How to deduct VAT

Each taxpayer-buyer has the right to reduce the accrued value added tax by the amount of “input” VAT on purchased goods (works, services).

The article “What are VAT deductions?” will tell you what VAT deductions are and how to apply them correctly.

This right is granted to him in accordance with paragraph 1 of Art. 171 Tax Code of the Russian Federation. At the same time, in accordance with this article, tax amounts that were (clause 2 of Article 171 of the Tax Code of the Russian Federation) are subject to deductions:

- paid when importing goods into Russia, both those that have undergone customs clearance and those that are transported without customs clearance;

- presented by sellers when purchasing goods and services (as well as when making advance payments for future deliveries) in the territory of the Russian Federation.

Please note that there is no right to deduct VAT if:

- goods were purchased and will be sold outside the Russian Federation (letter of the Ministry of Finance dated November 9, 2011 No. 03-07-13/01-46);

- goods purchased in Russia will be sold outside the country (letter of the Ministry of Finance dated November 25, 2011 No. 03-07-13/01-49).

Conditions for accepting VAT for deduction

In order to exercise the right to deduct VAT, it is necessary to comply with a number of requirements prescribed in paragraph 1 of Art. 171 and paragraph 1 of Art. 172 of the Tax Code of the Russian Federation:

- Goods (work, services) were purchased to carry out operations that are subject to VAT.

- Goods (work, services) are accepted for accounting (primary documents must be available).

- The seller provided a correctly executed invoice.

IMPORTANT! Another requirement for imported goods is the availability of payment documents that confirm the fact of payment of VAT upon import into the Russian Federation.

Adjustment of VAT offset

A fee that is accepted for reimbursement may be subject to exclusion from offset in some situations. This can happen if the product is returned in full or in part, as well as in a situation where the terms of the transaction have been changed. Adjustments are necessary when adding or subtracting value.

Adjustment is possible for products, services that were not used for the purposes of taxable turnover, in case of damage to goods, etc. Amounts can be excluded from the indicator in the tax order when there are grounds for making corrections. You can display information on the return of products and correct the VAT entered into the offset using documents on the return of goods to the supplier.

You can adjust the fee that was attributed to reimbursement in past cases using the document – Registration of other transactions on purchased goods for VAT purposes.

There are situations when the recipient of products or other valuables cannot attribute the indicator to compensation. This applies to goods that were not used for the purposes of taxable turnover, in the case of the purchase of passenger vehicles as fixed assets, if the invoice contains violations, inconsistencies, etc. You cannot carry out actions on transactions that were performed with a fake company, on transactions that have been declared invalid.

The absence of certain details or their incorrect display is considered grounds for excluding the collection indicator from the offset. These include information about the buyer and supplier, their Taxpayer Identification Number (TIN) and BIN, incorrect identification of the names of products or services, works, incorrectly indicated date of extract, and incorrect amount of taxable turnover. Uncertified invoices cannot be used.

A transaction that is declared invalid by a court decision or erroneously reflected in the documentation and that was completed without actual work being carried out may be excluded from the amount of the fee that is included in the compensation.

Acceptance of VAT for deduction: some features

First of all, for VAT to be deductible, it does not matter whether payment was made for the purchased goods. This means that the buyer can deduct VAT even with outstanding accounts payable (letter of the Ministry of Finance of Russia dated June 21, 2013 No. 03-07-11/23503, Federal Tax Service of Russia dated September 3, 2010 No. ShS-37-3/10621, resolutions of the Federal Antimonopoly Service Vostochno -Siberian District dated 02.25.2010 No. A74-3115/2009, FAS Central District dated 02.15.2011 in case No. A68-896/10).

As a general rule, from January 1, 2015, VAT is deducted in full on expenses that are normalized for income tax. From the specified date, para. 2 clause 7 art. 171 of the Tax Code of the Russian Federation, according to which VAT was deducted in an amount corresponding to the standard for recognizing expenses for income tax.

If you have access to ConsultantPlus, check whether you have correctly accepted VAT for deduction. If you don't have access, get a free trial of online legal access.

The exception is travel and entertainment expenses. The deduction of VAT on such expenses continues to be standardized (clause 7 of Article 171 of the Tax Code of the Russian Federation).

