- home

- About company

- Articles

- Advances / Settlement of advances in 1C: Accounting 8

September 17, 2019

From July 1, 2021, owners of online cash registers are required to punch checks not only for the advance payment, but also for offset of the advance payment. For a number of configurations there are already brief instructions on .

At the time of writing this instruction, there is no data regarding 1C: Accounting on the ITS website. Therefore, we will analyze the procedure on the demo base. As an example we will use:

| Platform | 8.3.15.1565 |

| Configuration | Enterprise accounting 3.0.72.66 Prof. |

| KKT model | ATOL FPrint-22PTK |

This instruction is current as of September 11, 2019.

A little theory

The process of breaking through Advance Receipts can be divided into two main stages:

- prepaid expense;

- advance credit.

For each stage, a separate document is created in 1C. And, subsequently, the check comes through.

| Type of transaction: | Document: |

| Prepaid expense | Receipt of cash (PKO), Payment card transaction (acquiring), Receipt to the current account; |

| Advance offset | Sales of goods, Sales of services. |

Reminder

:

Prepayment and Advance payment are different signs of the payment method.

Prepayment is the receipt of funds from the payer for a specific list of goods/services.

Advance – receipt of funds when the payer does not yet know what he wants to purchase

Receipt of payment from the buyer to the bank account (Advance payment)

Print (Ctrl+P)

In the 1C:Accounting 8″ program, to reflect the receipt of funds from the buyer in the form of an advance payment (partial or full), the document

Receipt of payment from the buyer to the current . The advance payment received from the buyer is registered under the credit of account 62.02 “Settlements for advances received.”

At the time of shipment of goods (performance of work, services), the previously received prepayment amount is offset (Dt 62.02 Kt 62.01). When posting a document, the program automatically distributes the payment amount to advances or payments for goods (work, services) sold. When an advance is received, a credit entry is generated to account 62.02 “Calculations for advances received.” When funds are received for goods (work, services) already sold, a credit entry is generated to account 62.01 “Settlements with buyers and customers”. In other words, if the shipment was not made, the posting will be generated on the debit of account 51 “Settlement accounts” and on the credit of account 62.02 “Calculations for advances received” for the amount of the payment. In order to view the prepayment from the buyer, you can use the report Turnover balance sheet for account 62.02 “Calculations for advances received.” To reflect the payment received from the buyer for goods, work and services, you must select the Payment from buyer . After selecting the operation, you need to fill in the payment decryption details:

- Agreement – an agreement with a counterparty. Must have the form “With the buyer”, “With the commission agent (agent)” or “With the principal (principal)”.

- Debt repayment is a method of repaying the buyer’s debt in the context of settlement documents. You must select one of the possible methods: Automatically, By document or Do not repay.

- Settlement document – indicated only when choosing a debt repayment method According to the document. In this case, during the transaction, the debt will be repaid only according to the specified settlement document.

- Settlement account – an accounting account in which the balance of the debt will be repaid upon posting. Not indicated when choosing the debt repayment method Do not repay.

- Advances account is an accounting account to which the part of the payment that remains undistributed after the repayment of the counterparty's debt is allocated.

The total amount of payment received can be distributed to be reflected in accounting across several contracts or settlement documents.

Step-by-step instruction

BP3_receipt of payment from the buyer

0

Share link:

- Click to share on Twitter (Opens in new window)

- Click here to share content on Facebook. (Opens in a new window)

Liked this:

Like

Similar

Author of the publication

offline 2 hours

master1c8

1

Comments: 33Publications: 467Registration: 12/25/2016

Step-by-step instruction. Prepaid expense

1) To reflect the Advance in 1C, create one of the documents:

- “Cash receipt”;

- “Receipt by payment card”;

- “Receipt to the current account”;

2) After filling out all the details, click on the button at the top of the document;

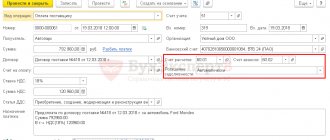

Figure 1 — Filling out the “Cash receipt” document

3) If the DS receipt document did not have a basis document, then in the preview of the check, “Indicator of the payment method” and “VAT” take on the correct values automatically;

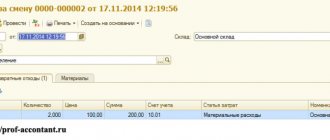

Figure 2 - Preview of the check, comparison of details, punching the check on the cash register

4) To punch a check, press the corresponding button;

5) The payment method sign is visible on the check – “Advance”. Depending on the document from which the check was punched, the payment type is substituted: Cash/non-cash

Figure 3 - Example of a check for “Advance”

The first recovery option in 1C

It is necessary to consider the situation in which the organization receives an advance from the buyer

The system independently classifies the funds received as “advance” and generates the corresponding accounting entries.

