Where can I see the classifier and what does it contain?

The regulated units of measurement and their codes are in the document “OK 015-94 (MK 002-97). All-Russian classifier of units of measurement”, adopted by Decree of the State Standard of the Russian Federation No. 366 of December 26, 1994.

The All-Russian Classifier of Units of Measurement (OKEI) is part of the Unified System of Classification and Coding of Technical, Economic and Social Information of the Russian Federation (ESKK). The measures and values contained in it are used to regulate the economic activities of business entities, carry out statistical reconciliations, organize customs audits, prepare reports, fill out primary documentation and strict reporting forms.

Code 362 in the invoice for services

The all-Russian classifier of units of measurement consists of three blocks: an identification block, a name block and a block of additional characteristics. The code and national symbol are used when drawing up the Consignment Note or UPD and are indicated in the list of goods in the corresponding columns.

Interesting: Okpo form, what is it for individual entrepreneurs

OKEI was developed on the basis of the international classification of units of measurement of the United Nations Economic Commission for Europe (UNECE) “Codes for units of measurement used in international trade” (Recommendation No. 20 of the Working Group on Facilitation of International Trade Procedures (WG 4) of the UNECE - hereinafter Recommendation N 20 RG 4 UNECE), Commodity nomenclature of foreign economic activity (TN FEA) in terms of the units of measurement used and taking into account the requirements of international standards ISO 31/0-92 “Values and units of measurement. Part 0: General principles" and ISO 1000-92 "SI units and recommendations for the use of multiples and certain other units".

How are the fields filled out?

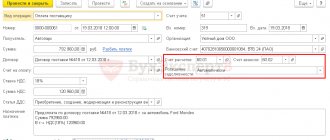

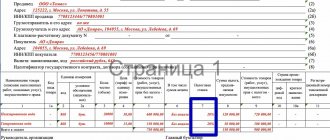

According to Appendix No. 1 to Decree of the Government of the Russian Federation No. 1137 dated December 26, 2011, the table of the invoice form contains the column “Unit of measurement”, which is divided into two columns 2 “code” and 2a “symbol (national)”. They must be filled out, if such a possibility exists (subclause 5, clause 5, article 169 of the Tax Code of the Russian Federation).

Reference. In column 2 you need to enter a code consisting of three digits, and in column 2a - the conventional name of the unit of measurement. When filling out these details, you should rely on the data from sections 1 and 2 of the OKEI directory.

In what case is it not necessary to fill out the column?

In situations where it is impossible to enter a code for units of measurement, it is necessary to write a dash in the free columns 2 and 2a (as well as in the subsequent columns 3 and 4) (clauses “b” - “d”, clause 2, clause 4 of the Rules filling out an invoice approved by the Decree of the Government of the Russian Federation dated December 26, 2011, Letter of the Ministry of Finance No. 03-07-09/28 dated March 27, 2012).

This option is possible if:

- An invoice for prepayment is generated.

- The agreement between the counterparties of the transaction includes only the total price for all shipped goods, and does not indicate the cost of a unit of product.

- The operation concerns leasing (clause 3 of the Letter of the Ministry of Finance No. 03-07-09/06 dated 02/10/2012).

- The goods are calculated in units that are not displayed in sections 1 and 2 of OKEI. For example, Megabyte. First, you need to try to select a measure that is suitable in terms of content from those presented in the classifier. Often a missing item can be replaced by a piece.

- Services are provided or work is performed, the results of which cannot be expressed by any of the classifier codes.

We talked about filling out other fields, such as address and country code, in other materials on our website.

The organization provides services (performs work) for the maintenance and repair of medical equipment

Having considered the issue, we came to the following conclusion: If it is impossible to determine the unit of measurement (as well as the quantity and price (tariff) per unit of measurement) in relation to a specific object of sale (in particular, the provision of services (performance of work) for the repair and maintenance of medical equipment) In the indicator of column 2 (as well as in indicators 2a, 3 and 4) of the invoice, it is possible to enter dashes.