Value added tax deduction can also be applied in the following cases:

- if the purchased goods were paid for using funds subsidized from municipal (regional) budgets (letter of the Ministry of Finance dated November 2, 2012 No. 03-07-11/475);

- compensation for the costs incurred was made by the insurer (letter of the Ministry of Finance dated July 29, 2010 No. 03-07-11/321);

- at the request of the seller, payment for the goods was made to a third party, if this was specified in the supply agreement (letter of the Ministry of Finance dated November 22, 2011 No. 03-07-11/320).

What to do with overpaid taxes

Overpayments are treated differently. For some companies, an overpayment of 100 rubles is critical, but for others, even 10,000 rubles is a barely tangible amount. The choice of option depends on the approach of management and the size of the company.

Let it be as it is

This approach works if the overpayment is pennies. But what to do if the overpayment exceeds tens of thousands of rubles? In such a situation, there is no point in “freezing” the company’s turnover.

VAT offset

The overpayment amount can be used to pay off other taxes, penalties and fines. Until October 2021, VAT was credited only for paying taxes at the federal level. For example, this is a tax on profit or on the extraction of minerals. It was impossible to use the overpayment to pay off regional and local payments.

From October 1, 2021, this procedure has been simplified. Now you can offset overpaid VAT against regional or local taxes and fines thereon (Federal Law No. 325-FZ of September 29, 2019).

But there are limitations. You cannot use VAT overpayments to pay off other taxes if you have debts, penalties and fines. First, you will have to make an offset against them (clause 6, article 78 of the Tax Code of the Russian Federation).

Refund of overpayment

The overpayment amount can be returned to the company's account. But if you have a debt to the budget, the amount of the overpayment will be counted towards its repayment. And the rest will be returned to your bank account.

The tax office often takes a long time to return money from the budget, but it is more willing to offset it.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

Reasons for refusal to accept VAT for deduction

The main reason for refusal to use the right to deduction is an incorrectly executed invoice. At the same time, it is necessary to pay attention to the fact that errors in the preparation of such a document, which do not create problems for the inspector with identifying the parties to the transaction, the object of taxation, the calculated tax amounts and the VAT rate, are not grounds for refusing to accept them. This norm is prescribed in paragraph 2 of Art. 169 of the Tax Code of the Russian Federation.

See also our material “What errors in filling out an invoice are not critical for VAT deduction?” .

Also, VAT deduction will be denied if:

- there are no primary documents confirming the purchase of goods (works, services);

- goods (work, services) were not accepted for accounting;

- the purchased goods were subsequently used in activities that are not subject to VAT.

In practice, the tax office refuses to deduct VAT in the following cases:

- lack of sales during the tax period in which the right to deduction was claimed;

- using the deduction partially, that is, splitting the amount of tax to be deducted under one invoice into several parts;

- The tax inspectorate is confident that the seller is evading payment of VAT (in this case, the buyer and seller are accused of creating a scheme to illegally reimburse VAT from the budget).

Read about actions that allow you to challenge a refusal to deduct in the material “[LIFEHACK] We defend VAT deductions for “dubious” counterparties.”

For the most frequently identified errors when applying VAT deductions, see the material “[LIFE HACK] How not to reduce VAT payable.”

Let's look at some of these cases in more detail.

VAT deduction in the absence of sales

For a long time, officials believed that the lack of sales (tax base) prevented them from receiving a VAT deduction. However, after some time, the financial department and the Federal Tax Service of Russia changed their position. Thus, officials admitted that the presence of a VAT tax base is not a condition for deduction (see letters from the Ministry of Finance of Russia dated November 19, 2012 No. 03-07-15/148, Federal Tax Service of Russia dated February 28, 2012 No. ED-3-3/ [email protected] ).

Therefore, if the tax office denies you a VAT deduction, you can safely challenge this decision. Note that the courts fully support the taxpayer. For example, the Arbitration Court of the Far Eastern District rejected the tax inspectorate’s argument that in the absence of activities aimed at generating income, the deduction is unlawful. The judges indicated that the Tax Code of the Russian Federation does not contain such a condition for deducting VAT as the presence of sales transactions in the tax period (resolution of the Far Eastern District AS dated November 17, 2014 No. F03-4979/2014, West Siberian District AS dated December 7, 2015 No. F04 -27771/2015 in case No. A46-2573/2015).

Splitting the deduction amount for one invoice into several parts

Since 2015, the question of the possibility or impossibility of splitting the deduction has become irrelevant. The edition of the Tax Code of the Russian Federation, in force since 2015, allows deductions to be made within 3 years from the date of registration of the acquisition (clause 1.1 of Article 172 of the Tax Code of the Russian Federation), in very rare cases limiting it to the full amount (paragraph 3, clause 1, p. 4 Article 172 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated December 19, 2017 No. 03-07-11/84699) presented by the tax supplier.

