is the Internet. You can create an account even if you are not in the office and do not have access to a work computer. You can access our website from a tablet or smartphone, and send an invoice to the buyer from it.

So enjoy it to your health!

– this is a document on the basis of which a company’s client pays for its services or purchased goods.

It contains the details of the contractor or seller used by the payer to make the transfer, as well as a list of services provided or goods supplied.

It can also serve as an offer if there is no agreement between the supplier and the buyer. In this case, payment according to it means acceptance of the offer by the buyer.

List of forms for issuing an invoice for payment

In Russian business practice, two types of documents are used: a standard invoice for payment and an invoice.

Many people confuse these documents. In fact, they have different purposes and differ from each other in terms of the order in which they are filled out. An invoice serves as a tax document intended for VAT accounting and reflects the movement of inventory items. It is issued after delivery of goods or upon completion of work.

Important: An invoice for payment is an optional document; payment to the seller can be made without it. It also does not apply to primary documents that serve as confirmation of expenses incurred (unlike invoices and certificates of work performed), but is widely used by organizations

For international deliveries, an invoice is also used. There are customs and commercial invoices, each of which has its own set of details. It can simultaneously serve as a certificate of conformity.

How to issue an invoice for payment?

ng>A unified payment form has not been developed, so the company has the right to develop its own template. The law does not provide a list of required fields, but organizations usually include the following sections in the invoice:

- name of the seller (contractor);

- its details: INN and KPP (for companies only), legal and actual address;

- supplier contact details: phone, fact and email;

- serial number and date of issue - this will make it easier to understand why exactly the money was received on the account (usually the buyer writes in the purpose section of the payment order something like the following phrase “Payment of invoice No.... dated ... 2016 for construction materials”); bank details of the supplier: name of the bank and its BIC, bank address, correspondent account and current account;

- the name of the services provided or goods shipped, their quantity, unit price and total cost.

Instead of indicating the name of the product, you can refer to the Agreement (for example, “Advance payment under contract No. 245 dated September 28, 2016”) or simply indicate the basis for its issuance (“For, etc.”).

To create an invoice as an offer, it must contain important terms of the transaction.

For example, the goods will be shipped within 3 business days after payment or receipt of money to the seller’s account. In this case, specifying the due date for payment of the invoice allows you to fix the terms of the agreement for a certain period. Thus, complying with the rules for preparing invoices for payment becomes a very important element of the enterprise’s work, since it bears a certain legal responsibility.

At the request of the company, you can include other information in the document:

- place the company logo;

- indicate the payer's details;

- payment currency – it can be billed in rubles or another currency;

- other important conditions - for example, indicate how long the document is valid (for example, “This document is valid for 30 days”), which is especially important for goods and services for which prices change quickly.

Differences when issuing with VAT and without VAT

All companies or organizations that work for OSNO must charge VAT on the cost of services provided or goods shipped. Therefore, they are required to indicate in a separate line the amount of allocated VAT “including VAT”.

Some taxpayers are exempt from VAT. These are individual entrepreneurs and organizations that have switched to a simplified system. Therefore, they must indicate a dash in the column “including VAT” or write “excluding VAT”. Some buyers may require an official letter from the Federal Tax Service, which confirms the legality of work without VAT. This letter contains an indication of the applicable taxation system (STS with the object “income” or “income minus expenses”).

In some cases, large companies require the supplier to issue them an invoice with zero VAT. Simplified companies have the right to issue zero invoices and this does not serve as a basis for filing VAT reports or transferring tax to the budget.

Invoice registration

Organizations are not required to keep records of issued and paid invoices. They take into account the costs of paying for goods and services using invoices and acts, income - upon receipt of money on the account.

Moreover, organizations using the simplified tax system do not have to pay VAT and cannot count on compensation for this tax from the budget. But they can, at their own discretion, take into account the issued and paid documents in a convenient form. Based on this information, the company can carry out additional work with customers: clarify why there was no payment and offer various incentives to resolve the issue (discounts, related services).

Organizations should only record invoices in the Sales Ledger (based on invoices issued) or the Purchase Ledger (based on invoices received). This responsibility is assigned only to organizations at OSNO. Information such as the date and number of the invoice, its number, the amount including tax, the amount of tax, etc. is indicated here.

Do you need a seal?

The seal and signature of the responsible person (chief accountant, manager himself or individual entrepreneur) are not mandatory details of the invoice for payment. But many companies refuse to pay for documents without a signature and seal.

The invoice must be signed by an authorized person (director, chief accountant or individual entrepreneur indicating OGRNIP).

Does the payer need the original invoice?

In modern conditions, most invoices are issued and paid remotely. Thus, you can make an invoice for payment electronically. Scanned invoices are sent by mail or fax. But in some cases, you can send the original document by mail or through a courier.

The VAT payer requires the original invoice so that he can accept VAT for deduction. Therefore, it is issued in two copies, one of them remains with the seller, the other with the buyer.

Today, electronic exchange of documents is allowed, but they must be signed using an electronic signature. Facsimile signature and seal are not acceptable and such invoices may not be accepted for accounting.