Interesting: What is indicated in a certificate of no criminal record

Justification for the conclusion: Clause 1 of Art. 168 of the Tax Code of the Russian Federation provides that when selling goods (work, services), transferring property rights, the taxpayer, in addition to the price (tariff) of the goods sold, is obliged to present the corresponding amount of tax for payment to the buyer of these goods. Moreover, in accordance with paragraph 2 of Art. 168 of the Tax Code of the Russian Federation, the amount of tax imposed by the taxpayer on the buyer of goods (work, services), property rights is calculated for each type of these goods (work, services), property rights (as the percentage corresponding to the tax rate specified in paragraph 1 of Article 168 of the Tax Code of the Russian Federation prices (tariffs)). By virtue of clause 3 of Art. 168 of the Tax Code of the Russian Federation, when selling goods, the corresponding invoices are issued no later than five calendar days counting from the date of shipment. The invoice is drawn up in accordance with the norms of paragraphs. 5-7 tbsp. 169 of the Tax Code of the Russian Federation, as well as in accordance with the Rules for filling out an invoice used in VAT calculations, which are established in Appendix No. 1 to the Decree of the Government of the Russian Federation of December 26, 2011 N 1137 (hereinafter referred to as the Rules) (clause 8 of Article 169 of the Tax Code RF). Based on paragraphs. “b” clause 2 of the Rules, in columns 2 and 2a of the invoice, the unit of measurement is indicated (code and the corresponding symbol (national) in accordance with sections 1 and 2 of the All-Russian Classifier of Units of Measurement) (if it is possible to indicate it). The all-Russian classifier of units of measurement OK 015-94 (MK 002-97) (OKEI) was approved by Decree of the State Standard of the Russian Federation dated December 26, 1994 N 366) (as amended by N 1, 2, 3). Thus, columns 2 and 2a of invoices provide for an indication of both the unit of measurement (its conventional designation (national)) of the goods (work, service) being sold and its code. If there are no indicators, a dash is added. The Ministry of Finance of Russia pays attention to this circumstance in letter dated 09/08/2014 N 03-07-09/44915. Thus, the unit of measurement code is a mandatory detail of the invoice, but only if it can be specified. Units of measurement in the above-mentioned OKEI classifier are divided into seven groups, among which there is a group of economic units. If none of the units specified in the classifier can be used in relation to a specific sales object, the taxpayer, when drawing up an invoice, has the right in the “unit of measurement” column not to indicate “code” and “symbol (national)” and put a dash in these fields of the document. In the letter of the Federal Tax Service for Moscow dated March 15, 2012 N 16-15/22629, the tax authority explains that if the unit of measurement (code) used when performing maintenance and repair work (in particular heating networks) is not provided Section 1 and 2 of the All-Russian Classifier of Units of Measurement, then in this case, when filling out columns 2, 2a, as well as columns 3 and 4 *(1) of the invoice, dashes are added. Note that this approach also applies to the provision of services. Thus, a service for tax purposes is recognized as an activity whose results do not have material expression and are sold and consumed in the process of carrying out this activity (Clause 5 of Article 38 of the Tax Code of the Russian Federation). In this regard, the service does not have a quantitative expression; accordingly, the service cannot be expressed in certain units of measurement in the invoice. In this case, a dash is placed in column 2 of the invoice. At the same time, for example, in relation to a lease agreement, if the agreement stipulates a unit of measurement, in particular, the amount of the monthly payment is established, then the organization can indicate the unit of measurement - month (code - 362); if the agreement establishes a rental rate per square meter, then it is possible indicate the unit of measurement - square meter (code - 055). The Russian Ministry of Finance also indicates that columns 2, 2a (as well as columns 3 and 4) of the invoice are filled out if it is possible to indicate the relevant indicators. If it is impossible to indicate indicators in the indicated columns, dashes are placed (see, for example, letters of the Ministry of Finance of Russia dated 09/08/2014 N 03-07-09/44915, dated 06/05/2020 N 03-07-09/32579, dated 10/15/2012 N 03 -07-05/42, dated 07/19/2012 N 03-07-09/69, dated 05/15/2012 N 03-07-09/54, dated 05/14/2012 N 03-07-09/49). The judges proceed from the fact that if the object of sale (goods, work, service) does not have a unit of measurement, quantitative volume and price of a unit of measurement, then these indicators cannot be detailed in the invoice due to the impossibility of indicating them (see , for example, resolution of the FAS East Siberian District dated December 15, 2009 N A33-6571/2009, resolution of the FAS East Siberian District dated March 28, 2011 N A78-5740/2010, resolution of the FAS North Caucasus District dated June 7, 2007 N F08- 3198/07-1320A). The resolution of the Federal Antimonopoly Service of the Moscow District dated May 25, 2012 N F05-4663/12 in case N A40-97547/2011 states that if the invoices contain a description of the services provided, any other quantitative characteristics in this case are not required to be indicated. It is sufficient to identify the business transaction by indicating the name of the services provided on the invoice. Thus, when drawing up invoices, the Tax Code of the Russian Federation (clause 5 of Article 169 of the Tax Code of the Russian Federation) and the Rules allow for the possibility of the absence of details in columns 2, 2a, 3 and 4 of the invoice, but only if it is impossible to indicate them *(2). By virtue of clause 2 of Art. 169 of the Tax Code of the Russian Federation, invoices are the basis for accepting VAT amounts presented to the buyer by the seller for deduction when the requirements established by paragraphs 5, 5.1 and 6 of Art. 169 of the Tax Code of the Russian Federation. At the same time, according to the second paragraph of clause 2 of Art. 169 of the Tax Code of the Russian Federation, errors in invoices that do not prevent tax authorities from identifying the seller, buyer of goods (work, services), property rights, the name of goods (work, services), property rights, their value, as well as the tax rate and the amount of tax presented to the buyer is not a basis for refusing to accept tax amounts for deduction (see also letters of the Ministry of Finance of Russia dated 08/14/2020 N 03-03-06/1/47252, dated 09/18/2014 N 03-07-09/46708 , dated 05/30/2013 N 03-07-09/19826). The resolution of the Arbitration Court of the Ural District dated 06/09/2020 N F09-3067/15 in case N A47-13182/2013 notes the case of claims by the tax inspectorate for the absence of indicators in the columns “quantity” and “price per unit of measurement” of invoices when purchasing work and services. The court ruled in favor of the taxpayer, justifying this by the fact that the absence of this information in the invoice during the actual provision of services cannot serve as a basis for refusing to apply a VAT deduction on such an invoice.