About the possibility of splitting the VAT deduction on fixed assets, read the article “Is VAT deduction on fixed assets allowed in parts?”

How to deduct “import” VAT, read the material “Import” VAT: can it be deducted in parts?”

Determination of deductions in the presence of both taxable and non-taxable VAT transactions

If an organization carries out both taxable and non-taxable VAT transactions, it must maintain separate accounting for VAT. The procedure for maintaining separate accounting must be prescribed in the Accounting Policy for tax accounting. Also read the article ⇒ “How to determine sales revenue for VAT distribution in 2021.”

Since there are 2 accounting methods, the company must choose one of them:

Option 1.

If the share of total expenses for the acquisition, production, sale of goods, works, services, and non-VAT-taxable transactions does not exceed 5% of the total share of expenses, then all VAT is deductible. If the share exceeds 5%, separate accounting is carried out according to option 2.

Option 2.

Input VAT is deductible in accordance with separate accounting, regardless of the share of expenses on non-VAT-taxable transactions in the company's total expenses.

The very distribution (division) of input VAT occurs based on the ratio of revenue from transactions subject to VAT to the total revenue of the company.

Example 3.

The company has prescribed the first option for separate VAT accounting.

Revenue for the quarter amounted to 10,000.00 for non-VAT-taxable transactions and 40,000.00 (excluding VAT) for VAT-taxable transactions. At the same time, expenses for non-taxable transactions are 2,000.00, total expenses are 20,000.00. Expenses are given without VAT. VAT in the amount of 3,600.00 – (20,000.00 * 18%) is accounted for in account 19. Determine VAT to be deducted.

Solution.

- First, we will determine whether we can deduct all input VAT, or whether separate accounting is necessary.

2,000.00 / 20,000.00 * 100% = 10%, i.e. exceeds the 5% barrier, which means that we cannot accept all VAT for deduction.

- We determine the share of VAT that we can deduct.

40,000.00 / (10,000.00 + 40,000.00) * 100% = 80% of the VAT recorded on account 19 can be deducted.

3,600.00 * 80% = 2,880.00 – accepted for deduction

3,600.00 – 2,880.00 = 720.00 – taken into account in expenses for ordinary activities.

Accounting entries for VAT deductions (based on Example 3)

table 2

| Operation | Posting by debit | Loan posting | Sum |

| VAT presented by the supplier is reflected | D 19.3 | K 60 | 3 600,00 |

| VAT is reflected in the part subject to deduction | D 19.1 | K 19.3 | 2 880,00 |

| VAT is reflected in the part to be included in expenses | D 19.2 | K 19.3 | 720,00 |

| VAT accepted for deduction | D 68.2 | K 19.1 | 2 880,00 |

| VAT not deducted is reflected in expenses for ordinary activities | D 26 (20, etc.) | K 19.2 | 720,00 |

Where:

19.1 “VAT on taxable transactions”;

19.2 “VAT on non-taxable transactions”;

19.3 “VAT on both taxable and non-taxable transactions.”

Transferring the deduction to a later period

Since 01.01.2015, the Tax Code of the Russian Federation has enshrined the taxpayer’s right to apply a VAT deduction within 3 years from the date of registration of purchased goods (works, services) (Clause 1.1. Article 172 of the Tax Code of the Russian Federation). The established 3-year period will expire simultaneously with the deadline for submitting a declaration for the same quarter in which 3 years earlier the acquired goods (work, services) were registered (letter of the Ministry of Finance of Russia dated May 12, 2015 No. 03-07-11/27161 ).

However, some deductions cannot be transferred to a later period (letters of the Ministry of Finance of Russia dated October 17, 2017 No. 03-07-11/67480, dated April 9, 2015 No. 03-07-11/20290 and No. 03-07-11/20293), and they must be taken into account in reducing the accrued tax in full in the quarter when the appropriate conditions for this arose. These are the deductions:

- on OS, intangible materials, and equipment for installation imported to Russia;

- VAT tax agent;

- advances issued and received;

- travel expenses.

See also the material “Transferring the VAT deduction to another period - when it is prohibited.”

What is VAT, what are its features?

In tax reference books, VAT is defined as a tax on the profits of enterprises that they receive by setting prices for their goods above market prices.

The difference between the old and new prices for goods becomes the object of taxation. In other words, we can say that the tax is charged on the difference between the proceeds from the sale of goods and their original price (the cost of raw materials for its production or the funds spent on its purchase).