The posting to the VAT account triggers the creation of an advance invoice. In this case, an invoice can optionally be generated at the time of crediting funds or at the end of the reporting month.

After the sale of goods, the advance received is reversed

The sales invoice does not provide for the formation of any transactions, but its data is used for entering into the registers necessary for working with VAT.

VAT recovery is carried out through the document “Creating purchase ledger entries”

All data in the “Received advances” tab is filled in automatically by the system, including all information on VAT accrued on previously received advances.

The final results of the work are reflected in the “Sales Book” and “Purchases Book”

For example, a couple of entries are made in the sales book. The first is to receive an advance payment, and the second is to carry out the sale of goods.

There is also an entry for this counterparty in the Purchase Book. It acts as a compensating agent for the advance receipts reflected in the Sales Book. At the same time, it is easy to notice that each of the entries made provides for an amount of 7627.12 rubles.

Despite the presence of three entries, tax payment to the budget will be made only once.

It is also necessary to check the closure of account 76. It is closed.

Offset of advances in 1C 8.3 Accounting

Advance payment is usually called prepayment, namely the funds that the buyer will transfer to the seller. This amount can be transferred both for goods not sold and for services used. At the same time, the advance payment for today is not included in the income of the organization. This article will tell you in detail how the crediting of advances is implemented in 1C. The algorithm discussed in it concerns the procedure for offsetting received and issued advances. It should also be noted that several methods for crediting advance payments have been implemented. Each of them will be effective in its own way.

In the first option, the advance payment will be credited “Automatically”. Each advance issued (received) will be recorded in a document recording the receipt (sale). The described procedure will be most convenient in the case when settlements between the parties are carried out under the entire agreement. When using specific accounts or receipt (sale) documents, using this option is not entirely advisable.

Let's say that an advance of 10 thousand rubles. under Agreement No. 1 is transferred by the buyer (that is, LLC “Magazin No. 23”) to the settlement account specified by the seller (Trading House “Complex” LLC). Next, the product itself is sold (in this case, for 15 thousand rubles).

The fact indicating the accrual of an advance is reflected by the creation of a special document “Receipt to the current account”. In this case, in the field called “Debt repayment” the corresponding value is set – “Automatic”.

As soon as the buyer transfers the agreed advance payment, you should proceed to the preparation of the “Sale of Goods” document. The method for crediting the advance will also be indicated - in this case, it corresponds to the status “Automatic”.

Next, you should go through the implementation document itself and look at the resulting postings.

The offset of the buyer's advance will be reflected in the second posting. In the event that we transfer the advance to our supplier, the procedure for offset will be carried out in a similar way. We can talk about the document “Write-off from the current account”. The next step will be the preparation of the “Receipt of Goods” document.

Now let's move on to the second option of the advance payment method “According to document”. Each sale (receipt) in this case is carried out against a specific advance payment. For a specific sale (receipt), subsequent payment is also made. This option is more convenient to use in a situation where calculations are carried out for specific documents.

Let’s say an advance of 5 thousand rubles from our organization Trade House “Complex” LLC. is transferred to the supplier Ethnopark Perun LLC (the transfer of the advance is provided for in Agreement No. 2, as well as a specific settlement document with the counterparty). Next, we receive the ordered goods from the counterparty. We will formalize the data on the performed operation in the program.

After registering the necessary goods, we will use the document and select the required method of crediting the advance payment (the corresponding link is placed in the header).

We look for a window called “Calculations”, where we select the “By document” method. Then click the “Add” button. After moving to the next window, select our document indicating the debit from the current account. Next, we proceed to filling out the tabular part with the selected goods and only then post the document. We look at the received postings.

The advance payment to the supplier will be credited as the very first posting.

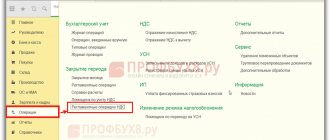

Now let’s get acquainted with the third option “Do not read out”. To offset the advance, the “Debt Adjustment” document is used. You will need to go to the “Purchases” section of the program or to the “Sales” section (followed by selecting the “Debt Adjustment” item). Next, in the “Type of operation” field, you must indicate the value “Advance offset”, and also fill in the remaining empty fields. Filling out the tabular parts is done using the “Fill” button or manually.

Do you want to install, configure, modify or update 1C? Leave a request!