Interesting: Pros and cons of individual entrepreneurs and LLCs 2020

How to specify different measures?

The OKEI Directory is extensive and includes a fairly comprehensive list of units of measurement for assessing technical and economic indicators. The codes for the most common calculus measures are as follows:

- Weight:

- Metric ton: code "168", symbol "t".

- Kilogram: code "166" and "kg".

- Gram: "163" and "g".

- Dimensions:

- Meter: code “006” and letter value “m”.

- Square meter: "055" and "m2".

- Linear meter: “018” and “linear meters”.

- Kilometer, thousand meters: “008” and “km; 103 m".

- Volume:

- Liter, cubic decimeter: code “112” and abbreviation “l; dm3".

- Cubic meter: "113" and "m3".

- Flights on OKI: indicating such a unit of measurement for transport, “trip”, “transportation” is unacceptable, since these measures are not included in the All-Russian Classifier of Units of Measurement. However, the following indicators can be used:

- One thousand tonnage flights: code “966” with the symbol “103 tonnage. flight".

- Car-day: "959" and "car-day".

- Code “796” - what is it and how is it measured? This code corresponds to the national letter abbreviation “piece” and is measured in pieces.

- Time:

- Hour: code “356” and indicator “h”.

- Minute "355" and "min".

- Day “359” and “day; days".

- Machine hours: not directly included in the All-Russian Classifier of Units of Measurement, but can be replaced by a thousand car (machine) hours with code “951” and o.