Value added tax is credited to the federal budget. It is considered an indirect tax due to the fact that it is paid in full by buyers (or consumers of the product).

An organization engaged in sales must keep accounting and record taxes that it itself pays to suppliers.

To determine the tax, you must use the tax base, which is determined by the price of the product. At the same time, the cost of such a product increases by 10-18 percent with each purchase. These numbers must be indicated on the invoice.

Who is obliged to pay VAT

The obligation to pay VAT falls on:

- organizations;

- individual entrepreneurs;

- persons who transport certain goods across the state border of the Russian Federation.

Legal entities (individual entrepreneurs and organizations) may, in certain cases, be exempt from paying value added tax. To do this, revenue for the previous three months should not exceed two million rubles. But this applies only to those organizations that sell non-excisable goods.

There is no need to pay VAT to the following types of taxpayers (except for those transporting goods across the border):

- who pay the Unified Agricultural Tax and the simplified tax system. How to draw up a notification about the transition of the simplified tax system - read here.

- who use UTII in their activities.

These are special tax regimes that are exempt from VAT.

You can find out what the value added tax is in this video:

When and at what point does the obligation to pay arise?

Since tax is paid on the proceeds from the sale, the obligation to pay it arises from the very moment of sale. This can be either unloading or direct payment of money for the goods provided.

Moreover, tax payment occurs in several stages:

- when an enterprise purchases raw materials for the manufacture of goods from another organization, it pays VAT, which is included in its cost;

- when determining the cost of goods, the cost of VAT is added, but in this case it fits into the tax credit;

- When determining the final cost of a product, it also includes the amount of VAT, which buyers will then have to pay.

VAT rates and amount

In most cases, the VAT tax rate is 18 percent. But for the sale of special goods (children's products, food, some types of medicines), the legislation provides for a reduced rate of 10 percent. Also, when exporting goods, a 0 percent rate is often used.

A zero rate is applied to those goods that are exported for sale abroad. It can also be used for services aimed at international transportation.

Formula for calculating VAT. Photo: web-dl.ru

Deduction for “late” invoices

From 01/01/2015 in clause 1.1 of Art. 172 of the Tax Code of the Russian Federation establishes that if an invoice is received after the end of the tax period in which goods (work, services), property rights are registered, but before the deadline for submitting the declaration for this period, then VAT can be deducted during the acquisition period.

ConsultantPlus experts explained what documents can be used to confirm VAT deductions:

If you do not have access to the K+ system, get a trial online access for free.

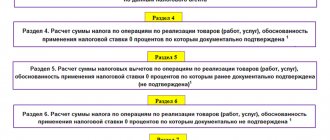

How to reflect the VAT deduction in the declaration

The amounts of VAT to be deducted are reflected in lines 120-190 of section 3 of the VAT return. In lines 120-185, the deduction is distributed by type. And in line 190 the total amount of deduction for the quarter is calculated; for this, the values from lines 120-185 are added together.

Next, from line 118, which indicates the amount of tax including recovery, subtract line 190. This way you will receive the amount of VAT payable or refundable. If the difference between lines 118 and 190 is greater than 0, reflect the VAT payable in line 200, if less, reflect the VAT payable in line 210.

How to return VAT - step-by-step instructions

VAT refund occurs according to the following scheme:

- You need to submit a tax return, which will indicate the amount of VAT to be refunded. The tax inspectorate will conduct a desk audit within three months. During this process, tax officials may require documents confirming the right to tax deductions. If no violations were identified during the inspection, a positive decision will be made. If violations still exist, then further steps need to be taken.

- After identifying violations, tax officials must draw up an inspection report, which must indicate the identified violations.

- The taxpayer may express his disagreement with the violations found in writing. The legislation allocates no more than 1 month from the date of receipt of the act for this purpose.

- The tax authorities draw up an act on holding the taxpayer liable or refusing to do so.

After receiving objections, the tax office has 10 days to make a decision. The taxpayer must be notified of this within five working days. If, nevertheless, a decision was made to prosecute, then there can be no talk of VAT refund. Before making a decision, the tax office must find out whether there is a VAT arrears. - If there is a VAT arrears, tax officials independently credit the VAT to the tax arrears or fines.

- If the desk audit does not reveal any violations, then the tax authorities make a decision on VAT refund. They have no more than 7 days from the end of the inspection to do this.

- If the taxpayer does not have arrears of VAT, fines and other taxes, then the VAT is returned to him.