How to issue an invoice for payment by bank transfer?

Here are the instructions for issuing an invoice for payment:

- In the header of the document, indicate the full name of the organization, legal address and contact information.

- Fill out the table with your registration data (TIN and KPP) and bank details. In the recipient column, indicate the name of the recipient and the current account number next to it. At the bottom of the table, information about the bank is written down: name, address, BIC (this number can be found in the documents for opening a current account or the bank’s official website) and indicate its correspondent account (this is the account from which money is distributed between the recipients’ current accounts). Correspondent account starts from 3010, settlement account – from 4070 or 4080.

- Indicate the invoice number (the numbering system can be any) and the date it was issued.

- Fill in the information about the payer and consignee (if they are different). Here you can limit yourself to only the name of the company or individual entrepreneur, or enter the details in more detail (including TIN, KPP, legal address, bank details).

- Please indicate the total amount to be paid excluding VAT in the “Total” column.

- Fill in the name of the goods or work for which the invoice is issued, their price and cost excluding VAT.

- Calculate VAT and indicate its rate (standard is 18%, but for some categories of goods the rate is 10%). For example, for goods worth 100,000 rubles. VAT will be 18,000 rubles.

- Enter the amount to be paid including VAT. For example, Without VAT – 200,000 rubles, VAT – 36,000 rubles. The total amount to be paid is 236,000 rubles. Write down the number of items in the invoice and the amount in words.

Print the document and affix your signature and seal. All that remains is to send it to the supplier and wait for the money to arrive at the specified details.

Thus, an invoice for payment significantly simplifies settlements between the seller and the buyer. Therefore, it is widely used in organizations and individual entrepreneurs , although it is not a mandatory document.

Does the payer need the original invoice?

Nowadays, electronic documentation is mainly used.

Scanned copies of the papers are sent to the counterparty by fax or mail. Read also: Tax limitation period

If there is a need to transfer originals, then use a courier service or mail. The original copy of the invoice is handed over to the VAT payer (required for tax deduction). Therefore, two copies are prepared, one of which remains with the seller, the second is sent to the buyer.

Important: VAT payers can also use an electronic version of the invoice, but it must have a digital signature. Other options for document endorsement are unacceptable.

How to issue an invoice for payment by bank transfer

Federal Law No. 161 “On the National Payment System” states that all payments made by non-cash form can only be carried out with the consent of the client.

The procedure for filling out the document is identical to that used for other types of payment.

How to reflect VAT on an invoice

If a businessman is a VAT payer, then the amount of the contribution must be displayed in payment documents. You can do it like this:

- The tax is included in the final cost, but is highlighted as a separate line for clarity.

- The cost of the service (product) is shown excluding tax, then its size is calculated. The final price is formed as the sum of these two quantities.

Important: it is recommended to always enter the tax amount on a separate line - this will avoid possible errors in calculations.

When should you indicate the due date on your invoice?

The money must arrive to the seller within the period stipulated by the agreement. It is indicated in the text of the contract, or on the payment document itself. Changing the deposit period is not allowed.

Note: if funds were deposited by bank transfer and inaccuracies in the details were discovered, the supplier must be notified of the error as soon as possible. This is done in writing. This procedure will increase the payment period.

We issue invoices in English

We are talking about invoices used when working with foreign counterparties. Invoices must contain information:

- outgoing and incoming document number;

- data of counterparties, their contacts;

- date of discharge;

- taxation system in the companies participating in the transaction;

- date of dispatch of the goods, its receipt;

- information allowing the parties to the contract to track the status of the order;

- total transaction amount;

- payment terms;

- other necessary information - for example, return conditions, a description of penalties for violation of the contract, etc.

You need to take into account everything, even the smallest details, since the legislation under which foreign partners work differs from the Russian one.

Basic mistakes when issuing an invoice

The most common errors found in this paper:

- failure to comply with invoice deadlines - on the basis of Article 168, paragraph 3 of the Tax Code of the Russian Federation, it is established that payment must be made no later than 5 days after receipt of the goods (contains inaccuracies or outdated information;

- the dates on the copies of the document are different;

- violation of the deadlines for submitting a document for processing a VAT tax deduction - it is recommended to claim the deduction in the same reporting period when the invoice was received;

- when writing, facsimile signatures of authorized persons were used - in this case, the deduction may be denied;

- no decryption of signatures.

Note: the use of a digital signature already eliminates the error associated with the lack of decryption, since the electronic digital signature already contains all the necessary information.

If an error is identified in the document, it must be corrected: cross out the incorrect data, enter valid information, indicate the date of the changes, affix the company seal and have it endorsed by the manager.

When is the invoice issued?

The invoice can be issued at any time, it all depends on the existence of any agreements between the parties. As a rule, the document is transferred to the buyer after receiving a request or after concluding any agreement.

The request may be made orally or in writing, depending on the situation. To confirm your position, it is best to send it on paper or electronically; it is almost impossible to confirm an oral request.

Issuing an invoice makes sense if the individual entrepreneur to whom it is sent has a bank account. Individual entrepreneurs do not have such an obligation, so you should clarify the information in advance.