Accounting for VAT from the buyer

Now let’s look at an example of how the buyer’s VAT accounting operations are reflected in the 1C: Accounting 8 version 3.0 program when returning the transferred advance payment.

Example 2

Clothes and Shoes LLC (buyer) entered into an agreement for the supply of goods with Trading House LLC (seller) for a total amount of RUB 180,000.00. (including VAT 20% - RUB 30,000.00) on the terms of full advance payment. After the prepayment was transferred, the delivery contract was terminated and the prepayment amount was returned by the seller.

The sequence of operations is given in Table 2.

Payment to the supplier

To perform operation 1.1 “Registering an invoice for payment from a supplier,” you must create an Invoice from a supplier document (Purchases section - Purchases subsection) using the Create button.

To perform operation 1.2 “Drawing up a payment order for advance payment to a supplier,” a Payment order document is created (section Bank and cash desk - subsection Bank) using the Create button.

You can create a Payment order document based on the Invoice to buyer document.

Based on the Payment order document, the document Write-off from the current account is entered (operation 1.3 “Registration of prepayment”).

If payment orders are created in the Client-Bank program, then it is not necessary to create them in the 1C: Accounting 8 program. In this case, only the document Write-off from the current account is entered, which generates the necessary transactions. The document Write-off from a current account can be created manually or based on downloading from other external programs (for example, “Client-Bank”).

As a result of posting the document Write-off from the current account, the following accounting entry will be generated:

Debit 60.02 Credit 51 - for the amount of advance payment transferred to the seller, which is 180,000.00 rubles.

In accordance with paragraph 1 of Article 168 of the Tax Code of the Russian Federation, the buyer of goods who has transferred the prepayment amount must be issued an invoice no later than 5 calendar days, counting from the date of receipt of the prepayment by the seller. This invoice is the basis for the buyer, who has transferred the prepayment, to accept for deduction the amounts of tax calculated and presented by the seller, in the presence of documents confirming the actual transfer of the prepayment amounts, and an agreement providing for the transfer of these amounts (clause 2 of article 169, clause 12 Article 171, paragraph 9 Article 172 of the Tax Code of the Russian Federation).

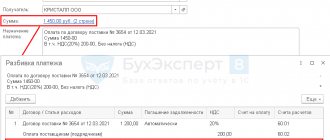

To claim a deduction by the buyer based on an invoice received from the seller (operations 1.4 “Registration of a received invoice for prepayment”, 1.5 “Deduction of VAT from the transferred prepayment”), it is necessary to create the document Invoice received on the basis of the document Write-off from the current account using the Create on base button (see Fig. 4).

In the new Invoice document received, most of the fields are filled in automatically.

This will also automatically install:

- in the Invoice type field – the value For advance;

- in the Transaction type code field - code 02, which corresponds to payment, partial payment (received or transferred) on account of upcoming deliveries of goods (work, services), property rights (Appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/ [email protected] ).

In addition, in the new Invoice document received, you should additionally indicate:

- in the Invoice No. and from fields - the number and date of the invoice received from the seller;

- in the Received field - the date of actual receipt of the invoice, which by default is entered similar to the invoice date specified in the from field.

To automatically reflect the deduction of VAT from the transferred prepayment in accordance with paragraph 12 of Article 171 and paragraph 9 of Article 172 of the Tax Code of the Russian Federation, it is necessary to check the presence of the flag in the line Reflect VAT deduction in the purchase book (Fig. 4).

As a result of posting the Invoice document received, an accounting entry will be made in the accounting register:

Debit 68.02 Credit 76.VA - for the amount of input VAT in the amount of RUB 30,000.00. (RUB 180,000.00 x 20/120), claimed for tax deduction.

From 01/01/2015, taxpayers who are not intermediaries (forwarders, developers) do not keep a log of received and issued invoices. However, after posting the document Invoice received in the Invoice Journal register, an entry is also made to store the necessary information about the received invoice.

To register the received advance invoice in the purchase book, an entry will be made in the Purchase VAT accumulation register with the transaction type code 02, which corresponds to payment, partial payment (received or transferred) on account of upcoming deliveries of goods (work, services), property rights ( Appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/ [email protected] ).

Based on the entries in the VAT Purchases register, a purchase book is formed for the first quarter of 2021 (section Reports - VAT subsection), fig. 5.

The amount of VAT claimed for deduction from the transferred prepayment is reflected on line 130 of Section 3 of the VAT tax return for the first quarter of 2021 (approved by order of the Ministry of Finance of Russia dated October 29, 2014 No. ММВ-7-3 / [email protected] ) (section Reports - subsection 1C-Reporting - hyperlink Regulated reports).