- Within 5 working days, funds are credited to the taxpayer’s account;

- If the funds were not returned on time, then from the 12th day interest begins to accrue, which is then necessarily credited to the taxpayer’s account.

How to pay VAT?

Preparation of invoices and other recommendations for returns

Quite often, the main reason for refusal of a VAT refund is inconsistency of data and incorrect completion of documents. In certain cases, the reason for this may be incorrect indication of the address (actual instead of legal), or confusion in indicating the numbers of payment documents.

The court allows the use of corrected documents, but it is much easier to do everything correctly from the very beginning.

It is recommended to keep records in such a way as to separate taxable and non-taxable transactions. If such a separation is not made, then it will be almost impossible to return VAT, since this procedure is tied to certain types of work.

You can also expect a refusal to apply to those organizations whose counterparty has not paid VAT.

Invoices

A regular invoice is drawn up for the sale of goods (work, services) no later than five days counting from the date of shipment of the goods (performance of work, provision of services) (clause 3 of Article 168 of the Tax Code of the Russian Federation). The list of details of the “shipping” invoice is given in clause 5 of Art. 169 of the Tax Code of the Russian Federation, and the rules for filling it out are in section. II of Annex 1 to Resolution N 1137. Let us recall that for the seller (executor) the invoice serves as a document on the basis of which VAT accrued on the shipment increases the tax base. The buyer (customer) has an invoice as a necessary document for tax deduction.

If the invoice is drawn up incorrectly or incompletely, then the tax deduction may formally be denied, but in fact, tax officials have not had such a “right” for several years. Article 169 of the Tax Code of the Russian Federation introduced a rule: errors in invoices that do not prevent the tax authorities from identifying the seller, buyer, names of goods (works, services), their cost, as well as the tax rate and amount of tax during a tax audit, are not grounds for refusal to accept VAT deduction. Such minor errors in filling out invoices include the following: confusion with numbering, inaccuracies in indicating the consignor and consignee (provided that the buyer and seller are named correctly), errors in units of measurement (code and symbol), neglect of accuracy when reflecting the country origin of the goods and customs declaration number.

It should be noted that for AUs that provide services and do not sell goods, the errors we have listed are unusual.

Inaccuracies in indicating the name, address, TIN of the seller or buyer may also deprive the tax deduction. But if there are typos in the buyer’s name (capital letters are replaced with lowercase ones or vice versa, extra symbols are added (dashes, commas, etc.), then such an invoice does not prevent tax authorities from identifying the indicators, it can confirm the right to deduct VAT (Letter from the Ministry of Finance of the Russian Federation dated 02.05.2012 N 03-07-11/130).

If, when filling out an invoice, arithmetic and technical errors were made when reflecting and calculating the cost of services, and tax rates and amounts were incorrectly indicated, then this is considered a gross violation in the preparation of the document, which gives auditors reason to refuse a tax deduction for such incorrectly executed invoices - invoices (Letter of the Ministry of Finance of the Russian Federation dated May 30, 2013 N 03-07-09/19826). At the same time, if the cost and quantity of goods (work, services) are incorrectly indicated due to objective reasons (due to subsequent changes in these indicators), this can be corrected by drawing up another invoice - an adjustment one.

On a note.

Cost data in invoices is reflected in rubles and kopecks.

In the VAT return, all amounts are rounded to whole rubles (letters of the Ministry of Finance of the Russian Federation dated 04/15/2014 N 03-07-09/17172, dated 02/17/2014 N 03-07-09/6395). Substitute for a regular invoice. As the reader guessed, we will talk about a universal transfer document (UDD), which is recommended by the Letter of the Federal Tax Service of the Russian Federation dated October 21, 2013 N ММВ-20-3 / [email protected] The UTD confirms the fact of transfer (implementation) (the name of the document itself speaks to this) , therefore, it is logical that the UPD form is based on the “shipping” invoice form, which is supplemented with details of another primary document (invoice) used for accounting and tax accounting purposes (for calculating income tax and when calculating the single tax when applying the simplified tax system ) (letters from the Federal Tax Service of the Russian Federation dated 04/21/2014 N GD-4-3/7593, dated 03/05/2014 N GD-4-3/ [email protected] ).

On a note.

Due to the fact that the UPD is a recommended document, and also if the accounting accountant decided to use it instead of a regular invoice, such a decision must be fixed in the accounting policy for the purposes of calculating VAT.

It remains to add that, unlike a regular invoice, there is no format approved by the Federal Tax Service in electronic form for the UTD. In the Letter of the Federal Tax Service of the Russian Federation dated 02/06/2014 N ГД-4-3/ [email protected] there is no clear answer to the question of what a taxpayer should do with UTD in such a situation. It only says that if a document in electronic form is compiled in the format established by the Federal Tax Service, then it can be transmitted to the tax authority in electronic form via telecommunication channels. It turns out that in the absence of the format provided by the Federal Tax Service, this will not be possible, which means that the taxpayer has no choice but to issue and receive the UTD in paper form.

An advance invoice is issued upon receipt of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services) no later than five days from the date of payment (advance) (clause 3 of Article 168 of the Tax Code of the Russian Federation). The list of mandatory details for an advance invoice is established in clause 5.1 of Art. 169 of the Tax Code of the Russian Federation. In particular, the consignee does not have the name and address of the consignor in the invoice issued for an advance payment (prepayment). It is sufficient to indicate the name, address and identification numbers of the taxpayer and the buyer. It is also mandatory to reflect the number of the payment and settlement document (for received advance payment). The advance invoice does not indicate the quantity (volume) of goods supplied (shipped) under it, the price per unit of measurement and the cost of goods without tax. But the name of the prepaid goods (works, services) is reflected (if the nomenclature is significant, you can also indicate a general name). In addition, the VAT rate for advance payment (18/118 or 10/110) and the amount of tax are indicated, as well as the final amount of advance payment (including tax) paid towards future deliveries of goods (work, services).

The Government of the Russian Federation (see Resolution No. 1137) has not approved a separate advance invoice form. Therefore, the AU accountant should take as a basis the form of a traditional invoice (for the shipment of goods (works, services)) and fill in only those details that are mandatory by virtue of clause 5.1 of Art. 169 of the Tax Code of the Russian Federation.

An adjustment invoice is issued to the buyer when the cost of goods shipped (work performed, services provided) changes, that is, when their price changes and (or) the quantity (volume) is specified. In this case, it is necessary to have a contract, agreement, or other primary document confirming the consent (fact of notification) of the buyer to such a change. No later than five calendar days from the date of drawing up this document, an adjustment invoice is issued.

The required details of the adjustment invoice are given in clause 5.2 of Art. 169 of the Tax Code of the Russian Federation, and the form and rules for filling out can be found in Appendix 2 to Resolution N 1137. When adjusting the indicators specified in two or more invoices issued to one buyer (customer), the seller (performer) has the right to draw up a single adjustment invoice - invoice (paragraph 2, paragraph 13, paragraph 5.2, article 169 of the Tax Code of the Russian Federation).

An adjustment invoice is issued not only for a normal change in the price or quantity of goods shipped (work performed, services rendered), but also in the following cases:

— when returning goods (Letter of the Ministry of Finance of the Russian Federation dated July 24, 2012 N 03-07-09/89);

— in case of short delivery of goods (Letter of the Ministry of Finance of the Russian Federation dated May 12, 2012 N 03-07-09/48);

— when providing a retro discount with recalculation of the price of goods sold (work performed, services rendered) (Letter of the Ministry of Finance of the Russian Federation dated September 3, 2012 N 03-07-15/120);

- when selling goods at a preliminary price under long-term supply contracts, when the final cost is determined after all deliveries of goods and their transfer to the final buyer (Letter of the Ministry of Finance of the Russian Federation dated January 31, 2013 N 03-07-09/1894).

On a note.

If a change in the cost of goods (work, services) occurred simply as a result of correcting an error that arose when issuing an invoice, then the seller does not issue an adjustment invoice, but the invoice issued upon shipment of goods (performance of work, provision of services) the necessary corrections are made (Letter of the Ministry of Finance of the Russian Federation dated August 23, 2012 N 03-07-09/125).

An accountant needs to know not only how to draw up an adjustment invoice, but also the adjustment mechanism itself. Changes to the VAT tax base are made by the accountant for the difference. It is reflected in the current period (the one in which the adjustment document was drawn up) regardless of the period in which the goods (work, services) themselves were shipped. The difference can be either positive (if the cost is adjusted upward) or negative (if the adjustment was made downward). In the adjustment invoice, the data is indicated either with a plus sign or with a minus sign, respectively. In this case, penalties (if the tax base increases as a result of adjustment) are not assessed by tax authorities (Letter of the Ministry of Finance of the Russian Federation dated May 14, 2013 N 03-07-11/16590).